Compendium of Policies, Guidelines and Procedures

Table Of Contents

- Introduction and Purpose of the Stakeholder Consultations

- Board Positions on Proposed Revisions to the Compendium of Policies, Guidelines and Procedures

- Preamble

- Part I – Legal Framework

- Part II – Policies

- Part III – Guidelines and Procedures

- Chapter 1 – The Scientific Review Process

- Chapter 2 – The Price Review Process

- Chapter 3 – Investigations

- Schedules

- Schedule 1 – Submissions by Patentees on Therapeutic Improvement

- Schedule 2 – Comparable Dosage Forms

- Schedule 3 – Therapeutic Class Comparison Test

- Schedule 4 – Reasonable Relationship Test

- Schedule 5 – Median International Price Comparison Test

- Schedule 6 – Highest International Price Comparison Test

- Schedule 7 – International Therapeutic Class Comparison Test

- Schedule 8 – Application of Price Tests for New Drug Products

- Schedule 9 – CPI-Adjustment Methodology

- Schedule 10 – DIP Methodology

- Schedule 11 – Criteria for Commencing an Investigation

- Schedule 12 – “Any Market” Price Reviews

- Schedule 13 – Offset of Excess Revenues

Introduction and Purpose of the Stakeholder Consultations

The Patented Medicine Prices Review Board has developed a further draft revised Compendium of Policies, Guidelines and Procedures (Compendium) as part of the next phase of the Guidelines review exercise. This draft document builds on all previous consultation activities that have taken place since the launch of the Guidelines review in 2005, particularly the August 20, 2008, Notice and Comment document.

Pursuant to subsection 96(5) of the Patent Act, the Board is consulting with all stakeholders on this draft revised Compendium in order to seek final feedback on proposed modifications to its various policies, guidelines and procedures. This consultation package is organized into two parts:

- Part A – A summary of the issues that have been under review, along with stakeholder views provided since the last Notice and Comment document released in August 2008, and Board positions; and

- Part B – The draft revised Compendium of Policies, Guidelines and Procedures.

The specific purpose of the consultation is to seek final comments on those sections of the draft revised Compendium that were amended, or added to, since the version released on August 20, 2008. Other sections of the Compendium, as identified in Part A, have already been approved by the Board following previous consultations, and are not the subject of this consultation.

The Board will review all submissions and publish the final revised Compendium in early June 2009, with implementation planned to take effect on July 1, 2009.

Your written feedback on the draft Compendium should be sent directly to Ms. Sylvie Dupont, Secretary of the Board, no later than April 27, 2009, but earlier submissions are encouraged. Submissions should be sent electronically at:

sylvie.dupont@pmprb-cepmb.gc.ca

Or at the following address:

Box L40

Standard Life Centre

333 Laurier Avenue West

Suite 1400

Ottawa, Ontario, K1P 1C1

If your comments are significant in length, please include a summary highlighting the key points of your submission. As with previous consultations, all submissions received by the Board will be posted on its Web site as part of its commitment to openness and transparency.

Board Positions on Proposed Revisions to the Compendium of Policies, Guidelines and Procedures

The following provides an overview of the major issues under review, including those that were raised in the August 2008 Notice and Comment document and those that are being raised for the first time in this consultation package. The background of each issue is discussed, along with stakeholder views (where available) and the Board´s position and/or proposed direction.

Overall Changes to the Board´s Compendium

In the draft revised Compendium released for consultation in August 2008, the Board put forward several overall changes to the existing document, including: modifications to the general structure to improve information flow, a new “Legal Framework” section to provide greater clarity to stakeholders, and wording changes in the mandate statement to clarify the underlying purpose of the PMPRB.

Stakeholder Views

In general, stakeholders were supportive of the changes to the overall structure of the Compendium and additional clarity provided with respect to the PMPRB´s legal framework. Stakeholders had a divergence of opinion as to the adjusted wording of the mandate. Some felt that the PMPRB´s purpose should be to ensure that the prices charged by patentees for patented medicines sold in Canada are not excessive, thereby protecting consumers and contributing to Canadian health care; while others felt that the purpose should be to maintain an appropriate balance between the incentives for research and development and protection against excessive prices.

Board Position

The Board believes that the interests of Canadians and the Canadian health care system are the key reasons the PMPRB was created in 1987. The Board has decided to include language to this effect in its revised mandate statement.

Furthermore, in the August 2008 Notice and Comment document, the Board noted in section 8 of the Legal Framework that any information submitted by a patentee to the PMPRB that is in the public domain will not be considered privileged under subsection 87(1) of the Patent Act (Act). Although it has been the Board´s practice to not publish the publicly available ex-factory prices of a patented medicine in Canada and other countries listed in the Patented Medicines Regulations (Form 2, Block 5) without the patentee´s consent, the Board is of the view that since the Form 2, Block 5 information is by definition required to be publicly available, it will no longer be considered privileged information under subsection 87(1) of the Act.

| Summary of Major Changes for Consultation |

Location |

| The PMPRB´s regulatory mandate statement has been updated as follows: “To ensure that the prices charged by patentees for patented drug products sold in Canada are not excessive, consistent with the interests of consumers and the Canadian health care system.” |

Part I, Subsection 2.1 |

| The Legal Framework of the Compendium has been updated to expressly include, as publicly available information, the publicly available international prices of a patented drug product that are filed with the PMPRB (Form 2 – Block 5). |

Part I, Subsection 9.2 |

Modification of Terminology Regarding the “Maximum Non-Excessive Price”

During recent discussions with industry stakeholders, a concern was raised that the existing terminology describing the regulated maximum price is confusing and potentially misleading to some stakeholders.

Stakeholder Views

Industry stakeholders are concerned that the term “Maximum Non-Excessive (MNE) Price” implies a price ceiling which no one can exceed. However, the PMPRB actually reviews theaverage price of patented drug products in a particular market. Given the possibility of different pricing in different markets, some variability around the National Average Transaction Price is to be expected. As long as the price in each market does not exceed the introductory maximum non-excessive price and over time does not increase by more than what is allowed under the CPI-Adjustment Methodology or become the highest of all the comparator countries, its price would not be presumed to be excessive. Nevertheless, when that market average price is compared to the aggregate National Average Transaction Price and to the national maximum non-excessive price, it may appear excessive.

Board Position

The Board agrees that clear terminology is important in ensuring transparency for all stakeholders. The Board believes that revised terminology is also needed to better assist stakeholders in understanding price reviews at the level of the individual market. The Board is seeking stakeholder feedback on the following revised terms:

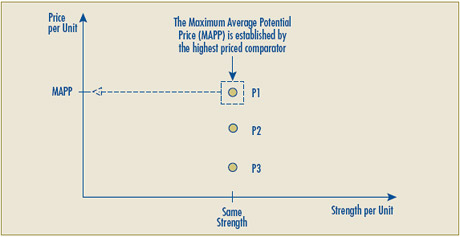

- The term “Introductory Maximum Non-Excessive Price” would be replaced by the “Maximum Average Potential Price”, since it is intended that this would set the upper price threshold for the introductory average price in any and all markets (national, class of customer, province/territory).

- For existing patented drug products, the term “Maximum Non-Excessive Price” would be replaced by “Non-Excessive Average Price”. Each market (national, class of customer, province/territory) would have its own unique Non-Excessive Average Price, calculated based on the previous years´ actual non-excessive Average Transaction Prices for that market.

| Summary of Major Changes for Consultation |

Location |

| “Maximum Average Potential Price” used in lieu of “Introductory Maximum Non-Excessive (MNE) Price” for new drug products. |

Throughout Guidelines |

| “Non-Excessive Average Price” used in lieu of “Maximum Non-Excessive (MNE) Price” for existing drug products. |

Throughout Guidelines |

Publication of the CPI-Inflated Maximum Average Potential Price

Industry stakeholders have asked the Board to publish both the Maximum Average Potential Price (which is the price at introduction that no market may exceed), and this price grown by CPI on a cumulative basis every year

The Board is prepared to consider acting on this proposal and is seeking stakeholder comments as part of its final round of consultations.

It should be noted that the CPI-Inflated Maximum Average Potential Price could not be relied upon for regulatory purposes. One should not assume that the CPI-Inflated Maximum Average Potential Price represents a non-excessive average price for a particular market. The Non-Excessive Average Price for existing drug products will continue to be determined on the basis of actual Average Transaction Prices in each market and allowable CPI increases, and the highest international price.

It should also be noted that published CPI-Inflated Maximum Average Potential Prices will not be public prices that can be used for the purposes of the PMPRB´s price review.

Finally, the confidentiality provisions of the Act require that any published price be based on a public source and not the commercially confidential prices filed by patentees with the Board. It may not always be possible for the PMPRB to find public prices suitable for reporting purposes.

Levels of Therapeutic Improvement

During consultations undertaken in 2006, stakeholders expressed concern that the PMPRB´s approach to assessing the level of therapeutic improvement of a drug product did not recognize the nature of incremental pharmaceutical innovation. Additional stakeholder consultations were held, and a multi-stakeholder Working Group on Therapeutic Improvement was formed to provide recommendations on how to improve the PMPRB´s method of assessing a drug product´s level of therapeutic improvement. In the draft revised Guidelines released for consultation in August 2008, the PMPRB proposed four new levels of therapeutic improvement (with the addition of “moderate improvement” as a level), as well as revised primary and secondary factors for determining levels of therapeutic improvement.

Stakeholder Views

Stakeholder comments on the August 2008 Notice and Comment document were supportive of creating a new “moderate” level of therapeutic improvement, which was considered an improvement over the existing categories. Stakeholder comments were mixed on primary and secondary factors, with some favouring inclusion of additional factors on economic impacts, while others supported those selected by the Board.

Board Position

The Board has decided to adopt the proposed changes regarding levels of therapeutic improvement as put forward in the August 2008 Notice and Comment document. The Board has also decided to adopt the proposed changes regarding the primary and secondary factors for determining levels of therapeutic improvement, with the exception that secondary factors can only result in the level of therapeutic improvement being assessed at up to the level of moderate therapeutic improvement. The Board´s position is that secondary factors do not carry sufficient weight to move the level of therapeutic improvement from “moderate” to “substantial improvement”, which should only be possible through consideration of primary factors.

Introductory Price Tests

The development of new levels of therapeutic improvement necessitated a reconsideration of the associated price tests. In 2008, the multi-stakeholder Working Group on Price Tests was formed to consider how the introductory price tests should be revised in light of the newly proposed levels of therapeutic improvement.

i) The Reasonable Relationship (RR) Test

In the draft revised Guidelines released for consultation in August 2008, the Board adopted many of the recommendations of the Working Group, including maintaining the Reasonable Relationship test for line extensions (where no therapeutic improvement is proposed by the patentee or, if proposed, not recommended by the Human Drug Advisory Panel).

Stakeholder Views

Industry stakeholders reacted to a modification in the third part of the RR test put forward in the August 2008 Notice and Comment document. The Board had proposed that the price of a new lower strength drug product would be proportional to that of a higher strength product already being sold in Canada, rather than allowing the lower strength to be priced as high as the higher strength. Industry stakeholders commented that this would create a disincentive to making available drug products used in “titration dosing”.

Board Position

The Board acknowledges that the original RR test did not create disincentives to making available a “titration dose”, whereas the revised test may discourage such a practice. Therefore, the Board proposes to revert back to the original intent and methodology of this test.

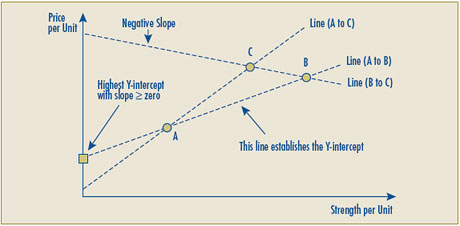

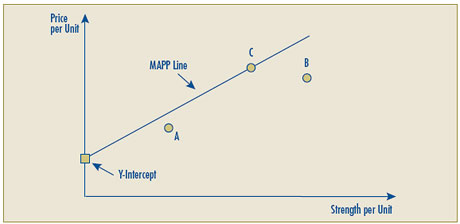

In reviewing all of the aspects of the RR test, the Board has determined that modifications are needed to test number two of the RR test. The purpose of these modifications is twofold. First, the proposed changes recognize the possibility of level pricing per unit for multiple strengths of a patented drug product. Second, the proposed changes address the issue of a possible negative price due to a negative Y-intercept. The Board is putting forward the following for notice and comment:

- RR test number two has been modified to allow for the possibility of a zero slope in the calculation of the reasonable relationship. This has been done to rectify a problem with the existing Guidelines that move drug products with a clear reasonable relationship under test two (e.g., level pricing per unit for multiple strengths of a patented drug) to test three by virtue of the zero slope linear relationship.

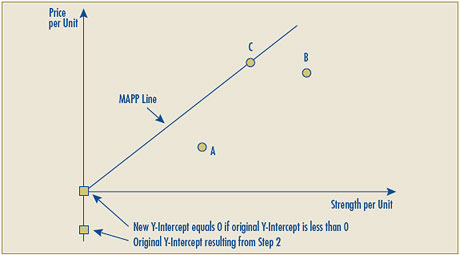

- Given the possibility that the line representing the highest positive linear relationship between the prices of existing strengths may result in a Y-intercept that is negative, implying that for some new strengths the allowable price would be less than zero, the Board proposes that in such cases the negative Y-intercept would be replaced by zero and the linear relationship would be established by drawing a line between the origin (0) and the per unit price of the highest priced comparable drug product.

The Board has also generally added to the description of the RR test in order to better assist stakeholders in their understanding of when and how this test would be conducted.

| Summary of Major Changes for Consultation |

Location |

| Additional clarity provided on when and how the Reasonable Relationship test would be conducted. |

Schedule 4 |

| Reverting back to existing Reasonable Relationship test number three. |

Schedule 4, Test 3 |

| RR test number two has been modified to recognize level pricing per unit for multiple strengths of a patented drug product. |

Schedule 4, Test 2, Bullet 2 |

| Reasonable Relationship test number two has been modified so that if the Y-intercept is less than zero, the negative Y-intercept would be replaced by drawing the reasonable relationship line between the origin (0) and the per unit price of the highest priced comparable drug product. |

Schedule 4, Test 2, Bullet 5 |

ii) Modified Guidelines for Certain Patented Generic Drug Products

A) Limited Therapeutic Class Comparison

In the August 2008 Notice and Comment document, the Board put forward for consultation a proposal for modified Guidelines for patented generic drug products, which would limit the comparators used in a therapeutic class comparison to only the reference (bioequivalent) or licensing brand´s drug product. This was a proposal that was championed by representatives of the generic pharmaceutical industry and considered a reasonable approach by the Board.

Stakeholder Views

Stakeholders from the generic pharmaceutical industry supported the proposals in the draft revised Guidelines of August 2008. No significant concerns were expressed by other stakeholders about limiting the therapeutic class comparison to the reference/licensing brand drug product.

Board Position

The Board considers a streamlined therapeutic class comparison, where a “bioequivalent” or “licensed” generic drug product would have as its sole comparator either the referenced or licensing brand´s drug product to be reasonable. In fact, this limitation involves comparing products with the same chemical entity, the same indication or use, the same or comparable dosage form and the same dosage regimen. Therefore it is appropriate to place text regarding this limited comparison in the Reasonable Relationship section (see chapter 2, paragraph 2.11(c)) and Schedule 4 of the draft revised Guidelines. This is a proposal that has been accepted by the regulated parties, would be less demanding of Board Staff time and would not require the resources of the Human Drug Advisory Panel. This change will be retained.

ii) Modified Guidelines for Certain Patented Generic Drug Products

B) Highest International Price Comparison (HIPC) Test

In 2008, consultations involving the generic pharmaceutical industry identified a number of issues that were argued to be unique to the market dynamics and competitive forces faced by generic drug products. In the draft revised Guidelines released in August 2008, the Board put forward for consultation a proposal whereby, for a bioequivalent patented generic drug product, the result of the domestic Therapeutic Class Comparison test would prevail even if the new patented generic drug product´s price in Canada exceeded the same drug product´s price in the comparator countries i.e., effectively exempting the generic drug product from the Board´s Highest International Price Comparison (HIPC) test.

Stakeholder Views

Stakeholders from the generic pharmaceutical industry supported the proposal in the draft revised Guidelines of August 2008. Nearly all other stakeholders that commented on the issue indicated that there should be no special category of patentee based on the type of company selling the drug product (i.e., generic versus brand/innovative), and that patentees should be treated equally. The Board was urged not to allow the exemption from the HIPC test.

Board Position

The Board met with representatives of the generic pharmaceutical industry and invited any further submissions on this point. The Board agrees that fairness is a key principle in price regulation and therefore all patentees should face the same Highest International Price Comparison constraint.

| Summary of Major Changes for Consultation |

Location |

| Removed the proposed exception for patented “bioequivalent” generic drug products to the HIPC rule in the draft revised Compendium. |

Removed from: Part III, Chapter 2, Subsection 2.11, Paragraph C, Bullet 1 |

iii) International Therapeutic Class Comparison (ITCC) Test

In 2007, the Board tasked the multi-stakeholder Working Group on International Therapeutic Class Comparison (ITCCWG) to make recommendations on the selection of comparators in the ITCC test. Following many of the recommendations of the ITCCWG, the August 2008 Notice and Comment document proposed that the ITCC test not be a primary price test, but that it be used to provide information in the context of an investigation into apparent excessive prices. The Board also proposed that two variations may be used to calculate the ITCC test: 1) the “ratio approach” and 2) the “straight class approach”.

Stakeholder Views

Industry stakeholders expressed concern that the PMPRB was not adopting the particular recommendation of the ITCCWG, which specified that generic drug products should not be included in the ITCC if the Board decides that the relevant result is established by any measure below the “top” of the ITCC test.

Board Position

The Board has re-examined this test and is proposing some further changes:

- When using both the “straight class” and “ratio” approaches of the ITCC test, the PMPRB proposes to use the resulting median international price as the measure of an excessive price.

- When undertaking the ITCC test, the comparable generic drug products used in the ITCC test will only be those sold by companies that also sell the same generic drug product in Canada.

The first modification is being put forward to provide clarity to stakeholders as to what measure will be used in applying the ITCC test. The Board considers that the previous reference to developing a “series of statistical values” is not very helpful. Stakeholders will benefit from knowing in advance what statistical measure will be predominantly considered when undertaking the ITCC test.

The second modification addresses industry´s concerns over the inclusion of generics in the ITCC test. The Board does not support the complete exclusion of generic drug products from the test, but given the vast number of potential generic drug product comparators in foreign countries, it acknowledges that the inclusion of all available generic drug products could unfairly skew the results of the test. In order to ensure that the comparators used in the test are both relevant and appropriate, the patented drug product under review will only be compared against those generic drug products that are being sold by a company that also sells the same generic drug product in Canada.

| Summary of Major Changes for Consultation |

Location |

| When using both the “straight class” and “ratio” approaches of the ITCC test, the resulting median international price will be compared against the patentee´s National Average Transaction Price. |

Schedule 7, Section 3 |

| The comparable generic drug products used in the ITCC test will only be those sold by companies that sell the same generic drug product in Canada. |

Schedule 7, Section 2 |

Any Market Price Reviews

In earlier consultations, some stakeholders expressed concerns that the ability of some classes of customers or provinces to obtain favourable prices might result in other customers/provinces paying a price that would be excessive. In response to this concern, pursuant to sections 83 and 85 of the Act, the August 2008 Notice and Comment document put forward proposals for price review in “any market”, including: ensuring that the introductory prices of particular markets are not excessive; and undertaking price reviews at the level of any market for existing drug products on a case-by-case basis where price variability in different markets appears to be an issue. The Board also sought feedback from stakeholders on the appropriate methodology for calculating excess revenues arising from a price that is excessive in a particular market.

Stakeholder Views

Feedback from stakeholders indicated that support for price review at the level of any market was mixed. In general, industry stakeholders felt that the need for such analysis has not been sufficiently demonstrated, while non-industry stakeholders clearly saw a need to undertake such price reviews. Common among many of the submissions received was that the language used to describe the proposals for price review at the level of any market was vague and unclear.

Board Position

In principle, the Board believes that some level of market-specific price review is part of its statutory mandate. The fact that some markets at introduction can pay as much as 25% or more above the Maximum Average Potential Price (formerly known as the Introductory Maximum Non-Excessive Price) was clearly demonstrated in the Board´s Discussion Guide released for consultation in May 2006.

The Board acknowledges that the approach to Any Market price reviews should be clarified. The new version of the draft revised Guidelines has more clear and detailed language with respect to Any Market price reviews, including a new schedule that clearly explains the methodology.

In addition to reviewing the price nationally, and for each of the three classes of customers, the Board is proposing to review the price in each province and territory at introduction.

For existing drug products, the Board will continue to review the price at the national level and only conduct reviews at the level of class of customer and/or province/territory if the national Average Transaction Price appears excessive or in the case of a complaint.

With respect to the appropriate methodology for the calculation of excessive revenues, stakeholders indicated that the excess revenue should be based on the average price across all markets in Canada (i.e., the National Average Transaction Price) to recognize and also take into account lower prices in other markets, rather than being limited to the market where the price was excessive. The Board supports this position and has included language to this effect in the draft revised Guidelines.

| Summary of Major Changes for Consultation |

Location |

| A new Schedule 12 was added to clarify the approach to any market price review. |

Schedule 12 |

| The markets that will undergo any market price review at introduction have been expanded to include: each province and territory in addition to each of the three classes of customers (hospital, pharmacy and wholesaler) and the national level. |

Part III, Chapter 2, Subsection 2.13 |

| Excess revenue will be calculated on the basis of the average price across all markets in Canada (i.e., the National Average Transaction Price). |

Schedule 12, Bullet 7, Sub-bullet 2 |

Re-Setting the Non-Excessive Average Price After Introduction

In the Discussion Paper released in January 2008, the PMPRB proposed three possible circumstances when it may be appropriate to “re-set” a Non-Excessive Average Price: 1) in the case of new scientific information; 2) when the new drug product was sold in too few countries and the Median International Price test was the pivotal introductory price test; and 3) because of potential cost of making and marketing arguments.

In the August 2008 Notice and Comment document, the Board took the position that:

- With respect to new scientific information, the Human Drug Advisory Panel would be asked to identify any important weaknesses or gaps in scientific evidence, but a specific Guideline was not needed on the subject.

- When a new patented drug product is sold in too few countries and the Median International Price (MIP) test is the pivotal introductory price test, the status quo approach is appropriate (i.e., reviewing the MIP within three years or once the patented drug product is sold in five comparator countries, whichever is earlier).

- Reviewing a price in regard to the costs of making and marketing may be appropriate, but this is not a mandatory price factor (under ss. 85(1)) which the Board must consider. Flexibility on the part of Board Staff was permitted but no specific Guideline was proposed.

Stakeholder Views

Feedback received on the August 2008 Notice and Comment document indicated that, in general, stakeholders were supportive of the direction taken by the Board. One concern identified by stakeholders was the omission of the following clause, which is in the existing Guidelines, but did not appear in the draft revised Guidelines of August 2008:

“The PMPRB recognizes that once a Notice of Compliance (NOC) has been obtained, it may be appropriate to adjust the benchmark price of a drug product first sold as an Investigational New Drug or under the Special Access Programme. In these cases, the average transaction price of the drug product following receipt of the NOC may be reviewed to determine if it appears to be excessive, based on the Guidelines applicable to new drug products.”

Board Position

The Board understands the concerns of stakeholders seeking to potentially re-set the Non-Excessive Average Price of a patented drug product once it receives an NOC, but takes the position that simply receiving an NOC in and of itself is not sufficient cause to trigger consideration of re-setting. The Board recognizes that it may be appropriate to adjust the Non-Excessive Average Price of a drug product based on cost arguments, and such arguments could arise in situations where the patented drug product was first sold on a compassionate basis as an Investigational New Drug or through the Special Access Programme and then, having obtained an NOC, other costs are incurred in bringing the drug to market in Canada. Language to this effect is included in the new draft revised Guidelines for Notice and Comment.

| Summary of Major Changes for Consultation |

Location |

| Addition of the following paragraph to the Guidelines: “The Board recognizes that there may be cost of making and marketing arguments, whereby it may be appropriate to adjust the Non-Excessive Average Price of a patented drug product (e.g., once a Notice of Compliance has been obtained and the drug product was first sold on a compassionate basis as an Investigational New Drug, through a Clinical Trial Application or under the Special Access Programme).” |

Part III, Chapter 2, Subsection 3.5 |

Recognizing Benefits (DIP Methodology)

In the August 2008 Notice and Comment document, the Board highlighted that it did not wish to unduly create disincentives to the offering of benefits to customers, and proposed what has come to be known as the “DIP Methodology” as a possible alternative to the application of the CPI-Adjustment Methodology in certain specific circumstances. The proposed methodology was based on the principle that in a circumstance where an apparent excessive price was due solely to the termination or reduction in a benefit, and the patentee provides evidence in this regard, the resulting average transaction price (ATP) should not be viewed as excessive if it simply “rebounds” to the pre-benefit price.

Stakeholder Views

Industry stakeholders shared many common concerns with the DIP Methodology, including: that the methodology is overly complex; that it will increase the workload of patentees and Board Staff; and that offering benefits and keeping track of them is not as straightforward as the methodology assumes. It was also recommended that a committee of representatives from the PMPRB and Rx&D be struck to discuss the challenges the proposal posed for the industry. An ad hoc bilateral Rx&D/PMPRB Board-level committee was formed and met on three occasions to discuss various issues of concern to industry.

Board Position

The Board´s position is that a methodology to address potential disincentives stemming from the mandatory reporting of benefits is appropriate. In essence the DIP Methodology allows flexibility for patentees whose prices, net of such benefits, would otherwise be constrained by the CPI-Adjustment Methodology even when such benefits end. The new draft revised Guidelines provide further clarification on the DIP Methodology, including:

- Clearer descriptions of how the DIP Methodology would work in practice;

- Flexibility to allow the ATP within a specific market to potentially “re-bound” up to the pre-benefit price in that market if evidence is provided;

- Flexibility to allow the price in a market that, from the date of first sale and in every period thereafter, received a benefit to potentially “rebound” up to the non-excessive price in another market that never received a benefit, again following receipt of evidence of the introductory benefit; and

- Guidelines on the minimum expectations from patentees in terms of the evidence of benefits that would be required in order to qualify for the DIP Methodology.

| Summary of Major Changes for Consultation |

Location |

| A new Schedule was added to provide greater clarity on the DIP Methodology. |

Schedule 10 |

Use of Patented and Non-Patented Drug Products in the Price Tests

During the price review of a new patented drug product, it is the current practice of Board Staff to examine the price of all pivotal comparator drug products, both patented and non-patented, to determine if they are priced excessively according to the Excessive Price Guidelines. While this has been the practice of Board Staff for some time, no consolidated policy statement exists.

Board Position

The Board is including a Policy on the Use of Patented and Non-Patented Drug Products in the Price Tests, in order to provide greater clarity to stakeholders on the current practices of Board Staff. The Board has also added details in the Guidelines as to how the prices of patented and non-patented drug products will be assessed to determine whether or not they would appear excessive.

| Summary of Major Changes for Consultation |

Location |

| Addition of Policy on the Use of Patented and Non-Patented Drug Products in the Price Tests |

Part II, Section 6 |

| Additional details have been added as to how the prices of patented and non-patented drug products will be assessed to determine whether or not they would appear excessive. |

Schedule 3, Section 2, Paragraphs 3-5 Schedule 4, Paragraphs 5-8 |

Offset of Excess Revenues

Under the existing Guidelines, when the Average Transaction Price of a drug product exceeds its Maximum Non-Excessive Price, excess revenues are generated. While the current Guidelines provide some guidance to patentees and Board Staff regarding how such excess revenues may be offset, the Board believes it is timely as part of the Guidelines review exercise to provide clarification and direction with respect to the measures patentees may take to offset excess revenues.

Board Position

As part of this consultation, the Board is putting forward a policy statement and a consolidated Schedule on the Offset of Excess Revenues. Stakeholders should note the following proposed modifications:

- To offset excess revenues via a price reduction, the average price of a patented drug product will only be considered to have been reduced if it is below the previous year´s Non-Excessive Average Price; not taking an allowable price increase will not be considered for purposes of offsetting excess revenues.

The rationale is that excess revenues generated by a patentee reflect the fact that customers on average were paying a price that appeared excessive, and that in accordance with Section 83 of the Act an actual price reduction is necessary, as described above, to offset the revenue.

- Excess revenue balances below the amount sufficient to trigger the investigation criteria that are carried for six consecutive six-month reporting periods (3 years) will be expected to be offset through a Voluntary Compliance Undertaking. Failing this, Board Staff will refer the matter to the Chairperson.

The rationale here is that under the existing Guidelines, patentees with excess revenue balances at levels below the investigation criteria can effectively maintain these balances indefinitely. Internal research by Board Staff indicates that it is not an uncommon occurrence that such excess revenues can exist over multiple years.

- The following exception to the CPI-Adjustment Methodology applies when a price reduction below the Non-Excessive Average Price is taken in one or more markets specifically to offset excess revenues. Following the repayment of excess revenues, the Average Transaction Prices in those markets may return in the next reporting period up to the Market-Specific Non-Excessive Average Prices prior to the price reduction.

The rationale here is that the Board does not wish to create a disincentive to taking a price reduction to offset excess revenues.

| Summary of Major Changes for Consultation |

Location |

| Addition of a Policy on the Offset of Excess Revenues |

Part II, Section 7 |

| A new Schedule was added for stakeholder comment on the proposed Policy on the Offset of Excess Revenues |

Schedule 13 |

Preamble

The Patented Medicine Prices Review Board (PMPRB) is committed to making the price review process more open and transparent to all stakeholders.

One of the primary objectives of the Compendium of Policies, Guidelines and Procedures (Compendium) is to ensure that patentees are aware of the policies, guidelines and procedures under which Board Staff reviews the prices of patented drug products sold in Canada, and the procedures normally undertaken in the scientific and price review processes and when a price appears to be excessive.

From time to time, the PMPRB finds it necessary to update the Guidelines under which it operates to ensure that they remain relevant and appropriate, as well as uphold the principles of fairness, transparency, openness and predictability. When considering Guidelines amendments, the PMPRB consults with its stakeholders through its Notice and Comment process.

The Compendium is organized as follows:

Part I – Legal Framework

Part II – Policies

Part III – Guidelines and Procedures

Chapter 1 – The Scientific Review Process

Chapter 2 – The Price Review Process

Chapter 3 – Investigations

Schedules

Part I – Legal Framework

1. Origin of the PMPRB

1.1 The PMPRB was established pursuant to amendments to the Patent Act (the Act) that came into force on December 7, 1987. Prior to 1987, Canada sought to moderate the prices of patented medicines by means of compulsory licenses to increase competition. Under the 1987 amendments, Canada strengthened patent protection of medicines to provide patentees with an incentive to invest in more pharmaceutical research and development (R&D) in Canada. These amendments also established the PMPRB as the consumer protection pillar of the pharmaceutical patent law reform to ensure that the prices of patented medicines are not excessive.

1.2 Further amendments to the Act, which came into force on February 15, 1993, abolished the granting of compulsory licenses for patented medicines so that patentees have a statutory monopoly for the entire term of their patents. In order to fill the vacuum created by the abolition of compulsory licenses, these amendments also expanded the PMPRB´s remedial powers so that it could now order payment of excess revenues derived by patentees while selling a medicine at an excessive price, in addition to ordering price reductions.

2. Mandate of the PMPRB

2.1 The PMPRB has the following dual mandate:

- Regulatory – To ensure that the prices charged by patentees for patented medicines sold in Canada are not excessive, consistent with the interests of consumers and the Canadian health care system; and

- Reporting – To report annually to Parliament on its activities, on the ratios of R&D expenditures to sales by the patented pharmaceutical industry and by individual patentees, and on pricing trends within the pharmaceutical industry, relating to all medicines, thereby contributing to informed decisions and policy making in health care; other reporting activities include inquiring into and reporting on any matter that the Minister of Health refers to it, pursuant to section 90 of the Act.

3. Structure and Operation of the PMPRB

3.1 The PMPRB is an independent and autonomous quasi-judicial body. To ensure this independence and autonomy, the Act provides no power, either expressly or implicitly, to the government to direct the PMPRB or to review its decisions and orders. As well, the PMPRB has no involvement in federal policy-making.

3.2 Decisions of the PMPRB are subject to judicial review by the Federal Court on substantive or procedural grounds in accordance with administrative law principles.

3.3 The PMPRB is composed of Board members, appointed pursuant to subsection 91(1) of the Act, and staff (Board Staff), appointed pursuant to subsection 94(1) of the Act.

3.4 The PMPRB has the authority to develop policies and procedures as to how it will carry out its statutory duties in a fair and effective manner. Part of the process by which the PMPRB has determined to carry out its statutory obligations is by the administrative separation of its review and prosecutorial functions, performed by Board Staff, and its adjudicative function performed by Board members.

3.5 Board Staff carries out the day-to-day work of the PMPRB including the administration of the Patented Medicines Regulations (the Regulations) to ensure compliance with the prescribed filing requirements. The review of prices of patented medicines is carried out in accordance with the Guidelines, which are approved by the Board.

3.6 If the Chairperson of the Board decides that it is in the public interest that a hearing be held, pursuant to subsection 83(6) of the Act, to determine whether a patented medicine is being or has been sold at an excessive price in any market in Canada, the Chairperson will issue a Notice of Hearing and will appoint a panel of Board members to preside at the hearing (Hearing Panel).

3.7 To preserve the impartiality of Board members, until a matter is brought before a Hearing Panel at a public hearing, no Board member is informed of the results of Board Staff´s review into an instance of possible excessive pricing, other than the Chairperson in his management capacity as the Chief Executive Officer of the PMPRB, pursuant to subsection 93(2) of the Act, which is done solely for the purpose of determining whether a hearing is in the public interest.

4. Jurisdiction of the PMPRB Pertaining to Price Regulation

4.1 The Act gives the PMPRB jurisdiction to determine whether a patentee or former patentee of an invention pertaining to a medicine is selling or has sold the medicine at an excessive price in any market in Canada if the following criteria are satisfied:1

4.1.1 Patentee or Former Patentee

- Subsection 79(1) of the Act defines a “patentee” as a person for the time being entitled to the benefit of a patent for an invention, including any other person entitled to exercise rights in relation to the patent, with the exception of a person granted a compulsory license by the Commissioner of Patents before December 20, 1991 that was not terminated before the day amendments to the Act came into force on February 15, 1993.

- The PMPRB also has jurisdiction over a former patentee of an invention, while it was a patentee.

4.1.2 Patent pertains to the medicine

Medicine

- The term “medicine” is not defined in the Act. Please refer to the Board´s Policy with respect to the Meaning of Medicine.

Patent

- Subsection 79(2) of the Act provides that a patent for an invention pertains to a medicine if the invention is intended or capable of being used for medicine or for the preparation or production of medicine.

- The PMPRB considers a patent to include any Canadian patent of invention that pertains to a medicine. This includes, but is not restricted or limited to:

- Patents for active ingredients;

- Patents for processes of manufacture;

- Patents for a particular delivery system or dosage form that are integral to the delivery of the medicine;

- Patents for indications/uses; and

- Patents for formulations.

- A patent pertains to a medicine if it is capable of being used, whether or not it is being worked.

- On the face of the patent, there must be a rational connection or nexus between the invention described in the patent and the medicine, which can be one of the merest slender thread.2

4.1.3 Sale in any market in Canada

- The patentee or former patentee must be selling or have sold the patented medicine in any market in Canada.

- With the exception of medicines sold under compulsory licenses granted by the Commissioner of Patents before December 20, 1991 that were not terminated before the day amendments to the Act came into force on February 15, 1993, all patented medicines sold in any market in Canada for human or veterinary use are covered by the PMPRB´s price review jurisdiction, including patented medicines sold pursuant to Notices of Compliance, under the Special Access Programme, through Clinical Trial Applications, or as Investigational New Drugs.

- The PMPRB reviews the prices of the first sale of a patented medicine at arm´s-length by the patentee, directly to a class of customer, namely a wholesaler, hospital, pharmacy or other. The PMPRB has no authority over prices charged by wholesalers or retailers or over pharmacists´ professional fees.

- Prices do not need to be approved by the PMPRB before patented medicines are sold in Canada. At the request of the patentee, Board Staff may provide pre-sale advisory assistance on whether a price would appear to be excessive.

- The PMPRB does not set the prices at which patented drug products can be sold but determines the Maximum Average Potential Price and the Non-Excessive Average Prices at which these drug products can be sold in Canada.

5. Price Regulation Factors

5.1 Subsection 85(1) of the Act stipulates those factors that the Board, during the course of a hearing, must take into consideration when determining whether a patented medicine is being sold or has been sold at an excessive price in any market in Canada by a patentee or former patentee. These factors are:

- The prices at which the medicine has been sold in the relevant market;

- The prices at which other medicines in the same therapeutic class have been sold in the relevant market;

- The prices at which the medicine and other medicines in the same therapeutic class have been sold in countries other than Canada;

- Changes in the Consumer Price Index; and

- Such other factors as may be specified in any regulations made for the purposes of this subsection.

5.2 If after considering the above factors, the Board is unable to determine if a price is excessive, subsection 85(2) of the Act stipulates that it may consider the costs of making and marketing the medicine, as well as other factors which can be specified by regulations or that the Board considers relevant in the circumstances.

5.3 The Board, following considerable deliberation and consultation with all stakeholders, pursuant to subsection 96(5) of the Act, published the PMPRB´s Guidelines pursuant to subsection 96(4) of the Act. Although the Guidelines are not binding on the Board or the patentee, they establish an approach and methodology in applying the factors set out in subsection 85(1) of the Act.

6. Remedies

6.1 Where the Board finds that a patentee is selling a patented medicine in any market in Canada at an excessive price, the Board may order the patentee to reduce the maximum price at which the patentee sells the medicine in that market.

6.2 In addition, where the Board finds that a patentee or former patentee, while a patentee, has sold a patented medicine in any market in Canada at an excessive price, the Board may order the patentee to offset the amount of excess revenues estimated by it to have been derived by the patentee or former patentee from the sale of the medicine at an excessive price.

6.3 Where the Board finds that the patentee or former patentee has engaged in a policy of selling the medicine at an excessive price, the Board may order the patentee to offset up to twice the amount of excess revenues estimated by it to have been derived by the patentee or former patentee from the sale of the medicine at an excessive price.

6.4 In order to offset excess revenues, the Board may order a patentee or former patentee to:

- reduce the price at which the patentee sells the medicine in any market in Canada;

- reduce the price at which the patentee sells one other patented medicine in any market in Canada; or

- make a payment to Her Majesty in right of Canada.

7. Filing Requirements Pertaining to Price Regulation

7.1 The PMPRB must have timely and accurate information to fulfill its regulatory mandate.

7.2 The Act and the Regulations set out the filing requirements pertaining to price regulation for a patentee or former patentee of an invention pertaining to a patented medicine that falls under the jurisdiction of the PMPRB. Further details on each element of information to be reported, and how and when the information is to be submitted to the PMPRB, can be found in the Patentee´s Guide to Reporting.

Notification of Intention to Sell a Patented Medicine

- Section 82 of the Act requires a patentee to notify the PMPRB of its intention to offer a patented medicine for sale in a market in Canada in which it has not previously been sold, and of the date on which sales are expected to begin, as soon as it is practicable to do so.

- The Board may order a patentee to provide information relating to the price at which it intends to sell the patented medicine. However, information relating to the price need not be provided earlier than 60 days before the date on which the product is intended to be sold.

Form 1 (Medicine Identification Sheet)

- Subsection 3(1) of the Regulations requires a patentee or former patentee of an invention pertaining to a medicine to report to the PMPRB prescribed information identifying the patented medicine (Form 1). Form 1 is required for all patented medicines for human or veterinary use and shall be accompanied by the product monograph for the patented medicine or, if an NOC has not been issued in respect of the patented medicine, by information similar to that contained in a product monograph.

- Subsections 3(2) and 3(3) of the Regulations require that Form 1 information must be reported if an NOC has been issued in respect of the medicine or if the medicine is being offered for sale in Canada, within seven days after the day on which the first NOC is issued in respect of the medicine, or within seven days after the day on which the medicine is first offered for sale in Canada, whichever comes first.

- If a patentee or former patentee begins selling a medicine in Canada during the pre-grant period, once the patent is issued the patentee or former patentee is required to file Form 1 information with the PMPRB.

Form 2 (Information on the Identity and Prices of the Medicine)

- Subsection 4(1) of the Regulations requires a patentee or former patentee of an invention pertaining to a medicine, which is selling or has sold the medicine in any market in Canada, to report to the PMPRB prescribed information identifying the medicine and concerning the price of the medicine (Form 2). This includes the date on which the medicine is first sold in Canada, the quantity of medicine sold in final dosage form, and either the average price per package or net revenues from the sales of each dosage form, strength and package size in which the medicine was sold by the patentee or former patentee to each class of customer in each province and territory.

- Subsection 4(4) of the Regulations provides that, in calculating the average price per package or net revenues, the actual price or actual revenue after any reduction including rebates, discounts, refunds, free goods, free services, gifts or any other benefit of a like nature and after the deduction of federal sales taxes shall be used.

- Subsection 4(2) of the Regulations requires that, if the medicine is for human use and contains a controlled substance as defined in the Controlled Drugs and Substances Act, such as opioids, amphetamines, barbiturates and benzodiazepines, or is a substance listed or described in Schedules C or D of the Food and Drugs Act, such as radiopharmaceuticals, vaccines, blood products and insulins, or is listed or described in Schedule F of the Food and Drug Regulations, such as medicines requiring a prescription, the prescribed information under Form 2 must be reported within 30 days after the day on which the medicine is first sold in Canada (for the first day´s sales), and within 30 days after each six month period commencing on January 1 and July 1 of each year, in respect of each of these periods, including the final partial period.

- Subsection 4(3) of the Regulations requires that, for medicines for human use that do not contain a controlled substance or do not contain a substance listed or described in the schedules listed in subsection 4(2), including non-prescription medicines for human use or all medicines for veterinary use, the prescribed information under Form 2 must be reported for all periods of sale, within 30 days after the date on which the PMPRB sends a request in response to a complaint, and for the two years following the request, within 30 days after each reporting period. A patentee or former patentee shall maintain up-to-date Form 2 information from the date of first sale in the event of a request for this information from the PMPRB in response to a complaint.

- A patentee or former patentee who does not voluntarily file Form 2 information for a medicine being sold during the pre-grant infringement period is required to ensure that this information is kept up-to-date for ultimate submission to the PMPRB, upon the issuance of the patent pertaining to the medicine.

7.3 All required information referenced in Paragraph 7.2, must be submitted using the appropriate electronic documents made available on the PMPRB´s Web site, under the heading “Legislation, Regulations and Guidelines – Patentee´s Guide to Reporting”. The completed electronic document, in its original format and file type, must be sent to the e-mail address specified on the PMPRB´s Web site.

7.4 The electronic documents submitted to the PMPRB must bear the electronic signature of an authorized individual, certifying that the information set out in the document is true and complete.

8. Consequences of Failure to File Required Information Pertaining to Price Regulation

8.1 Evidence of failure to file a Notification of Intent to Sell a Patented Medicine, pursuant to subsection 82(1) of the Act, may be brought to the attention of the Chairperson who may issue an order requiring production of this information.

8.2 If a patentee or former patentee, as the case may be, fails to file some or all of its Form 1 or Form 2 information for one or more periods by the regulatory deadlines, it will be advised in writing by Board Staff that it is in failure to file and be given seven days from the date the letter is sent out to file the missing information. If the patentee or former patentee does not comply, Board Staff will bring a motion before the Chairperson seeking a Board Order, pursuant to section 81 of the Act, requiring the patentee or former patentee to file the information within such time as is specified in the order.

8.3 If it appears to the Chairperson or to the Board that the patentee or former patentee failed to file information pursuant to sections 80, 81 or 82 of the Act or pursuant to an Order of the Board, the Board may refer the matter to the Attorney General of Canada to determine if summary conviction proceedings should be commenced under subsection 76.1(1) of the Act.

8.4 Pursuant to section 99 of the Act, any Order of the Board may be made an order of the Federal Court or any superior court of a province, enforceable in the same manner as an order of the court.

9. Protection of Confidential Information Pertaining to Price Regulation

9.1 Pursuant to subsection 87(1) of the Act, apart from the exceptions noted below, any information or document provided to the PMPRB under sections 80, 81 or 82 of the Act, or in any proceeding under section 83, is privileged, and cannot be disclosed without the authorization of the person who provided it, unless it has been disclosed at a public hearing under section 83.

9.2 Any information that a patentee or former patentee submits to the PMPRB that is in the public domain will not be considered privileged under subsection 87(1) of the Act. This information includes the publicly available ex-factory prices of a patented medicine in Canada and other countries listed in the Regulations (Form 2, Block 5), publicly available product monographs, clinical trials and practice guidelines.

9.3 The privilege provided under subsection 87(1) does not extend to information and materials collected by the PMPRB, including any analysis performed by Board Staff of that information.

9.4 Subsection 86(1) of the Act gives the Board discretion to hold a hearing, or any part of it, in private if satisfied on representations from the patentee that specific, direct and substantial harm would be caused to the patentee by the disclosure of information or documents at a public hearing.

9.5 Information on the status of the price review by Board Staff, including the compliance status of patentees, is not protected by privilege under subsection 87(1) and may be made publicly available. As such, the PMPRB will publish summary reports on the results of the price review for all new active substances. The PMPRB may publish the results of other reviews.

9.6 Under subsection 87(2) of the Act, any information or document provided to the PMPRB under sections 80, 81 or 82 of the Act, or in any proceeding under section 83, may be disclosed to any person engaged in the administration of the Act under the direction of the Board; the Minister of Industry or other federal Minister designated by the Regulations; and the provincial ministers of health and their officials, for the purpose of making representations to the Board with respect to a hearing under section 83.

Part II – Policies

Introduction

From time to time, the Board finds it necessary to adopt policies to indicate to stakeholders the principles it applies when interpreting its mandate. The following is a consolidation of the key policies that have been decided on by the Board. While the following policies are not binding on the Board, they help to promote consistency and transparency for stakeholders.

1. Patent Pending Policy

1.1 When a medicine subject to a pending patent is being sold in any market in Canada, the PMPRB will, when the patent is issued, review the price as of the date of first sale or the date on which the patent application was laid open, whichever comes later. Once the patent is granted, the PMPRB´s jurisdiction over the price at which the medicine was sold extends to the pre-grant period, as the party selling the medicine derives the benefit of the patent during this period and so is a “patentee”, pursuant to subsection 79(1) of the Act.

2. Patent Dedication Policy

2.1 The PMPRB will continue to assert jurisdiction over the price at which a patented medicine is sold in any market in Canada after the patent has been dedicated until the cancellation or surrender of the patent pursuant to the express provisions of the Act or the expiry of the term of the patent. The Act, which is the mechanism by which the state grants patents, and which confers rights and benefits for the duration of the term of the patent, does not expressly recognize patent dedication as a mechanism by which patent rights may be terminated before the normal expiry of the patent term.

3. Policy on the Meaning of Medicine

3.1 A medicine is defined as any substance or mixture of substances made by any means – whether produced biologically, chemically or otherwise – that is applied or administered in vivo in humans or in animals to aid in the diagnosis, treatment, mitigation or prevention of disease, symptoms, disorders, abnormal physical states, or in modifying organic functions in humans or animals, however administered.

3.2 For greater certainty, this definition includes vaccines, topical preparations, anaesthetics and diagnostic products used in vivo, regardless of delivery mechanism (e.g., transdermally, capsule form, injectable, inhaler, etc.). This definition excludes medical devices, in vitro diagnostic products and disinfectants that are not used in vivo.

4. Policy on Unit of Price Review

4.1 The PMPRB reviews the average price of each strength of an individual, final dosage form of each patented drug product sold in Canada, including:

- Drug products that have been assigned a Drug Identification Number (DIN) by Health Canada

- Drug products available under the Special Access Programme

- Drug products available through a Clinical Trial Application, and

- Investigational New Drug Products

4.2 Each strength of an individual, final dosage form of a patented drug product is referred to as a “patented drug product” throughout this Compendium.

4.3 The average price of a patented drug product will normally be expressed as the price per unit in which that patented drug product is sold (i.e., tablet, millilitre, inhaler, etc.) rounded to the fourth decimal place.

5. Policy for When a Price May be Considered Excessive

5.1 The price of a patented drug product will be presumed to be excessive in the following cases:

- If the National Average Transaction Price exceeds the Maximum Average Potential Price at introduction, or after introduction it exceeds the National Non-Excessive Average Price;

- If any Market-Specific Average Transaction Price exceeds the Maximum Average Potential Price at introduction, or after introduction it exceeds its respective Market-Specific Non-Excessive Average Price.

5.2 If the National Average Transaction Price exceeds the Maximum Average Potential Price or National Non-Excessive Average Price, but does not trigger the criteria for commencing an investigation (see Schedule 11), the patentee will be notified and the patented drug product will be reported on the PMPRB Web site as “Appears Excessive.” The patentee will be expected to decrease its price and offset any excess revenues (see the PMPRB´s Policy on the Offset of Excess Revenues in section 7).

5.3 If the National Average Transaction Price is found to exceed the Maximum Average Potential Price or the National Non- Excessive Average Price by an amount which triggers the investigation criteria, the patentee will be notified of the commencement of an investigation and the patented drug product will be reported as “Under Investigation” (see Chapter 3, Investigations).

6. Policy on the Use of Patented and Non-Patented Drug Products in the Price Tests

6.1 Board Staff may exclude from the price tests any drug product identified for comparison purposes, both patented and non-patented, if it has reason to believe it is being sold at an excessive price.

6.2 Pivotal drug products used for comparison purposes in a price test will generally be assessed against the price tests described in the Guidelines.

7. Policy on the Offset of Excess Revenues

7.1 As set out in section 6 of the Legal Framework, the Board may allow a patentee to offset any excess revenues estimated by it to have been derived from the sale of the medicine at an excessive price through either: (i) the reduction of the price of the medicine or the price at which the patentee sells another patented medicine in Canada; or (ii) a payment to Her Majesty in right of Canada.

7.2 To offset excess revenues via a price reduction, the average price of a patented drug product will only be considered to have been reduced if it is below the previous year´s Non-Excessive Average Price; not taking an allowable price increase will not be considered for purposes of offsetting excess revenues.

7.3 Cumulative excess revenues cannot fall below zero.

Part III – Guidelines and Procedures

Preface

The following Guidelines and procedures represent direction from the Board, to patentees and Board Staff, in order to provide assistance on how to comply with the Patent Act and the Patented Medicines Regulations. Please note: These Guidelines are not binding on patentees or on the Board in the context of a hearing.

The Guidelines are organized as follows:

Chapter 1 – The Scientific Review Process: An evidence-based process that assesses the level of therapeutic improvement of a patented drug product and recommends, where appropriate, the drug products to be used for comparison purposes and the comparable dosage regimens.

Chapter 2 – The Price Review Process: The level of therapeutic improvement of a patented drug product is used to determine the Maximum Average Potential Price at introduction. Following introduction, the price of an existing patented drug product is reviewed according to the relevant price tests to establish the National and Market-Specific Non-Excessive Average Prices.

Chapter 3 – Investigations: The approach used and procedures undertaken when a price appears to exceed the investigation criteria (see Schedule 11).

Schedules: These Schedules form part of the Guidelines.

Chapter 1 – The Scientific Review Process

1. Introduction

1.1 The PMPRB´s scientific review is an evidence-based process that recommends the level of therapeutic improvement of a patented drug product.

1.2 The scientific review process for all new patented drug products (including those with an NOC or available through the Special Access Programme, Clinical Trial Applications and as Investigational New Drugs) will be undertaken following the Guidelines and procedures in this chapter.

2. Sources of Scientific Information

2.1 The scientific review of a new patented drug product is based on information from a variety of sources:

- Patentee Submission – Patentees may provide Board Staff with a brief submission (see Schedule 1), which clearly explains the rationale for the patentee´s proposals relative to level of improvement, drug products for comparison purposes and comparable dosage regimens.

- Research by a Drug Information Centre (DIC) – Board Staff uses the services of various drug information centres to obtain scientific information, such as clinical trial information, clinical practice guidelines, etc. The basis of the review by the DIC is the product monograph or information similar to that contained in a product monograph if an NOC has not been granted.

- Research by Board Staff – Board Staff may also update research and supplement data and evidence from the patentee and DIC using other sources.

- Research by HDAP Members – Members of the Human Drug Advisory Panel (HDAP) may also undertake their own research and supplement the evidence obtained from the patentee, the DIC and Board Staff for a review.

3. Human Drug Advisory Panel

3.1 The Human Drug Advisory Panel provides expertise and advice to Board Staff in conducting the scientific review. HDAP performs the following functions:

- Reviews and evaluates scientific information provided as described in Paragraph 2;

- Considers advice from other experts (when deemed necessary);

- Recommends the level of therapeutic improvement of the new patented drug product, and identifies drug products for comparison purposes and dosage regimens where possible; and

- Identifies significant uncertainties in the evidence which may affect the analysis on which its recommendations are based.

3.2 In general, new patented drug products are referred to HDAP. However, the following new patented drug products will not be referred to HDAP unless the patentee files a submission claiming therapeutic improvement:

- The new patented drug product represents a new DIN of an existing dosage form of an existing drug product, or a new DIN of another dosage form of the existing drug product that is comparable to the existing dosage form as per Schedule 2 and has the same indication or use as the existing DIN; or

- The new patented drug product is a combination drug product, the individual components of which are sold in Canada and have the same indication or use; or

- The new patented generic drug product is considered by Health Canada to be bioequivalent to the reference brand drug product sold in Canada; or

- The new patented generic drug product is a licensed version of an existing brand drug product sold in Canada.

Procedures:

3.3 HDAP is composed of members with recognized expertise in drug therapy who have experience in clinical research methodology, statistical analysis and the evaluation of new drug products.

3.4 HDAP and its individual members do not meet with patentees.

3.5 The names of the members of HDAP are posted on the PMPRB´s Web site.

3.6 The dates of HDAP meetings are posted on the PMPRB´s Web site.

3.7 At the request of a patentee, a new patented drug product will also be referred to HDAP to provide pre-sale and/or pre-patent advisory assistance.

3.8 For a new patented drug product referred to HDAP, a patentee must file a submission which contains the elements referred in Schedule 1 at least two months prior to an HDAP meeting.

3.9 In the event that a large number of submissions are received for any one HDAP meeting, priority will be determined as follows:

- Drug products that are patented and sold;

- Drug products that are patented and about to be sold;

- Drug products that are patented but not sold;

- Drug products that are not patented but sold;

- Drug products that are not patented and are not sold.

3.10 The patentee will be advised of the date of the HDAP meeting at which its submission will be considered.

3.11 The HDAP report will include recommendations on the level of therapeutic improvement, the drug products to be used for comparison purposes and comparable dosage regimens, as well as an explanation of how the primary and secondary factors (see section 6 below) were applied and a description of the evidence (see section 7 below) relied upon.

3.12 A copy of the HDAP report will be sent to the patentee.

4. Determining the Primary Indication/Use of a New Patented Drug Product

4.1 Determining the primary approved indication (or proposed indication if an NOC is pending), or primary use if not approved for market in Canada, is important for the assessment of the level of therapeutic improvement of a new patented drug product with multiple approved indications/multiple uses.

Procedures:

4.2 The level of therapeutic improvement for new patented drug products with multiple approved indications or multiple uses will be based on the approved indication or use for which the drug product offers the greatest therapeutic advantage in relation to alternative therapies for the same indication/use in a significant patient population. This would exclude rare medical conditions or diseases (i.e., low incidence and prevalence in Canada).

4.3 This approved indication or use will be considered the “primary indication” for the purpose of selecting drug products to be used for comparison purposes.

4.4 Where there is no apparent single approved indication or use for which the new patented drug product offers the greatest therapeutic advantage, the approved indication or use representing, potentially, the greatest proportion of sales will be the basis for recommending its level of therapeutic improvement and selection of drug products to be used for comparison purposes.

4.5 Estimates of potential sales can be based on several sources including actual prescribing patterns (when available), epidemiological data (Canadian incidence and prevalence) and prescribing patterns in other countries.

5. The Level of Therapeutic Improvement

5.1 HDAP utilizes the following set of definitions to recommend the level of therapeutic improvement of a drug product:

Breakthrough: A breakthrough drug product is the first one to be sold in Canada that treats effectively a particular illness or addresses effectively a particular indication.

Substantial Improvement: A drug product offering substantial improvement is one that, relative to other drug products sold in Canada, provides substantial improvement in therapeutic effects.

Moderate Improvement: A drug product offering moderate improvement is one that, relative to other drug products sold in Canada, provides moderate improvement in therapeutic effects.

Slight or No Improvement: A drug product offering slight or no improvement is one that, relative to other drug products sold in Canada, provides slight or no improvement in therapeutic effects.

6. Factors Considered in Recommending the Level of Therapeutic Improvement

6.1 The following factors are to be used in recommending the level of therapeutic improvement of a drug product:

Primary Factors

- Increased efficacy

- Reduction in incidence or grade of important adverse reactions

Secondary Factors

- Route of administration

- Patient convenience

- Compliance improvements leading to improved therapeutic efficacy

- Caregiver convenience

- Time required to achieve the optimal therapeutic effect

- Duration of usual treatment course Success rate

- Percentage of affected population treated effectively

- Disability avoidance/savings

6.2 The primary factors will be given the greatest weight, followed by an assessment of any additional improvement as a result of the secondary factors.

6.3 In recommending the level of therapeutic improvement of new patented drug products, factors such as the following will generally not be taken into consideration, unless the impact of these factors results in either increased efficacy and/or a reduction in the incidence or grade of important adverse reactions:

- The mechanism of action

- A new chemical entity

- A different pharmacokinetic profile

Procedures:

6.4 Primary factors will be considered in order to assess if the new patented drug product is a breakthrough, or represents substantial, moderate or slight/no improvement relative to other drug products available in Canada.

6.5 Secondary factors will then be considered. These factors will be weighed by HDAP based on sound evidence and reasonable clinical judgement. These secondary factors could result in the level of therapeutic improvement being assessed at up to the level of moderate therapeutic improvement.

7. Methodology for the Evaluation of the Level of Therapeutic Improvement

7.1 An evidence-based approach will be used to assess the new patented drug product under review using the hierarchy of evidence from the Oxford Centre for Evidence-Based Medicine (see Schedule 1).

Procedures:

7.2 HDAP will critically appraise the evidence with regards to validity, impact and applicability. Level 1 evidence will be given greater weight compared to other levels of evidence in recommending the level of therapeutic improvement and the selection of drug products to be used for comparison purposes.

7.3 Since uncertainty in the relative efficacy of a new patented drug product is common, level 1 evidence is preferred for new patented drug products to be assessed as having a breakthrough or substantial level of improvement relative to other drug products sold in Canada.

7.4 HDAP may consider other levels of evidence, as required, on a case by case basis in order to assess the secondary factors.

8. Selection of Drug Products to be Used for Comparison Purposes and Comparable Dosage Regimens

Drug Products to be Used for Comparison Purposes

8.1 HDAP uses the World Health Organization (WHO) Collaborating Centre for Drug Statistics Methodology´s Anatomical Therapeutic Chemical (ATC) Classification System in the selection of drug products to be used for comparison purposes.

8.2 The chemical substances to be used for comparison purposes will typically be those identified under the ATC classification system at the sub-class level above the single chemical substance. This will normally be the fourth sub-class level. HDAP may also choose from the next higher sub-class or another sub-class. In some instances, it may be appropriate to select from the fifth or single chemical substance level.

8.3 HDAP may omit from the comparison a chemical substance of the same ATC therapeutic class as the new patented drug product under review if, in HDAP´s opinion, it is unsuitable for comparison. For example, drug products with a primary indication/use other than the primary indication/use of the new patented drug product under review may be omitted from the comparison.

Procedures:

8.4 HDAP will identify all drug products to be used for comparison purposes, which have the same approved indication or use as the new patented drug product under review.

Breakthrough:

8.5 There will be no drug products recommended by HDAP for comparison purposes for a new patented drug product that represents a breakthrough, given that such a drug product is, by definition the first one to be sold in Canada that treats effectively a particular illness or addresses effectively a particular indication.

Substantial Improvement:

8.6 For new patented drug products that represent a substantial therapeutic improvement, HDAP will identify drug products with the same approved indication or use over which the new patented drug product represents a substantial therapeutic improvement.

Moderate Improvement:

8.7 For new patented drug products that represent a moderate therapeutic improvement, HDAP will identify drug products with the same approved indication or use over which the new patented drug product represents a moderate therapeutic improvement.

Slight or No Improvement: