Trends in Sales of Patented Drug Products

Analysis Briefs

Number 1, October 2011

Growth in use, not price, is driving cost increases

The cost of medication has become a major public policy issue. As governments at all levels try to contain costs, attention has focussed on patented drug products and cheaper generic or non-patented alternatives. Indeed, in the past 10 years the amount Canadians and the Canadian healthcare system spent on patented drug products has more than doubled, reaching $12.9 billion in 2010.

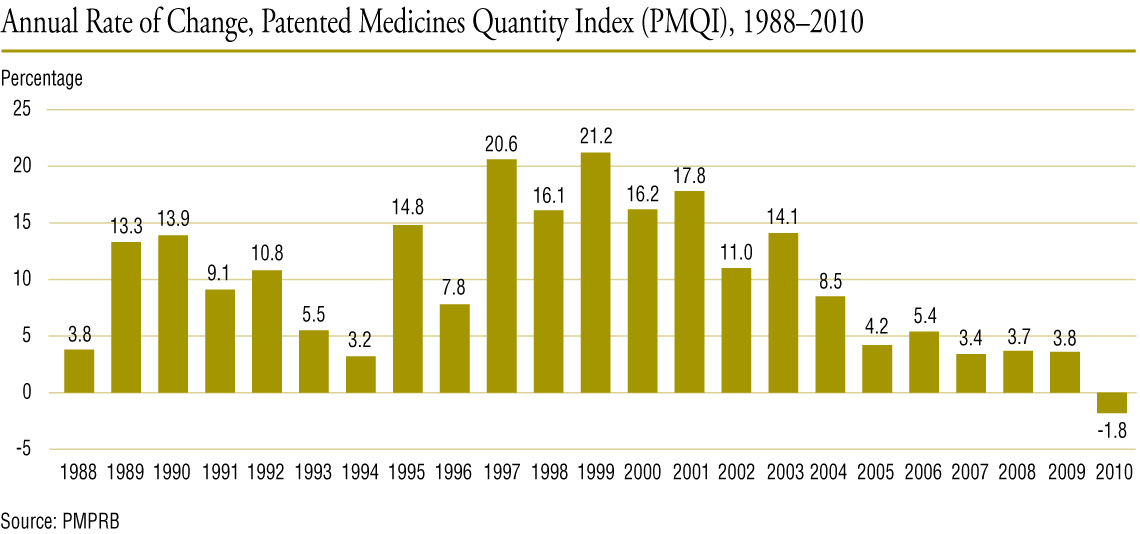

However that rate of growth is slowing dramatically. In 1999, the annual growth in sales of patented drug products was 27%, but last year it actually declined (-3.4%) for the first time in more than 15 years.

The share of patented drugs in Canada's annual spend on pharmaceuticals is also declining. Last year, 58% of drug sales were for patented drugs, compared to 72.7% in 2003.

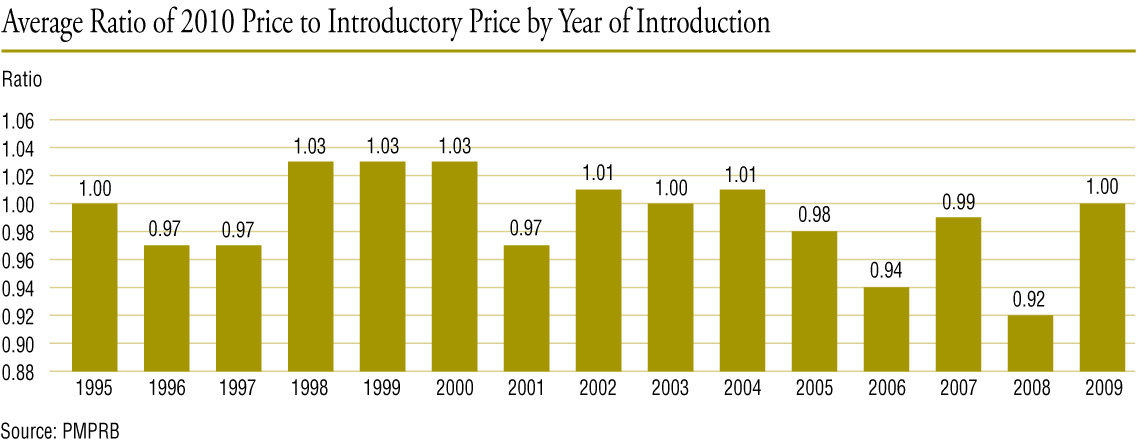

At the same time, the Patented Medicine Prices Review Board monitored price increases, ensuring that prices of existing patented drugs did not, on average, grow faster than the Consumer Price Index (CPI). Between 2009 and 2010, prices of patented drug products declined, on average, by 0.4%.

It is not the price that is growing, but the use of patented drug products. Analysis by the PMPRB found that the growth in the use of patented drugs roughly matches the growth in sales.

A variety of factors can produce these changes.

These include:

- Canada's population is growing

- the demographic mix is changing

- there is a rise in the incidence of health problems that require drug therapy

- the prescribing practices of physicians have changed

- drug therapy is becoming more popular than other forms of treatment

- there are new drug therapies to treat conditions for which no effective treatment existed before

Canada is facing the same situation as other OECD countries. In 2008, pharmaceutical expenditures absorbed 1.8% of Canada's Gross Domestic Product (GDP), in the same ballpark as Germany (1.6% of GDP), Italy (1.7%), France (1.8%) and the U.S. (1.9%). While in recent years Canada's year-over-year growth in drug sales has been higher than many other countries, last year it fell below the average of its basket of comparator countries, which includes the UK, Switzerland, Sweden, Germany, Italy, France and the U.S.