NEWSletter July 2006

Volume 10, Issue No. 3

Table Of Contents

- Appointment of Chair and Vice-Chairperson

- Since our last issue...

- National Public Service Week 2006

- Comings and Goings

- News from the Chairperson

- Notices of Hearing Issued Since the April 2006 NEWSletter

- Voluntary Compliance Undertakings

- Monitoring and Reporting of Non-Patented Prescription Drug Prices

- Amendments to the Patented Medicines Regulations, 1994 - Publication in the Canada Gazette, Part II

- Practice of Board Staff Respecting the Reissue of Existing DINs to a Subsequent Patentee

- ERBITUX, Bristol-Myers Squibb Canada Inc.

- The Scope of the PMPRB's Jurisdiction: When Does a Patent Pertain to a Medicine?

- Public Consultations on the Board's Excessive Price Guidelines

- NPDUIS - Update

- National Drug Expenditure Trends (CIHI)

- Report on Pharmaceutical Expenditures (OECD)

- List of New Drugs introduced since the publication of the April 2006 NEWSletter

- Report on New Patented Drug - Tarceva

- Patented Medicine Prices Review Board - May 17-18, 2006 Meeting

- Questions and Comments

- Upcoming Events

Welcome to the Board´s new Executive

The Minister of Health recently announced the appointments of Dr. Brien G. Benoit as Chairperson of the Board and of Mary Catherine Lindberg as Vice-Chairperson.

Dr. Benoit was first appointed to the Board in May 2005. He became Vice-Chairperson in October 2005 at which point he also fulfilled the functions of Chairperson.

Mary Catherine Lindberg, formerly Assistant Deputy Minister with the Ontario Ministry of Health, is the Executive Director of the Council of Academic Hospitals of Ontario.

The Members´ biographical notes are available on our Web site under About the PMPRB; Membership.

Here are some of the key events that occurred since the end of April 2006.

- April 24-26: The Board held its first session of the public hearing in the matter of Shire BioChem Inc. and the medicine Adderall XR, in Ottawa.

- April 27-28: Ria Mykoo, Legal Counsel, attended a conference on the Fundamentals of Administrative Law & Practice - An In-Depth, Practical Guide for Lawyers, Arbitrators and Tribunal Members, in Toronto.

- May 4: Sylvie Dupont, Secretary of the Board, gave a presentation on the role of the PMPRB, at the Conference on Pharmacotherapy, McGill University Health Centre, in Montréal.

- May 8: The Board issued a Notice of Hearing in the matter of Teva Neuroscience G.P.-S.E.N.C. and the medicine Copaxone.

- May 11-12: Catherine Lombardo, Manager of Compliance, attended the Advisory Committee on Pharmaceuticals meeting, in Ottawa.

- May 16: Brigitte Joly, Compliance Officer, gave a presentation on the role of the PMPRB, at the Pharmacy Outcomes Conference, in Montréal.

- May 18: Andrew MacDonald, Senior Economist, gave a presentation on the role of the PMPRB, at the Pharmacy Outcomes Conference, in Mississauga.

- May 17-18: The Board held its quarterly meeting. A summary of the Board Minutes is available on page 15.

- May 19: The Board held a pre-hearing conference in the matter of 3M Canada Company Inc. and the price of the medicine Airomir, in Ottawa. The hearing on the merits will be held October 16-19, 2006. More information on the Board's public hearings is available on our Web site under Regulatory; Hearings.

- May 31: The PMPRB presented its 2005 Annual Report to the Minister of Health.

- June 2: Barbara Ouellet and Paul De Civita presented the highlights of the Health 2005 Annual Report to Health Canada officials.

- June 6: Barbara Ouellet attended the Minister of Health's appearance before the Standing Committee on Health regarding Main Estimates.

- June 7-9: The Board held the first session of its public hearing in the matter of Janssen-Ortho Inc. and the price of the medicine Risperdal Consta, in Ottawa. A second session was also held on June 27 and 28. The Hearing Panel will reconvene on this matter on September 28. For more information, please visit our Web site under Regulatory; Hearings; Risperdal Consta.

- June 11-13: Barbara Ouellet and Ria Mykoo attended the 22nd Annual Conference of the Canadian Council of Administrative Tribunals (CCAT) – The Integrated Administrative Tribunal: from Concept to Reality – in Ottawa. At this conference, Sylvie Dupont moderated a workshop – Preparing for a case.

- June 21: The PMPRB 2005 Annual Report was tabled before Parliament.

- June 22-23: The NPDUIS Steering Committee met. The Pharmaceutical Trends Overview Report, 1997-1998 to 2003-2004 was released.

- June 26-27: Greg McComb, Senior Economist, attended a workshop - "Improving Drug Accessibility in Canada", in Toronto.

- July 4: The PMPRB released its first quarterly Report on Non-Patented Prescription Drug Prices: Canadian and Foreign Price Trends.

National Public Service Week 2006

National Public Service Week, a nation-wide celebration for all federal public service employees, was held the week of June 12. The specific theme for the 2006 celebrations was "Our people, our diversity, our future."

The PMPRB held a luncheon on June 15 to recognize employees' contributions!

- We welcome Murray Suchorab who has joined the Information Systems Group.

- Robert Sauvé, PMPRB's Director of Corporate Services since 1997, retired from the Public Service after 32 years. Thank you Robert for your valuable contribution to the PMPRB! We wish you the very best for a well deserved retirement.

- Also, best of luck to Richard McAteer who recently left the PMPRB to join Health Canada.

Congratulations Robert!

PMPRB 2005 Annual Report

Dr. Brien G. Benoit, Chairperson

The Minister of Health, the Honourable Tony Clement, tabled our 2005 Annual Report in Parliament on June 21, 2006.

The report provides detailed information on: sales and price trends of all medicines in Canada, including international comparisons; patentees´ compliance with the Board´s Excessive Price Guidelines; enforcement activities; patentees´ R&D spending; and various studies.

In summary, for 2005, total sales of all medicines amounted to $16.1 billion. This represents a slight increase, 1.3%, over 2004, and is the lowest rate of growth in the last fifteen years.

Manufacturers´ prices of patented drugs, as measured by the Patented Medicine Price Index (PMPI), increased on average by 0.8% in 2005. The ratio of Canadian prices to the international median of prices in comparator countries was again below parity, with Canadian patented drug prices being on average about 92% of the corresponding median international price.

Sixty-six new patented drug products were reported to the PMPRB in 2005 - 16 drugs were new active substances. This brought the total of patented medicines under the Board´s jurisdiction to 1,109 in 2005. Enforcement activities also increased with the Board approving eight Voluntary Compliance Undertakings. The Board completed its hearing in the matter of LEO Pharma Inc. and the price of the medicine Dovobet. Furthermore, the Board issued five Notices of Hearing since the beginning of the year.

Patentees reported total R&D expenditures of $1.23 billion in 2005. R&D-to-sales ratios increased slightly from 2004 to 8.7% for all patentees and 8.8% for Rx&D members. A total of $215.1 million was spent on basic research.

While it represents 18.2% of current R&D expenditures, spending on basic research decreased by 3% from 2004.

Consultations on the review of the Patented Medicines Regulations, 1994 were initiated to streamline the price review process and increase efficiency. Proposed amendments were published in the Canada Gazette, Part I, on December 31, 2005. With the participation of stakeholders, the Board also reviewed the issue of price increases for patented medicines. As a result, more pressing issues related to the review of introductory patented drug prices were identified, and are currently the subject of further consultations.

In November 2005, the PMPRB received direction from the federal Minister of Health to monitor and report on non-patented prescription drug prices. The first quarterly report, Canadian and Foreign Price Trends, was published on July 4. In addition, a total of four studies under the National Prescription Drug Utilization Information System were published over the last eighteen months, the latest one being the Pharmaceutical Trends Overview Report 1997-1998 to 2003-2004, which was released in June.

The PMPRB continues its work with the same commitment to effectiveness, transparency and consumer protection as it has in the past.

Brien G. Benoit, M.D.

Chairperson of the PMPRB

Copaxone1, Teva Neuroscience G.P.-S.E.N.C.

On May 8, 2006, the Vice-Chairperson of the Board issued a Notice of Hearing in the matter of Teva Neuroscience G.P.-S.E.N.C. (Teva) and the price of the medicine Copaxone. A pre-hearing conference is scheduled for September 20, 2006.

The purpose of the hearing is to determine whether, under sections 83 and 85 of the Patent Act, Teva is selling or has sold the medicine known as Copaxone in any market in Canada at a price that, in the Board's opinion, is or was excessive; and, if so, what order, if any, should be made.

Concerta2, Janssen-Ortho Inc.

On July 21, 2006, the Chairperson of the Board issued a Notice of Hearing in the matter of Janssen-Ortho Inc. (Janssen-Ortho) and the price of the medicine Concerta. A pre-hearing conference is scheduled for September 15, 2006.

The purpose of the hearing is to determine whether, under sections 83 and 85 of the Patent Act, Janssen-Ortho is selling or has sold Concerta in any market in Canada at a price that, in the Board's opinion, is or was excessive; and, if so, what order, if any, should be made.

All requests for information on hearings should be addressed to the Secretary of the Board:

Sylvie Dupont

Secretary of the Patented Medicine Prices Review Board

Standard Life Centre, 333 Laurier Avenue West, Suite 1400

Ottawa ON K1P 1C1

Toll-free number: 1 877 861-2350

Direct line: (613) 954-8299

Fax: (613) 952-7626

E-mail: sdupont@pmprb-cepmb.gc.ca

- Copaxone is indicated for use in ambulatory patients with relapsing-remitting multiple sclerosis to reduce the frequency of relapses.

- Concerta is indicated for the treatment of Attention Deficit Hyperactivity Disorder ("ADHD").

NuvaRingTM 1, Organon Canada Ltd.

On June 20, 2006, the Vice-Chairperson of the Board accepted a Voluntary Compliance Undertaking (VCU4) for NuvaRing, submitted by Organon Canada Ltd. (Organon).

Organon undertook to reduce the average transaction price of NuvaRing to a level at or below the 2006 Maximum Non-Escessive (MNE) price of $13.6791 and to file evidence with Board Staff by July 31, 2006, that the price has been reduced in a manner consistent with the terms of the VCU.

To offset excess revenues, as calculated by Board Staff, for the period January 17 to June 30, 2005, Organon will make a payment to the Government of Canada in the amount of $115,584.93, by July 31, 2006. The excess revenues remaining, as calculated by Board Staff, for the period July 1, 2005 to June 30, 2006, will be offset by the reduction of the price of Remeron RD 15 mg, 30 mg and 45 mg. In the event that any excess revenues have not been offset, Organon shall make a payment to the Government of Canada by January 30, 2007, for such an amount as determined by Board Staff.

Organon will ensure that the price of NuvaRing remains within the Guidelines while it is under the PMPRB´s jurisdiction, that is, until the patent expires in 2018.

Eloxatin2, sanofi-aventis Canada Inc.

On July 14, 2006, the Chairperson of the Board accepted a VCU for Eloxatin, submitted by sanofiaventis Canada Inc. (Sanofi-Aventis).

Sanofi-Aventis agrees that the MNE prices for Eloxatin 50 mg and 100 mg were $430.9208 and $922.6750 at introduction and that they are $490.5901 and $1,030.0175 in 2006. In lieu of a price reduction for the 50 mg vial and in order to avoid a distortion in the pricing relationship between the 50 mg and 100 mg vials, Sanofi-Aventis will maintain the price of Eloxatin 100 mg vial at $1,000.00 until such time as the MNE price for the 50 mg vial reaches $500.00.

In order to offset excess revenues received from the sale of Eloxatin, Sanofi-Aventis will make payments, by August 14, 2006, totalling $1,767,078.84 to hospitals, cancer clinics and cancer boards that previously purchased Eloxatin at excessive prices. The individual payments shall reflect the distribution of purchases of Eloxatin across Canada up to the end of March 31, 2006. Customers receiving payments will be notified that the payment is the result of an undertaking to the PMPRB. Sanofi-Aventis will provide a reference to the PMPRB Web site for the complete text of the VCU, and further provide copies of such notifications to Board Staff.

Sanofi-Aventis will ensure that the prices of Eloxatin remain within the Guidelines while it is under the PMRPB´s jurisdiction, at least until the end of the January to June 2019 reporting period.

Hextend3, Hospira Healthcare Corporation

On July 14, 2006, the Chairperson approved a VCU for Hextend submitted by Hospira Healthcare Corporation (Hospira).

Hospira agrees that the 2004 and 2005 MNE prices of Hextend are $0.0858 per mL. It will ensure that the average transaction price of Hextend in all future periods does not exceed the MNE price - where the price in the United States in local currency terms remains unchanged or increases, the MNE shall be the lower of the CPIadjusted price and $0.0858 per mL; and where the price in the United States in local currency terms decreases, the MNE shall be calculated using the new U.S. price in conducting the IPC test as set out in the Guidelines.

Hospira will ensure that the average transaction price for 2006 does not exceed the 2006 MNE price. Hospira will offset excess revenues accrued between March 15 and December 31, 2004 by making a payment to the government of Canada in the amount of $8,823.60.

Hospira will ensure that the price of Hextend remains within the Guidelines in all future periods in which Hextend remains under the PMPRB´s jurisdiction.

- NuvaRingTM is a new form of contraception. It is a flexible, soft, transparent, slow release vaginal ring.

- Eloxatin is used to treat patients with metastatic carcinoma of the colon or rectum whose disease has recurred or progressed during or within 6 months of completion of first-line therapy with the combination of bolus 5-FU/LV and irinotecan.

- Hextend is indicated for the treatment of hypovolemia when plasma volume expansion is required.

- VCUs are public documents and as such are posted on the PMPRB Web site under Regulatory; Voluntary Compliance Undertakings.

On July 4, 2006, the PMPRB released its first quarterly report on non-patented prescription drug prices: Canadian and Foreign Price Trends, as part of its role in the National Pharmaceuticals Strategy (NPS). Canada´s First Ministers committed to the development and implementation of the NPS in September 2004 to address the challenges to Canada´s health care system arising from pharmaceuticals. An important aspect of the NPS involves achieving international parity on the prices of non-patented drugs.

This first quarterly report provides an overview of prescription drug sales and price trends, including international price comparisons and notable price changes. The report covers sales of manufacturers and wholesalers to pharmacies. Price trends reported refer to prices paid by pharmacies through wholesalers or directly to manufacturers and not prices paid by consumers or drug plans.

Canadian drug prices are compared to those in eleven other countries using market exchange rates and purchasing power parities. The list of countries covered in the report (Australia, Finland, France, Germany, Italy, the Netherlands, New Zealand, Spain, Switzerland, the United Kingdom, and the United States) was determined by FPT governments. Reporting is presented by various market segments, by country and by major therapeutic class. The market segments covered include both generic and non-patented brand drugs; some information on patented prescription drugs is also included to complete the overview of prescription drug trends.

The PMPRB has maintained transparency throughout the process, including providing opportunities for the pharmaceutical industry and stakeholders to review and provide comments on both the Table of Contents and methodology used in the Report. Both the methodologies utilized and the draft of the Report were reviewed by experts engaged by the PMPRB.

The second quarterly report, scheduled for publication this fall, will provide further insight into Canadian and foreign price trends, including an examination of market structure trends and the state of competition in prescription drug markets.

Work has progressed on amending the Patented Medicines Regulations, 1994, since original proposals were first published in the Canada Gazette, Part I, on December 31, 2005. Since then, stakeholder comments were received and we have met with Rx&D, the association for Canada´s research-based pharmaceutical companies. Further revisions have been made as a result of all the feedback we received.

The revised regulatory package, including an updated Regulatory Impact Analysis Statement (RIAS), was recently presented to the Minister of Health for approval. Upon ministerial approval, the package will be submitted to the Treasury Board Cabinet Committee for approval for final publication in the Canada Gazette, Part II. The regulations will come into force on the day on which they are registered.

Paragraph 9.5 of Chapter 1 of the PMPRB´s Excessive Price Guidelines (Guidelines) entitled “Existing Drug Products Subsequently Sold by Another Patentee” provides that, “Where an existing drug product is sold in Canada by persons other than the initial patentee, the PMPRB´s Guidelines will apply to the DINs sold by these persons as if they were the DINs of the initial patentee. For example, if a patentee ceases to sell a patented drug product and the marketing rights to the product are transferred to another patentee, the new DIN will be considered as a continuation of the original DIN for purposes of application of the Guidelines.”

Board Staff has consistently interpreted and applied this provision of the Guidelines in a manner which binds a subsequent patentee of a DIN to the maximum non-excessive (MNE) price of the initial patentee of the drug product. It has been the established practice of Board Staff to effectively consider this situation as a “reissue of an existing DIN”, and therefore, if the average transaction price (ATP) of a subsequent patentee is less than the MNE price of the initial patentee, Board Staff considers the ATP at which that subsequent patentee sells the drug product in the first year in which it is the patentee as the introductory benchmark price for purposes of applying the CPI-adjustment methodology on a going forward basis.

This application of the Guidelines is predicated on the principle that the price of the DIN sold by the subsequent patentee cannot exceed the MNE price of the previous patentee. As a result, the benchmark price for the subsequent patentee is established as the lower of the MNE price of the previous patentee and the ATP of the subsequent patentee. The resulting application of the Guidelines is that, once the benchmark price of the DIN is established in this manner for the subsequent patentee, the CPI-adjustment methodology is applied as though sales of that drug product are in the first year of sale. This operational practice of Board Staff has presupposed that the subsequent patentee does not have access to the pricing information of the previous patentee respecting its ATP.

It is recognized by Board Staff, however, that there may be legitimate circumstances in which a subsequent patentee, on acquisition of the marketing rights to a particular DIN, is given access to the previous patentee´s price and sales information in respect of that DIN.

In Board Staff´s view, in a situation where a subsequent patentee can demonstrate, to Board Staff´s satisfaction, that it was provided with access to the price and sales information of the previous patentee, it is appropriate to allow the application of the same CPI-adjustment methodology to which the original patentee would have been entitled.

Board Staff will therefore apply the Guidelines in this manner for the subsequent patentee of a DIN where the subsequent patentee demonstrates it has access to the relevant historical price and sales information of the previous patentee.

The PMPRB posted its Summary Report on the price of the medicine Erbitux1. Erbitux was first sold in June 2005 under Health Canada's Special Access Program (SAP) and received its Notice of Compliance on September 9, 2005. The price of Erbitux is under the jurisdiction of the PMPRB until the expiry of the patent. For more information on Erbitux, please consult our Web site under Regulatory; Patented Medicines; Reports on New Patented Drugs for Human Use; Erbitux.

- Erbitux is used in combination with irinotecan, for the treatment of EGFR-expressing, metastatic colorectal carcinoma in patients who are refractory to irinotecanbased chemotherapy.

The Patent Act gives the PMPRB jurisdiction over a “patentee of an invention pertaining to a medicine”. For greater certainty, an “invention pertaining to a medicine” is defined in subsection 79 (2) of the Patent Act, which reads as follows:

For the purposes of subsection (1) and sections 80 to 101, an invention pertains to a medicine if the invention is intended or capable of being used for medicine or for the preparation or production of medicine.

The term “medicine” is defined in s.1 of the Preamble to the PMPRB´s Compendium of Guidelines, Policies, and Procedures (Compendium):

1.5 A medicine is defined as any substance or mixture of substances made by any means whether produced biologically, chemically or otherwise that is applied or administered in vivo in humans or in animals to aid in the diagnosis, treatment, mitigation or prevention of disease, symptoms, disorders, abnormal physical states, or modifying organic functions in humans or animals, however administered.

1.6 For greater certainty, this definition includes vaccines, topical preparations, anaesthetics and diagnostic products used in vivo, regardless of delivery mechanism (e.g. transdermally, capsule form, injectable, inhaler, etc.). This definition excludes medical devices, in vitro diagnostic products and disinfectants that are not used in vivo.

Section 1 of the Preamble also states that for the purposes of its jurisdiction, the PMPRB considers as a patent, any Canadian patent of invention that pertains to a medicine. This includes, but is not restricted or limited to, patents with the following status:

- patents for active ingredients;

- patents for processes of manufacture;

- patents for a particular delivery system or dosage form that are integral to the delivery of the medicine;

- patents for indications; and

- patents capable of being used, whether or not they are being worked.

A full analysis of the issue of whether a patent pertains to a medicine was given by the Federal Court of Appeal in ICN Pharmaceuticals Inc. v. Canada (Staff of the Patented Medicine Prices Review Board) (C.A.) (1997) 1 F.C. 32 (ICN), where the Court set out a three-part test to determine whether the PMPRB has jurisdiction over patents pertaining to a medicine:

- the PMPRB must determine that a party is a patentee of an invention;

- the patentee´s invention must pertain to the medicine:

- the pharmaceutical end product in question, must qualify as a medicine – the term “medicine” must be interpreted broadly, not narrowly;

- there must be a rational connection or nexus between the invention described in the patent and the pharmaceutical end product, that is between the invention described in the patent and the medicine:

- one does not have to, and ought not to, go beyond the face of a patent to establish the required nexus;

- the nexus can be one of the “merest slender threads”.

- the invention must be intended or capable of being used for medicine or for the preparation or production of medicine;

- there is no requirement that the invention described in the patent actually be used for the medicine or for the preparation or production of the medicine; and

- the patentee must be selling the medicine in any market in Canada.

The application of the second branch of the test, and in particular sub tests (b) and (c) under this branch, often involves issues of interpretation based on the facts of the specific situation.

In ICN, the Court rejected submissions that would have narrowed or restricted the Board´s jurisdiction and instead found that the broad language of ss. 79(2) and ss. 83(1) (the latter subsection deals with the order the Board may make when it finds that a “patentee of an invention pertaining to a medicine” is selling the medicine in Canada at an excessive price) of the Patent Act clearly evinced Parliament´s intention that it is unnecessary to go beyond the face of the patent when establishing the required nexus, or rational connection between the patent and the medicine in question, which can be of the “merest slender thread”. The Federal Court of Appeal also explained why this threshold is so low:

“…subsection 83(1) of the Act is concerned only with the existence of a related patent and not its potential or actual effect on the ability of potential competitors to enter a market, or for that matter the ability of patent holders to exercise market power… the phrase, an invention pertaining to a medicine [emphasis added], and in particular the word pertaining, evinces a clear intention that the nexus between the patent and the medicine is of broad import. For example, there is no requirement that the patent actually be used in the production of the medicine. Nor could subsection 83(1) be reasonably construed to support such a construction. Furthermore, the Board´s jurisdiction extends not only to patents which contain product claims (a claim for the medicine itself), but also patents which contain “process” and “use” claims. The law might be otherwise if subsection 83(1) had been drafted to read, for example, “an invention for a medicine”. That the word pertaining invites a broad construction is reinforced by subsection 79(2) which expands upon the notion of when a patent pertains to a medicine.”1

“There is nothing to suggest that it [ss. 79(2)] is to be interpreted restrictively… There need only be a slender thread of a connection between a patented invention and the medicine sold in Canada in order to satisfy the test for a nexus. The legislative reason for this is simple. Requiring a stronger nexus would provide a window of opportunity for pharmaceutical companies to avoid the jurisdiction of the Board, and would limit the ability of the Board to protect Canadian consumers from excessive pricing.”2

“…the broad language found in subsections 83(1) and 79(2) of the Act clearly evinces an intention on the part of Parliament that it is unnecessary to go beyond the face of a patent when establishing the required nexus. The validity of this conclusion is reinforced by the fact that the Board´s statutory mandate is limited to the pricing of patented medicines. Its members have neither the experience nor the expertise to engage in the task of patent construction… the matter of patent or claims construction is a question of law to be decided by the Court. It is simply unrealistic to expect the Board to engage the services of expert witnesses for the purpose of assessing evidence proffered by parties such as ICN, and then for the Board itself to assess opposing expert evidence. Recognizing that the Board is charged with both the prosecution (through its staff) and adjudication of each case as opposed to being a neutral arbiter of evidence presented by two opposing parties, ICN´s rational connection test (based on patent construction) is impractical…”3

In order to establish the required nexus or rational connection between an invention described in a patent and a medicine, the patent must first be read as a whole and, in particular, all the claims of the patent must be examined as a whole to determine the invention the patent describes on its face. Considering the fact that the nexus can be “the merest slender thread”, the required nexus between the invention described in the patent and the medicine is easily established. For example, in many cases the patent on its face describes an invention, which makes reference to the therapeutically active ingredient found in the medicine itself. This therapeutically active ingredient is the rational connection or nexus between the invention described in the patent and the medicine, even though all of the elements of the invention described in the patent may not be found in the medicine as it currently exists. The Federal Court of Appeal in ICN noted that the chemical formulation of a therapeutically active agent found in a medicine, the generic name of this agent, and the trade or brand name of a medicine containing this agent are often all synonymous and interchangeable so that any of these names can be used to establish a rational connection or nexus between the invention described in the patent and the medicine:

“If we examine the ‘756 patent, which expired on September 28, 1993, it discloses several chemical processes to produce a substance with the chemical formulation 1-8-D-ribofuranosyl- 1,2,4-triazole-3-carboxamide. The ‘756 patent lists this chemical formulation as the preferred nucleoside of the ‘756 invention. The ‘264 describes a method for the enzymatic synthesis of the same formulation and makes explicit reference to the ‘756 patent. Neither patent, however, contains the word “ribavirin”. However, the ‘265 patent outlines several uses of the same chemical formulation, and refers to it as “Ribavirin (non-proprietary name adopted by the United States Adopted Names Council)”:

see Appeal Book, Vol. 1, at page 81. Turning to the notice of compliance and product monograph both refer to Virazole as the registered trade name for ribavirin. As is obvious, it is not difficult to establish a nexus between the two patents and the medicine being sold in Canada. For all intents and purposes, the chemical formulation outlined in the patents and the names ribavirin and Virazole are synonymous and interchangeable.”4

After the PMPRB has determined that there is a rational connection or nexus between the invention described in a patent and the medicine, the PMPRB must next examine whether the invention described in the patent is intended or capable of being used for the medicine or for the preparation or production of the medicine. [Emphasis added]. It is irrelevant whether the patent is actually being used for the medicine or for the preparation or production of the medicine. [Emphasis added]

In ICN, the Federal Court of Appeal noted that, on its face, one of the patents in issue, the ‘264 patent, described a method for the production of ribavirin, the therapeutically active agent in the medicine, Virazole. Even though, on its face, the invention described in the ‘264 patent was not “capable” of producing ribavirin in sufficient quantities for pharmaceutical application, it was “intended” to produce ribavirin and so the ‘264 patent pertained to the medicine, Virazole. The Court noted:

“On its face, the ‘264 patent does not teach that it is intended to serve solely as a research and development process or that it is only capable of producing minute quantities of ribavirin.

On its face the ‘264 patent outlines an enzymatic process which is “intended” to produce ribavirin. According to subsection 79(2) it is not necessary that a patent be “capable” of producing that chemical substance, as long as that is the “intended” result.”5

Even if the invention described in the patent is not ever used or is never intended to be used for the medicine or for the preparation or production of the medicine, it may be capable of being used for the medicine or the preparation or production of the medicine. [Emphasis added] In ICN, the Federal Court Trial Division noted that the word “capable”, in the context of the Patent Act “should not be given a meaning that is akin to “commercially feasible” or “reasonably practicable”.6 Also in the recent case of Hoechst Marion Roussel Canada Inc. v. Canada (Attorney General) [2005] F.C.J. No. 1928 (T.D.) (“Hoechst”), in which the Federal Court Trial Division affirmed and applied the three-part test set out in ICN, the Court rejected the patentee´s argument that on its face, the patent, which was for a transdermal nicotine delivery system, did not pertain to the medicine Nicoderm, because the structure of the delivery system protected by the patent was not the system used in Nicoderm. The Court noted:

“…in ICN, supra, both the Board and the trial judge concluded that whether a patentee is making use of the patent in question is irrelevant to the legal question of whether that patent “pertains” to a medicine within the meaning of the Act.”7

“On the face of the ‘689 Patent, it is clear that it is a patent for a transdermal nicotine patch, that is the type of medicine of which Nicoderm is a particular example. It is …capable of being used for medicine such as Nicoderm.”8

“… the fact that the ‘689 Patent is for a nicotine transdermal patch system, capable of being used in the drug product Nicoderm, is a sufficient connection to support the conclusion that the ‘689 Patent pertains to Nicoderm. It is irrelevant whether the ‘689 Patent is actually being used in connection with the medicine Nicoderm.”9

In light of the foregoing discussion, patentees should be aware of the fact that any patents that pertain to modified release formulations of a medicine may also pertain to regular formulations of the same medicine. Patentees should avoid making unilateral decisions as to whether a patent pertains. Rather than failing to disclose the existence of a patent based on the view that it does not pertain, patentees should advise the PMPRB as to any decisions made in this regard, as well as the reasons supporting the decision. In this regard, the Federal Court of Appeal in ICN underlined the importance for the pharmaceutical industry to be mindful of its reporting obligations under the Patent Act and its Regulations and warned patentees that where they unilaterally fail to disclose the existence of a patent on the basis that it does not pertain to a medicine, they may be undermining their credibility and that of their witnesses before the PMPRB in addition to making it more difficult for the PMPRB to fulfill its legislated mandate.10

- ICN Pharmaceuticals Inc. v. Canada (Staff of the Patented Medicine Prices Review Board) (C.A.) [for 1997] 1 F.C. 32 (ICN) at para. 57

- ICN at para. 60

- ICN at para. 61

- ICN at para. 67

- ICN at para. 63

- [1996] F.C.J. No. 206 (T.D.) at para. 23

- Hoechst Marion Roussel Canada Inc. v. Canada (Attorney General) [2005] F.C.J. No. 1928 (T.D.) (“Hoechst”) at para. 118

- Hoechst at para.119

- Hoechst at para. 120

- ICN at para. 78

Announced in the April 2006 NEWSletter, the consultation on the Board´s Excessive Price Guidelines (Guidelines) focuses on key issues regarding the review of introductory prices of patented medicines: the categorization of new drugs; introductory price tests of new drugs; and, how the Board addresses the “any market” clause of the Patent Act in the price review process. The first step of the process began on May 23 with the release for public comment of a discussion guide on these issues. Distributed to specific stakeholders as well as being posted on our Web site, written submissions are due by August 25, 2006.

The next step in the consultation will be a series of targeted meetings to take place across Canada with key stakeholders in November. Meetings are planned for Edmonton, Toronto, Montreal, Halifax and Ottawa. Their purpose is to further engage stakeholders both to better understand the issues with the current Guidelines and to explore potential options for change. A final meeting is planned for the spring of 2007, to discuss potential changes to the Guidelines.

The NPDUIS Steering Committee met in Ottawa on June 22 and 23. Face-to-Face meetings take place on a bi-annual basis to review projects already underway and to discuss new research ideas and other outstanding issues related to NPDUIS. At this meeting, Kevin Wilson, Executive Director, Drug Plan & Extended Benefits Branch at Saskatchewan Health stepped down as Chair upon completing two consecutive terms. The PMPRB would like to thank Kevin for his excellent leadership over the past several years. Olaf Koester, Director, Drug Management Policy Unit, Healthy Living and Health Programs, Manitoba Health, was elected as the new Chair. As per the NPDUIS Steering Committee terms of reference, the new Chair is elected for a period of two years.

The Pharmaceutical Trends Overview Report, 1997-1998 to 2003-2004 is available on the PMPRB Web site; Phase one of the Program Expenditure Forecasting Methodology is near completion and is currently in the approval process.

The following projects are in progress:

- Pharmaceutical Trends Overview Report, 1997-1998 to 2004-2005

- Budget Impact Analysis Guidelines

- Program Expenditure Forecasting Methodology - Phase two

- New Drug Pipeline.

On May 10, 2006, the Canadian Institute for Health Information (CIHI) released the latest edition of Drug Expenditure in Canada. This annual publication is recognized as the reference for retail spending on drugs in Canada and is based on the organization´s National Health Expenditure Database (NHEX). Data available in the NHEX database are estimates of the consumption of pharmaceuticals by Canadians, outside of the institutional setting, and represent the final price paid by Canadians, including retail and wholesale mark-ups, dispensing fees and taxes.

Providing annual estimates of drug spending made by Canadians between 1985 and 2005, this report includes updated information on national and provincial/territorial drug expenditures; international comparisons; and factors affecting drug expenditure in Canada. The report also includes analysis of drug expenditure in hospitals based on CIHI´s Canadian MIS Database.

According to CIHI´s estimates, the total spending on drugs in Canada, including prescription and non-prescription medicines is expected to have risen to $24.8 billion in 2005, representing a 10.9% increase over the forecast $22.3 billion spent the previous year, and approximately a six and a half fold increase over the $3.8 billion spent by Canadians in 1985. As a share of the total health care expenditure, the amount spent on drugs has risen from 9.5% in 1985 to an expected 17.5% in 2005. Once again, as has been the case since 1997, drug expenditures surpassed physician spending as the second largest category of health care spending after hospitals.

Of the total drug expenditure, prescription drugs is expected to account for an increasing amount of total spending, rising from 67.5% in 1985 to an estimated 83.2% in 2005. It is anticipated that the public sector will have paid for 46.0% of these expenditures. By province, CIHI estimates the proportion of prescription drugs financed by the public sector ranged from a low of 32.3% in New Brunswick to a high of 50.9% in Manitoba. Provincial drug expenditures in hospitals are separate from these figures and amount to $1.5 billion in 2003, the last year for which data are available.

When looking at individual spending, CIHI has forecast that the average Canadian spent approximately $698 in 2004 and $770 in 2005 for medications, representing an annual increase of 9.9% and 10.2% each year. Across the provinces in 2005, the per capita expenditure is expected to range from a high of $837 in Ontario to a low of $652 in British Columbia.

The PMPRB is partnered with CIHI on the assessment of public sector drug utilization and expenditures as part of the National Prescription Drug Utilization Information System (NPDUIS). The information published in Drug Expenditure in Canada is a valuable complement to this collaboration.

In June 2006, the Organization for Economic Co-operation and Development (OECD) released its annual update of health system statistics for developed countries. This year´s edition provides statistics up to the year 2004, inclusively.

The following is a brief summary of key OECD statistics for the pharmaceutical sector. It is limited to results reported for Canada and the seven countries the PMPRB considers in performing international price comparisons.

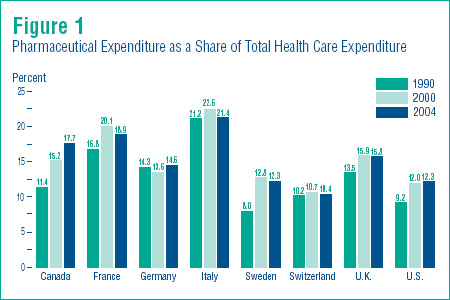

Figure 1 (on page 13) shows pharmaceutical expenditure as a share of total health care expenditure for the years 1990, 2000 and 2004.

Pharmaceutical expenditure accounted for 17.7% of total health care expenditure in Canada in 2004, up from 15.2% in 2000 and 11.4 % in 1990.

Similar increases have occurred in Germany and the United States. Interestingly, the share of pharmaceuticals fell between 2000 and 2004 in all other countries.

Figure 1 shows that the share of pharmaceuticals in overall health spending varies widely across countries, from 10.4 % in Switzerland to 21.4% in Italy. Canada´s share, at 17.7%, remains near the middle of this range.

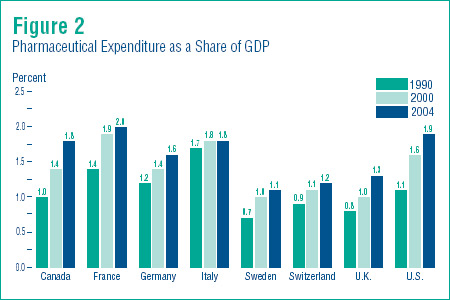

Figure 2 shows pharmaceutical expenditure as a share of national income, as measured by Gross Domestic Product (GDP). All countries spent a considerably larger portion of their national income on pharmaceuticals in 2004 than was the case in 1990. The expenditure-to-GDP ratio has also risen relative to its 2000 value. At the upper end, France, the U.S. and Italy reported ratios of 2.0%, 1.9% and 1.8%, respectively. Sweden, Switzerland and the U.K., on the other hand, all saw expenditure-to-GDP ratios of 1.1%, 1.2% and 1.3%. Canada´s ratio, at 1.8%, remains within the range of values reported for the other countries.

Critics of Canadian pharmaceutical policy often accuse this country of “free riding” on research financed by consumers elsewhere, particularly in the U.S. Based on Figure 2, this accusation seems unjustified. Proportionately speaking, Canadians turn over nearly as much of their national income to pharmaceutical expenditure as residents of the U.S.

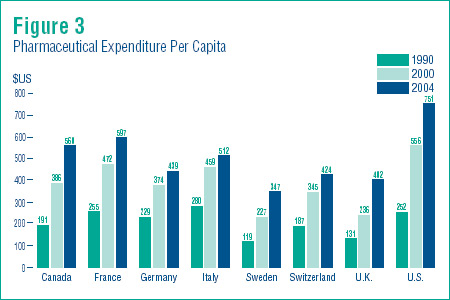

Figure 3 provides further evidence that Canada continues to pay its fair share. This shows pharmaceutical expenditure per capita in U.S. dollars for 1990, 2000 and 2004.

In 2004, only the U.S. and France spent more per person on pharmaceuticals than Canadians. Per capita expenditure was less in all other countries, and considerably less in the cases of Sweden, the U.K., and Switzerland.

As of June 30, 2006, there were 33 new DINs for human use (representing 18 medicines) reported to the PMPRB for the year 2006. Of these 33 DINs, 10 DINs (representing 7 medicines) are new active substances.

The following table presents the new active substances reported to the PMPRB during the period January to June 2006.

As of June 30, 2006

| Brand Name |

Generic Name |

Company |

Faslodex

(250 mg/syringe) |

fulvestrant |

AstraZeneca Canada Inc. |

Sativex 27/25

(52 mg/ml) |

delta-9-tethydrocannabinol/cannabidiol |

Bayer Inc. |

Thalomid

(50 mg/cap) |

thalidomide |

Celegene Corporation |

Enablex

(7.5 mg/tab, 15 mg/tab) |

darifenacin hydrobromide |

Novartis Pharma Canada Inc. |

Levemir Penfill

(100 unit/ml) |

insulin detemir |

Novo Nordisk Canada Inc. |

Macugen

(0.3 mg/vial) |

pegaptanib sodium |

Pfizer Canada Inc. |

Somavert

(10 mg/vial, 15 mg/vial, 20 mg/vial) |

pegvisomant |

Pfizer Canada Inc. |

Brand Name: Tarceva

Generic Name: erlotinib

DIN:

02269023 150 mg/tablet

02269015 100 mg/tablet

Patentee: Hoffmann-La Roche Limited, Canada

Indication - as per product monograph:

For the treatment of patients with locally advanced or metastatic cell lung cancer (NSCLC) after failure of at least one prior chemotherapy regimen, and whose EGFR expression status is positive or unknown.

Date of Issuance of First Patent(s) Pertaining to the Medicine: February 17, 2004

Notice of Compliance: July 7, 2005

Date of First Sale:

July 19, 2005 (150 mg/tablet)

July 20, 2005 (100 mg/tablet)

ATC Class:

L01XX341

Antineoplastic and Immunomodulating Agents, Antineoplastic Agents, Other Antineoplastic Agents

Application of the Guidelines

Summary

The introductory price of Tarceva 150 mg/tablet was found to be within the Guidelines because the cost of therapy did not exceed the cost of therapy of existing drugs in the therapeutic class comparison and the price did not exceed the prices in the other comparator countries where Tarceva 150 mg was sold.

The introductory price of Tarceva 100 mg/tablet was found to be within the Guidelines because its price bore a reasonable relationship to the price of Tarceva 150 mg/tablet and the price did not exceed the prices in the other comparator countries where Tarceva 100 mg was sold.

Scientific Review

The PMPRB´s Human Drug Advisory Panel (HDAP) recommended that Tarceva be reviewed as a category 3 new medicine (provides moderate, little or no therapeutic advantage over comparable medicines).

The Therapeutic Class Comparison (TCC) test of the Guidelines provides that the price of a category 3 new drug product cannot exceed the prices of other drugs that treat the same disease or condition. Comparators are generally selected from among existing drug products in the same 4th level of the Anatomical Therapeutic Chemical (ATC) System that are clinically equivalent in addressing the approved indication. See the PMPRB´s Compendium of Guidelines, Policies and Procedures for a more complete description of the Guidelines and the policies on TCCs.

The HDAP identified Taxotere (docetaxel), Alimta (pemetrexed) and Taxol (paclitaxel) as the most appropriate comparators for Tarceva. Based on clinical studies and available guidelines, these agents have proven efficacy rates in the second line treatment of advanced lung cancer after the failure of first line platinum-based therapy.

The Guidelines provide that the dosage recommended for comparison purposes will normally not be higher than the maximum of the usual recommended dosage. The recommended comparable dosage regimens for Tarceva and the comparators are based on their respective product monographs, available comparative clinical trial information as well as guidelines relevant to the subject matter.

Because Tarceva 100 mg/tablet represents titration strength for dose adjustment, a clinically equivalent therapeutic class comparison could not be established. The HDAP recommended that this strength should be compared to the 150 mg/tablet on an mg to mg basis.

Price Review

Under the Guidelines, the introductory price of a new category 3 drug product will be presumed to be excessive if it exceeds the prices of all of the comparable drug products in the TCC test, or if it exceeds the prices of the same medicine in the seven countries listed in the Patented Medicines Regulations (Regulations). The price of Tarceva 150 mg/tablet was within the Guidelines as the cost per treatment did not exceed the cost per treatment of the comparator medicines. The price of Tarceva 100 mg/tablet was within the Guidelines as the price of $53.33331 per tablet did not exceed the price of Tarceva 150 mg when compared on a mg to mg basis, as recommended by the HDAP.

Introductory Period (July to December 2005)

| Name |

Strength |

Dosage Regimen |

Cost per Treatment |

| Tarceva (erlotinib) |

150 mg/tab |

150 mg daily PO |

$1,680.00001 |

| Taxotere (docetaxel) |

80 mg/vial + 20 mg/vial |

100 mg/m2 every 3 weeks |

$1804.25252 |

| Alimta (pemetrexed) |

500 mg/vial |

500 mg/m2 every 3 weeks |

$3617.00002 |

| Taxol (paclitaxel) |

6 mg/ml |

175 mg/m2 every 3 weeks |

$ 904.34152 |

- Association québécoise des pharmaciens propriétaires (AQPP), October 2005

- IMS, December 2005

In 2005, Tarceva 150 mg/tablet and 100 mg/tablet were being sold in two of the seven countries listed in the Regulations, namely Switzerland and the United States. In compliance with the Guidelines, the prices in Canada did not exceed the range of prices in those countries; the prices of Tarceva in Canada were the lowest of those countries, below the median international price.

Where comparators and dosage regimens are referred to in the Summary Reports, they have been selected by the PMPRB Staff and the HDAP for the purpose of carrying out the PMPRB´s regulatory mandate, which is to review the prices of patented medicines sold in Canada to ensure that such prices are not excessive. The publication of these reports is also part of the PMPRB´s commitment to make its price review process more transparent.

The information contained in the PMPRB´s Summary Reports should not be relied upon for any purpose other than its stated purpose and is not to be interpreted as an endorsement, recommendation or approval of any drug nor is it intended to be relied upon as a substitute for seeking appropriate advice from a qualified health care practitioner. PMPRB PMPRB Summary Reports on New-Drugs are available on our Web site under Regulatory; Patented Medicines; Reports on New Patented Drugs for Human Use.

At the meeting, the Board:

Approved:

- The 2005 Annual Report and the Communications Plan

- The first quarterly Report on Non-Patented Prescription Drug Prices: Canadian and Foreign Price Trends

- Revised Amendments to the Patented Medicines Regulations, 1994

- Discussion Guide for the Consultations on the Board's Excessive Price Guidelines

Was briefed on:

- The mandate and activities of the Canadian Expert Drug Advisory Committee (CEDAC) by its Chairperson, Dr. Andreas Laupacis.

- Ongoing PMPRB activities:

- National Pharmaceuticals Strategy

- NPDUIS

Please forward all subscriptions to the PMPRB e-mail or mailing lists, and requests for publications to Elaine McGillivray at Elaine@pmprb-cepmb.gc.ca. For more information on our Web site, please contact our Communications Officer at pmprb@pmprb-cepmb.gc.ca.

Upcoming Events are available on our Web site under Consultations; Events.

- August 8-10

Hearing - Adderall XR

- August 21

HDAP Teleconference

- August 25

Deadline for Submissions on the Discussion Guide on the Board's Excessive Price Guidelines

- September 15

Pre-hearing conference - Concerta

- September 20

Pre-hearing conference - Copaxone

- September 27

Board Meeting

- September 28-29

Hearing - Risperdal Consta

- October 14

National Oncology Pharmacy Symposium - Dollars and Sense of Quality Cancer Care, Montréal

- October 16-19

Hearing - Airomir

- November 20

HDAP Teleconference

- November 27-29

Hearing - Risperdal Consta

- 2006 Consultations on the Board's Excessive Price Guidelines

November 2: Edmonton

November 8: Montréal

November 16: Toronto

November 28: Halifax

November 30: Ottawa

- December 6-8

Hearing - Concerta

- December 13-14

Board Meeting