ISSN : 1495-057X

N° de catalogue : H78-2013F-PDF

La version PDF

Le Conseil d'examen du prix des médicaments brevetés a pour mandat de veiller à ce que les brevetés ne vendent pas leurs médicaments brevetés au Canada à des prix excessifs ainsi que de faire rapport des tendances pharmaceutiques de tous les médicaments et des dépenses de R-D des brevetés.

Aperçu statistique de 2013

Mandat de réglementation

Conformité

- Cent-quinze (115) nouveaux produits médicamenteux brevetés pour usage humain ont fait l’objet d’un rapport au CEPMB.

- Les prix de 93 nouveaux produits médicamenteux brevetés ont été jugés conformes aux Lignes directrices.

- Au total, 1 343 nouveaux produits médicamenteux brevetés pour usage humain relevaient de la compétence du CEPMB.

Application

Jusqu’au 30 mai 2014 :

- Le Conseil a accepté 6 Engagements de conformité volontaire en vertu desquels des prix ont été réduits et des recettes excessives totalisant 10,5 millions de dollars ont été remboursées au moyen de paiements au gouvernement du Canada.

- Le Conseil a mené à terme deux audiences : Copaxone (réexamen) et Tactuo, les deux sur le prix.

- Aucune décision du Conseil n’est en attente.

- Le Conseil compte deux affaires dans son calendrier d’audiences : Apotex Inc. et Apo-Salvent exempt de CFC.

- La Cour fédérale a émis des décisions dans trois affaires : ratio-Salbutamol HFA, ratiopharm Inc. et Sandoz Canada Inc.

Mandat de rapport

Tendances observées au niveau des ventes

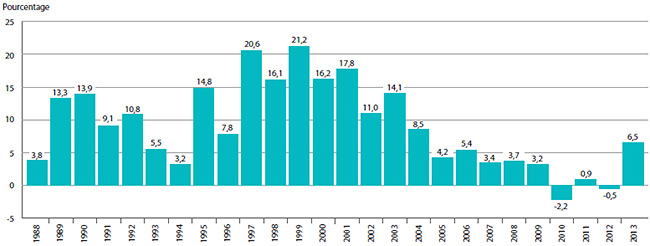

- Les ventes de produits médicamenteux brevetés ont augmenté de 6,5 %, totalisant 13,6 milliards de dollars.

- La part des ventes de produits médicamenteux brevetés exprimée en pourcentage de la valeur de l’ensemble des ventes a augmenté, passant de 59,3 % en 2012 à 61,8 % en 2013.

- Les agents antinéoplasiques et les agents immunomodulateurs ont le plus contribué à l’accroissement des ventes.

Tendances observées au niveau des prix des produits médicamenteux brevetés

- Les prix départ-usine des produits médicamenteux brevetés, mesurés à l’aide de l’indice des prix des médicaments brevetés, ont augmenté de 0,5 % en moyenne, alors que l’indice des prix à la consommation augmenté de 0,9 %.

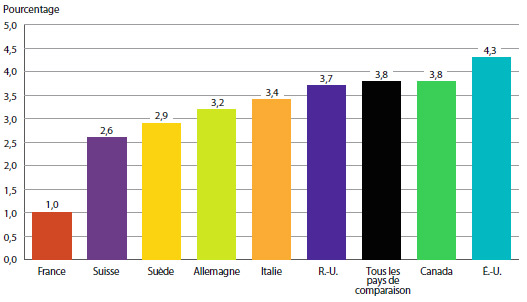

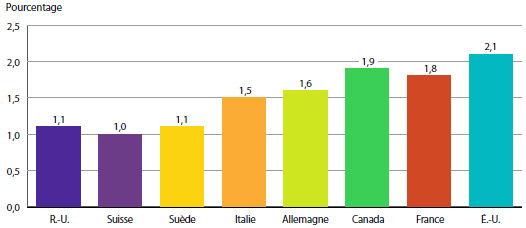

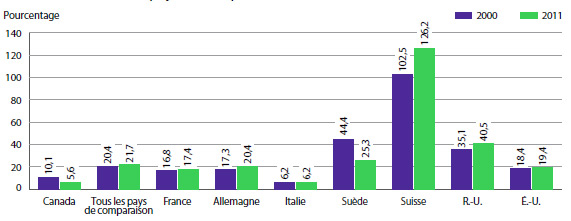

- Les prix au Canada des produits médicamenteux brevetés se situaient au troisième rang des prix les plus élevés par rapport aux prix pratiqués dans les sept pays de comparaison, moins élevés que les prix pratiqués en Allemagne et aux États-Unis.

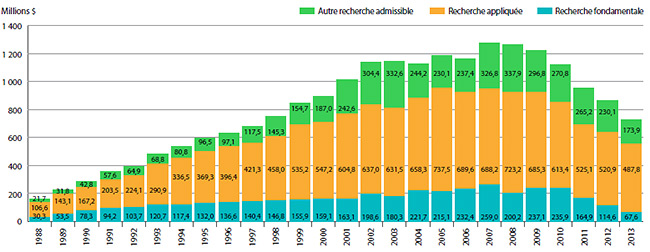

Recherche-développement

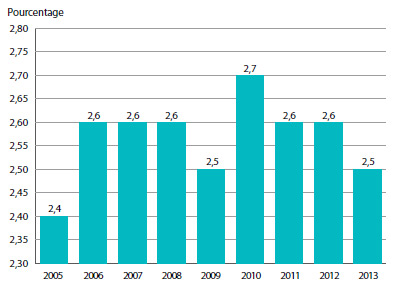

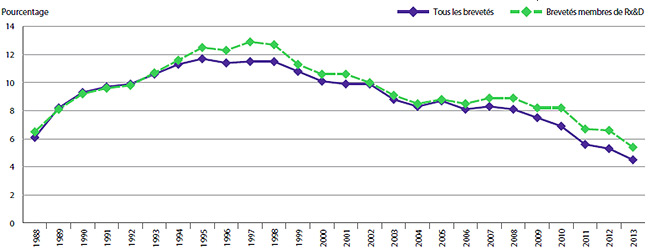

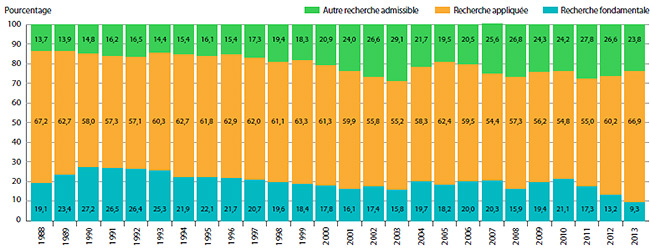

- Les brevetés ont fait rapport de dépenses de R-D totalisant 752,8 millions de dollars, ce qui représente un recul de 15,9 % par rapport à 2012.

- Les brevetés membres de Rx&D ont fait rapport de dépenses de R-D totalisant 652,0 millions de dollars, ce qui représente un recul de 16,7 % par rapport à 2012.

- Les ratios des dépenses de R-D par rapport aux recettes tirées des ventes ont enregistré un recul en 2013 :

- Chez tous les brevetés, le ratio est passé de 5,3 % en 2012 à 4,5 %.

- Chez les brevetés membres de Rx&D, le ratio est passé de 6,6 % en 2012 à 5,4 %.

Lettre à la Ministre

Le 30 mai 2014

L'honorable Rona Ambrose, C.P., députée

Ministre de la Santé

Chambre des communes

Ottawa (Ontario)

K1A 0A6

Madame la ministre,

J'ai le plaisir de vous présenter, conformément aux articles 89 et 100 de la Loi sur les brevets, le Rapport annuel du Conseil d'examen du prix des médicaments brevetés pour l'exercice terminé le 31 décembre 2013.

Croyant le tout conforme, je vous prie d'agréer, Madame la ministre, l'assurance de mes sentiments distingués.

Mary Catherine Lindberg

Présidente

Message de la présidente

À la lumière de notre 25e anniversaire, la dernière année a marqué l'aube d'une nouvelle ère en ce qui concerne l'historique des rapports du CEPMB. Au moment où nous nous tournons vers l'avenir, il paraît évident que notre organisme devra composer avec de multiples évolutions concurrentes. Les responsables de la réglementation et les intervenants de l'industrie pharmaceutique ont rarement eu la chance de témoigner d'une période si intéressante. Bien sûr, il peut s'agir d'une bénédiction ou d'une malédiction, selon la perspective adoptée. Au CEPMB, toutefois, nous sommes du premier avis, et c'est dans cette optique que nous cherchons à rapprocher les liens parfois très écartés au sein de notre environnement afin d'établir nos priorités stratégiques en vue des prochaines années.

Au cours des dernières années, nous avons observé une très faible croissance des dépenses relatives aux médicaments d'ordonnance au Canada, une tendance tout à fait opposée à celle observée à la fin des années 1990 et au début des années 2000. En effet, les dépenses relatives aux médicaments ont affiché une croissance de seulement 2,3 % en 2012, et ce taux était de 1,3 % l'année précédente, soit le plus faible taux observé depuis des décennies. Les experts s'entendent pour dire que cette tendance découle principalement des initiatives récentes d'achats groupés par les provinces, de l'arrivée à échéance des brevets d'un nombre important de « médicaments vedettes » et de la réduction du taux de lancement de nouveaux médicaments de ce type. Les avis sont toutefois plus partagés sur la question de savoir s'il s'agit d'une tendance à court ou à long terme, et sur l'incidence éventuelle de la population vieillissante au Canada et de la récente émergence de médicaments onéreux dans certaines catégories thérapeutiques quant à la viabilité des régimes privés et publics d'assurance-médicaments pour l'avenir.

Comme l'on peut s'y attendre, les dépenses relatives aux médicaments brevetés ont suivi cette tendance générale au cours des dernières années, bien que l'augmentation de 6,5 % observée pour l'année de rapport à l'étude contraste vivement avec la diminution de 0,3 % observée pour l'année précédente. Malgré les dernières tendances en faveur de la stabilisation, la croissance des ventes de médicaments brevetés au Canada continue de dépasser la croissance au sein des pays de comparaison nommés dans le Règlement, sauf les États-Unis. De même, les prix des médicaments brevetés au Canada se situent actuellement au troisième rang parmi les pays de comparaison, à presque égalité avec l'Allemagne. Alors que les prix augmentent, le ratio de R-D est à la baisse, représentant actuellement 5,4 % pour tous les brevetés, soit le plus faible taux depuis avant l'adoption du projet de loi C-22. Même si le Canada prend plusieurs mesures pour aborder les coûts des médicaments d'ordonnance, il en va de même pour la plupart des pays auxquels nous comparons les prix et la R-D. Il est essentiel de surveiller de près les évolutions au pays et à l'étranger afin de s'assurer que nos règlements, nos lignes directrices et nos procédures opérationnelles demeurent pertinents et efficaces.

Les éléments susmentionnés nous aideront à définir nos priorités stratégiques en vue de l'avenir. Or, au cours de la dernière année, nous nous sommes concentrés sur l'amélioration de nos programmes en surveillant l'incidence des modifications apportées aux Lignes directrices et sur la publication d'études qui font état des dernières tendances du marché et qui tiennent compte des intérêts immédiats des payeurs publics et privés. Nous avons également poursuivi nos activités de liaison, élargi et diversifié nos échanges avec les intervenants et participé de façon plus active aux consultations avec nos partenaires fédéraux, provinciaux et internationaux.

En cadrant avec le Plan d'action pour la réduction du fardeau administratif du gouvernement, nous avons achevé un processus de consultation sur des initiatives proposées pour réduire le fardeau réglementaire. Par conséquent, nous avons simplifié la méthodologie de rajustement du prix selon l'indice des prix à la consommation (IPC). La méthodologie simplifiée entrera en vigueur en 2015. De plus, nous avons proposé des modifications au Règlement sur les médicaments brevetés afin de faire la transition vers un seul dépôt annuel au lieu de deux, et nous envisageons la prépublication des modifications proposées dans la Partie I de la Gazette du Canada cette année, aux fins de consultation officielle.

À la veille de la publication du présent rapport, nous avons appris que la Cour fédérale avait rendu ses décisions dans les affaires de ratiopharm et de Sandoz. Comme c'est le cas pour toute nouvelle jurisprudence, nous examinerons attentivement l'incidence éventuelle de ces décisions quant à la compétence et au mandat du Conseil, et nous continuerons à collaborer étroitement avec le Bureau du procureur général en cas de recours.

Malgré tous ces nouveaux défis et enjeux, nous continuons à prioriser la protection des intérêts des consommateurs, tout en reconnaissant la valeur des médicaments novateurs pour les patients. Cela ne sera rendu possible que grâce aux efforts de collaboration et au dévouement des membres du Conseil et de son personnel.

Enfin, il serait négligent de ma part de ne pas prendre le temps de reconnaître les cadres clés du CEPMB qui ont récemment quitté l'organisme ou qui ont pris leur retraite cette année, notamment Martine Richard, avocate générale, ainsi que Catherine Lombardo, Béatrice Mullington et Anna Chodos de la Direction de la réglementation et de la liaison auprès des brevetés. On peut qualifier ces dernières de fonctionnaires au sens le plus noble du terme, et cette affirmation s'applique tout particulièrement à Sylvie Dupont, notre Directrice du Secrétariat du Conseil et communications de longue date, qui a été l'une des premières employées du CEPMB. Éternelle professionnelle jusqu'au bout des ongles, Sylvie a diligemment tenté, sans toutefois réussir, de me déconseiller de la mentionner dans le présent rapport annuel puisque ce serait « sans précédent ». J'exerce alors ma prérogative de présidente, à cette occasion exceptionnelle, afin d'exprimer nos sentiments de profonde gratitude à Sylvie pour son dévouement et tous les excellents conseils qu'elle a su fournir, à moi et à mes prédécesseurs, au cours de ses nombreuses années de service. Sylvie, tu nous manqueras. À toutes celles qui nous ont quittés, nous tenons à vous remercier de votre long service dévoué et nous vous souhaitons une longue et heureuse retraite bien méritée.

Au nom de mes collègues, je réaffirme notre engagement à assurer l'exécution efficace du mandat du CEPMB au service de la population canadienne.

Mary Catherine Lindberg

Le Conseil d’examen du prix des médicaments brevetés

Le Conseil d'examen du prix des médicaments brevetés (CEPMB) est un organisme indépendant qui détient des pouvoirs quasi judiciaires. Il a été créé par le Parlement en 1987 en vertu de la Loi sur les brevets.

Le CEPMB protège les intérêts des Canadiens en s'assurant que les produits médicamenteux brevetés ne sont pas vendus au Canada à des prix excessifs. Il le fait en examinant les prix auxquels les brevetés vendent les produits médicamenteux brevetés sur les marchés canadiens. Si un prix semble être excessif, le Conseil peut tenir des audiences publiques et ordonner la réduction des prix et (ou) le remboursement des recettes excessives. Le CEPMB doit également déclarer les tendances observées au niveau des ventes de produits pharmaceutiques et de l'établissement des prix pour tous les médicaments, ainsi que les dépenses de recherche-développement (R-D) des brevetés.

Le ministre de la Santé est responsable de l'application des dispositions de la Loi sur les brevets (la Loi) formulées aux articles 79 à 103. Le CEPMB fait partie du portefeuille de la Santé, qui est également constitué de Santé Canada, de l'Agence de la santé publique du Canada, des Instituts de recherche en santé du Canada et de l'Agence canadienne d'inspection des aliments. Le portefeuille de la Santé aide le ministre de la Santé à maintenir et à améliorer la santé des Canadiens.

Même s'il fait partie du portefeuille de la Santé, le CEPMB exerce son mandat en toute indépendance vis-à-vis du ministre de la Santé. Le CEPMB fonctionne également d'une façon indépendante des autres organismes, à savoir Santé Canada, qui autorise la vente des médicaments au Canada après avoir vérifié leur innocuité, leur efficacité et leur qualité; les régimes publics fédéral, provinciaux et territoriaux d'assurance-médicaments qui autorisent l'inscription des médicaments sur leurs formulaires de médicaments admissibles à un remboursement; et le Programme commun d'examen des médicaments, géré par l'Association canadienne des médicaments et des technologies de la santé, qui évalue l'efficience des médicaments avant leur inscription sur les formulaires des régimes publics d'assurance-médicaments participants.

Compétence

Réglementation

Le CEPMB vérifie les prix auxquels les brevetés vendent leurs produits médicamenteux brevetés pour usage humain ou pour usage vétérinaire distribués sous ordonnance ou en vente libre au Canada, afin de s'assurer qu’ils ne sont pas excessifs. Cela comprend les ventes aux grossistes, aux hôpitaux, aux pharmacies et autres clients pour usage humain ou pour usage vétérinaire. Le CEPMB réglemente le prix de chaque médicament breveté. Cela comprend chaque concentration et chaque forme posologique finale de tout médicament.

La compétence du Conseil ne s'applique pas exclusivement aux produits médicamenteux dont le brevet porte sur l'ingrédient actif, mais aussi aux médicaments auxquels un brevet est lié, que ce soit au niveau de son procédé de fabrication, de son mode d'administration, de sa forme posologique, de l'indication/utilisation, de la préparation ou autre.

Les produits médicamenteux brevetés ne sont pas par définition exclusivement des produits de marque. En effet, certains fabricants de produits génériques sont assujettis à la compétence du Conseil du fait qu'ils vendent en vertu d'une licence d'exploitation le même produit que le produit de marque ou, encore, qu'ils sont titulaires d'un brevet visant le procédé de conditionnement ou de traitement de produits génériques.

Le CEPMB n'est pas habilité à réglementer les prix des médicaments non brevetés et n'a aucun droit de regard sur les prix auxquels les grossistes et les pharmacies vendent les médicaments ni sur les honoraires des pharmaciens. La distribution, l'ordonnance et le remboursement des médicaments échappent aussi à sa compétence.

En vertu de la Loi, les brevetés doivent informer le CEPMB de leur intention de vendre un nouveau produit médicamenteux breveté. Après leur première vente, les brevetés doivent faire rapport au CEPMB du prix de vente de leur produit médicamenteux et de la quantité vendue. Par la suite, à la fin de chaque semestre, ils doivent faire rapport des prix et des ventes au Canada des différentes concentrations de leurs produits médicamenteux.

Même s’ils ne sont pas tenus de faire approuver au préalable les prix de vente de leurs produits médicamenteux, les brevetés doivent respecter à la lettre les dispositions de la Loi pour s’assurer que les prix auxquels ils vendent leurs produits médicamenteux au Canada ne sont excessifs. Lorsque, à l’issue d’une audience publique, il apparaît que le prix d’un produit médicamenteux vendu sur un marché canadien est excessif, le Conseil peut rendre une ordonnance qui oblige le breveté à réduire le prix de son produit médicamenteux et à appliquer les mesures qui lui sont dictées pour rembourser les recettes excessives qu’il a encaissées.

Rapport

Chaque année, le CEPMB rend compte de ses activités au Parlement par le truchement du ministre de la Santé. Le rapport annuel présente une analyse des tendances relatives à la vente et aux prix de tous les produits médicamenteux et fait rapport des dépenses de R-D des brevetés.

Au moyen de l’initiative du Système national d’information sur l’utilisation des médicaments prescrits (SNIUMP), le CEPMB effectue des analyses critiques des tendances des prix des produits médicamenteux d’ordonnance, de l’utilisation faite de ces produits et des coûts en produits médicamenteux au Canada. Les résultats de ces analyses éclairent le processus de décision des régimes d’assurance-médicaments fédéraux, provinciaux et territoriaux participants.

Gouvernance

Le Conseil est composé d’au plus cinq membres siégeant à temps partiel, dont un président et un vice-président. Tous les membres du Conseil sont nommés par le gouverneur en conseil. En vertu de la Loi, le président du Conseil assume également les fonctions de chef de la direction et, en cette qualité, est chargé de la gouverne et de la supervision des activités du CEPMB.

Les membres du Conseil, y compris le président, sont collectivement responsables de la mise en oeuvre des dispositions applicables de la Loi. Ensemble, ils établissent les lignes directrices, les règles, les règlements administratifs et les autres politiques du Conseil, comme le prévoit la Loi et consultent au besoin des intervenants, y compris les ministres provinciaux et territoriaux de la Santé et les représentants de groupes de consommateurs, l’industrie pharmaceutique et d’autres personnes.

En date du 30 mai 2014, il y avait un seul poste vacant au Conseil.

Membres du Conseil

Présidente

Mary Catherine Lindberg,

B. Sc. Pharm.

Mary Catherine Lindberg a d’abord été nommée membre et vice-présidente du Conseil d’examen du prix des médicaments brevetés en juin 2006. Le 19 mai 2010, Mme Lindberg assumait les fonctions de la présidence pendant la vacance du poste. Elle a été officiellement nommée présidente du Conseil le 3 mars 2011.

Mme Lindberg a occupé de 2002 à 2009 le poste de directrice exécutive du Ontario Council of Academic Hospitals, un regroupement de 25 hôpitaux universitaires affiliés à une université et à sa faculté de médecine. Avant d’occuper ce poste, Mme Lindberg était sous-ministre adjointe des Services de santé, au ministère de la Santé et des Soins de longue durée de l’Ontario. Elle s’occupait entre autres du Régime d’assurance-maladie de l’Ontario et des Programmes de médicaments.

Mme Lindberg a fait ses études en pharmacie à l’Université de la Saskatchewan et a son permis de pratique en Saskatchewan et en Ontario.

Vice-président

Mitchell Levine,

B. Sc., M. Sc., M.D., FRCPC, FISPE

Le Dr Mitchell Levine a été nommé membre et vice-président du Conseil le 3 mars 2011.

Le Dr Levine est professeur au sein des départements de médecine et d’épidémiologie clinique et biostatistiques à la faculté des sciences de la santé de l’Université McMaster à Hamilton, en Ontario. Il est également directeur du Centre for Evaluation of Medicines à St. Joseph’s Healthcare, à Hamilton.

Le Dr Levine a obtenu son diplôme en médecine à l’Université de Calgary en 1979, qui a été suivi d’études supérieures en médecine interne (FRCPC) et en pharmacologie clinique à l’Université de Toronto (de 1981 à 1987). Il a obtenu un diplôme de maîtrise ès sciences en épidémiologie clinique de l’Université McMaster en 1988.

Avant sa nomination au Conseil, le Dr Levine était membre du Groupe consultatif sur les médicaments pour usage humain du CEPMB. Il agit comme consultant spécial en pharmacologie clinique au ministère de la Santé et des Soins de longue durée de l’Ontario. De plus, il est rédacteur en chef du Journal de la thérapeutique des populations et de la pharmacologie clinique et est corédacteur de l’ACP Journal Club: Evidence-Based Medicine.

Membres

Normand Tremblay,

ASC, M. Sc., Adm. A., C.M.C.

Normand Tremblay a été nommé membre du Conseil le 31 mai 2012.

M. Tremblay enseigne la gestion stratégique à l’Université du Québec à Trois-Rivières. Il fait bénéficier le Conseil d’une vaste expérience en planification stratégique et opérationnelle.

M. Tremblay a siégé comme membre au Conseil national de recherches du Canada de 2007 à 2010. Il est membre de l’Ordre des administrateurs agréés du Québec.

Richard Bogoroch, LL. B.

Richard Bogoroch a été nommé membre du Conseil le 13 décembre 2012.

M. Bogoroch est le fondateur et directeur associé de Bogoroch & Associates LLP, le successeur de Bogoroch and Associates, un cabinet d’avocats spécialisé en litige civile établi à Toronto en novembre 1999. Bogoroch & Associates LLP exerce principalement en litige lié aux blessures personnelles graves, à la mort dommageable, à la faute médicale, à la responsabilité des produits et aux réclamations d’invalidité.

M. Bogoroch a obtenu un B. C.L. en 1978 et un LL. B en 1979 de l’Université McGill. Il a été reçu au Barreau de l’Alberta en 1980 et appelé au Barreau de l’Ontario en 1983. Richard a complété son stage à Thomson Rogers et, suite à son appel au Barreau en 1983, s’est joint au cabinet. En 1993, il a été certifié en tant que spécialiste en contentieux civil par le Barreau du Haut-Canada. Il a agi à titre d’associé au cabinet Thomson Rogers de 1987 à 1999. M. Bogoroch est ancien directeur de l’Ontario Centre for Advocacy Training et de l’Advocates’ Society. Il est également ancien président de de l’Association du Barreau canadien – comité provincial de l’Ontario sur le pouvoir judiciaire. M. Bogoroch a donné de nombreux exposés et écrit bon nombre de documents sur les diverses facettes du contentieux du dommage corporel dans le cadre des programmes de formation juridique permanente offerts par l’Advocates’ Society, le Barreau du Haut-Canada, l’Association du Barreau de l’Ontario, l’Ontario Trial Lawyers Association, l’Institut canadien, l’Osgoode Hall Law School, Insight, et autres. Depuis 1999, il est professeur invité dans le cadre de l’atelier intensif en techniques de plaidoirie à la Osgoode Hall Law School. De 2011 à 2014, il a présidé ou co-présidé le programme annuel du programme de formation permanente d’Osgoode sur le droit de préjudice personnel. Depuis 2011, il co-préside le programme « Tricks of the Trade » de l’Advocates’ Society, son programme annuel de formation juridique permanente sur le droit de préjudice personnel.

M. Bogoroch a été reconnu par LEXPERT en tant qu’avocat de premier rang en droit du préjudice personnel et a été nommé parmi les « meilleurs avocats » en litige en matière de préjudice personnel.

Structure organisationnelle et personnel

Directeur exécutif

Le directeur exécutif avise le Conseil, supervise le travail du personnel et en assume le leadership.

Réglementation et liaison auprès des brevetés

La Direction de la réglementation et de la liaison auprès des brevetés fait l’examen des prix des produits médicamenteux brevetés vendus au Canada pour s’assurer qu’ils ne sont pas excessifs. De plus, elle encourage les brevetés à se conformer volontairement aux Lignes directrices du Conseil, veille à la bonne application des politiques de conformité et fait enquête sur les plaintes reçues concernant les prix de certains produits médicamenteux brevetés. De plus, la Direction sensibilise les brevetés sur les Lignes directrices du Conseil et les informe de leurs obligations en matière de présentation de rapports.

Politiques et analyse économique

La Direction des politiques et de l’analyse économique formule lorsqu’il y a lieu des conseils stratégiques concernant les changements qui pourraient être apportés aux Lignes directrices et à d’autres politiques du Conseil. Elle effectue des recherches, ainsi que des analyses des tendances des prix des produits médicamenteux, et en présente les résultats dans des rapports. Enfin, elle effectue les études à l’appui des activités de conformité et d’application et les études que lui commande le ministre de la Santé.

Services généraux

La Direction des services généraux offre conseils et services en matière de gestion des ressources humaines, des installations, de la santé et sécurité au travail, de la technologie et de la gestion de l’information. Elle s’occupe également de la planification stratégique et financière de même que des rapports, des vérifications, de l’évaluation et de la liaison auprès des agences centrales fédérales compétentes.

Secrétariat du Conseil et communications

La Direction du Secrétariat du Conseil et des communications planifie et orchestre le programme des communications du CEPMB, les relations avec les médias, le suivi aux demandes de renseignements du grand public et le processus relatif aux plaintes officielles. Elle gère les réunions et les audiences du Conseil, dont les dossiers de procédure. Ils coordonnent les activités du Conseil relatives à l’application de la Loi sur l’accès à l’information et de la Loi sur la protection des renseignements personnels.

Avocate générale

L’avocate générale fournit des opinions juridiques au CEPMB et dirige l’équipe de la poursuite dans les audiences du Conseil.

Budget

En 2013-2014, le Conseil disposait d’un budget de 10,944 millions de dollars et d’un effectif approuvé de 74 équivalents temps plein (ETP).

Tableau 1 Budget et effectif 2012

| |

2012-2013 |

2013-2014 |

2014-2015 |

| * L’affectation à but spécial est réservée aux coûts externes liés à la tenue d’audiences publiques (conseillers juridiques, témoins experts, etc.). Les fonds non dépensés sont retournés au Trésor. |

| Budget |

11,058 M$ |

10,944 M$ |

10,927 M$ |

| Salaires |

7,034 M$ |

6,920 M$ |

6,903 M$ |

| Opérations |

1,554 M$ |

1,554 M$ |

1,554 M$ |

| Affectation à but spécial* |

2,470 M$ |

2,470 M$ |

2,470 M$ |

| ETP |

76 |

74 |

73 |

Communications et liaison auprès des brevetés

Le programme des communications est responsable de la planification et de la gestion des communications externes du CEPMB. Il assure également la visibilité de l’organisme et la participation des intervenants. Des renseignements sont échangés sous diverses formes et au moyen de différents supports, avec les consommateurs, les partenaires provinciaux et territoriaux, l’industrie et d’autres intervenants. Les principales activités du programme comprennent, entre autres, les relations avec les médias, répondre aux demandes de renseignements du public, et renseigner le public par la publication de mises à jour sur les audiences devant le Conseil et les décisions du Conseil et de résultats de recherche.

Le groupe des Communications cherche tout particulièrement à adapter le CEPMB aux nouvelles exigences de son environnement opérationnel, en évaluant son efficacité et en envisageant constamment des produits de communication de rechange.

À titre de source fiable et impartiale de renseignements exhaustifs et exacts sur les prix des médicaments, le CEPMB s’engage à développer et à entretenir de façon continue une collaboration avec ses intervenants.

Les intervenants de l’industrie sont consultés et informés de tout changement de l’environnement opérationnel et sont rapidement informés de toute mise à jour au processus de réglementation. Afin de faciliter l’accès à l’information, la Direction de la réglementation et de la liaison auprès des brevetés tient régulièrement des séances d’information à l’intention des brevetés.

Publications

Outre ses publications régulières, dont le Rapport annuel et le bulletin d’information trimestriel La Nouvelle, le CEPMB publie des rapports de recherche du SNIUMP en réponse aux exigences de programme ou de l’organisme.

Le CEPMB publie ses documents uniquement en format électronique dans le but de réduire les coûts et l’incidence environnementale de l’imprimerie. Il compte davantage sur son site Web et les médias sociaux à des fins de collaboration avec ses intervenants. Le CEPMB est toujours résolu à réaliser son mandat de façon ouverte et transparente.

Réglementation des prix des médicaments brevetés

Le CEPMB protège les intérêts des consommateurs canadiens en s’assurant que les produits médicamenteux brevetés ne sont pas vendus au Canada à des prix excessifs. Il le fait en examinant les prix auxquels les brevetés vendent chaque produit médicamenteux breveté sur les marchés canadiens aux grossistes, aux hôpitaux et aux pharmacies.

Exigences en matière de rapport

Les brevetés sont tenus par la loi de produire des renseignements relatifs à la vente de leurs produits médicamenteux au Canada. La Loi sur les brevets (la Loi) et le Règlement sur les médicaments brevetés (le Règlement) dictent les rapports que doivent soumettre les brevetés, et le personnel du Conseil examine de façon continue les renseignements sur les prix afin de s’assurer que les prix ne sont pas excessifs, et ce, jusqu’à échéance de tous les brevets applicables.

Il existe divers facteurs servant à déterminer si le prix d’un produit médicamenteux est excessif, comme l’énonce l’article 85 de la Loi. Le Compendium des politiques, des Lignes directrices et des procédures (les Lignes directrices) fournit des renseignements sur les tests appliqués aux prix pour décider si le prix auquel un breveté vend son produit est inférieur au prix maximal permis. Les Lignes directrices ont été élaborées en collaboration avec les intervenants, dont les ministres de la Santé provinciaux et territoriaux, les associations de consommateurs et l’industrie pharmaceutique. Lorsqu’à l’issue d’une enquête, on juge qu’il y a un problème relativement au prix d’un produit médicamenteux breveté, on offre au breveté la possibilité de réduire volontairement son prix et (ou) de rembourser ses recettes excessives aux termes des modalités d’un Engagement de conformité volontaire. Si le breveté ne souscrit pas aux résultats de l’enquête et choisit de ne pas présenter un Engagement, le président du Conseil peut émettre un Avis d’audience. Après l’audition de la preuve, si le Conseil conclut que le prix est excessif, il peut rendre une ordonnance obligeant le breveté à réduire le prix de son produit et (ou) à rembourser les recettes excessives. Le breveté peut également soumettre un Engagement de conformité volontaire après l’émission d’un Avis d’audience afin de résoudre l’affaire. Des copies de la Loi, du Règlement, des Lignes directrices et du Guide du breveté sont affichées sur le site Web du CEPMB.

Défaut de présenter ses rapports

Le CEPMB compte sur la ponctualité des brevetés en ce qui a trait à la présentation de leurs rapports sur tous les produits médicamenteux brevetés qu’ils vendent au Canada auxquels un brevet s’applique. En 2013, cinq produits médicamenteux ont été déclarés au CEPMB pour la première fois, même s’ils avaient été brevetés et vendus avant 2013. De plus, trois produits médicamenteux déclarés antérieurement au CEPMB et dont le brevet était arrivé à échéance, ont de nouveau été déclarés comme ayant un brevet applicable.

Le tableau 2 présente les produits médicamenteux qui étaient brevetés et vendus au Canada avant de faire l’objet d’un rapport au CEPMB.

Tableau 2 Défaut de présenter ses rapports sur les ventes de produits médicamenteux brevetés

| Breveté |

Nom de marque |

Nom générique |

Année où le médicament est devenu assujetti à la compétence du Conseil |

Année où le médicament est devenu assujetti à la compétence du Conseil et dont le brevet était nouveau |

| Alcon Canada Inc. |

Triesence |

Acétonide de triamcinolone |

2012 |

|

| CSL Behring |

Fibrogammin |

Facteur XIII (humain) |

1997 |

|

| GlaxoSmithKline Inc. |

Arixtra |

Fondaparinux |

|

2007 |

| Novartis Pharmaceuticals Canada Inc. |

Lamisil |

Hydrochloride de terbinafine |

|

2005 |

| Paladin Laboratories Inc. |

GlucaGen |

Glucagon |

2010 |

|

| Paladin Laboratories Inc. |

GlucaGen HypoKit |

Glucagon |

2010 |

|

| Sanofi-aventis Canada Inc. |

Deflazacort |

Deflazacort |

2006 |

|

| Sanofi pasteur Limited |

Adacel-Polio |

Vaccin DaPT-IPV |

|

2011 |

Défaut de présenter les données sur les prix et sur les ventes (Formulaire 2)

Le défaut de présenter ses rapports fait référence au défaut partiel ou complet d’un breveté de présenter les rapports qu’il est tenu de présenter en vertu de la Loi et du Règlement. Le Conseil n’a pas été appelé à rendre des ordonnances pour défaut de présenter ses rapports en 2013.

Examen scientifique

Groupe consultatif sur les médicaments pour usage humain

Tous les nouveaux produits médicamenteux brevetés ayant fait l’objet d’un rapport au CEPMB sont soumis à une évaluation scientifique dans le cadre du processus d’examen du prix. Le Groupe consultatif sur les médicaments pour usage humain (GCMUH) a été créé par le Conseil dans le but d’offrir une expertise et des conseils indépendants au personnel du Conseil. Le GCMUH entreprend un examen lorsqu’un breveté présente une demande relative à l’amélioration thérapeutique. De plus, les membres du groupe examinent et évaluent les renseignements scientifiques pertinents et disponibles, notamment toute preuve présentée par le breveté quant au niveau d’amélioration thérapeutique proposé, le choix de produits médicamenteux aux fins de comparaison et les posologies comparables.

Examen du prix

Le CEPMB examine le prix moyen de chaque concentration et chaque forme posologique d’un médicament breveté. Dans la plupart des cas, cette unité est conforme au numéro d’identification du médicament (DIN) attribué par Santé Canada au moment où la vente au Canada du médicament est approuvée.

Nouveaux produits médicamenteux brevetés ayant fait l’objet d’un rapport au CEPMB en 2013

Aux fins du présent rapport, tout produit médicamenteux breveté lancé ou vendu sur le marché canadien avant l’attribution de son premier brevet entre le 1er décembre 2012 et le 30 novembre 2013 est réputé avoir été breveté en 2013.

Il y avait 115 nouveaux produits médicamenteux brevetés pour usage humain ayant été rapportés comme vendus en 2013. Certains constituent une ou plusieurs concentrations d’une nouvelle substance active et d’autres, de nouvelles présentations de médicaments existants. Dix (8,7 %) des 115 nouveaux produits médicamenteux brevetés ont été commercialisés au Canada avant d’avoir obtenu un premier brevet canadien qui les aurait automatiquement assujettis à la compétence du CEPMB. Le tableau 3 indique l’année de la première commercialisation de ces produits médicamenteux.

Tableau 3 Nombre de nouveaux produits médicamenteux brevetés pour usage humain en 2013 selon l’année de leur première vente

| Année de la première vente |

Nbre de produits médicamenteux |

| 2013 |

105 |

| 2012 |

4 |

| 2011 |

2 |

| 2006 |

1 |

| 2000 |

3 |

| Total |

115 |

La liste des nouveaux produits médicamenteux brevetés ayant fait l’objet d’un rapport au CEPMB est mise à jour chaque trimestre et affichée sur le site Web sous la rubrique « Réglementation des prix ». Cette liste présente de l’information sur l’état d’avancement de l’examen (p. ex. la question de savoir si le prix du médicament est sous examen, conforme aux Lignes directrices, sous enquête ou assujetti à un Engagement de conformité volontaire ou à un Avis d’audience).

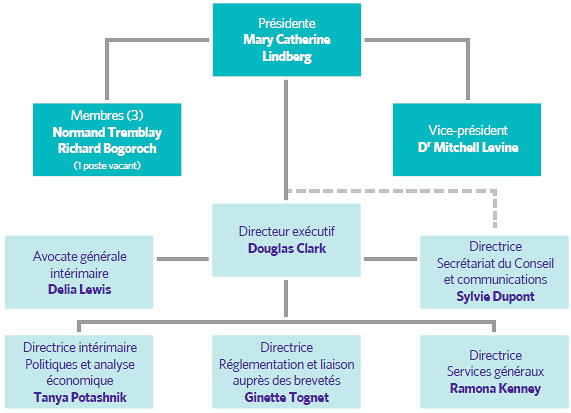

Le graphique 1 illustre le nombre de nouveaux produits médicamenteux brevetés pour usage humain ayant fait l’objet d’un rapport au CEPMB de 1989 à 2013.

Des 115 nouveaux produits médicamenteux brevetés :

- les prix de tous les produits médicamenteux brevetés ont été soumis à un examen :

- les prix de 93 produits médicamenteux brevetés ont été jugés conformes aux Lignes directrices;

- les prix de 7 produits médicamenteux brevetés semblaient excessifs aux termes des Lignes directrices d’un montant ne justifiant pas d’enquête;

- les prix de 15 produits médicamenteux brevetés semblaient excessifs aux termes des Lignes directrices; ainsi, des enquêtes ont été lancées.

Pour la liste complète des 115 nouveaux produits médicamenteux brevetés, y compris l’état d’avancement de l’examen de leur prix, consultez l’Annexe 2.

GRAPHIQUE 1 Nouveaux produits médicamenteux brevetés pour usage humain

Source : CEPMB

Examen des prix des produits médicamenteux brevetés existants pour usage humain en 2013

Aux fins du présent rapport, l’expression « produits médicamenteux brevetés existants » désigne tous les produits médicamenteux brevetés vendus sur le marché canadien et ayant fait l’objet d’un rapport au CEPMB avant le 1er décembre 2013.

Au moment de la rédaction du présent rapport, il y avait 1 228 produits médicamenteux brevetés existants :

- les prix de 1 005 produits médicamenteux brevetés étaient conformes aux Lignes directrices;

- les prix de 157 produits médicamenteux brevetés étaient excessifs aux termes des Lignes directrices d’un montant ne justifiant pas d’enquête;

- les prix de 51 produits médicamenteux brevetés existants faisaient l’objet d’une enquête :

- 9 enquêtes provoquées par le prix de lancement en 2012;

- 42 enquêtes lancées en fonction des prix annuels.

- les prix de 2 produits médicamenteux étaient sous enquête;

- les prix de 13 produits médicamenteux étaient visés par un Engagement de conformité volontaire;

- 1 autre produit médicamenteux fait toujours l’objet d’une audience, même s’il n’était plus breveté en 2013.

Un aperçu de l’état d’avancement de l’examen en 2013 du prix des produits médicamenteux brevetés pour usage humain nouveaux et existants est présenté au tableau 4.

Tableau 4 Produits médicamenteux brevetés pour usage humain vendus au Canada en 2013 – État d’avancement de l’examen du prix en date du 31 mars 2014

|

Nouveaux produits médicamenteux lancés sur le marché en 2013 |

Produits médicamenteux brevetés existants |

Total |

| Total |

115 |

1 228 |

1 343 |

| Conformes aux Lignes directrices |

93 |

1 005 |

1 098 |

| Sous examen |

0 |

2 |

2 |

| Ne justifient pas d’enquête |

7 |

157 |

164 |

| Sous enquête |

15 |

51 |

66 |

| Engagements de conformité volontaire |

0 |

13 |

13 |

| Audiences sur le prix |

0 |

0 |

0 |

Mise à jour : Rapport annuel 2012

- L’examen de l’ensemble des produits médicamenteux brevetés pour usage humain ayant fait l’objet d’un rapport « sous examen » dans le rapport annuel de 2012 est terminé.

- Des 59 enquêtes mentionnées dans le rapport annuel de 2012, 39 d’entre elles se sont soldées par les résultats suivants :

- la fermeture de l’enquête lorsqu’il apparaît que le prix est conforme aux Lignes directrices;

- un Engagement de conformité volontaire par lequel le breveté s’engage à réduire le prix de son produit et à rembourser les recettes excessives au moyen d’un paiement et (ou) d’une réduction du prix d’un autre produit médicamenteux breveté (voir la section « Engagements de conformité volontaire »);

- une audience publique dont l’objet est de déterminer si le prix du produit médicamenteux est ou non excessif, y compris une ordonnance corrective rendue par le Conseil (voir la section «Audiences »).

Produits médicamenteux brevetés en vente libre et produits médicamenteux brevetés pour usage vétérinaire

Le personnel du Conseil fait l’examen des prix des produits médicamenteux brevetés en vente libre et des produits médicamenteux brevetés pour usage vétérinaire à la suite de la réception d’une plainte. Une plainte a été reçue concernant le prix du Vetoryl, vendu au Canada par Vetoquinol Canada Inc.

Conformément au Règlement sur les médicaments brevetés (le Règlement), le breveté a présenté ses données sur les prix et les ventes rétrospectivement jusqu’à la date de première vente en 2009. Les prix des trois concentrations du Vetoryl (10 mg, 30 mg et 60 mg) étaient conformes au Lignes directrices à la date de première vente en 2009. Les prix sont demeurés conformes aux Lignes directrices jusqu’à la fin de 2013. Conformément au Règlement, le breveté fera rapport de ses données sur les prix et les ventes sur une période de deux ans, jusqu’à la fin de 2015. Un tableau sommaire de l’examen du prix peut être consulté sur le site Web du CEPMB.

Demandes de renseignements et plaintes officielles

En 2013, Le CEPMB a reçu de nombreuses demandes de renseignements concernant le statut de conformité de différents produits médicamenteux. Le personnel du Conseil était en mesure de confirmer que les prix des médicaments brevetés en question étaient conformes aux Lignes directrices. Si le prix d’un produit médicamenteux breveté avait été excessif aux termes des Lignes directrices, le personnel du Conseil aurait entamé une enquête.

De plus, le CEPMB a reçu trois plaintes officielles quant aux prix du Differin, du Nexium et du Spiriva. Des enquêtes quant aux prix de ces trois produits médicamenteux brevetés ont été entamées. On a conclu que les prix du Nexium et du Spiriva étaient conformes aux Lignes directrices. L’enquête quant au prix du Differin est en cours.

Si l’on conclut que le prix d’un produit médicamenteux est excessif en vertu des Lignes directrices, le breveté peut soumettre un Engagement de conformité volontaire aux fins d’approbation de la présidente du Conseil. La présidente peut aussi juger que l’intérêt public justifie la tenue d’une audience publique. Dans les deux cas, la décision et les résultats sont affichés sur le site Web du CEPMB.

Engagements de conformité volontaire et audiences

Engagements de conformité volontaire

L’Engagement de conformité volontaire est un engagement écrit par lequel le breveté s’engage à rendre le prix de son produit médicamenteux conforme aux Lignes directrices du Conseil. En vertu des Lignes directrices, les brevetés peuvent soumettre un Engagement de conformité volontaire lorsque le personnel du Conseil détermine, à la suite d’une enquête, que le prix auquel le produit médicamenteux breveté est vendu au Canada est excessif aux termes des Lignes directrices. Il peut également soumettre un Engagement de conformité volontaire après l’émission d’un Avis d’audience.

En 2013, la présidente a approuvé cinq Engagements de conformité volontaire visant 14 produits médicamenteux. En plus de la réduction du prix de certains produits médicamenteux, des recettes excessives totalisant 10 281 679,63 $ ont été remboursées au moyen de paiements versés au gouvernement du Canada.

En 2014, à ce jour, la présidente a accepté un Engagement de conformité volontaire dans l’affaire Copaxone, mettant ainsi fin à cette instance.

Les brevetés doivent s’assurer que les prix de leurs produits médicamenteux brevetés sont conformes aux Lignes directrices du Conseil et ce, au cours de toutes les périodes où les produits médicamenteux relèvent de la compétence du CEPMB.

Tableau 5 Engagements de conformité volontaire en 2013 jusqu’au 30 mai 2014

| Produit médicamenteux breveté |

Usage thérapeutique |

Breveté |

Date d’approbation |

Remboursement des recettes excessives |

| Réduction de prix |

Paiement à la Couronne |

|

1 Le brevet lié à ce médicament est expiré.

2 Au cours de l’exercice 2013-2014, le CEPMB a remboursé à Teva Canada Innovation la somme de 2 801 285,00 (plus les intérêts) suite à l’ordonnance de la Cour fédérale dans sa décision du 14 mai 2013.

|

| Engagements de conformité volontaire en 2013 |

| Novolin® (8 produits médicamenteux) |

Diabète sucré |

Novo Nordisk Canada Inc. |

Avril |

✓ |

6 503 426,81 $ |

| Mavik (1 produit médicamenteux) |

Hypertension |

Abbott Laboratories Limited |

Avril |

✓ |

118 168,48 $ |

| Airomir1 (1 produit médicamenteux) |

Asthma |

Graceway Canada Inc. |

Avril |

|

206 583,48 $ |

| Tactuo (1 produit médicamenteux) |

Acné |

Galderma Canada Inc. |

Avril |

|

Ordonnance du Conseil : 419 468,12 $ |

| Elocom (3 produits médicamenteux) |

Psoriasis et atopic dermatite |

Merck Canada Inc. |

Juillet |

✓ |

3 034 032,74 $ |

| Total |

|

|

|

|

10 281 679,63 $ |

| Engagements de conformité volontaire en 2014 jusqu’au 30 mai |

| Copaxone2 (1 produit médicamenteux) |

Sclérose en plaques |

Teva Canada Innovation G.P.-S.E.N.C. |

Février |

|

Ordonnance du Conseil :248 222,32 $ |

| Total |

|

|

|

|

10 529 901,95 $ |

Audiences

Lorsque le prix d’un médicament breveté semble excessif, le Conseil peut tenir une audience publique et, s’il est démontré que le prix du produit médicamenteux est excessif, rendre une ordonnance obligeant le breveté à réduire le prix de son produit et à rembourser les recettes excessives qu’il a tirées de la vente de son produit à un prix excessif. Les décisions du Conseil peuvent être assujetties à une révision judiciaire devant la Cour fédérale du Canada.

En 2013, le Conseil a rendu des décisions et (ou) des ordonnances pour mener à terme une affaire : Tactuo, sur le prix. En février 2014, le Conseil a aussi mené à terme l’affaire Copaxone.

Le Conseil compte deux affaires dans son calendrier d’audiences : Apotex Inc. et Apo-Salvent exempt de CFC. Les résultats de ces affaires seront examinés à la lumière des décisions de la Cour fédérale dans trois autres affaires : ratio-Salbutamol HFA, ratiopharm et Sandoz, sur des questions relatives à la compétence du Conseil.

Sommaire

En 2013 et jusqu’au 30 mai 2014, des recettes excessives totalisant 10 529 901,95 $ ont été remboursées au moyen de paiements versés au gouvernement du Canada en vertu d’Engagements de conformité volontaire et d’ordonnances du Conseil.

Depuis 1993, 95 Engagements de conformité volontaire ont été approuvés et 26 audiences publiques ont été entamées. Ces mesures ont donné lieu à des réductions de prix et au remboursement des recettes excessives au moyen de réductions supplémentaires de prix ou de paiements versés au gouvernement du Canada. Plus de 147 millions de dollars ont été recueillis en vertu d’Engagements de conformité volontaire et d’ordonnances du Conseil par l’entremise de paiements versés au gouvernement du Canada et (ou) aux clients, dont les hôpitaux et les cliniques médicales.

Affaires interjetées auprès de la Cour fédérale

L’audition de l’affaire de Copaxone (réexamen) (T-586-12) devant la Cour fédérale a eu lieu le 5 février 2013. La Cour a rendu sa décision le 30 avril 2013; elle a accueilli la demande de Teva, a annulé la décision du Conseil rendue le 23 février 2012 et a renvoyé l’affaire à un différent panel d’audience du Conseil pour réexamen. Le nouveau panel a reçu une demande conjointe des parties et a accepté un Engagement de conformité volontaire visant le remboursement des recettes excessives. Une ordonnance mettant fin à cette affaire a été rendue le 14 février 2014.

Trois autres décisions du Conseil ont fait l’objet de révisions judiciaires devant la Cour fédérale : ratio-Salbutamol HFA (T-1058-11; T-1825-11); ratiopharm Inc. (actuellement Teva Canada) (T-1252-11); et Sandoz Canada Inc. (T-1616-12). Les audiences devant la Cour ont été tenues en novembre 2013, et la Cour a rendu ses décisions le 27 mai 2014. La Cour fédérale a fait droit aux demandes de révision judiciaire et a renvoyé les affaires au Conseil avec une directive de statuer que ratiopharm Inc. et Sandoz Canada Inc. ne sont pas des brevetés.

Tableau 6 État d’avancement des audiences devant le Conseil en 2012 jusqu’au 30 mai 2014

| Produit médicamenteux breveté |

Usage thérapeutique |

Breveté |

Date de l’Avis d’audience |

État d’avancement |

| Apo-Salvent exempt de CFC |

Asthme |

Apotex Inc. |

Le 8 juillet 2008 |

En cours |

| Copaxone – Réexamen |

Sclérose en plaques |

Teva Canada |

Nouveau panel nommé en février 2010 |

Décision de la Cour fédérale rendue le 30 avril 2013

Affaire renvoyée au nouveau panel pour réexamen

Ordonnance du Conseil rendue le 14 février 2014

Audience conclue suite à l’acceptation d’un Engagement de conformité volontaire – Recettes excessives remboursées : 248 222,32 $

|

| ratio-Salbutamol HFA |

Asthme |

ratiopharm Inc. (actuellement Teva Canada) |

Le 18 juillet 2008 |

Décision du Conseil rendue le 27 mai 2011

Ordonnance du Conseil rendue le 17 octobre 2011

Révision judiciaire entendue par la Cour fédérale du 4 au 6 novembre 2013; décision rendue le 27 mai 2014

|

| Tactuo |

Acné |

Galderma Canada Inc. |

Le 26 septembre 2012 |

Ordonnance du Conseil rendue le 24 avril 2013 Audience conclue suite à l’acceptation d’un Engagement de conformité volontaire – Recettes excessives remboursées : 419 468,12 $ |

| Breveté |

Objet de l’audience |

Date de l’Avis de demande |

État d’avancement |

| Apotex Inc. |

Défaut de soumettre ses rapports (questions relatives à la compétence du Conseil) |

Le 3 mars 2008 |

En cours |

| ratiopharm Inc. (actuellement Teva Canada) |

Défaut de soumettre ses rapports (questions relatives à la compétence du Conseil) |

Le 28 août 2008 |

Ordonnance du Conseil rendue le 30 juin 2011; modifiée le 17 octobre 2011

Révision judiciaire entendue par la Cour fédérale du 4 au 6 novembre 2013; décision rendue le 27 mai 2014

|

| Sandoz Canada Inc. |

Défaut de soumettre ses rapports (questions relatives à la compétence du Conseil) |

Le 8 mars 2010 |

Ordonnance du Conseil rendue le 1er août 2012; rendue de nouveau le 1er octobre 2012

Révision judiciaire entendue par la Cour fédérale les 19 et 20 novembre 2013; décision rendue le 27 mai 2014

|

Réduction du fardeau réglementaire

En cadrant avec le Plan d’action pour la réduction du fardeau administratif, le CEPMB s’est engagé à revoir son processus d’examen des prix afin de cerner des moyens possibles d’accroître l’efficience et de réduire le fardeau réglementaire imposé aux brevetés sans porter atteinte à son mandat visant à protéger les consommateurs.

À ce jour, l’examen s’est focalisé sur deux initiatives, notamment :

- la méthodologie de rajustement du prix du médicament pour tenir compte des variations de l’indice des prix à la consommation (IPC);

- la faisabilité d’une transition vers un seul dépôt annuel par les brevetés des données relatives aux médicaments brevetés existants.

Suite à une consultation au sujet de ces initiatives, le Conseil a approuvé la mise en oeuvre d’une nouvelle méthodologie de rajustement du prix selon l’IPC retardé à compter de 2015. La nouvelle approche utilisera l’IPC réel de 2013 pour déterminer les facteurs de rajustement du prix selon l’IPC pour 2015. L’augmentation maximale du prix permise sera annoncée sur une base annuelle dans le numéro de janvier de La Nouvelle.

On tiendra compte de cette modification, lorsqu’elle entrera en vigueur, dans le cadre la mise à jour de juin 2014 du Compendium des politiques, des Lignes directrices et des procédures.

Suite aux commentaires reçus de la part des intervenants concernant les modifications proposées au Règlement sur les médicaments brevetés relativement à la fréquence de dépôt des renseignements sur les prix et les ventes, on a annoncé une consultation officielle conformément au Processus fédéral d’élaboration de règlements par l’entremise du Cabinet et d’une publication dans la Gazette du Canada.

De plus, le CEPMB a élaboré et publié de nouvelles normes de service afin de préciser les attentes et d’accroître la prévisibilité du système réglementaire fédéral. Les normes de service suivantes ont été élaborées et publiées sur le site Web du CEPMB :

- Norme de service pour l’examen scientifique des nouveaux produits médicamenteux brevetés

- Norme de service pour l’examen du prix des nouveaux produits médicamenteux brevetés

- Norme de service pour l’examen du prix des produits médicamenteux brevetés existants

Les mesures et modifications proposées visent à réduire le fardeau réglementaire imposé aux brevetés, et à accroître l’efficience du processus d’examen du prix tout en protégeant le mandat de base du CEPMB visant la protection des consommateurs.

Tendances relatives aux ventes des produits médicamenteux brevetés

Le CEPMB fait rapport des tendances observées au chapitre des ventes de produits pharmaceutiques et des prix de tous les médicaments, ainsi que des dépenses de recherche-développement des brevetés. De plus, il dirige des études et mène des analyses portant sur diverses questions relatives aux prix et aux coûts des produits pharmaceutiques.

En vertu du Règlement sur les médicaments brevetés (le Règlement), les brevetés doivent faire rapport au CEPMB de leurs ventes de produits médicamenteux brevetés au Canada, à savoir les quantités vendues et les recettes nettes tirées des ventes de chaque produit médicamenteux, par catégorie de clients et par province ou territoire. Le CEPMB utilise ces éléments d’information dans ses analyses des tendances aux niveaux des ventes, des prix et de l’utilisation faite des produits médicamenteux brevetés1. La présente section donne les résultats statistiques clés de cette analyse.

Ventes et prix

La population canadienne consacre aujourd’hui une partie beaucoup plus grande de son budget à l’achat de produits médicamenteux qu’elle ne le faisait il y a une dizaine d’années; toutefois, il est important de préciser qu’une augmentation des dépenses en produits médicamenteux n’est pas nécessairement attribuable à une augmentation des prix. Par exemple, selon les rapports annuels des années 1995 à 2003, la valeur des ventes de produits médicamenteux brevetés a augmenté de plus de 10 % par année, alors que les taux moyens de variation des prix n’atteignaient même pas 1 %. Dans ces cas, ce sont le volume et la composition de l’utilisation faite des produits médicamenteux qui sont à l’origine de la croissance de la valeur des ventes.

Différents facteurs peuvent être à l’origine de tels changements, dont les suivants :

- augmentation de la population totale;

- variations de la composition démographique de la population (p. ex. vieillissement de la population et, partant, une plus grande incidence de problèmes de santé);

- augmentation de l’incidence des problèmes de santé nécessitant une pharmacothérapie;

- nouvelles pratiques d’ordonnance des médecins (p. ex. tendance à prescrire des nouveaux produits médicamenteux plus onéreux pour traiter une condition qui était jusque-là traitée avec des produits existants souvent vendus à moindre prix, ou ordonnance de concentrations plus fortes ou plus fréquentes);

- recours plus régulier à des pharmacothérapies en remplacement d’autres formes de traitement;

- recours à de nouveaux produits médicamenteux pour traiter des conditions pour lesquelles il n’existait pas encore un traitement efficace.

Tendances observées au niveau des ventes

Le tableau 7 présente la valeur des ventes par les brevetés au Canada des produits médicamenteux brevetés pour les années 1990 à 2013. Les ventes de produits médicamenteux brevetés ont totalisé 13,6 milliards de dollars en 2013, soit 6,5 % de plus qu’en 2012, où ce montant totalisait 12,8 milliards de dollars. En guise de comparaison, la croissance annuelle des ventes de produits médicamenteux brevetés était de 27,0 % en 1999, et s’est maintenue à deux chiffres jusqu’en 2003.

La dernière colonne du tableau 7 présente la valeur des ventes des produits médicamenteux brevetés exprimée en pourcentage de la valeur des ventes de tous les produits médicamenteux brevetés et non brevetés. Entre 1990 et 2003, le pourcentage de la valeur des ventes est passé respectivement de 43,2 % à un sommet de 72,7 %. En général, ce pourcentage a reculé depuis 2003, avec un léger redressement de la tendance au cours des trois dernières années, ce qui signifie que les ventes des produits médicamenteux de marque non brevetés et des produits médicamenteux génériques ont augmenté davantage au cours de cette période que celles de produits médicamenteux brevetés.

Tableau 7 Ventes de produits médicamenteux brevetés, 1990-2013

| Année |

Produits médicamenteux brevetés |

Valeur des ventes de produits médicamenteux brevetés exprimée en pourcentage de la valeur des ventes de tous les médicaments (%)* |

| Ventes (milliards $) |

Variation (%) |

|

* Le dénominateur dans ce ratio comprend la valeur des ventes des produits médicamenteux de marque brevetés, des produits médicamenteux de marque non brevetés, et des produits médicamenteux génériques. L’estimation de la valeur totale des ventes utilisée pour calculer le ratio à compter de 2005 se fonde sur les données tirées de la base de données MIDAS d’IMS Health. Pour les années antérieures, les données d’IMS Health n’ont été utilisées que pour calculer la valeur des ventes des produits médicamenteux génériques. Quant à la valeur des ventes des produits médicamenteux de marque non brevetés, elle était alors estimée à l’aide des données fournies par les brevetés. Pour mettre un terme aux anomalies attribuables aux variations annuelles de la liste des brevetés, le CEPMB n’utilise plus cette approche. Les ratios rapportés pour les années avant 2005 gonflaient légèrement la part des produits médicamenteux brevetés. Ce léger écart n’invalide toutefois pas la forte tendance à la hausse observée pour les années 1990 à 2003.

Sources : CEPMB et MIDAS©, 2005-2013, IMS Health Incorporated ou sociétés affiliées. Tous droits réservés2

|

| 2013 |

13,6

|

6,5

|

61,8

|

| 2012 |

12,8

|

-0,3

|

59,3

|

| 2011 |

12,9

|

4,0

|

58,6

|

| 2010 |

12,4

|

-3,8

|

56,0

|

| 2009 |

12,9

|

2,4

|

59,2

|

| 2008 |

12,6

|

2,4

|

61,7

|

| 2007 |

12,3

|

3,4

|

63,2

|

| 2006 |

11,9

|

3,5

|

67,8

|

| 2005 |

11,5

|

4,5

|

70,6

|

| 2004 |

11,0

|

7,8

|

72,2

|

| 2003 |

10,2

|

14,3

|

72,7

|

| 2002 |

8,9

|

17,5

|

67,4

|

| 2001 |

7,6

|

18,9

|

65,0

|

| 2000 |

6,3

|

16,7

|

63,0

|

| 1999 |

5,4

|

27,0

|

61,0

|

| 1998 |

4,3

|

18,9

|

55,1

|

| 1997 |

3,7

|

22,6

|

52,3

|

| 1996 |

3,0

|

12,8

|

45,0

|

| 1995 |

2,6

|

10,8

|

43,9

|

| 1994 |

2,4

|

-2,1

|

40,7

|

| 1993 |

2,4

|

9,4

|

44,4

|

| 1992 |

2,2

|

14,0

|

43,8

|

| 1991 |

2,0

|

13,1

|

43,2

|

| 1990 |

1,7

|

–

|

43,2

|

Facteurs à la source de la croissance des ventes

Le tableau 8 décompose en différents éléments la croissance des ventes enregistrée entre 2012 et 2013. Ces éléments sont les suivants :

- produits médicamenteux brevetés dont le brevet est arrivé à échéance ou dont le brevet a été cédé au domaine public (« effet du retrait du médicament »);

- produits médicamenteux brevetés lancés sur le marché canadien en 2013 (« effet du nouveau médicament »);

- variations des prix des produits médicamenteux brevetés vendus au Canada en 2012 et en 2013 (« effet du prix »);

- écarts de quantités vendues de ces produits médicamenteux en 2012 et en 2013 (« effet du volume »);

- interactions des variations de prix et de quantité (« effets croisés »).

La première rangée du tableau 8 présente les incidences d’après leur valeur monétaire et la deuxième rangée les présente au moyen de la variation des ventes en 2013 par rapport à 2012. Pour des fins de comparaison, la troisième rangée présente les incidences avec les taux moyens annuels de variation des ventes pour la période de 2008 à 20123.

Les résultats de ce tableau révèlent que l’augmentation du volume des ventes des nouveaux produits médicamenteux et des produits médicamenteux existants était à l’origine de la croissance observée au niveau de ventes en 2013 par rapport à 2012. Pris seul, l’effet du volume était assez important pour atténuer la forte incidence négative de l’effet du retrait du médicament.

Tableau 8 Décomposition des variations au chapitre des ventes de produits médicamenteux brevetés

| |

Variation totale |

Effet du retrait du médicament |

Effet du nouveau médicament |

Effet du prix |

Effet du volume |

Effets croisés |

| Source : CEPMB |

| Incidence sur les ventes, 2013/2012 (millions $) |

859,81 |

-268,20 |

285,86 |

149,87 |

790,12 |

-97,84 |

| Proportion de la variation totale, 2013/2012 (%) |

100,00 |

-31,19 |

33,25 |

17,43 |

91,90 |

-11,38 |

| Proportion moyenne de la variation totale, 2008-2012 (%) |

100,00 |

180,69 |

-136,98 |

-20,49 |

33,18 |

43,61 |

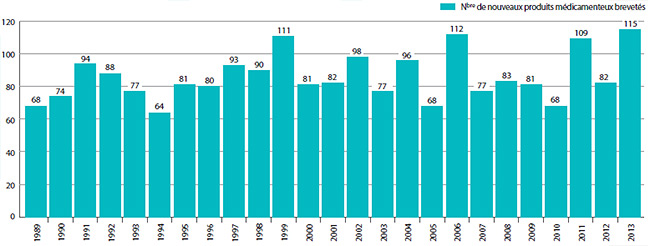

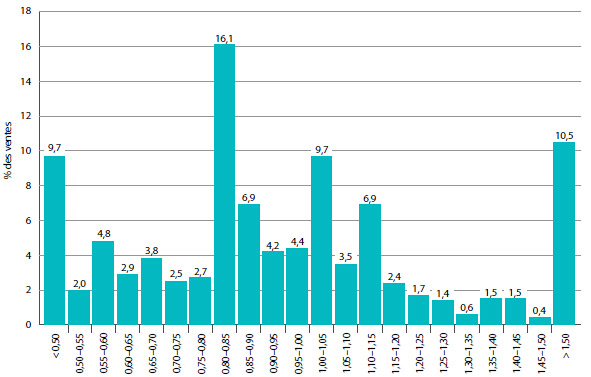

Le graphique 2 présente pour 2013 une ventilation des ventes de produits médicamenteux brevetés selon l’année de leur première vente au Canada. Au cours de la dernière partie des années 1990 et du début des années 2000, la croissance des ventes a été associée à une succession de nouveaux médicaments « vedettes » qui ont donné lieu à des volumes de ventes très élevés. Malgré l’expiration récente des brevets (chute des brevets), ces produits représentent toujours un pourcentage important des ventes en 2013. Depuis le début des années 2000, les changements observés dans l’environnement pharmaceutique canadien ainsi que la diminution du taux de mise en marché de nouveaux produits médicamenteux de grande vente ont ralenti la croissance.

GRAPHIQUE 2 Pourcentage des ventes de produits médicamenteux brevetés selon l'année de lancement, 2013

Source : CEPMB

Ventes selon la catégorie thérapeutique

Pour ses analyses de prix au niveau du groupe thérapeutique, le CEPMB classe généralement les produits médicamenteux à l’aide du Système de classification anatomique, thérapeutique, chimique (ATC) de l’Organisation mondiale de la Santé (OMS). Ce système hiérarchique classe les produits médicamenteux selon leur utilisation thérapeutique principale et leur composition chimique. Au premier niveau de ce système, à savoir au niveau 1, le système ATC classe les médicaments selon la partie de l’anatomie à laquelle ils sont principalement associés.

Le tableau 9 ventile les ventes des produits médicamenteux brevetés effectuées au Canada en 2013 selon le groupe thérapeutique principal, à savoir le premier niveau de la classification ATC. Il présente les ventes effectuées en 2013 dans les différents groupes de produits médicamenteux, leur part de l’ensemble des ventes, ainsi que le taux d’augmentation de la valeur de leurs ventes par rapport à 2012. Les valeurs présentées dans la dernière colonne correspondent à la composante de la croissance de l’ensemble des ventes attribuables aux produits médicamenteux du groupe4. La mesure ainsi obtenue permet de dégager que ce sont les agents antinéoplasiques et immunomodulateurs qui ont le plus contribué à la croissance de la valeur des ventes. Il convient de noter le recul important des ventes de médicaments agissant sur le système cardiovasculaire et, accessoirement, sur le système génito-urinaire et hormones sexuelles.

Tableau 9 Ventes des produits médicamenteux brevetés selon leur groupe thérapeutique principal, 2013

| Groupe thérapeutique |

Ventes en 2013

(millions $) |

Part de ventes

en 2013 (%) |

Croissance :

2013/2012

(millions $) |

Croissance :

2013/2012 (%) |

Incidence sur la variation

des dépenses (%) |

|

* Pour des raisons de confidentialité, les données sur ces deux groupes ont été combinées.

Source : CEPMB

|

| A : Tube digestif et métabolisme |

1 425,0 |

10,4 |

160,8 |

12,7 |

19,3 |

| B : Sang et organes sanguinoformateurs |

784,3 |

5,7 |

-7,3 |

-0,9 |

-0,9 |

| C : Système cardiovasculaire |

1 023,8 |

7,5 |

-319,0 |

-23,8 |

-38,4 |

| D : Produits dermatologiques |

130,0 |

1,0 |

15,2 |

13,2 |

1,8 |

| G : Système génito-urinaire et hormones sexuelles |

509,7 |

3,7 |

-63,3 |

-11,0 |

-7,6 |

| H : Préparations hormonales systémiques |

62,4 |

0,5 |

7,1 |

12,7 |

0,8 |

J : Antiinfectieux généraux pour usage systémique;

P : Produits antiparasitaires* |

1 515,6 |

11,1 |

57,1 |

3,9 |

6,9 |

L : Agents antinéoplastiques et

agents immunomodulateurs |

3 947,6 |

28,9 |

646,0 |

19,6 |

77,7 |

| M : Système musculo-squelettaire |

431,4 |

3,2 |

11,0 |

2,6 |

1,3 |

| N : Système nerveux |

1 853,8 |

13,6 |

-46,5 |

-2,4 |

-5,6 |

| R : Système respiratoire |

1 274,9 |

9,3 |

212,1 |

20,0 |

25,5 |

| S : Organes sensoriels |

643,1 |

4,7 |

137,8 |

27,3 |

16,6 |

| V : Divers |

75,1 |

0,5 |

20,3 |

36,9 |

2,4 |

Tendances observées au niveau des prix

Le CEPMB utilise l’indice des prix des médicaments brevetés (IPMB) pour faire le suivi des tendances des prix des produits médicamenteux brevetés. L’IPMB mesure la variation moyenne des prix auxquels les brevetés vendent leurs produits médicamenteux brevetés sur le marché canadien (prix départ-usine) par rapport à l’année précédente. L’indice est calculé à l’aide de la formule qui correspond à la moyenne de la variation des prix au niveau du produit médicamenteux pondérée en fonction des ventes5. La méthodologie utilisée rappelle celle qu’utilise Statistique Canada pour compiler l’indice des prix à la consommation (IPC). L’IPMB est fondée sur l’information sur les prix moyens par transaction et sur les ventes pour une période de six mois, dont les brevetés font rapport au Conseil.

Il est important de bien comprendre la relation théorique qui existe entre l’IPMB et les coûts des produits médicamenteux. L’IPMB ne mesure pas les effets des changements de l’utilisation faite des produits médicamenteux. Cette mesure est prise par un autre indice appelé l’indice du volume des ventes de médicaments brevetés – l’IVVMB (voir la section « Utilisation faite des produits médicamenteux brevetés »). L’IPMB ne mesure pas non plus l’incidence sur les coûts des nouvelles habitudes d’ordonnance des médecins ou de l’arrivée sur le marché de nouveaux produits médicamenteux. L’IPMB est conçu pour isoler la composante de variation des ventes attribuable aux variations des prix des produits médicamenteux brevetés.

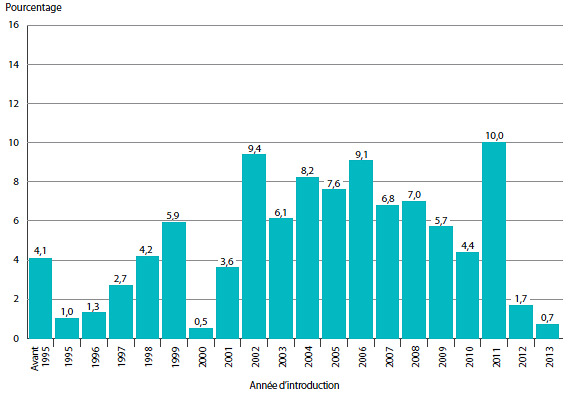

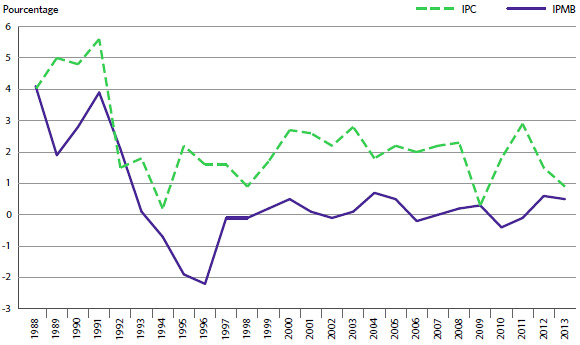

Le graphique 3 présente le taux annuel de variation de l’IPMB pour les années 1988 à 2013. Selon la mesure prise par l’IPMB, les prix départ-usine des produits médicamenteux brevetés ont augmenté (0,5 %), en moyenne, en 2013 par rapport à 2012.

GRAPHIQUE 3 Taux annuel de variation de l’indice des prix des médicaments brevetés (IPMB), 1988-2013

Source : CEPMB

La Loi sur les brevets prévoit que le CEPMB doit tenir compte des variations de l’IPC, entre autres facteurs, lorsqu’il est appelé à déterminer si le prix d’un médicament breveté est ou non excessif. Le graphique 4 présente les variations annuelles de l’IPMB par rapport aux variations de l’IPC pour les mêmes années. L’inflation générale des prix, mesurée au moyen de l’IPC, a été supérieure à l’augmentation moyenne des prix des produits médicamenteux brevetés presque chaque année depuis 1988. En 2013, l’IPC a augmenté de 0,9 %, alors que l’IPMB a légèrement augmenté, en moyenne, de 0,5 %.

GRAPHIQUE 4 Taux annuel de variation de l’indice des prix des médicaments brevetés (IPMB) et de l’indice des prix à la consommation (IPC), 1988-2013

Source : CEPMB, Statistique Canada

Il n’est pas surprenant que l’IPMB ait rarement augmenté au même rythme que l’IPC. Les Lignes directrices du CEPMB prévoient en effet que les prix des produits médicamenteux brevetés ne peuvent augmenter davantage que le taux moyen d’augmentation de l’indice des prix à la consommation calculé sur une période de trois ans. (Les Lignes directrices limitent également les augmentations annuelles de prix à une fois et demie le taux d’inflation calculé à l’aide de l’IPC.) Cette exigence a pour effet de limiter les augmentations des prix des produits à celles de l’IPC sur une période de trois années6. En pratique, les variations de l’IPC n’atteignent jamais cette limite, étant donné qu’un grand nombre de brevetés n’augmentent pas les prix de leurs médicaments dans toute la mesure autorisée par les Lignes directrices, ou lorsqu’ils ne les réduisent pas.

Variation du prix selon le groupe thérapeutique

Le tableau 10 présente les taux moyens de variation des prix des produits médicamenteux brevetés selon leur groupe thérapeutique principal. Ce tableau a été établi en appliquant la méthode de calcul de l’IPMB aux données sur les prix des différents produits médicamenteux brevetés ventilées selon le groupe thérapeutique principal (niveau 1 de la classification ATC). La dernière colonne du tableau présente le résultat de la décomposition de la variation globale de l’IPMB où chaque entrée représente la composante attribuable aux produits médicamenteux du groupe thérapeutique correspondant. Selon cette mesure, la légère augmentation de l’IPMB (0,5 %) indique que les prix des produits médicamenteux des différentes catégories thérapeutiques sont relativement stables. Veuillez noter que toutes les catégories thérapeutiques ont affiché, en moyenne, un taux de variation des prix inférieur au taux d’inflation de l’IPC.7.

Tableau 10 Variation de l’indice des prix des médicaments brevetés (IPMB) selon le groupe thérapeutique principal, 2013

| Groupe thérapeutique |

Pourcentage des

ventes en 2013 (%) |

Variation des prix de

2012 à 2013 (%) |

Contribution :

variation de l'IPMB (%) |

|

* Pour des raisons de confidentialité, les données sur ces deux groupes ont été combinées.

** Il se peut que les valeurs n’équivaillent pas à 100,0 en raison de l’arrondissement.

Source : CEPMB

|

| A : Tube digestif et métabolisme |

10,4 |

5,5 |

0,6 |

| B : Sang et organes sanguinoformateurs |

5,7 |

-5,6 |

-0,3 |

| C : Système cardiovasculaire |

7,5 |

0,6 |

0,0 |

| D : Produits dermatologiques |

1,0 |

0,0 |

0,0 |

| G : Système génito-urinaire et hormones sexuelles |

3,7 |

-2,2 |

-0,1 |

| H : Préparations hormonales systémiques |

0,5 |

2,0 |

0,0 |

J : Antiinfectieux généraux pour usage systémique;

P : Produits antiparasitaires* |

11,1 |

-0,9 |

-0,1 |

| L : Agents antinéoplastiques et agents immunomodulate |

urs 28,9 |

0,3 |

0,1 |

| M : Système musculo-squelettaire |

3,2 |

2,4 |

0,1 |

| N : Système nerveux |

13,6 |

1,0 |

0,1 |

| R : Système respiratoire |

9,3 |

0,8 |

0,1 |

| S : Organes sensoriels |

4,7 |

1,1 |

0,1 |

| V : Divers |

0,5 |

-0,6 |

0,0 |

| Tous les groupes thérapeutiques |

100,0** |

0,5 |

0,5 |

Variation des prix selon la catégorie de clients

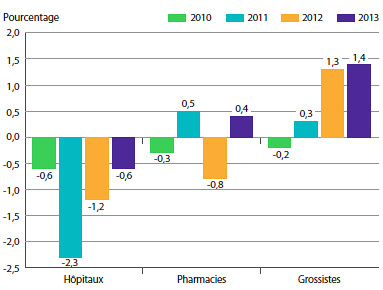

Le graphique 5 présente les taux moyens de variation des prix selon la catégorie de clients8. Ces taux ont été obtenus en appliquant la méthodologie de l’IPMB aux données sur les ventes faites aux hôpitaux, aux pharmacies et aux grossistes9. Pour 2013, les taux de variation des prix étaient de 0,6 %, 0,4 % et 1,4 %, respectivement.

GRAPHIQUE 5 Taux annuel de variation de l’indice des prix des médicaments brevetés (IPMB) selon la catégorie de clients, 2010-2013

Source : CEPMB

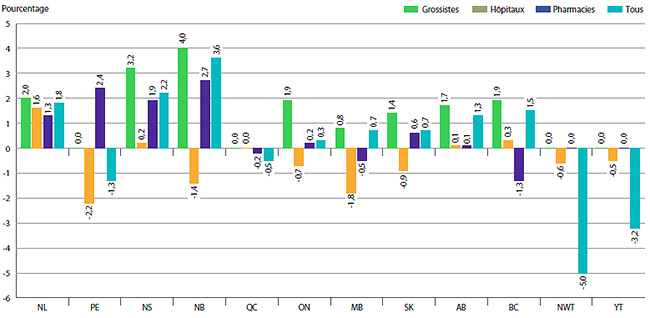

Variation des prix selon la province ou le territoire

Le graphique 6 présente les taux moyens de variation des prix des produits médicamenteux brevetés selon la province ou le territoire. Ces taux ont été obtenus en appliquant la méthodologie du calcul de l’IPMB aux données sur les prix ventilées selon la province ou le territoire dans lequel les ventes ont été effectuées. Ces résultats révèlent que, entre 2012 et 2013, les prix des produits médicamenteux brevetés aux T.N.-O. ont reculé, en moyenne. Le Nouveau-Brunswick a connu la plus importante augmentation moyenne des prix (3,6 %).

GRAPHIQUE 6 Taux annuel de variation des prix par province ou territoire*, par catégorie de clients**, 2013

* Les valeurs pour le Nunavut sont comprises dans celles des Territoires du Nord-Ouest (T.N.-O.).

** Les résultats pour la catégorie « Tous » dans le graphique 6 comprennent ceux de la catégorie « Autre ».

Source : CEPMB

Variation du prix d'un produit médicamenteux breveté dans les années qui suivent son lancement sur le marché canadien

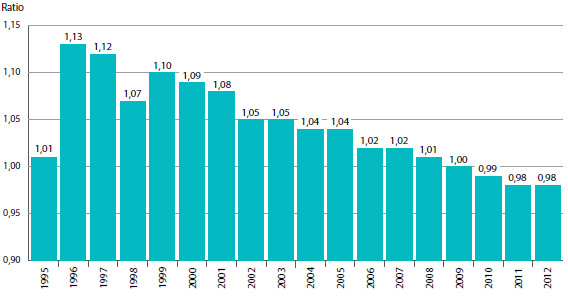

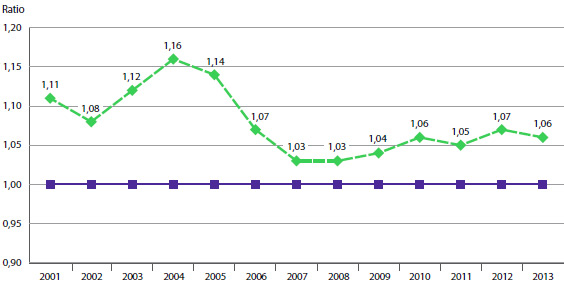

Le prix d’un produit médicamenteux breveté varie-t-il beaucoup au cours des années qui suivent son lancement sur le marché canadien? Le graphique 7 répond à cette question en présentant le ratio moyen des prix de vente des produits médicamenteux en 2013 par rapport aux prix auxquels ils ont été offerts au moment de leur lancement sur le marché canadien.

Les résultats présentés dans le graphique 7 ne révèlent pas une tendance à la hausse ou à la baisse des prix après la période de lancement des produits médicamenteux sur le marché canadien. En 2013, le prix moyen d’un produit médicamenteux breveté se situait dans une marge de quelques points de son prix de lancement, et ce, pour toute année de lancement du produit médicamenteux sur le marché canadien10.

GRAPHIQUE 7 Ratio moyen du prix de 2013 par rapport au prix de lancement, par année de lancement

Source : CEPMB

Variation des prix selon le pays

La Loi et son Règlement obligent les brevetés à faire rapport au CEPMB des prix de leurs produits médicamenteux brevetés accessibles au public qu’ils pratiquent dans les sept pays de comparaison nommés dans le Règlement. Ces pays sont la France, l’Allemagne, l’Italie, la Suède, la Suisse, le Royaume-Uni et les États-Unis.

Le CEPMB utilise ces données aux fins suivantes :

- pour effectuer ses comparaisons des prix internationaux prévues dans les Lignes directrices;

- pour comparer les prix des produits médicamenteux pratiqués au Canada avec les prix pratiqués dans d’autres pays.

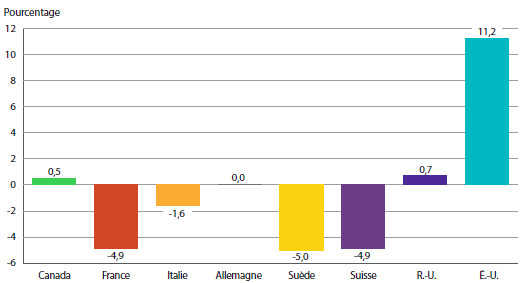

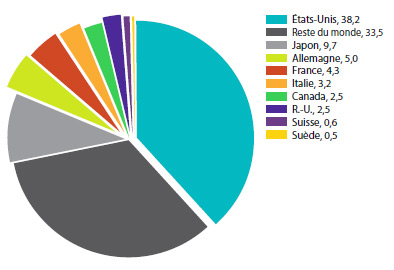

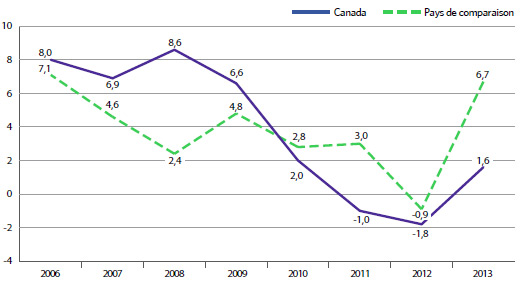

Le graphique 8 présente les taux moyens annuels de variation des prix pour le Canada et pour les sept pays de comparaison. Ces valeurs ont été obtenues en appliquant la méthodologie de l’IPMB (avec pondération pour tenir compte des tendances des ventes au Canada) aux données sur les prix pratiqués dans les différents pays de comparaison soumises par les brevetés. À titre d’information, les résultats pour les États Unis sont fondés sur des prix moyens qui tiennent compte des prix de la Classification fédérale des approvisionnements (US Federal Supply Schedule ou FSS)11.

Selon le graphique 8, les prix des produits médicamenteux brevetés aux États-Unis ont augmenté en 2013 d’un taux moyen de 11,2 %. Les augmentations de prix ont été beaucoup plus modestes au Royaume-Uni, alors que les prix en France, en Italie, en Suisse et en Suède ont enregistré un recul.

GRAPHIQUE 8 Taux moyens annuels de variation des prix pratiqués au Canada et dans les pays de comparaison, 2013

Source : CEPMB

Comparaison des prix pratiqués au Canada avec ceux pratiqués dans les pays de comparaison

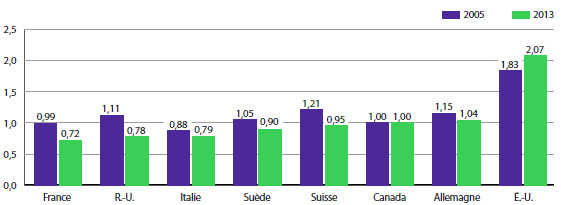

Les tableaux 11 et 12 présentent des statistiques détaillées qui permettent de comparer les prix des produits médicamenteux pratiqués dans les sept pays de comparaison avec ceux pratiqués au Canada. Chaque tableau présente deux séries de ratios de prix moyens. Ils sont différents l’un de l’autre selon la méthode de conversion en équivalents dollars canadiens des prix exprimés dans la devise des différents pays. Les deux tableaux présentent également le nombre de produits médicamenteux (DIN) et le volume des ventes couverts par chaque ratio de prix12.

Les ratios de prix moyens donnés dans les tableaux 11 et 12 sont des moyennes d’arithmétique pondérées de ratios de prix obtenues pour des produits médicamenteux individuels, dont la pondération est fondée sur les tendances des ventes au Canada. Les ratios moyens de prix interprétés de cette façon donnent des réponses exactes aux questions comme celle-ci :

« Combien les Canadiens auraient-ils payé, en plus ou en moins, leurs produits médicamenteux brevetés en 2013 s’ils les avaient achetés aux prix pratiqués dans le pays X? »

Par exemple, vous pouvez voir dans le tableau 11 que le ratio du prix moyen en France par rapport au prix moyen au Canada calculé avec la moyenne arithmétique est de 0,72 pour 2013. Ce ratio signifie que les Canadiens auraient payé leurs médicaments brevetés 28 % de moins en 2012 s’ils avaient pu les acheter aux prix pratiqués en France.

Pendant bon nombre d’années, le CEPMB a fait rapport des ratios des prix moyens pratiqués dans les pays de comparaison par rapport aux prix moyens pratiqués au Canada après avoir converti les prix pratiqués dans les pays de comparaison en équivalents dollars canadiens à l’aide des moyennes des taux de change (ou, plus précisément, les moyennes mobiles des taux de change sur une période de 36 mois que le CEPMB utilise généralement lorsqu’il applique ses Lignes directrices). Le tableau 11 compare également les ratios des prix des produits médicamenteux dans les pays de comparaison par rapport à leurs prix au Canada, après avoir converti la devise à l’aide de la parité des pouvoirs d’achat. Le taux de parité des pouvoirs d’achat représente le coût de la vie relatif dans ces deux pays exprimé dans leurs devises respectives. En pratique, le coût de la vie est calculé à l’aide d’un panier de produits et de services aux prix courants.