Annual Public Drug Plan Expenditure Report, 2013/14

Executive Summary

The CompassRx annual report explores the underlying forces driving prescription drug expenditures in Canadian public drug plans. It analyzes trends in demographics, pricing and the use of drugs, and measures their impact on expenditure levels. The report also monitors major developments in drug approval, review, pricing and reimbursement in Canada. This edition of the report focuses on the 2013/14 fiscal year and provides a retrospective review of trends since 2009/10.

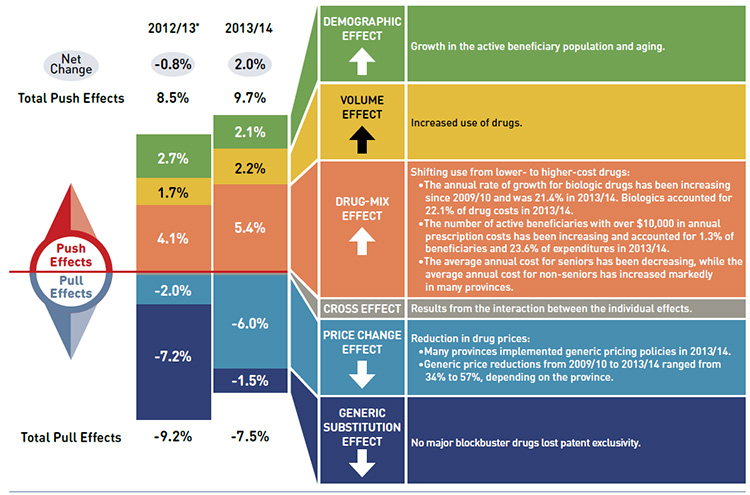

The change in prescription drug expenditures is driven by a number of opposing “push” and “pull” effects. Increases in the beneficiary population, the increased use of drugs, and/or the use of more expensive drugs put an upward pressure on expenditures, resulting in a push effect; while generic substitutions and price reductions exert a downward pull effect. In any given year, the weight of each of these effects may vary, and as a result, the rates of change in prescription drug expenditures evolve over time and may differ across public drug plans.

The main data source for this report is the National Prescription Drug Utilization Information System (NPDUIS) Database managed by the Canadian Institute for Health Information (CIHI). Results are presented for the following public drug plans participating in NPDUIS: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, and Health Canada’s Non-Insured Health Benefits drug plan. The data for British Columbia and Newfoundland and Labrador have been added to this edition of the report, giving a broader overview of the public plans.

Identifying the major drivers of change and the effect they have on prescription drug expenditures supports policy makers and researchers in better understanding the current trends and anticipating future cost pressures and expenditure levels.

Key findings

Overview of Prescription Drug Expenditures for 2013/14

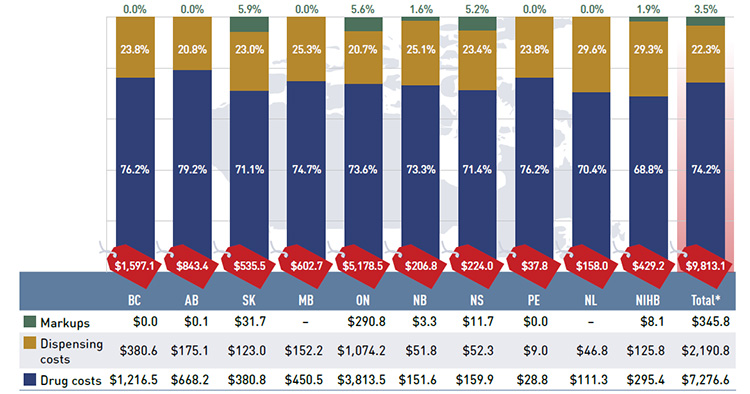

Prescription drug expenditures for the NPDUIS public drug plans totaled $9.8 billion in 2013/14 and included $7.3 billion in drug costs (74.2%), $2.2 billion in pharmacy dispensing costs (22.3%), and $0.3 billion in markups (3.5%).

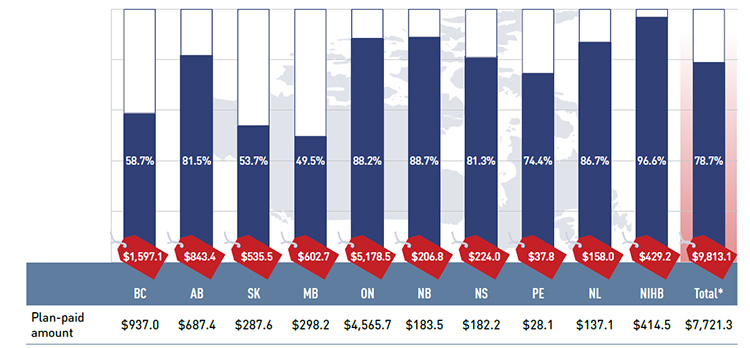

The NPDUIS public drug plans paid 78.7% of the overall prescription drug expenditures. The remaining share was paid by drug plan beneficiaries either out-of-pocket or through a third-party private insurer.

Drug Cost Component of Prescription Drug Expenditures

The average rate of change in the cost of drugs for all NPDUIS public plans steadily declined from 2010/11 to 2012/13, reaching a low of -1.5%. This trend reversed in 2013/14, with the average drug costs increasing by 2.0%.

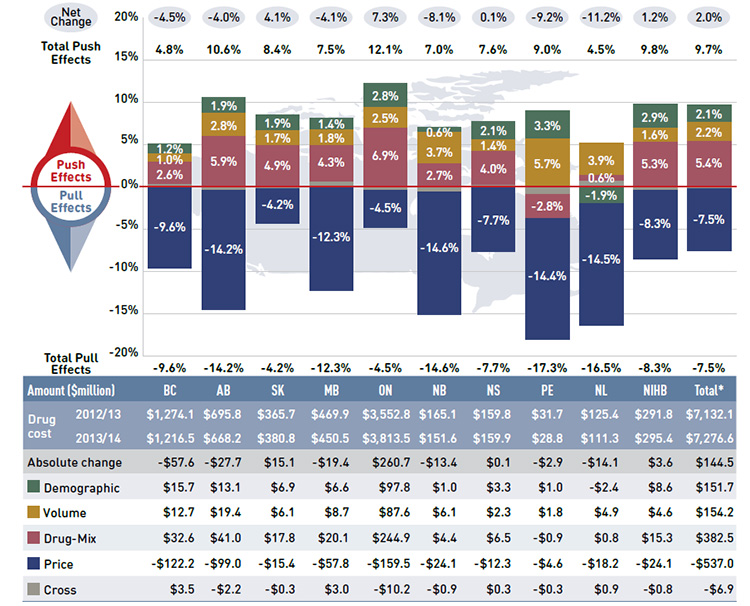

In 2013/14, generic drug policies markedly reduced drug costs by 6.0%; however, this decrease was almost completely offset by an increase in the use of higher-cost drugs, which put a 5.4% upward pressure on costs. The impact of higher-cost drugs was more pronounced in 2013/14 than in 2012/13, when it was 4.1%Footnote I.

The tipping point towards positive growth rates in 2013/14 was the modest cost-saving effect of generic substitution (1.5%), which only partially compensated for the increases in the beneficiary population and their use of drugs (2.1% and 2.2%, respectively). The low generic substitution effect signals the end of the patent cliff, as no major blockbuster drugs lost patent protection in 2013/14. In contrast, 2012/13 was marked by a sizable savings due to generic substitution, which pulled drug costs downward by 7.2%Footnote I.

Highlights for 2013/14

- The demographic, volume, and drug-mix effects had an important “push” effect in 2013/14. Without the impact of generic savings, increases in the size and age of the active beneficiary population, the volume of drugs and the use of higher-cost drugs would have driven up drug costs by 9.7%.

- Generic substitution and especially price changes had an important “pull” effect in 2013/14. In the absence of other cost pressures, lower generic drug prices and the shift from brand-name to generic drugs would have decreased drug cost levels by 7.5%.

Drug cost drivers 2012/13* versus 2013/14

* Results for 2012/13 do not capture the data for the British Columbia and Newfoundland and Labrador provincial public drug plans.

Note: Values may not add to totals due to rounding and the cross effect.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This diagram illustrates the drug cost drivers for 2013/14 and compares them to the overall results for 2012/13 for the NPDUIS public drug plans in Canada. Cost drives are categorized as push (increasing) or pull (decreasing) effects.

The overall net change in drug costs from 2012/13 to 2013/14 was 2.0% compared to a -0.8% change from 2011/12 to 2012/13.

The total push effect in 2013/14 was 9.7% (compared to 8.5% in 2012/13) and included the following key effects:

- The demographic effect was 2.1% due to a growth in the active beneficiary population and aging. In 2012/13 it was 2.7%.

- The volume effect was 2.2% due to the increased use of drugs. In 2012/13 it was 1.7%.

- The drug-mix effect was 5.4% (up from 4.1% in 2012/13) due to the shifting use from lower- to higher-cost drugs:

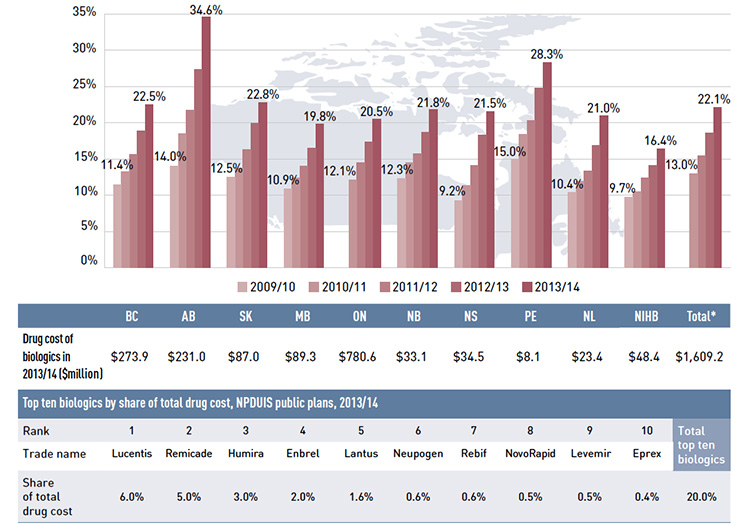

- The annual rate of growth for biologic drugs has been increasing since 2009/10 and was 21.4% in 2013/14. Biologics accounted for 22.1% of drug costs in 2013/14.

- The number of active beneficiaries with over $10,000 in annual prescription costs has been increasing and accounted for 1.3% of beneficiaries and 23.6% of expenditures in 2013/14.

- The average annual costs for seniors have been decreasing, while the average annual costs for non-seniors have increased markedly in many provinces.

The total pull effect was -7.5% (compared to -9.2% in 2012/13) and included the following key effects:

- The price change effect was -6.0% (compared to -2.0% in 2012/13) due to a reduction in drug prices:

- Many provinces implemented generic pricing policies in 2013/14.

- Generic price reductions from 2009/10 to 2013/14 ranged from 34% to 57%, depending on the province.

- The generic substitution effect was -1.5% (compared to -7.2% in 2012/13) as no blockbuster drugs lost patent exclusivity in 2013/14.

A cross effect resulted from the interaction between the individual effects. No value is given for the cross effect.

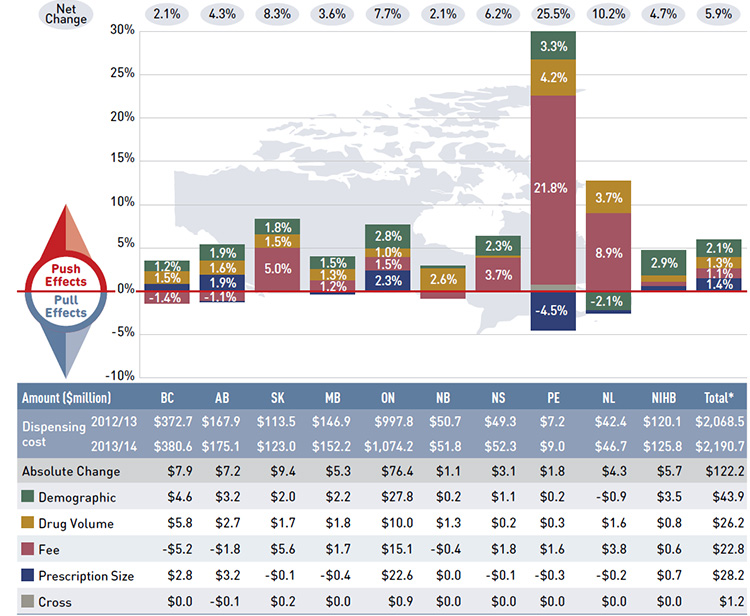

Dispensing Cost Component of Prescription Drug Expenditures

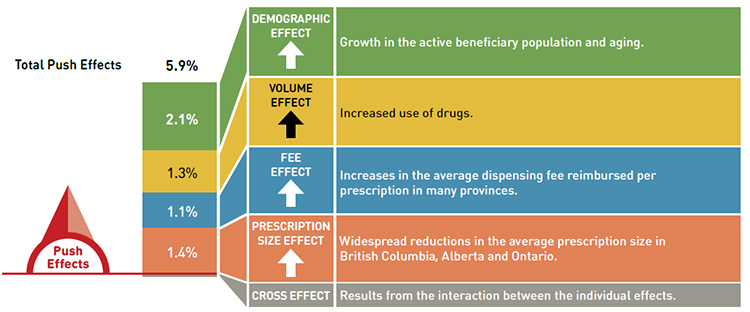

Dispensing costs have been increasing in recent years in most public plans, growing at a rate of 5.9% from 2012/13 to 2013/14. Dispensing costs accounted for an increased share of prescription drug expenditures: 22.3% in 2013/14, up from 19.0% in 2010/11.

Highlights for 2013/14

- The 5.9% rate of change in dispensing costs was mainly driven by increases in the size and age of the active beneficiary population (2.1%), growth in the use of drugs (1.3%), and increases in dispensing fee levels (1.1%), as well as a trend toward smaller prescription sizes in some provinces (1.4%).

Dispensing cost drivers 2013/14

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This diagram illustrates dispensing cost drivers for 2013/14. It shows the totals for the NPDUIS public drug plans in Canada.

The total push (increasing) effect from 2012/13 to 2013/14 was 5.9% and included the following key effects:

- The demographic effect (2.1%) was driven by the growth in the active beneficiary population and aging.

- The volume effect (1.3%) was driven by the increased use of drugs.

- The fee effect (1.1%) was driven by increases in the average dispensing fee reimbursed per prescription in many provinces.

- The prescription size effect (1.4%) was driven by widespread reductions in the average prescription size in British Columbia, Alberta, and Ontario.

A cross effect resulted from the interaction between the individual effects. No value is given for the cross effect.

Note that overall key findings mask important variations at the jurisdictional level, which are detailed in the report.

Canadian Pricing and Reimbursement Environment, 2013/14

- Five provinces implemented generic pricing policies in 2013/14.

- British Columbia, New Brunswick, Prince Edward Island, and Newfoundland and Labrador lowered the prices of generic drugs to 25% of their brand-name equivalents, while Alberta reduced this ratio to 18%, with a few exceptions for specific drugs.

- The PMPRB reviewed 115 new drug products in 2013.

- Of the new drugs, 7 were either breakthrough drugs or demonstrated a substantial improvement; and 20 were classified as having a moderate improvement; and the remaining 88 drugs were classified as having slight or no improvement.

- In 2013, the Canadian Agency for Drugs and Technologies in Health (CADTH) Common Drug Review made 34 recommendations for 29 drugs; a few drugs received multiple recommendations depending on their indication.

- Recommendations included: list: 0; list with criteria/condition: 18; list with clinical criteria and/or conditions: 4; do not list at the submitted price: 4; and do not list: 8.

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) as part of the National Prescription Drug Utilization Information System (NPDUIS).

The PMPRB would like to acknowledge the contributions of:

- The members of the NPDUIS Advisory Committee, for their expert oversight and guidance in the preparation of this report.

- The PMPRB staff for their contribution to the analytical content of the report:

- Tanya Potashnik – Director, Policy and Economic Analysis

- Elena Lungu – Manager, NPDUIS

- Greg McComb – Senior Economic Analyst

- Ai Chau – SAS Analyst

- Carol McKinley – Publications Advisor

- The PMPRB scientific and editing groups

Disclaimer

NPDUIS is a research initiative that operates independently of the regulatory activities of the Board of the PMPRB. The statements and opinions expressed in this report do not represent the position of the PMPRB with respect to any regulatory matter.

Parts of this material are based on data and information provided by the Canadian Institute for Health Information. However, the analyses, conclusions and/or statements expressed herein are not those of the Canadian Institute for Health Information.

- Executive Summary

- Introduction

- Methods

- Limitations

- 1 Canadian Pricing and Reimbursement Environment, 2013/14

- 2 Overview of Prescription Drug Expenditures and Utilization, 2013/14

- 3 Trends in Prescription Drug Expenditures, 2009/10 to 2013/14

- 4 The Drivers of Drug Costs, 2012/13 to 2013/14

- 5 The Drivers of Dispensing Costs, 2012/13 to 2013/14

- References

- Appendix A – Public Drug Plan Designs

- Appendix B – Pricing Policies for Generic Drugs in Provincial Drug Plans

- Appendix C – Markup Policies in Public Drug Plans, 2013/14

- Appendix D – Dispensing Fee Policies in Public Drug Plans, 2013/14

- Appendix E – Common Drug Review Listing Recommendations by Drug and Indication, 2013/14

- Appendix F – Top 100 Patented Drugs, NPDUIS Public Drug Plans, 2013/14

- Appendix G – Top 100 Non-Patented Single Source Drugs, NPDUIS Public Drug Plans, 2013/14

- Appendix H –Top 100 Multi-Source Generic Drugs, NPDUIS Public Drug Plans, 2013/14

- Appendix I –Top 100 Manufacturers by Drug Cost, NPDUIS Public Drug Plans, 2013/14

- Appendix J – Glossary

Introduction

The amount spent on prescription drugs in Canada represents a significant component of the overall health care costs. After sustained double-digit rates of growth in prescription drug expenditures a decade ago, the annual rates have gradually declined in recent years,

reaching 2.3% in 2013, the second lowest point in more than two decades.Footnote 1

To aid in understanding the recent trends in prescription drug expenditures and to anticipate their future direction, the CompassRx report provides a comprehensive cost driver analysis of prescription drug expenditures for all of the Canadian provincial public drug

plans (except Quebec), as well as the federal Non-Insured Health Benefits (NIHB) drug plan. The report highlights the most significant cost pressures, measures their impact on expenditure levels, and delves into the factors determining trends in costs, pricing and utilization in public plans. It also monitors major developments in the drug approval, review, pricing and reimbursement environment in Canada.

The 2013/14 CompassRx is the second edition of this report and identifies developing trends based on the baseline established in the 2012/13 publication. Two new jurisdictions have been added to this edition, providing a more comprehensive view of the public

plan environment.

The recent low rates of growth in prescription drug expenditures are the net result of a number of “push” and “pull” effects. Factors such as an increase in the beneficiary population, the increased use of drugs, and the use of more expensive drugs are putting an upward pressure (“push”) on expenditures. At the same time, expenditure levels are pulled downward by factors such as generic substitution and generic price reductions.

The analysis in this report isolates and quantifies the impact of each of the principal contributing factors. Four broad categories of effects are considered: demographic effects, volume effects, price effects and drug-mix effects. Important sub-effects are also analyzed.

In any given year, the weight of the opposing “push” and “pull” effects may vary due to changes in market trends, reimbursement decisions, changing treatment practices and other factors. These factors evolve over time and may vary across public drug plans.

This report is divided into five sections. Section 1 monitors recent pricing and reimbursement developments. Section 2 provides an overview of the prescription drug expenditure and utilization levels in 2013/14 for the NPDUIS public drug plans. Section 3 reports on five-year trends in prescription drug expenditures (from fiscal year 2009/10 to 2013/14). Sections 4 and 5 provide a cost driver analysis of the factors that drive drug and dispensing costs, respectively.

Methods

The main data source for this report is the National Prescription Drug Utilization Information System (NPDUIS) Database, developed by the Canadian Institute for Health Information (CIHI). This database houses pan-Canadian information on public drug programs, including anonymous claims-level data collected from the plans participating in the NPDUIS initiative.

Results are presented for all NPDUIS provincial plans, which include the public drug plans in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador, as well as Health Canada’s Non-Insured Health Benefits (NIHB) drug plan. The totals reported include data from all of the NPDUIS plans. A detailed description of the plans contributing to the NPDUIS Database is available in CIHI’s Plan Information Document.Footnote 2

The study analyzes data from 2009/10 to 2013/14, with a focus on the rates of change in prescription drug expenditures from 2012/13 to 2013/14. The drug costs, markups and dispensing costs reported in this study are the amounts accepted toward reimbursement by the public plans. (See the glossary in Appendix J for definitions of the variables in the report).

The results reported for Saskatchewan and Manitoba include the accepted prescription drug expenditures for individuals who are eligible for coverage but have not submitted an application and, therefore, do not have a defined deductible.Footnote 1 For the NIHB, claims that were coordinated with provincial public drug plans are excluded from the analysis to ensure consistency in the annual data reporting. The results reported for New Brunswick include the number of active beneficiaries enrolled in the Medavie Blue Cross Seniors’ Prescription Drug Program and their related drug expenditures, which are offset by monthly premiums.

The analysis of the drivers of drug and dispensing costs follows the methodological approach detailed in the PMPRB report The Drivers of Prescription Drug Expenditures: A Methodological Report.Footnote 3

Analyses of the average prescription size, as well as generic pricing, are limited to oral solid formulations. This is to avoid data reporting inconsistencies that may exist in the day supply and unit reporting of non-oral formulations.

Population data is derived from the Non-Insured Health Benefits Annual Report and Statistics Canada census data for 2007 and 2013.

Limitations

The results presented in this report are intended for individual reviews of each public plan. Comparative analyses across plans are limited by differences in the plan designs, demographics and the disease profiles of the eligible beneficiary populations. For example, British Columbia, Saskatchewan and Manitoba have universal income-based drug programs that provide broad-based coverage for the general population. Other public drug plans offer programs with specific design structures for seniors, income assistance recipients and

various patient groups.

The Non-Insured Health Benefits Program provides universal coverage to First Nations and Inuit people across Canada. This population has specific demographic and health profiles that differ from those reimbursed by other public plans.

The NPDUIS Database includes sub-plan data specific to particular jurisdictions. This further limits the comparability of results across plans. For instance, some sub-plans that are available in most provinces are not captured in the data for Alberta, Nova Scotia and Prince Edward Island. Appendix A provides a comprehensive summary of the sub-plans available in the NPDUIS Database, along with the eligibility criteria.

The totals for the NPDUIS public drug plans are heavily skewed toward Ontario due to its size.

The prescription drug expenditure data for the NPDUIS public drug plans represents only one segment of the overall pharmaceutical market, and hence, the findings in this report should not be extrapolated to the overall Canadian marketplace. The total prescription drug

expenditure reported for the NPDUIS public plans was $9.8 billion in the fiscal year 2013/14. This represents 33.4% of the $29.3 billion in total Canadian prescription drug spending in the 2013 calendar year. In total, 41.6% of prescription drug spending was financed by

public drug plans in calendar year 2013, with the remainder financed by private plans (35.5%) and out-of-pocket by households and individuals (23.9%).Footnote 1

This edition of the CompassRx reports on data up to and including the 2013/14 fiscal year. Important developments that have taken place in the Canadian environment since then are not captured in this report.

Drug costs reported are the amounts accepted toward reimbursement by the public plans and do not reflect off-invoice price rebates or price reductions resulting from confidential product listing agreements.

1 Canadian Pricing and Reimbursement Environment, 2013/14

This section provides an overview of provincial and federal developments related to public drug plan expenditure and utilization in 2013/14.

Public Drug Plans: Initiatives and Policy Updates

The information in this section was obtained from publicly available sources, including CIHI’s NPDUIS Plan Information DocumentFootnote 2 and IMS Brogan’s Provincial Reimbursement Advisor.Footnote 4

Generic and Brand-name Drug Prices

Since 2010 most provincial governments have implemented generic pricing policies that reduced the price of generic drugs in Canada and resulted in important cost savings. In 2013/14, five provinces implemented new generic pricing policies. British Columbia,

New Brunswick, Prince Edward Island, and Newfoundland and Labrador lowered the prices of generic drugs to 25% of the equivalent brand-name prices, while Alberta reduced this ratio to 18%, with some exceptions for specific drugs.

As part of a continuing effort to reduce the cost of drugs, the pan-Canadian Generic Value Price Initiative was established in 2013 (currently referenced as the pan-Canadian Pharmaceutical Alliance or pCPA). As of April 1, 2013, the prices of six of the most commonly used generic drugs were lowered to 18% of the brand-name price: atorvastatin, ramipril, venlafaxine, amlodipine, omeprazole and rabeprazole.

Since 2013/14, subsequent generic pricing policies have been introduced, either individually by the provinces or collectively through the pCPA process. In addition, all provinces and territories (except Quebec) reached an agreement on a Tiered Pricing Framework. This framework sets the prices of generic drugs based on the number of products available in the Canadian market. Tiered pricing is not intended to supersede the existing provincial regulations and policies. Appendix B provides a summary of generic pricing policies implemented since 2010.

The pCPA also conducts joint provincial/territorial negotiations for brand-name drugs to achieve greater value for Canadian publicly funded drug programs. A total of 90 joint negotiations or product listing agreements (PLAs) for brand-name drugs were completed as of January 31, 2016. PLA prices are not reflected in the drug costs captured by the NPDUIS Database.

Dispensing Fees

Several provinces increased their dispensing fees in 2013/14. Saskatchewan increased the maximum dispensing fee from $10.25 to $10.75, while Ontario raised dispensing fees for non-rural pharmacies from $8.40 to $8.62, and set the range for rural pharmacies at $9.69 to $12.92. Nova Scotia increased dispensing fees from $10.90 to $11.05, and Prince Edward Island raised their fees from $11.65 to $12.00.

Public drug plans may also reimburse fees for professional pharmacy services other than the dispensing of medications. These fees are not reflected in the data reported in this study.

Plan Design Changes

Prince Edward Island introduced a Catastrophic Drug Program on October 1, 2013. This program assists individuals or families with high prescription costs relative to their income. Beneficiary co-payments are capped on a sliding scale based on annual income.

Both Alberta and Nova Scotia introduced insulin pump therapy programs in 2013. These programs provide funding for eligible residents with type 1 diabetes.

In British Columbia, Health Canada transferred management and delivery of First Nations health programs – including prescription drugs – to the new First Nations Health Authority on October 1, 2013. British Columbia also made additional vaccines available through pharmacists including vaccines for measles, mumps, hepatitis and tetanus.

In July 2013, New Brunswick introduced a Frequency of Dispensing and Payment Policy. According to this policy, pharmacies are eligible for one dispensing fee every 28 days or more for drugs taken continuously (long-term).

Approval, Review and Assessment of Drugs and Prices in Canada

Three separate federal institutions are responsible for drug approval, price reviews, and health technology assessments: Health Canada, the Patented Medicine Prices Review Board (PMPRB), and the Canadian Agency for Drugs and Technologies in Health (CADTH).

Health Canada

Health Canada grants the authority to market a drug in Canada once it has met the regulatory requirements for safety, efficacy and quality, and issues a Notice of Compliance (NOC). In 2013/14, Health Canada issued 979 NOCsFootnote 5 (Table 1.1).

Table 1.1 Health Canada Notices of Compliance issued in 2013/14

| Pharmaceutical / biologic status |

Number of NOCs |

| Prescription pharmaceutical |

908 |

| Biologic |

71 |

| Total |

979 |

Table 1.1

| Brand name, generic or supplement status |

Number of NOCs |

| Brand name |

204 |

| Generic |

431 |

| Supplements to existing drugs* |

344 |

| Total |

979 |

* After an initial NOC is issued for a drug, a subsequent NOC may be issued for reasons such as a change to the drug’s name, a new indication or strength, a new manufacturing site or a new process to manufacturer the drug.

Patented Medicine Prices Review Board

The PMPRB reviews the factory-gate prices of patented drugs sold in Canada and ensures that they are not excessive. It also reports on pharmaceutical trends for all medicines and research and development spending by patentees. In 2013, the PMPRB reviewed

115 new drug products and classified each based on its level of therapeutic improvement (Table 1.2).

Table 1.2 Patented Medicine Prices Review Board, drugs reviewed in 2013 by level of therapeutic improvement

| Level of therapeutic improvement |

Number of drugs |

| Breakthrough |

4 |

| Substantial improvement |

2 |

| Moderate improvement |

20 |

| Slight / no improvement |

85 |

| Category 2* |

1 |

| Category 1* |

3 |

| Total |

115 |

* Drugs reviewed by the PMPRB prior to the implementation of the 2010 Guidelines. Category 2 drugs are equivalent to breakthrough and substantial improvement levels; Category 1 drugs are line extensions, which are the equivalent of a slight/no improvement under the 2010 Guidelines.

As part of its reporting mandate, the PMPRB uses the Patented Medicines Price Index (PMPI) to monitor trends in prices of patented drug products. The PMPI measures the average year-over-year change in the factory-gate (manufacturer) prices of patented drug

products sold in Canada. These prices are based on publically available information and do not include confidential rebates. In 2013, the PMPI, on average, increased slightly by 0.5%, which was less than the 0.9% increase in inflation measured by the Consumer Price

Index (CPI).Footnote 6

The PMPRB compares the prices of Canadian patented drug products to the median price of a basket of seven comparator countries (PMPRB7): France, Italy, Germany, Sweden, Switzerland, United Kingdom and the United States. While average foreign prices were 6% higher than Canadian prices in 2013, this result was greatly influenced by the high drug prices in the United States. In fact, Canadian prices were decidedly higher than prices in the United Kingdom, France and Italy, and somewhat higher than prices in Sweden and

Switzerland.Footnote 6

Canadian Agency for Drugs and Technologies in Health

The CADTH Common Drug Review (CDR) conducts evaluations of the clinical, economic, and patient evidence on drugs marketed in Canada and uses this information to provide reimbursement recommendations and advice to Canada’s publicly funded drug plans, with

the exception of Quebec. The provinces take these recommendations under advisement when determining what drugs will be listed in their formularies.

In 2013/14, the CDR made 34 recommendations for 29 drugs; a few drugs received multiple recommendations depending on the indication.Footnote 7 See Table 1.3 for a summary of results and Appendix E for a complete list of drugs and their recommendations by indication.

Table 1.3 Common Drug Review listing recommendations,* 2013/14

| Recommendation |

Number of recommendations |

Number of drugs |

| List |

0 |

0 |

| List with criteria/condition |

18 |

14 |

| List with clinical criteria and/or conditions |

4 |

4 |

| Do not list at submitted price |

4 |

4 |

| Do not list |

8 |

8 |

| Total |

34 |

29† |

* CADTH implemented revised Canadian Drug Expert Committee (CDEC) recommendation options on November 21, 2012, which included the creation of the “do not list at the submitted price” category and greater usage of conditions related to price in

the “list with clinical criteria and/or conditions” category.

† The value does not add to the sum of the number of drugs by listing recommendation, as several drugs had separate recommendations for two indications.

2 Overview of Prescription Drug Expenditures and Utilization, 2013/14

This section provides an overview of prescription drug expenditures and utilization for the NPDUIS public drug plans in fiscal year 2013/14. The expenditures reported here include the drug costs, dispensing costs, and markups, where applicable. These expenditures reflect both the plan-paid and beneficiary-paid portions of the costs, such as co-payments and deductibles. They represent the total amount accepted for reimbursement by the public drug plans (including the amount eligible toward deductibles). See Appendix A for a

summary of the individual plan designs and the glossary in Appendix J for a definition of the expenditure components.

Figure 2.1 presents the total prescription drug expenditures levels for the NPDUIS public drug plans in 2013/14 broken down into the three major components: drug costs, dispensing costs and markups.

Figure 2.1 Prescription drug expenditures in NPDUIS public drug plans, 2013/14 ($million, % share)

*Total results for the public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

A wholesale upcharge amount may be captured either in the drug cost or the markup component, depending on the reimbursement policies specific to each drug plan (see Appendix C). Thus, the comparison of the relative size of these two components across plans is limited.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes prescription drug expenditures for the NPDUIS public drug plans in 2013/14 broken out into the three components: drug costs, dispensing costs and markups.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| Total prescription drug expenditures (millions of dollars) |

$1,597.1 |

$843.4 |

$535.5 |

$602.7 |

$5,178.5 |

$206.8 |

$224.0 |

$37.8 |

$158.0 |

$429.2 |

$9,813.1 |

| Markups (millions of dollars, percent share) |

$0.0 (0.0%) |

$0.1 (0.0%) |

$31.7 (5.9%) |

‒ |

$290.8 (5.6%) |

$3.3 (1.6%) |

$11.7 (5.2%) |

$0.0 (0.0%) |

‒ |

$8.1 (1.9%) |

$345.8 (3.5%) |

| Dispensing costs (millions of dollars, percent share) |

$380.6 (23.8%) |

$175.1(20.8%) |

$123.0 (23.0%) |

$152.2 (25.3%) |

$1,074.2 (20.7%) |

$51.8 (25.1%) |

$52.3 (23.4%) |

$9.0 (23.8%) |

$46.8 (29.6%) |

$125.8 (29.3%) |

$2,190.8 (22.3%) |

| Drug costs (millions of dollars, percent share) |

$1,216.5 (76.2%) |

$668.2 (79.2%) |

$380.8 (71.1%) |

$450.5 (74.7%) |

$3,813.5 (73.6%) |

$151.6 (73.3%) |

$159.9 (71.4%) |

$28.8 (76.2%) |

$111.3 (70.4%) |

$295.4 (68.8%) |

$7,276.6 (74.2%) |

Of the $9.8 billion in total prescription expenditures, nearly three quarters (74.2%) was represented by the drug cost component. Dispensing costs made up 22.3% of the total, and markups represented 3.5%.

Prescription drug expenditure levels differ widely among the plans. This is mainly due to variations in the size of the beneficiary populations, but also reflects the demographic and disease profiles of the beneficiaries, as well as differences in plan

designs. The relative size of the these components also varies across the plans, reflecting differences in the reimbursement of markups and dispensing costs, as well as the quantity of drugs dispensed per prescription and the choice of drugs.

Appendices C and D summarize the policies governing markups and dispensing fees for the NPDUIS public drug plans in 2013/14.

A portion of the prescription drug expenditures reported in Figure 2.1 is reimbursed by the public plans, while the rest is paid by the beneficiaries either out-of-pocket or through a third-party private insurer. Figure 2.2 reports the share paid by the public plans.

Figure 2.2 Plan-paid share of prescription drug expenditures for NPDUIS public drug plans, 2013/14 ($million, % share)

*Total results for the public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes the plan-paid share of prescription drug expenditures for the NPDUIS public drug plans in 2013/14. Absolute values are given in millions of dollars. British Columbia: $937.0 (58.7%); Alberta: $687.4 (81.5%); Saskatchewan: $287.6 (53.7%); Manitoba: $298.2 (49.5%); Ontario: $4,565.7 (88.2%); New Brunswick: $183.5 (88.7%); Nova Scotia: $182.2 (81.3%); Prince Edward Island: $28.1 (74.4%); Newfoundland and Labrador: $137.1 (86.7%); Non-Insured Health Benefits: $414.5 (96.6%); Total plans: $7,721.3 (78.7%).

The graph also shows total prescription drug expenditures for the plans in millions of dollars: British Columbia: $1,597.1; Alberta: $843.4; Saskatchewan: $535.5; Manitoba: $602.7; Ontario: $5,178.5; New Brunswick: $206.8; Nova Scotia: $224.0; Prince Edward Island: $37.8; Newfoundland and Labrador: $158.0; Non-Insured Health Benefits: $429.2; Total plans: $9,813.1.

The results suggest that the public drug plans paid 78.7% of the overall prescription drug expenditure level for their beneficiaries, including drug costs, dispensing costs and markups.

Variations among the plans are mainly due to differences in plan designs and the specific government–patient cost-sharing structures (Appendix A). These differences limit the comparability of results among the jurisdictions. For instance, public drug plans in British Columbia, Saskatchewan and Manitoba provide income-based coverage to the general population, and the expenditure levels include accepted amounts for individuals who are eligible for coverage but have not submitted an application and, therefore, do not have a

defined deductible.Footnote 1

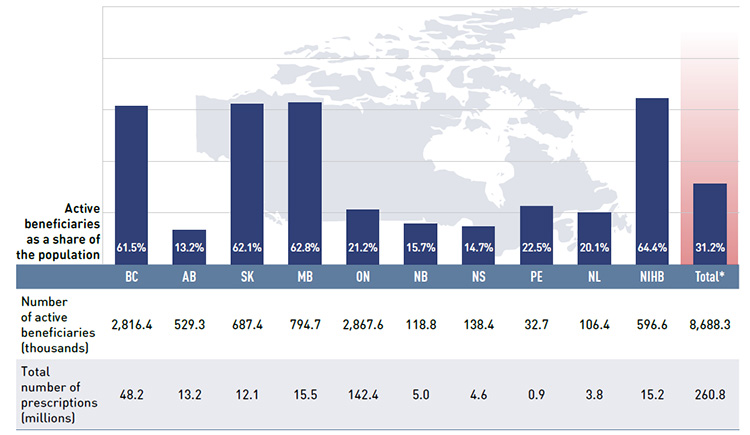

Figure 2.3 gives the number of active beneficiaries as an absolute number and as a share of the total population for each jurisdiction for 2013/14.Footnote 8 Footnote 9 It also reports the number of prescriptions that were accepted for reimbursement.

Figure 2.3 Number of active beneficiaries and associated number of prescriptions in NPDUIS public drug plans, 2013/14

*Total results for the public drug plans reported in this figure.

Data sources: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information;

Statistics Canada, CANSIM Table 051-0001; Non-Insured Health Benefits Program Annual Report, 2013/14.

Figure description

This bar graph describes the number of active beneficiaries, their share of the population, and the associated number of prescriptions for the NPDUIS public drug plans in 2013/14.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| Number of active beneficiaries (thousands); percent share of population |

2,816.4 (61.5%) |

529.3 (13.2%) |

687.4 (62.1%) |

794.7 (62.8%) |

2,867.6 (21.2%) |

118.8 (15.7%) |

138.4 (14.7%) |

32.7 (22.5%) |

106.4 (20.1%) |

596.6 (64.4%) |

8,688.3 (31.2%) |

| Total number of prescriptions (millions) |

48.2 |

13.2 |

12.1 |

15.5 |

142.4 |

5.0 |

4.6 |

0.9 |

3.8 |

15.2 |

260.8 |

Nearly 8.7 million active beneficiaries had 260.8 million prescriptions accepted towards a deductible or paid for (in full or in part) by the NPDUIS public drug plans. These beneficiaries accounted for almost a third (31.2%) of the total provincial and NIHB client populations.

The variations in the active beneficiary share of the population are related to the plan designs, with income-based plans in British Columbia (61.5%), Saskatchewan (62.1%) and Manitoba (62.8%) providing drug coverage for the general population. Other plans that focused their coverage on seniors, income assistance recipients and various patient groups had a smaller representation of active beneficiaries in the population, ranging from 13.2% to 22.5%. Nevertheless, these provinces also paid a higher share of the prescription cost for their active beneficiaries (Figure 2.2). The NIHB had the highest participation rate (64.4%), as it provided universal coverage to its clients.

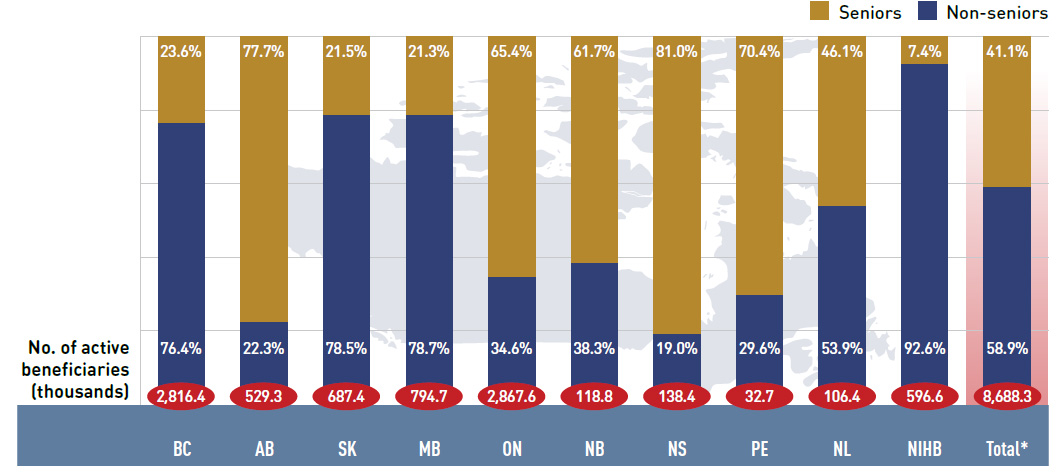

Figure 2.4 reports the shares of non-senior and senior beneficiaries in 2013/14. Overall there was a greater proportion of non-seniors (58.9%) than seniors (41.1%).

There were wide variations in distribution at the jurisdictional level, mainly related to the specific plan designs. As discussed, British Columbia, Saskatchewan and Manitoba have income-based plans, and hence, a relatively high non-senior representation (76.4%, 78.5%

and 78.7%, respectively). In other plans, the share of non-senior beneficiaries ranged from 19.0% to 53.9%. In the NIHB, non-seniors accounted for 92.6% of the active beneficiaries, reflecting its unique demographic profile.

Alberta, Nova Scotia and Prince Edward Island do not submit data to NPDUIS for all their sub-plans, so their non-senior shares may be under-represented.

Figure 2.4 Shares of non-senior and senior active beneficiaries in NPDUIS public drug plans, 2013/14

*Total results for the public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes the shares of senior and non-senior active beneficiaries for the NPDUIS public drug plans in 2013/14.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| Number of active beneficiaries (thousands) |

2,816.4 |

529.3 |

687.4 |

794.7 |

2,867.6 |

118.8 |

138.4 |

32.7 |

106.4 |

596.6 |

8,688.3 |

| Seniors |

23.6% |

77.7% |

21.5% |

21.3% |

65.4% |

61.7% |

81.0% |

70.4% |

46.1% |

7.4% |

41.1% |

| Non-seniors |

76.4% |

22.3% |

78.5% |

78.7% |

34.6% |

38.3% |

19.0% |

29.6% |

53.9% |

92.6% |

58.9% |

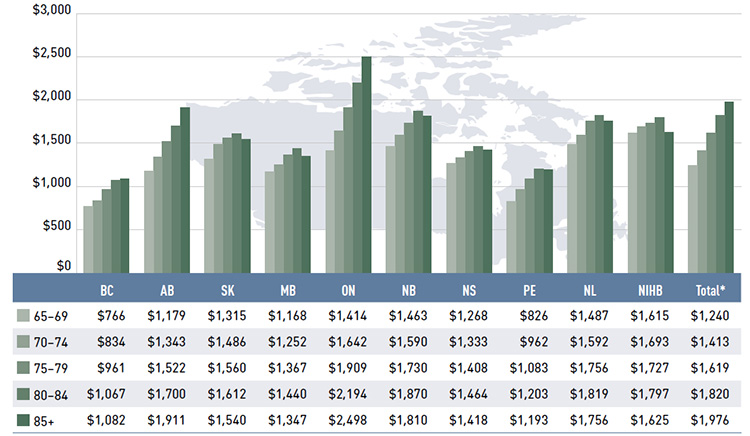

Figure 2.5 reports the average annual prescription drug cost per senior beneficiary in 2013/14, stratified by five-year age bands. Limiting the data to seniors allows for a greater comparability across plans.

With a few exceptions, the results show that the annual drug cost for seniors was higher in the older age groups. The average drug cost for all plans ranged from $1,240 for beneficiaries between 65 and 69 years old to $1,976 for those over 85, as comorbidity and chronic

conditions generally increase with age.

There is some jurisdictional variation in the annual drug costs for these age groups. This may be due to the differences in plan designs, the disease profiles of the population, drug coverage or prescribing patterns. Annual drug costs for seniors have declined in recent years due to generic entry and pricing policies for drugs that are generally used by older beneficiaries. This trend is explored further in Figure 3.5.

Figure 2.5 Average annual prescription drug cost per senior beneficiary, by five-year age bands, NPDUIS public drug plans, 2013/14

*Total results for the public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes the average annual prescription drug cost per senior beneficiary by five-year age bands for the NPDUIS drug plans in 2013/14.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| 65-69 |

$766 |

$1,179 |

$1,315 |

$1,168 |

$1,414 |

$1,463 |

$1,268 |

$826 |

$1,487 |

$1,615 |

$1,240 |

| 70-74 |

$834 |

$1,343 |

$1,486 |

$1,252 |

$1,642 |

$1,590 |

$1,333 |

$962 |

$1,592 |

$1,693 |

$1,413 |

| 75-79 |

$961 |

$1,522 |

$1,560 |

$1,367 |

$1,909 |

$1,730 |

$1,408 |

$1,083 |

$1,756 |

$1,727 |

$1,619 |

| 80-84 |

$1,067 |

$1,700 |

$1,612 |

$1,440 |

$2,194 |

$1,870 |

$1,464 |

$1,203 |

$1,819 |

$1,797 |

$1,820 |

| 85+ |

$1,082 |

$1,911 |

$1,540 |

$1,347 |

$2,498 |

$1,810 |

$1,418 |

$1,193 |

$1,756 |

$1,625 |

$1,976 |

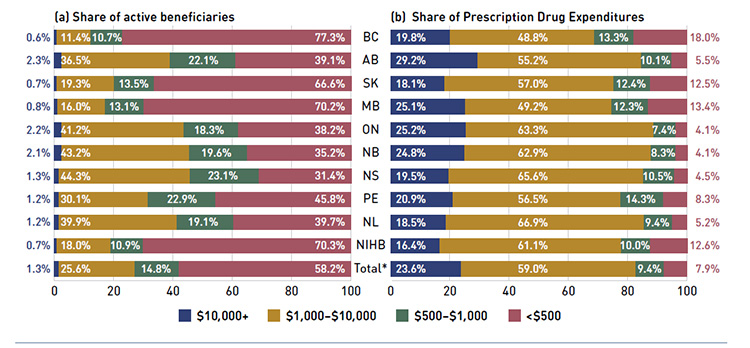

Figure 2.6 shows the distribution of active beneficiaries in 2013/14 based on their annual prescription cost levels: ‹$500, $500–$1,000, $1,000–$10,000 and $10,000+. The share of active beneficiaries in each of these groups is presented in Figure 2.6a, with the

corresponding share of prescription drug expenditures provided in Figure 2.6b.

The results show that high-cost beneficiaries with $10,000 or more in annual prescription costs represented a small proportion of the active beneficiaries, ranging from 0.6% to 2.3% depending on the plan. However, they accounted for a disproportionate share of expenditures, ranging from 16.4% to 29.2% across the public drug plans. These high-cost beneficiaries are more likely to have chronic conditions, comorbiditiesFootnote 10 or require treatment with expensive therapies such as biologics.

Conversely, those with annual treatment costs under $1,000 represented the majority of active beneficiaries, ranging from 54.5% to 88.0% depending on the plan. These beneficiaries accounted for a relatively low share of prescription drug expenditures, ranging from

11.5% to 31.3% of the total for 2013/14.

Figure 2.6 Share of active beneficiaries and prescription drug expenditures, by annual individual prescription drug cost levels, NPDUIS public drug plans, 2013/14

*Total results for the public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure shows two complementary bar graphs side-by-side.

The left-hand graph shows the shares of active beneficiaries in 2013/14 by annual prescription drug cost levels in the NPDUIS public drug plans:

|

$10,000 or greater |

$1,000 to $10,000 |

$500 to $1,000 |

Less than $500 |

| Total |

1.3% |

25.6% |

14.8% |

58.2% |

| Non-Insured Health Benefits |

0.7% |

18.0% |

10.9% |

70.3% |

| Newfoundland and Labrador |

1.2% |

39.9% |

19.1% |

39.7% |

| Prince Edward Island |

1.2% |

30.1% |

22.9% |

45.8% |

| Nova Scotia |

1.3% |

44.3% |

23.1% |

31.4% |

| New Brunswick |

2.1% |

43.2% |

19.6% |

35.2% |

| Ontario |

2.2% |

41.2% |

18.3% |

38.2% |

| Manitoba |

0.8% |

16.0% |

13.1% |

70.2% |

| Saskatchewan |

0.7% |

19.3% |

13.5% |

66.6% |

| Alberta |

2.3% |

36.5% |

22.1% |

39.1% |

| British Columbia |

0.6% |

11.4% |

10.7% |

77.3% |

The right-hand graph depicts the corresponding shares of prescription drug expenditures:

|

$10,000 or greater |

$1,000 to $10,000 |

$500 to $1,000 |

Less than $500 |

| Total |

23.6% |

59.0% |

9.4% |

7.9% |

| Non-Insured Health Benefits |

16.4% |

61.1% |

10.0% |

12.6% |

| Newfoundland and Labrador |

18.5% |

66.9% |

9.4% |

5.2% |

| Prince Edward Island |

20.9% |

56.5% |

14.3% |

8.3% |

| Nova Scotia |

19.5% |

65.6% |

10.5% |

4.5% |

| New Brunswick |

24.8% |

62.9% |

8.3% |

4.1% |

| Ontario |

25.2% |

63.3% |

7.4% |

4.1% |

| Manitoba |

25.1% |

49.2% |

12.3% |

13.4% |

| Saskatchewan |

18.1% |

57.0% |

12.4% |

12.5% |

| Alberta |

29.2% |

55.2% |

10.1% |

5.5% |

| British Columbia |

19.8% |

48.8% |

13.3% |

18.0% |

3 Trends in Prescription Drug Expenditures, 2009/10 to 2013/14

A review of the recent trends in prescription drug expenditures suggests that the rate of growth in the dispensing cost component exceeded that in the drug cost component, with dispensing costs accounting for an increased share of prescription costs. In 2013/14, drug cost levels in some plans continued to decline, following the trend observed in 2012/13; however, other plans saw a reversal of this trend, having positive rates of growth in drug cost.

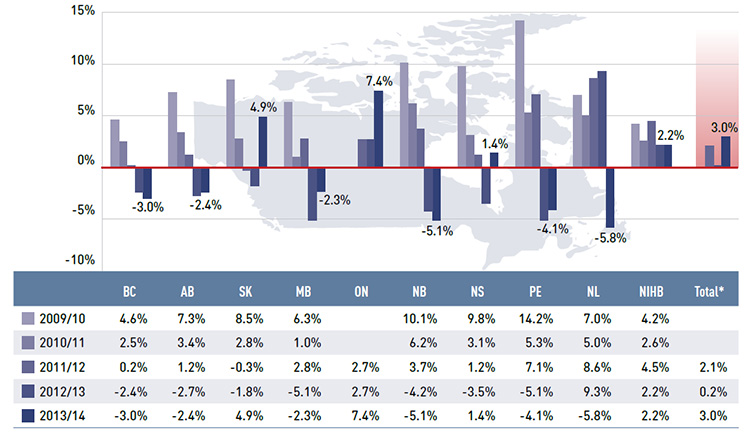

Figure 3.1 reports the annual rates of change in prescription drug expenditures from fiscal year 2009/10 to 2013/14. Growth has slowed considerably in recent years, with low positive or negative rates of change in most public plans.

In 2013/14, the rates of change in prescription costs averaged 3.0% for the public drug plans, which exceeded the overall growth in the previous two years (0.2% in 2012/13 and 2.1% in 2011/12). For just over half of plans, these rates were negative, ranging from –5.8% in Newfoundland and Labrador to –2.3% in Manitoba. Ontario and Saskatchewan had the highest rate of growth at 7.4% and 4.9%, respectively, while Nova Scotia and the NIHB had low positive rates of growth of 1.4% and 2.2%, respectively. The prescription

drug expenditures reported include drug costs, dispensing costs and markups, where applicable.

A number of factors drive the year-over-year change in prescription drug expenditures, such as demographic, volume, price and drug-mix effects. These are discussed in detail in Sections 4 and 5, with a focus on the rates of change from 2012/13 to 2013/14.

Figure 3.1 Annual rates of change in prescription drug expenditures, NPDUIS public drug plans, 2009/10 to 2013/14

*Total results for the public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph shows the trend in annual rates of change in prescription drug expenditures from 2009/10 to 2013/14 for the NPDUIS public drug plans.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| 2009/10 |

4.6% |

7.3% |

8.5% |

6.3% |

‒ |

10.1% |

9.8% |

14.2% |

7.0% |

4.2% |

‒ |

| 2010/11 |

2.5% |

3.4% |

2.8% |

1.0% |

‒ |

6.2% |

3.1% |

5.3% |

5.0% |

2.6% |

‒ |

| 2011/12 |

0.2% |

1.2% |

-0.3% |

2.8% |

2.7% |

3.7% |

1.2% |

7.1% |

8.6% |

4.5% |

2.1% |

| 2012/13 |

-2.4% |

-2.7% |

-1.8% |

-5.1% |

2.7% |

-4.2% |

-3.5% |

-5.1% |

9.3% |

2.2% |

0.2% |

| 2013/14 |

-3.0% |

-2.4% |

4.9% |

-2.3% |

7.4% |

-5.1% |

1.4% |

-4.1% |

-5.8% |

2.2% |

3.0% |

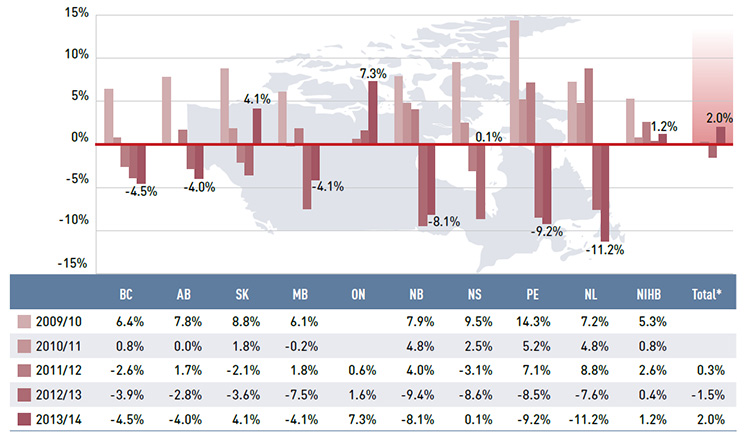

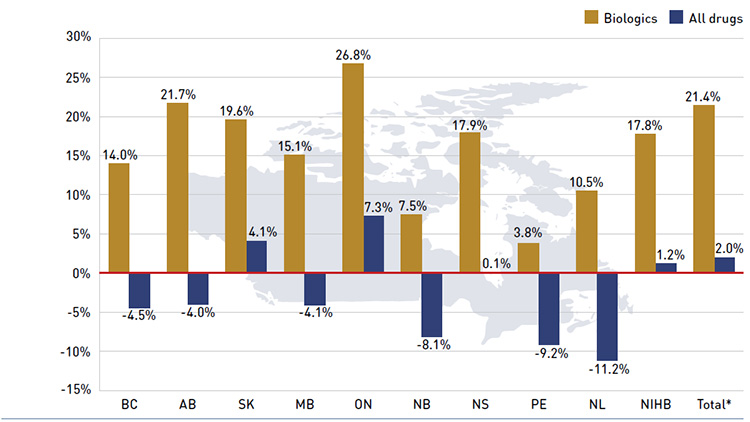

Figure 3.2 reports the annual rates of change in drug costs, which is the largest component of prescription expenditure (74.2% in 2013/14, see Figure 2.1).

While the overall drug cost levels increased by 2.0% in 2013/14, this reflects very diverse rates of growth across the public plans. Many plans continued the trend of declining drug costs observed in previous years. A few provinces saw positive rates of growth in 2013/14, a reversal of what was observed the year before. Ontario had the highest rate of growth at 7.3%, followed by Saskatchewan at 4.1%. The NIHB and Nova Scotia had small or virtually no growth in drug costs, with rates of 1.2% and 0.1%, respectively. All the other drug plans

had negative rates of change in drug costs ranging from -4.0% to -11.2%.

The changes in drug costs are driven by several opposing “push” (positive) effects and “pull” (negative) effects which nearly off-set each other in recent years. Section 4 provides a detailed analysis of the factors behind these trends.

Figure 3.2 Annual rates of change in drug costs, NPDUIS public drug plans, 2009/10 to 2013/14

*Total results for the public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph shows the trend in annual rates of change in drug costs from 2009/10 to 2013/14 for the NPDUIS public drug plans.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| 2009/10 |

6.4% |

7.8% |

8.8% |

6.1% |

‒ |

7.9% |

9.5% |

14.3% |

7.2% |

5.3% |

‒ |

| 2010/11 |

0.8% |

0.0% |

1.8% |

-0.2% |

‒ |

4.8% |

2.5% |

5.2% |

4.8% |

0.8% |

‒ |

| 2011/12 |

-2.6% |

1.7% |

-2.1% |

1.8% |

0.6% |

4.0% |

-3.1% |

7.1% |

8.8% |

2.6% |

0.3% |

| 2012/13 |

-3.9% |

-2.8% |

-3.6% |

-7.5% |

1.6% |

-9.4% |

-8.6% |

-8.5% |

-7.6% |

0.4% |

-1.5% |

| 2013/14 |

-4.5% |

-4.0% |

4.1% |

-4.1% |

7.3% |

-8.1% |

0.1% |

-9.2% |

-11.2% |

1.2% |

2.0% |

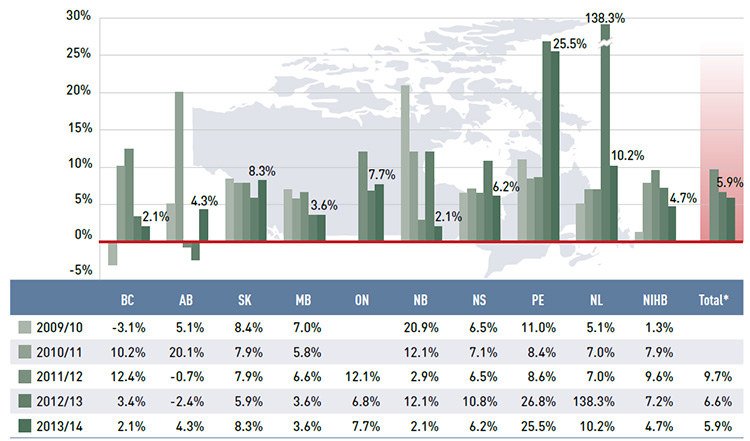

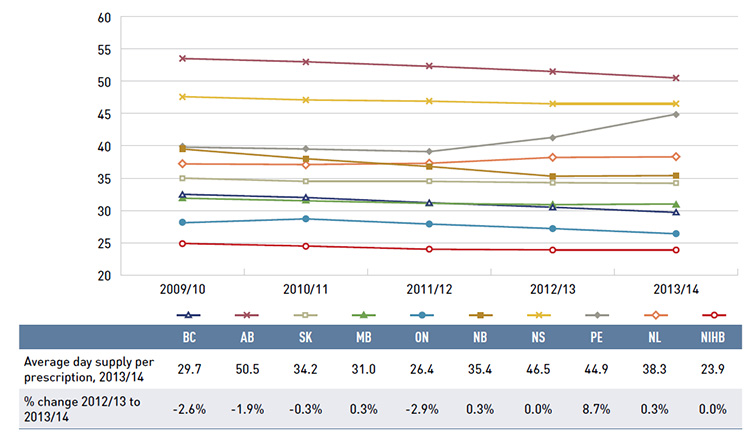

Figure 3.3 reports the annual rates of change in the dispensing component of the prescription cost. Unlike drug costs, dispensing costs grew in all public drug plans. In 2013/14, the rate of change averaged 5.9%, following considerable increases in previous years (6.6% in 2012/13 and 9.7% in 2011/12). Prince Edward Island had a particularly high rate of growth of 25.5%, mainly due to an increase in the dispensing fees per prescription reimbursed (see Section 5). Newfoundland and LabradorFootnote II, Saskatchewan and Ontario had substantial rates of growth in dispensing costs: 10.2%, 8.3% and 7.7%, respectively. The rates of growth in dispensing costs in other plans ranged from 2.1% in New Brunswick and British Columbia to 6.2% in Nova Scotia.

Figure 3.3 Annual rates of change in dispensing costs, NPDUIS public drug plans, 2009/10 to 2013/14

*Total results for the public drug plans reported in this figure.

Note: Due to the lack of available data, a limited number of years are reported for Ontario.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph shows the trend in annual rates of change in dispensing costs from 2009/10 to 2013/14 for the NPDUIS public drug plans.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| 2009/10 |

-3.1% |

5.1% |

8.4% |

7.0% |

‒ |

20.9% |

6.5% |

11.0% |

5.1% |

1.3% |

‒ |

| 2010/11 |

10.2% |

20.1% |

7.9% |

5.8% |

‒ |

12.1% |

7.1% |

8.4% |

7.0% |

7.9% |

‒ |

| 2011/12 |

12.4% |

-0.7% |

7.9% |

6.6% |

12.1% |

2.9% |

6.5% |

8.6% |

7.0% |

9.6% |

9.7% |

| 2012/13 |

3.4% |

-2.4% |

5.9% |

3.6% |

6.8% |

12.1% |

10.8% |

26.8% |

138.3% |

7.2% |

6.6% |

| 2013/14 |

2.1% |

4.3% |

8.3% |

3.6% |

7.7% |

2.1% |

6.2% |

25.5% |

10.2% |

4.7% |

5.9% |

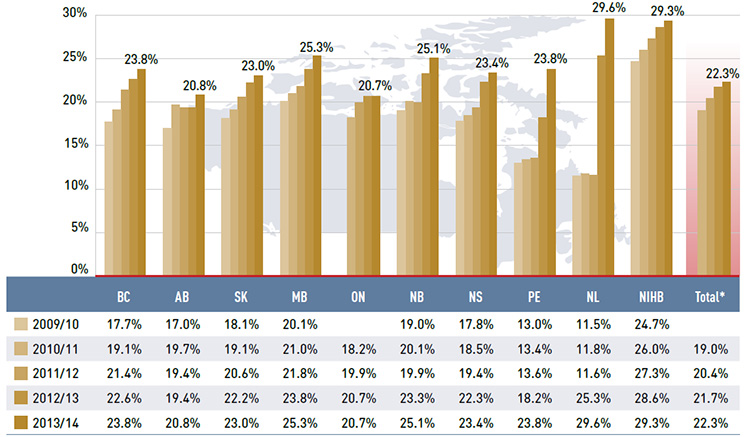

Figure 3.4 reports the dispensing costs as a share of total prescription costs by fiscal year. Without exception, dispensing cost shares increased markedly in recent years. In 2010/11, the average share was 19.0% and by 2013/14 it rose to 22.3%, an increase of 3.3%. The increase from 2009/10 to 2013/14 was most notable in two jurisdictions: Newfoundland and Labrador, where the dispensing cost share increased from 11.5% to 29.6%; and Prince Edward Island, with a 10.8% increase in the dispensing cost share over the study period.

These increases were mainly due to changes in plan designs and the reimbursed dispensing fees (see Table 5.1). Other jurisdictions with notable increases included Nova Scotia, British Columbia and New Brunswick, with the dispensing cost share increasing in the range

of 5.6% to 6.1% over the five-year period.

Jurisdictional variations are driven by differences in the average dispensing fee per prescription, prescription size and the market share of brand-name and generic drugs in each plan. The results only reflect fees for dispensing medications; other professional pharmacy services are excluded.

Section 5 provides a detailed analysis of the factors impacting dispensing costs from 2012/13 to 2013/14.

Figure 3.4 Annual dispensing costs as a share of prescription costs, NPDUIS public drug plans, 2009/10 to 2013/14

* Total results for the public drug plans reported in this figure.

Note: Due to the lack of available data, a limited number of years are reported for Ontario.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph shows the trend in annual dispensing costs as a share of prescription costs from 2009/10 to 2013/14 for the NPDUIS public drug plans.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| 2009/10 |

17.7% |

17.0% |

18.1% |

20.1% |

‒ |

19.0% |

17.8% |

13.0% |

11.5% |

24.7% |

‒ |

| 2010/11 |

19.1% |

19.7% |

19.1% |

21.0% |

18.2% |

20.1% |

18.5% |

13.4% |

11.8% |

26.0% |

19.0% |

| 2011/12 |

21.4% |

19.4% |

20.6% |

21.8% |

19.9% |

19.9% |

19.4% |

13.6% |

11.6% |

27.3% |

20.4% |

| 2012/13 |

22.6% |

19.4% |

22.2% |

23.8% |

20.7% |

23.3% |

22.3% |

18.2% |

25.3% |

28.6% |

21.7% |

| 2013/14 |

23.8% |

20.8% |

23.0% |

25.3% |

20.7% |

25.1% |

23.4% |

23.8% |

29.6% |

29.3% |

22.3% |

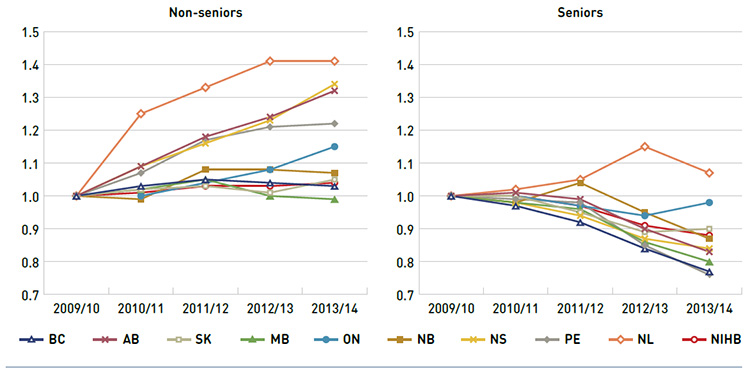

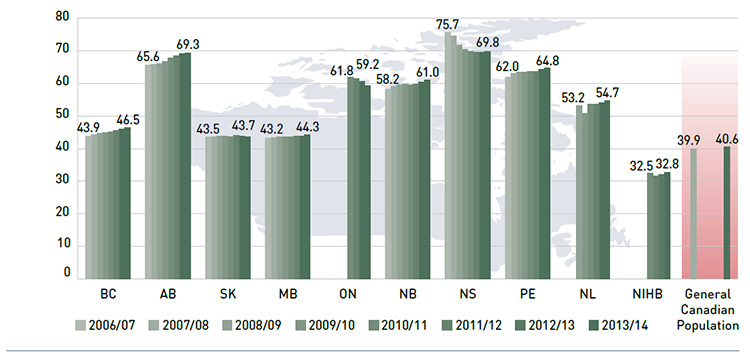

Public drug plan expenditures can vary depending on the plan designs and the demographic and disease profiles of the beneficiary populations. Some plans mainly cover the senior population and catastrophic drug costs, while others are more broadly income-based. To provide for greater comparability across plans, Figure 3.5 reports separately on trends in the average annual prescription cost per active beneficiary for non-seniors and seniors from 2009/10 to 2013/14. An index was used to equate the average annual cost in each plan and for each patient group to the value of 1 for the base year 2009/10. The values for subsequent years were then calculated relative to the base year.

The results indicate that, in general, the annual cost of drug treatment for senior beneficiaries has been declining. This is mainly due to their relatively high use of drugs that benefited from generic launches and generic pricing policies. Newfoundland and Labrador is the only plan with increases in the average annual prescription cost per active beneficiary in the senior population.

In contrast, the cost to treat non-senior patients rose rapidly in several provinces: Alberta, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, and Ontario. This may be due to the increased use of high-cost drugs, such as biologics, and the introduction of new sub-plans that expanded drug coverage to non-seniors (e.g., Nova Scotia’s Family Pharmacare Program, launched in March 2008). The plans in British Columbia, Saskatchewan, Manitoba and the NIHB, which provide coverage to a general population, had a more stable average annual prescription cost for non-seniors.

The variability in results for Newfoundland and Labrador are due to changes in the dispensing fee portion of total prescription cost, which includes fees, drug costs and markup. There was a large increase in dispensing fee costs in 2012/13 for two reasons: (i) fees became part of the co-payment structure for seniors; and (ii) there were increases in the fees paid to pharmacies in light of generic price reductions.

Figure 3.5 Index of the average annual prescription cost per beneficiary, non-seniors and seniors, NPDUIS public drug plans, 2009/10 to 2013/14

Note: Due to a lack of available data, the index for Ontario starts with 2010/11.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure shows two complementary line graphs side-by-side. Using an index, the left graph describes the change in the annual prescription cost per beneficiary for non-seniors in the NPDUIS public drug plans over a five-year period:

|

2009/10 |

2010/11 |

2011/12 |

2012/13 |

2013/14 |

| British Columbia |

1.00 |

1.03 |

1.05 |

1.04 |

1.03 |

| Alberta |

1.00 |

1.09 |

1.18 |

1.24 |

1.32 |

| Saskatchewan |

1.00 |

1.02 |

1.03 |

1.01 |

1.05 |

| Manitoba |

1.00 |

1.02 |

1.05 |

1.00 |

0.99 |

| Ontario |

‒ |

1.00 |

1.04 |

1.08 |

1.15 |

| New Brunswick |

1.00 |

0.99 |

1.08 |

1.08 |

1.07 |

| Nova Scotia |

1.00 |

1.09 |

1.16 |

1.23 |

1.34 |

| Prince Edward Island |

1.00 |

1.07 |

1.17 |

1.21 |

1.22 |

| Newfoundland and Labrador |

1.00 |

1.25 |

1.33 |

1.41 |

1.41 |

| Non-Insured Health Benefits |

1.00 |

1.01 |

1.03 |

1.03 |

1.04 |

The right graph shows the same index for seniors:

|

2009/10 |

2010/11 |

2011/12 |

2012/13 |

2013/14 |

| British Columbia |

1.00 |

0.97 |

0.92 |

0.84 |

0.77 |

| Alberta |

1.00 |

1.01 |

0.99 |

0.90 |

0.83 |

| Saskatchewan |

1.00 |

1.00 |

0.95 |

0.89 |

0.90 |

| Manitoba |

1.00 |

0.98 |

0.96 |

0.86 |

0.80 |

| Ontario |

‒ |

1.00 |

0.97 |

0.94 |

0.98 |

| New Brunswick |

1.00 |

0.98 |

1.04 |

0.95 |

0.87 |

| Nova Scotia |

1.00 |

0.98 |

0.94 |

0.87 |

0.84 |

| Prince Edward Island |

1.00 |

0.99 |

0.98 |

0.85 |

0.76 |

| Newfoundland and Labrador |

1.00 |

1.02 |

1.05 |

1.15 |

1.07 |

| Non-Insured Health Benefits |

1.00 |

1.00 |

0.97 |

0.91 |

0.88 |

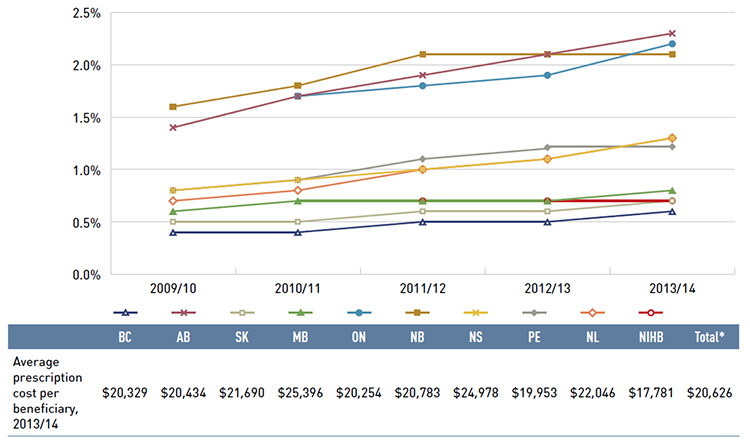

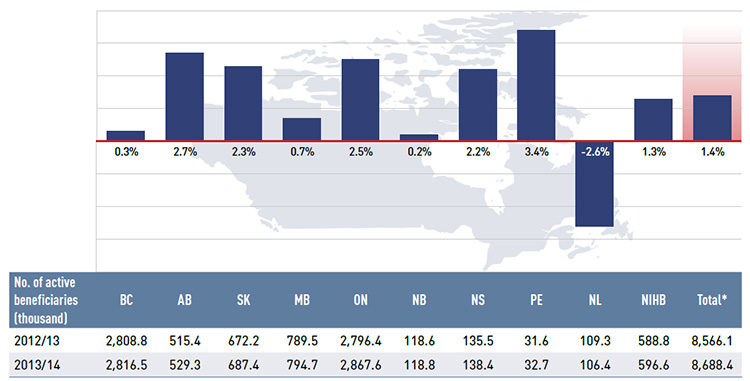

Figure 3.6 reports on trends in the share of high-cost beneficiaries with annual prescription drug costs exceeding $10,000. The results indicate that although the proportion of these patients is relatively small (1.3% across plans in 2013/14, see Figure 2.6), it has been gradually increasing in all public drug plans from 2009/10 to 2013/14.

In 2013/14, the average annual prescription cost per beneficiary for this group ranged from $17,781 in the NIHB to $25,396 in Manitoba.

Figure 3.6 Share of patients with $10,000+ in annual prescription drug costs, NPDUIS public drug plans, 2009/10 to 2013/14

* Total results for the public drug plans reported in this figure.

Note: Due to the lack of available data, a limited number of years are reported for Ontario (2010/11 to 2013/14) and the NIHB (2011/12 to 2013/14).

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure gives the share of patients with more than $10,000 in annual prescription drug costs in the NPDUIS public drug plans from 2009/10 to 2013/14. An associated table lists the average prescription costs per beneficiary in 2012/13 for all of the plans.

The share of patients is as follows:

|

2009/10 |

2010/11 |

2011/12 |

2012/13 |

2013/14 |

| British Columbia |

0.4% |

0.4% |

0.5% |

0.5% |

0.6% |

| Alberta |

1.4% |

1.7% |

1.9% |

2.1% |

2.3% |

| Saskatchewan |

0.5% |

0.5% |

0.6% |

0.6% |

0.7% |

| Manitoba |

0.6% |

0.7% |

0.7% |

0.7% |

0.8% |

| Ontario |

‒ |

1.7% |

1.8% |

1.9% |

2.2% |

| New Brunswick |

1.6% |

1.8% |

2.1% |

2.1% |

2.1% |

| Nova Scotia |

0.8% |

0.9% |

1.0% |

1.1% |

1.3% |

| Prince Edward Island |

0.8% |

0.9% |

1.1% |

1.2% |

1.2% |

| Newfoundland and Labrador |

0.7% |

0.8% |

1.0% |

1.1% |

1.2% |

| Non-Insured Health Benefits |

‒ |

‒ |

0.7% |

0.7% |

0.7% |

The average prescription cost per beneficiary for the public drug plans in 2013/14 was British Columbia: $20,329; Alberta: $20,434; Saskatchewan: $21,690; Manitoba: $25,396; Ontario: $20,254; New Brunswick: $20,783; Nova Scotia: $24,978; Prince Edward Island: $19,953; Newfoundland and Labrador: $22,046; Non-Insured Health Benefits: $17,781; Total NPDUIS plans: $20,626.

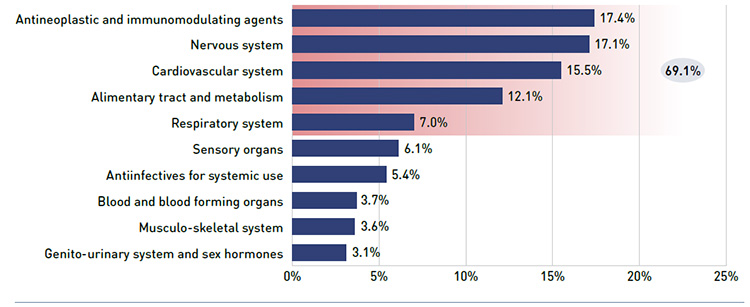

4 The Drivers of Drug Costs, 2012/13 to 2013/14

Changes in drug costs are driven by a number of opposing “push” and “pull” effects. An increase in the beneficiary population, the use of drugs, and the use of more expensive drugs will put an upward pressure on costs, resulting in a push effect; while generic substitutions and price reductions will exert a downward pull effect. The net effect of these opposing forces yields the overall rate of change.

In any given year, the weight of each of these effects may vary, and as a result, the rates of change in drug costs evolve over time and vary across public drug plans.

This section of the CompassRx report provides a comprehensive cost driver analysis that reveals the most important cost pressures, measures their impact on drug cost levels, and delves into the factors determining trends in costs, pricing and utilization in public plans.

This edition of the report focuses on the rates of change in drug expenditures from fiscal year 2012/13 to 2013/14 and includes data for two additional public plans – British Columbia and Newfoundland and Labrador – that were not included in the first edition. Thus, the results reported for the total of all drug plans in the two editions are not directly comparable. However, plan-by-plan comparisons are still relevant, and the interpretation of general trends is still appropriate.

Four broad categories of effects are analyzed along with their corresponding sub-effects.

Price Effects

- Price change effect – changes in the prices of both brand-name and generic drugs

- Generic substitution effect – shifts from brand-name to generic drugs

Demographic Effects

- Population effect – changes in the number of active beneficiaries

- Aging effect – shifts in the distribution of the population across age groups

- Gender effect – shifts in the distribution of the population by gender

Volume Effects

- Prescription volume effect – changes in the number of prescriptions dispensed to patients

- Prescription size effect – changes in the average number of units of a drug dispensed per prescription

- Strength-form effect – shifts in the use of various strengths or forms of an ingredient

Drug-Mix EffectsFootnote III

- Shifts in the use of drugs

Each of these effects was determined by assuming that all the other effects remained constant over the periods analyzed. The results provide an answer to the following question:

"How much would public plan drug costs have changed between 2012/13 and 2013/14 if only one factor (e.g., the price of drugs) changed while all the others remained the same?"

In reality, multiple factors change simultaneously, creating a residual or a cross effect, which is also reported to account for the total change.

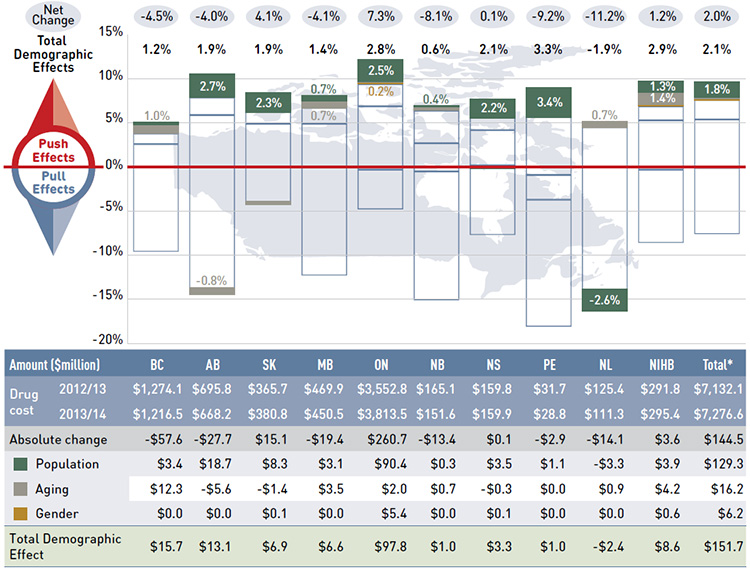

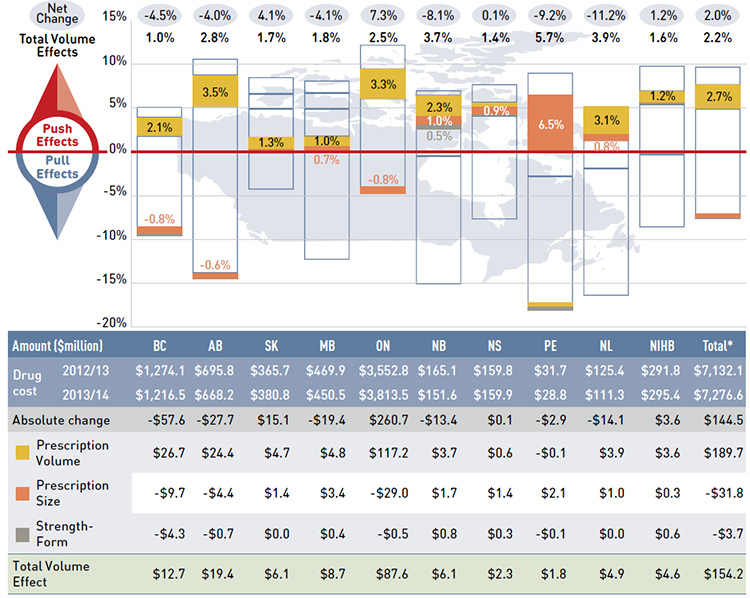

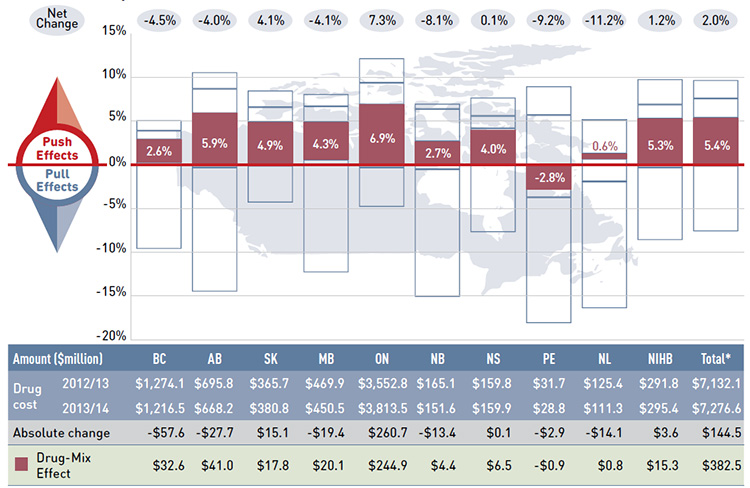

Figure 4.1 reports the rate of change in drug costs for the public drug plans over the fiscal years 2012/13 to 2013/14 separated into the four broad categories of effects. The bar graph and the associated table show the impacts of each effect as a percent and absolute change in drug cost, respectively.

While the overall rate of change in drug costs across all plans was 2.0% or $144.5 million in absolute terms, there are important jurisdictional variations, with some plans such as New Brunswick, Prince Edward Island, and Newfoundland and Labrador experiencing

significant negative rates of change. The net effect conceals the underlying opposing components of change, and the total rate of change is heavily influenced by Ontario because of its size.

Figure 4.1 Rates of change in drug costs by demographic, volume, price and drug-mix effects, NPDUIS public drug plans, 2012/13 to 2013/14

*Total results for the public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph and table describe the factors that impacted the rates of change in drug cost in the NPDUIS public drug plans from 2012/13 to 2013/14.

The bar graph shows the percent change from 2012/13 to 2013/14 for each public drug plan. The results are as follows:

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| Net change |

-4.5% |

-4.0% |

4.1% |

-4.1% |

7.3% |

-8.1% |

0.1% |

-9.2% |

-11.2% |

1.2% |

2.0% |

| Total push effects |

4.8% |

10.6% |

8.4% |

7.5% |

12.1% |

7.0% |

7.6% |

9.0% |

4.5% |

9.8% |

9.7% |

| Demographic Effect |

1.2% |

1.9% |

1.9% |

1.4% |

2.8% |

0.6% |

2.1% |

3.3% |

-1.9% |

2.9% |

2.1% |

| Volume Effect |

1.0% |

2.8% |

1.7% |

1.8% |

2.5% |

3.7% |

1.4% |

5.7% |

3.9% |

1.6% |

2.2% |

| Drug-Mix Effect |

2.6% |

5.9% |

4.9% |

4.3% |

6.9% |

2.7% |

4.0% |

-2.8% |

0.6% |

5.3% |

5.4% |

| Price Effects |

-9.6% |

-14.2% |

-4.2% |

-12.3% |

-4.5% |

-14.6% |

-7.7% |

-14.4% |

-14.5% |

-8.3% |

-7.5% |

| Cross Effect |

0.3% |

-0.3% |

-0.1% |

0.6% |

-0.3% |

-0.5% |

0.2% |

-0.9% |

0.7% |

-0.3% |

-0.1% |

The accompanying table gives the corresponding changes in millions of dollars.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| Drug cost 2012/13 |

$1,274.1 |

$695.8 |

$365.7 |

$469.9 |

$3,552.8 |

$165.1 |

$159.8 |

$31.7 |

$125.4 |

$291.8 |

$7,132.1 |

| Drug cost 2013/14 |

$1,216.5 |

$668.2 |

$380.8 |

$450.5 |

$3,813.5 |

$151.6 |

$159.9 |

$28.8 |

$111.3 |

$295.4 |

$7,276.6 |

| Absolute change |

-$57.6 |

-$27.7 |

$15.1 |

-$19.4 |

$260.7 |

-$13.4 |

$0.1 |

-$2.9 |

-$14.1 |

$3.6 |

$144.5 |

| Demographic Effect |

$15.7 |

$13.1 |

$6.9 |

$6.6 |

$97.8 |

$1.0 |

$3.3 |

$1.0 |

-$2.4 |

$8.6 |

$151.7 |

| Volume Effect |

$12.7 |

$19.4 |

$6.1 |

$8.7 |

$87.6 |

$6.1 |

$2.3 |

$1.8 |

$4.9 |

$4.6 |

$154.2 |

| Drug-Mix Effect |

$32.6 |

$41.0 |

$17.8 |

$20.1 |

$244.9 |

$4.4 |

$6.5 |

-$0.9 |

$0.8 |

$15.3 |

$382.5 |

| Price Effects |

-$122.2 |

-$99.0 |

-$15.4 |

-$57.8 |

-$159.5 |

-$24.1 |

-$12.3 |

-$4.6 |

-$18.2 |

-$24.1 |

-$537.0 |

| Cross Effect |

$3.5 |

-$2.2 |

-$0.3 |

$3.0 |

-$10.2 |

-$0.9 |

$0.3 |

-$0.3 |

$0.9 |

-$0.8 |

-$6.9 |

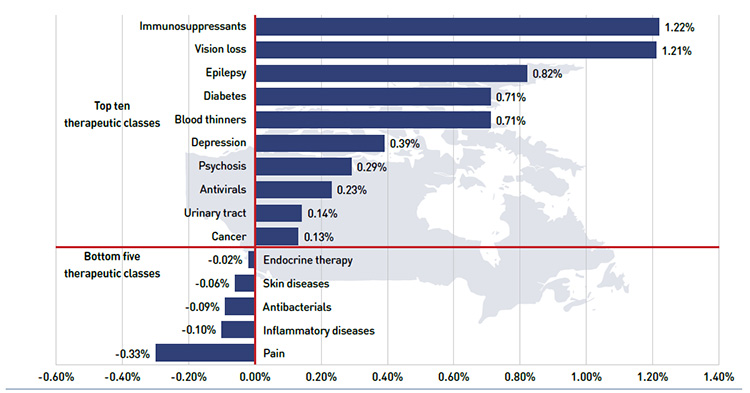

Price effects had the greatest “pull” on drug cost levels, with the implementation of generic price reductions and generic substitutions resulting in significant savings to the public plans. If all other factors had remained unchanged, the reduction in drug prices along with the shift from higher-cost brand-name products to lower-cost generic products would have reduced the drug costs in 2013/14 by an average of 7.5% ($537.0 million). Note that price effects exerted a less pronounced pull force on drug costs in 2013/14 (-7.5%) than

in 2012/13 (-9.2%).Footnote 11

Conversely, demographic, volume and drug-mix effects had a large “push” effect, increasing drug cost levels. For most plans, these push effects offset most or all of the cost savings resulting from generic substitutions and price reductions. In the absence of price effects, the combined impact of increases in the active beneficiary populations, the volume of drugs used and the use of more expensive drugs would have raised the drug cost levels in 2013/14 by an average of 9.7% ($688.4 million).

These effects exerted a more pronounced push force on drug costs in 2013/14 (9.7%) than in 2012/13 (8.5%),Footnote 11 mainly due to a higher drug-mix effect in 2013/14 (5.4% or $382.5 million) compared to the previous year (4.1%). The demographic and volume effects pushed the drug cost levels upwards by 2.1% ($151.7 million) and 2.2% ($154.2 million), respectively, in 2013/14. The combined cross effect was -0.1% (-$6.9 million).

In the following sections, each of the broad categories of effects is examined in more detail.

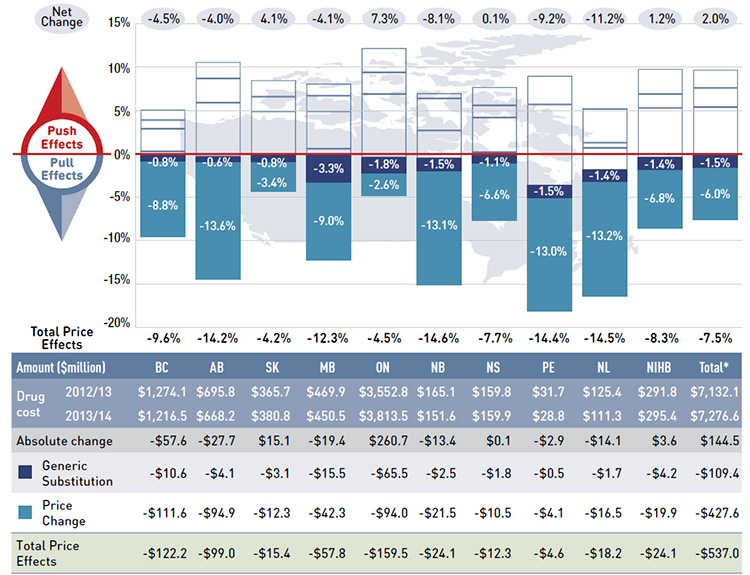

4.1 Price Effects

The general category of price effects can be further broken down to capture the precise impact of the price change and generic substitution effects. These effects had a marked pull down effect on drug cost levels in 2013/14, resulting in significant cost savings to the public drug plans.

Price Change Effect

This effect captures the impact of changes in drug prices and is determined at the strength, form and brand-name or generic level. It can have either a positive (increasing) or negative (decreasing) impact on drug costs. For instance, the recent generic price reforms that resulted in lower prices would have a negative price change effect on drug costs. In this analysis, drug prices are measured as the average unit cost accepted for reimbursement.

Generic Substitution Effect

This effect captures the impact of shifts in use from higher-cost brand-name products to lower-cost generic products, and has a negative (decreasing) impact on drug costs.

Figure 4.1.1 reports the rate of change in drug costs from 2012/13 to 2013/14 focusing on the two price effects: price change and generic substitution. The bar graph and accompanying table show the year-over-year impacts of each effect as a relative and absolute change in drug cost.

Figure 4.1.1 Rates of change in drug costs due to price effects, NPDUIS public drug plans, 2012/13 to 2013/14

*Total results for the public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure describes the factors that impacted the rates of change in drug cost due to price effects in the NPDUIS public drug plans from 2012/13 to 2013/14. It is composed of a bar graph with a table underneath.

The bar graph shows the percent change from 2012/13 to 2013/14 for each public drug plan. The results are as follows:

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| Net change |

-4.5% |

-4.0% |

4.1% |

-4.1% |

7.3% |

-8.1% |

0.1% |

-9.2% |

-11.2% |

1.2% |

2.0% |

| Total Price Effects |

-9.6% |

-14.2% |

-4.2% |

-12.3% |

-4.5% |

-14.6% |

-7.7% |

-14.4% |

-14.5% |

-8.3% |

-7.5% |

| Price Change Effect |

-8.8% |

-13.6% |

-3.4% |

-9.0% |

-2.6% |

-13.1% |

-6.6% |

-13.0% |

-13.2% |

-6.8% |

-6.0% |

| Generic Substitution Effect |

-0.8% |

-0.6% |

-0.8% |

-3.3% |

-1.8% |

-1.5% |

-1.1% |

-1.5% |

-1.4% |

-1.4% |

-1.5% |

The table below the bar graph gives the corresponding changes in millions of dollars.

|

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Non-Insured Health Benefits |

Total |

| Drug cost 2012/13 |

$1,274.1 |

$695.8 |

$365.7 |

$469.9 |

$3,552.8 |

$165.1 |

$159.8 |

$31.7 |

$125.4 |

$291.8 |

$7,132.1 |

| Drug cost 2013/14 |

$1,216.5 |

$668.2 |

$380.8 |

$450.5 |

$3,813.5 |

$151.6 |

$159.9 |

$28.8 |

$111.3 |

$295.4 |

$7,276.6 |

| Absolute change |

-$57.6 |

-$27.7 |

$15.1 |

-$19.4 |

$260.7 |

-$13.4 |

$0.1 |

-$2.9 |

-$14.1 |

$3.6 |

$144.5 |

| Price Change Effect |

-$111.6 |

-$94.9 |

-$12.3 |

-$42.3 |

-$94.0 |

-$21.5 |

-$10.5 |

-$4.1 |

-$16.5 |

-$19.9 |

-$427.6 |

| Generic Substitution Effect |

-$10.6 |

-$4.1 |

-$3.1 |

-$15.5 |

-$65.5 |

-$2.5 |

-$1.8 |

-$0.5 |

-$1.7 |

-$4.2 |

-$109.4 |

| Total Price Effect |

-$122.2 |

-$99.0 |

-$15.4 |

-$57.8 |

-$159.5 |

-$24.1 |

-$12.3 |

-$4.6 |

-$18.2 |

-$24.1 |

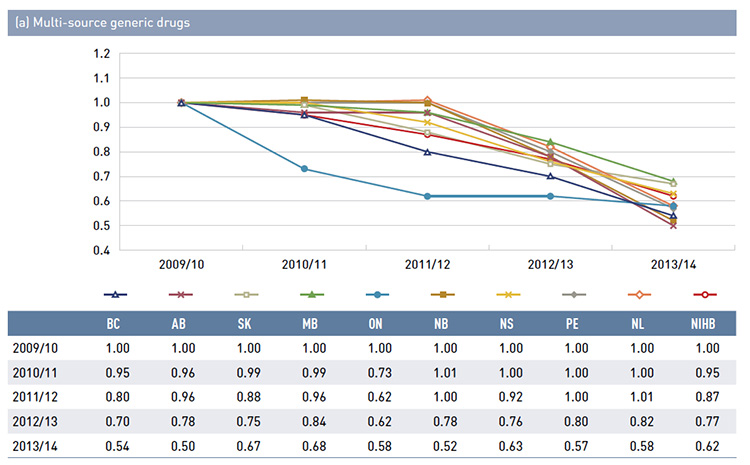

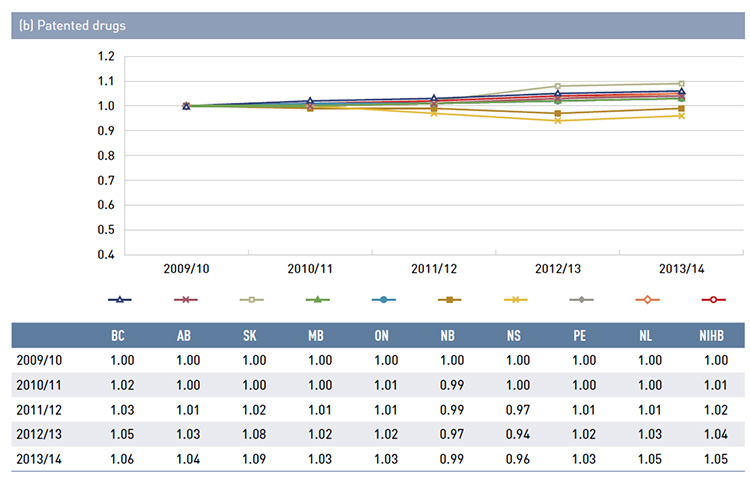

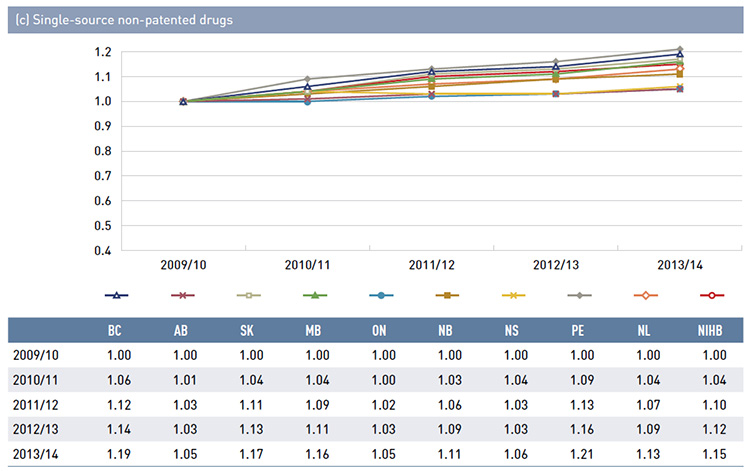

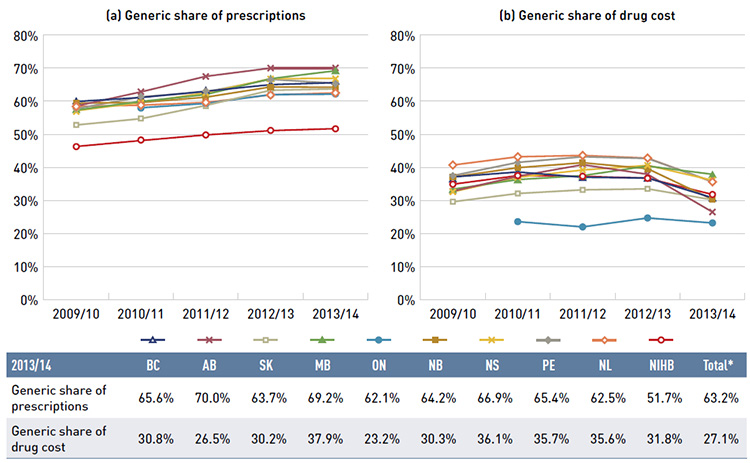

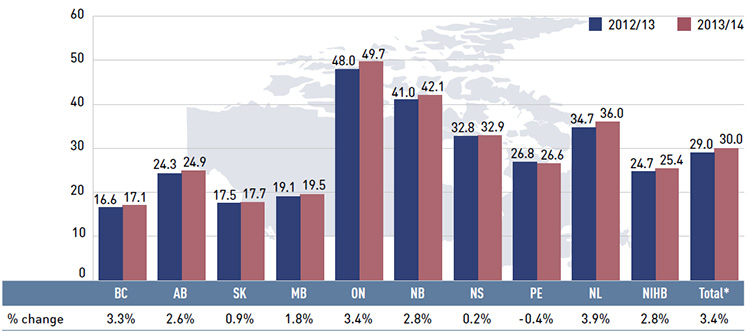

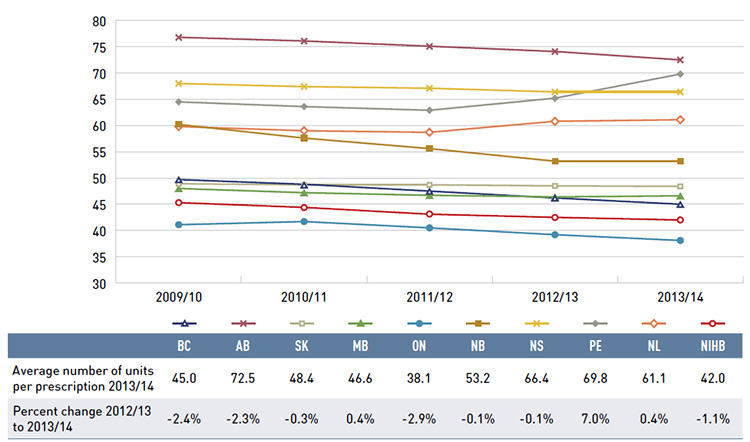

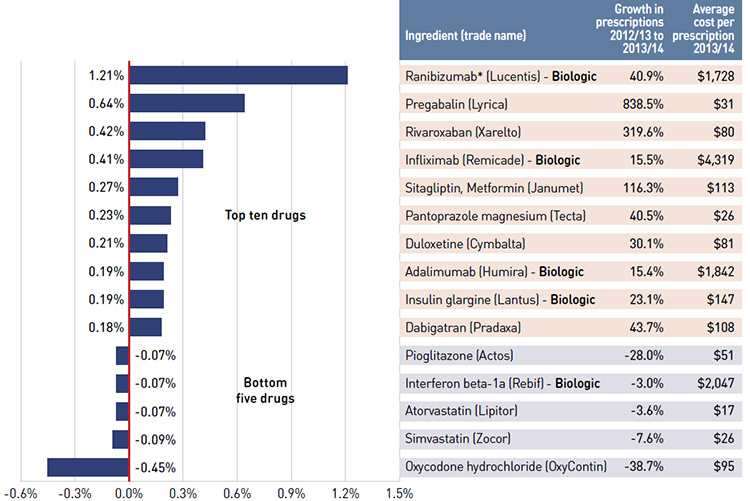

-$537.0 |