Generic Drugs in Canada, 2013

The price of generic drugs in Canada is an important issue for drug plan managers, policy makers and consumers. To inform stakeholders and to contribute to policy development, the Patented Medicine Prices Review Board (PMPRB) regularly analyzes and reports on the prices and markets of generic drugs in Canada and compares them to those of other industrialized countries. Generic Drugs in Canada, 2013 is the PMPRB’s most recent generic drug report.

Since 2010, provincial governments have implemented policies aimed at reducing the price of generic drugs. Provincial and territorial governments are collaborating on a pan-Canadian Pharmaceutical Alliance initiative (formerly the Generic Value Price Initiative), which will set the stage for further price reductions. Generic Drugs in Canada, 2013 reports on the early effects of generic pricing policies and sets the benchmark for Canadian generic price levels prior to the full implementation of the Value Price Initiative, which will be in place by April 2016.

Key Findings

Canadian Generic Prices Dropped Compared to Brand-Name Levels

Domestically, the average Canadian generic prices dropped from 56% of branded product prices in 2011 to 39% in 2013 due to changes in provincial reimbursement policies.

Ontario prices in the second quarter of 2013 more accurately reflect evolving domestic generic policies, with generic prices at 31% of the brand levels. This result reflects the price reductions resulting from the early phase of the Value Price Initiative.

Average generic price relative to the brand level, Canada

This bar graph compares average generic drug prices in Canada and Ontario to brand-name prices. For Canada: Q1-2011 generics were 0.56 of brand prices; Q1-2012 0.46; Q1-2013 0.39. Ontario: Q2-2013 0.31.

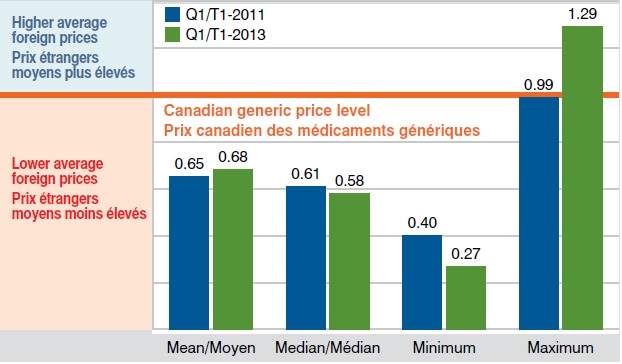

Compared to International Prices, Generic Drugs Were Still More Costly in Canada in Q1-2013

Despite a significant reduction in Canadian generic drug prices in recent years, they remain appreciably higher than international levels.

In 2011, international generic prices were, on average, 35% lower than Canadian prices; by 2013, they were still 32% lower.

Changes in international price levels and variations in exchange rates may explain these findings.

Average generic foreign price relative to the Canadian level Q1-2011 and Q1-2013

This bar graph compares average international generic price levels to Canadian levels for Q1-2011 and Q1-2013. Q1-2011 international prices: mean – 0.65; median – 0.61; minimum – 0.40; maximum 0.99. Q1-2013 international prices: mean – 0.68; median – 0.58; minimum – 0.27; maximum – 1.29.

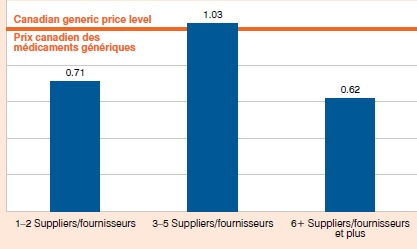

The Foreign-to-Canadian Price Gap was Wider for Molecules with a Greater Number of Suppliers

The price differences are particularly pronounced in markets with six or more suppliers, with mean international prices 38% lower than in Canada. A closer alignment of foreign-to-Canadian prices is observed in markets with fewer suppliers, with mean international prices 3% higher than in Canada for drugs with three to five suppliers and 39% lower than in Canada for drugs with one to two suppliers.

Average foreign-to-Canadian price ratios, generic drugs, by number of suppliers, Q1-2013

This bar graph compares average foreign-to-Canadian generic price ratios by number of suppliers. 1-2 suppliers: 0.71; 3-5 suppliers: 1.03; 6 or more suppliers: 0.62.

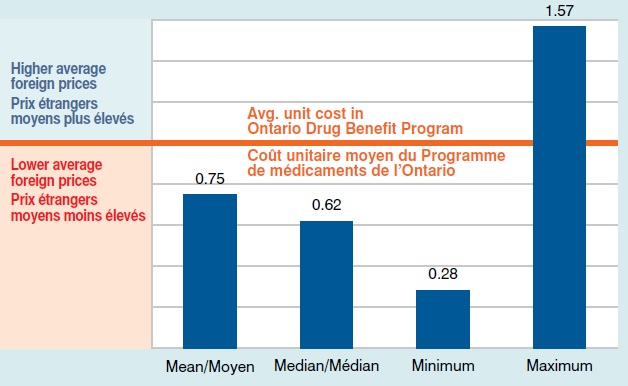

Ontario Prices Reduce the Price Gap with International Levels, Q2-2013

Compared to international levels, the price differential was less pronounced, with mean international prices 25% lower than in Ontario.

These results do not capture the full impact of the Value Price Initiative.

The analysis does, however, reflect the policies that reduced the generic prices relative to the reference brand price for most drugs to a maximum of 25% and 18% for six of the most common generic drugs.

Average generic foreign price relative to the Ontario level Q2-2013

This bar graph compares average international generic price levels to Ontario levels for Q2-2013. International prices: mean – 0.75; median – 0.62; minimum – 0.28; maximum – 1.57.

Methods: The analysis compares the 2013 ex-factory generic prices of 487 leading drugs in Canada with international prices for the same drugs. The main international markets considered were: France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

Data Source: Data was collected from the MIDAS™, IMS AG (All Rights Reserved) database for Canadian and international generic and brand prices. Data for the Ontario Drug Benefit Program was collected from the NPDUIS CIHI database.

Limitations: Differences in regulations, marketing practices and reimbursement policies are important to consider when interpreting international price comparisons.

NPDUIS is a research initiative that operates independently of the regulatory activities of the PMPRB.