New Drug Pipeline Monitor, 6th edition – December 2014

ISSN 2292-3136

Catalogue number: H79-5/2015E - PDF

Executive Summary

The New Drug Pipeline Monitor (NDPM) provides information on drugs currently under development that may have an impact on future drug plan expenditures in Canada. This publication contains a select list of pipeline drugs that are in Phase III clinical trials or under review by the US Food and Drug Administration (FDA) and that demonstrate the potential to have a significant clinical impact.

The BioPharm Insight® database is the main data source for this drug selection.

This is the sixth edition of the NDPM, and it updates the pipeline list reported in the December 2013 edition. This report provides an update on the 31 drugs previously identified in the pipeline and identifies 10 additions to the list.

Key Findings

- Of the 31 pipeline drugs carried forward from the previous NDPM editions:

- 17 are retained in this edition of the NDPM, as they continue to satisfy the criteria for drug selection, 6 of which are biologics;

- 7 have been excluded from the list following an updated scientific assessment;

- 4 have been excluded as they are no longer in the Phase III clinical trials in the US or under review by the FDA, and are not yet approved in Canada; and

- 3 are removed following the granting of market authorization by Health Canada.

- This edition of the NDPM identifies 10 pipelines drugs, 3 of which are biologics.

- The current pipeline list features a total of 27 pipeline drugs that may have an impact on drug plan expenditures in Canada, 9 of which are biologics.

About the PMPRB

The Patented Medicine Prices Review Board (PMPRB) is an independent quasi-judicial body established by Parliament in 1987.

The PMPRB has a dual role: to ensure that prices at which patentees sell their patented medicines in Canada are not excessive; and to report on pharmaceutical trends of all medicines and R&D spending by patentees.

The PMPRB reports annually to Parliament, through the Minister of Health, on its activities, on pharmaceutical trends relating to all medicines, and on R&D spending by patentees.

The NPDUIS Initiative

The National Prescription Drug Utilization Information System (NPDUIS) provides critical analyses of drug price, utilization, and cost trends in Canada to support drug plan policy decision-making for participating federal, provincial, and territorial governments.

The NPDUIS initiative is a partnership between the PMPRB and the Canadian Institute for Health Information. It was established in 2001 by the federal, provincial and territorial Ministers of Health.

Acknowledgements

The PMPRB would like to acknowledge the contributions of:

- The members of the NPDUIS Advisory Committee, for their expert oversight and guidance in the preparation of this report

- The PMPRB NPDUIS staff for their contribution to the analytical content of the report:

- Greg McComb – Senior Economic Analyst

- Elena Lungu – Manager, NPDUIS

- Branka Pejcic-Karapetrovic – Pharmaceutical Analyst

- The PMPRB scientific and editing groups

- Patricia Carruthers-Czyzewski, BScPhm, MSc, Sintera Inc., for providing pharmaceutical expertise in the development of the methodology and the scientific input of the report

Disclaimer

NPDUIS is a research initiative that operates independently of the regulatory activities of the Board of the PMPRB. The statements and opinions expressed in this NPDUIS report do not represent the official position of the PMPRB.

Parts of this study are based on information obtained from the BioPharm Insight® database, published by © Infinata. The analyses, conclusions and/or statements in this NPDUIS report do not represent the position of © Infinata.

1. Introduction

This is the sixth edition of the New Drug Pipeline Monitor (NDPM), a publication that provides information on drugs currently under development that may have an impact on future drug plan expenditures in Canada. Each report contains a list of pipeline drugs identified as part of a search of the BioPharm Insight® databaseFootnote 1; a specialized database that provides information on over 21,000 drugs in clinical trials. The search is supported by a review of pharmacy literature, with a focus on Canadian studies.

Only drugs that meet a set of selection criteria are candidates for the NDPM. The selection criteria were prepared by Sintera Inc. for the PMPRB and were approved by the NPDUIS Advisory Committee in 2006.Footnote 2 This standardized approach has been consistently applied to all editions of the NDPM. The criteria include: the phase of development, the indication, the mechanism of action and the impact on clinical practice. A decision-tree algorithm was developed to ensure a consistent application of the criteria. The selection of pipeline drugs includes broad representation across therapeutic areas. In addition, consideration is given to high-cost drugs and classes where a new drug could have a financial impact on budgets, along with classes with a high utilization share of generic drugs.

As in previous reports, this edition of the NDPM updates the status of pipeline drugs identified in prior publications. Some drugs were removed from the list either because they received authority to market the drug in Canada or because a scientific assessment no longer supports retention on the pipeline list. Similarly, drugs were retained if ongoing trials supported the initial assessment for inclusion in the pipeline list.

The report is organized into seven sections. Following this Introduction, Section 2 provides an overview of the criteria used for drug selection, while Section 3 describes the algorithm used to apply the criteria. Section 4 discusses the BioPharm Insight® database search and literature review, while section 5 provides a list of the new pipeline drugs identified for this report. Section 6 provides status updates of the pipeline drugs identified in previous reports, while Section 7 reviews the past and current pipeline drugs.

2. Criteria for Drug Selection

This section provides a brief description of the criteria developed for selecting drugs in the pipeline.

2.1 Phase of Development

Only drugs in Phase III clinical trials or under review by the US FDA are considered as potential candidates for the NDPM. Most drugs reaching this stage are more likely to proceed to regulatory approval and marketing in the near future in Canada. Drugs in earlier phases of development may not necessarily progress beyond these stages.

2.2 Indication and Therapeutic Area

Drugs are considered to be potential candidates if they could be used to treat life-threatening conditions, conditions with unmet needs or rare diseases, or if they could potentially change clinical practice in a therapeutic area.

2.3 Drug Description

Drug description keywords that flag that a new drug could potentially change clinical practice include: first drug in a class, different mechanism of action, novel technology, add-on therapy, targeted niche, or an existing drug with a new indication.

2.4 Clinical and Other Impacts

Drugs must demonstrate the potential to have a significant clinical impact or a significant impact on other sectors of the health care system. Examples include: increased efficacy versus existing drugs; impacts on patient health, such as increased life expectancy or quality of life; new or redefined outcomes; or an improved safety profile.

3. Methodology for Drug Selection

The main source of information for the NDPM is the BioPharm Insight® database, which tracks drugs from pre-clinical discovery through clinical trials to market launch and subsequent sales.

The database is a comprehensive resource on investigational drugs and, at any one time, may contain more than 21,000 drugs. The database search capabilities allow drugs to be selected under various fields, including phase of development, therapeutic area, indication, drug mechanism, orphan drug, fast track and molecule type.

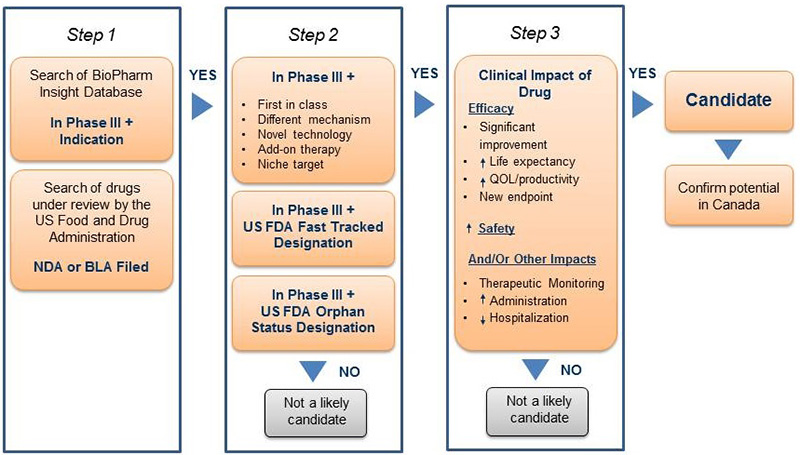

An algorithm developed for selecting drugs is illustrated in Figure 1. The algorithm combines the search capabilities of the BioPharm Insight® database and the key criteria used to identify a potentially high-impact drug. Because the sources of information for this database are largely from the US, additional sources are used to determine whether the new drugs are in development in Canada.

Figure 1. Algorithm for drug selection for the New Drug Pipeline Monitor*

*Figure 1 modifies the diagram presented in previous editions of the NDPM. While the algorithm has not changed, the diagram clarifies the steps taken to select drugs.

As a first step in identifying potential candidates for the NDPM, the BioPharm Insight® database is searched for drugs currently in Phase III development or under review by the FDA, with a New Drug Application (NDA) or Biological License Application (BLA) filed. Phase III trials may have just been initiated for these drugs or some Phase III results may be available.

For the second step, drugs in Phase III development are then screened by therapeutic area and indication. Drugs are considered as potential candidates for the NDPM if they have been identified by the FDA as orphan drugs, which treat rare diseases, or fast-track drugs. The FDA considers drugs for fast-track development if they are intended to treat serious or life-threatening conditions or if they demonstrate the potential to address unmet medical needs.

For Phase III drugs that are neither fast tracked nor designated as orphan drugs, the drug profiles are searched for keywords relating to specific drug descriptions, such as first-in-class, different mechanism, novel technology, add-on therapy, targeted niche or existing drugs with a new indication. If the drugs have these key descriptors, Phase III results are scanned to further validate the drug characteristics identified in the profile, such as a significantly increased efficacy or increased safety. At this point, drugs just entering Phase III trials are screened out, since there is insufficient information to make a scientific assessment.

In the third step, the clinical impact of each drug is considered. Canadian sources are consulted to determine whether there is information on any Canadian development. The main source of information is Pharmacy Practice, which publishes an annual list of promising new drugs in the later stages of development (Phase III or beyond) in Canada. This is followed by a scientific assessment of the identified drugs. If the preliminary Phase III results suggest an efficacy/safety impact, the drugs are then considered for inclusion in the NDPM. Finally, to confirm the selection of new drugs for the NDPM, consideration is given to the likelihood of coverage by federal, provincial, and territorial public drug plans, based on indication and formulation.

4. Drug Selection Process

The first step in identifying potential candidates for this edition of the NDPM was a search of the BioPharm Insight® database to identify drugs currently in Phase III development or under review by the US FDA, with a NDA or BLA filed. The database search for drugs was completed on October 3, 2014, in accordance with the algorithm described in the previous section.

The BioPharm Insight® database is updated on an ongoing basis: some data is updated every few hours, while other sections are updated weekly as the information is refreshed by the source.Footnote 3 Just before publication, the status of drugs in the NDPM was checked against current information in the BioPharm Insight® database.

Table 1 summarizes, by therapeutic area, the results of this first step in the search. The database profile for each of these drugs was reviewed, with particular attention given to the drug description field. Specific keywords were sought, such as first-in-class or different mechanism. If these keywords were identified, the next step was to determine the results, if any, of Phase III clinical trials. Under the development history field of the drug profile, details of the Phase III results were scanned to further validate drug characteristics, such as increased efficacy or safety. If this scan revealed a lack of effect or a safety issue, the drug was screened out.

Based on this selection process, a total of 1,262 drugs were identified in Phase III development, and 592 drugs were identified as currently under review by the US FDA. As reported in Table 1, these drugs cover a large spectrum of therapeutic areas.

Table 1. Step 1 in drug selection process:

Number of drugs in Phase III development or under review by the US Food and Drug Administration by therapeutic area

| Therapeutic area |

In Phase III |

NDA/BLA* filed |

| Cancer |

251 |

49 |

| Cardiovascular |

95 |

39 |

| Central nervous system |

100 |

90 |

| Dermatology |

49 |

21 |

| Eye and ear |

54 |

14 |

| Gastrointestinal |

59 |

49 |

| Genitourinary |

42 |

31 |

| Hematological |

65 |

33 |

| HIV infections |

13 |

18 |

| Hormonal system |

93 |

42 |

| Immune system |

116 |

40 |

| Infectious diseases |

121 |

83 |

| Musculoskeletal |

75 |

11 |

| Nephrology |

20 |

7 |

| Pain |

66 |

42 |

| Respiratory |

43 |

23 |

| Total** |

1,262 |

592 |

* New Drug Application/Biological License Application.

**The total reported for Phase III trials or NDA/BLA filed is not necessarily the sum of the number of drugs in each therapeutic class, as some drugs may belong to multiple therapeutic classes.

Source: BioPharm Insight®. Note that the database search for drugs was completed as of October 3, 2014.

Table 2 reports the list of drugs from Table 1 that were further screened in as part of the second step in the selection process. Biologics are identified separately, as they tend to be high-cost drugs with the potential to impact drug plan budgets. Of the 112 drugs screened in, 38 were biologics. In most therapeutic areas, one or more biologics were identified, with the greatest number selected for cancer (11) and the immune system (5). Hormonal, infectious disease and musculoskeletal drugs each had four biologics in Phase III clinical trials and NDA/BLA filed that were retained in this second step.

Table 2. Step 2 in drug selection process:

Number of drugs by therapeutic area

| Therapeutic area |

In Phase III |

NDA/BLA* filed |

| Drug |

Biological |

Drug |

Biological |

| Cancer |

11 |

10 |

4 |

1 |

| Cardiovascular |

4 |

1 |

0 |

0 |

| Central nervous system |

4 |

1 |

5 |

0 |

| Dermatology |

2 |

3 |

1 |

0 |

| Eye and ear |

0 |

0 |

0 |

1 |

| Gastrointestinal |

3 |

0 |

2 |

0 |

| Genitourinary |

4 |

0 |

1 |

0 |

| Hematological |

4 |

2 |

0 |

0 |

| HIV infections |

0 |

0 |

2 |

0 |

| Hormonal system |

4 |

3 |

0 |

1 |

| Immune system |

8 |

3 |

0 |

2 |

| Infectious diseases |

4 |

3 |

3 |

1 |

| Musculoskeletal |

5 |

4 |

1 |

0 |

| Nephrology |

0 |

1 |

0 |

0 |

| Pain |

2 |

0 |

0 |

0 |

| Respiratory |

0 |

1 |

0 |

0 |

| Total: in Phase III and with NDA/BLA filed |

55 |

32 |

19 |

6 |

| Total |

112 |

* New Drug Application/Biological License Application.

Source: BioPharm Insight®. Note that the database search for drugs was completed as of October 3, 2014.

This list was further narrowed by checking all drugs against the most recent pipeline list in Pharmacy PracticeFootnote 4 and Health Canada’s clinical trial databaseFootnote 5 to determine whether there was information on Canadian development. The next step was a scientific assessment of this preliminary list. For this assessment, details of the Phase III results from the BioPharm drug profiles were reviewed, specifically looking for significant improvements in efficacy and safety outcomes. In addition, the MEDLINE® database was searched to gain a sense of how the drug was viewed in the published literature.

The final screening ensured that drugs from a diverse set of therapeutic classes were included in the pipeline list. The potential financial impact on public drug plans was also taken into consideration. New drugs entering a class with high utilization (e.g., cardiovascular) or costly drugs (e.g., cancer) can be expected to increase the overall expenditure for a drug plan. The same logic can be applied to drugs entering a therapeutic area with a high utilization of generic drugs.

5. New Drugs Added to the New Drug Pipeline Monitor

Based on the drug selection process described in the previous section, 10 drugs were added to this edition of the NDPM, 3 of which are biologics. Table 3 lists these drugs, clearly identifies the ones that are biologics and provides information pertaining to the drug's trade name, company, therapeutic area and rationale for inclusion in the NDPM.

Table 3. Drugs added to the New Drug Pipeline Monitor

Drug

(Trade name)* – Companies** |

Therapeutic area (ATC) - Indication |

Rationale for inclusion in the NDPM |

| Cancer |

|

ABT-199

(Venetoclax)

Abbott Laboratories; AbbVie; Genentech, Inc.; Roche Holdings AG

|

Cancer (L01)

Leukemia

|

- In Phase III clinical trials

- New class: a selective BCL-2 inhibitor that is thought to impact tumour formation, tumour growth and resistance

- For patients with chronic lymphocytic leukemia

- Oral formulation; has been used as an add-on therapy (e.g., in combination with rituximab)

- Is being investigated in Canadian clinical trials (for systemic lupus erythematosus (SLE), lymphocytic leukemia, and non-Hodgkin lymphoma)Footnote 6

- Appears to spare platelets while achieving potent antitumour activityFootnote 7

|

|

Rigosertib sodium

(Estybon)

Baxter International, Inc.; Onconova Therapeutics, Inc.; SymBio Pharmaceuticals Limited

|

Cancer (L01)

Solid and hematological cancers

|

- In Phase III clinical trials

- New class: an inhibitor of the phosphoinositide 3-kinase and polo-like kinase pathways that induces mitotic arrest and apoptosis in neoplastic cells, while sparing normal cellsFootnote 8

- May be particularly useful in treatment of refractory patients with myelodysplastic syndromes, who have no effective options available

- Also useful in solid tumours; it was shown to be a more effective radiosensitizer than cisplatin in concurrent chemoradiation treatment of cervical carcinoma, in vitro and in vivoFootnote 9

- Administered as an injection but has potential as an oral agentFootnote 10

- Not listed in Health Canada’s clinical trials database

|

| Cardiovascular |

|

Betrixaban

Lee's Pharmaceutical Holdings Limited; Merck & Co., Inc.; Millennium Pharmaceuticals, Inc.; Portola Pharmaceuticals Inc.

|

Cardiovascular (C01)

Stroke, thrombosis

|

- In Phase III clinical trials

- Belongs to the class of direct factor Xa inhibitor anticoagulants

- Orally active

- Used in patients who are at risk of stroke

- Not listed in Health Canada's clinical trials database

- Is highly selective for factor Xa anticoagulant with distinct pharmacological characteristics, including a long half-life, minimal renal clearance and minimal hepatic metabolismFootnote 11

- May allow greater flexibility for use in patients with poor renal function; offers convenience of once daily dosing and exhibits less drug interactionsFootnote 12

|

| Dermatology |

|

Ixekizumab

Eli Lilly & Co.

|

Dermatology

Psoriasis

Biologic

|

- In Phase III clinical trials

- New class: interleukin-17A (IL-17) inhibitor

- Administered as a subcutaneous injection

- New therapeutic approach for patients with psoriasis

- Is being investigated in Canadian clinical trials (for plaque psoriasis and ankylosing spondylitis).Footnote 13

- A high proportion of patients with psoriasis responded to ixekizumab therapy and maintained clinical responses over 1 year of treatment with no unexpected safety signalsFootnote 14

|

| Gastrointestinal |

|

DIMS0150

(Kappaproct)

InDex Pharmaceuticals AB

|

Gastrointestinal

Ulcerative colitis (UC)

|

- In Phase III clinical trials

- New class: Toll-like receptor 9 (TLR9) agonist

- Induces production of key cytokines such as interleukin-10 and also enhances steroid sensitivity in steroid-rfractory UC patientsFootnote 15

- Canada has one of the highest incidence rates of inflammatory bowel disease (UC and Crohn’s disease) in the world Footnote 16

- Rectal formulation

- Not listed in Health Canada’s clinical trials database

- Effective, non-invasive treatment option for severe UC patients who no longer respond to steroid therapy and whose only current alternative is surgical removal of the colon

|

| Hematological |

|

Avatrombopag

(E5501)

Eisai Co., Ltd.

|

Hematological

Thrombocytopenia

|

- In Phase III clinical trials

- Second-generation thrombopoietin receptor agonist that stimulates platelet production

- Oral formulation

- Is being investigated in Canadian clinical trials (for liver disease)Footnote 17

- Generally well-tolerated and increased platelet counts in patients with cirrhosis undergoing elective invasive proceduresFootnote 18

|

| Infections |

|

Cethromycin

(Restanza)

Advanced Life Sciences, Inc.; Pfizer, Inc.

|

Infections

Community-acquired pneumonia (CAP)

|

- In Phase III clinical trials

- Belongs to the class of ketolide antibiotics

- Is designed to overcome emerging bacterial resistance to macrolides and penicillinsFootnote 19

- Used to treat CAP, a major health challenge globally and a leading cause of death

- Oral formulation

- Not listed in Health Canada’s clinical trials database

- May provide prescribing physicians with an additional agent to supplement a continually limited choice of effective agentsFootnote 20

|

| Musculoskeletal |

|

Ocrelizumab

Biogen Idec Inc.; Genentech, Inc.; Roche Holdings AG

|

Musculoskeletal

Multiple sclerosis (MS)

Biologic

|

- In Phase III clinical trials

- Belongs to the class of humanized monoclonal antibodies

- Selectively targets the CD20-positive B-cells implicated in the inflammatory and neurodegenerative processes of MS

- Being studied in MS and in rheumatoid arthritis

- Intravenous formulation

- Not listed in Health Canada’s clinical trials database

- Has the potential to impact disease progression

|

| Pain |

|

Ranirestat

(AS3201)

Dainippon Sumitomo Pharma Co. Ltd.; Eisai Co., Ltd.; Kyorin Pharmaceutical Co., Ltd.

|

Pain

Diabetic neuropathy

|

- In Phase III clinical trials

- First of a new class: aldose reductase inhibitor (ARI); ARIs are potential disease modifiers for diabetes complicationsFootnote 21

- There are limited treatment options for managing diabetic neuropathy

- Oral formulation

- Not listed in Health Canada’s clinical trials database

- Has a stronger inhibitory effect and is longer-acting compared to other drugs (e.g., pregabalin (Lyrica)) in this therapeutic area

|

|

Tanezumab

Eli Lilly & Co.; Pfizer, Inc.

|

Pain

Biologic

|

- In Phase III clinical trials

- Humanized monoclonal antibody that inhibits nerve growth factor

- It is being studied for multiple pain indications including osteoarthritis (OA) pain

- Tanezumab has a modulating effect on pain, does not appear to increase neurological safety signals, and offers a potentially promising, novel approach in treatment of painFootnote 22

- Not listed in Health Canada’s clinical trials database

- Administered subcutaneously

- It may have therapeutic utility in patients with OA who experience inadequate analgesia with nonsteroidal anti-inflammatory drugsFootnote 23

|

*If the drug and trade name are the same, only one entry is made.

** Companies 'working on a drug' as defined by the BioPharm Insight® database. More than one company may develop and market a drug, and their relationship may be defined by a licensing agreement.

6. Status Update

This section provides a status update of the 31 drugs listed in the previous edition of the New Drug Pipeline Monitor for December 2013:

- 17 drugs are retained in this edition of the NDPM, as they continue to satisfy the criteria for drug selection (Section 2), see Table 4

- 7 drugs are excluded from the NDPM, as current scientific assessments of the results of the Phase III clinical trials no longer point toward the potential for the drug to have a significant clinical impact, see Table 5

- 4 drugs are removed from the NDPM, as they are no longer in Phase III clinical trials in the US or are not under the review by the US FDA, and are not yet approved in Canada, see Table 6

- 3 drugs are removed from the NDPM because they received market authorization granted by Health Canada, see Table 7

Table 4 lists the 17 drugs (including 6 biologics) from previous editions of the NDPM that remain as pipeline candidates, as they continue to satisfy the criteria for drug selection (Section 2). A status update based on a review of the BioPharm Insight® database and recent scientific literature is provided, along with a rationale for retaining the drugs in the pipeline list. Key resources consulted include a summary of drugs in late-stage development in Canada in Pharmacy Practice,Footnote 24 and the Health Canada database of clinical trials in CanadaFootnote 25.

Table 4. Drugs retained in the New Drug Pipeline Monitor

| Drug (Trade name) – Company |

Therapeutic area (ATC) – Indication |

Rationale for inclusion in the NDPM |

|

Albiglutide

(Syncria)

Tanzeum - GlaxoSmithKline plc; Human Genome Sciences, Inc.

|

Diabetes (A10) and Cardiac Therapy (C01)

Type 2 diabetes and heart failure

Biologic

|

Previous description:

- Overall higher treatment satisfaction for patients because of ease of use and need for less frequent dosingFootnote 26

Update:

- Marketed in the US in July 2014 for type 2 diabetes; also approved in Europe

- Uses Novozymes' VELTIS technology to achieve an extended half-life that means patients are only required to inject their medication once a week.Footnote 27

- “Advantages include once-weekly dosing and fewer gastrointestinal side effects compared with liraglutide, but it is less effective at reducing A1C and weight compared to liraglutide.”Footnote 28

Rationale: Current literature continues to suggest that albiglutide is effective in the management of type 2 diabetes and may improve compliance through ease of use and less side effects.

|

|

Ataluren

(Translarna)

Genzyme Corporation, a Sanofi Company; PTC Therapeutics, Inc.; Sanofi

|

Genetic diseases (with nonsense mutations) therapy

Cystic fibrosis

|

Previous description:

- “Correction of the underlying gene effect a particularly exciting prospect as a new therapy for Cystic Fibrosis.”Footnote 29

Update:

- Approved conditionally in Europe (2014-08-14) for Duchenne muscular dystrophyFootnote 30

- Phase III clinical trial results in nonsense mutation cystic fibrosis have been publishedFootnote 31

- Is being investigated in Canadian clinical trials (Phase III for cystic fibrosis and Duchenne muscular dystrophy)Footnote 32

Rationale: Current literature continues to suggest that ataluren is an important new therapy for cystic fibrosis and muscular dystrophy.

|

|

Cetilistat

(Cametor)

Norgine BV; Takeda Pharmaceutical Company Limited

|

Antiobesity (A08)

Obesity

|

Previous description:

- Showed similar weight loss to that seen with orlistat (Xenical) but with up to 90% fewer severe GI side effectsFootnote 33

Update:

- Approved in Japan (2013-09-24)

- Not listed in Health Canada’s clinical trials database

- “Cetilistat showed mild to moderate adverse events, predominantly of gastrointestinal nature (steatorrhea), with an incidence lower than orlistat.”Footnote 34

Rationale: Although there is limited new published literature, it has the potential to be a better tolerated alternative for obesity treatment.

|

|

Istradefylline

(Nouriast)

Kyowa Hakko Kirin Pharma, Inc.; Valeant Pharmaceuticals International, Inc.

|

Anti-Parkinson Drugs (N04)

Parkinson's disease (PD)

|

Previous description:

- First in a new class: selective adenosine A2A receptor antagonist

- Impacts on disease progression rather than treating symptoms

Update:

- Is being investigated in Canadian clinical trials (Phase III)Footnote 35

- Data obtained from seven randomized controlled trials, including 2205 patients, showed significant reductions in the daily OFF time (primary outcome): “Based on these results, Istradefylline could be an efficacy and safety augmentation drug added on to levodopa or other existing anti-Parkinsonian therapies.”Footnote 36

Rationale: Current literature continues to suggest that istradefylline may be a promising non-dopaminergic therapy for the treatment of PD.

|

|

Laquinimod

(Nerventra)

Active Biotech AB; Teva Pharmaceutical Industries Ltd.

|

Immunostimulants (L03) and Immunosuppressants (L04)

Multiple sclerosis, Crohn's disease (CD) and lupus

Biologic

|

Previous description:

- Novel once-daily, orally administered immunomodulatory compound with a favourable risk–benefit profileFootnote 37

Update:

- Long-term safety data was presented at scientific meeting in September 2014Footnote 38

- Phase II study in Crohn’s has been published: “Laquinimod was safe and well tolerated, and the effects on remission and response of the 0.5 mg dose suggest a treatment benefit in patients with CD.”Footnote 39

Rationale: Current literature continues to suggest that laquinimod may be a promising therapy for the treatment of relapsing–remitting multiple sclerosis.

|

|

Lebrikizumab

Chugai Pharmaceutical Co., Ltd; Genentech, Inc.; Roche

|

Respiratory (R07)

Asthma

Biologic

|

Previous description:

- First biologic for the treatment of asthma that demonstrates benefits in patients with poorly controlled asthma

Update:

- Is being investigated in Canadian clinical trials (Phase III)Footnote 40

Rationale: Current literature continues to suggest that lebrikizumab may be a promising therapy for the treatment of asthma.

|

|

Lorcaserin hydrochloride

(Belviq)

Arena Pharmaceuticals, Inc.; CY Biotech Company Ltd. ; Eisai Co., Ltd.; Ildong Pharmaceutical Co., Ltd.

|

Gastrointestinal (A08)

Obesity

|

Previous description:

- Significant population; high demand

- An oral, serotonin (5-hydroxy-tryptamine, 5-HT) 5-HT2C receptor agonist that regulates food intake

Update:

- Is being investigated in Canadian clinical trials (cardiovascular disease and diabetes)Footnote 41

- Approved in the US in 2012

- “Lorcaserin patients with a week 12 response achieved mean week 52 weight losses of 10.6 kg (without diabetes) and 9.3 kg (with diabetes).”Footnote 42

Rationale: Current literature continues to suggest that lorcaserin may be a promising therapy for the treatment of obesity.

|

|

Mipomersen

(Kynamro)

Genzyme Corporation, a Sanofi Company; Isis Pharmaceuticals, Inc.

|

Antilipidemic agent (C10)

Hypercholesterolemia

|

Previous description:

- “Significantly reduced LDL-C, apolipoprotein B, and Lp(a) in hypercholesterolemic patients with, or at risk for, CHD not controlled by existing therapies.”Footnote 43

Update:

- Not listed in Health Canada’s clinical trials database

- Approved in the US in 2013 for homozygous familial hypercholesterolemia

- “Mipomersen therapy is effective for lowering ApoB-containing lipoproteins in patients with severe hypercholes-terolemia.”Footnote 44

Rationale: Current literature continues to suggest that mipomersen may be a promising therapy for the treatment of hypercholesterolemia.

|

|

Nintedanib

(Ofev)

Boehringer Ingelheim GmbH

|

Cancer (L01)

Non-small cell lung cancer and ovarian cancer

Biologic

|

Previous description:

- Phase III trials ongoing for ovarian and non-small cell lung cancer (BioPharm Insight database)

- Is being investigated in Canadian clinical trials (Phase III for colorectal cancer)Footnote 45

Update:

- “In patients with IPF, nintedanib reduced the decline in forced vital capacity, which is consistent with a slowing of disease progression; nintedanib was frequently associated with diarrhea, which led to discontinuation of the study medication in less than 5% of patients.”Footnote 46

- Approved in the US for the treatment of idiopathic pulmonary fibrosis (IPF)

Rationale: Current literature continues to suggest that nintedanib may have a role to play in lung cancer. It may also be useful in IPF.

|

|

NX-1207

Nymox Pharmaceutical Corporation; Recordati S.P.A.

|

Genitourinary (G04)

Benign prostatic hyperplasia

|

Previous description:

- First-in-class for the treatment of benign prostatic hyperplasia (BPH) a disorder that causes difficulties with urination associated with aging

Update:

- “…[symptomatic improvement was] considerably higher than typically reported for the currently approved BPH medications (3 to 5 points) the latter which need to be taken on a daily basis indefinitely.”Footnote 47

Rationale: Current literature is limited but continues to suggest that NX-1207 may have a role to play in BPH.

|

|

Ponesimod

Actelion Pharmaceuticals Ltd; Roche

|

Immunostimulants (L03) and Immunosuppressants (L04)

Multiple sclerosis and psoriasis

Biologic

|

Previous description:

- Potential for once-a-day oral dosing, for multiple autoimmune disordersFootnote 48

Update:

- “Significant clinical benefit was seen [with ponesimod for treatment of psoriasis] at week 16 that increased with maintenance therapy.”Footnote 49

Rationale: Although current literature is limited, ponesimod is likely to be an important therapy for multiple sclerosis and seems promising for treatment of psoriasis.

|

|

Rebamipide

(Mucosta)

Acucela, Inc.; Novartis AG; Otsuka Pharmaceutical Co., Ltd.

|

Ophthalmological Preparations (S03)

Dry eye syndrome

|

Previous description:

- Large population: 22 million patients visit an ophthalmologist worldwide for dry eye symptoms

- “Rebamipide administered to treat the short break-up time type of dry eye significantly improved optical quality because of the improvement in tear stability.”Footnote 50

Update:

- “The results of the study show that 2% rebamipide is effective in improving both the objective signs and subjective symptoms of dry eye patients for at least 52 weeks. In addition, 2% rebamipide treatment was generally well tolerated.”Footnote 51

Rationale: Current literature continues to suggest that repamipide is effective in the treatment of dry eye.

|

|

Sacubitril (previously listed as LCZ696)

Novartis AG

|

Cardiovascular (C09)

Heart failure, hypertension

|

Previous description:

- If Phase III trials show improved clinical outcomes, it could become the new standard of care; current standard of care in heart failure includes ACE inhibitors (e.g., enalapril)

Update:

- Superior to ACE-inhibitor enalapril on key endpoints in the largest heart failure study ever done (PARADIGM-HF)Footnote 52

- Is being investigated in Canadian clinical trials (Phase III)Footnote 53

Rationale: Current literature continues to suggest that sacubitril may be a promising therapy for heart failure.

|

|

Safinamide

Meiji Seika Pharma Co., Ltd.; Merck Serono SA; Newron Pharmaceuticals; Zambon Group

|

Anti-Parkinson Drugs (N04) and Antiepileptics (N03)

Parkinson's disease (PD), epilepsy and restless leg syndrome

|

Previous description:

- Significant population

- “Safinamide has the potential to become an important compound for the therapy of PD, since its symptomatic efficacy appears to be superior to available monoamine oxidase-B inhibitors or N-methyl-d-aspartate receptor antagonists like amantadine, according to available trial outcomes” Footnote 54

Update:

- Filed for approval in Europe (2013-12-05) and in the US (2014-05-29)

- Not listed in Health Canada’s clinical trials database

- “In Phase III trials, safinamide has been found to be a useful adjunctive to dopamine agonists in early PD and has been shown to increase time without increasing troublesome dyskinesias when used as an adjunct to levodopa in patients with advanced PD.”Footnote 55

Rationale: Current literature continues to suggest that safinamide may be an effective treatment for Parkinson’s disease.

|

|

Selexipag

Actelion Pharmaceuticals Ltd; Nippon Shinyaku Co., Ltd.

|

Antihypertensives (C02)

Pulmonary arterial hypertension (PAH)

|

Previous description:

- “The Phase III trial – GRIPHON - has a clinically relevant and highly robust primary end-point of time to first morbidity/mortality event and will provide vital information on the long-term effects of selexipag in patients with PAH.”Footnote 56

Update:

- “Selexipag met its primary goal in a late-stage study.”Footnote 57

- Not listed in Health Canada’s clinical trials database

Rationale: Current literature continues to suggest that selexipag may be an effective treatment for pulmonary arterial hypertension.

|

|

Sotatercept

Acceleron Pharma; Celgene Corporation

|

Cancer (L01)

Anemia, bone cancer

Biologic

|

Previous description:

- Potential to stimulate bone formation: unmet medical need in treatment of bone loss

Update:

- “Multiple doses of sotatercept plus thalidomide appear to be safe and generally well-tolerated in multiple myeloma patients.”Footnote 58

Rationale: Current literature continues to suggest that sotatercept may be an effective treatment.

|

|

Vatalanib

Bayer AG; Novartis AG

|

Cancer (L01)

Colorectal cancer

|

Previous description:

- Potentially first oral tyrosine kinase inhibitor to be used long-term in combination with standard chemotherapy for the treatment of patients with metastatic colorectal cancer.

Update:

- “Vatalanib was well tolerated as a second-line therapy and resulted in favorable 6-month survival rate in patients with metastatic pancreatic cancer, compared with historic controls.”Footnote 59

Rationale: Current literature continues to suggest that vatalanib may be an effective treatment for pancreatic cancer.

|

Table 5 lists the seven drugs from the previous edition of the New Drug Pipeline Monitor (December 2013) that are excluded from this edition, as current scientific assessments of the results of the Phase III clinical trials no longer point toward the potential for the drugs to have a significant clinical impact. At this point it is unclear whether these drugs may have an impact on drug plan expenditures in Canada.

A status update based on a review of the BioPharm Insight® database and recent scientific literature is provided, along with a rationale for excluding the drugs from the pipeline list. Reasons for removal relate to discontinuation of clinical trials for safety and/or efficacy reasons.

Table 5. Drugs excluded from the New Drug Pipeline Monitor:

Current scientific assessment

| Drug (Trade name) – Company |

Therapeutic area (ATC) –Indication |

Rationale for Removal |

|

Alisporivir

Debiopharm Group; Novartis AG

|

Anti-infective (J05)

AIDS; hepatitis C

|

Clinical trials halted for safety reasons.Footnote 60

|

|

Darapladib

DiaDexus, LLC; GlaxoSmithKline plc; Human Genome Sciences, Inc.

|

Cardiac Therapy (C01)

Atherosclerosis

|

Did not meet primary endpoint in phase 3 trials.Footnote 61

|

|

Edivoxetine

(LY2216684)

Eli Lilly & Co.

|

Central Nervous System (N06)

Depression, attention deficit hyperactivity disorder

|

Did not meet the primary study objective of superior efficacy in depression.Footnote 62

|

|

Ispronicline

AstraZeneca PLC; Targacept, Inc.

|

Psycholeptics (N05) and Psychoanaleptics (N06)

Alzheimer’s disease, attention deficit hyperactivity disorder; depression/stress and anxiety

|

Clinical program halted.Footnote 63

|

|

Phenoxodiol

Marshall Edwards, Inc.; Novogen Limited

|

Cancer (L01)

Ovarian, cervical, head and neck, kidney, prostate cancer, leukemia

|

Orally delivered phenoxodiol showed no evidence of clinical activity, when combined with weekly AUC2-carboplatin in platinum-resistant ovarian cancer.Footnote 64

|

|

Serelaxin

(Relaxin)

Novartis AG; Paladin Labs, Inc.

|

Cardiac Therapy (C01)

Heart failure

|

An FDA advisory panel voted against approving it for heart failure: “We recommend that seralaxin not be approved at this time because there is insufficient evidence to support the proposed indication to ‘improve the symptoms of acute heart failure through reduction of the rate of worsening of heart failure.”Footnote 65

|

|

Voclosporin

(Luveniq)

3SBio Inc.; Iljin Life Science, Co., Ltd.; Isotechnika, Inc.; Lux Biosciences; Paladin Labs, Inc.; Roche

|

Ophthalmological Preparations (S03) and Immunosuppressants (L04)

Uveitis, kidney and other transplantations, psoriasis

|

“…a second Phase III trial did not show a statistically significant difference between the placebo and disease groups. No additional studies are planned at this time to evaluate this agent.”Footnote 66

|

Table 6 lists the four drugs from the previous edition of the New Drug Pipeline Monitor (December 2013) that are removed in this edition, as they are not currently in the Phase III clinical trials in the US or are not under the review by the US FDA, and are not yet approved in Canada. These drugs may receive market authorization in Canada in the future, and at that point they may have an impact on drug plan expenditures. A rational for the removal of the drugs from the list is provided in the table.

Table 6. Drugs excluded from the New Drug Pipeline Monitor:

Not in Phase III in the US or NDA/BLA* filed; market authorization not yet granted by Health Canada

| Drug

(Trade name) – Company |

Rationale for removal |

|

Agomelatine

(Valdoxan)

Les Laboratoires Servier; Novartis AG

|

Development for the US market discontinuedFootnote 67; previously approved in the EUFootnote 68; it is not listed in Health Canada’s clinical trials database.

|

|

Ecallantide

(Kalbitor)

Dyax Corporation; Sigma-Tau Pharmaceuticals

|

This drug is approved in the USFootnote 69; it is not listed in Health Canada’s clinical trials database.

|

|

Satraplatin

Celgene Corporation; Spectrum Pharmaceuticals, Inc.

|

Apart from reported phase II studiesFootnote 70,Footnote 71, there is no new published data on this compound and it is not listed in Health Canada’s clinical trials database.

|

|

Mesna Disulfide

(Tavocept)

BioNumerik Pharmaceuticals; Takeda Pharmaceutical Company Limited

|

There is no new published data on this compound since 2012, and it is not listed in Health Canada’s clinical trials database.

|

Table 7 reports the three drugs (including one biologic) from the previous edition of the New Drug Pipeline Monitor (December 2013) that are removed from this edition, as they have received market authorization granted by Health Canada. The Notice of Compliance (NOC) date issued by Health Canada, as well as the date of first sale, are provided in the table.

This table also includes information on recommendations made by the Common Drug Review (CDR). The CDR conducts reviews of the clinical effectiveness and cost-effectiveness of drugs, as well as reviews of patient input for drugs and provides formulary listing recommendations to public drug plans. The CDR is part of the Canadian Agency for Drugs and Technologies in Health (CADTH).

This table also reports on the status of the price review of the Patented Medicine Prices Review Board (PMPRB) for the new drugs. The PMPRB ensures that the prices of patented medicines sold in Canada are not excessive by reviewing the prices that patentees charge for each individual patented drug product to wholesalers, hospitals and pharmacies. Once the review is completed, the drug may be found to (i) be priced within the PMPRB Guidelines, (ii) exceed the Guidelines by an amount that does not trigger the investigation criteria or (iii) exceed the Guidelines and become subject to an investigation.

Table 7. Drugs removed from the New Drug Pipeline Monitor:

Market authorization granted by Health Canada

Drug (Trade name) –

Company |

Therapeutic area

– Indication |

NOC* date /

date of first sale** |

Common Drug Review (CDR)

recommendation† |

PMPRB review status |

|

Aflibercept

(Eylea)

Bayer Inc.

|

Ophthamology (S01)

Macular degeneration neovascular, age-related

Biologic

|

NOC granted: 2013-11-08Footnote 72

Date of first sale: 2013-12-23

|

CDR recommended listing on 2014-10-20, with the following condition:

“Drug plan cost for the treatment of wet age-related macular degeneration with aflibercept should provide cost-savings relative to the treatment of wet AMD with ranibizumab.”

Two new indications are currently under review: (i) macular edema secondary to central retinal vein occlusion and (ii) macular edema, diabetic.

|

Price within Guidelines

|

|

Macitentan

(Opsumit)

Actelion Pharmaceuticals Ltd.

|

Antihypertensives (C02)

Pulmonary arterial hypertension

|

NOC granted: 2013-11-06Footnote 73

Date of first sale: 2014-01-15

|

Under review

2014-11-05: Embargo period and validation of redacted CDR review reports. Manufacturers may make a request for reconsideration and drug plans may make a request for clarification of the recommendation

|

Price within Guidelines

|

|

Tofacitinib

(Xeljanz)

Pfizer Canada Inc.

|

Immunosuppressants (L04)

Rheumatoid arthritis

|

NOC granted: 2013-04-17Footnote 74

Date of first sale: 2014-06-06

|

Under review

2014-10-27: Patient group input summary comments received

|

Not currently under review

|

*A Notice of Compliance issued by Health Canada indicates that the drug product meets the regulatory requirements for use in humans or animals and that the product is approved for sale in Canada.

**The date of first sale is as reported to the PMPRB. This date may precede the Health Canada NOC date, as a product may be sold under the Special Access Programme or the Clinical Trial Applications or it may be an Investigational New Drug.

†CDR recommendations are made by the Canadian Drug Expert Committee (CDEC), an independent advisory body composed of individuals with expertise in drug therapy and drug evaluation. Submissions by manufacturers are voluntary, so recommendations may not be available for some drugs. The information on the current CDR status is available at: http://www.cadth.ca/en/products/cdr/.

7. Review of past and current NDPM drugs

To date, a total of 61 new drugs have been selected in six NDPM reports, published since 2007. At the time of inclusion in the NDPM, these drugs were either in Phase III clinical trials or under review by the US FDA and demonstrated the potential to have a significant clinical impact. Of these:

- 10 (16.4%) are new drugs identified in this edition of the NDPM

- 17 (27.9%) continue to satisfy the NDPM criteria for drug selection

- 17 (27.9%) no longer satisfy the NDPM criteria for drug selection

- 17 (27.9%) subsequently received market authorization granted by Health Canada

This suggests that the majority of the NDPM drugs (72.1%) continue to have promising scientific assessments or have received market authorization by Health Canada. A relatively small proportion of the drugs (27.9%) was excluded from NDPM because (i) the scientific assessment no longer supported retention or (ii) they are no longer in the Phase III clinical trials in the US or under review by the US FDA, and are not yet approved in Canada.