New Drug Pipeline Monitor - April 2013

About the PMPRB

The Patented Medicine Prices Review Board (PMPRB) is an independent quasi-judicial body established by Parliament in 1987.

The PMPRB has a dual role: to ensure that prices at which patentees sell their patented medicines in Canada are not excessive; and to report on pharmaceutical trends of all medicines and R&D spending by patentees.

The PMPRB reports annually to Parliament, through the Minister of Health, on its activities, on pharmaceutical trends relating to all medicines, and on R&D spending by patentees.

The NPDUIS Initiative

The National Prescription Drug Utilization Information System (NPDUIS) provides critical analyses of drug price, utilization, and cost trends in Canada to support drug plan policy decision-making for participating federal, provincial, and territorial governments.

The NPDUIS initiative is a partnership between the PMPRB and the Canadian Institute for Health Information. It was established in 2001 by the federal/provincial/territorial Ministers of Health.

Acknowledgements

The PMPRB would like to acknowledge the following contributors:

- The members of the NPDUIS Steering Committee, for their expert oversight and guidance in the preparation of this report;

- Greg McComb, Senior Economist, NPDUIS, PMPRB, for his contribution to the analytical content of the report, as well as the PMPRB scientific and editing groups; and

- Patricia Carruthers-Czyzewski, BScPhm, MSc, Sintera Inc., for providing pharmaceutical expertise in the development of the methodology and the scientific input of the report.

1. Introduction

This is the fourth edition of the New Drug Pipeline Monitor (NDPM), a publication that provides information on drugs currently under development that may have an impact on federal, provincial and territorial (F/P/T) drug plan expenditure. Each report contains a list of pipeline drugs identified as part of a search of the BioPharm Insight® database1; a specialized database that provides information on over 21,000 drugs in clinical trials. The search is supported by a review of pharmacy literature, with a focus on Canadian studies.

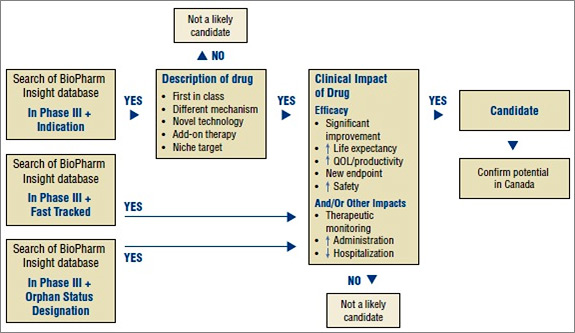

Only drugs that meet a set of selection criteria are candidates for the NDPM. The selection criteria were prepared for the PMPRB in 2006 and include: the phase of development, the indication, the mechanism of action and the impact on clinical practice. A decision-tree algorithm was developed so that criteria could be applied in a consistent, step-wise manner. Once a preliminary list is screened in, an effort is made to include pipeline drugs from a diverse set of therapeutic classes covered by public drug plans. In particular, consideration is given to high-cost drugs and classes where a new drug could have a financial impact, along with classes with a high utilization share of generic drugs.

As this is the fourth edition of the NDPM, it updates the status of pipeline drugs identified in the three previous reports. Some drugs were removed from the list either because they have entered the Canadian market or because the manufacturer is no longer conducting clinical trials. Similarly, drugs were retained if ongoing trials supported the initial assessment for inclusion.

This edition is organized into six sections. Following the Introduction, Section 2 gives an overview of the criteria used for drug selection, while Section 3 describes the algorithm used to apply the criteria. Section 4 discusses the BioPharm Insight database search and literature review, and provides a list of drugs identified for this report. Section 5 provides updates of the pipeline drugs identified in previous reports, while Section 6 lists the references cited in the report.

2. Criteria for Drug Selection

This section provides a brief description of the criteria used to select pipeline drugs.

2.1 Phase of Development

Only drugs in Phase III clinical trials are considered as potential candidates for the NDPM. Most drugs reaching this stage are more likely to proceed to regulatory approval and marketing in the near future. Drugs in earlier phases of development may not necessarily progress beyond these stages.

2.2 Indication and Therapeutic Area

Drugs are considered to be potential candidates if they could be used to treat life-threatening conditions, conditions with unmet needs or rare diseases, or if they could potentially change clinical practice in a therapeutic area.

2.3 Drug Description

Drug description keywords that flag that a new drug could potentially change clinical practice include: first drug in a class, different mechanism of action, novel technology, add-on therapy, targeted niche, or an existing drug with a new indication.

2.4 Clinical and Other Impacts

Drugs must demonstrate the potential to have a significant clinical impact or a significant impact on other sectors of the health care system. Examples include: increased efficacy versus existing drugs; impacts on patient health such as increased life expectancy or quality of life; new or redefined outcomes; or an improved safety profile.

3. Methodology for Applying Criteria

The main source of information for the NDPM is the BioPharm Insight database, which tracks drugs from pre-clinical discovery through clinical trials to market launch and subsequent sales.

The database is a comprehensive resource on investigational drugs and, at any one time, may contain more than 21,000 drugs. The database search capabilities allow drugs to be selected under various fields, including phase of development, therapeutic area, indication, drug mechanism, orphan drug, fast track and molecule type.

An algorithm developed for selecting drugs is illustrated in Figure 1. The algorithm combines the search capabilities of the BioPharm Insight database and the key criteria used to identify a potentially high-impact drug. Because the sources of information for this database are largely from the US, additional sources are used to determine whether the new drugs are in development in Canada.

Figure 1. Algorithm to select drugs for the New Drug Pipeline Monitor

As a first step in identifying potential candidates for the NDPM, the BioPharm Insight database is searched for drugs currently in Phase III development. Phase III trials may have just been initiated for these drugs or some Phase III results may be available. Drugs in Phase III development are then screened by therapeutic area and indication. Drugs are considered as potential candidates for the NDPM if they have been identified by the US Food and Drug Administration (FDA) as orphan drugs, which treat rare diseases, or fast-track drugs. The FDA considers drugs for fast-track development if they are intended to treat serious or life-threatening conditions or if they demonstrate the potential to address unmet medical needs.

For drugs that are neither fast tracked nor designated as orphan drugs, the drug profiles are searched for keywords relating to specific drug descriptions, such as first in class, different mechanism, novel technology, add-on therapy, targeted niche or existing drugs with a new indication. If the drugs have these key descriptors, Phase III results are scanned to further validate the drug characteristics identified in the profile, such as a significantly increased efficacy or increased safety. At this point, drugs just entering Phase III trials are screened out, since there is insufficient information to make a scientific assessment.

Next, Canadian sources are consulted to determine whether there is information on any Canadian development. The main source of information is Pharmacy Practice, which publishes an annual list of promising new drugs in the later stages of development (Phase III or beyond) in Canada. The next step in identifying potential drugs for the NDPM involves the scientific assessment of all drugs for which preliminary Phase III results suggest an efficacy/safety impact.

Finally, to confirm the selection of new drugs for the NDPM, consideration is given to the likelihood of coverage by F/P/T public drug plans, based on indication and form.

4. Identification of Candidates for the New Drug Pipeline Monitor

4.1. BioPharm Insight database search

The first step in identifying potential candidates was a search of the BioPharm Insight database. As in previous analyses, only drugs currently in Phase III development or under review by the FDA (i.e., NDA/BLA2 filed) were screened in for the first step. Only entities filed since March 1, 2011, were considered, since candidates prior to that would have been identified in the previous NDPM 2011 report. The search for drugs was conducted as of March 22, 2012, in accordance with the algorithm described in the previous section. An additional review was conducted as of February 18, 2013, to update any changes in the stages of development of the selected drugs.

Table 1 summarizes the results of this search by therapeutic area. The database profile for each of these drugs was reviewed, with particular attention given to the drug description field. Specific keywords were sought, such as first in class or different mechanism. If these keywords were identified, the next step was to determine the results, if any, of Phase III clinical trials. Under the development history field of the drug profile, details of the Phase III results were scanned to further validate drug characteristics, such as increased efficacy or safety. If this scan revealed a lack of effect or a safety issue, the drug was screened out.

Table 1. BioPharm Insight search results by therapeutic class

| Therapeutic area |

Number of “hits” |

| In Phase III |

NDA/BLA filed |

| Cancer |

287 |

27 |

| Cardiovascular |

97 |

14 |

| Central nervous system |

107 |

17 |

| Dermatology |

39 |

4 |

| Eye & ear |

30 |

7 |

| Gastrointestinal |

44 |

17 |

| Genitourinary |

46 |

8 |

| Hematological |

64 |

9 |

| HIV infections |

28 |

5 |

| Hormonal system |

93 |

17 |

| Immune system |

95 |

5 |

| Infectious diseases |

99 |

27 |

| Musculoskeletal |

54 |

7 |

| Nephrology |

12 |

1 |

| Pain |

58 |

17 |

| Respiratory |

34 |

5 |

| Total* |

1181 |

187 |

*The total number of ‘hits' in Phase III trials is not necessarily the sum of the total reported due to the fact that some drugs may belong to multiple therapeutic classes.

Table 2 is a working list of drugs that were screened in for this step. Biologics are identified separately, as they tend to be high-cost drugs with the potential to impact drug plans. Of the 135 drugs screened in, 37 were biologics, which is an emerging class of drugs. In most therapeutic areas, one or more biologics were identified, with the most ‘hits' in the cardiovascular (9), immune system (5) and cancer (4) classifications.

Table 2. Specific drugs screened in by therapeutic area

| Therapeutic area |

Number of 'hits' |

| In Phase III |

NDA/BLA filed |

| Chemical |

Biologic |

Chemical |

Biologic |

| Cancer |

2 |

1 |

2 |

3 |

| Cardiovascular |

16 |

9 |

1 |

0 |

| Central nervous system |

12 |

0 |

0 |

0 |

| Dermatology |

2 |

2 |

0 |

0 |

| Eye & ear |

4 |

1 |

2 |

1 |

| Gastrointestinal |

3 |

1 |

5 |

0 |

| Genitourinary |

4 |

1 |

1 |

0 |

| Hematological |

3 |

2 |

0 |

0 |

| HIV infections |

3 |

0 |

1 |

0 |

| Hormonal system |

13 |

2 |

2 |

1 |

| Immune system |

5 |

5 |

0 |

0 |

| Infectious diseases |

7 |

2 |

2 |

1 |

| Musculoskeletal |

0 |

2 |

0 |

1 |

| Nephrology |

1 |

0 |

0 |

1 |

| Pain |

3 |

0 |

3 |

0 |

| Respiratory |

0 |

1 |

1 |

0 |

| Total: in Phase III and with NDA/BLA filed |

78 |

29 |

20 |

8 |

| Total |

135 |

To narrow the list further, all drugs screened in were checked against the most recent pipeline list in Pharmacy Practice3 to determine whether there was information on Canadian development. The next step was a scientific assessment of this preliminary list. For this assessment, details of the Phase III results from the BioPharm drug profiles were reviewed, specifically looking for significant improvements in efficacy and safety outcomes. In addition, the MEDLINE® database was searched to gain a sense of how the drug was viewed in the published literature.

As part of the final screening, an effort was made to include pipeline drugs from a diverse set of therapeutic classes covered by public drug plans. The potential financial impact on public drug plans was also taken into consideration. New drugs entering a class with high utilization (e.g., cardiovascular) or costly drugs (e.g., cancer) can be expected to increase the overall expenditure for a drug plan. The same logic can be applied to drugs entering therapeutic classes with a high utilization share of generic drugs. For example, numerous high-expenditure lipid-lowering medications (atorvastatin, simvastatin and pravastatin) have lost patent protection and have been replaced with less expensive generics. If a new drug enters this market, it has the potential to be an important cost driver.

4.2 Drugs Added to the New Drug Pipeline Monitor

Table 3 lists new candidates for the NDPM. Each drug met the selection criteria outlined in Section 3. The table lists the drug's trade name, company, therapeutic area and rationale for inclusion in the NDPM.

As in previous screening steps, biologics were identified as an emerging class of drugs; 5 of the 12 drugs added to this edition of the NDPM belong to this class. They are highlighted in the table for ease of identification.

Table 3. Drugs added to the New Drug Pipeline Monitor

|

Drug (Trade name* - Companies**)

|

Therapeutic area (ATC) - Indication(s)

|

Rationale for inclusion in the NDPM

|

|

Cardiovascular

|

|

Serelaxin (Relaxin - Corthera Inc.; Novartis AG; Paladin Labs, Inc.)

|

Cardiac Therapy (C01)

Heart failure

Biologic

|

- In Phase III trials

- Hormone-based drug

- Constitutes a major advance in acute heart failure since it addresses two of the most important aspects of treating the disease: hemodynamic improvement and renal protection4

|

|

Selexipag (Actelion Pharmaceuticals Ltd; Nippon Shinyaku Co., Ltd)

|

Antihypertensives (C02)

Pulmonary arterial hypertension

|

- In Phase III trials

- Oral, long-acting, selective prostacyclin receptor agonist for pulmonary arterial hypertension

- Investigational drug status in Canada (Pharmacy Practice Dec. 2011/Jan. 2012)

|

|

Macitentan (Opsumit - Actelion Pharmaceuticals Ltd.)

|

Cardiac Therapy

(C01) and Acid Related Disorders (A02)

Pulmonary arterial and digital ulcers

|

- Phase III trials ongoing for digital ulcers; regulatory filing for FDA approval for pulmonary arterial indication (BioPharm Insight database)

- An orally active dual endothelin receptor antagonist that improves long-term outcome in cardiovascular conditions

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/Jan 2012)

- Recurrent digital ulcers are a manifestation of vascular disease in patients with systemic sclerosis and are an important source of morbidity

- Macitentan is expected to protect tissue from the damaging effects of endothelins by completely blocking their action — endothelins are proteins that constrict blood vessels and raise blood pressure

|

|

Cancer

|

|

Nintedanib (Boehringer Ingelheim GmbH)

|

Cancer (L01)

Non-small cell and ovarian cancer

Biologic

|

- Phase III trials ongoing for ovarian and non-small cell cancer (Biopharm Insight database)

- Oral

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/Jan 2012)

- A triple angiokinase inhibitor that targets three growth factor receptors: vascular endothelial, platelet-derived and fibroblast

- Interferes with the angiogenesis-signaling cascade and overcomes drug resistance5

|

|

Immune System

|

|

Laquinimod (Active Biotech AB; Teva Pharmaceutical Industries Ltd.)

|

Immunostimulants (L03) and Immunosuppressants (L04)

Multiple sclerosis, Crohn's disease and lupus

Biologic

|

- Regulatory filing for FDA approval for multiple sclerosis; Phase II trials ongoing for Crohn's disease and lupus (Biopharm Insight database)

- Novel once-daily, orally administered immunomodulatory compound

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/Jan 2012)

- Slowed the progression of disability and reduced the rate of relapse in patients with relapsing–remitting multiple sclerosis (NEJM 20126)

|

|

Ponesimod (Actelion Pharmaceuticals Ltd; Roche)

|

Immunostimulants (L03) and Immunosuppressants (L04)

Multiple sclerosis and psoriasis

Biologic

|

- Phase III trials ongoing for psoriasis; Phase II trials for multiple sclerosis (BioPharm Insight database)

- First selective sphingosine-1-phosphate receptor agonist

- Potential for once-a-day oral dosing for multiple autoimmune disorders

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/ Jan 2012)

|

|

Central Nervous System

|

|

Ispronicline (AstraZeneca PLC; Targacept, Inc.)

|

Psycholeptics (N05) and Psychoanaleptics (N06)

Alzheimer's disease; attention deficit hyperactivity disorder; depression/stress and anxiety

|

- Phase II trials for Alzheimer's disease and attention deficit hyperactivity disorder; Phase III trials for depression/stress and anxiety

- Oral

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/ Jan 2012)

- Neuronal nicotinic acetylcholine receptor partial agonist with antidepressant, nootropic and neuroprotective effects

- Achieved statistically significant results on all of the primary endpoints, reflecting improved cognitive performance by memory-impaired older adults

|

|

Genitourinary

|

|

Mirabegron (Myrbetriq - Astellas Pharma Inc.)

|

Urologicals (G04)

Incontinence, overactive bladder

|

- Approved by the FDA for overactive bladder indication; regulatory filing for FDA approval for incontinence (Biopharm Insight database)

- First in class, beta-3 adrenoceptor agonist as a bladder smooth muscle relaxant

- Substantial population of potential overactive bladder sufferers

- Oral, once-daily administration

- Different mechanism of action to anticholinergics: could offer more options for treatment

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/ Jan 2012)

- Significantly decreased the mean number of incontinence episodes and micturition episodes per 24 hours, and was safe and well tolerated7

|

|

Diabetes/Obesity

|

|

Albiglutide (Syncria - GlaxoSmithKline plc; Human Genome Sciences, Inc.)

|

Diabetes (A10) and Cardiac Therapy (C01)

Type 2 diabetes and heart failure

Biologic

|

- Regulatory filing for FDA approval for type 2 diabetes; Phase II trials ongoing for heart failure (Biopharm Insight database)

- Hormone-based drug

- A long-lasting (once-weekly injection) glucagon-like peptide-1 agonist

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/ Jan 2012)

- Overall higher treatment satisfaction for patients because of ease of use and need for less-frequent dosing8

- May have direct therapeutic potential for improving cardiac energetics and function9

|

|

Cetilistat (Alizyme Therapeutics Ltd.; Norgine BV; Takeda Pharmaceutical Company Limited)

|

Antiobesity (A08)

Obesity

|

- Phase III trials complete in US for obesity; New Drug Application (NDA) submitted in Japan10

- Oral

- A gastrointestinal lipase inhibitor

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/ Jan 2012)

- Showed similar weight loss to that seen with orlistat (Xenical), but with up to 90% fewer severe gastrointestinal side effects11; could provide a better alternative

|

|

Eye/ear

|

|

Rebamipide (Mucosta - Acucela, Inc.; Novartis AG; Otsuka Pharmaceutical Co., Ltd)

|

Ophthalmological Preparations (S03)

Dry eye syndrome

|

- Phase III clinical trials in US (Biopharm Insight database), approved for dry eye syndrome in Japan12

- Need for effective therapy for dry eye that treats the underlying cause of the syndrome

- Large population: 22 million patients visit an ophthalmologist worldwide for dry eye symptoms

- Novel mechanism of action to enhance tear secretion and increase the levels of mucin covering the conjunctiva and cornea of the eye

- A prostaglandin-inducer

|

|

Voclosporin (Luveniq - 3SBio Inc.; Iljin Life Science, Co., Ltd.; Isotechnika, Inc.; Lux Biosciences; Paladin Labs, Inc.; Roche)

|

Ophthalmological Preparations (S03) and Immunosuppressants (L04)

Uveitis, kidney and other transplantations; psoriasis

|

- Phase III trials for uveitis; filing for FDA approval for psoriasis; Phase III for kidney transplantation (Biopharm Insight database)

- Phase III Canadian study showed significantly improved quality of life for patients with psoriasis13

- Oral

- Could become the first corticosteroid-sparing agent for uveitis: the swelling and irritation of the uvea, the middle layer of the eye

- A potent novel calcineurin inhibitor and immunmodulator

- Investigational drug status in Canada (Pharmacy Practice Dec 2011/ Jan 2012)

|

|

*If the drug and trade name are the same, only one entry is made.

** Companies ‘working on a drug' as defined by the BioPharm Insight® database. More than one company may develop and market a drug, and their relationship may be defined by a licensing agreement.

Abbreviation: FDA, US Food and Drug Administration.

|

5. Status Updates

5.1. Drugs Retained in the Pipeline List

Table 4 lists the drugs from previous editions of the NDPM that remain as pipeline candidates. A status update based on recent scientific literature is provided, along with a rationale for retaining the drugs on the pipeline list.

Table 4. Drugs retained in pipeline list

|

Drug (Trade name - Company)

|

Therapeutic area (ATC) - Indication

|

Status update and rationale for retaining in the pipeline list

|

|

Agomelatine (Valdoxan - Les Laboratoires Servier; Novartis AG)

|

Antidepressants (N06A)

Major depression

|

Previous description:

- Approved by the FDA and EMA (BioPharm Insight)

- First in a new class of antidepressants with a unique mechanism of action

- Comparable efficacy with the added clinical benefit of sleep regulation

- Described in literature as an “ideal antidepressant”

Update:

- “May be a unique pharmacological addition in the clinical war on depression in both psychiatric and primary care settings, if further evaluation in clinical trials supports reasonable risk.” (Innov Clin Neurosci 201114)

Rationale: Current literature continues to suggest that agomelatine is an important new approach to depression with at least comparable and maybe superior efficacy and fewer side effects. Retain in the pipeline list.

|

|

Darapladib (DiaDexus, LLC; GlaxoSmithKline plc; Human Genome Sciences, Inc.)

|

Cardiac Therapy (C01)

Atherosclerosis

|

Previous description:

- Phase III trials are in most advanced stage (Biopharm Insight database)

- New class: inhibitor of lipoprotein associated phosphor-lipase A2 (Lp-PLA2)

- Significant population (cardiovascular)

- Different mechanism of action for atherosclerosis compared to statins

- Add-on therapy

- Decreases cardiovascular risk; inhibits formation of atherosclerotic plaques; has the potential to affect patient outcomes (myocardial infarction, stroke, cardiovascular death)

Update:

- Still listed as an Investigational drug in Canada (Pharmacy Practice 2011/2012)

Rationale: Current literature continues to suggest that darapladib could be an important cardiovascular drug. Retain in the pipeline list.

|

|

Ecallantide (Kalbitor - Dyax Corporation; Sigma-Tau Pharmaceuticals)

|

Antihemorrhagics (B02)

Hereditary angioedema (HAE)

|

Previous description:

- Novel plasma kallikrein inhibitor

- Unmet medical need: first specific therapy for acute attacks—HAE is a debilitating, potentially fatal disease

Update:

- Approved by the FDA and marketed in the US as Kalbitor (2009-11-27)

- Not listed as an investigational drug in Canada (Pharmacy Practice 2011/2012)

Rationale: Current literature continues to suggest that ecallantide fills a medical need for treatment of acute HAE. There is a risk of anaphylaxis that needs to be managed. Affects a small population. Retain in the pipeline list.

|

|

Istradefylline (Kyowa Hakko Kirin Pharma, Inc; Valeant Pharmaceuticals International, Inc.)

|

Anti-Parkinson Drugs (N04)

Parkinson's disease

|

Previous description:

- Phase III studies ongoing (BioPharm Insight database)

- First in a new class

- Impacts on disease progression rather than treating symptoms

Update:

- Not listed as an investigational drug in Canada (Pharmacy Practice 2011/2012)

Rationale: Current literature continues to suggest that istradefylline may be a promising non-dopaminergic therapy for the treatment of Parkinson's disease. Retain in the pipeline list.

|

|

Phenoxodiol (Marshall Edwards, Inc.; Novogen Limited)

|

Cancer (L01)

Ovarian, cervical, head and neck, kidney, leukemia, prostate cancer

|

Previous description:

- FDA has granted fast track status to the development of phenoxodiol as a chemo-sensitizer for platinum and taxane drugs used in the treatment of recurrent ovarian cancer

- Has demonstrated improved survival in difficult to treat cancers

Update:

- Currently being tested for a large number of cancer indications:

- cervical cancer (Phase I )

- head and neck cancer (Phase II)

- kidney cancer (Phase I)

- leukemia (Phase II)

- ovarian cancer (Phase III)

- prostate cancer (Phase II)

Rationale: Although current literature is limited, phenoxodiol has the potential to improve survival. Indicator expansion indicates the drug has the potential to treat a wide spectrum of cancers. Retain in the pipeline list.

|

|

Safinamide (Meiji Seika Pharma Co., Ltd.; Merck Serono SA; Newron Pharmaceuticals; Zambon Group)

|

Anti-Parkinson Drugs (N04) and Antiepileptics (N03)

Parkinson's disease, epilepsy and restless leg syndrome

|

Previous description:

- Significant population

- Multiple mechanisms of action and multiple indications

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

- If efficacy is improved over existing agents, could replace inexpensive alternatives, such as quinine in restless leg syndrome

Update:

- Phase III trials for Parkinson's and Phase II trials for epilepsy and restless leg syndrome (Biopharm Insight Database)

- Still listed as an Investigational drug in Canada (Pharmacy Practice 2011/2012)

Rationale: Current literature continues to suggest that safinamide may be an effective treatment for Parkinson's disease. Retain in the pipeline list.

|

|

Satraplatin (Agennix AG; Celgene Corporation; GPC Biotech AG; Spectrum Pharmaceuticals, Inc.)

|

Cancer (L01)

Prostate cancer and small-cell lung cancer

|

Previous description:

- First oral platinum compound

- Fast track designation in US as a second-line chemotherapy treatment for prostate cancer

- Under review by the FDA

- One of four oral platinum compounds under investigation

- Delayed progression of disease and pain in patients with metastatic castrate-refractory prostate cancer (CRPC) experiencing progression after initial chemotherapy but did not provide a significant overall survival benefit

Update:

- Filing for FDA approval for prostate cancer with Phase III trials for general cancer and phase II trials for small-cell lung cancer

- Not listed as an investigational drug in Canada (Pharmacy Practice 2011/2012)

Rationale: Although current literature suggests that satraplatin may not increase survival, it is the first oral platinum compound. If approved, it will have an impact on clinical practice. Retain in the pipeline list.

|

|

Sipuleucel-T (Provenge - Dendreon Corporation)

|

Cancer (L01)

Prostate cancer

Biologic

|

Previous description:

- New immunotherapy approach to the management of prostate cancer at an early stage

- Fast track designation in US

- Approved by the FDA

- In a randomized, double-blind, placebo-controlled study in patients with metastatic castrate-refractory prostate cancer (CRPC), sipuleucel-T was associated with a 22% relative reduction in the risk of death (HR 0.78; p = 0.03), which was the primary endpoint of the trial

Update:

- Not listed as an investigational drug in Canada (Pharmacy Practice 2011/2012)

Rationale: Current literature continues to suggest that sipuleucel-T represents a novel approach for the treatment of prostate cancer, and it decreases the risk of death. Retain in the pipeline list.

|

|

Tofacitinib (Xeljanz - Pfizer Inc.; Takeda Pharmaceutical)

|

Immunosuppressants (L04)

Numerous indications: ankylosing spondylitis, rheumatoid arthritis, Crohn's disease, psoriasis, transplants, others

|

Previous description:

- In Phase III trials

- Significant population: rheumatoid arthritis

- Oral dosage form; injectable products currently the standard

- New mechanism of action: JAK-1/ JAK-3 antagonist

- Multiple indications: rheumatoid arthritis, Crohn's disease, psoriasis

Update:

- FDA approval for rheumatoid arthritis with clinical trials ongoing for other indications:

- ankylosing spondylitis (Phase II);

- colitis (Phase III);

- Crohn's disease (Phase II);

- inflammatory bowel disease (Phase II);

- kidney transplantation (Phase II);

- psoriasis (Phase III) and

- transplants (Phase II)

- Still listed as an investigational drug in Canada (Pharmacy Practice 2011/2012)

- May carry a risk of tuberculosis reactivation15

Rationale: Current literature continues to suggest that tofacitinib may be an effective treatment for chronic inflammatory conditions. The FDA approved tofacitinib for rheumatoid arthritis in November 2012. As the first pill form in this therapeutic class, it is expected to be competitive with injectable drugs.

|

|

Abbreviations: CRPC: metastatic castrate-refractory prostate cancer; EMA: European Medicines Agency; FDA, US Food and Drug Administration; HAE, hereditary angioedema; JAK, Janus kinase.

|

5.2 Drugs Removed from Pipeline List

Tables 5 and 6 provide a list of drugs from previous editions of the NDPM that have been removed from the pipeline list. Drugs in Table 5 were removed because the manufacturer was granted authority to market the drug in Canada. Health Canada grants that authority in a Notice of Compliance (NOC). Table 5 also provides information on recommendations made by the Canadian Drug Expert Committee (CDEC), which is an advisory body to the Canadian Agency for Drugs and Technologies in Health (CADTH).16 The CDEC makes recommendations to each of the participating federal, provincial, and territorial publicly funded drug plans regarding the listings on their formularies.

The Patented Medicine Prices Review Board (PMPRB) reviews prices of patented medicines to ensure they are not excessive. Of the seven drugs in Table 5, five reviewed are within guidelines, the price for one is subject to investigation, and one drug has not been sold in Canada as of March 2013.17

Table 6 lists the drugs that have been removed because a scientific assessment no longer supports retention on the pipeline list. Reasons for removal include lack of information or subsequent clinical trials that cite insufficient efficacy or safety.

Table 5. Drugs removed from pipeline list: market authority granted by Health Canada

| Drug (Trade name - company) |

Therapeutic area (ATC) -Indication |

NOC* date / Date of first sale** |

CADTH recommendation† |

PMPRB

review |

|

Pirfenidone (Esbriet - Ildong Pharmaceutical Co., Ltd.; InterMune, Inc.; Shanghai Genomics, Inc.; Shionogi & Co., Ltd)

|

Respiratory (R07)

Pulmonary fibrosis

|

Oct. 1, 2012 / May 31, 2012

|

The CADTH submission for pirfenidone was under review in February 2013. A target date of March 27, 2013 was set for a CADTH recommendation to be sent to drug plans and the manufacturer.

|

Price subject to investigation

|

|

Retigabine (Potiga - GlaxoSmithKline plc; Meda AB; Valeant Pharmaceuticals International Inc.)

|

Antiepileptics (N03)

Epilepsy

|

Oct. 21, 2012 / No sales as of March 2013

|

— |

—

|

|

Ipilimumab (Yervoy - Bristol-Myers Squibb)

|

Cancer (L01)

Melanoma

Biologic

|

Feb. 1, 2012 / Nov. 7, 2011

|

— |

Price within guidelines

|

| Plerixafor (Mozobil - Genzyme Corp) |

Immunostimulants (L03)

Stem cell mobilization

|

Dec.8, 2011 /

Feb. 8, 2011

|

CADTH recommended (Sept. 2012) that plerixafor not be listed by public drug plans.

Reason for recommendation: No randomized controlled trials included in the systematic review adequately identified a patient population that might be expected to benefit from plerixafor. Thus, the clinical and cost-effectiveness of plerixafor in the relevant patient population was uncertain.

|

Price within guidelines |

| Telaprevir (Incivek -Janssen-Ortho) |

Antivirals for Systemic Use (J05)

Hepatitis C

|

Aug.16, 2011 /

Oct. 3, 2011 |

CADTH recommended (Jan. 2012) that telaprevir be listed for the treatment of chronic hepatitis C genotype 1 infection in patients with compensated liver disease,

in combination with peginterferon alpha if all of the following criteria are met:

- a reduced price

- detectable levels of hepatitis C virus (HCV) RNA in the last six months

- a fibrosis stage, based on liver biopsy, of F2, F3, or F4

- patient not co-infected with HIV

- one course of treatment only (12 weeks duration)

|

Price within guidelines |

|

Ticagrelor (Brilinta - AstraZeneca)

|

Antithrombotic Agent (B01)

Heart

|

May 30, 2011 /

June 8, 2011

|

CADTH recommended (Dec. 2011) that ticagrelor not be listed at the submitted price.

Reason for recommendation: Evidence was not provided of superiority compared to clopidogrel in North American patient populations to support a higher price for ticagrelor.

|

Price within guidelines

|

|

Vandetanib (Caprelsa - AstraZeneca)

|

Protein Kinase Inhibitors (L01XE)

Thyroid cancer

|

Jan.12, 2012 /

Feb. 23, 2012

|

— |

Price within guidelines

|

| Perampanel (Fycompa – Eisai Ltd.) |

Antiepileptics (N03)

Epilepsy

|

April 4, 2013 / — |

— |

— |

|

*A Notice of Compliance is issued by Health Canada and indicates that the drug product meets the regulatory requirements for use in humans or animals and that the product is approved for sale in Canada.

**The Date of First Sale is as reported to the PMPRB. This date may precede the Health Canada NOC date, as a product may be sold under the Special Access Programme, the Clinical Trial Application or it is an Investigational New Drug.

†CADTH recommendations are made by the Canadian Drug Expert Committee (CDEC), an independent advisory body composed of individuals with expertise in drug therapy and drug evaluation. Submissions by manufacturers are voluntary, so recommendations may not be available for some drugs.

|

Table 6. Drugs removed from pipeline list: scientific assessment

| Drug (Trade name - Company) |

Rationale for Removal |

| Bapineuzumab (Pfizer, Inc) Biologic |

- Although immunotherapy with bapineuzumab resulted in clearance of amyloid plaques in patients with Alzheimer's disease, this clearance did not show a significant cognitive effect

|

Oxycodone and supplemental ingredients

(Oxecta/Acura Pharmaceuticals, Pfizer Inc) |

- Oxecta uses aversion technology. When the crushed tablet is dissolved in water or alcohol, it is converted into a viscous gel mixture, making it difficult to inject. Crushing the tablet and inhaling it through the nose causes burning and irritation. Whether the new formulation will actually prevent abuse of the drug has not been established18

|

6. References

1 BioPharm Insight® database. Available at: http://www.infinata5.com/BioPharm/AccessPoint.aspx?action=Login.ShowLogin&datakey=BioPharm (Accessed March 12–22, 2012).

2 US Food and Drug Administration (FDA) New Drug Application/ Biologic License Application (NDA/BLA).

3 Murdoch LA. Promising drugs in the late stages of development in Canada. Pharmacy Practice. Dec 2011/Jan 2012. Available at: http://www.CanadianHealthcareNetwork.ca (Accessed March 22, 2012).

4 Bani D, Bigazzi M. Relaxin as a cardiovascular drug: a promise kept. Current Drug Safety. 2011;6(5):324–328.

5 Gori B, Ricciardi S, Fulvi A, et al. New antiangiogenics in non-small cell lung cancer treatment: Vargatef™ (BIBF 1120) and beyond. Therapeut Clin Risk Manag. 2011;7:429–440.

6 Comi G, Jeffery D, Kappos L, et al: ALLEGRO Study Group. Placebo-controlled trial of oral laquinimod for multiple sclerosis. N Engl J Med. 2012;366(11):1000–1009.

7 Gras J. Mirabegron for the treatment of overactive bladder. Drugs Today (Barc). 2012;48(1):25–32.

8 Tzefos M, Harris K, Brackett A. Clinical efficacy and safety of once-weekly glucagon-like peptide-1 agonists in development for treatment of type 2 diabetes mellitus in adults. Ann Pharmacother. 2012;46(1):68–78.

9 Bao W, Aravindhan K, Alsaid H, et al. Albiglutide, a long lasting glucagon-like peptide-1 analog, protects the rat heart against ischemia/reperfusion injury: evidence for improving cardiac metabolic efficiency. PLoS One. 2011;6(8):e23570.

10 Takeda Pharmaceutical Co. Corporate news release. October, 2012.

11 Kopelman P, Groot Gde H, Rissanen A, et al. Weight loss, HbA1c reduction, and tolerability of cetilistat in a randomized, placebo-controlled Phase II trial in obese diabetics: comparison with orlistat (Xenical). Obesity (Silver Spring). 2010;18(1):108–115.

12 Otsuka Pharmaceutical Co. Corporate news release. July, 2012.

13 Kunynetz R, Carey W, Thomas R, et al. Quality of life in plaque psoriasis patients treated with voclosporin: a Canadian Phase III, randomized, multicenter, double-blind, placebo-controlled study. Eur J Dermatol. 2011;21(1):89–94.

14 Sansone RA, Sansone LA. Agomelatine: A novel antidepressant. Innov Clin Neurosci. 2011;8(11):10–14.

15 Maiga M, Lun S, Guo H, et al. Risk of tuberculosis reactivation with Tofacitinib (CP-690550). J Infect Dis. 2012;Apr 3. [Epub ahead of print]

16 The Common Drug Review database Available at: http://www.cadth.ca/en/products/cdr/search (Accessed February 25, 2013). [Only publicly available information is cited]

17 The New Patented Medicines Reported to PMPRB database. Available at http://www.pmprb-cepmb.gc.ca/english/pmpmedicines.asp?x=1 (Accessed March 5, 2013). [Only publicly available information is cited]

18 In Brief: Immediate-Release Oxycodone (Oxecta) for Pain. The Medical Letter for Drugs and Therapeutics. March 5, 2012;1385:20