Cost Drivers of Public Drug Plans in Canada, 2016/17

PDF - 366 kb

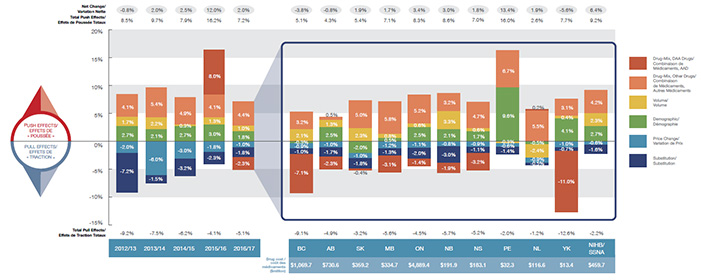

Public drug plan expenditures account for a significant portion of the overall health-care budget. Through its flagship CompassRx report, the PMPRB monitors and analyzes the evolving pressures driving these expenditures including changes in the beneficiary population (demographic effect); changes in the amount of drugs used (volume effect); shifts between lower- and higher-priced drugs (drug-mix effect); changes in drug prices (price effect); and shifts from brand-name to generic or biosimilar options (substitution effect). The overall change in expenditures in any given year is the net result of these opposing “push” and “pull” effects.

The analysis focuses on Canadian public drug plans participating in the National Prescription Drug Utilization Information System (NPDUIS) initiative: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, the Yukon Territory and Health Canada’s Non-Insured Health Benefits (NIHB) drug plan. The main data source for this report is the NPDUIS Database at the Canadian Institute for Health Information (CIHI). The drug costs reported here do not reflect rebates resulting from confidential product listing agreements.

After an unprecedented increase of 12% in 2015/16, drug costs rose by an additional 2% in 2016/17

Drug costs for the NPDUIS public plans reached $8.4 billion in 2016/17, an increase of over $1 billion from the total two years before. This period was marked by a sharp increase and then relative decline in the cost impact of the new direct-acting antiviral (DAA) drugs for hepatitis C. The new hepatitis C drugs had an average push effect of 3.1% per year over and above the upward pressure of other higher-cost drugs, which had a more consistent annual impact of over 4%.

Cost savings from generic and biosimilar substitution as well as price reductions continued to decline, following a steady diminishing trend, while the other drivers maintained a predictable, steady upward pressure on drug costs.

The rates of growth in drug costs in 2016/17 varied widely across plans, mainly driven by differences in the impact of the downward pull of hepatitis C drugs and the upward push of other high-cost drugs.

Drug cost drivers, 2012/13 to 2016/17

Click on image for larger view

Figure description

The first section of this column graph describes the factors or effects that impacted the yearly rates of change in drug costs across all NPDUIS public drug plans from 2012/13 to 2016/17: demographic, volume, drug-mix, price change and substitution effects. A percent change is assigned to each. The drug-mix effect for direct-acting antiviral hepatitis C drugs is isolated because of its high impact. The total positive or push effects; negative or pull effects; and net change is given for each year. The second section breaks down the overall results for 2016/17 by jurisdiction. The total drug cost for each plan is also given for 2016/17.

Section 1: Cost drivers from 2012/13 to 2016/17

blank

| Effect |

2012/13 |

2013/14 |

2014/15 |

2015/16 |

2016/17 |

| Demographic |

2.7% |

2.1% |

2.7% |

3.0% |

1.8% |

| Volume |

1.7% |

2.2% |

0.3% |

1.3% |

1.0% |

| Drug-Mix, Other Drugs |

4.1% |

5.4% |

4.9% |

4.1% |

4.4% |

| Drug-Mix, Direct-Acting Antiviral Drugs |

0.0% |

0.0% |

0.0% |

8.0% |

-2.3% |

| Price Change |

-2.0% |

-6.0% |

-3.0% |

-1.8% |

-1.0% |

| Substitution |

-7.2% |

-1.5% |

-3.2% |

-2.3% |

-1.8% |

| Total Pull Effects |

-9.2% |

-7.5% |

-6.2% |

-4.1% |

-5.1% |

| Total Push Effects |

8.5% |

9.7% |

7.9% |

16.2% |

7.2% |

| Net Change |

-0.8% |

2.0% |

2.5% |

12.0% |

2.0% |

Section 2: Cost drivers by jurisdiction for 2016/17

blank

| Effect |

British Columbia |

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Newfoundland and Labrador |

Yukon |

Non-Insured Health Benefits |

| Demographic |

-0.3% |

2.5% |

-2.0% |

0.5% |

2.5% |

2.1% |

1.7% |

9.6% |

-0.5% |

4.1% |

2.7% |

| Volume |

2.1% |

1.3% |

2.3% |

0.8% |

0.6% |

3.3% |

0.6% |

-0.3% |

-2.4% |

0.4% |

2.3% |

| Drug-Mix, Other Drugs |

3.2% |

0.5% |

5.0% |

5.8% |

5.2% |

3.2% |

4.7% |

6.7% |

5.5% |

3.1% |

4.2% |

| Drug-Mix, Direct-Acting Antiviral Drugs |

-7.1% |

-2.3% |

-0.4% |

-3.1% |

-1.4% |

-1.9% |

-3.2% |

0.0% |

0.2% |

-11.0% |

0.0% |

| Price Change |

-0.9% |

-1.0% |

-1.0% |

-1.2% |

-1.1% |

-0.8% |

-0.9% |

-0.6% |

-0.9% |

-1.0% |

-0.6% |

| Substitution |

-1.0% |

-1.7% |

-1.8% |

-1.3% |

-2.0% |

-3.0% |

-1.1% |

-1.4% |

-0.5% |

-0.7% |

-1.6% |

| Total Pull Effects |

5.1% |

4.3% |

5.4% |

7.1% |

8.3% |

8.6% |

7.0% |

16.0% |

2.6% |

7.7% |

9.2% |

| Total Push Effects |

-9.1% |

-4.9% |

-3.2% |

-5.6% |

-4.5% |

-5.7% |

-5.2% |

-2.0% |

-1.2% |

-12.6% |

-2.2% |

| Net Change |

-3.8% |

-0.8% |

1.9% |

1.7% |

3.4% |

3.0% |

1.8% |

13.4% |

1.9% |

-5.6% |

6.4% |

| Drug cost in millions of dollars |

$1,069.7 |

$730.6 |

$359.2 |

$334.7 |

$4,889.4 |

$191.9 |

$183.1 |

$32.3 |

$116.6 |

$13.4 |

$459.7 |

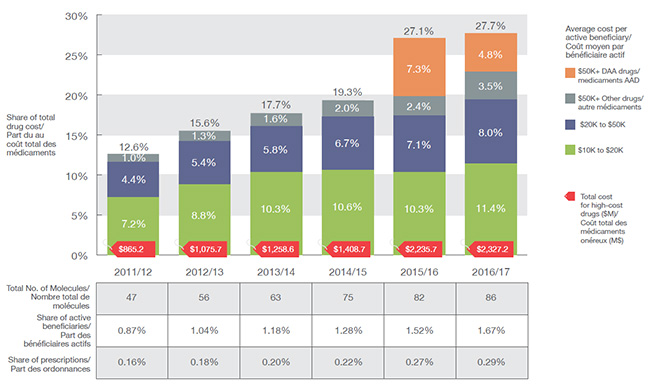

An increasing number of high-cost drugs are reimbursed, often treating small patient populations

In 2016/17, NPDUIS public plans reimbursed 86 drugs with average annual costs per active beneficiary exceeding $10,000, a significant increase from 47 drugs six years before. These drugs, which accounted for more than one quarter of the total drug costs, were attributed to a very small percentage of active beneficiaries (1.7%). Although the share of hepatitis C drugs declined over the last year, this was more than compensated by the increase in the share of other high-cost drugs.

Trends in high-cost drugs, 2011/12 to 2016/17

Click on image for larger view

Figure description

This stacked column graph and accompanying table give the trends in high-cost drugs from 2011/12 to 2016/17. A graph reports the share of drug costs for high-cost drugs broken out by average cost per active beneficiary: $10,000‒20,000; $20,000–$50,000 and greater than $50,000. The share of new direct-acting antiviral drugs for hepatitis C is reported separately. The table gives the total number of high-cost molecules, the share of beneficiaries using these drugs and the share of prescriptions that they represent.

High-cost drug share of total drug costs

blank

|

2011/12 |

2012/13 |

2013/14 |

2014/15 |

2015/16 |

2016/17 |

| Total number of molecules |

47 |

56 |

63 |

75 |

82 |

86 |

| Total drug cost for all high-cost drugs in millions of dollars |

$865.2 |

$1,075.7 |

$1,258.6 |

$1,408.7 |

$2,235.7 |

$2,327.2 |

| Average cost per active beneficiary of $10,000‒20,000: share of total drug cost |

7.2% |

8.8% |

10.3% |

10.6% |

10.3% |

11.4% |

| Average cost per active beneficiary of $20,000–$50,000: share of total drug cost |

4.4% |

5.4% |

5.8% |

6.7% |

7.1% |

8.0% |

| Average cost per active beneficiary of greater than $50,000: share of total drug cost for direct-acting antiviral drugs |

0% |

0% |

0% |

0% |

7.3% |

4.8% |

| Average cost per active beneficiary of greater than $50,000: share of total drug cost for other drugs |

1.0% |

1.3% |

1.6% |

2.0% |

2.4% |

3.5% |

| High-cost drugs - share of active beneficiaries |

0.9% |

1.0% |

1.2% |

1.3% |

1.5% |

1.7% |

| High-cost drugs - share of total prescriptions |

0.16% |

0.18% |

0.20% |

0.22% |

0.27% |

0.29% |

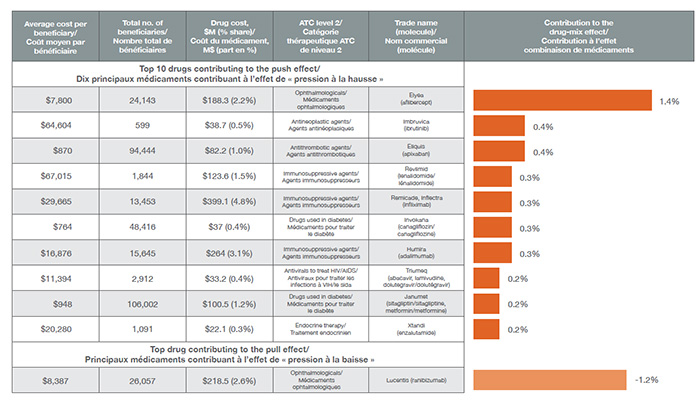

High-cost drugs are among the greatest contributors to the drug-mix effect

The shifting use from lower- to higher-cost drugs, other than for hepatitis C, had a 4.4% push effect on drug costs in 2016/17. Ophthalmological drugs contributed both positively (Eylea) and negatively (Lucentis) to the increase in drug cost, almost offsetting one another. Most of the other major contributors were high-cost oral oncology products, immunosuppressants and antivirals. The remaining top contributors were used by a larger beneficiary population to treat more common conditions.

Top drugs driving costs, 2016/17

Click on image for larger view

Figure description

blank

| Average cost per beneficiary |

Total number of beneficiaries |

Drug cost, in millions of dollars (% share) |

ATC level 2 |

Trade name (molecule) |

Contribution to the drug-mix effect |

| Top 10 drugs contributing to the push effect |

| $7,800 |

24,143 |

$188.3 (2.2%) |

Ophthalmologicals |

Elyea (aflibercept) |

1.4% |

| $64,604 |

599 |

$38.7 (0.5%) |

Antineoplastic agents |

Imbruvica (ibrutinib) |

0.4% |

| $870 |

94,444 |

$82.2 (1.0%) |

Antithrombotic agents |

Eliquis (apixaban) |

0.4% |

| $67,015 |

1,844 |

$123.6 (1.5%) |

Immunosuppressive agents |

Revlimid (lenalidomide) |

0.3% |

| $29,665 |

13,453 |

$399.1 (4.8%) |

Immunosuppressive agents |

Remicade, Inflectra (infliximab) |

0.3% |

| $764 |

48,416 |

$37 (0.4%) |

Drugs used in diabetes |

Invokana (canagliflozin) |

0.3% |

| $16,876 |

15,645 |

$264 (3.1%) |

Immunosuppressive agents |

Humira (adalimumab) |

0.3% |

| $11,394 |

2,912 |

$33.2 (0.4%) |

Antivirals to treat HIV/AIDS |

Triumeq (abacavir, lamivudine, dolutegravir) |

0.2% |

| $948 |

106,002 |

$100.5 (1.2%) |

Drugs used in diabetes |

Janumet (sitagliptin, metformin) |

0.2% |

| $20,280 |

1,091 |

$22.1 (0.3%) |

Endocrine therapy |

Xtandi (enzalutamide) |

0.2% |

| Top drug contributing to the pull effect |

| $8,387 |

26,057 |

$218.5 (2.6%) |

Ophthalmologicals |

Lucentis (ranibizumab) |

-1.2% |

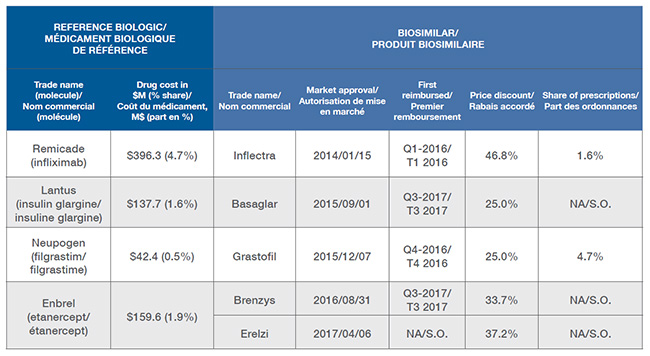

Biosimilars may offer future cost savings as the impact of generic price reductions declines

A number of biosimilar products have recently entered the Canadian market, some of which are for top-selling drugs such as Remicade, Enbrel and Lantus. However, their initial uptake has been relatively slow, as these products are not considered interchangeable with the reference biologic and may not be approved for the same indications at introduction. In 2016/17, the biosimilars for Remicade and Neupogen only captured 1.6% and 4.7% of the volume of prescriptions for their respective molecules, resulting in minimal cost savings. Price discounts, which also impact the potential cost savings, varied considerably by product, ranging from 25% to 47%.

Biosimilar availability, NPDUIS public drug plans, 2016/17

Click on image for larger view

Figure description

blank

| Reference Biologic |

Biosimilar |

| Trade name (molecule) |

Drug cost in

millions of dollars (% share) |

Trade name |

Market approval |

First reimbursed |

Price discount |

Share of prescriptions |

| Remicade (infliximab) |

$396.3

(4.7%) |

Inflectra |

2014/01/15 |

Q1-2016 |

46.8% |

1.6% |

| Lantus (insulin glargine) |

$137.7

(1.6%) |

Basaglar |

2015/09/01 |

Q3-2017 |

25.0% |

NA |

| Neupogen (filgrastim) |

$42.4

(0.5%) |

Grastofil |

2015/12/07 |

Q4-2016 |

25.0% |

4.7% |

| Enbrel (etanercept) |

$159.6

(1.9%) |

Brenzys |

2016/08/31 |

Q3-2017 |

33.7% |

NA |

| Erelzi |

2017/04/06 |

NA |

37.2% |

NA |

Note: The cost driver analysis follows the approach detailed in the PMPRB report titled The Drivers of Prescription Drug Expenditures: A Methodological Report, 2013.

Source: NPDUIS Canadian Institute for Health Information database.

NPDUIS is a research initiative that operates independently of the regulatory activities of the PMPRB.