Analysis Brief: Generic Drugs in Canada, 2013

December 2014

- Analysis Brief: Generic Drugs in Canada, 2013 (PDF)

- Generic Drugs in Canada, 2013 (PDF)

The price of generic drugs in Canada is a critical issue for drug plan managers, policy makers and consumers. To contribute to discussions and inform policy decisions affecting generic pricing, the Patented Medicine Prices Review Board (PMPRB) has published its latest analytical report, Generic Drugs in Canada, 2013. This report is one of several the PMPRB has produced in recent years, comparing the price of generic drugs in Canada with those in other industrialized countries.

Historically, generic drugs in Canada have offered some savings over the equivalent branded products but have been priced high relative to their international counterparts. Since 2010, provincial governments have implemented policies aimed at reducing the price of generic drugs in Canada. Currently, provincial and territorial governments are collaborating on the pan-Canadian Generic Value Price Initiative, which will set the stage for further price reductions. The PMPRB 2013 report provides an early indication of the effects of some of these generic pricing policies. It also sets a potentially useful benchmark for Canadian generic price levels prior to the full implementation of the Value Price Initiative, which will take place by April 1, 2016.

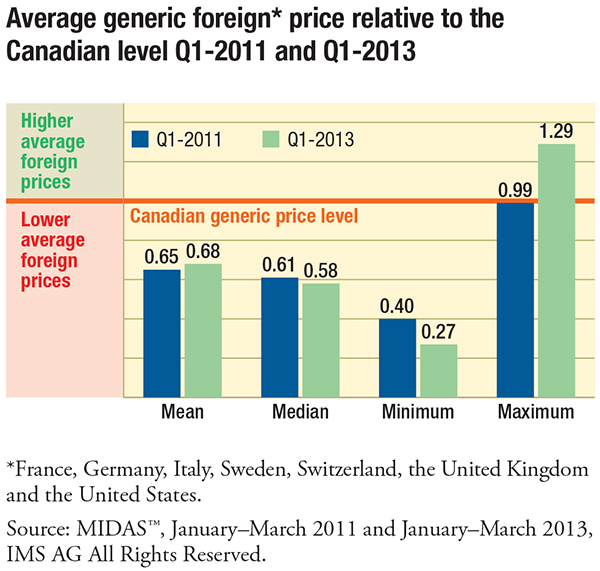

The report finds that despite a significant reduction in Canadian generic drug prices in recent years, they remain appreciably higher than international levels. In 2011, international generic prices were, on average, 35% lower than Canadian prices; by 2013, they were still 32% lower. Changes in international price levels as well as variations in exchange rates may explain these findings.

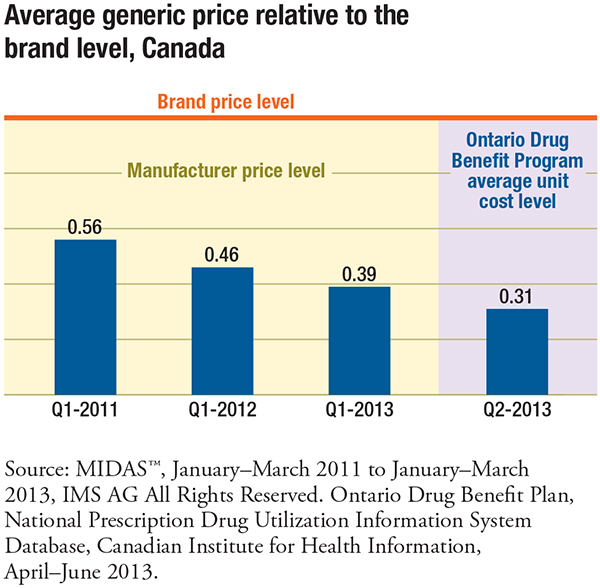

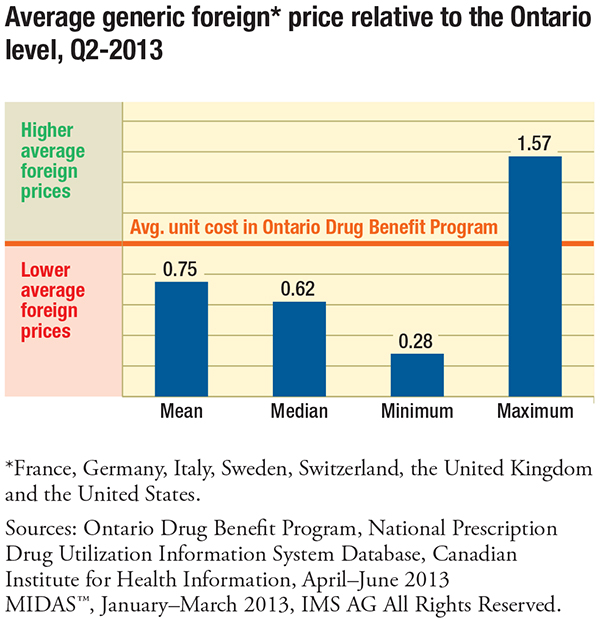

Domestically, average Canadian generic prices dropped from 56% of branded product prices in 2011 to 39% in 2013 due to changes in provincial reimbursement policies. Ontario fared even better, with 2013 generic prices at 31% of the brand levels, which translates into a 25% price differential compared to the international average.

The results based on Ontario prices in the second quarter of 2013, which are presumed to be more reflective of price reductions resulting from the early phase of the Value Price Initiative, reduce the price gap and are a marked improvement. Since then, there have been further generic price reductions which are not captured in the report.

Surprisingly, the report found that the gap between foreign and Canadian generic prices was the widest (38%–39%) for drugs with a greater number of suppliers competing in the Canadian marketplace (six or more suppliers) and for drugs with greater sales ($10 million or more).

Note that differences in regulations, marketing practices and reimbursement policies are important to consider when interpreting international price comparisons

Methods

The analysis compares the 2013 ex-factory generic prices of 487 leading drugs in Canada with international prices for the same drugs. The main international markets considered are: France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States. Data was collected from the MIDAS™, IMS AG (All Rights Reserved) for Canadian and international generic and brand prices. Data for the Ontario Drug Benefit Program was collected from the NPDUIS-CIHI database.

The PMPRB protects and informs Canadians by ensuring that the prices of patented medicines sold in Canada are not excessive and by reporting on pharmaceutical trends.

The National Prescription Drug Utilization Information System (NPDUIS) is a partnership between the PMPRB and the Canadian Institute for Health Information (CIHI). NPDUIS provides policy makers and drug plan managers with information and insights on trends in prices, utilization and costs.