New Drug Pipeline Monitor – July 2011

About the PMPRB

The Patented Medicine Prices Review Board (PMPRB) is an independent quasi-judicial body established by Parliament in 1987.

The PMPRB has a dual role: to ensure that prices at which patentees sell their patented medicines in Canada are not excessive; and to report on pharmaceutical trends of all medicines and R&D spending by patentees.

The PMPRB reports annually to Parliament, through the Minister of Health, on its activities, on pharmaceutical trends relating to all medicines, and on R&D spending by patentees.

The NPDUIS Initiative

The National Prescription Drug Utilization Information System (NPDUIS) provides critical analyses of drug price, utilization, and cost trends in Canada to support drug plan policy decision-making for participating federal, provincial, and territorial governments.

The NPDUIS initiative is a partnership between the PMPRB and the Canadian Institute for Health Information. It was established in 2001 by the federal/provincial/territorial Ministers of Health.

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) under the provisions of the National Prescription Drug Utilization Information System (NPDUIS).

The PMPRB recognizes the contributions of the members of the NPDUIS Steering Committee for their expert oversight and guidance in the preparation of this report.

1. Introduction

This is the third edition of the New Drug Pipeline Monitor (NDPM), a publication that provides information on drugs currently under development that may have an impact on federal, provincial and territorial (F/P/T) drug plan expenditure. Each report contains a list of pipeline drugs identified as part of a search of a specialized database1 that provides information on over 20,000 drugs in clinical trials. The search is supported by a review of pharmacy literature, with a focus on Canadian studies.

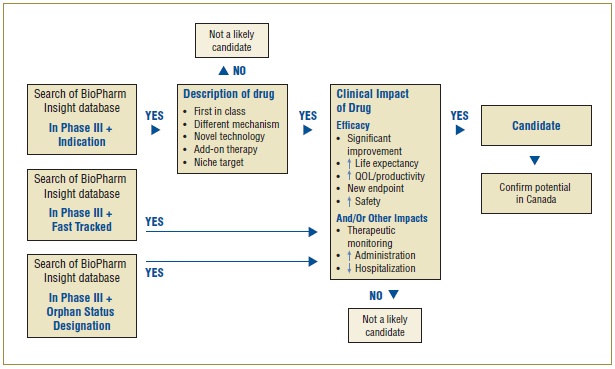

Only drugs that meet a set of selection criteria are candidates for the NDPM. The selection criteria were prepared for the PMPRB in 2006 and include: the phase of development; indication; mechanism of action; and impact on clinical practice. A decision-tree algorithm was developed so that criteria could be applied in a consistent, step-wise manner. Once a preliminary list is screened in, an effort is made to include pipeline drugs from a diverse set of therapeutic classes covered by public drug plans. In particular, consideration is given to high-cost drugs and classes where a new drug could have a financial impact, along with classes with a high utilization share of generic drugs.

As this is the third edition of the NDMP, it provides an update of pipeline drugs identified in the two previous reports. Some drugs were removed from the list either because they have entered the Canadian market or because the manufacturer is no longer conducting clinical trials. Similarly, drugs were retained if ongoing trials supported the initial assessment for inclusion.

This edition is organized into five sections. Following the introduction, Section 2 gives an overview of the criteria for drug selection, while Section 3 describes the algorithm used to apply the criteria. Section 4 discusses the BioPharm Insight® database search and literature review, and provides a table of drugs identified for the 2011 pipeline report. Section 5 provides updates of the pipeline drugs identified in previous reports.

2. Criteria for Drug Selection

This section provides a brief description of the criteria used to select pipeline drugs.

2.1 Phase of Development

Only drugs in Phase III clinical trials are considered as potential candidates for the NDPM. Most drugs reaching this stage have a higher likelihood of proceeding to regulatory approval and marketing in the near future. Drugs in earlier phases of development may not necessarily progress beyond these stages.

2.2 Indication and Therapeutic Area

Drugs are considered to be potential candidates if they could be used to treat life-threatening conditions, conditions with unmet needs or rare diseases, or if they could potentially change clinical practice in a therapeutic area.

2.3 Drug Description

Drug description keywords that would flag that a new drug could potentially change clinical practice include: first drug in a class; different mechanism of action; novel technology; add-on therapy; targeted niche; or an existing drug with a new indication.

2.4 Clinical and Other Impacts

Drugs must demonstrate the potential to have a significant clinical impact or a significant impact on other sectors of the health care system. Examples include: increased efficacy versus existing drugs; impacts on patient health such as increased life expectancy or quality of life; new or redefined outcomes; or an improved safety profile.

3. Methodology for Applying Criteria

The main source of information for the NDPM is the BioPharm Insight database, which tracks drugs from pre-clinical discovery through clinical trials to market launch and subsequent sales.

The database is a comprehensive resource on investigational drugs and, at any one time, may contain more than 20,000 drugs. The database search capabilities allow drugs to be selected under various fields, including phase of development, therapeutic area, indication, drug mechanism, orphan drug, fast track and molecule type.

An algorithm developed for selecting drugs for the NDPM is illustrated in Figure 1. The algorithm combines the search capabilities of the BioPharm Insight database and the key criteria used to identify a potentially high-impact drug. Because the sources of information for this database are largely from the US, additional sources are used to determine whether the new drugs are in development in Canada.

Figure 1. Algorithm to select drugs for the NDPM

As a first step in identifying potential candidates for the NDPM, the BioPharm Insight database is searched for drugs currently in Phase III development. Phase III trials may have just been initiated for these drugs, or some Phase III results may be available. Drugs in Phase III development are then screened by therapeutic area and indication. Drugs are considered as potential candidates for the NDPM if they have been identified by the US Food and Drug Administration (FDA) as orphan drugs, which treat rare diseases, or fast track drugs. The FDA considers drugs for fast track development if they are intended to treat serious or life-threatening conditions or if they demonstrate the potential to address unmet medical needs.

For drugs that are neither fast tracked nor designated as orphan drugs, the drug profiles are searched for keywords relating to specific drug descriptions, such as first in class, different mechanism, novel technology, add-on therapy, targeted niche or existing drugs with a new indication. If the drugs have these key descriptors, Phase III results are scanned to further validate the drug characteristics identified in the profile, such as a significantly increased efficacy or increased safety. At this point, drugs just entering Phase III trials are screened out, since there is insufficient information to make a scientific assessment.

Next, Canadian sources are consulted to determine whether there is information on any Canadian development. The main source of information is Pharmacy Practice, which publishes an annual list of promising new drugs in the later stages of development (Phase III or beyond) in Canada. The next step in identifying potential drugs for the NDPM involves the scientific assessment of all drugs for which preliminary Phase III results suggest an efficacy/safety impact.

Finally, to confirm the selection of new drugs for the NDPM, consideration is given to the likelihood of coverage by F/P/T public drug plans, based on indication and form.

4. Identification of Candidates for the NDPM

4.1. BioPharm Insight database search

The first step in identifying potential candidates for the pipeline monitor was a search of the BioPharm Insight database. As in previous analyses, only drugs currently in Phase III development or under review by the FDA (i.e., New Drug Application/Biologic License Application, NDA/BLA, filed) were screened in for the first step. The search was done on the week of March 7, 2011, and so is current for that period.

Table 1 summarizes the results of this search by therapeutic area. The database profile for each of these drugs was reviewed, with particular attention given to the drug description field. Specific keywords were sought, such as first in class or different mechanism. If these keywords

Table 1. BioPharm Insight search results by therapeutic class

| Therapeutic area |

Number of “hits” |

| In Phase III |

NDA/BLA filed |

| Cancer |

261 |

30 |

| Cardiovascular |

101 |

14 |

| Central nervous system |

112 |

16 |

| Dermatology |

33 |

5 |

| Eye & ear |

27 |

4 |

| Gastrointestinal |

56 |

16 |

| Genitourinary |

37 |

7 |

| Hematological |

51 |

7 |

| HIV infections |

27 |

2 |

| Hormonal system |

82 |

14 |

| Immune system |

50 |

2 |

| Infectious diseases |

106 |

27 |

| Musculoskeletal |

44 |

7 |

| Pain |

53 |

19 |

| Respiratory |

28 |

4 |

| TOTAL |

1068 |

174 |

were identified, the next step was to determine the results, if any, of Phase III clinical trials. Under the development history field of the drug profile, details of the Phase III results were scanned to further validate drug characteristics, such as increased efficacy or safety. If this scan revealed a lack of effect or a safety issue, the drug was screened out.

Table 2 is a working list of drugs that were screened in at this stage. All of these drugs were checked against the most recent pipeline list in Pharmacy Practice2 to determine if there was information on any Canadian development. From this working list, all drugs for which preliminary Phase III results suggested an efficacy or safety impact on the disease therapy were added to a draft table of potential candidates.

The next step was a scientific assessment of this preliminary list. For this assessment, details of the Phase III results from the BioPharm drug profiles were reviewed, specifically looking for significant improvements in efficacy and safety outcomes. In addition, a search of the MEDLINE® database was done to gain a sense of how the drug was viewed in the published literature.

Table 2. Specific drugs screened in by therapeutic area

| Therapeutic area |

Number of “hits” |

| In Phase III |

NDA/BLA filed |

| Cancer |

21 |

6 |

| Cardiovascular |

19 |

13 |

| Central nervous system |

22 |

18 |

| Dermatology |

3 |

4 |

| Eye & ear |

7 |

1 |

| Gastrointestinal |

8 |

10 |

| Genitourinary |

6 |

0 |

| Hematological |

1 |

1 |

| HIV infections |

2 |

2 |

| Hormonal system |

6 |

1 |

| Immune system |

5 |

0 |

| Infectious diseases |

8 |

7 |

| Musculoskeletal |

1 |

3 |

| Pain |

1 |

4 |

| Respiratory |

5 |

0 |

| Total |

115 |

70 |

As part of the final screening, an effort was made to include pipeline drugs from a diverse set of therapeutic classes covered by public drug plans. The potential financial impact on public drug plans was also taken into consideration. New drugs entering a class with high utilization (e.g., cardiovascular) or costly drugs (e.g., cancer) can be expected to increase the overall expenditure for a drug plan. The same logic can be applied to drugs entering therapeutic classes with a high utilization share of generic drugs. As an example, numerous high-expenditure drugs to treat high cholesterol (atorvastatin, simvastatin and pravastatin) have recently lost patent protection and have been replaced with less expensive generics. If a new drug enters this market, it has the potential to be an important cost driver.

4.2 Drugs Added to the New Drug Pipeline Monitor

Table 3 lists new candidates for the NDPM. Each drug met the selection criteria discussed in Section 3. The table lists the drug's trade name, company, therapeutic area and rationale for inclusion in the NDPM.

Table 3. Drugs added to the New Drug Pipeline Monitor

| Drug (Trade name, Company) |

Therapeutic area (ATC*) - Indication |

ationale for inclusion in the NDPM |

| Cardiovascular |

| Darapladib (GlaxoSmithKline) |

Cardiac therapy (C01) |

- In Phase III trials

- Significant population (cardiovascular)

- New class: inhibitor of lipoprotein associated phosphor-lipase A2 (Lp-PLA2)

- Decreases cardiovascular risk; inhibits formation of atherosclerotic plaques; has the potential to affect patient outcomes (myocardial infarction, stroke, cardiovascular death)3

- Different mechanism of action for atherosclerosis compared to statins

- Add-on therapy

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

|

| Ticagrelor (AZD6140; Brilinta; AstraZeneca) |

Antithrombotic agents (B01) |

- In Phase III trials

- Under review by the FDA; approved by the EMA

- Significant population (cardiovascular/stroke)

- New class of antiplatelet agent: oral P2Y12-receptor antagonist

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

- Improved efficacy and more consistent than clopidogrel4

|

| Arthritis |

| Tofacitinib, tasocitinib (Pfizer Inc./Takeda Pharmaceutical) |

Immunosuppressants (L04) |

- In Phase III trials

- Significant population (rheumatoid arthritis)

- Oral dosage form; injectable products currently the standard

- New mechanism of action: JAK-1/ JAK-3 antagonist

- Multiple indications: rheumatoid arthritis, acute rejection of kidney transplantation

|

| Hepatitis |

| Telaprevir (Tibotec/Janssen-Ortho)

|

Antivirals for systemic use (J05) |

- Approved by FDA

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

- Significant population (hepatitis C)

- Effective in patients who have failed other treatments, e.g., peginterferon alfa and ribavirin5

- Add-on therapy; triple therapy could impact on the cost of treatment

|

| Epilepsy |

| Perampanel (Eisai Co., Ltd.)

|

Antiepileptics (N03) |

- In Phase III trials

- First in class: non-competitive AMPA-type glutamate receptor antagonist

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

- Add-on therapy

|

| Retigabine (ezogabine; Valeant Pharmaceuticals) |

Antiepileptics (N03) |

- Approved by FDA and EMA

- New mechanism of action: a potassium channel opener and potentiator of GABA

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

- Add-on therapy

- Reduction in seizure frequencies of approximately 23–44% across the dose range6

|

| Parkinson's Disease |

| Safinamide (EMD Serono)

|

Anti-parkinson drugs (N04) |

- In Phase III trials

- Multiple mechanisms of action and multiple indications: Parkinson's disease, epilepsy, restless leg syndrome (RLS)

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

- Significant population

- If efficacy is improved over existing agents, could replace inexpensive alternatives, such as quinine in RLS.

|

| Pain |

| Oxycodone, Niacin and supplemental ingredients (Oxecta/Acura Pharmaceuticals, Pfizer Inc.)

|

Pain treatment (N02) |

§ Oxycodone and unique combination of ingredients intended to effectively treat pain while discouraging the three most common methods of prescription drug abuse including (i) intravenous injection of dissolved tablets, (ii) nasal snorting of crushed tablets and (iii) intentional swallowing of excessive numbers of tablets (BioPharm Insight) § Approved by FDA and EMA (BioPharm Insight) § The individual ingredients of this combination are existing active ingredients § Although it does not meet the criteria for a new pipeline drug, it does represent a new presentation of a commonly prescribed medication. |

| Alzheimer |

| Bapineuzumab (Pfizer, Inc.) |

Monoclonal antibody (L01) |

- In Phase III trials

- Significant population: Alzheimer patients

- Different mechanism of action: anti-beta amyloid monoclonal antibody

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

|

| Cancer |

| Ipilimumab (Bristol-Myers Squibb)

|

Monoclonal antibody (L01) |

- Recently approved by FDA for metastatic melanoma, marketed as Yervoy

- Multiple indications (melanoma, prostate cancer, other cancers)

- Significant population (cancer)

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

- Improved survival in patients previously treated for metastatic melanoma7

|

| Vandetanib (Zactima; AstraZeneca)

|

Protein kinase inhibitors (L01XE) |

- Under review by FDA; classified as a priority review

- Significant population (cancer)

- Different mechanism of action

- Efficacy improved in advanced medullary thyroid cancer8

|

|

Abbreviations: EMA, European Medicines Agency; FDA, US Food and Drug Administration; JAK, Janus kinase.

* A 4th level ATC code was provided for drugs that are listed in the ATC Index. As these drugs are investigational for the most part, many are not yet classified in the ATC Index; however, based on their mechanism of action, a likely 2nd level ATC code has been proposed.

|

5. Status Updates

5.1. Drugs Retained in the Pipeline List

Table 4 lists the drugs from the first and second editions of the New Drug Pipeline Monitor that remain as pipeline candidates. A status update based on recent scientific literature is provided, along with a rationale for retaining the drugs on the pipeline list.

Table 4. Drugs retained in pipeline list

| Drug (Trade name, Company) |

Therapeutic area (ATC)/ Indication |

Status update and rationale for retaining in the pipeline list |

| Agomelatine (Valdoxan, Servier)

|

CNS (N06AX)

Major depression

|

Previous description:

- First in a new class of antidepressants

- Comparable efficacy with added clinical benefits, e.g., sleep regulation

- Described in literature as an “ideal antidepressant”

Update:

- Approved by the FDA and EMA (BioPharm Insight)

- Good efficacy and tolerability; fewer side effects on sexual health than with selective serotonin reuptake inhibitors (SSRI) antidepressants9

- Agomelatine showed superior antidepressant efficacy over fluoxetine in treating patients with a severe episode of major depressive disorder (MDD) after 8 weeks of treatment with a good tolerability profile10

- The improvement in sleep disturbances, the tolerability in terms of sexual side effects, and the lack of withdrawal symptoms after abrupt discontinuation of treatment may represent important clinical benefits compared to established antidepressants

- Investigational drug status in Canada (Pharmacy Practice 2010/2011)

Rationale: Current literature continues to suggest that agomelatine is an important new approach to depression: at least comparable and perhaps superior efficacy with fewer side effects. Retain in the pipeline list.

|

| Ecallantide (DX-88; Dyax Corp., Genzyme Corp.) |

Antihemorrhagics (B02)

Hereditary angioedema (HAE)

|

Previous description:

- Novel plasma kallikrein inhibitor

- Unmet medical need: first specific therapy for acute attacks—HAE is a debilitating, potentially fatal disease

Update:

- Approved by the FDA

- In clinical trials, ecallantide provided relief of acute HAE attack symptoms, with rapidity of response commensurate with therapeutic needs for HAE attack locations11

Rationale: Current literature continues to suggest that ecallantide is an effective treatment for acute HAE and fills a medical need. There is a risk of anaphylaxis that needs to be managed. Affects a small population. Retain in the pipeline list.

|

| Istradefylline (KW-6002, Kyowa Hakko Kogyo Co. Ltd.)

|

CNS (N04)

Parkinson's disease

|

Previous description:

- First in a new class

- Impacts on disease progression rather than treating symptoms

- Phase III studies ongoing (BioPharm Insight)

Update:

- Add-on therapy to levodopa

- Clinical trial has shown that istradefylline at 20 mg and 40 mg once daily is effective in relieving wearing-off fluctuations of Parkinson's disease patients and was well tolerated at both doses12

- Long-term efficacy has been demonstrated13

Rationale: Current literature continues to suggest that istradefylline is an effective treatment for Parkinson's disease. Retain in the pipeline list.

|

| Phenoxodiol (Marshall Edwards Inc.) |

Cancer (L01)

Ovarian cancer

|

Previous description:

- Has demonstrated improved survival in a difficult to treat cancer

Update:

- No Phase III results available at this time

- FDA has granted fast track status to the development of phenoxodiol as a chemo-sensitizer for platinum and taxane drugs used in the treatment of recurrent ovarian cancer

Rationale: Although current literature is limited, it has the potential to improve survival. Retain in the pipeline list.

|

| Pirfenidone (Intermune Inc.) [orphan status]

|

Respiratory (R07)

Idiopathic pulmonary fibrosis

|

Previous description:

- Rare, progressive disease with poor prognosis

- Current treatment options (e.g., anti-inflammatory, immunosuppressants) have limited proven efficacy

- Orphan drug designation

- May prevent fibrosis in muscular dystrophy

Update:

- Approved by the FDA and EMA

- Three trials, conducted in 1046 patients, provided data on progression-free survival: pirfenidone significantly reduced the risk of disease progression by 30% (HR 0.70, 95% CI 0.56 to 0.88, P = 0.002)14

Rationale: Current literature continues to suggest that pirfenidone is an effective treatment for pulmonary fibrosis. Retain in the pipeline list.

|

| Plerixafor (Mozobil; Genzyme Corp.) |

Immunostimulants (L03)

Multiple myeloma (MM), Non-Hodgkin's lymphoma (NHL)

|

Previous description:

- Novel small molecule CXCR4 chemokine antagonist

- Approved by the FDA and EMA

Update:

- Orphan status in US and in Europe

- Well-tolerated mobilization regimen with the potential of successful stem cell collection in patients with previous mobilization failure

- Results of clinical trials have shown that plerixafor plus granulocyte-colony-stimulating factor (G-CSF) allow for the collection of a high yield of hematopoetic stem cells (HSC) with fewer apheresis sessions in patients with NHL and MM. Plerixafor has also shown promising results in small studies enrolling patients with Hodgkin's lymphoma. Moreover, for patients who fail G-CSF mobilization alone, plerixafor with G-CSF may be useful as a salvage mobilization strategy.15

Rationale: Current literature continues to suggest that plexifor is an effective treatment for mobilization of stem cell collection, particularly in patients who have failed on current strategies. Retain in the pipeline list.

|

| Satraplatin (LA 12, GPB Biotech AG; Spectrum Pharma-ceuticals Inc.; Pharmion Corp.) |

Cancer (L01)

Variety (hormone-refractory prostate cancer (HRPC), ovarian cancer and small-cell lung cancer)

|

Previous description:

- First oral platinum compound

- Fast track designation in US as a second-line chemotherapy treatment for HRPC

Update:

- Under review by the FDA

- One of four oral platinum compounds under investigation

- Oral satraplatin delayed progression of disease and pain in patients with metastatic castrate-refractory prostate cancer (CRPC) experiencing progression after initial chemotherapy but did not provide a significant overall survival benefit16

Rationale: Although current literature suggests that satraplatin may not increase survival, if it is the first oral platinum compound approved, it will have an impact on clinical practice. Retain in the pipeline list.

|

| Sipuleucel-T (Provenge, Dendrion Corporation) |

Cancer (L01)

Prostate cancer

|

Previous description:

- New immunotherapy approach to the management of prostate cancer at an early stage

- Fast track designation in US

Update:

- Approved by the FDA

- In the randomized, double-blind, placebo-controlled study in patients with metastatic castrate-refractory prostate cancer (CRPC), sipuleucel-T was associated with a 22% relative reduction in the risk of death (HR 0.78; p = 0.03), which was the primary endpoint of the trial17

Rationale: Current literature continues to suggest that sipuleucel-T represents a novel approach to treatment of prostate cancer and decreases the risk of death. Retain in the pipeline list.

|

|

Abbreviations: EMA, European Medicines Agency; FDA, US Food and Drug Administration.

|

5.2 Drugs Removed from Pipeline List

Tables 5 and 6 provide a list drugs from the first and second editions of the New Drug Pipeline Monitor that have been removed from the pipeline list. Drugs in Table 5 were removed because the manufacturer was granted authority to market the drug in Canada. Health Canada grants that authority in a Notice of Compliance (NOC). Table 5 also provides information on recommendations made by CADATH's Canadian Expert Drug Advisory Committee on whether public drug plans should list the drug, as well as rulings of the Patented Medicine Prices Review Board (PMPRB) on whether a drug was priced within its excessive price guidelines. Table 6 lists the drugs that have been removed because a scientific assessment no longer supports retention on the pipeline list. Reasons cited include lack of information or subsequent clinical trials that cite insufficient efficacy or safety.

Table 5. Drugs removed from pipeline list: market authority granted by Health Canada

| Drug (Trade name, company) |

Therapeutic area (ATC) —Indication |

Notice of Compliance (NOC) date* |

CADTH/PMPRB recommendations/rulings** |

| Eculizumab (Soliris; Alexion Pharmaceuticals Inc.) |

Immunosuppressive agent (L04) |

Jan. 2009 |

CADTH recommended (Feb. 2010) that eculizumab not be listed. Reason: not cost effective without a substantial reduction in price. |

| Lapatinib (Tykerb; GSK) |

Antineoplastic agents (L01) |

May 2009 |

— |

| Raltegravir (Isentress; Merck Frosst Canada Ltd.) |

Antivirals for systemic use, HIV (J05) |

Nov. 2007 |

CADTH recommended (June 2010) that raltegravir not be listed at the submitted price. PMPRB found the introductory price (Nov. to Dec. 2007) was within its excessive price guidelines. |

| Rivaroxaban (Xarelto; Bayer Inc.) |

Antithrombotic agent (B01) |

Sept. 2008 |

CADTH recommended (Dec. 2008) that rivaroxaban be listed as an alternative to heparins following knee or hip replacement surgery. PMPRB accepted a voluntary compliance undertaking (VCU) for Xarelto, Jan. 2010. Xarelto's price exceeded PMPRB guidelines when it was introduced in Sept. 2008. |

| Sapropterin (Kuvan; Biomarin Pharmaceutical Inc.) |

Alimentary tract and metabolism (A16) |

April 2010 |

CADTH recommended (Jan. 2011) that sapropterin not be listed. Reason: patient details insufficient to identify a clinical benefit that is cost-effective. |

|

* An NOC is granted when a drug product meets Health Canada's regulatory requirements for safety, efficacy and quality.

**CADTH recommendations are made by the Canadian Expert Drug Advisory Committee (CEDAC), an independent advisory body composed of individuals with expertise in drug therapy and drug evaluation.

|

Table 6. Drugs removed from pipeline list: scientific assessment

| Drug (Trade name, Company) |

Rationale for Removal |

| Efaproxiral (Efaproxyn, Revaproxyn, Allos Therapeutics) |

- Very little information on this drug since 2008

- One review does not recommend its use for the treatment of metastatic brain tumours because of lack of evidence of efficacy19

|

| Tolvaptan (Otsuka Maryland Research Institute (OMRI); Otsuka Pharmaceutical Co., Ltd.) |

- A review describes tolvaptan as prompting rapid free water elimination and improving short-term signs and symptoms of heart failure (HF), but no effect on long-term mortality or HF-related morbidity was observed20

- It will likely be reserved for select patients and not broadly used to replace diuretics

|

| Tramiprosate (Alzhemed, Neurochem Inc.) |

- Very little information on this drug since 2008

- No Phase III results have been published

|

6. References

1 The BioPharm Insight® database was accessed the week of March 7, 2011, for this report. The web address is: http://www.infinata5.com/BioPharm/AccessPoint.aspx?action=Login.ShowLogin&datakey=BioPharm

2 Murdoch LA. Promising drugs in the late stages of development in Canada. Pharmacy Practice Dec 2010/Jan 2011. Available online at: www.CanadianHealthcareNetwork.ca.

3 White H. Editorial: why inhibition of lipoprotein-associated phospholipase A2 has the potential to improve patient outcomes. Curr Opin Cardiol. 2010; 25(4):299–301.

4 Steg PG, James S, Harrington RA, Ardissino D, et al. Ticagrelor versus clopidogrel in patients with ST-elevation acute coronary syndromes intended for reperfusion with primary percutaneous coronary intervention: A Platelet Inhibition and Patient Outcomes (PLATO) trial subgroup analysis. Circulation. 2010; 122(21):2131–41.

5 McHutchison JG, Manns MP, Muir AJ, et al; PROVE3 Study Team. Telaprevir for previously treated chronic HCV infection. N Engl J Med. 2010; 362(14):1292–303.

6 Brodie MJ, Lerche H, Gil-Nagel A, et al; for RESTORE 2 Study Group. Efficacy and safety of adjunctive ezogabine (retigabine) in refractory partial epilepsy. Neurology. 2010; 75(20):1817–24.

7 Hodi FS, O'Day SJ, McDermott DF, et al. Improved survival with ipilimumab in patients with metastatic melanoma. N Engl J Med. 2010; 363(8):711–23.

8 Robinson BG, Paz-Ares L, Krebs A, Vasselli J, Haddad R. Vandetanib (100 mg) in patients with locally advanced or metastatic hereditary medullary thyroid cancer. Clin Endocrinol Metab. 2010; 95(6):2664–71.

9 Green B. Focus on agomelatine. Curr Med Res Opin. 2011; 27(4):745–9.

10 Hale A, Corral RM, Mencacci C, Ruiz JS, Severo CA, Gentil V. Superior antidepressant efficacy results of agomelatine versus fluoxetine in severe MDD patients: a randomized, double-blind study. Int Clin Psychopharmacol. 2010 ; 25(6):305–14.

11 Riedl M, Campion M, Horn PT, Pullman WE. Response time for ecallantide treatment of acute hereditary angioedema attacks. Ann Allergy Asthma Immunol. 2010; 105(6):430–6.

12 Mizuno Y, Hasegawa K, Kondo T, Kuno S, Yamamoto M; Japanese Istradefylline Study Group. Clinical efficacy of istradefylline (KW-6002) in Parkinson's disease: a randomized, controlled study. Mov Disord. 2010; 25(10):1437–43.

13 Factor S, Mark MH, Watts R, Struck L, Mori A, Ballerini R, Sussman NM;Istradefylline 6002-US-007 Study Group. A long-term study of istradefylline in subjects with fluctuating Parkinson's disease. Parkinsonism Relat Disord. 2010; 16(6):423–6.

14 Spagnolo P, Del Giovane C, Luppi F, et al. Non-steroid agents for idiopathic pulmonary fibrosis. Cochrane Database Syst Rev. 2010; (9):CD003134.

15 Kessans MR, Gatesman ML, Kockler DR. Plerixafor: a peripheral blood stem cell mobilizer. Pharmacotherapy. 2010; 30(5):485–92.

16 Sternberg CN, Petrylak DP, Sartor O, et al. Multinational, double-blind, phase III study of prednisone and either satraplatin or placebo in patients with castrate-refractory prostate cancer progressing after prior chemotherapy: the SPARC trial. J Clin Oncol. 2009; 27(32):5431–8.

17 Kantoff PW, Higano CS, Shore ND, et al; for IMPACT Study Investigators. Sipuleucel-T immunotherapy for castration-resistant prostate cancer. N Engl J Med. 2010; 363(5):411–22.

18 CADTH recommendations available at the agency's Common Drug Review (CDR) online database: http://www.cadth.ca/index.php/en/cdr/search. PMPRB rulings available at web address: http://www.pmprb-cepmb.gc.ca/english/home.asp?x=1 Only publicly available recommendations/rulings are cited.

19 Olson JJ, Paleologos NA, Gaspar LE, et al. The role of emerging and investigational therapies for metastatic brain tumors: a systematic review and evidence-based clinical practice guideline of selected topics. J Neurooncol. 2010; 96(1):115–42.

20 Ferrer E. Tolvaptan for the treatment of hyponatremia and congestive heart failure. Drugs Today (Barc). 2010; 46(3):163–71.