2015-16 Departmental Performance Report

The Honourable Jane Philpott

Minister of Health

Catalogue number: H79-2E-PDF

ISSN: 2368-1063

Table of Contents

Minister's Message

Result's Highlights

Section I: Organizational Overview

Section II: Expenditure Overview

Section III: Analysis of Programs and Internal Services

Section IV: Supplementary Information

Appendix: Definitions

Endnotes

Minister's Message

As the Minister responsible for the Health Portfolio, I am pleased to present the 2015-16 Departmental Performance Report for the Patented Medicine Prices Review Board (PMPRB). This report highlights how the PMPRB has supported the government’s commitments to help Canadians maintain and improve their health.

The PMPRB is an independent, quasi-judicial administrative agency with a dual mandate: to protect Canadians from excessively priced patented drug products; and to report on pharmaceutical trends in general, and on patentees’ research and development (R&D) spending in Canada.

The past year has been a particularly productive one for the PMPRB. The PMPRB has worked closely with lead jurisdictions through the pan-Canadian Pharmaceutical Alliance (pCPA), to provide relevant pricing and market analyses aimed at reducing the cost of brand and generic drugs in Canada. The work of the PMPRB was referenced in achieving price reductions in 18 commonly-used generic drugs and continues to support policy development on a national generic tiered pricing framework. Through these and other efforts, the PMPRB is working to ensure that payers of drug products have the information they need to make smart reimbursement choices and Canadians have access to patented medicines at prices they can afford.

In December 2015, the PMPRB published its 2015–2018 Strategic Plan identifying a new vision, revised mission statement, and new strategic priorities. The overarching objective of the plan is to re-position the organization in light of recent changes in its regulatory environment so that it can leverage its unique legislative remit to better complement the efforts of its federal, provincial and territorial partners and other stakeholders in advancing a common goal of a sustainable health system in Canada.

One of the PMPRB’s new priorities is framework modernization. As a first step in the fulfilment of that priority, the PMPRB will publish a discussion paper in 2016 on potential reform to its pricing guidelines. Publication of the paper will be followed by national consultations with interested members of the public, provincial and territorial ministries of health, private insurers, industry and other stakeholders groups.

I look forward to the continued support of the PMPRB in moving ahead on my key mandate priorities i, including improving patient access to necessary prescription medications, by reducing their costs and making them more affordable for Canadians.

The Honourable Jane Philpott, P.C., M.P.

Minister of Health

Results Highlights

What funds were used? Actual Spending - $9,498,361

Who was involved? Actual FTEs - 62.5

Regulatory Mandate

- 1359 patented drug products for human use were reported to the PMPRB, including 86 new patented drug products.

- The PMPRB accepted nine Voluntary Compliance Undertakings which resulted in price reductions for certain drug products, and the offset of excess revenues totalling $7,272,305.55 by way of payments to the Government of Canada. In addition to this amount, one of the VCUs required the patentee to pay back $5,522,632.96 to hospitals that had purchased the drug product in question at an excessive price.

- The hearing in the matter of the price of the patented medicine Soliris and Alexion Pharmaceuticals Inc. continues and is currently scheduled to be heard in January and February 2017.

- The PMPRB commenced two failure to file hearings; one against Baxalta Canada Corporation and the other, against Galderma Canada Inc.

- On November 6, 2015, the Federal Court of Appeal upheld the finding of the original Board Panel decision that held that “generic” drug manufacturers Sandoz and ratio-pharm are patentees under section 79 of the Patent Act. The decision also reaffirmed the constitutionality of sections 79-103 of the Act. In this regard, the Federal Court of Appeal found that the Board correctly held that the control of prices charged for patented medicines comes within the jurisdiction conferred on Parliament over patents under subsection 91(22) of the Constitution Act, 1867 when applied to patent holders, patent owners, or any other persons exercising rights under patents (such as licensees).

Reporting Mandate

- In 2015-16, in addition to tabling the 2014 Annual Report, the PMPRB published 7 poster presentations, a slide presentation, its 2015–2018 Strategic Plan and the following 5 analytical reports: Generics360 – Generic Drugs in Canada, 2014, February 2016; Private Drug Plans in Canada - Part 1: Generic Market 2005–2013, December 2015; New Drug Pipeline Monitor, 7th Edition, December 2015; CompassRx Annual Public Drug Plan Expenditure Report, 1st Edition, March 31, 2016; Analysis Brief: NPDUIS CompassRx 1st Edition, March 31, 2016.

- The PMPRB also worked closely with provincial and territorial governments through NPDUIS, and directly with lead jurisdictions through the Council of the Federation, to provide relevant pricing and market analyses aimed at reducing the price of drugs purchased by public payers in Canada.

Section I: Organizational Overview

Organizational Profile

Appropriate Minister: The Honorable Jane Philpott

Institutional Head: Douglas Clark, Executive Director

Ministerial Portfolio: Health

Enabling Instrument(s): Patent Act ii and Patented Medicines Regulations iii

Year of Incorporation / Commencement: 1987

Other: The Minister of Health is responsible for the pharmaceutical provisions of the Patent Act (Act) set out in sections 79 to 103. The PMPRB is part of the Health Portfolio, which includes Health Canada, the Public Health Agency of Canada, the Canadian Institutes of Health Research and the Canadian Food Inspection Agency. The Health Portfolio supports the Minister of Health in maintaining and improving the health of Canadians.

Although part of the Health Portfolio, the PMPRB carries out its mandate at arm’s length from the Minister. It also operates independently of other bodies such as Health Canada, which authorizes the sale of drugs in Canada after their assessment for safety, efficacy and quality; federal, provincial and territorial public drug plans, which are responsible for listing and reimbursement decisions for their respective plans; and the Common Drug Review, administered by the Canadian Agency for Drugs and Technologies in Health (CADTH), which provides listing recommendations to participating public drug plans based on cost-effectiveness.

Organizational Context

Raison d’être

The PMPRB is an independent, quasi-judicial body created by Parliament in 1987. Its mandate is two-fold:

- Regulatory – to ensure that prices charged by patentees for patented medicines sold in Canada are not excessive; and

- Reporting – to report on pharmaceutical trends of all medicines and on research and development (R&D) spending by pharmaceutical patentees.

In carrying out its mandate, the PMPRB ensures Canadians are protected from excessive prices for patented medicines sold in Canada and stakeholders are informed on pharmaceutical trends.

Responsibilities

The PMPRB was created as a result of amendments to the Act in 1987 (Bill C-22), and its remedial powers supplemented by further amendments in 1993 (Bill C-91). These amendments were part of policy reforms intended to balance the PMPRB’s consumer protection mandate with patent protection measures intended to encourage the R&D efforts of pharmaceutical patentees

The PMPRB has a dual mandate:

Regulatory

The PMPRB is responsible for ensuring the factory-gate prices that patentees charge for prescription and non-prescription patented medicines sold in Canada to wholesalers, hospitals, pharmacies or others, for human and veterinary use, are not excessive. The PMPRB regulates the price of each patented medicine to which Health Canada has assigned a Drug Identification Number (DIN) as part of its price review process. The PMPRB’s mandate also includes medicines that are available under the Special Access Programme, through a Clinical Trial Application, and Investigational New Drug Products. Over-the-counter (OTC) patented medicines and patented medicines for veterinary use are regulated by the PMPRB on a complaints basis.

Reporting

The PMPRB reports annually to Parliament through the Minister of Health on its price review activities, the prices of patented medicines and price trends of all prescription drugs, and on the R&D expenditures reported by pharmaceutical patentees. In addition, as a result of the establishment of the National Prescription Drug Utilization Information System (NPDUIS) iv (NPDUIS) by federal/provincial/territorial (F/P/T) Ministers of Health in September 2001, the PMPRB conducts critical analysis of price, utilization, and cost trends for patented and non-patented prescription drugs to provide Canada’s health system with more comprehensive, accurate information on how all prescription drugs are being used and on the sources of cost increases. This function is aimed at providing F/P/T governments and other interested stakeholders with a centralized credible source of information on pharmaceutical trends. Increasingly, as part of its reporting function, the PMPRB works closely with provincial and territorial (P/T) governments through NPDUIS, and directly with lead jurisdictions through the Council of the Federation, to provide relevant pricing and market analyses aimed at reducing the prices of prescription drugs purchased by public payers in Canada.

Strategic Outcome and Program Alignment Architecture

1. Strategic Outcome: Canadians are protected from excessive prices for patented medicines sold in Canada and stakeholders are informed on pharmaceutical trends.

1.1 Program: Patented Medicine Prices Regulation Program

1.2 Program: Pharmaceutical Trends Program

Internal Services

Operating Environment and Risk Analysis

Key Risks

| Risk |

Risk Response Strategy |

Link to the Organization’s Program(s) |

| As the number of drug prices negotiated through the pan-Canadian Pharmaceutical Alliance (pCPA) process increases, along with the number of participating public drug plans, and achieves even greater discounts off the list price, there is a risk that the price ceilings set by the PMPRB will become irrelevant to public payers. |

- The PMPRB worked closely with P/T governments through NPDUIS, and directly with lead jurisdictions through the Council of the Federation, to provide relevant pricing and market analyses aimed at assisting public payers in their efforts to reduce the price they pay for pharmaceuticals.

- The PMPRB amended its Guidelines to ensure that public list prices, which often serve as a starting point in negotiations between payers and industry, do not exceed the Maximum Average Potential Price (MAPP) established by the introductory price test, with the result that no Canadian will be paying more than the PMPRB regulated ceiling price.

- As a first step in modernizing its legal framework to make it a more effective price regulator, the PMPRB will publish a discussion paper and consult with the public on reform to its pricing guidelines.

|

This risk is linked to the Patented Medicine Prices Regulation Program and the Pharmaceutical Trends Program. |

| There is a risk that continued efforts by pharmaceutical pricing and reimbursement authorities in the EU to lower prices will soon result in Canada having the second highest patented drug prices, below only the US, of the PMPRB’s seven comparator countries and/or prices that are higher than the international median. |

- As a first step in modernizing its legal framework to make it a more effective price regulator, the PMPRB will publish a discussion paper and consult with the public on reform to its pricing guidelines.

- The PMPRB continues to strengthen ties with pricing and reimbursement authorities in other countries to share market intelligence and stay abreast of the latest developments in cost containment internationally, particularly through its membership in the Pharmaceutical Pricing and Reimbursement Information (PPRI) but also through its collaborative work with the World Health Organization on the fair pricing of pharmaceuticals.

- As part of its ongoing efforts to seek better, more reliable and comprehensive sources of foreign prices for its price review process, the PMPRB changed its recognized source for Germany from Rote Liste to Lauer-Taxe, effective January 2016. In addition, the PMPRB is increasingly using other sources of price information to validate and assess the foreign prices submitted to the PMPRB by patentees.

|

This risk is linked to the Patented Medicine Prices Regulation Program. |

| Implementation of the Comprehensive Economic and Trade Agreement (CETA) may precipitate a debate on whether the balance between patent protection and consumer protection is working as intended. |

- As a first step in modernizing its legal framework to make it a more effective price regulator, the PMPRB will publish a discussion paper and consult with the public on reform to its pricing guidelines.

|

This risk is linked to the Patented Medicine Prices Regulation Program. |

| Impact of pending litigation on the PMPRB’s jurisdiction |

- In November 2015, the Federal Court of Appeal issued a precedent-setting decision confirming that a person need not own the patent over a particular medicine to be considered a “patentee” in respect of that medicine within the meaning of subsection 79(1) of the Patent Act.

Therefore, the status of a company as a “generic” or “brand” drug manufacturer is irrelevant to the question of whether the PMPRB has jurisdiction over a particular drug product.

- The decision also reaffirmed the constitutionality of sections 79–103 of the Act which state that the control of prices charged for patented medicines comes within the jurisdiction conferred on Parliament over patents under subsection 91(22) of the Constitution Act, 1867 when applied to patent holders, patent owners, or any other persons exercising rights under patents, such as licensees.

- PMPRB Legal Services also continued to work closely with counterparts in the Attorney General’s office to ensure other outstanding litigation before the Federal Court and Supreme Court involving the PMPRB is managed carefully to ensure the most favorable outcome possible as it relates to jurisdictional and related matters.

|

This risk is linked to the Patented Medicine Prices Regulation Program. |

| Given the highly specialized nature of its consumer protection mandate, the PMPRB depends on its ability to attract and retain subject matter experts. |

- The PMPRB has made employee engagement one of its strategic priorities and continues to hire new staff from both within government and the private sector that possess the skills needed to advance the organization’s priorities.

- PMPRB Human Resources established a Workplace Improvement Team (WIT) to solicit the views of employees on how the organization can implement its engagement strategy. The terms of reference of the WIT include advising management on how to create a respectful, healthy and enabling workplace by embracing change, fostering effective communication, and recognizing high performance.

- The PMPRB hired a consultant to develop and conduct an employee survey on overall workplace satisfaction and to obtain employee feedback on the degree to which managers are meeting their engagement objectives.

- Training sessions on how to navigate change, value diversity, communicate in a respectful way and collaborate in problem solving were provided to all employees.

|

This risk is linked to the Patented Medicine Prices Regulation Program and the Pharmaceutical Trends Program. |

PMPRB’s 2015-2018 Strategic Plan

In December 2015, the PMPRB published its three-year strategic plan which commits the organization to pursuing the following four strategic objectives:

- Consumer-focused regulation and reporting

- Framework modernization

- Strategic partnerships and public awareness

- Employee engagement

Organizational Priorities

Name of Priority – Address current price and information gaps

Description

Today’s pharmaceutical environment is dynamic and rapidly evolving. In order to function effectively as a price regulator, the PMPRB must have a complete and accurate picture of what the regulated party is earning from sales of its products. However, the PMPRB is doubly handicapped in this respect in that neither the publicly available foreign price sources upon which it relies, nor the information reported by patentees about prices in Canada account for the confidential rebates and discounts which are now the norm both domestically and internationally in negotiated agreements between pharmaceutical manufacturers and many payers. In Canada, these confidential discounts are said to be resulting in a growing price gap between public payers, who are able to negotiate collectively through the pCPA, private payers, who may lack the flexibility to do so under competition laws, and cash customers, who have no ability to negotiate.

Priority Type1 New

Key Supporting Initiatives

| Planned Initiatives |

Start Date |

End Date |

Status |

Link to the

Organization’s Program(s) |

Regulatory:

- Seek opportunities to address instances of excessive pricing in the form of price discrimination and market segmentation |

April 1, 2015 |

Spring/Summer 2017 |

On track |

This initiative is linked to the Patented Medicine Prices Regulation Program. |

|

Reporting:

- Intensify its partnership with public payers to provide even more timely and relevant pricing information

- Expand the scope of pharmaceutical topics on which it reports to provide private payers and consumers with information to help them make better, more cost effective choices

|

2014-15 |

2018 |

On track |

This initiative is linked to the Pharmaceutical Trends Program. |

| Progress Toward the Priority |

From the regulatory perspective, the PMPRB has made some progress in addressing current price and information gaps, namely:

- It amended its Guidelines to ensure that public list prices do not exceed the Maximum Average Potential Price (MAPP) established by the introductory price test to ensure that no Canadian is paying more than the PMPRB regulated ceiling price.

- It changed its recognized public list price source for Germany from Rote Liste to Lauer-Taxe, which is considered to be a more reliable indicator of the true price paid for drugs in Germany net of rebates and discounts.

- It placed a greater emphasis on market segmentation issues when considering how to resolve investigations into excessive pricing.

|

From the reporting perspective, the PMPRB has also made some progress, namely:

- It has been working closely with P/T governments through NPDUIS, and directly with lead jurisdictions through the Council of the Federation, to provide relevant pricing and market analyses aimed at reducing the prescription drug prices paid by public payers in Canada.

- On March 31, 2015, the PMPRB released the first edition of CompassRx, a flagship annual report and the first of its kind to identify the major drivers behind changes in prescription drug expenditures in public plans in Canada – an important element in allowing policy-makers and researchers to understand current trends and anticipate future cost pressures and expenditure levels.

- It revised the NPDUIS Research Agenda v to reflect the most current analytical priorities identified by the NPDUIS Advisory Committee for completion and publication in 2015-16 and 2016-17.

|

Name of Priority – Increase Public Awareness

Description

In order to be fully informed of, and respond to, the relevant changes in its environment, the PMPRB must engage with a heterogeneous network of pharmaceutical industry stakeholders, each with its own unique interest and perspective on these changes. To do so effectively, the PMPRB must enhance awareness of its consumer protection mandate and build on its honest broker reputation with stakeholders and the public at large.

Priority Type: New

Key Supporting Initiatives

| Planned Initiatives |

Start Date |

End Date |

Status |

Link to the

Organization’s Program(s) |

- Adopt a more proactive approach to communicating its regulatory and reporting achievements to stakeholders and the public

- Look for opportunities to leverage strategic partnerships

- Broaden the scope of pharmaceutical issues on which it reports

|

April 2015 |

2018 |

On track |

This priority is linked to the Patented Medicine Prices Regulation Program and the Pharmaceutical Trends Program. |

| Progress Toward the Priority |

|

The PMPRB has continued to intensify its communication activities, taking a more proactive approach to elevate its social and traditional media profile. This included press release distribution, targeted social media campaigns and more direct engagement with the public. It resulted in interviews and increased coverage with domestic and international media outlets including the CBC, CPAC, The Globe and Mail, the Wall Street Journal and CBS.

The PMPRB closely tracks and reports internally on social media uptake of its communication efforts with respect to its key activities and reports.

The PMPRB made improvements to its website and publications in terms of clarity of language and accessibility of content, and continues to respond to public enquiries and inform the public by publishing updates of Board proceedings and decisions, and research results.

The PMPRB has been working closely with F/P/T governments through NPDUIS, and directly with lead jurisdictions through the Council of the Federation, to provide relevant pricing and market analyses aimed at reducing the price of prescription drugs paid by public payers in Canada.

The PMPRB has organized external information sessions for various stakeholder groups, and prepared and delivered presentations for stakeholder engagement events to raise awareness of NPDUIS initiatives and the results of studies. As well, the PMPRB organized and participated in meetings of the NPDUIS Advisory Committee vi to identify analytical priorities for the NPDUIS Research Agenda.

The PMPRB continues to participate as a member or observer in external committees such as the Canadian Network for Environmental Scanning in Health (CNESH), the Drug Therapeutics Advisory Committee (DTAC) at Non-Insured Health Benefits (NIHB) and the Drug Policy Advisory Committee (DPAC) at CADTH.

The PMPRB hosted its second invitational Researchers’ Forum with academics and subject-matter experts to discuss current areas of policy-relevant research in the pharmaceutical marketplace.

The PMPRB continues to participate in and present at various relevant networks, conferences and symposia nationally and internationally, including the PPRI, the WHO and the Vancouver Group.

The PMPRB has addressed substantially more complaints in 2015-16 from the public about drug pricing than in previous years.

|

Name of Priority – Regulatory Modernization

Description

In Canada, public payers are entering into confidential product listing agreements (PLAs) with pharmaceutical manufacturers, either individually or under the auspices of the pCPA. As mentioned, this complicates the PMPRB’s ability to ascertain the true price of a drug, and may result in upward pressure on prices in the private market. As other countries experiment with new cost control methods, Canadian patented drug prices are rising relative to the 7 other countries to which Canada compares itself under the Patented Medicines Regulations. Canada’s commitment under the Comprehensive Economic Trade Agreement (CETA) with the European Union to amend the Patent Act to extend the terms of pharmaceutical patents by up to two years may precipitate a debate over the appropriate balance between intellectual property rights and consumer protection.

Priority Type: New

Key Supporting Initiatives

| Planned Initiatives |

Start Date |

End Date |

Status |

Link to the

Organization’s Program(s) |

| Examine whether and to what extent changes to the PMPRB’s pricing and/or reporting functions are warranted if it is to continue to meet its strategic outcome of ensuring that Canadians do not pay excessive prices for patented drugs |

April 2015 |

Summer 2017 |

Ongoing |

This priority is linked to the Patented Medicine Prices Regulation Program |

| Progress Toward the Priority |

| As a first step in modernizing its legal framework to make it a more effective price regulator, the PMPRB developed a discussion paper which will serve as the basis for public consultations on reform to its pricing guidelines. |

Guidelines Modernization Discussion Paper

In June 2016, the PMPRB launched its discussion paper, as the first step in its 2015-18 strategic objective of framework modernization. Through the discussion paper the PMPRB is seeking to generate an open, informed dialogue with stakeholders and members of the public on area its drug pricing guidelines in need of reform as a result of changes to the pharmaceutical environment in Canada and abroad. Comments must submitted by October 24, 2016.

The Guidelines Modernization Discussion Paper vii is available on the PMPRB website.

Name of Priority – Employee engagement and organizational synergy

Description

In response to feedback from the 2011 Public Service Employee Survey and a succession planning report produced by independent experts, the PMPRB has initiated a process to engage staff and obtain their input and buy in on the PMPRB’s strategic direction and priorities over the next three years. As part of that process, staff will gain a better understanding of the PMPRB’s operational framework and how the work of each branch contributes to the achievement of the organization’s strategic outcome.

Priority Type: New

Key Supporting Initiatives

| Planned Initiatives |

Start Date |

End Date |

Status |

Link to the

Organization’s Program(s) |

The PMPRB will focus on:

- clearer and more structured communication between and among management and staff

- greater internal collaboration

- better integrating its business processes

- optimal utilization of its diverse employee skill sets

|

February 2015 |

March 2018 |

Ongoing |

This program is linked to the Patented Medicine Prices Regulation Program and the Pharmaceutical Trends Program. |

| Progress Toward the Priority |

Progress toward this priority includes:

- The establishment of a Speaker Series whereby key opinion leaders and experts in various fields of relevance to the PMPRB’s work come and speak to staff on a regular basis to explain the latest developments in the pharmaceutical regulatory environment;

- Regular all-staff meeting where employees are provided an opportunity to present their work to their colleagues in other branches;

- Training sessions for employees on how to navigate change, value diversity, communicate in a respectful way and collaborate in problem solving;

- The establishment of a Workplace Improvement Team (WIT) to solicit the views of employees on how the organization can implement its engagement strategy. The terms of reference of the WIT include advising management on how to create a respectful, healthy and enabling workplace by embracing change, fostering effective communication, and recognizing high performance;

- The hiring of a consultant to develop and conduct an employee survey on overall workplace satisfaction and to obtain employee feedback on the degree to which managers are meeting their engagement objectives;

- The development of a new and improved Intranet site which will enable employees to share information, track developments within the organization with greater ease and foster increased socialization and collegiality.

|

For more information on organizational priorities, see the PMPRB’s 2015-2018 Strategic Plan viii and the Minister’s mandate letter. ix

Section II: Expenditure Overview

Actual Expenditures

Budgetary Financial Resources (dollars)

2015–16

Main Estimates |

2015–16

Planned Spending |

2015–16

Total Authorities

Available for Use |

2015–16

Actual Spending

(authorities used) |

Difference

(actual minus planned) |

| 10,945,181 |

10,945,181 |

11,249,206 |

9,498,361 |

(1,446,820) |

| The variance of $1,446,820 between actual and planned spending is mainly due to the fact that planned spending was based on the assumption that the full amount of the Special Purpose Allotment (SPA) reserved for conducting public hearings ($2.47 million) will be spent each year. In 2015-16 expenditures from the SPA totalled $1,213,627. |

Human Resources (Full-Time Equivalents [FTEs])

2015–16

Planned |

2015–16

Actual |

2015–16

Difference

(actual minus planned)

|

| 71.0 |

62.5 |

(8.5) |

| Note: The variance between actual and planned FTEs is mainly the result of management's efforts to stabilize and control future salary requirements through personnel departures and delays in staffing vacant positions. |

Budgetary Performance Summary

Budgetary Performance Summary for Program(s) and Internal Services (dollars)

| Program(s) and Internal Services |

2015–16 Main Estimates |

2015–16 Planned Spending |

2016–17 Planned Spending |

2017–18 Planned Spending |

2015–16 Total Authorities Available for Use |

2015–16 Actual Spending (authorities used) |

2014–15 Actual Spending (authorities used) |

2013–14 Actual Spending (authorities used) |

| Patented Medicine Prices Regulation Program |

6,834,096 |

a 6,834,096 |

6,646,758 |

6,646,758 |

7,030,734 |

b 5,399,127 |

3,543,891 |

c 6,395,602 |

| Pharmaceutical Trends Program |

1,506,994 |

1,506,994 |

1,704,508 |

1,704,508 |

1,546,129 |

1,688,584 |

1,301,871 |

1,146,790 |

| Internal Services |

2,604,091 |

2,604,091 |

2,613,842 |

2,613,842 |

2,672,343 |

2,410,650 |

3,084,518 |

2,998,175 |

| Total |

10,945,181 |

10,945,181 |

10,965,108 |

10,965,108 |

11,249,206 |

9,498,361 |

7,930,280 |

10,540,567 |

Footnotes

- a The PMPRB always bases planned spending on the assumption that it will spend the full $2.47 million held in the SPA reserved for conducting public hearings. This is done because these expenditures are dependent on the number of hearings, and the length and complexity of the hearings held, which are difficult to predict.

- b Actual spending for 2015-16 was significantly higher than actual spending in 2014-15. This variance is due in large part to expenditures from the SPA of $1,213,627 most of which related to costs associated with the Soliris Hearing.

- c Expenditures for 2013-14 were significantly higher than expenditures in 2014-15. This variance is due in large part to a Federal Court decision that quashed a Board Order and directed the PMPRB return to the patentee the sum of $2,801,275 paid to the Board as a payment of excess revenues earned, plus appropriate interest costs.

|

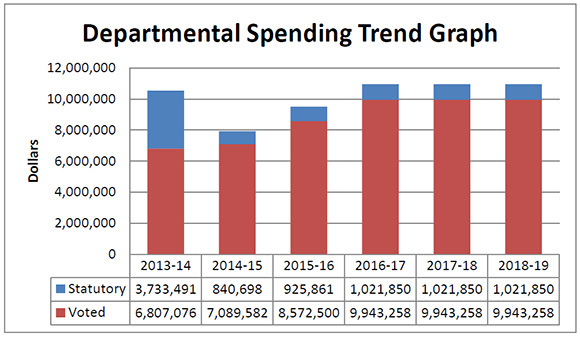

Departmental Spending Trend

Figure description

This graph shows the PMPRB's spending trend. It illustrates on a bar graph the actual statutory and voted spending for 2013-14, 2014-15 and 2015-16, and planned statutory and voted spending in 2016-17, 2017-18 and 2018-19.

Statutory spending in 2013-14 was significantly higher than statutory spending in subsequent years largely due to additional funding received through an adjustment warrant to cover the amount the PMPRB was ordered by the Federal Court to refund a patentee. The Federal Court quashed a Board Order and directed in its judgement that a payment of excess revenues in the sum of $2,801,285 be returned by the PMPRB to the patentee with appropriate interest and specified costs.

Expenditures by Vote

For information on PMPRB’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2016 x.

Alignment of Spending With the Whole-of-Government Framework

Alignment of 2015-16 Actual Spending With the Whole-of-Government Framework xi (dollars)

| Program |

Spending Area |

Government of Canada Outcome |

2015–16 Actual Spending |

| Patented Medicine Prices Regulation Program |

Social affairs |

Healthy Canadians |

5,399,127 |

| Pharmaceutical Trends Program |

Social affairs |

Healthy Canadians |

1,688,584 |

Total Spending by Spending Area (dollars)

| Spending Area |

Total Planned Spending |

Total Actual Spending |

| Economic affairs |

|

|

| Social affairs |

8,341,090 |

7,087,711 |

| International affairs |

|

|

| Government affairs |

|

|

Financial Statements and Financial Statements Highlights

Financial Statements Highlights

Condensed Statement of Operations (unaudited)

For the Year Ended March 31, 2016 (dollars)

| Financial Information |

2015–16

Planned

Results |

2015–16

Actual |

2014–15

Actual |

Difference (2015–16 actual minus 2015–16 planned) |

Difference (2015–16 actual minus 2014–15 actual) |

| Total expenses |

12,016,985 |

10,716,714 |

8,806,161 |

(1,300,271) |

1,910,553 |

| Total revenues |

- |

2,265 |

114 |

2,265 |

2,151 |

| Net cost of operations before government funding and transfers |

12,016,985 |

10,714,449 |

8,806,047 |

(1,302,536) |

1,908,402 |

The PMPRB’s total expenses were $10,716,714 in 2015-16, an increase of $1,910,553 from 2014-15, which is due mainly to the following:

- Salaries and employee benefits increased by $910,529.

- Professional and special services increased by $877,448.

- Information services increased by $181,296.

- Utilities, materials and supplies decreased by $90,099.

The PMPRB’s total revenues which are usually made up of fees for Access to information requests and proceeds from disposal of assets were $2,265 in 2015-16, representing an increase of $2,151 over the prior year actual revenues. This increase is primarily a result of exchange rate adjustments.

Condensed Statement of Financial Position (unaudited)

As at March 31, 2016 (dollars)

| Financial Information |

2015–16 |

2014–15 |

Difference

(2015–16 minus 2014–15) |

| Total net liabilities |

1,995,264 |

1,510,991 |

484,273 |

| Total net financial assets |

1,291,599 |

851,654 |

439,945 |

| Departmental net debt |

703,665 |

659,337 |

44,328 |

| Total non-financial assets |

155,071 |

165,738 |

(10,667) |

| Departmental net financial position |

(548,594) |

(493,599) |

(54,995) |

The PMPRB’s total liabilities were $1,995,264 at the end of 2015-16, an increase of $484,273 from the previous year, which is due mainly to the following:

- Accounts payable and accrued liabilities increased by $440,028.

- Vacation pay and compensatory leave decreased by $14,733.

- Employee future benefits increased by $58,978.

The PMPRB’s total assets were $1,446,670 at the end 2015-16, an increase of $429,278 from the previous year, which is due mainly to the following:

- Due from the Consolidated Revenue Fund increased by $624,935.

- Accounts receivable and advances decreased by $184,990.

- Tangible capital assets decreased by $10,667.

Section III: Analysis of Programs and Internal Services

Programs

Patented Medicine Prices Regulation Program

Description

The PMPRB is an independent quasi-judicial body that is responsible for ensuring that the prices that patentees charge for patented medicines sold in Canada are not excessive based on the price review factors in the Act. To make this determination the Board must consider each of the following factors: prices at which the medicine and other medicines in the same therapeutic class have been sold in Canada and in the seven comparator countries listed in the Regulations; changes in the Consumer Price Index (CPI); and in accordance with the Act, such other factors as may be specified in any regulations made for the purposes of the price review. Under the Act, and as per the Regulations, patentees are required to file price and sales information for each patented medicine sold in Canada, for the duration of the patent(s). Board Staff reviews the introductory and ongoing information filed by patentees, for all patented medicines sold in Canada. When it finds that the price of a patented medicine appears to be excessive, Board Staff will conduct an investigation into the price. An investigation could result in: its closure, where it is concluded that the price was non-excessive; a Voluntary Compliance Undertaking by the patentee to reduce the price and offset excess revenues obtained as a result of excessive prices through a payment and/or a price reduction of another patented drug product; or a public hearing to determine if the price is excessive, including any remedial order determined by the Board. In the event that the Board Hearing Panel finds, after a public hearing, that a price is or was excessive, it may order the patentee to reduce the price and take measures to offset any excess revenues. This program, by reviewing the prices charged by patentees for patented medicines sold in Canada, protects Canadians and the health care system from excessive prices.

$157 million in excess revenues recovered

Since 1993, when the PMPRB’s remedial powers were amended, excess revenues of over $157 million have been offset by way of payments to the Government of Canada through VCUs and Board Orders.

Program Performance Analysis and Lessons Learned

The PMPRB was created in 1987 as part of a major overhaul of Canada’s drug patent regime, which sought to balance potentially competing policy objectives. On the one hand, the government strengthened patent protection for drugs in an effort to encourage more pharmaceutical industry research and development (R&D) investment in Canada. On the other, it sought to mitigate the financial impact of that change on Canadians by creating the PMPRB. The PMPRB was described as the consumer protection pillar of Bill C-22. That description has been endorsed on multiple occasions by the courts, including by the Supreme Court of Canada in 2011. The stated purpose of the PMPRB was to ensure that patentees did not abuse their newly strengthened patent rights by charging consumers excessive prices during the statutory monopoly period.

At the time Bill C-22 was enacted, policy makers believed that patent protection and price were key drivers of pharmaceutical R&D investment. The choice was thus made to offer a comparable level of patent protection and pricing for drugs as exists in countries with a strong pharmaceutical industry presence, on the assumption that Canada would come to enjoy comparable levels of R&D. In exchange for amendments to the Act which strengthened drug patent protection, Canada’s Research-Based Pharmaceutical Companies (recently rebranded as “Innovative Medicines Canada” or “IMC”) committed to double R&D output in Canada to 10% of sales.

The impact of the policy over time has been the opposite of what was intended. Canadian patented drug prices have been steadily rising relative to prices in the seven countries to which Canada compares itself under its regulations (France, Germany, Italy, Sweden, Switzerland, the UK and the US – the “PMPRB7”) and are now third highest, behind only Germany and the US. Since 2000, Canada’s growth in patented drug expenditures as a share of GDP has increased by 184%, outpacing all the PMPRB7 countries over that period. Outside of the PMPRB7, prices in Australia, Austria, Spain, Finland, the Netherlands and New Zealand are between 14% and 34% lower than Canadian prices. Looking beyond just patented drugs to all prescription drugs, Canada spends more per capita and as a percentage of GDP than most other countries.

As prices in Canada rise, R&D investment is declining. Since 2003, IMC members have failed to meet their 10% commitment and the current ratio stands at 5% of sales. This is the lowest recorded ratio since 1988, when the PMPRB first began reporting on R&D. In contrast, the average R&D ratio of the PMPRB7 countries has held steady at above 20%.

The coupling of high Canadian patented drug prices and record low investment in R&D has many questioning the effectiveness of the PMPRB in meeting the government’s 1987 policy objectives. This viewpoint was echoed recently by the Advisory Panel on Healthcare Innovation in its July 17, 2015 report Unleashing Innovation: Excellent Healthcare for Canada, which concluded that the PMPRB needs to be “strengthened” to better “protect consumers from high patented drug prices.” These same concerns are what prompted the PMPRB to undertake a year-long strategic planning process, the results of which seek to reaffirm the organization as an effective check on the patent rights of pharmaceutical manufacturers and a valued source of market intelligence for policy makers and payers. The former of these two objectives will require adjustments to the PMPRB’s legal framework. These adjustments are consonant with and complementary to the ongoing efforts of the Federal, Provincial and Territorial Ministers of Health to “reduce pharmaceutical prices” while “enhancing the affordability, accessibility and appropriate use of prescription drugs."

As a first step in this process, the PMPRB will be undertaking public consultations to obtain submissions from stakeholders and the public regarding reform of its Compendium of Policies, Guidelines and Procedures (Guidelines). The public consultation process is an invitation for all interested parties to collectively rethink the Guidelines to ensure they remain relevant and effective in enabling the PMPRB to protect consumers from excessive prices in a dynamic and evolving pharmaceutical market.

Budgetary Financial Resources (dollars)

| 2015–16 Main Estimates |

2015–16 Planned Spending |

2015–16 Total Authorities Available for Use |

2015–16 Actual Spending (authorities used) |

2015–16 Difference (actual minus planned) |

| 6,834,096 |

6,834,096 |

7,030,734 |

5,399,127 |

(1,434,969) |

Human Resources (Full-Time Equivalents [FTEs])

| 2015–16 Planned |

2015–16 Actual |

2015–16 Difference(actual minus planned) |

| 42.0 |

31.1 |

(10.9) |

Performance Results

| Expected Results |

Performance Indicators |

Targets |

Actual Results |

| Patentees comply with the Patent Act, the Regulations and the Excessive Price Guidelines (Guidelines) |

Percentage of patented medicines that are priced, as a result of voluntary compliance, within the Guidelines or at a price which does not trigger the investigation criteria |

95% |

93% xiii |

| Percentage of compliance with Board Orders related to price and/or jurisdiction and with VCUs |

100% |

100% |

| Canadian prices for patented medicines are on average in line with prices in the seven comparator countries listed in the Regulations |

Canadian prices for new patented medicines are, on average, at or below the median of international prices |

100% |

100% |

| Canadian prices for existing patented medicines are on average at or below the median of international prices |

100% |

100% |

Pharmaceutical Trends Program

Description

The PMPRB reports annually to Parliament through the Minister of Health on its price review activities, the prices of patented medicines and price trends for all drugs, and R&D expenditures as reported by pharmaceutical patentees. In supporting this requirement, the pharmaceutical trends program provides complete and accurate information on trends in manufacturers' prices of patented medicines sold in Canada and on patentees' research and development expenditures to interested stakeholders including: industry (i.e., brand-name, biotech, generic); federal, provincial and territorial (F/P/T) governments; consumer and patient advocacy groups; third party payers; and others. This information also provides assurance to Canadians that the prices of patented medicines are not excessive. In addition, as a result of the establishment of the NPDUIS by F/P/T Ministers of Health the Federal Minister of Health requested that the PMPRB conduct analysis of price, utilization and cost trends for patented and non-patented prescription drugs so that Canada's health system has more comprehensive, accurate information on how all prescription drugs are being used and on the sources of cost increases. This function is aimed at providing F/P/T governments and other interested stakeholders with a centralized credible source of information on all prescription drug prices.

Program Performance Analysis and Lessons Learned

In 2015-16, in addition to tabling its 2014 Annual Report, the PMPRB published 7 poster presentations xiv, a slide presentation xv, its 2015-2018 Strategic Plan xvi and the following 5 analytical reports:

- Generics360 – Generic Drugs in Canada, 2014 xvii, February 2016

- Private Drug Plans in Canada - Part 1: Generic Market 2005–2013 xviii, December 2015

- New Drug Pipeline Monitor, 7th Edition xix, December 2015

- CompassRx Annual Public Drug Plan Expenditure Report, 1st Edition xx, March 31, 2016

- Analysis Brief: NPDUIS CompassRx 1st Edition xxi, March 31, 2016

Furthermore, in recent years, the PMPRB has worked closely with provincial and territorial governments through the NPDUIS, and directly with lead jurisdictions through the Council of the Federation, to provide relevant pricing and market analysis aimed at reducing the price of prescription drugs purchased by public payers.

The PMPRB has organized external information sessions for various stakeholder groups, and prepared and delivered presentations for stakeholder engagement events to raise awareness of NPDUIS initiatives and the results of studies. As well the PMPRB organized and participated in meetings of the NPDUIS Advisory Committee to identify analytical priorities for the NPDUIS Research Agenda.

The PMPRB continues to participate as a member or observer in external committees such as the Canadian Network for Environmental Scanning in Health (CNESH), the Drug Therapeutics Advisory Committee (DTAC) at Non-Insured Health Benefits (NIHB) and the Drug Policy Advisory Committee at CADTH, among others. It also continues to participate in and present at various relevant networks, conferences and symposia nationally and internationally, including the Pharmaceutical Pricing Reimbursement Information, the World Health Organization and the Vancouver Group.

The PMPRB hosted its second invitational Researchers’ Forum with academics and subject-matter experts to discuss current areas of policy-relevant research in the pharmaceutical marketplace.

Over the past year, the PMPRB has continued to intensify its activities, taking a more proactive approach to elevate its traditional and social media presence. This included press release distribution, targeted social media campaigns and direct engagement with the public and resulted in interviews with and increased coverage from domestic and international media outlets including the CBC, CPAC, The Globe and Mail, the Wall Street Journal and CBS. The PMPRB made improvements to its website and publications in terms of clarity of language and accessibility of content, and continues to respond to public enquiries and inform the public by publishing updates of Board proceedings and decisions, and research results.

The PMPRB works collaboratively with the pan-Canadian Pharmaceutical Alliance

PMPRB reporting has been referenced by the provinces and territories as contributing toward significant reductions in generic drug prices in recent years.

Budgetary Financial Resources (dollars)

| 2015–16 Main Estimates |

2015–16 Planned Spending |

2015–16 Total Authorities Available for Use |

2015–16 Actual Spending (authorities used) |

2015–16 Difference (actual minus planned) |

| 1,506,994 |

1,506,994 |

1,546,129 |

1,688,584 |

181,590 |

Human Resources (Full-Time Equivalents [FTEs])

| 2015–16 Planned |

2015–16 Actual |

2015–16 Difference (actual minus planned) |

| 10.0 |

12.8 |

2.8 |

Performance Results

| Expected Results |

Performance Indicators |

Targets |

Actual Results |

| Information on pharmaceutical trends and cost drivers is available to stakeholders |

Number of new reports/studies posted on the PMPRB website |

12 reports/studies |

15 new reports/studies as at March 31, 2016 |

| Number of presentations made by the PMPRB to an external audience |

10 information sessions |

13 information sessions as at March 31, 2016 xxii |

Internal Services

Description

Internal services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. Internal services include only those activities and resources that apply across an organization, and not those provided to a specific program. The groups of activities are Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; and Acquisition Services.

Program Performance Analysis and Lessons Learned

In December 2015, the PMPRB released its Strategic Plan for the years 2015–2018. One of the strategic objectives identified in this document is employee engagement. To that end, over the past year, the PMPRB has undertaken the following:

- The establishment of a Speaker Series whereby key opinion leaders and experts in various fields of relevance to the PMPRB’s work come and speak to staff on a regular basis to explain the latest developments in the pharmaceutical regulatory environment;

- Regular all-staff meetings where employees are provided an opportunity to present their work to their colleagues in other branches;

- Training sessions for employees on how to navigate change, value diversity, communicate in a respectful way and collaborate in problem solving;

- The establishment of a Workplace Improvement Team (WIT) to solicit the views of employees on how the organization can implement its engagement strategy. The terms of reference of the WIT include advising management on how to create a respectful, healthy and enabling workplace by embracing change, fostering effective communication, and recognizing high performance;

- The hiring of a consultant to develop and conduct an employee survey on overall workplace satisfaction and to obtain employee feedback on the degree to which managers are meeting their engagement objectives;

- The development of a new and improved Intranet site which will enable employees to share information, track developments within the organization with greater ease and foster increased socialization and collegiality.

The PMPRB also implemented its Departmental Security Plan and undertook a review of its financial reporting practices in order to simplify the process and improve the quality of financial information being provided to senior management.

Budgetary Financial Resources (dollars)

| 2015–16 Main Estimates |

2015–16 Planned Spending |

2015–16 Total Authorities Available for Use |

2015–16 Actual Spending (authorities used) |

2015–16 Difference (actual minus planned) |

| 2,604,091 |

2,604,091 |

2,672,343 |

2,410,650 |

(193,441) |

Human Resources (FTEs)

| 2015–16 Planned |

2015–16 Actual |

2015–16 Difference (actual minus planned) |

| 19.0 |

18.6 |

(0.4) |

Section IV: Supplementary Information

Supplementary Information Tables

The following supplementary information tables are available on the PMPRB’s website.

Federal Tax Expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures annually in the Report on Federal Tax Expenditures. xxv This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational Contact Information

The Patented Medicine Prices Review Board

Box L40

Standard Life Centre

333 Laurier Avenue West

Suite 1400

Ottawa, Ontario K1P 1C1

Telephone: (613) 952-7360

Toll-free no.: 1-877-861-2350

Facsimile: (613) 952-7626

TTY: (613) 957-4373

Email: pmprb@pmprb-cepmb.gc.ca

Website: www.pmprb-cepmb.gc.ca

Appendix: Definitions

appropriation (crédit): Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires): Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Departmental Performance Report (rapport ministériel sur le rendement): Reports on an appropriated organization’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Reports on Plans and Priorities. These reports are tabled in Parliament in the fall.

drug identification number (DIN) (numéro d’identification du médicament (DIN)): A registration number (drug identification number) that the Health Products and Food Branch of Health Canada assigns to each prescription and non-prescription drug product marketed under the Food and Drug Regulations. The DIN is assigned using information in the following areas: manufacturer of the product; active ingredients(s); strength of the active ingredient(s); pharmaceutical dosage form; brand/trade name; and route of administration.

drug product (produit médicamenteaux): A particular presentation of a medicine characterized by its pharmaceutical dosage form and the strength of the active ingredient(s).

full-time equivalent (équivalent temps plein): A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

generic product (produit générique): A drug product with the same active ingredient, strength and dosage form of a brand name drug product.

Government of Canada outcomes (résultats du gouvernement du Canada): A set of 16 high-level objectives defined for the government as a whole, grouped in four spending areas: economic affairs, social affairs, international affairs and government affairs.

Management, Resources and Results Structure (Structure de la gestion, des ressources et des résultats): A comprehensive framework that consists of an organization’s inventory of programs, resources, results, performance indicators and governance information. Programs and results are depicted in their hierarchical relationship to each other and to the Strategic Outcome(s) to which they contribute. The Management, Resources and Results Structure is developed from the Program Alignment Architecture.

medicine (médicament): Any substance or mixture of substances made by any means, whether produced biologically, chemically, or otherwise, that is applied or administered in vivo in humans or in animals to aid in the diagnosis, treatment, mitigation or prevention of disease, symptoms, disorders, abnormal physical states, or modifying organic functions in humans and or animals, however administered. For greater certainty, this definition includes vaccines, topical preparations, anaesthetics and diagnostic products used in vivo, regardless of delivery mechanism (e.g., transdermal, capsule form, injectable, inhaler, etc.). This definition excludes medical devices, in vitro diagnostic products and disinfectants that are not used in vivo.

non-budgetary expenditures (dépenses non budgétaires): Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

patent (brevet): An instrument issued by the Commissioner of Patents in the form of letters patent for an invention that provides its holder with a monopoly limited in time, for the claims made within the patent. A patent gives its holder and its legal representatives, the exclusive right of making, constructing and using the invention and selling it to others to be used.

patentee (breveté): As defined by subsection 79(1) of the Patent Act, “the person for the time being entitled to the benefit of the patent for that invention and includes, where any other person is entitled to exercise any rights in relation to that patent other than under a license continued by subsection 11(1) of the Patent Act Amendment Act, 1992, that other person in respect of those rights.”

performance (rendement): What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance indicator (indicateur de rendement): A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement): The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

planned spending (dépenses prévues): For Reports on Plans and Priorities (RPPs) and Departmental Performance Reports (DPRs), planned spending refers to those amounts that receive Treasury Board approval by February 1. Therefore, planned spending may include amounts incremental to planned expenditures presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their RPPs and DPRs.

plans (plan): The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

PMPRB7 (CEPMB7): The seven foreign comparator countries for which patentees must report publicly available prices of patented drug products for price review purposes: France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

priorities (priorités): Plans or projects that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s).

program (programme): A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results and that are treated as a budgetary unit.

Program Alignment Architecture (architecture d’alignement des programmes): A structured inventory of an organization’s programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

Report on Plans and Priorities (rapport sur les plans et les priorités): Provides information on the plans and expected performance of appropriated organizations over a three-year period. These reports are tabled in Parliament each spring.

results (résultats): An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

statutory expenditures (dépenses législatives): Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

Strategic Outcome (résultat stratégique): A long-term and enduring benefit to Canadians that is linked to the organization’s mandate, vision and core functions.

sunset program (programme temporarisé): A time-limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration.

target (cible): A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées): Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.

Whole-of-government framework (cadre pangouvernemental): Maps the financial contributions of federal organizations receiving appropriations by aligning their Programs to a set of 16 government-wide, high-level outcome areas, grouped under four spending areas.

Endnotes

i The Minister’s mandate priorities can be found at: http://pm.gc.ca/eng/minister-health-mandate-letter, Minister of Health Mandate Letter

ii Patent Act: http://laws-lois.justice.gc.ca/eng/acts/P-4/

iii Patented Medicines Regulations: http://laws-lois.justice.gc.ca/eng/regulations/SOR-94-688/

iv Additional information on the National Prescription Drug Utilization Information System can be found on the PMPRB website: http://www.pmprb-cepmb.gc.ca/en/npduis/about-npduis

v NPDUIS Research Agenda: http://www.pmprb-cepmb.gc.ca/en/npduis/research-agenda

vi NPDUIS Advisory Committee: http://www.pmprb-cepmb.gc.ca/en/npduis/npduis-advisory-committee

vii PMPRB Guidelines Modernization – Discussion Paper – June 2016: http://www.pmprb-cepmb.gc.ca/en/news-and-events/consultations/current-major-consultations/rethinking-the-guidelines/discussion-paper

viii Strategic Plan 2015-2018: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1197

ix Minister of Health Mandate Letter: http://pm.gc.ca/eng/minister-health-mandate-letter

x Public Accounts of Canada 2016, http://www.tpsgc-pwgsc.gc.ca/recgen/cpc-pac/index-eng.html

xi Whole-of-Government Framework, http://www.tbs-sct.gc.ca/hgw-cgf/finances/rgs-erdg/wgf-ipp-eng.asp

xii 2015-16 Departmental Financial Statements: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1280&lang=en

xiii This percentage, based on the number of price reviews completed at March 31, 2016, is calculated as follows: the sum of the number of price reviews found to be within the Guidelines, plus the number of price reviews which did not trigger an investigation, plus the number of Voluntary Compliance Undertakings; divided by the total number of patented drug products at March 31, 2016 minus the number of drug products still under review.

xiv 2016 Conference Posters: http://www.pmprb-cepmb.gc.ca/en/npduis/analytical-studies

xv Slide Presentation - Tamper-Resistant Properties of Drugs Regulations (TRPDR) – Cost Impact Analysis, 2019: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1240

xvi Strategic Plan 2015-2018: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1197

xvii Generics360 – Generic Drugs in Canada, 2014: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1233&lang=en

xviii Private Drug Plans in Canada - Part 1: Generic Market 2005 –2013: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1200&lang=en

xix New Drug Pipeline Monitor, 7th Edition – December 2015: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1199&lang=en

xx NPDUIS CompassRx, 1st Edition http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1159&lang=en

xxi Analysis Brief, NPDUIS CompassRx, 1st Edition: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1167&lang=en

xxii The PMPRB provided 13 information sessions on 8 different topics (5 presentations related to CompassRX). In two of these information sessions the PMPRB provided 4 separate sessions, at the CADTH Symposium the PMPRB provided one oral and three poster presentations and at the CAHSPR conference the PMPRB provided three oral and one poster presentations.

xxiii Departmental Sustainable Development Strategy: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1281&lang=en

xxiv Internal Audits and Evaluations: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1279&lang=en

xxv Report of Federal Tax Expenditures, http://www.fin.gc.ca/purl/taxexp-eng.asp