PMPRB Annual Public Drug Plan Expenditure Report 2012/13

ISSN 2369-0518

Executive Summary

The amount spent on prescription drugs in Canada represents a significant component of the overall health care costs. After sustained double-digit rates of growth in prescription drug expenditures a decade ago, the annual rate has gradually declined, reaching 1.2% in 2012 (CIHI 2014).

To aid in understanding the recent trends in prescription drug spending and anticipate the direction of future spending levels, the NPDUIS CompassRx report provides a comprehensive cost driver analysis of prescription drug expenditures for a number of select Canadian public drug plans. The analysis points towards the most important cost pressures, measures their impact on expenditure levels, and delves into the factors determining trends in costs, pricing and utilization in public plans. The report also monitors major developments in the Canadian environment related to drug approval, review, pricing and reimbursement. The 2012/13 NPDUIS CompassRx is the first edition of this annual publication and provides a baseline for future Public Drug Plan Expenditure reports.

Changes in prescription drug expenditures are driven by a number of opposing “push” and “pull” effects. An increase in the beneficiary population, the use of drugs, and the use of more expensive drugs puts an upward pressure on expenditures, resulting in a push effect; while generic substitutions and price reductions exert a downward pull effect. In any given year and market segment, the weight of each of these effects may vary, and as a result, the rates of change in prescription drug expenditures evolve over time and vary across public drug plans.

The analysis in this report employs a cost driver model to disaggregate and quantify the impact of each of the major drivers of change for the two main components of prescription drug expenditures: drug costs and dispensing fees. Four broad categories of effects are considered: demographic, volume, price and drug-mix effects.

The main data source for this report is the National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information (CIHI). The results are presented for a select number of public drug plans with available data: Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia and Prince Edward Island and Health Canada’s Non-Insured Health Benefits drug plan. The study focuses on the cost levels and drivers in the 2012/13 fiscal year and provides a retrospective look at trends since 2008/09.

Identifying the major drivers of change and the effect they have on prescription drug expenditures allows policy makers and researchers to understand the current trends and anticipate future cost pressures and expenditure levels.

Key findings

Overview of Expenditures for 2012/13

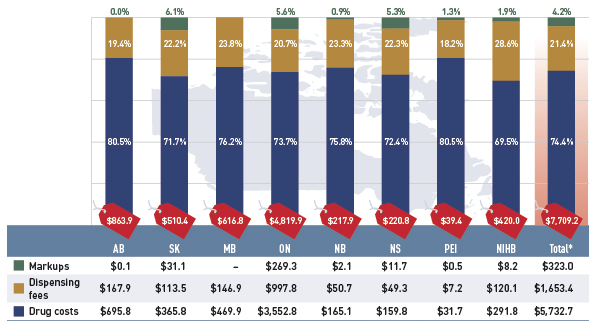

Prescription drug expenditures in the select public drug plans totaled $7.7 billion in 2012/13 and were composed of the following components: drug costs (74.4%), pharmacy dispensing fees (21.4%) and markups (4.2%).

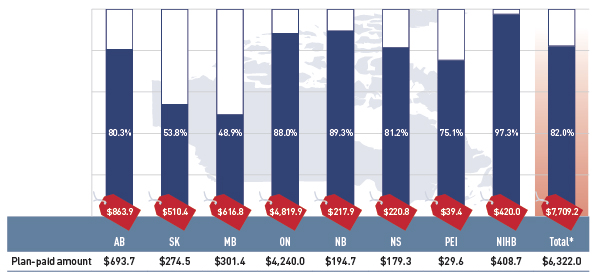

The select public drug plans paid 82.0% of the overall prescription drug expenditure level, with the remaining share being paid by the drug plan beneficiaries either out-of-pocket or through a third-party private insurer.

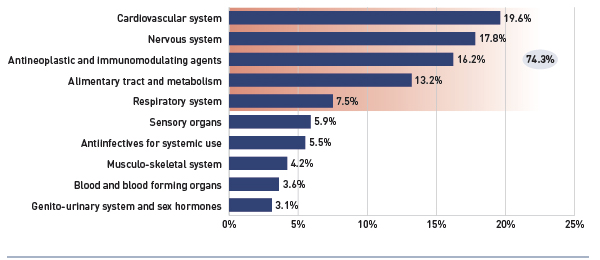

Drug Cost Component

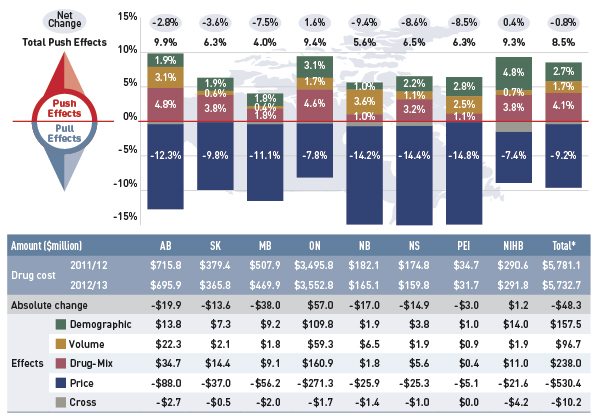

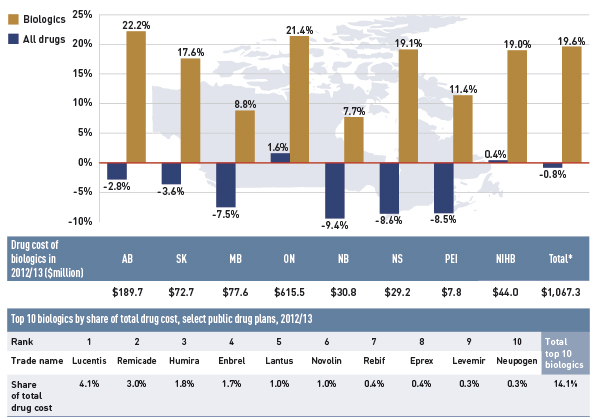

The rates of change in the drug cost component of prescription drug expenditures in public drug plans have been steadily declining in recent years, with the overall cost levels decreasing in 2012/13 by 0.8% compared to 2011/12.

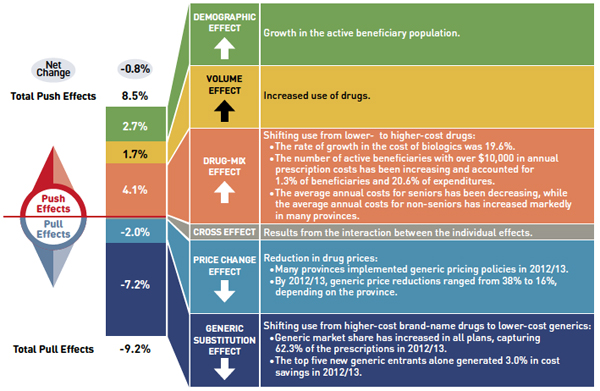

The low net rate of change was driven by opposing “push” (increasing) effects and “pull” (decreasing) effects which nearly off-set each other.

- The demographic, volume, and drug-mix effects had an important “push” effect, and in the absence of generic savings, they would have increased drug cost levels by 8.5% in 2012/13.

- The generic price change and substitution effects had an important “pull” effect, and in the absence of other cost pressures, they would have decreased drug cost levels by 9.2% in 2012/13.

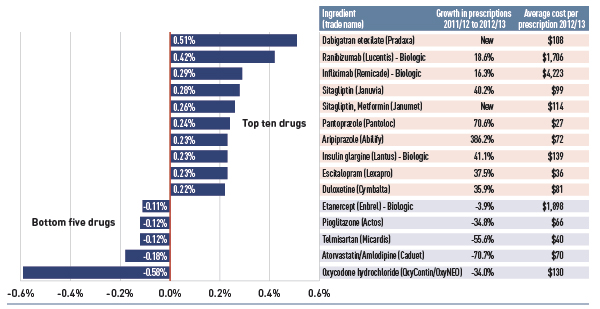

Drug cost drivers 2012/13

Note: Values may not add to totals due to rounding and the cross effect.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This diagram illustrates drug cost drivers for 2012/13, breaking them out into push (increasing) and pull (decreasing) effects. It shows the totals for the select public drug plans in Canada.

The overall net change in drug costs from 2011/12 to 2012/13 was -0.8%.

The total push effect was 8.5% and included the following key effects:

- The drug-mix effect (4.1%) due to shifting use from lower- to higher-cost drugs:

- The rate of growth in the cost of biologics was 19.6%.

- The number of active beneficiaries with over $10,000 in annual prescription costs has been increasing and accounted for 1.3% of beneficiaries and 20.6% of expenditures.

- The average annual costs for seniors have been decreasing, while the average annual costs for non-seniors have increased markedly in many provinces.

- The volume effect (1.7%) due to the increased use of drugs.

- The demographic effect (2.7%) due to the growth in the active beneficiary population.

The total pull effect was -9.2% and included the following key effects:

- The generic substitution effect (-7.2%) due to shifting use from higher-cost brand-name drugs to lower-cost generics:

- Generic market share has increased in all plans, capturing 62.3% of the prescriptions in 2012/13.

- The top five new generic entrants alone generated 3.0% in cost savings in 2012/13.

- The price change effect (-2.0%) due to a reduction in drug prices:

- Many provinces implemented generic pricing policies in 2012/13.

- By 2012/13, generic price reductions ranged from 38% to 16%, depending on the province.

A cross effect resulted from the interaction between the individual effects. No value is given for the cross effect.

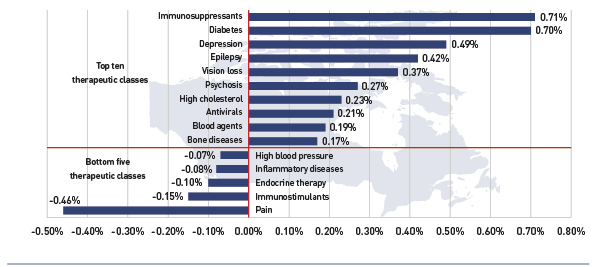

Dispensing Fee Component

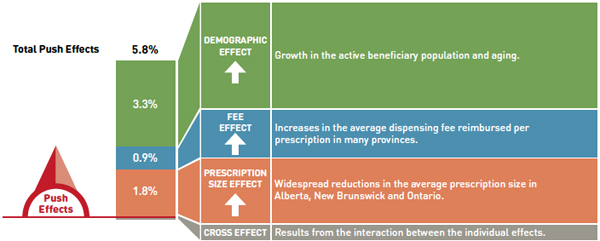

Dispensing fee expenditures have been increasing in recent years in most plans, with the overall fee levels growing in 2012/13 by 5.8% compared to 2011/12.

- The rate of change in dispensing fees was generally driven by increases in the size and age of the active beneficiary population, by a growth in the use of drugs and in dispensing fee levels, as well as a trend toward shorter prescription sizes in some provinces.

Dispensing fee drivers 2012/13

Note: Values may not add to totals due to rounding and the cross effect.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This diagram illustrates dispensing fee drivers for 2012/13. It shows the totals for the select public drug plans in Canada.

The total push (increasing) effect from 2011/12 to 2012/13 was 5.8% and included the following key effects:

- The demographic effect (3.3%) driven by the growth in the active beneficiary population and aging.

- The fee effect (0.9%) driven by increases in the average dispensing fee reimbursed per prescription in many provinces.

- The prescription size effect (1.8%) driven by widespread reductions in the average prescription size in Alberta, New Brunswick and Ontario.

A cross effect resulted from the interaction between the individual effects. No value is given for the cross effect.

Note that overall key findings mask important variations at jurisdictional level, which are detailed in the report.

Canadian Pricing and Reimbursement Environment 2012/13

- Important generic pricing policies were implemented in 2012/13:

- A number of provinces lowered the price of generic drugs to 35% (British Columbia, Alberta, Saskatchewan, New Brunswick, Nova Scotia and Prince Edward Island) and 40% of the reference brand (Newfoundland and Labrador).

- Generic drug reforms in Ontario that reduced generic prices to 25% of the brand-name price for the public plan were extended to private drug plans and out-of-pocket markets.

- The PMPRB reviewed 82 new drug products in 2012:

- One was a breakthrough drug, three demonstrated a substantial improvement and six were classified as having a moderate improvement. The remaining 72 drugs were classified as having slight or no improvement.

- The Common Drug Review provided recommendations for 33 drugs in 2012/13:

- List: 2; list in a similar manner to other drugs in its class: 2; list with criteria/condition: 11; list with clinical criteria and/or conditions: 3; do not list at the submitted price: 2; and do not list: 13.

Canadian Institute for Health Information (CIHI). 2014. National Health Expenditure Trends, 1975 to 2014. Ottawa, ON, page 137. Available from: http://www.cihi.ca/web/resource/en/nhex_2014_report_en.pdf (Accessed March 2015)

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) as part of the National Prescription Drug Utilization Information System (NPDUIS).

The PMPRB would like to acknowledge the contributions of:

- The members of the NPDUIS Advisory Committee, for their expert oversight and guidance in the preparation of this report.

- The PMPRB NPDUIS staff for their contribution to the analytical content of the report:

- Tanya Potashnik – Director, Policy and Economic Analysis

- Elena Lungu – Manager, NPDUIS

- Greg McComb – Senior Economic Analyst

- Gary Warwick – Senior Economic Analyst

- Orlando Manti – Senior Economist

- Ai Chau – SAS Analyst

- The PMPRB scientific and editing groups

Disclaimer

NPDUIS is a research initiative that operates independently of the regulatory activities of the Board of the PMPRB. The statements and opinions expressed in this NPDUIS report do not represent the position of the PMPRB with respect to any regulatory matter.

Parts of this material are based on data and information provided by the Canadian Institute for Health Information. However, the analyses, conclusions and/or statements expressed herein are not those of the Canadian Institute for Health Information.

- Executive Summary

- Introduction

- Methods

- Limitations

- 1 Canadian Pricing and Reimbursement Environment, 2012/13

- 2 Overview of Prescription Drug Expenditures and Utilization, 2012/13

- 3 Trends in Prescription Drug Expenditures, 2008/09 to 2012/13

- 4 The Drivers of Drug Costs, 2011/12 to 2012/13

- 5 The Drivers of Dispensing Fee Expenditures, 2011/12 to 2012/13

- References

- Appendix A – Public Drug Plan Design

- Appendix B – Pricing Policies for Generic Drugs in Provincial Drug Plans

- Appendix C – Markup Policies in Public Drug Plans, 2012/13

- Appendix D – Dispensing Fee Policies in Public Drug Plans, 2012/13

- Appendix E – Top 100 Patented Drugs by Drug Cost, NPDUIS Select Public Drug Plans, 2012/13

- Appendix F – Top 100 Non-Patented Single Source Drugs by Drug Cost, NPDUIS Select Public Drug Plans, 2012/13

- Appendix G –Top 100 Multi-Source Generic Drugs by Drug Cost, NPDUIS Select Public Drug Plans, 2012/13

- Appendix H –Top 100 Manufacturers by Drug Cost, NPDUIS Select Public Drug Plans, 2012/13

- Appendix I – Glossary

Introduction

The amount spent on prescription drugs in Canada represents a significant component of the overall health care costs. After sustained double-digit rates of growth in prescription drug expenditures a decade ago, the annual rate has gradually declined, reaching 1.2% in 2012.Footnote 1

To aid in understanding recent trends in prescription drug spending and anticipate the direction of future spending levels, the NPDUIS CompassRx report provides a comprehensive cost driver analysis of prescription drug expenditures for a number of select Canadian public drug plans. The report highlights the most significant cost pressures, measures their impact on expenditure levels and delves into the factors determining trends in costs, pricing and utilization in public plans. The report also monitors major developments in the drug approval, review, pricing and reimbursement environment in Canada. The 2012/13 NPDUIS CompassRx is the first edition of this annual publication and provides a baseline for future Public Drug Plan Expenditure reports.

The recent low rates of growth in prescription drug expenditures are the net result of a number of “push” and “pull” effects on costs. Factors such as an increase in the beneficiary population, the increased use of drugs, and the use of more expensive drugs, to name a few, are putting an upward pressure (“push”) on expenditures. At the same time, expenditure levels are pulled downward by factors such as generic substitution and price reductions.

The analysis in this report disaggregates and quantifies the impact of each of the principal contributing factors. Four broad categories of effects are considered: demographic effects, volume effects, price effects and drug-mix effects. Important sub-effect are also analyzed.

In any given year and market segment, the weight of the opposing “push” and “pull” effects may vary, depending on market trends, reimbursement decisions, changing treatments practices etc. These rates of change in prescription drug expenditures evolve over time and vary across public drug plans.

Identifying the major drivers of change and the effect they have on prescription drug expenditures will allow policy makers and researchers to understand the current trends and anticipate future cost pressures and expenditure levels.

This report is divided into five sections: Section 1 monitors recent pricing and reimbursement developments. Section 2 provides an overview of the prescription drug expenditure and utilization levels for 2012/13 for the select Canadian public drug plans. Section 3 reports on five-year trends (2008/09 to 2012/13) in prescription drug expenditures. Sections 4 and 5 provide a cost driver analysis of the factors that drive drug and dispensing fee expenditures, respectively.

Methods

The main data source for this report is the National Prescription Drug Utilization Information System (NPDUIS) Database, developed by the Canadian Institute for Health Information (CIHI). This database houses pan-Canadian information on public drug programs, including anonymous claims-level data collected from the plans participating in the NPDUIS initiative.

Results are presented for the following select public drug plans: Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Health Canada’s Non-Insured Health Benefits (NIHB) drug plan. Totals include data from all of the plans listed above. While British Columbia and Newfoundland and Labrador participate in the NPDUIS initiative, data for these provinces was not available at the time of the study. A detailed description of the plans available in the NPDUIS database is available in a Plan Information Document produced by CIHI.Footnote 2

The study analyzes data from 2008/09 to 2012/13, with a focus on the rates of change in prescription drug expenditures from 2011/12 to 2012/13. The drug costs, pharmacy markups and dispensing fees reported in this study are the amounts accepted toward reimbursement by the public plans. See the glossary in Appendix I for definitions of other variables in the report.

The results reported for Saskatchewan and Manitoba include the accepted prescription drug expenditures for individuals who are eligible for coverage but have not submitted an application and, therefore, do not have a defined deductible.Footnote 3 For the NIHB, claims that were coordinated with provincial public drug plans are excluded from the analysis to ensure consistency in the annual data reporting.

The results reported for New Brunswick include the number of active beneficiaries enrolled in the Medavie Blue Cross Seniors’ Prescription Drug Program and their related drug expenditures, which are offset by monthly premiums.

The analysis of the drivers of drug expenditures and dispensing fees follows the methodological approach detailed in the PMPRB report The Drivers of Prescription Drug Expenditures: A Methodological Report, 2013.Footnote 4

Analyses of the average prescription size, as well as generic pricing, are limited to oral solid formulations. This is to avoid data reporting inconsistencies that may exist in the day supply and unit reporting of non-oral formulations.

Population data is derived from the Non-Insured Health Benefits Annual Report and Statistics Canada census data for 2006 and 2011.

Limitations

The results presented in this report are intended for individual reviews of each public plan. Comparative analyses across plans are limited due to the differences among the plan designs, demographics and the disease profiles of the eligible beneficiary populations.

For example, Saskatchewan and Manitoba have universal income-based drug programs that provide broad-based coverage for the general population. Other public drug plans offer programs with differing design structures for seniors, income assistance recipients and various patient groups.

The Non-Insured Health Benefits plan provides universal coverage to First Nations and Inuit recipients across Canada. This population has specific demographic and health profiles that differ from those reimbursed by other public plans.

The NPDUIS Database includes sub-plan data specific to particular jurisdictions. This further limits the comparability of results across plans. For instance, some sub-plans that are available in most provinces are not captured in the data for Alberta, Nova Scotia and Prince Edward Island. Appendix A provides a comprehensive summary of the sub-plans available in the NPDUIS Database, along with the beneficiary eligibility criteria.

The totals for the "select public drug plans", which include all the plans analyzed in this report, are heavily weighted toward Ontario due to its size.

The prescription drug expenditure data for the select public drug plans represents only one segment of the overall pharmaceutical market, and hence, the findings in this report should not be extrapolated to the overall Canadian marketplace. The total prescription drug expenditure reported for the select public plans was $7.7 billion in the fiscal year 2012/13. By comparison, this represents 64.2% of the $12.0 billion spent on prescription drugs in the public sector and 27.3% of the $28.3 billion in total Canadian prescription drug spending in the 2012 calendar year.Footnote 1

This edition of the CompassRx monitors developments in the pricing and reimbursement environment and reports on the data up to and including the 2012/13 fiscal year. Since then important developments have taken place in the Canadian environment which are not captured in this report. The current CompassRx provides a baseline as of 2012/13. Future editions of the report will monitor developments and report on public drug plan data for subsequent fiscal years.

Note that the drug costs reported are the amounts accepted toward reimbursement by the public plans and are not reflective of any off-invoice price rebates or confidential product listing agreements.

1 Canadian Pricing and Reimbursement Environment, 2012/13

This section provides a high-level overview of provincial and federal developments that may have had an impact on public drug plan expenditure and utilization in 2012/13.

Public Drug Plans: Initiatives and Policy Updates

The information in this section was obtained from publicly available sources, including CIHI’s NPDUIS Plan Information DocumentFootnote 2 and IMS Brogan’s Provincial Reimbursement Advisor.Footnote 5

Generic and Brand-name Drug Prices

Most provinces implemented generic pricing policies in 2012/13. Six provinces (British Columbia, Alberta, Saskatchewan, New Brunswick, Nova Scotia and Prince Edward Island) lowered the prices of generic drugs to 35% of the equivalent brand-name prices, while Newfoundlanad and Labrador reduced this ratio to 40%. In April 2012, generic drug reforms implemented in the Ontario public plan were extended to private drug plans and out-of-pocket markets. These reforms reduced generic prices to a maximum of 25% of the reference brand-name prices for most drugs.

Since 2012/13, subsequent generic pricing policies have been introduced either individually by provinces or through the coordinated approach to price setting led by the Council of the Federation’s Health Care Innovation Working Group (HCIWG).Footnote 6 The impact of the policies introduced after 2012/13 is not reflected in the data presented in this report. Appendix B provides a summary of generic pricing policies implemented since 2010.

The Council of the Federation through the pan-Canadian Pharmaceutical Alliance (pCPA) conducts joint provincial/territorial negotiations for brand-name drugs to achieve a greater value for Canadian publicly funded drug programs. As a result, a total of 43 product listing agreements (PLAs) for brand-name drugs were completed by July 2013 (10 drugs) and July 2014 (33 drugs). PLA prices are not reflected in the drug costs captured by the NPDUIS Database.

Dispensing Fees

Several provinces increased their dispensing fees in 2012/13, some differentiating between rural and non-rural pharmacies. Saskatchewan increased the maximum dispensing fee from $9.85 to $10.24, while Ontario raised dispensing fees for non-rural pharmacies from $8.20 to $8.40, and set the range for rural pharmacies at $9.45 to $12.61. Nova Scotia increased dispensing fees from $10.73 to $10.90.The dispensing fee for non-interchangeable drugs and extemporaneous preparations was increased in New Brunswick on June 1, 2012, including providing an additional $2 dispensing fee to qualifying rural pharmacies.

Public drug plans may also reimburse fees for professional pharmacy services other than the dispensing of medications. However, these fees are not reflected in the data reported in this study.

Plan Design Changes

Ontario established a Narcotics Monitoring System, which was activated on April 16, 2012, and began to collect dispensing data from all Ontario pharmacies for all monitored drugs dispensed to people in Ontario.

Saskatchewan increased the maximum co-payment for both the Seniors’ and Children’s drug plans from $15 to $20.

Manitoba increased the annual deductible range from between 2.73% and 6.17% of household income to between 2.81% and 6.36%. The Pediatric Insulin Pump Program was launched on April 12, 2012. On April 19, 2012, Manitoba Health announced the Home Cancer Drug Program for Manitobans who are diagnosed with cancer. The program allows these patients to access eligible outpatient oral cancer and specific supportive drugs at no cost.

A methadone program was implemented in Prince Edward Island on November 20, 2012, to provide coverage for the cost of Metadol for clients who were registered through the provincial Methadone Maintenance Program.

Approval, Review and Assessment of Drugs and Prices in Canada

At a national level, three institutions approve drugs, review their prices or conduct health technology assessments:

- Health Canada grants the authority to market a drug in Canada once it has met the regulatory requirements for safety, efficacy and quality, and issues a Notice of Compliance (NOC).

- The Patented Medicine Prices Review Board (PMPRB) reviews the prices of patented drugs sold in Canada and ensures that they are not excessive. It also reports on pharmaceutical trends for all medicines and research and development spending by patentees.

- The Canadian Agency for Drugs and Technologies in Health (CADTH) Common Drug Review (CDR) reviews the clinical effectiveness and cost-effectiveness of drugs marketed in Canada and provides formulary listing recommendations to Canada’s publicly funded drug plans (excluding that of Quebec).

Health Canada

In 2012/13, Health Canada issued 965 Notices of Compliance (NOCs)Footnote 7 – see Table 1.1.

Table 1.1 Health Canada Notices of Compliance issued in 2012/13

| Pharmaceutical / biologic status |

Number of NOCs |

| Prescription pharmaceutical |

912 |

| Biologic |

53 |

| Total |

965

|

Table 1.1

| Brand name, generic or supplement status |

Number of NOCs |

| Brand name |

190 |

| Generic |

479 |

| Supplements to existing drugs* |

296 |

| Total |

965 |

*NOCs were issued for reasons such as a change to the drug’s name, a new indication or strength, a new manufacturing site or a new process to manufacturer a drug.

Patented Medicine Prices Review Board

In 2012, the PMPRB reviewed 82 new drug products and classified each based on its level of therapeutic improvement (see Table 1.2)

Table 1.2 Patented Medicine Prices Review Board, drugs reviewed in 2012 by level of therapeutic improvement

| Level of therapeutic improvement |

Number of drugs |

| Breakthrough |

1 |

| Substantial improvement |

3 |

| Moderate improvement |

6 |

| Slight / no improvement |

72 |

| Total |

82 |

As part of its reporting mandate, the PMPRB produces the Patented Medicines Price Index (PMPI) to monitor trends in prices of patented drug products. The PMPI measures the average year-over-year change in the ex-factory prices of patented drug products sold in Canada. In 2012, the PMPI, on average, increased slightly by 0.6%, while the Consumer Price Index (CPI), a measure of inflation, increased by 1.5%.Footnote 8

The PMPRB Annual Report compares the prices of Canadian patented drug products to the median price of a basket of seven comparator countries: France, Italy, Germany, Sweden, Switzerland, United Kingdom and the United States. Canadian prices were 7% below the median of this basket in 2012.Footnote 8

Canadian Agency for Drugs and Technologies in Health

In 2012/13, the CADTH Common Drug Review (CDR) made recommendations for 33 drugs – see Table 1.3 for the results.Footnote 9

CADTH implemented revised CDEC recommendation options on November 21, 2012 which included the creation of the “do not list at the submitted price” category and greater usage of conditions related to price in the “list with clinical criteria and/or conditions” category.

Table 1.3 Common Drug Review listing recommendations, 2012/13

| Recommendation |

Number of drugs |

| List* |

2 |

| List in a similar manner to other drugs in class |

2 |

| List with criteria/condition |

11 |

| List with clinical criteria and/or conditions* |

3 |

| Do not list at submitted price* |

2 |

| Do not list* |

13 |

| Total |

33 |

*Recommendation options retained or introduced by the revised CDEC recommendation options on November 21, 2012.

2 Overview of Prescription Drug Expenditures and Utilization, 2012/13

This section provides an overview of prescription drug expenditures and utilization for the select public drug plans in fiscal year 2012/13. The expenditures reported here include the drug costs, dispensing fees, and pharmacy markups, where applicable. Note that these expenditures include both the plan-paid and beneficiary-paid portions, such as co-payments and deductibles. They represent the amounts accepted by the public drug plans toward the deductible or for the reimbursement of their beneficiaries. The glossary in Appendix I defines these expenditure components, and Appendix A summarizes the individual plan designs. A Plan Information Document produced by the Canadian Institute for Health Information (CIHI) provides a detailed description of the plans available in the NPDUIS Database.Footnote 2

Figure 2.1 reports the prescription drug expenditures levels for 2012/13, along with the three components of expenditure: drug costs, dispensing fees and pharmacy markups.

Figure 2.1 Prescription drug expenditures in select public drug plans, 2012/13 ($million, % share)

*Total results for the select public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

A wholesale upcharge amount may be captured either in the drug cost or the markup component, depending on the reimbursement policies specific to each drug plan (see Appendix C). This limits the comparability of the relative size of these two components across plans.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes prescription drug expenditures for 2012/13 in select public drug plans in Canada, and breaks out the three components: drug cost, dispensing fees and markups.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Total prescription drug expenditures ($million) |

$863.9 |

$510.4 |

$616.8 |

$4,819.9 |

$217.9 |

$220.8 |

$39.4 |

$420.0 |

$7,709.2 |

| Markups ($million, % share) |

$0.1(0.0%) |

$31.1 (6.1%) |

- (0.0%) |

$269.3 (5.6%) |

$2.1 (0.9%) |

$11.7 (5.3%) |

$0.5 (1.3%) |

$8.2 (1.9%) |

$323.0 (4.2%) |

| Dispensing fees ($million, % share) |

$167.9 (19.4%) |

$113.5 (22.2%) |

$146.9 (23.8%) |

$997.8 (20.7%) |

$50.7 (23.3%) |

$49.3 (22.3%) |

$7.2 (18.2%) |

$120.1 (28.6%) |

$1,653.4 (21.4%) |

| Drug costs ($million, % share) |

$695.8 (80.5%) |

$365.8 (71.7%) |

$469.9 (76.2%) |

$3,552.8 (73.7%) |

$165.1 (75.8%) |

$159.8 (72.4%) |

$31.7 (80.5%) |

$291.8 (69.5%) |

$5,732.7 (74.4%) |

The total prescription expenditure for the drug plans was $7,709.2 million, nearly three quarters of which (74.4%) was represented by the drug cost component. Dispensing fees made up 21.4%, and pharmacy markups represented 4.2%.

Prescription drug expenditure levels differ widely among the plans. This is mainly due to variations in the size of the beneficiary populations, but also reflects the demographic and disease profiles of the populations, as well as differences in plan designs. The relative size of the three expenditure components also varies across the plans, reflecting policy differences in the reimbursed drug costs, pharmacy markups and dispensing fees, as well as the unit amount dispensed per prescription and the choice of drugs.

Appendices C and D summarize the policies governing markups and dispensing fees, respectively, for public drug plans in 2012/13.

A portion of the prescription drug expenditures reported in Figure 2.1 is reimbursed by the public plans, while the rest is paid by the beneficiaries either out-of-pocket or through a third-party private insurer. Figure 2.2 reports the public plan-paid share.

Figure 2.2 Plan-paid share of prescription drug expenditures for select public drug plans, 2012/13 ($million, % share)

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes the plan-paid share of prescription drug expenditures for 2012/13 in select public drug plans in Canada ($million, % share): Alberta: $693.7 (80.3%); Saskatchewan: $274.5 (53.8%); Manitoba: $301.4 (48.9%); Ontario: $4240.0 (88.0%); New Brunswick: $194.7 (89.3%); Nova Scotia: $179.3 (81.2%); Prince Edward Island: $29.6 (75.1%); Non-Insured Health Benefits: $408.7 (97.3%); Total select plans: $6322.0 (82.0%).

The graph also shows total prescription drug expenditures for select plans ($million): Alberta: $863.9; Saskatchewan: $510.4; Manitoba: $616.8; Ontario: $4,819.9; New Brunswick: $217.9; Nova Scotia: $220.8; Prince Edward Island: $39.4; Non-Insured Health Benefits: $420.0; Total select plans: $7,709.2

The results suggest that the public drug plans paid 82.0% of the overall prescription drug expenditure level for their beneficiaries, which included the drug costs, dispensing fees and pharmacy markups.

Jurisdictional variations are mainly due to differences in plan design and the specific government–patient cost-sharing structures (Appendix A). These differences limit the comparability of the jurisdictional results.

For instance, public drug plans in Saskatchewan and Manitoba provide income-based coverage for the general population, and the expenditure levels are accepted amounts for individuals who are eligible for coverage but have not submitted an application and, therefore, do not have a defined deductible.Footnote 3

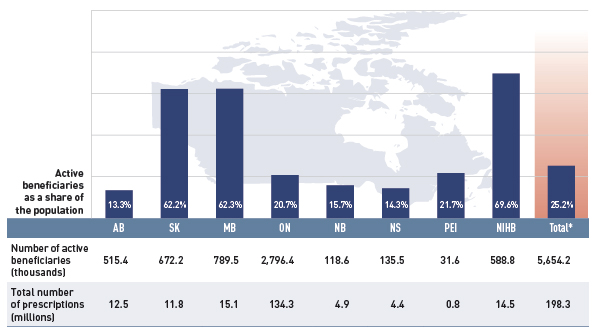

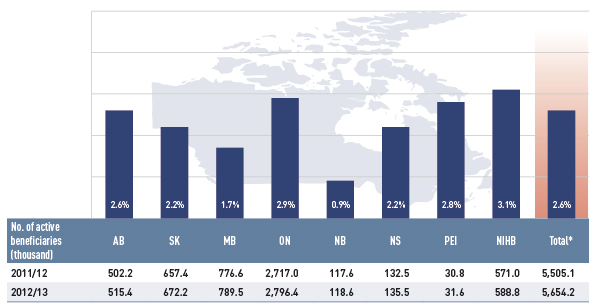

Figure 2.3 gives the number of active beneficiaries as an absolute number and as a share of the total population for each jurisdiction for 2012/13.Footnote 10, Footnote 11 It also reports the number of prescriptions that were accepted for reimbursement.

Figure 2.3 Number of active beneficiaries and associated number of prescriptions in select public drug plans, 2012/13

*Total results for the select public drug plans reported in this figure.

Data sources: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information;

Statistics Canada, CANSIM Table 051-0001; Non-Insured Health Benefits Program Annual Report, 2011/12.

Figure description

This bar graph describes the number of active beneficiaries, their share of the population, and the associated number of prescriptions for 2012/13 in select public drug plans in Canada.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Number of active beneficiaries (thousands); share of population (%) |

515.4 (13.3%) |

672.2 (62.2%) |

789.5 (62.3%) |

2,796.4 (20.7%) |

118.6 (15.7%) |

135.5 (14.3%) |

31.6 (21.7%) |

588.8 (69.6%) |

5,654.2 (25.2%) |

| Total number of prescriptions (millions) |

12.5 |

11.8 |

15.1 |

134.3 |

4.9 |

4.4 |

0.8 |

14.5 |

198.3 |

Nearly 5.7 million active beneficiaries had 198.3 million prescriptions accepted towards a deductible or paid for (in full or in part) by the public drug plans. These beneficiaries accounted for a quarter (25.2%) of the total provincial and NIHB client populations.

The variations in the active beneficiary share of the population are related to plan design, with income-based plans in Saskatchewan (62.2%) and Manitoba (62.3%) providing drug coverage for the general population. Other plans that focused their coverage on seniors, income assistance recipients and various patient groups, had a smaller representation of active beneficiaries in the population, ranging from 13.3% to 21.7%. Nevertheless, these provinces also pay a higher share of the prescription cost for their active beneficiaries (Figure 2.2).

The NIHB had the highest participation rate (69.6%), as it provided universal coverage to its clients.

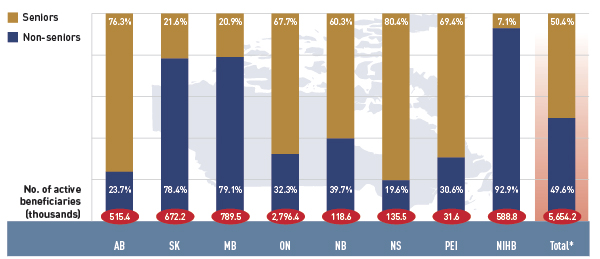

Figure 2.4 reports the shares of non-senior and senior beneficiaries in 2012/13. Overall across the plans there was an almost equal split between non-seniors and seniors, 49.6% and 50.4%, respectively.

Figure 2.4 Shares of non-senior and senior active beneficiaries in select public drug plans, 2012/13

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes the shares of senior and non-senior active beneficiaries for 2012/13 in select public drug plans in Canada.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Number of active beneficiaries (thousands) |

515.4 |

672.2 |

789.6 |

2,796.4 |

118.6 |

135.5 |

31.6 |

588.8 |

5,654.2 |

| Seniors |

76.3% |

21.6% |

20.9% |

67.7% |

60.3% |

80.4% |

69.4% |

7.1% |

50.4% |

| Non-seniors |

23.7% |

78.4% |

79.1% |

32.3% |

39.7% |

19.6% |

30.6% |

92.9% |

49.6% |

However, there were wide variations in distribution at the jurisdictional level, mainly related to plan design. As discussed, Saskatchewan and Manitoba have income-based plans, and hence, a relatively high non-senior representation (78.4% and 79.1%, respectively).

In other plans, the share of non-senior beneficiaries ranged from 19.6% to 39.7%. In the NIHB, non-seniors accounted for 92.9%, reflecting its unique demographic profile.

Alberta, Nova Scotia and Prince Edward Island do not submit data to NPDUIS for all their sub-plans, so their non-senior shares may be under-represented.

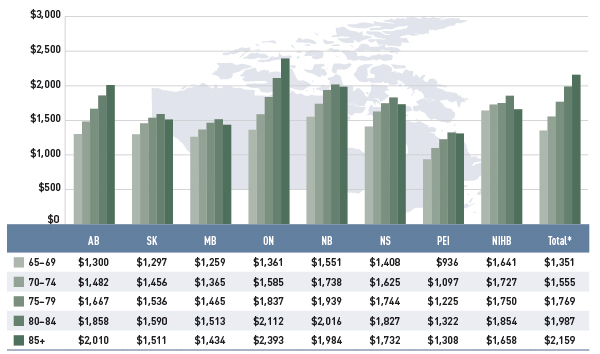

Figure 2.5 reports the annual average prescription drug cost per senior beneficiary in 2012/13, stratified by five-year age bands. Limiting the data to seniors allows for a greater comparability across plans.

Figure 2.5 Average annual prescription drug cost per senior beneficiary, by five-year age bands, select public drug plans, 2012/13

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph describes the average annual prescription drug cost per senior beneficiary by five-year age bands for 2012/13 in select public drug plans in Canada.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| 65-69 |

$1,300 |

$1,297 |

$1,259 |

$1,361 |

$1,551 |

$1,408 |

$936 |

$1,641 |

$1,351 |

| 70-74 |

$1,482 |

$1,456 |

$1,365 |

$1,585 |

$1,738 |

$1,625 |

$1,097 |

$1,727 |

$1,555 |

| 75-79 |

$1,667 |

$1,536 |

$1,465 |

$1,837 |

$1,939 |

$1,744 |

$1,225 |

$1,750 |

$1,769 |

| 80-84 |

$1,858 |

$1,590 |

$1,513 |

$2,112 |

$2,016 |

$1,827 |

$1,322 |

$1,854 |

$1,987 |

| 85+ |

$2,010 |

$1,511 |

$1,434 |

$2,393 |

$1,984 |

$1,732 |

$1,308 |

$1,658 |

$2,159 |

With a few exceptions, the results show that the annual drug cost for seniors was higher in older age groups. The average drug cost for all plans increased from $1,351 for beneficiaries between 65 and 69 years old to $2,159 for those over 85, as comorbidity and chronic conditions generally increase with age.

There is some jurisdictional variation in the annual drug costs for these age groupings. Reasons for this may include differences in plan design, the disease profile of the population, drug coverage or prescribing patterns.

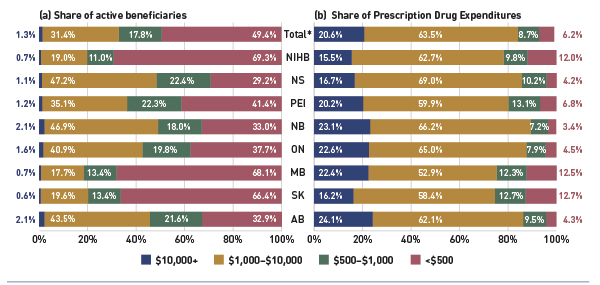

Figure 2.6 shows the distribution of active beneficiaries in the select drug plans in 2012/13 based on their annual prescription cost levels: <$500, $500–$1,000, $1,000–$10,000 and $10,000+. The share of active beneficiaries in each of these groups is presented in Figure 2.6a, with the corresponding share of prescription drug expenditures provided in Figure 2.6b.

Figure 2.6 Share of active beneficiaries and prescription drug expenditures, by annual individual prescription drug cost levels, select public drug plans, 2012/13

*Total results for the select public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure shows two complementary bar graphs side-by-side. The left graph shows the shares of active beneficiaries in 2012/13 by annual prescription drug cost levels in select public drug plans in Canada:

Table

|

$10,000+ |

$1,000–$10,000 |

$500–$1,000 |

<$500 |

| Alberta |

2.1% |

43.5% |

21.6% |

32.9% |

| Saskatchewan |

0.6% |

19.6% |

13.4% |

66.4% |

| Manitoba |

0.7% |

17.7% |

13.4% |

68.1% |

| Ontario |

1.6% |

40.9% |

19.8% |

37.7% |

| New Brunswick |

2.1% |

46.9% |

18.0% |

33.0% |

| Prince Edward Island |

1.2% |

35.1% |

22.3% |

41.4% |

| Nova Scotia |

1.1% |

47.2% |

22.4% |

29.2% |

| Non-Insured Health Benefits |

0.7% |

19.0% |

11.0% |

69.3% |

| Total select plans |

1.3% |

31.4% |

17.8% |

49.4% |

The results show that high-cost beneficiaries with $10,000 or more in annual prescription costs represented a small proportion of the active beneficiaries, ranging from 0.6% to 2.1% depending on the plan. However, they accounted for a disproportionate share of expenditures, ranging from 15.5% to 24.1% across the public drug plans. These high-cost beneficiaries are more likely to have chronic conditions, comorbiditiesFootnote 12 or require treatment with expensive therapies such as biologics.

Conversely, those with annual treatment costs under $1,000 represented the majority of active beneficiaries in most plans, ranging from 51.0% 81.5%. These beneficiaries accounted for a relatively low share of prescription drug expenditures, ranging from 10.6% to 25.4% of the total for 2012/13.

3 Trends in Prescription Drug Expenditures, 2008/09 to 2012/13

A review of the recent trends in prescription drug expenditure and its components (Figures 3.1 to 3.3) suggests that not only have the rates of change in drug costs diminished in recent years, but they actually have negative values for most of the select public drug plans in 2012/13.

The beneficiary-level analysis (Figures 3.4 and 3.5) indicates that this trend was supported by a reduction in the average costs for the senior population. However, the analysis also reveals increases in the average costs for non-seniors and a growth in the high-cost claimant population.

Due to the lack of available data, a limited number of years are reported for Ontario (2010/11 to 2012/13) and the NIHB (2011/12 to 2012/13). The prescription drug expenditures reported include the drug costs, dispensing fees and pharmacy markups, where applicable.

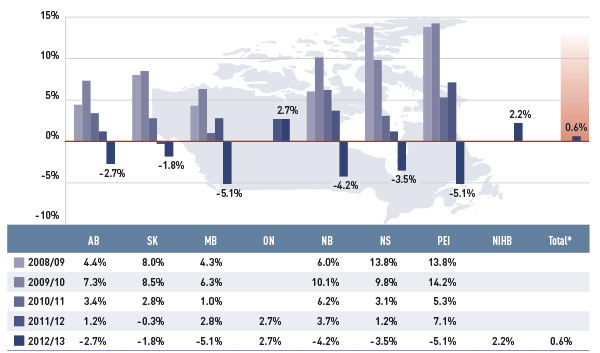

Figure 3.1 reports the annual rates of change in prescription drug expenditures from fiscal years 2008/09 to 2012/13. Growth has slowed considerably in recent years, with low positive or negative rates of change in most public plans.

Figure 3.1 Annual rates of change in prescription drug expenditures, select public drug plans, 2008/09 to 2012/13

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph shows the trend in annual rates of change in prescription drug expenditures from 2008/09 to 2012/13 for select public drug plans in Canada.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| 2008/09 |

4.4% |

8.0% |

4.3% |

– |

6.0% |

13.8% |

13.8% |

– |

– |

| 2009/10 |

7.3% |

8.5% |

6.3% |

– |

10.1% |

9.8% |

14.2% |

– |

– |

| 2010/11 |

3.4% |

2.8% |

1.0% |

– |

6.2% |

3.1% |

5.3% |

– |

– |

| 2011/12 |

1.2% |

-0.3% |

2.8% |

2.7% |

3.7% |

1.2% |

7.1% |

– |

– |

| 2012/13 |

-2.7% |

-1.8% |

-5.1% |

2.7% |

-4.2% |

-3.5% |

-5.1% |

2.2% |

0.6% |

In 2012/13, the rates of change averaged 0.6% for the select public drug plans. For most plans (except Ontario and NIHB), these rates have dipped into negative values, ranging from –5.1% in Manitoba and Prince Edward Island to –1.8% in Saskatchewan. Ontario and NIHB’s rate of growth were a modest 2.7% and 2.2%, respectively.

A number of factors drive the change in prescription drug expenditures, such as demographic, volume, price and drug-mix effects. These are discussed in detail in Sections 4 and 5, with a focus on the rates of change from 2011/12 to 2012/13.

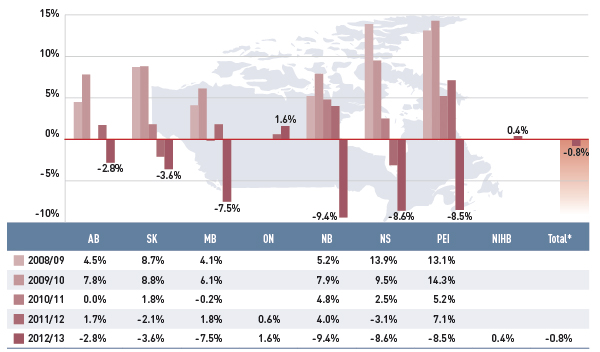

Figure 3.2 reports the annual rates of change in drug cost, which is the largest component of prescription expenditure (74.4% in 2012/13, see Figure 2.1).

Figure 3.2 Annual rates of change in drug costs, select public drug plans, 2008/09 to 2012/13

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph shows the trend in annual rates of change in drug costs from 2008/09 to 2012/13 for select public drug plans in Canada.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| 2008/09 |

4.5% |

8.7% |

4.1% |

– |

5.2% |

13.9% |

13.1% |

– |

– |

| 2009/10 |

7.8% |

8.8% |

6.1% |

– |

7.9% |

9.5% |

14.3% |

– |

– |

| 2010/11 |

0.0% |

1.8% |

0.2% |

– |

4.8% |

2.5% |

5.2% |

– |

– |

| 2011/12 |

1.7% |

-2.1% |

1.8% |

0.6% |

4.0% |

-3.1% |

7.1% |

– |

– |

| 2012/13 |

-2.8% |

-3.6% |

-7.5% |

1.6% |

-9.4% |

-8.6% |

-8.5% |

0.4% |

-0.8% |

While the overall drug cost dropped by only 0.8% in 2012/13, some plans saw significant reductions over the past years. For instance, the rate of change in Nova Scotia and Prince Edward Island dropped from 13.9% and 13.1%, respectively, in 2008/09 to –8.6% and –8.5% in 2012/13. New Brunswick had the greatest decrease in drug cost in 2012/13, with a 9.4% reduction. Drug cost also fell markedly in Manitoba (–7.5%), followed by the other two western provinces, Saskatchewan at –3.6% and Alberta at –2.8%.

Ontario and NIHB’s rate of change in drug cost in 2012/13 were a modest 1.6% and 0.4%, respectively.

While these rates of change have provided a much needed break for drug plan budgets from the higher rates of growth in prior years, the results are driven by ample opposing “push” (positive) effects and “pull” (negative) effects which nearly off-set each other. Section 4 provides a detailed analysis of the factors that drove drug costs from 2011/12 to 2012/13.

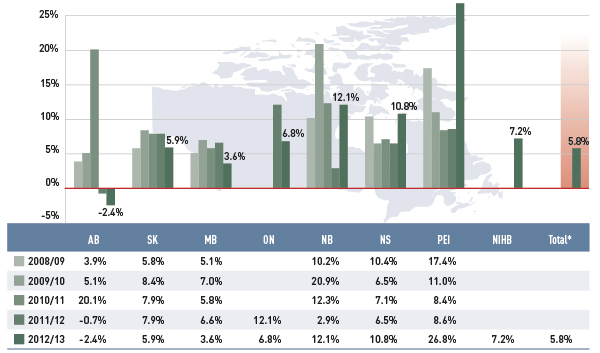

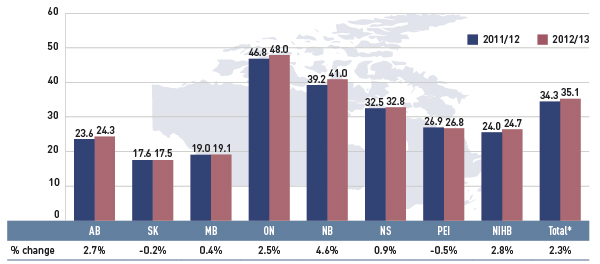

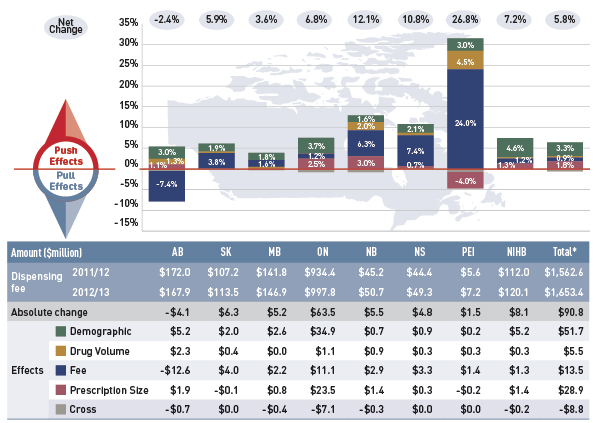

Figure 3.3 reports the annual rates of change in the dispensing fee component of the prescription cost. These rates tell a different story than that of the overall prescription cost reported in Figure 3.1.

Figure 3.3 Annual rates of change in dispensing fee expenditures, select public drug plans, 2008/09 to 2012/13

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This bar graph shows the trend in annual rates of change in dispensing fee expenditures from 2008/09 to 2012/13 for select public drug plans in Canada.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| 2008/09 |

3.9% |

5.8% |

5.1% |

– |

10.2% |

10.4% |

17.4% |

– |

– |

| 2009/10 |

5.1% |

8.4% |

7.0% |

– |

20.9% |

6.5% |

11.0% |

– |

– |

| 2010/11 |

20.1% |

7.9% |

5.8% |

– |

12.3% |

7.1% |

8.4% |

– |

– |

| 2011/12 |

-0.7% |

7.9% |

6.6% |

12.1% |

2.9% |

6.5% |

8.6% |

– |

– |

| 2012/13 |

-2.4% |

5.9% |

3.6% |

6.8% |

12.1% |

10.8% |

26.8% |

7.2% |

5.8% |

Unlike drug costs, dispensing fee expenditures grew in recent years in most public drug plans. In 2012/13, the average total rate of change was 5.8%. The rates were highest in the eastern provinces, ranging from 26.8% in Prince Edward Island to 12.1% and 10.8% in New Brunswick and Nova Scotia, respectively.

Manitoba, Saskatchewan and Ontario had more moderate rates of growth in dispensing fee expenditures, ranging from 3.6% to 6.8%. Alberta was the only province with negative rates of change during the last two fiscal years (–2.4% in 2012/13 and –0.7% in 2011/12). This followed an increase of 20.1% in 2010.

Jurisdictional variations are driven by changes in the dispensing fees or the volume of prescriptions reimbursed by each plan. The results do not reflect fees for professional pharmacy services other than the dispensing of medications.

Section 5 provides a detailed analysis of the factors that impacted dispensing fee expenditures from 2011/12 to 2012/13.

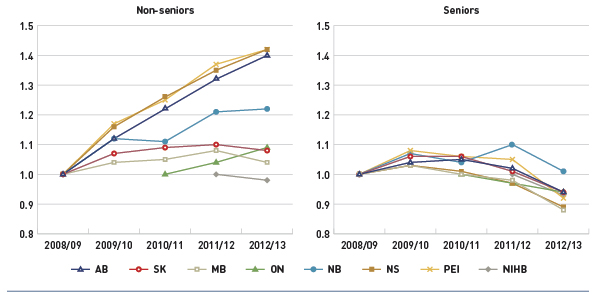

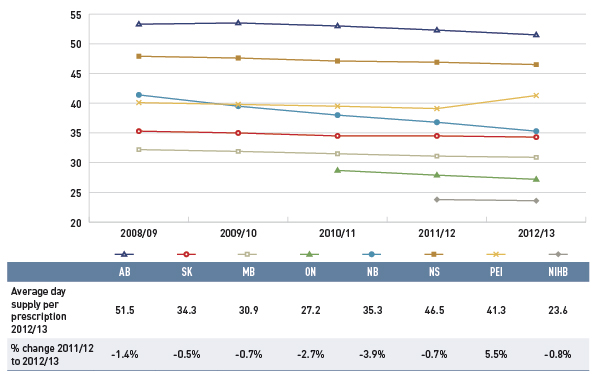

Figure 3.4 reports on trends in the average annual prescription cost per active beneficiary for non-seniors and seniors from 2008/09 to 2012/13. An index was used to equate the average annual cost in each plan and for each patient group for the base year 2008/09 to the value of 1. The values for the subsequent years were then calculated relative to the base year.

Figure 3.4 Index of the average annual prescription cost per beneficiary, non-seniors and seniors, select public drug plans, 2008/09 to 2012/13

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure shows two complementary line graphs side-by-side. Using an index, the left graph describes the change over 5 years of the annual prescription cost per beneficiary for non-seniors, in select Canadian public drug plans:

Table

|

2008/09 |

2009/10 |

2010/11 |

2011/12 |

2012/13 |

| Alberta |

1.00 |

1.12 |

1.22 |

1.32 |

1.40 |

| Saskatchewan |

1.00 |

1.07 |

1.09 |

1.10 |

1.08 |

| Manitoba |

1.00 |

1.04 |

1.05 |

1.08 |

1.04 |

| Ontario |

– |

– |

1.00 |

1.04 |

1.09 |

| New Brunswick |

1.00 |

1.12 |

1.11 |

1.21 |

1.22 |

| Nova Scotia |

1.00 |

1.16 |

1.26 |

1.35 |

1.42 |

| Prince Edward Island |

1.00 |

1.17 |

1.25 |

1.37 |

1.42 |

| Non-Insured Health Benefits |

– |

– |

– |

1.00 |

0.98 |

The right graph shows the same index for seniors:

Table

|

2008/09 |

2009/10 |

2010/11 |

2011/12 |

2012/13 |

| Alberta |

1.00 |

1.04 |

1.05 |

1.02 |

0.94 |

| Saskatchewan |

1.00 |

1.06 |

1.06 |

1.01 |

0.94 |

| Manitoba |

1.00 |

1.03 |

1.00 |

0.98 |

0.88 |

| Ontario |

– |

– |

1.00 |

0.97 |

0.94 |

| New Brunswick |

1.00 |

1.07 |

1.04 |

1.10 |

1.01 |

| Nova Scotia |

1.00 |

1.03 |

1.01 |

0.97 |

0.89 |

| Prince Edward Island |

1.00 |

1.08 |

1.06 |

1.05 |

0.92 |

| Non-Insured Health Benefits |

– |

– |

– |

1.00 |

0.95 |

Due to a lack of available data, the index for Ontario starts with 2010/11 and the NIHB starts with 2011/12.

Note that the average prescription cost level varied across plans, as reported in Figure 2.5 for the senior population.

The results indicate that the annual cost of drug treatment for senior beneficiaries has been declining, mainly due to their high utilization rates of drugs that benefited from generic launches and generic pricing policies.

In contrast, the cost to treat non-senior patients rose rapidly for several public drug plans. This may be due to the increased use of high-cost drugs, such as biologics, and the introduction of new sub-plans in several jurisdictions that expanded drug coverage to non-seniors (e.g., Nova Scotia’s Family Pharmacare Program, launched in March 2008). The plans in Saskatchewan, Manitoba and the NIHB, which provide coverage to a general population, had a decline in the average annual prescription cost for non-seniors.

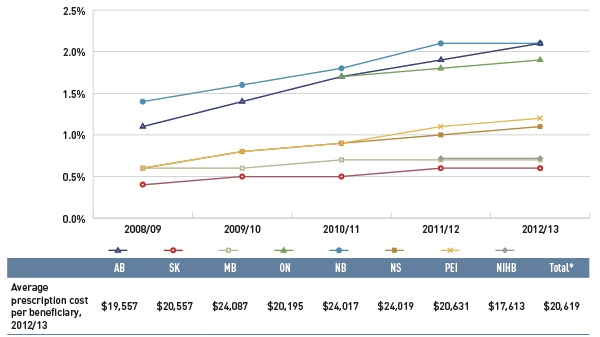

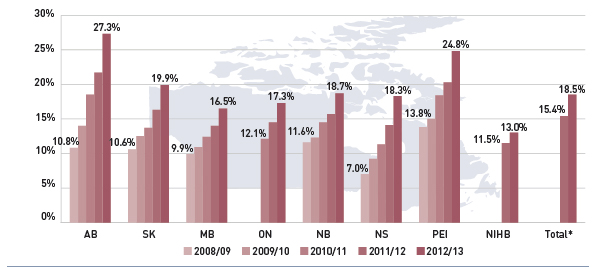

Figure 3.5 reports on trends in the share of high-cost beneficiaries, whose annual prescription drug cost exceeded $10,000. The results indicate that although the proportion of these patients was relatively small (≤2.1%, see Figure 2.6), it has been on the rise in all public drug plans from 2008/09 to 2012/13.

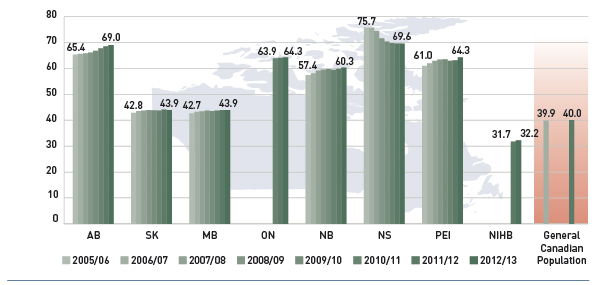

Figure 3.5 Share of patients with $10,000+ in annual prescription drug costs, select public drug plans, 2008/09 to 2012/13

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure gives the share of patients with more than $10,000 in annual prescription drug costs in Canadian public drug plans from 2008/09 to 2012/13. An associated table lists the average prescription costs per beneficiary in 2012/13 for all of the plans.

The share of patients is as follows:

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| 2008/09 |

1.1% |

0.4% |

0.6% |

– |

1.4% |

0.6% |

0.6% |

– |

– |

| 2009/10 |

1.4% |

0.5% |

0.6% |

– |

1.6% |

0.8% |

0.8% |

– |

– |

| 2010/11 |

1.7% |

0.5% |

0.7% |

1.7% |

1.8% |

0.9% |

0.9% |

– |

– |

| 2011/12 |

1.9% |

0.6% |

0.7% |

1.8% |

2.1% |

1.0% |

1.1% |

0.7% |

1.5% |

| 2012/13 |

2.1% |

0.6% |

0.7% |

1.9% |

2.1% |

1.1% |

1.2% |

0.7% |

1.6% |

The average prescription cost per beneficiary in 2012/13 was Alberta: $19,557; Saskatchewan: $20,557; Manitoba: 24,087; Ontario: $20,195; New Brunswick: $24,017; Nova Scotia: $24,019; Prince Edward Island: $20,631; Non-Insured Health Benefits: $17,613; total select plans: $20,619.

In 2012/13, the average annual prescription cost per beneficiary for this group ranged from $17,613 in the NIHB to just over $24,000 in Manitoba, New Brunswick and Nova Scotia.

4 The Drivers of Drug Costs, 2011/12 to 2012/13

Changes in drug cost are driven by a number of opposing “push” and “pull” effects. The increase in the beneficiary population, the use of drugs, and the use of more expensive drugs put an upward pressure on costs, resulting in a push effect; while generic substitutions and price reductions exerted a downward pull effect. The net effect of these opposing forces yields the overall rate of change.

In any given year and market segment, the weight of each of these effects may vary, and as a result, the rates of change in drug cost evolve over time and vary across public drug plans.

This section of the NPDUIS CompassRx report provides a comprehensive cost driver analysis that points toward the most important cost pressures, measures their impact on drug cost levels and delves into the factors determining trends in costs, pricing and utilization in public plans.

This edition of the report focuses on the rates of change in drug expenditures for the select drug plans over the fiscal years 2011/12 to 2012/13. Four broad categories of effects are analyzed along with their corresponding sub-effects:

Price Effects

- Price change effect – changes in the prices of both brand-name and generic drugs

- Generic substitution effect – shifts from brand-name to generic drugs

Demographic Effects

- Population effect – changes in the number of active beneficiaries

- Aging effect – shifts in the distribution of the population across age groups

- Gender effect – shifts in the distribution of the population by gender

Volume Effects

- Prescription volume effect – changes in the number of prescriptions dispensed to patients

- Prescription size effect – changes in the average number of units of a drug dispensed per prescription

- Strength-form effect – shifts in the use of various strengths or forms of an ingredient

Drug-Mix Effects

- Existing drug effect – shifts in the use of drugs available in both 2011/12 and 2012/13

- Entering drug effect – shifts in use of drugs that entered the market in 2012/13

- Exiting drug effect – shifts in the use of drugs that exited the market in 2012/13

Each of these effects was determined by assuming that all the other effects remained constant over the periods analyzed. The results provide an answer to the following question:

How much would public plan drug cost have changed between 2011/12 and 2012/13 if only one factor (e.g., the price of drugs) changed while all the others remained the same?

In reality, multiple factors change simultaneously, creating a residual or a cross effect, which is also reported to account for the total change.

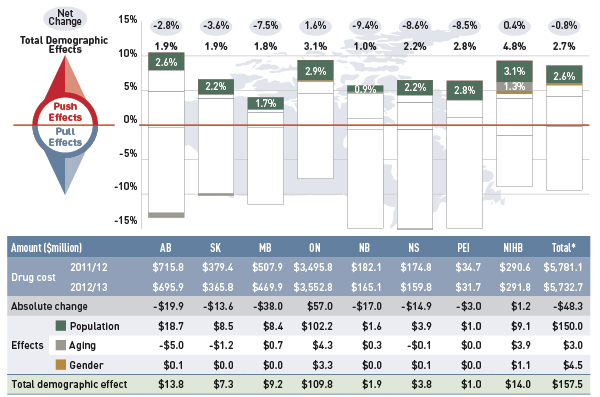

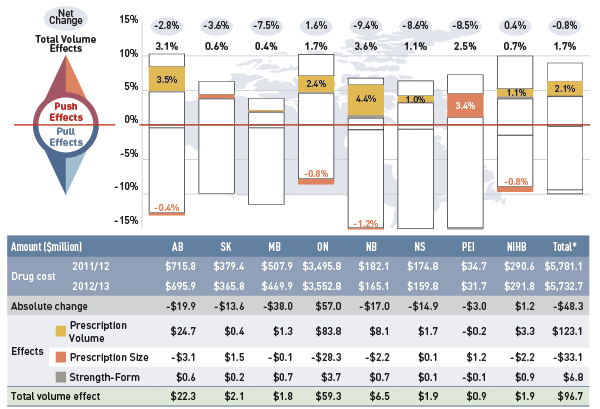

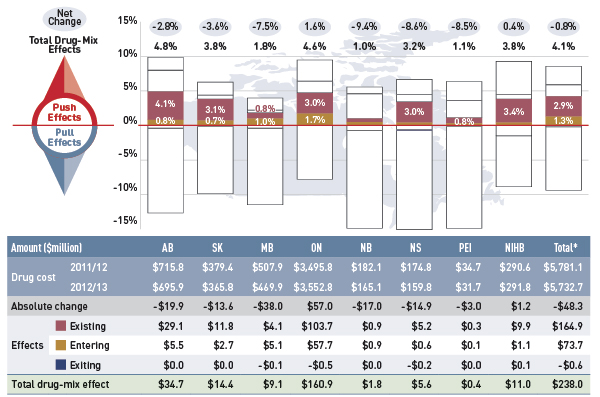

Figure 4.1 reports the rate of change in drug cost for the select public drug plans over the fiscal years 2011/12 to 2012/13 disaggregated into the four broad categories of effects. The bar graph and the associated table show the impacts of each effect as a percent and absolute change in drug cost, respectively.

Figure 4.1 Rates of change in drug cost by demographic, volume, price and drug-mix effects, select public drug plans, 2011/12 to 2012/13

*Total results for the select public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure and table describe the factors that impacted the rates of change in drug cost in select public drug plans in Canada from 2011/12 to 2012/13.

This table shows the % change for each factor:

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Net Change |

-2.8% |

-3.6% |

-7.5% |

1.6% |

-9.4% |

-8.6% |

-8.5% |

0.4% |

-0.8% |

| Total Push Effects |

9.9% |

6.3% |

4.0% |

9.4% |

5.6% |

6.5% |

6.3% |

9.3% |

8.5% |

| Demographic Effect |

1.9% |

1.9% |

1.8% |

3.1% |

1.0% |

2.2% |

2.8% |

4.8% |

2.7% |

| Volume Effect |

3.1% |

0.6% |

0.4% |

1.7% |

3.6% |

1.1% |

2.5% |

0.7% |

1.7% |

| Drug-Mix Effect |

4.8% |

3.8% |

1.8% |

4.6% |

1.0% |

3.2% |

1.1% |

3.8% |

4.1% |

| Price Effects |

-12.3% |

-9.8% |

-11.1% |

-7.8% |

-14.2% |

-14.4% |

-14.8% |

-7.4% |

-9.2% |

This table shows similar changes in the dollar amounts ($millions):

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Drug Cost 2011/12 |

$715.8 |

$379.4 |

$507.9 |

$3,495.8 |

$182.1 |

$174.8 |

$34.7 |

$290.6 |

$5,781.1 |

| Drug Cost 2012/13 |

$695.9 |

$365.8 |

$469.9 |

$3,552.8 |

$165.1 |

$159.8 |

$31.7 |

$291.8 |

$5,732.7 |

| Absolute Change |

-$19.9 |

-$13.6 |

-$38.0 |

$57.0 |

-$17.0 |

-$14.9 |

-$3.0 |

$1.2 |

-$48.3 |

| Demographic Effect |

$13.8 |

$7.3 |

$9.2 |

$109.8 |

$1.9 |

$3.8 |

$1.0 |

$14.0 |

$157.5 |

| Volume Effect |

$22.3 |

$2.1 |

$1.8 |

$59.3 |

$6.5 |

$1.9 |

$0.9 |

$1.9 |

$96.7 |

| Drug-Mix Effect |

$34.7 |

$14.4 |

$9.1 |

$160.9 |

$1.8 |

$5.6 |

$0.4 |

$11.0 |

$238.0 |

| Price Effect |

-$88.0 |

-$37.0 |

-$56.2 |

-$271.3 |

-$25.9 |

-$25.3 |

-$5.1 |

-$21.6 |

-$530.4 |

| Cross Effect |

-$2.7 |

-0.5 |

-$2.0 |

-$1.7 |

-$1.4 |

-$1.0 |

$0.0 |

-$4.2 |

-$10.2 |

The overall rate of change across all plans was –0.8% (or –$48.3 million in absolute terms). The low rates of net change in public plans were driven by ample opposing “push” (increasing) effects and “pull” (decreasing) effects which nearly off-set each other.

Price effects had the greatest “pull” on drug cost levels, with the implementation of generic price reductions and generic substitutions resulting in significant savings to the public plans. If all other factors had remained unchanged, the reduction in drug prices along with the shift from higher-cost brand-name products to lower-cost generic products would have reduced the drug costs in 2012/13 by an average of 9.2% ($530.4 million).

Conversely, demographic, volume, and drug-mix effects had a large “push” effect, increasing drug cost levels. This push effect offset most or all of the cost savings resulting from generic substitution and price reduction. Without the influence of price effects, the combined effect of increases in the active beneficiary populations, in the volume of drugs used and in the use of more expensive drugs would have raised the drug cost levels in 2012/13 by an average of 8.5% ($492.2 million).

Individually, the demographic, volume and drug-mix effects pushed the drug cost levels upwards in 2012/13 by 2.7% ($157.5 million), 1.7% ($96.7 million) and 4.1% ($238.0 million), respectively. The combined cross effect of the individual effects was -0.2% (-$10.2 million).

In the following sections, each of the broad categories of effects is examined in more detail.

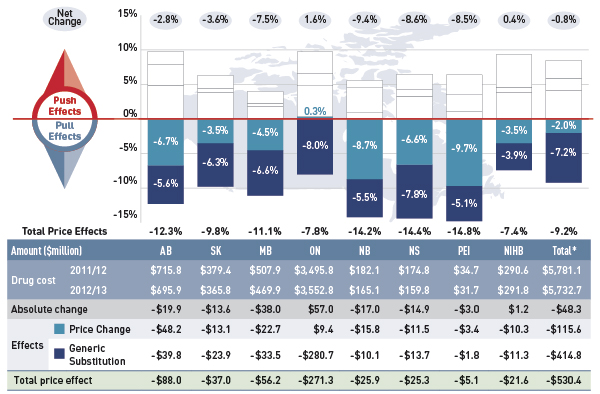

4.1 Price Effects

The general category of price effects can be further broken down to capture the precise impact of the price change and generic substitution effects. These effects had a marked pull effect on drug cost levels in 2012/13, resulting in significant cost savings to the public drug plans.

Price Change Effect

This effect captures the impact of changes in drug prices and is determined at the strength, form and brand-name or generic level. It can have either a positive (increasing) or negative (decreasing) impact on drug costs if brand prices increase or generic prices decrease, respectively. For instance, the recent generic price reforms that resulted in lower prices would translate into a negative price change effect on drug costs. In this analysis, drug prices are measured as the average unit cost accepted for reimbursement.

Generic Substitution Effect

This effect captures the impact of shifts in utilization from higher-cost brand-name products to lower-cost generic products and has a negative (decreasing) impact on drug costs.

Figure 4.1.1 reports the rate of change in drug cost from 2011/12 to 2012/13 focussing on the two price effects: price change and generic substitution. The bar graph and accompanying table show the year-over-year impacts of each effect as a relative and absolute change in drug cost.

Figure 4.1.1 Rates of change in drug costs due to price effects, select public drug plans, 2011/12 to 2012/13

*Total results for the select public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure describes the factors that impacted the rates of change in drug cost due to price effects in select public drug plans in Canada from 2011/12 to 2012/13. It is composed of a bar graph with a table underneath. The bar graph shows the percent change from 2011/12 to 2012/13 for each public drug plan. The results are as follows:

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Net change |

-2.8% |

-3.6% |

-7.5% |

1.6% |

-9.4% |

-8.6% |

-8.5% |

0.4% |

-0.8% |

| Total price effects |

-12.3% |

-9.8% |

-11.1% |

-7.8% |

-14.2% |

-14.4% |

-14.8% |

-7.4% |

-9.2% |

| Price change effect |

-6.7% |

-3.5% |

-4.5% |

0.3% |

-8.7% |

-6.6% |

-9.7% |

-3.5% |

-2.0% |

| Generic substitution effect |

-5.6% |

-6.3% |

-6.6% |

-8.0% |

-5.5% |

-7.8% |

-5.1% |

-3.9% |

-7.2% |

The table below the bar graph gives the corresponding changes in millions of dollars.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Drug cost 2011/12 |

$715.8 |

$379.4 |

$507.9 |

$3,495.8 |

$182.1 |

$174.8 |

$34.7 |

$290.6 |

$5,781.1 |

| Drug cost 2012/13 |

$695.9 |

$365.8 |

$469.9 |

$3,552.8 |

$165.1 |

$159.8 |

$31.7 |

$291.8 |

$5,732.7 |

| Absolute change |

-$19.9 |

-$13.6 |

-$38.0 |

$57.0 |

-$17.0 |

-$14.9 |

-$3.0 |

$1.2 |

-$48.3 |

| Price change effect |

-$48.2 |

-$13.1 |

-$22.7 |

$9.4 |

-$15.8 |

-$11.5 |

-$3.4 |

-$10.3 |

-$115.6 |

| Generic substitution effect |

-$39.8 |

-$23.9 |

-$33.5 |

-$280.7 |

-$10.1 |

-$13.7 |

-$1.8 |

-$11.3 |

-$414.8 |

| Total price effect |

-$88.0 |

-$37.0 |

-$56.2 |

-$271.3 |

-$25.9 |

-$25.3 |

-$5.1 |

-$21.6 |

-$530.4 |

The 2.0% decline in overall drug cost levels in 2012/13 was largely a result of generic price reforms (Appendix B). Variations in the impact of the price change effect across plans are due to differences in the timing of the generic reforms and the magnitude of price reductions, as well as the utilization rates for generic drugs.

Most plans reduced the price of generic drugs to 35% of the equivalent brand-name in 2012/13, which resulted in a pull-down effect on costs ranging from 3.5% to 9.7%.

Ontario had already implemented generic price reforms in 2010, reducing the generic price levels to 25% of the reference brand-name level. The savings generated by these earlier reductions were realized by 2011/12. With virtually constant generic price levels in 2012/13, the price change effect for Ontario was a positive 0.3%.

Generic substitution or the shift in use from brand-name drugs to less expensive generic drugs resulted in an average 7.2% reduction in drug costs across the select public plans in 2012/13. This is a result of the trend commonly referred to as the ‘patent cliff’, in which a number of top-selling brand-name drugs have reached the end of their patent life and are subject to generic competition for the first time.

The impact of this effect is more comparable across plans, as generic substitutes became available to all jurisdictions at approximately the same time. The small jurisdictional variations may be due to the specific disease profiles and demographic profiles of the eligible populations as well as the utilization rates of the newly genericized drugs.

The additional figures in this section provide supporting statistics on price indices, the generic share of prescriptions and drug costs, and generic savings for the select public plans.

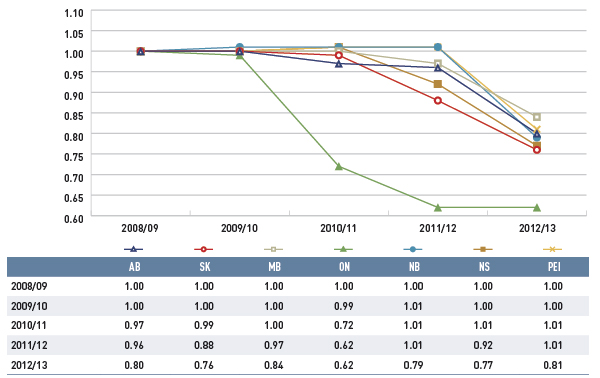

Figure 4.1.2 reports the trend in the average unit cost for generic drugs from 2008/09 to 2012/13 as an index.

Figure 4.1.2 Average unit cost index for generic drugs, select public drug plans, 2008/09 to 2012/13

Note: The average unit cost reimbursed was used to calculate the index. The analysis was limited to oral solid formulations.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information; PMPRB DIN-level database.

Figure description

This line graph describes the change over five years (from 2008/09 to 2012/13) in the average unit cost for generic drugs in select Canadian public drug plans. The results are shown as an index. There was a rapid decline in drug prices for Ontario starting in 2010/11, and a more gradual decline starting in 2012/13 for other plans.

Table

|

2008/09 |

2009/10 |

2010/11 |

2011/12 |

2012/13 |

| Alberta |

1.00 |

1.00 |

0.97 |

0.96 |

0.80 |

| Saskatchewan |

1.00 |

1.00 |

0.99 |

0.88 |

0.76 |

| Manitoba |

1.00 |

1.00 |

1.00 |

0.97 |

0.84 |

| Ontario |

1.00 |

0.99 |

0.72 |

0.62 |

0.62 |

| New Brunswick |

1.00 |

1.01 |

1.01 |

1.01 |

0.79 |

| Nova Scotia |

1.00 |

1.00 |

1.01 |

0.92 |

0.77 |

| Prince Edward Island |

1.00 |

1.00 |

1.01 |

1.01 |

0.81 |

The price change effect is for the most part the result of a reduction in the average unit cost reimbursed for generics drugs, as the prices of brand-name drugs have been relatively stable over the past five years.

The index is calculated using the cost-weighted average of the average unit cost changes at the individual drug level. This approach is similar to the one used by Statistics Canada to calculate the Consumer Price Index. This analysis was restricted to oral solid formulations to ensure unit reporting consistency.

The results show a rapid decline in generic drug prices for Ontario starting in 2010/11, and a more gradual decline in 2012/13 for the other plans. These changes reflect the timing of the introduction of the generic price reforms (see Appendix B). The average generic price reductions ranged in recent years from 38% to 16%, depending on the province.

Note that NIHB data was not available for this time frame.

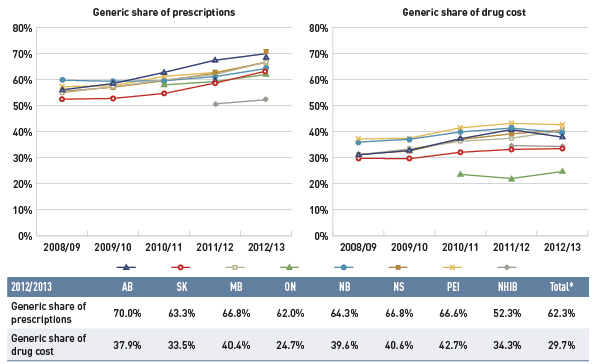

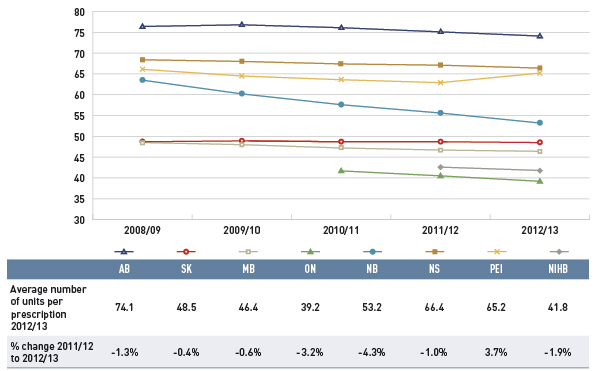

Figure 4.1.3 reports on trends in the generic share of total prescriptions and drug costs from 2008/09 to 2012/13.

Figure 4.1.3 Generic drug share of prescriptions and drug cost, select public drug plans, 2008/09 to 2012/13

*Total results for the select public drug plans reported in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure shows two complementary line graphs side-by-side.

The left graph shows the generic share of prescriptions from 2008/09 to 2012/13 for select public drug plans in Canada. The results show a marked increase for all public drug plans from around 55% in 2008/09 to 65% in 2012/13.

The right graph shows the generic share of drug costs for the same period and plans. This graph also shows an increasing trend, although less pronounced because generic price reductions occurred at the same time.

A table below the figure shows the generic shares of prescriptions and drug costs for 2012/13 (%).

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Generic share of prescriptions |

70.0% |

63.3% |

66.8% |

62.0% |

64.3% |

66.8% |

66.6% |

52.3% |

62.3% |

| Generic share of drug cost |

37.9% |

33.5% |

40.4% |

24.7% |

39.6% |

40.6% |

42.7% |

34.3% |

29.7% |

The large negative effect of generic substitution on drug costs is the result of the increased market capture of generic drugs.

The results show a marked increase in the generic share of prescriptions across the public drug plans: from 52.5%–59.8% in 2008/09, and from 62.0% (ON) to 70.0% (AB) in 2012/13. The generic share of the market in 2012/13 was lowest in the NIHB, at 52.3%.

The shift in the generic share of drug costs was less pronounced because the generic price reductions occurred at the same time in all jurisdictions.

The generic share of drug costs in 2012/13 ranged from 33.5% to 42.7% across the plans, except in Ontario where it was 24.7%. This was mainly due to the relatively low generic prices available in Ontario at that time, as well as the lower utilization rates for generics compared to the other plans.

Differences in generic market shares across Canada are driven by many factors, including, but not limited to, the disease profile of the population, prescribing practises, coverage of brand products and generic price levels.

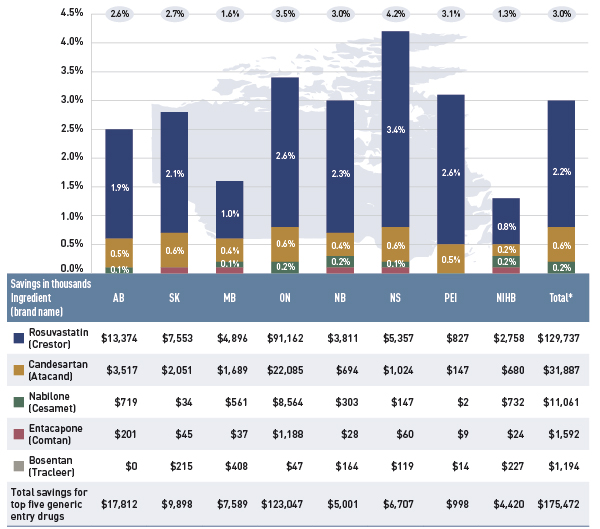

Figure 4.1.4 identifies the top five newly genericized drugs in 2012/13 and reports on their savings in the select public plans. Generic savings were calculated by subtracting the 2012/13 actual drug cost for the five generics from an estimate of the cost of the corresponding brand products, if their market exclusivity was retained. Savings are reported in absolute terms (thousands) and as a percentage of the total drug expenditure for 2012/13.

Figure 4.1.4 Savings for top five generic entry drugs 2012/13, select public drug plans (% of total drug expenditure, $thousand)

*Total results for the select public drug plans reported in this figure.

Note: Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Figure description

This figure composed of a bar graph and an associated table provides estimates of the savings from the top generic entrants in 2012/13 for select public drug plans in Canada.

The bar graph shows the percent savings for each public plan.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Rosvustatin (Crestor) |

1.9% |

2.1% |

1.0% |

2.6% |

2.3% |

3.4% |

2.6% |

0.8% |

2.2% |

| Candesartan (Atacand) |

0.5% |

0.6% |

0.4% |

0.6% |

0.4% |

0.6% |

0.5% |

0.2% |

0.6% |

| Nabilone (Cesamet) |

0.1% |

0.0% |

0.1% |

0.2% |

0.2% |

0.1% |

0.0% |

0.2% |

0.2% |

| Entacapone (Comtan) |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

| Bosentan (Tracleer) |

0.0% |

0.1% |

0.1% |

0.0% |

0.1% |

0.1% |

0.0% |

0.1% |

0.0% |

| Total savings for top five generic entry drugs |

2.6% |

2.7% |

1.6% |

3.5% |

3.0% |

4.2% |

3.1% |

1.3% |

3.0% |

The table below shows the monitory savings in thousands of dollars.

Table

|

Alberta |

Saskatchewan |

Manitoba |

Ontario |

New Brunswick |

Nova Scotia |

Prince Edward Island |

Non-Insured Health Benefits |

Total select plans |

| Rosvustatin (Crestor) |

$13,374 |

$7,553 |

$4,896 |

$91,162 |

$3,811 |

$5,357 |

$827 |

$2,758 |

$129,737 |

| Candesartan (Atacand) |

$3,517 |

$2,051 |

$1,689 |

$22,085 |

$694 |

$1,024 |

$147 |

$680 |

$31,887 |

| Nabilone (Cesamet) |

$719 |

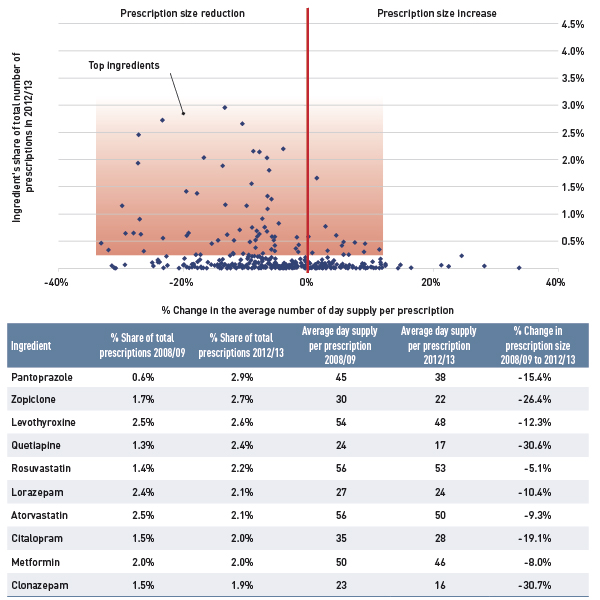

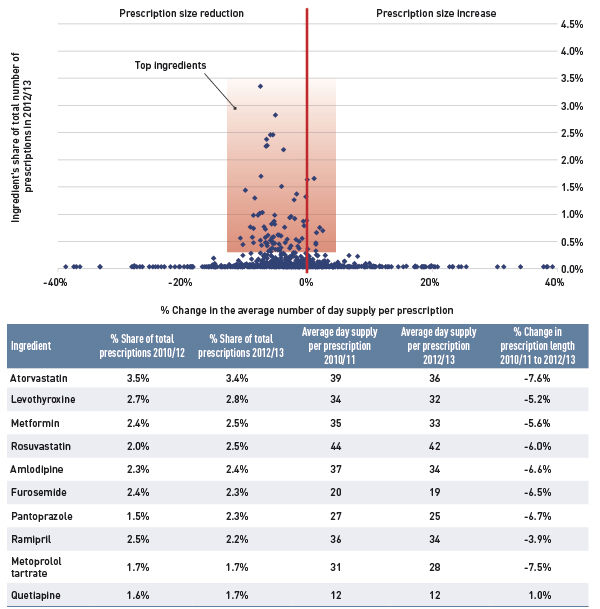

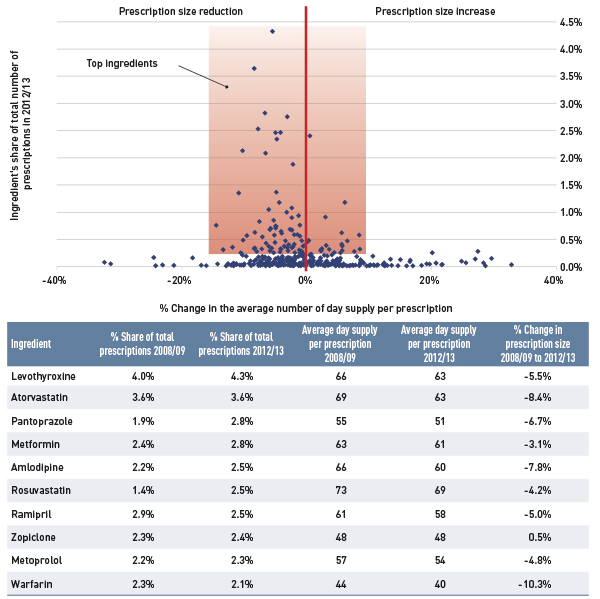

$34 |