RAPPORT ANNUEL 2008

Le mandat du Conseil d´examen du prix des médicaments brevetés est de veiller à ce que les prix auxquels les brevetés vendent leurs médicaments brevetés au Canada ne soient pas excessifs et de faire rapport des tendances des prix de vente de tous les médicaments et des dépenses de R-D des brevetés.

Table des matières

- FAITS SAILLANTS 2008

- MESSAGE DU PRÉSIDENT

- LE CONSEIL D’EXAMEN DU PRIX DES MÉDICAMENTS BREVETÉS : MANDAT ET COMPÉTENCES

- GOUVERNANCE

- EXIGENCES EN MATIÈRE DE RAPPORT

- ENGAGEMENTS DE CONFORMITÉ VOLONTAIRE

- AUDIENCES

- APPELS INTERJETÉS AUPRÈS DE LA COUR FÉDÉRALE

- MODIFICATIONS APPORTÉES AU RÈGLEMENT SUR LES MÉDICAMENTS BREVETÉS

- RÉVISION DES LIGNES DIRECTRICES DU CONSEIL SUR LES PRIX EXCESSIFS

- RAPPORT SUR LES PRINCIPALES TENDANCES, 2008

- Tendances des prix

- COMPARAISON DES PRIX AU CANADA AVEC CEUX PRATIQUÉS DANS LES PAYS DE COMPARAISON

- TENDANCES DE L’INDUSTRIE CANADIEN - NE DE FABRICATION DE MÉDICAMENTS

- ANALYSE DES DÉPENSES DE RECHERCHEDÉVELOPPEMENT

- SYSTÈME NATIONAL D’INFORMATION SUR L’UTILISATION DES MÉDICAMENTS PRESCRITS

- COMMUNICATIONS

- GLOSSAIRE

- ANNEXE 1

- ANNEXE 2

- ANNEXE 3

- ANNEXE 4

FAITS SAILLANTS 2008

MANDAT DE RÉGLEMENTATION

En 2008, nos activités de réglementation se sont faites plus pressantes.

CONFORMITÉ

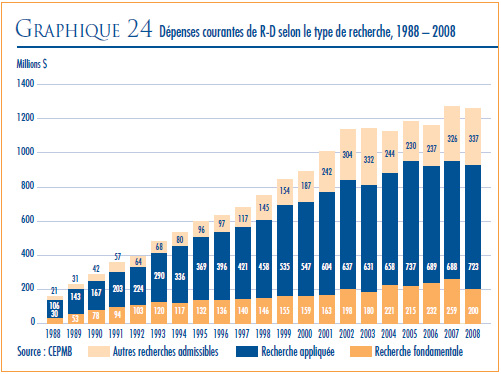

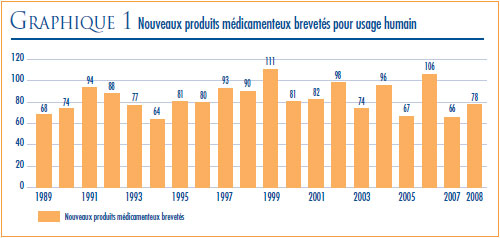

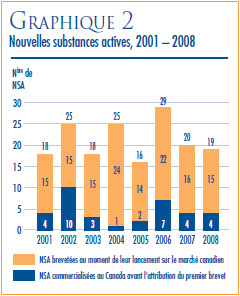

- 78 nouveaux produits médicamenteux pour usage humain ont fait l’objet d’un rapport au CEPMB. De ce nombre, 19 sont de nouvelles substances actives (commercialisées sous 26 DIN). Soixante-quatorze de ces 78 nouveaux produits médicamenteux ont été soumis à l’examen de prix. Les prix de 14 de ces produits ont été jugés plus élevés que ne l’autorisent les Lignes directrices, justifiant ainsi la tenue d’une enquête.

- Au total, 1 260 produits médicamenteux brevetés pour usage humain étaient en 2008 assujettis à la compétence du CEPMB en matière d’examen de prix.

APPLICATION

- En 2008 jusqu’en avril 2009 inclusivement, le Conseil a approuvé 9 engagements de conformité volontaire

- Le Conseil a clos 4 audiences et émis 5 nouveaux Avis d’audience (dont 1 en 2009). Dans deux autres affaires, le Conseil n’a pas encore rendu sa décision. Actuellement, 8 affaires sont en cours dont une, celle du Nicoderm, depuis 1999.

MANDAT DE RAPPORT TENDANCES DES VENTES

TENDANCES DES VENTES

- La valeur des ventes au Canada de produits médicamenteux brevetés a augmenté de 5,0 % en 2008 et totalisé 13,0 milliards de dollars.

- La part des ventes de produits médicamenteux brevetés déclarées par les brevetés par rapport aux ventes de tous les médicaments brevetés et non brevetés suit la même tendance que celle observée au cours des dernières années. En effet, cette part a diminué en 2008, passant de 66 % qu’elle était en 2007 à 64,9 %.

- Ce sont les produits du groupe antiinfectieux généraux pour usage systémique et les produits antiparasitaires et ceux du groupe agents antinéoplasiques et immunomodulateurs (médicaments utilisés en chimiothérapie) qui ont le plus contribué en 2008 à l’augmentation de la croissance de la valeur des ventes.

TENDANCES DES PRIX DES PRODUITS MÉDICAMENTEUX BREVETÉS

- Variations des prix au Canada – les prix départusine des produits médicamenteux brevetés, mesurés à l’aide de l’Indice des prix des médicaments brevetés (IPMB), ont augmenté de 0,1 % en 2008. Pour la même période, l’indice des prix à la consommation a augmenté de 2,3 %.

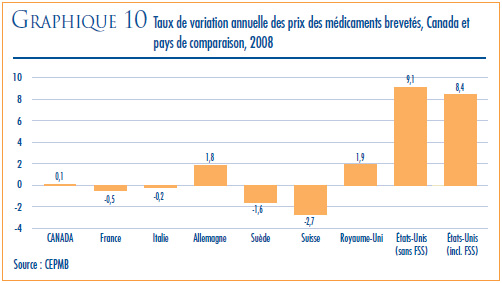

- Prix dans les pays de comparaison par rapport aux prix au Canada – les prix au Canada des produits médicamenteux brevetés se situaient en 2008 au troisième rang des prix les plus élevés des sept pays de comparaison.

- Le ratio du prix international médian (PIM) par rapport au prix au Canada est passé de 0,98 (2007) à 0,96 (2008).

RECHERCHE-DÉVELOPPEMENT

- En 2008, les brevetés ont fait rapport de dépenses de R-D de 1,3 milliard de dollars, ce qui représente une baisse de 1,1 % par rapport à 2007.

- Les brevetés membres de Rx&D sont à la source de 89,4 % des dépenses de R-D déclarées pour 2008. La valeur des dépenses de R-D déclarées par les brevetés non membres de Rx&D a totalisé 0,1 milliard de dollars.

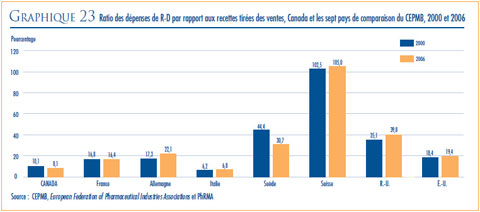

- Le ratio des dépenses de R-D par rapport aux recettes tirées des ventes pour l’ensemble des brevetés a légèrement diminué, passant de 8,3 % qu’il était en 2007 à 8,1 % en 2008, alors que celui des membres de Rx&D s’est maintenu à 8, 9 % qu’il était en 2007. Depuis 2001, ces ratio se situent sous la barre des 10 % pour l’ensemble des brevetés et depuis 2003 pour les brevetés membres de Rx&D.

Le 29 mai 2009

L’honorable Leona Aglukkaq, C.P., députée

Ministre de la Santé

Chambre des communes

Ottawa (Ontario)

K1A 0A6

Madame la ministre,

J’ai le plaisir de vous présenter, conformément aux articles 89 et 100 de la Loi sur les brevets, le Rapport annuel du Conseil d’examen du prix des médicaments brevetés pour l’exercice terminé le 31 décembre 2008. Croyant le tout conforme, je vous prie d’agréer, Madame la ministre, l’assurance de mes sentiments distingués.

Brien G. Benoit, MD

Président

MESSAGE DU PRÉSIDENT

L’année 2008 a marqué le vingtième anniversaire du début des activités du CEPMB. Tout au cours de ces vingt années, nous avons assisté à d’importants changements économiques et sociaux qui ont eu une incidence indéniable sur le régime canadien de soins de santé et sur l’environnement pharmaceutique.

L’année 2008 a également été remplie de rebondissements avec ses différentes priorités et un accroissement de la charge de travail du Conseil et des membres de son personnel. Sans pour autant négliger ses activités de réglementation et de rapport, le Conseil a mené à terme au cours de la dernière année quatre audiences et engagé quatre nouvelles affaires et même une cinquième en 2009. Dans la plupart des cas, les affaires devant le Conseil portent sur les prix ou sur des questions scientifiques touchant les médicaments de marque brevetés, quoique certaines affaires plus récentes ont porté sur la compétence du Conseil, nommément face aux médicaments provenant d’autres pays rendus disponibles sur notre marché en vertu du Programme d’accès spécial de Santé Canada et aux produits médicamenteux génériques brevetés. Les audiences devant le Conseil exigent beaucoup de temps, de ressources, d’engagement et de réflexion, mais en contrepartie elles donnent aux brevetés la possibilité de saisir le Conseil de questions essentielles pour leurs activités commerciales. Dans quelques cas, les décisions du Conseil ont fait l’objet d’une requête en révision judiciaire devant la Cour fédérale, ce qui a permis d’éclairer le Conseil et les brevetés sur l’interprétation de la loi.

Le processus consultatif du Conseil sur la révision de ses Lignes directrices a également engagé son dernier tournant au cours de l’exercice faisant l’objet du présent rapport. Mis en branle en 2005, cet examen avait pour objectif d’assurer l’équité et la transparence des examens de prix ainsi que la prévisibilité de leurs résultats. Les consultations, qui ont aussi profité de la contribution de cinq groupes de travail, ont cherché à déterminer s’il y avait lieu de réviser les Lignes directrices afin qu’elles demeurent utiles, pertinentes et efficaces dans l’environnement pharmaceutique que nous connaissons et, le cas échéant, quels changements devraient être apportés et comment ils devraient l’être. Les mémoires que nous ont fait parvenir les brevetés en suivi à notre document de discussion de janvier 2008 et les rapports des groupes de travail ont inspiré le Conseil dans la préparation de la version révisée des Lignes directrices qui a été soumise en août 2008 à la consultation des intervenants. En mars 2009, après avoir pris connaissance des commentaires exprimés par les intervenants, une nouvelle version des Lignes directrices a été finalisée et soumise à nouveau à l’examen des intervenants qui nous ont fourni des commentaires et des recommandations utiles. Le Conseil publiera en juin 2009 ses nouvelles Lignes directrices qui entreront en vigueur le 1er janvier 2010.

Le Conseil poursuit ses activités de rapport. En effet, il travaille toujours en étroite collaboration avec les provinces et les territoires au niveau des analyses effectuées au titre du Système national d’information sur l’utilisation des médicaments prescrits.

Le Conseil ne ménage aucun effort pour exercer son mandat d’une façon ouverte, efficace et efficiente dans un contexte de bonne gouvernance et de responsabilisation. À cette fin, nous nous proposons de continuer de faire appel à la participation de nos intervenants qui, comme ils l’ont démontré au cours des dernières années, a une valeur inestimable.

Enfin, permettez-moi de remercier tous les membres du personnel pour leur dévouement, leur enthousiasme et leur soutien assidu. Je profite également de l’occasion pour souligner le grand dévouement des membres du Conseil et pour les remercier pour leur bon travail.

Brien G. Benoit, MD

Président

LE CONSEIL D’EXAMEN DU PRIX DES MÉDICAMENTS BREVETÉS : MANDAT ET COMPÉTENCES

Le Conseil d’examen du prix des médicaments brevetés est un organisme indépendant qui détient des pouvoirs quasi judiciaires. Il a été créé par le Parlement en 1987 en vertu de la Loi sur les brevets (Loi). La Ministre de la Santé est responsable de l’application des dispositions pharmaceutiques de la Loi formulées aux articles 79 à 103.

Même s’il fait techniquement partie du portefeuille de la Santé, le CEPMB exerce son mandat en toute indépendance de la ministre de la Santé.1 Le CEPMB fonctionne également d’une façon indépendante des autres organismes, à savoir Santé Canada qui vérifie l’innocuité et l’efficacité des médicaments et les approuve ; les différents régimes publics fédéraux, provinciaux et territoriaux d’assurance-médicaments qui autorisent l’inscription des médicaments sur leurs formulaires de médicaments admissibles à un remboursement et qui déterminent la valeur des remboursements ; et le Programme commun d’examen des médicaments. Ce programme évalue l’efficience des médicaments avant leur inscription sur les formulaires des régimes publics d’assurance-médicaments participants.

MANDAT

Le mandat du CEPMB comporte les deux volets suivants :

RÉGLEMENTATION

Veiller à ce que le prix auxquels les brevetés vendent leurs médicaments brevetés au Canada ne soient pas excessifs.

RAPPORT

Faire rapport des tendances des prix de vente de tous les médicaments ainsi que des dépenses de R-D des brevetés.

COMPÉTENCE

RÉGLEMENTATION

Le CEPMB vérifie les prix auxquels les brevetés vendent leurs produits médicamenteux brevetés – le prix départ-usine – pour usage humain ou pour usage vétérinaire distribués sous ordonnance ou en vente libre aux grossistes, aux hôpitaux, aux pharmacies et autres clients canadiens et veille à ce que ces prix ne soient pas excessifs. Le CEPMB réglemente le prix de chaque produit médicamenteux breveté, plus précisément de chaque concentration de chaque forme posologique de chaque produit médicamenteux breveté offert sur le marché canadien. C’est généralement à ce niveau que Santé Canada attribue le numéro d’identification de drogue (DIN).

La Cour fédérale d’appel a déterminé les conditions où, légalement, un brevet est lié à un médicament. De l’avis de la Cour, il doit exister entre le brevet et le médicament « un lien si tenu soit-il », ce qui suppose une application vaste de la compétence du Conseil. La compétence du Conseil ne s’applique pas qu’aux produits médicamenteux dont le brevet porte sur son ingrédient actif, mais elle s’applique également aux médicaments auxquels un brevet est lié, que ce brevet porte sur un procédé de fabrication, un mode d’administration, une forme posologique, l’indication/utilisation, la préparation ou autre. Les produits médicamenteux brevetés ne sont pas nécessairement non plus des produits de marque. En effet, certains fabricants de produits génériques sont assujettis à la compétence du Conseil du fait qu’ils vendent en vertu d’une licence d’exploitation le même produit que le produit de marque ou, encore, qu’ils sont titulaires d’un brevet visant le procédé de conditionnement ou de traitement de produits génériques.

Le CEPMB n’est pas habilité à réglementer les prix des médicaments non brevetés. Il n’a aucun droit de regard sur les prix de vente au gros et au détail des médicaments brevetés et non brevetés ni sur les honoraires des pharmaciens. La distribution, l’ordonnance et le remboursement des médicaments ne relèvent pas non plus de sa compétence. En vertu du Règlement sur les médicaments brevetés, les brevetés doivent informer le CEPMB de leur intention de vendre un nouveau produit médicamenteux breveté sur le marché canadien. Après leur première vente, les brevetés doivent faire rapport au CEPMB du prix de vente de leur médicament et de la quantité vendue. Par la suite, pour chaque semestre, ils doivent faire rapport des prix et des ventes au Canada des différentes concentrations de leurs médicaments aux fins de la réglementation de leurs prix. Même s’ils ne sont pas tenus de faire approuver au préalable les prix de vente de leurs médicaments, les brevetés doivent respecter à la lettre les dispositions de la Loi pour que les prix de vente au Canada de leurs médicaments brevetés ne soient pas excessifs. Lorsque, à l’issue d’une audience publique, il apparaît que le prix d’un médicament vendu sur un marché canadien est excessif, le Conseil peut rendre une ordonnance qui oblige le breveté à réduire le prix de son médicament et à appliquer les mesures qui lui sont dictées pour rembourser les recettes excessives encaissées.

SANTÉ CANADA VÉRIFIE LA CONFORMITÉ DES NOUVEAUX MÉDICAMENTS À LA LOI SUR LES ALIMENTS ET DROGUES ET À SON RÈGLEMENT D’APPLICATION. L’AUTORISATION OFFICIELLE DE COMMERCIALISER OU DE DISTRIBUER UN MÉDICAMENT AU CANADA EST ACCORDÉE AU MOYEN D’UN AVIS DE CONFORMITÉ. MÊME SANS AVIS DE CONFORMITÉ, UN MÉDICAMENT PEUT ÊTRE TEMPORAIREMENT DISTRIBUÉ SUR UN MARCHÉ CANADIEN, NOMMÉMENT À TITRE DE NOUVELLE DROGUE DE RECHERCHE OU, ENCORE, AU TITRE DU PROGRAMME D’ACCÈS SPÉCIAL DE SANTÉ CANADA.

RAPPORT

Le CEPMB rend annuellement compte de ses activités au Parlement par le truchement du ministre de la Santé. Le rapport annuel, qui porte sur l’année civile terminée, présente également une analyse des tendances des prix de tous les médicaments et fait rapport des dépenses de R-D des brevetés au Canada. Par ailleurs, en vertu de l’article 90 de la Loi, le ministre de la Santé a confié deux responsabilités additionnelles au CEPMB, à savoir le Système national d’information sur l’utilisation des médicaments prescrits (SNIUMP) et les suivi et rapport des tendances des prix des médicaments non brevetés distribués sous ordonnance.

Système national d’information sur l’utilisation des médicaments prescrits (SNIUMP)

Depuis 2001, en vertu d’une entente intervenue entre les ministres fédéral, provinciaux et territoriaux de la Santé, le CEPMB effectue des recherches au titre du Système national d’information sur l’utilisation des médicaments prescrits (SNIUMP). Le SNIUMP a pour fonction de produire des analyses critiques des prix des médicaments distribués sous ordonnance, de l’utilisation faite de ces médicaments et des tendances observées au niveau de leurs coûts et d’en fournir les résultats au régime canadien de soins de santé pour améliorer sa compréhension de la façon dont les médicaments d’ordonnance sont utilisés au Canada et des facteurs d’augmentation des coûts.

Prix des médicaments non brevetés distribués sous ordonnance

En 2005, intervenant aux noms des ministres fédéral, provinciaux et territoriaux de la Santé, le ministre de Santé Canada a chargé le CEPMB d’exercer un suivi des prix des médicaments non brevetés distribués sous ordonnance et de faire rapport des tendances observées. Les ministres de la Santé souhaitaient ainsi constituer une source centralisée de données fiables sur les prix des médicaments non brevetés distribués sous ordonnance. Depuis avril 2008, les études sur les prix des médicaments non brevetés distribués sous ordonnances sont effectuées au titre du SNIUMP.

1Le portefeuille de la Santé contribue de multiples façons à améliorer l’état de santé de la population canadienne. Il est constitué de Santé Canada, de l’Agence de la santé publique du Canada, des Instituts de recerche en santé du Canada, du Conseil de contrôle des renseignements relatifs aux matières dangereuses, de l’Agence canadienne de contrôle de la procréation assistée et du Conseil d’examen du prix des médicaments brevetés.

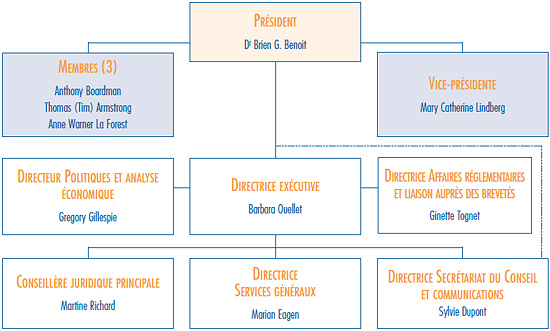

GOUVERNANCE

Le Conseil est formé d’au plus cinq membres siégeant à temps partiel, dont un président et un vice-président. Les membres du Conseil, y compris le président et le vice-président, sont nommés par le gouverneur en conseil. En vertu de la Loi sur les brevets, le président du Conseil assume également les fonctions de chef de la direction du CEPMB et, à ce titre, est chargé de la gouverne et de la supervision des activités du Conseil.

MEMBRES DU CONSEIL

PRÉSIDENT

Brien G. Benoit, BA, MD, MSc, FRCSC, FACS

Brien G. Benoit a été nommé au Conseil du CEPMB en mai 2005. En octobre 2005, il est devenu vice-président du Conseil et a exercé les responsabilités du président du Conseil jusqu’à sa nomination à la présidence du Conseil en juin 2006.

Le Dr Benoit, un neurochirurgien, est membre du Corps des médecins titulaires actifs de l’Hôpital d’Ottawa ainsi que professeur de neurochirurgie à l’Université d’Ottawa. À ce titre, il participe sur une base régulière à la formation des médecins faisant leur résidence en neurochirurgie. Le Dr Benoit a occupé au cours de sa carrière différents postes administratifs, dont chef du département de neurochirurgie à l’Hôpital Civic d’Ottawa/Hôpital d’Ottawa (1980 à 2003), chef du département de neurochirurgie de l’Hôpital Civic d’Ottawa (2002 et 2003), médecin-patron du département de neurochirurgie de l’Université d’Ottawa (1995 à 2003), titulaire de la chaire en neurochirurgie à l’Université d’Ottawa (1997 à 2003) et chirurgien-chef adjoint au campus Civic de l’Hôpital d’Ottawa (2002 à 2004). Le Dr Benoit a publié de nombreux articles dans des revues spécialisées et a participé à plusieurs essais cliniques multicentriques. Il a reçu en 1991 un premier prix d’excellence en enseignement chirurgical du département de chirurgie de l’Université d’Ottawa et un deuxième en 2000.

En plus d’être Fellow du Collège royal des chirurgiens du Canada (neurochirurgie), le Dr Benoit est membre de plusieurs associations professionnelles, dont l’Association médicale canadienne, l’Association médicale de l’Ontario, le American College of Surgeons, la Société canadienne de neurochirurgie et le Congress of Neurological Surgeons.

VICE-PRÉSIDENTE

Mary Catherine Lindberg, BSP

Mary Catherine Lindberg a été nommée membre et vice-présidente du Conseil d’examen du prix des médicaments brevetés en juin 2006. Mme Lindberg occupe actuellement le poste de directrice exécutive du Ontario Council of Academic Hospitals, un regroupement de 25 hôpitaux universitaires affiliés à une université et à sa faculté de médecine. Avant d’occuper ce poste, Mme Lindberg était sous-ministre adjointe des Services de santé, au Ministère de la Santé et des soins de longue durée de l’Ontario. Elle s’occupait entre autres du Régime d’assurancemaladie de l’Ontario et des Programmes de médicaments.

MEMBERS

Thomas (Tim) Armstrong, BA, LLB, QC, O. Ont.

Tim Armstrong a été nommé membre du Conseil en octobre 2002 et a été reconduit dans ses fonctions en 2007.

M. Armstrong a pratiqué le droit de 1958 à 1974. Il a commencé sa carrière à la division du contentieux des affaires civiles au ministère fédéral de la Justice pour passer ensuite au secteur privé au sein du cabinet Jolliffe, Lewis & Osler et, plus tard, dans le cabinet Armstrong & MacLean spécialisé en droit administratif où il était associé principal. Pendant toutes ces années, il a été appelé à plaider devant différents tribunaux administratifs, différentes cours de la province de l’Ontario, la Cour fédérale et la Cour suprême du Canada.

C’est en 1974 qu’il a choisi de relever de nouveaux défis, cette fois dans la fonction publique de l’Ontario à titre de président du Conseil des relations de travail de l’Ontario (1974-1976), de sousministre du Travail (1976-1986), d’agent général de l’Ontario à Tokyo (1986-1990) et de sousministre de l’Industrie, du commerce et de la technologie (1991-1992). De 1992 à 1995, M. Armstrong a occupé le poste de conseiller du premier ministre de l’Ontario en matière de développement économique. De 1995 à 2002, il a travaillé comme avocat-conseil au sein du cabinet d’avocats McCarthy Tétrault. Au cours des années 1990, M. Armstrong a siégé au conseil d’administration d’Algoma Steel, de deHavilland Aircraft et de Interlink Freight.

Depuis 1996, M. Armstrong est le représentant principal du Canada à la Japan Bank for International Cooperation. Il est également médiateur-arbitre en relations de travail. En 1998 et 1999, M. Armstrong a occupé le poste de facilitateurmédiateur à la Commission de restructuration des services de santé de l’Ontario. En 2002- 2003, il a servi comme médiateur-arbitre pour le gouvernement de l’Ontario en vertu de la City of Toronto Labour Disputes Resolution Act, 2002.

M. Armstrong est actuellement président de l’Institut de radioprotection du Canada. Son récent rapport sur les métiers et l’apprentissage a servi à l’élaboration de la Loi sur la qualification professionnelle et l’apprentissage des gens de métier, 2009, de l’Ontario.

M. Armstrong a été reçu membre de l’Ordre de l’Ontario en 1995 en reconnaissance de sa contribution insigne à la fonction publique de l’Ontario.

Anthony Boardman, BA, PhD

Anthony Boardman siège à notre Conseil depuis janvier 1999. Son mandat a été renouvelé en mars 2005.

M. Boardman est professeur Van Dusen d’administration des affaires au Sauder School of Business de l’Université de la Colombie-Britannique, plus particulièrement au sein de la Division de l’économie des entreprises. Il est diplômé de l’Université Kent de Canterbury (BA, 1970) ainsi que de l’Université Carnegie-Mellon (PhD, 1975). Avant de devenir professeur à l’Université de la Colombie- Britannique, M. Boardman a enseigné à la Wharton School de l’Université de la Pennsylvanie.M. Boardman mène actuellement des recherches sur les partenariats public-privé, sur les analyses coûts-avantages et sur la gestion stratégique.

Il a enseigné la gestion dans différents pays, dont la Finlande, la Chine, l’Australie, et a reçu au cours de sa carrière différents prix soulignant l’excellence de ses activités en enseignement dont le prix Alan Blizzard. Il a travaillé comme expert-conseil pour différents organismes privés et publics, dont Vodafone, Stora Enzo, PricewaterhouseCoopers, le ministère du Trésor de la Nouvelle-Zélande ainsi que pour différents gouvernements du Canada. Entre 1995 et 2001, M. Boardman a siégé au Comité scientifique sur l’initiative de pharmaco - économie de la Colombie-Britannique. Il a été président de la direction de Strategy and Business Economics de l’Université de la Colombie-Britannique au cours de deux mandats. Il siège actuellement sur les conseils éditoriaux du Journal of Comparative Policy Analysis and Strategic Outsourcing: An International Journal.

Au cours de sa carrière, M. Boardman a signé de nombreux articles savants. Il travaille actuellement sur la quatrième édition de son livre Cost-Benefit Analysis: Concepts and Practice.

Anne Warner La Forest, LLB (UNB), LLM (Cantab)

Anne Warner La Forest siège au Conseil depuis mars 2007.

Mme La Forest est professeure de droit à l’Université du Nouveau-Brunswick. De plus, elle siège depuis 2004 à la Commission des valeurs mobilières du Nouveau-Brunswick où elle préside le Comité sur les ressources humaines jusqu’en juin 2008. Elle a été nommée membre principal de la Commission en juillet 2008.

En 1991, après avoir pratiqué le droit pendant plusieurs années dans le cabinet Fraser & Beatty de Toronto, Mme La Forest a joint la faculté de droit de l’Université Dalhousie. De 1996 à 2004, elle a occupé le poste de doyenne de la faculté de droit à l’Université du Nouveau-Brunswick. Membre des barreaux du Nouveau-Brunswick, de la NouvelleÉcosse et de l’Ontario, Mme La Forest a une très vaste expérience en arbitrage et a agi à titre de consultante dans des affaires relatives au droit de la personne, à l’emploi, à la propriété et à l’extradition. Elle a été membre du Tribunal des droits de la personne de la Nouvelle-Écosse ainsi que membre du Conseil de recherche en sciences sociales et en sciences humaines et présidente du Comité d’attribution des bourses de recherche. Mme La Forest a aussi oeuvré comme arbitre dans la province de la Nouvelle-Écosse ainsi que comme Commissaire à la Commission des droits de la personne de la Nouvelle-Écosse. Elle est Fellow de la Cambridge Commonwealth Society et membre du Conseil des gouverneurs de l’Institut national de la magistrature.

Mme La Forest détient un baccalauréat spécialisé en droit international de l’Université de Cambridge, au Royaume-Uni.

Au cours de sa carrière, Mme La Forest a publié des articles, des livres ainsi que des arrêts remarqués. Elle a aussi participé à de nombreuses conférences de droit nationales et internationales, parfois à titre de présidente et d’autres fois à titre de panéliste.

HAUTE DIRECTION DU CEPMB

DIRECTRICE EXÉCUTIVE

La directrice exécutive est responsable de la gouverne générale des activités du CEPMB et des membres de son personnel.

AFFAIRES RÉGLEMENTAIRES ET LIAISON AUPRÈS DES BREVETÉS

La direction Affaires réglementaires et liaison auprès des brevetés fait l’examen des prix des médicaments brevetés vendus au Canada pour s’assurer qu’ils ne sont pas excessifs, encourage les brevetés à se conformer volontairement aux Lignes directrices du Conseil sur les prix excessifs, veille à la bonne application des politiques de conformité et d’application et fait enquête sur les plaintes reçues concernant les prix de certains médicaments brevetés. La Direction facilite également les interactions du CEPMB avec les brevetés.

POLITIQUES ET ANALYSE ÉCONOMIQUE

La direction Politiques et analyse économique formule au besoin des conseils stratégiques concernant les changements qui pourraient être apportés aux Lignes directrices sur les prix excessifs et à d’autres politiques du Conseil. Elle effectue des recherches et des analyses des tendances des prix des médicaments et prépare des rapports sur celles-ci. Enfin, elle effectue les études que lui commande le ministre de la Santé ainsi que des études à l’appui des activités de conformité et d’application.

SERVICES GÉNÉRAUX

La direction des Services généraux offre conseils et services en matière de gestion des ressources humaines, des installations, de la santé et sécurité au travail, de la technologie et de la gestion de l’information. Elle s’occupe également de la planification stratégique et de la planification financière, des vérifications, de l’évaluation et de la liaison auprès des agences centrales fédérales compétentes.

SECRÉTARIAT DU CONSEIL ET COMMUNICATIONS

Le Secrétariat du Conseil planifie et orchestre les communications du CEPMB, les relations avec les médias et le suivi aux demandes de renseignements du grand public. Il gère le processus d’audience du Conseil, dont les dossiers d’instance. Il coordonne les activités du Conseil relatives à l’application de la Loi sur l’accès à l’information et de la Loi sur la protection de la vie privée.

CONSEILLÈRE JURIDIQUE PRINCIPALE

La Conseillère juridique principale fournit des opinions juridiques au CEPMB et dirige l’équipe de la poursuite dans les audiences du Conseil.

CONSEIL D’EXAMEN DU PRIX DES MÉDICAMENTS BREVETÉS

BUDGET

Pour l’exercice 2008-2009, le Conseil a disposé d’un budget de 11,1 millions de dollars et d’un effectif approuvé de 71 équivalents temps plein. Ce budget comprend également une enveloppe pour le Système national d’information sur l’utilisation des médicaments prescrits (SNIUMP).

EN 2007-2008, LA VALEUR DES RECETTES EXCESSIVES REMBOURSÉES PAR LES BREVETÉS SOUS FORME DE PAIEMENTS AU GOUVERNEMENT DU CANADA OU DE REMISES AUX HÔPITAUX/ CLINIQUES A TOTALISÉ 10,5 MILLIONS DE DOLLARS. EN 2008-2009, CES REMBOURSEMENTS ET REMISES ONT TOTALISÉ 27,2 MILLIONS DE DOLLARS. VOUS TROUVEREZ DANS L’ANNEXE 3 LE SOMMAIRE DES ENGAGEMENTS DE CONFORMITÉ VOLONTAIRE ET DES ORDONNANCES DU CONSEIL.

TABLEAU 1 Budget

|

2007 – 2008 |

2008 – 2009 |

2009 – 2010 |

| Budget total du CEPMB |

11,925M |

11,122M |

11,358M |

| Equivalents temps plein |

62 |

71 |

76 |

EXIGENCES EN MATIÈRE DE RAPPORT

En vertu de l’article 82 de la Loi sur les brevets (Loi), les brevetés sont tenus d’informer le CEPMB de leur intention de lancer un médicament sur le marché canadien et de la date à laquelle ils prévoient le faire.

En vertu du Règlement sur les médicaments brevetés (Règlement), les brevetés doivent :

- remplir et soumettre le formulaire Renseignements identifiant le médicament (Formulaire 1) dans les 7 jours qui suivent la réception de l’Avis de conformité ou la date de la première vente du médicament au Canada, soit la première de ces deux éventualités. Le breveté doit également joindre en annexe à son formulaire la monographie de son médicament ou, si l’Avis de conformité n’a pas encore été attribué, les renseignements qui sont normalement présentés dans une monographie

- faire rapport des prix de lancement de leurs produits médicamenteux brevetés et des ventes effectuées le premier jour de commercialisation du produit médicamenteux au Canada (Formulaire 2) dans les 30 jours qui suivent la date de la première vente, et

- tant qu’un brevet est lié au produit médicamenteux, soumettre des données détaillées sur les prix et sur les ventes de chaque médicament breveté (Formulaire 2) et ce, dans les 30 jours qui suivent la fin de chaque semestre, soit au plus tard le 30 juillet et le 30 janvier de chaque année.

- Dans le cas des produits médicamenteux en vente libre et des produits médicamenteux pour usage vétérinaire, remplir et soumettre le formulaire 1 dans les 7 jours qui suivent la réception de l’Avis de conformité ou la date de la première vente du médicament au Canada, soit la première de ces deux éventualités. Pour ces produits, le rapport sur le prix et sur les ventes (Formulaire 2) n’est plus exigé, mais les brevetés doivent quand même conserver leurs données en dossier au cas où le Conseil les exigerait. Les renseignements demandés sur le formulaire 2 doivent être soumis pour toutes les périodes de vente dans les 30 jours qui suivent la date à laquelle le personnel du Conseil lui en fait la demande suite à la réception d’une plainte puis pour les deux années qui suivent la demande. Les rapports sont exigibles dans les 30 jours qui suivent chaque période de rapport.

Le CEPMB passe en revue sur une base régulière les données fournies sur les prix de tous les médicaments brevetés offerts sur le marché canadien afin de s’assurer qu’ils sont conformes à ses Lignes directrices sur les prix excessifs (Lignes directrices). Ces Lignes directrices sont publiées dans le Compendium des politiques, des Lignes directrices et des procédures du CEPMB.2

DÉFAUT DE PRÉSENTER SON RAPPORT SUR LE FORMULAIRE 1

Dans l’exercice du volet réglementation de son mandat (description à la page 2 du présent rapport), le CEPMB s’attend à ce que les brevetés lui soumettent leurs rapports dans les délais impartis et ce, pour tous les produits médicamenteux vendus au Canada auxquels au moins un brevet est lié.

Tout retard de présentation des rapports est source de problème pour le CEPMB en ce sens qu’il retarde l’examen du prix. En 2008, 4 nouveaux produits médicamenteux brevetés (8 DIN) qui étaient brevetés et vendus au Canada avant 2008 ont fait l’objet d’un premier rapport au CEPMB.

Les produits médicamenteux Trileptal, Physioneal (3 DIN), ratio-paroxetine (3 DIN) et ratio-fluticasone étaient brevetés et offerts sur le marché canadien avant même de faire l’objet d’un rapport au CEPMB aux fins de l’examen du prix. Ces médicaments sont respectivement vendus au Canada par Novartis Pharma Canada Inc., Baxter Corporation et ratiopharm.

TABLE 2 Défaut de présenter son rapport

| Breveté actuel |

Nom de marque |

Nom générique |

Année où le médicament est devenu assujetti à la compétence du CEPMB |

| Novartis Pharma Canada Inc. |

Trileptal 60 mg/mL |

oxcarbazepine |

2006 |

| Baxter Corporation |

Physioneal |

glucose |

2007 |

| 13.6 mg/mL, |

|

|

| 22.7 mg/mL, |

|

|

| 38.6 mg/mL |

|

|

| ratiopharm |

ratio-paroxetine |

chlorydrate |

2003 |

| 10 mg, 20 mg, |

de paroxétine |

|

| 30 mg tablet |

|

|

|

ratio-fluticasone |

propinate |

2007 |

| 50 mcg/dose |

de fluticasone |

|

DÉFAUT DE PRÉSENTER SON RAPPORT SUR LE FORMULAIRE 2

C’est aux brevetés qu’il incombe de s’assurer qu’ils soumettent au CEPMB tous les renseignements exigés dans les délais mentionnés dans le Règlement.

Même si, dans la plupart des cas, les brevetés finissent par se conformer et soumettre leurs rapports, un certain nombre de ceux-ci négligent de présenter leurs rapports complets dans les délais impartis dans le Règlement.

Pour les semestres de rapport de janvier à juin et de juillet à décembre 2008, le Conseil n’a toutefois pas eu à rendre d’ordonnances pour défaut de présenter son rapport.

De plus amples renseignements sur les différentes exigences en matière de rapport sont offerts dans la Loi, le Règlement, les Lignes directrices sur les prix excessifs et le Guide du breveté. Ces documents sont affichés dans le site Web du CEPMB sous « Loi, Règlement et Lignes directrices ».

LIGNES DIRECTRICES SUR LES PRIX EXCESSIFS

Les Lignes directrices sur les prix excessifs tiennent compte des facteurs de détermination des prix mentionnés dans l’article 85 de la Loi. Elles ont été formulées par le Conseil en consultation avec différents intervenants, dont les ministres de la Santé des provinces et des territoires, des associations de consommateurs et des représentants du secteur pharmaceutique. D’une façon générale, les Lignes directrices prévoient ce qui suit :

- les prix de la plupart des nouveaux médicaments brevetés sont assujettis à un plafond de manière à ce que le coût de revient de la nouvelle thérapie ne soit pas supérieur au coût de la thérapie jusque-là utilisée au Canada pour traiter la même maladie ou condition

- les prix des médicaments brevetés constituant une découverte ou une amélioration importante ne peuvent dépasser la médiane des prix pratiqués dans les sept pays industrialisés nommés dans le Règlement, à savoir la France, l’Allemagne, l’Italie, la Suède, la Suisse, le Royaume-Uni et les États-Unis

- les taux d’augmentation des prix des médicaments brevetés existants ne peuvent être plus élevés que les taux d’augmentation de l’Indice des prix à la consommation (méthodologie de l’IPC)

- le prix d’un médicament breveté au Canada ne peut en aucun temps dépasser le prix le plus élevé auquel il est vendu dans les pays de comparaison nommés dans le Règlement.

Le personnel du Conseil fait l’examen des prix de touts les produits médicamenteux brevetés vendus sur le marché canadien. S’il estime que le prix d’un médicament breveté semble plus élevé que le prix autorisé par les Lignes directrices du Conseil et que les circonstances le justifient, le personnel du Conseil ouvre une enquête pour déterminer si ce prix est ou non excessif. L’annexe 1, à la page 50, fournit de plus amples explications sur les critères qui justifient la tenue d’une enquête. Une enquête peut mener aux résultats suivants :

- sa fermeture lorsque le prix est reconnu conforme aux Lignes directrices

- un engagement de conformité volontaire en vertu duquel le breveté s’engage à réduire le prix de son produit médicamenteux et à appliquer d’autres mesures ordonnées par le Conseil pour se conformer aux Lignes directrices, dont une réduction du prix et (ou) la réduction du prix d’un autre produit médicamenteux du breveté ou le remboursement des recettes excessives encaissées, ou

- une audience publique pour déterminer si le prix du produit médicamenteux est ou non excessif ainsi que l’ordonnance qu’il y a lieu d’imposer.

Par souci de transparence, le CEPMB publie dans son site Web la liste des Nouveaux médicaments ayant fait l’objet d’un rapport au CEPMB. Cette liste, qui est mise à jour tous les mois, fait état du statut de l’examen de chaque nouveau médicament breveté au moyen des mentions « sous examen », « Conforme aux Lignes directrices », «Sous enquête », « Engagement de conformité volontaire » ou « Avis d’audience ».

GROUPE CONSULTATIF SUR LES MÉDICAMENTS POUR USAGE HUMAIN

Le Conseil a créé le Groupe consultatif sur les médicaments pour usage humain (GCMUH) pour qu’il lui soumette ses recommandations concernant le classement des nouveaux médicaments ainsi que concernant la sélection des médicaments qui se prêtent à la comparaison selon la catégorie thérapeutique avec le médicament sous examen.

Le GCMUH effectue l’évaluation scientifique des médicaments brevetés et formule des conseils scientifiques crédibles, indépendants et éclairés quant à l’élaboration et l’application des Lignes directrices du CEPMB relatives à l’examen scientifique. L’approche du Groupe se fonde sur l’expérience clinique et ses recommandations reflètent les connaissances médicales et scientifiques ainsi que la pratique clinique.

Le GCMUH est constitué de trois membres :

- Dr Jean Gray MD, FRCPC, Professeure émérite en enseignement de la médecine, en médecine et en pharmacologie à l’Université Dalhousie

- Dr Mitchell Levine MD, MSc, FRCPC, FISPE, Professeur, Département de l’épidémiologie clinique et de la biostatistique à l’Université McMaster et directeur du Centre d’évaluation des médicaments du St. Joseph’s Healthcare Hamilton, et

- Dr Adil Virani, BSc (Phm), Pharm.D., FCSHP, directeur des services pharmaceutiques à la Fraser Health Authority et chargé de cours à la faculté des sciences pharmaceutiques de l’Université de la Colombie-Britannique.

NOUVEAUX PRODUITS MÉDICAMENTEUX BREVETÉS LANCÉS SUR LE MARCHÉ CANADIEN EN 2008

Au total, 78 nouveaux produits médicamenteux brevetés (aussi appelés DIN) pour usage humain ont été lancés sur le marché canadien en 2008. Certains de ces médicaments représentent une ou plusieurs concentrations d’une nouvelle substance active (NSA) et d’autres, de nouvelles présentations de médicaments existants.

Aux fins de l’examen du prix, tout médicament breveté lancé ou vendu sur le marché canadien avant l’attribution de son premier brevet entre le 1er décembre 2007 et le 30 novembre 2008 est réputé avoir été breveté en 2008.3

Le graphique 1 présente le nombre de nouveaux médicaments brevetés pour usage humain lancés sur le marché canadien entre 1989 et 2008.

Vingt-deux (28 %) des 78 nouveaux DIN brevetés ont été commercialisés au Canada avant d’avoir obtenu un premier brevet canadien qui les aurait automatiquement assujettis à la compétence du CEPMB. Ces DIN sont identifiés par les lettres « PBA » (pour « premier brevet accordé ») dans l’annexe 2, à la page 51 du présent rapport. Le tableau 3 présente le nombre de produits médicamenteux brevetés classés selon l’année de leur première vente sur le marché canadien. Pour ces produits le délai écoulé entre la date de la première vente et celle de l’obtention d’un premier brevet varie entre plusieurs mois et cinq années. Un de ces produits (le Fucidin, un antibiotique vendu par LEO Pharma Inc.) était vendu sur le marché canadien avant 1987, année de la création du CEPMB.

TABLEAU 3 Nouveaux produits médicamenteux brevetés pour usage humain en 2008 selon l’année de leur première ven

| Année de la première vente |

Nbre de DIN |

| 2008 |

58 |

| 2007 |

8 |

| 2006 |

8 |

| 2005 |

|

| 2004 |

1 |

| 2003 |

2 |

| 1980 |

1 |

| Total |

78 |

NOUVELLES SUBSTANCES ACTIVES LANCÉES SUR LE MARCHÉ CANADIEN EN 2008

Une nouvelle substance active (NSA) peut être associée à plusieurs DIN lorsqu’elle est distribuée sous plusieurs concentrations ou sous plusieurs formes posologiques. Les 19 NSA lancées sur le marché canadien en 2008 ont été commercialisées sous 26 DIN. Comme on peut le voir dans le graphique 2 et dans le tableau 4, à la page 11, 4 des 19 NSA brevetées devenues assujetties à la compétence du CEPMB en 2008 étaient offertes sur le marché canadien avant 2008.

TABLEAU 4 Nouvelles substances actives pour usage humain, 2008

Nouveaux médicaments brevetés pour usage humain, 2008 – Nouvelles substances actives

| Nom de marque |

Nom chimique |

Breveté |

Nbre de DIN |

Utilisation thérapeutique |

| Catena |

idébénone |

Santhera Pharmaceuticals (Canada) Inc. |

1 |

Traitement symptomatique des patients

atteints de l’Ataxie de Friedreich |

| Cymbalta |

chlorhydrate de duloxétine |

Eli Lilly Canada Inc. |

2 |

Antidépresseur/analgésique |

| Eraxis |

anidulafungin |

Pfizer Canada Inc. |

1 |

Antifongique |

| Frova |

succinate de frovatriptan |

Teva Neuroscience |

1 |

Migraine |

| Januvia |

phosphate de sitagliptine monohydraté |

Merck Frosst Canada Ltd. |

1 |

Diabète |

| Natrecor |

nesiritide |

Janssen-Ortho Inc. |

1 |

Épisodes aigus d’insuffisance cardiaque |

| Nevanac |

népafénac |

Alcon Canada Inc. |

1 |

Traitement de la douleur et de l’inflammation

associées à une opération de la cataracte |

| Nimotuzumab |

nimotuzumab |

YM Biosciences Inc. |

1 |

Cancer |

| Pradax |

dabigatran etexilate |

Boehringer Ingelheim (Canada) Ltd. |

2 |

Prévention de la thromboembolie veineuse |

| Relistor |

bromure de méthylnaltrexone |

Wyeth Pharmaceuticals |

1 |

Traitement de la constipation causée par

les opioïdes |

| Revlimid |

lénalidomide |

Celgene |

2 |

Anémie |

| Torisel |

temsirolimus |

Wyeth Pharmaceuticals |

1 |

Traitement du carcinome rénal |

| Volibris |

ambrisentan |

GlaxoSmithKline Inc. |

2 |

Traitement de l’hypertension artérielle

pulmonaire |

| Xarelto |

rivaroxaban |

Bayer Inc. |

1 |

Prévention des événements thromboemboliques

veineux |

| Zeldox |

chlorydrate de ziprasidone |

Pfizer Canada Inc. |

4 |

Antipsychotique |

|

| Nouvelles substances actives vendues au Canada avant 2008 |

| Nom de marque |

Nom chimique |

Breveté |

Nbre de DIN |

Utilisation thérapeutique |

| Intelence |

etravirine |

Janssen-Ortho Inc. |

1 |

VIH |

| Lucentis |

ranibizumab |

Novartis Pharma Canada Inc. |

1 |

Traitement de la forme néovasculaire

(humide) de la dégénérescence maculaire

liée à l’âge |

| Myozyme |

alfa d’alglucosidase |

Genzyme Canada Inc. |

1 |

Traitement de la maladie de Pompe |

| Zevalin |

Ibritumomab tiuxétan |

Bayer Inc. |

1 |

Traitement des patients atteints d’un

lymphome non hodgkinien |

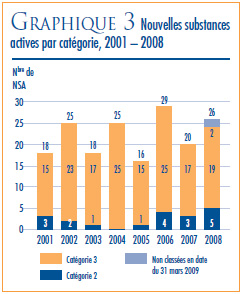

Le graphique 3, à la page 12, ventile pour la période 2001 à 2008 les NSA pour usage humain brevetées selon la catégorie dans laquelle elles ont été classées aux fins de l’examen du prix.4

Lorsque l’examen du prix d’une nouvelle substance active est terminé et que son prix a été jugé conforme aux Lignes directrices, le CEPMB affiche dans son site Web le rapport sommaire de son examen.

EXAMEN DU PRIX DES NOUVEAUX PRODUITS MÉDICAMENTEUX BREVETÉS POUR USAGE HUMAIN EN 2008

La liste des 78 nouveaux produits médicamenteux brevetés, incluant le statut de l’examen de leur prix au moment de la rédaction du présent rapport, est présentée dans l’annexe 2, à la page 51. Des 78 nouveaux DIN brevetés :

- 74 avaient été soumis à un examen du prix en date du 31 mars 2009. De ce nombre :

– les prix de 60 DIN ont été jugés conformes aux Lignes directrices

– les prix de 14 DIN semblaient plus élevés que ne l’autorisent les Lignes directrices et ont justifié une enquête. De plus amples explications sur les critères qui justifient la tenue d’une enquête sont offerts à l’annexe 1, à la page 50.

- enfin, les prix des 4 autres DIN étaient encore sous examen.

SUIVI : NOUVEAUX PRODUITS MÉDICAMENTEUX BREVETÉS DONT IL A ÉTÉ FAIT ÉTAT DANS DES RAPPORTS ANNUELS ANTÉRIEURS

Le tableau 5 présente une mise à jour du statut des nouveaux produits médicaments brevetés (DIN) dont il a été fait état dans des rapports annuels antérieurs.

TABLEAU 5 Statut de l’examen des nouveaux produits médicamenteux brevetés ayant fait l’objet d’un rapport au CEPMB en 2002, 2003, 2004, 2005, 2006 et 2007

|

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

Nouveaux médicaments brevetés

(DIN) mentionnés dans un

rapport annuel |

94 |

70 |

94 |

66 |

99 |

64 |

| Défaut de présenter un rapport |

4 |

4 |

2 |

1 |

7 |

2 |

| Nbre de DIN pour l’année |

98 |

74 |

96 |

67 |

106 |

66 |

| Sous examen |

0 |

3 |

0 |

0 |

1 |

1 |

| Conformes aux Lignes directrices |

91 |

66 |

78 |

59 |

90 |

56 |

| Sous enquête |

0 |

0 |

0 |

0 |

12 |

7 |

Engagements de conformité

volontaire |

3 (Starlix)

1 (Busulfex)

1 (Tamiflu) |

1 (Dukoral) |

2 (Paxil CR)

1 (Hextend)

2 (Eloxatin)

1 (Forteo) |

1 (Nuvaring)

1 (Vaniqa) |

1 (Denavir)

1 (Lantus)

|

2 (AndroGel) |

| Avis d’audience |

– |

– |

1 (Penlac)

1 (Neulasta) |

– |

– |

– |

Avis d’audience/Engagement

de conformité volontaire |

1 (Fasturec) |

1 (Evra)

3 (Concerta) |

3 (Risperdal

Consta) |

5 (Strattera)

1 (Concerta) |

– |

– |

| Audience conclue |

1 (Dovobet) |

– |

1 (Copaxone)

6 (Adderall XR)

|

– |

– |

– |

| Auprès de la Cour fédérale |

– |

– |

– |

– |

1 (Thalomid) |

– |

EXAMEN DES PRIX DES PRODUITS MÉDICAMENTEUX BREVETÉS EXISTANTS POUR USAGE HUMAIN, EN 2008

Aux fins du présent rapport, les médicaments existants (DIN) désignent tous les médicaments brevetés vendus sur le marché canadien et rapportés au CEPMB avant le 1er décembre 2008. Au moment de la rédaction du présent rapport, 1 182 DIN existants étaient offerts sur le marché canadien :

- les prix de 1 032 DIN existants (87,3 %) ont été jugés conformes aux Lignes directrices

- les prix de 111 DIN existants faisaient l’objet d’une enquête.

– de ce nombre, 19 enquêtes sont attribuables au prix de lancement du médicament :

12 en 2006

7 enquêtes ont été engagées en 2007

– 92 enquêtes sont attribuables aux augmentations annuelles des prix :

36 enquêtes ont été engagées en 2008

26 enquêtes ont été engagées en 2007

19 enquêtes ont été engagées en 2006

10 enquêtes ont été engagées en 2005

1 enquête a été engagée en 2003

- 9 DIN existants – Nicoderm (3 DIN), Penlac, Quadracel, Pentacel, Apo-Salvent exempt de CFC, ratio-Salbutamol HFA et Neulasta font l’objet d’une audience en vertu de l’article 83 de la Loi (voir la section « Audiences », à la page 17)

- 16 DIN – Copaxone, Strattera (5 DIN), Adderall XR (6 DIN) et Concerta (4 DIN) faisaient l’objet d’une audience qui a été close suite à un engagement de conformité volontaire ou à une ordonnance du Conseil

- 14 DIN existants étaient encore sous examen.

Le tableau 6 donne un aperçu du statut d’examen en 2008 des produits médicamenteux brevetés pour usage humain nouveaux et existants.

TABLEAU 6 Produits médicaments brevetés (DIN) pour usage humain vendus au Canada

en 2008 – Statut de l’examen du prix en date du 31 mars 2008

|

Nouveaux médicaments lancés

sur le marché canadien en 2008 |

Médicaments

existants |

Total |

| Total |

78 |

1,182 |

1,260 |

| Conformes aux Lignes directrices |

60 |

1,032 |

1,092 |

| Sous examen |

4 |

14 |

18 |

| Sous enquête |

14 |

111 |

125 |

| Avis d’audience |

0 |

9 |

9 |

| Audiences conclues |

|

16 |

16 |

MISE À JOUR : PRODUITS MÉDICAMENTEUX EXISTANTS DONT IL A ÉTÉ FAIT MENTION DANS LE RAPPORT ANNUEL 2007

Dans son rapport annuel de l’an dernier, le Conseil mentionnait que les prix de 20 des 1 114 produits médicamenteux brevetés pour usage humain vendus au Canada en 2007 étaient sous examen au moment d’aller sous presse. Il est ressorti de ces examens que les prix de 7 de ces 20 médicaments étaient conformes aux Lignes directrices et que les prix de 4 autres semblaient supérieurs aux prix autorisés et justifiaient la tenue d’une enquête. Par ailleurs, les prix de 8 autres DIN sont encore sous examen. Enfin, la Cour fédérale a statué que 1 DIN n’était pas assujetti à la compétence du CEPMB.

Le CEPMB mentionnait également dans son rapport annuel de 2007 que 97 DIN étaient sous enquête. Trente-trois de ces enquêtes étaient closes au moment de la rédaction du présent rapport : les prix de 26 de ces DIN ont été jugés conformes aux Lignes directrices et 4 DIN (Denavir, Vepesid, Suprax et Eligard) ont fait l’objet d’un engagement de conformité volontaire (voir la rubrique « Engagements de conformité volontaire » à la page 15). Enfin, des Avis d’audience ont été émis pour 3 DIN (Apo-Salvent exempt de CFC, ratio-Salbutamol HFA et Neulasta (voir la rubrique « Avis d’audience » à la page 17). Les prix de 64 autres DIN sont encore aujourd’hui sous enquête. Il était aussi mentionné dans le rapport annuel de 2007 que 22 DIN étaient visés par un Avis d’audience et, au moment d’aller sous presse, 4 audiences (16 DIN) avaient été conclues : Copaxone, Concerta (4 DIN), Adderall XR (6 DIN) et Strattera (5 DIN). Quant aux 4 audiences engagées pour les 6 autres DIN, elles poursuivent leur cours.

PCEM / CEPMB

Le Programme commun d’évaluation des médicaments (PCEM), un processus uniformisé d’évaluation des nouveaux médicaments, fournit aux régimes d’assurance-médicaments fédéral, provinciaux et territoriaux participants des recommandations quant à l’opportunité d’ajouter certains médicaments à leurs formulaires respectifs de médicaments admissibles à un remboursement. De toutes les provinces et de tous les territoires, seul le Québec ne participe pas à ce programme. Le PCEM fait l’examen des nouveaux médicaments et recommande les médicaments qui devraient être admissibles à un remboursement par les régimes publics d’assurance-médicaments. Au moment de prendre des décisions concernant l’inscription de médicaments sur les formulaires de médicaments admissibles à un remboursement, les différents régimes publics d’assurance-médicaments évaluent la recommandation du Comité consultatif canadien d’expertise sur les médicaments (CCCEM) dans le contexte de leur mandat, de leurs priorités et de leur budget. De plus amples renseignements sur le PCEM et sur le CCCEM sont offerts dans le site Web de l’Agence canadienne des médicaments et des technologies de la santé (ACMTS) (http://www.cadth.ca).

Le tableau 7 présente pour 2008 les recommandations formulées concernant les médicaments soumis à l’examen du PCEM et le statut des prix examinés par le CEPMB. Le PCEM fait l’examen du prix du médicament après l’obtention de son Avis de conformité de Santé Canada. Le CEPMB fait pour sa part l’examen du prix de tous les médicaments brevetés offerts sur le marché canadien. Un produit médicamenteux peut être vendu avant d’être breveté ou ne pas être breveté et, dans un tel cas, le médicament n’est pas assujetti à la compétence du CEPMB.

TABLEAU 7 Statut des examens

| Recommandation du PCEM en 2008 |

Statut du médicament |

Utilisation thérapeutique |

| acamprosate calcium |

Campral |

Recommandation positive** |

Non assujetti à la compétence du CEPMB |

Traitement contre la dépendance à l’alcool |

| adalimumab |

Humira |

Recommandation positive** |

Conforme aux Lignes directrices |

Polyarthrite rhumatoïde |

| aliskiren |

Rasilez |

Recommandation négative |

Conforme aux Lignes directrices |

Hypertension |

| ambrisentan |

Volibris |

Recommandation positive** |

Conforme aux Lignes directrices |

Hypertension artérielle pulmonaire |

| aprepitant |

Emend |

Recommandation positive** |

Conforme aux Lignes directrices |

Prévention des nausées et des vomissements associés à une chimiothérapie anticancéreuse |

| buprenorphine/naloxene |

Suboxone |

Recommandation positive** |

Non assujetti à la compétence du CEPMB |

Traitement de la dépendance envers les opiacés (narcotiques) |

| carbidopa/levodopa/entacapone |

Stalevo |

Recommandation positive*** |

Conforme aux Lignes directrices |

Maladie de Parkinson |

| ciclésonide |

Omnaris |

Recommandation négative |

Conforme aux Lignes directrices |

Allergies |

| daptomycine |

Cubicin |

Recommandation négative |

Conforme aux Lignes directrices |

Antibiotique |

| Chlorhydrate de duloxétine |

Cymbalta |

Recommandation positive** |

Conforme aux Lignes directrices |

Antidépresseur/analgésique |

| efavirenz/emtricitabine/tenofovir disoproxil fumarate |

Atripla |

Recommandation positive** |

Conforme aux Lignes directrices |

VIH |

| étravirine |

Intelence |

Recommandation positive** |

Conforme aux Lignes directrices |

VIH |

| Carbonate de lanthane hydraté |

Fosrenol |

Recommandation négative |

Conforme aux Lignes directrices |

Contrôle de l’hyperphosphorémie |

| palipéridone |

Invega |

Recommandation négative |

Conforme aux Lignes directrices |

Schizophrénie |

| posaconazole |

Spriafil*** |

Recommandation négative |

Conforme aux Lignes directrices |

Antifongique |

| raltegravir |

Isentress |

Recommandation positive** |

Conforme aux Lignes directrices |

VIH |

| ranibizumab |

Lucentis |

Recommandation positive** |

Conforme aux Lignes directrices |

Traitement de la forme néovasculaire (humide)

de la dégénérescence maculaire liée à l’âge |

| rivaroxaban |

Xarelto |

Recommandation positive** |

Sous enquête |

Prévention des accidents thromboemboliques

veineux |

| rivastigmine |

Exelon |

Recommandation négative |

Conforme aux Lignes directrices |

Maladie d’Alzheimer |

| phosphate de sitagliptine |

Januvia |

Recommandation négative |

Conforme aux Lignes directrices |

Diabète |

| sodium de sitaxsentan |

Thelin |

Recommandation négative |

Conforme aux Lignes directrices |

Hypertension pulmonaire |

| chlorhydrate de tramadol |

Tridural |

Recommandation négative |

Sous enquête |

Analgésique |

| chlorhydrate de tramadol |

Raliva |

Recommandation négative |

Non assujetti à la compétence du CEPMB |

Analgésique |

| chlorhydrate de ziprasidone |

Zeldox |

Recommandation positive** |

Conforme aux Lignes directrices |

Antipsychotique |

| acide zolédronique |

Aclasta |

Recommandation négative |

Conforme aux Lignes directrices |

Maladie de Paget |

* Inscrire sous réserve de critères/conditions

** Inscrire au même titre que d’autres produits médicamenteux

*** Maintenant appelé Posanol

Sources : CEPMB et ACMTS |

PRODUITS MÉDICAMENTEUX BREVETÉS EN VENTE LIBRE ET PRODUITS MÉDICAMENTEUX BREVETÉS POUR USAGE VÉTÉRINAIRE

Les modifications apportées au Règlement ont été enregistrées le 6 mars 2008 et publiées dans la Partie II de la Gazette du Canada du 19 mars 2008. Depuis, le personnel du Conseil ne fait l’examen des prix des produits médicamenteux brevetés en vente libre et des médicaments brevetés pour usage vétérinaire que suite à la réception d’une plainte. De plus amples renseignements sur ce processus sont offerts dans le site Web du CEPMB. Le Conseil n’a reçu en 2008 aucune plainte concernant les prix de ces deux types de produits médicamenteux brevetés.

MISE À JOUR : PRODUITS MÉDICAMENTEUX BREVETÉS POUR USAGE VÉTÉRINAIRE DONT IL A ÉTÉ QUESTION DANS LE RAPPORT ANNUEL 2007

Dans son rapport annuel 2007, le Conseil mentionnait que les prix de huit produits médicamenteux brevetés pour usage vétérinaire étaient sous examen et ils l’étaient encore au moment de la rédaction du présent rapport. Après l’examen du prix et lorsque le prix est jugé conforme aux Lignes directrices, les résultats du rapport sommaire de l’examen sont affichés dans le site Web du CEPMB.

ENGAGEMENTS DE CONFORMITÉ VOLONTAIRE

L’ENGAGEMENT DE CONFORMITÉ VOLONTAIRE EST UN ENGAGEMENT ÉCRIT DU BREVETÉ DE RENDRE LE PRIX DE SON PRODUIT MÉDICAMENTEUX BREVETÉ CONFORME AUX LIGNES DIRECTRICES SUR LES PRIX EXCESSIFS.

Les brevetés peuvent soumettre un engagement de conformité volontaire même si, après enquête, le personnel du Conseil est arrivé à la conclusion que le prix au Canada du produit médicamenteux breveté est plus élevé que le prix autorisé en vertu des Lignes directrices.

2 Vous trouverez le Compendium des politiques, des Lignes directrices et des prodécures (le Compendium) dans notre site Web sous « Loi, Règlement et Lignes directrices » ou en communiquant avec le CEPMB à son numéro d’interurbains sans frais : 1-877-861-2350.

3 En raison des dates de présentation des rapports établies par le Règlement sur les médicaments brevetés et de la méthode de calcul des prix de référence, les médicaments lancés sur le marché canadien ou brevetés en décembre d’une année sont comptabilisés dans les nouveaux médicaments de l’année suivante.

4 Pour de plus amples renseignements sur la categorisation des produits medicamenteux, consulter le Compendium des politiques, des Lignes directrices, et des procedures.

L’ENGAGEMENT DE CONFORMITÉ VOLONTAIRE EST UN ENGAGEMENT ÉCRIT DU BREVETÉ DE RENDRE LE PRIX DE SON PRODUIT MÉDICAMENTEUX BREVETÉ CONFORME AUX LIGNES DIRECTRICES SUR LES PRIX EXCESSIFS.

Les brevetés peuvent soumettre un engagement de conformité volontaire même si, après enquête, le personnel du Conseil est arrivé à la conclusion que le prix au Canada du produit médicamenteux breveté est plus élevé que le prix autorisé en vertu des Lignes directrices.

PUBLICATION DES ENGAGEMENTS DE CONFORMITÉ VOLONTAIRE

Le Conseil publie les engagements de conformité volontaire approuvés par le président du Conseil. Ce document devient public dès que le breveté est informé de l’acception de son engagement. Les engagements de conformité volontaire sont affichés dans le site Web du CEPMB. Ils font également l’objet d’un article dans La Nouvelle et, bien sûr, dans le Rapport annuel.

L’acceptation d’un engagement par le président du Conseil se veut une alternative aux procédures quasi judiciaires qui sont engagées suite à la publication d’un Avis d’audience.

Le breveté peut soumettre un engagement de conformité volontaire après l’émission d’un Avis d’audience, mais à ce point l’engagement doit recevoir l’aval du panel d’audience.

Entre janvier 2008 et la mise sous presse du présent rapport, neuf engagements de conformité volontaire ont été acceptés pour les produits médicamenteux brevetés nommés ci-après, dont deux après l’émission d’un Avis d’audience :

AndroGel, Solvay Pharma Inc.

– Juin 2008

Concerta5, Janssen-Ortho Inc.

– Avril 2009

Denavir, Barrier Therapeutics Canada Inc.

– Mai 2008

Eligard, sanofi-aventis Canada Inc.

– Avril 2009

Lantus, sanofi-aventis Canada Inc.

– Mars 2008

Strattera5, Eli Lilly Canada Inc.

– Février 2009

Suprax, sanofi-aventis Canada Inc.

– Mars 2009

Vaniqa, Barrier Therapeutics Canada Inc.

– Février 2008

Vepesid, Bristol-Myers Squibb Canada Co.

– Février 2009

AndroGel est un gel topique contenant 1 % de testostérone. Il est indiqué comme traitement de remplacement pour les hommes atteints d’une insuffisance ou d’une absence de testostérone endogène.

Le 24 juin 2008, le président du Conseil a approuvé l’engagement de conformité volontaire que lui a soumis Solvay Pharma Inc. pour son médicament AndroGel. En vertu de cet engagement, Solvay Pharma a réduit le prix du sachet de 2,5 mg de son médicament au prix maximum non excessif (MNE) de 2008 (2,1263 $) et a remboursé les recettes excessives qu’il a encaissées entre mai 2002 et le 31 décembre 2007 en remettant la somme de 3 327 180,61 $ au gouvernement du Canada. Solvay Pharma a également remboursé les recettes excessives encaissées en 2008.

Le Concerta est indiqué pour traiter les troubles déficitaires de l’attention avec hyperactivité (TDAH).

Le 24 juillet 2006, le Conseil a émis un Avis d’audience sur le prix du médicament Concerta. Le 24 avril 2009, le Panel d’audience a approuvé l’engagement de conformité volontaire que lui ont présenté les parties et ainsi mis fin aux procédures d’audience. L’engagement prévoit, entre autres, que Janssen-Ortho Inc. rembourse des recettes excessives totalisant 1 464 441,58 $ au gouvernement du Canada.

Le Denavir est indiqué pour traiter l’herpès labial récurrent chez les adultes.

Le 20 mai 2008, le président du Conseil a approuvé l’engagement de conformité volontaire soumis par Barrier Therapeutics Canada Inc. pour son médicament Denavir.

Barrier a remboursé au gouvernement du Canada la somme de 61 021,80 $ qui correspond à la valeur des recettes excessives encaissées entre août 2006 et décembre 2007.

Le Denavir n’est plus vendu au Canada.

Le Eligard est indiqué pour le traitement palliatif du cancer de la prostate ayant atteint un stade avancé.

Le 20 avril 2009, le président du Conseil a approuvé l’engagement de conformité volontaire que lui a soumis sanofi-aventis Canada Inc. pour son médicament Eligard. En plus de s’assurer que les prix auxquels il vend son médicament dans les différentes provinces ne dépassent pas le prix MNE de 2009, sanofi-aventis a remboursé les recettes excessives encaissées entre janvier 2005 et décembre 2008 en remettant la somme de 13 127 953,14 $ au gouvernement du Canada. De plus, sanofi-aventis remboursera directement à ses clients des différentes provinces ayant acheté son médicament à un prix excessif les recettes excessives encaissées en 2009.

Le Lantus est indiqué une fois par jour pour le traitement des adultes atteints de diabète de type 2 et des adultes et enfants (de 6 à 17 ans) atteints du diabète de type 1 à qui doit être administrée de l’insuline basale à durée d’action prolongée pour contrôler l’hypoglycémie.

Le 14 mars 2008, le président du Conseil a approuvé l’engagement de conformité volontaire soumis par sanofi-aventis Canada Inc. pour son médicament breveté Lantus. En plus d’avoir porté le prix de son médicament à un niveau où il n’est plus considéré excessif, sanofi-aventis a remboursé les recettes excessives encaissées en date du 18 septembre 2006. À cette fin, il a remis la somme de 694 239,50 $ au gouvernement du Canada et réduit le prix d’un autre de ses médicaments, le Altace HCT.

Le Strattera est indiqué pour le traitement des enfants de six ans et plus, des adolescents et des adultes atteints du trouble déficitaire de l’attention avec hyperactivité.

Le 19 février 2009, le Conseil a approuvé l’engagement de conformité volontaire pour le médicament Strattera, mettant ainsi fin aux procédures engagées suite à l’émission d’un Avis d’audience le 15 décembre 2006. L’engagement prévoit que Eli Lily Canada Inc. maintienne les prix de son médicament Strattera dans les limites des prix MNE de 2009 et rembourse au gouvernement du Canada les recettes excessives dont la valeur totalise 15 326 066,49 $. S’il y a lieu, Eli Lilly remettra au gouvernement du Canada la valeur des recettes excessives qui n’auront pas été remboursées en date du 30 juin 2009.

Le Suprax est un antibiotique utilisé pour traiter des infections causées par des souches sensibles de microorganismes spécifiés.

Le président du Conseil a approuvé l’engagement de conformité volontaire que lui a soumis sanofiaventis Canada Inc. pour son médicament Suprax 400 mg/comprimé. Aux termes de cet engagement, sanofi-aventis devait réduire le prix de son médicament Suprax pour qu’il se situe dans les limites du prix MNE de 2009 et remettre au gouvernement du Canada la somme de 97 900,30 $ en guise de remboursement des recettes excessives encaissées entre le 1er juillet 2007 et le 30 juin 2008. sanofi-aventis doit également rembourser les recettes excessives qu’il a encaissées entre juillet et décembre 2008.

Le Vaniqa est indiqué pour ralentir chez les femmes la pousse de poils indésirables au niveau de la figure. Son utilisation est recommandée en complément d’un traitement d’épilation.

Le 28 février 2008, le président du Conseil a approuvé l’engagement de conformité volontaire que lui a soumis Barrier Therapeutics Canada Inc. pour son médicament Vaniqa. Barrier a remboursé la partie excessive des recettes qu’il a tirées de la vente de son médicament à un prix excessif entre novembre 2005 et décembre 2007 en remettant au gouvernement du Canada la somme de 70 860,59 $.

Le Vaniqa n’est plus vendu au Canada.

Le Vepesid est utilisé en combinaison avec d’autres agents antinéoplasiques pour traiter en première ligne certaines maladies néoplasiques.

Le 23 février 2009, le président du Conseil a approuvé l’engagement de conformité volontaire que lui a soumis Bristol-Myers Squibb pour son médicament Vepesid. Bristol-Myers Squibb Canada Inc. a remboursé ses recettes excessives directement à ses clients qui, entre 2005 et 2007, ont acheté son médicament à des prix excessifs. La valeur de ces recettes totalisait 53 161,48 $.

Le Vepesid n’est plus vendu au Canada.

5 A fait l’objet d’un Avis d’audience.

AUDIENCES

DANS L’EXERCICE DE SON MANDAT DE RÉGLEMENTATION, LE CEPMB DOIT VEILLER À CE QUE LES BREVETÉS NE VENDENT PAS AU CANADA LEURS MÉDICAMENTS BREVETÉS À DES PRIX EXCESSIFS.

LORSQUE LE PRIX D’UN MÉDICAMENT BREVETÉ SEMBLE EXCESSIF, LE CONSEIL PEUT TENIR UNE AUDIENCE PUBLIQUE ET, S’IL EST DÉMONTRÉ QUE LE PRIX DU MÉDICAMENT EST EXCESSIF, RENDRE UNE ORDONNANCE OBLIGEANT LE BREVETÉ À RÉDUIRE LE PRIX DE SON MÉDICAMENT ET À REMBOURSER LA PARTIE EXCESSIVE DES RECETTES TIRÉES DE LA VENTE DE SON MÉDICAMENT À UN PRIX EXCESSIF. LES DÉCISIONS DU CONSEIL PEUVENT FAIRE L’OBJET D’UNE REQUÊTE EN RÉVISION JUDICIAIRE AUPRÈS DE LA COUR FÉDÉRALE DU CANADA.

En date du 1er janvier 2008, huit audiences étaient en cours dans les affaires suivantes : Adderall XR, Concerta, Copaxone, Nicoderm, Penlac, Pentacel et Quadracel, Strattera et Thalomid. Le Conseil a réglé cinq de ces affaires en cours d’année : deux affaires (Strattera et Concerta) ont été réglées au moyen d’un engagement de conformité volontaire. De plus amples détails sur ces engagements de conformité volontaire sont offerts dans la section du présent rapport qui traite spécifiquement des engagements de conformité volontaire.

Au moyen d’ordonnances, le Conseil a conclu les procédures dans deux affaires : Adderall XR et Copaxone. Le Panel d’audience a également rendu sa décision dans l’affaire du médicament Thalomid, mais le breveté a interjeté appel de cette décision. L’affaire est maintenant devant de la Cour d’appel fédérale. De plus amples détails sur cette affaire sont offerts à la page 19 sous la rubrique « Appels interjetés auprès de la Cour fédérale ».

Durant l’année 2008, le Conseil a émis quatre Avis d’audience, nommément dans les affaires de Apotex et de ratiopharm Inc. pour défaut de présenter ses rapports et dans les affaires des prix des médicaments Apo-Salvent exempt de CFC et ratio-Salbutamol HFA. Le 16 mars 2009, le Conseil a émis un Avis d’audience dans l’affaire de Amgen Canada Inc. et du prix du médicament Neulasta.

Au moment d’aller sous presse, le Conseil comptait huit affaires dans son calendrier d’audiences : Apotex (défaut de présenter son rapport), Apo-Salvent exempt de CFC, Neulasta, Nicoderm, Penlac, Pentacel et Quadracel, ratiopharm (défaut de présenter son rapport) et ratio-Salbutamol HFA.

Le tableau 8, à la page 18, présente un sommaire des affaires dont le Conseil a été saisi entre le 1er janvier 2008 et la date de publication du présent rapport.

TABLEAU 8 Statut des audiences devant le Conseil

Produit mé

dicamenteux

breveté |

Indication/Utilisation |

Breveté |

Date de l’Avis d’audience |

Règlement |

| Adderall XR |

Traitement des troubles déficitaires de l’attention avec hyperactivité (TDAH) |

Shire Canada Inc. (Shire BioChem Inc. lors de l’émission de l’Avis d’audience) |

18 janvier 2006 |

Décision : 10 avril 2008

Ordonnance : 27 août 2008

i) Réduction du prix

ii) Remboursement des recettes excessives – 5 622 863,63 $

iii) Autres recettes excessives à rembourser : pour

la période du 8 janvier au 15 septembre 2008

|

| Apotex Inc. |

|

|

3 mars 2008 |

en cours |

Apo-Salvent

CFC-Free |

Bronchodilatateur qui atténue le malaise respiratoire causé par des spasmes et par le rétrécissement du diamètre des bronches |

Apotex Inc. |

8 juillet 2008 |

en cours |

| Concerta |

Traitement des troubles déficitaires de l’attention avec hyperactivité (TDAH) |

Janssen-Ortho Inc. |

24 juillet 2006 |

Engagement de conformité volontaire : 24 avril 2009 (voir page 15) |

| Copaxone |

Réduction de la fréquence des rechutes chez les malades en traitement ambulatoire atteints de la sclérose en plaques à périodes progressives et rémittentes |

Teva Neuroscience

G.P.-S.E.N.C. |

8 mai 2006 |

Décision : 25 février 2008

Ordonnance : 12 mai 2008

i) Remboursement des recettes excessives : 2 417 223,29 $ |

| Neulasta |

Réduction de la fréquence des infections se manifestant par une neutropénie fébrile chez les patients atteints d’un cancer et traités par chimiothérapie myélosuppresseur |

Amgen Canada Inc. |

16 mars 2009 |

Conférence préparatoire : 3 juin 2009 |

| Nicoderm |

Atténuation des malaises causés par l’assuétude du tabac |

sanofi-aventis Canada Inc. (Hoechst Marion Roussel

Canada lors de l’émission

de l’Avis d’audience) |

20 avril 1999 |

Audience : 5 octobre 2009 |

| Penlac |

Traitement des ongles des patients immunocompétents atteints d’une onychomycose ou infection fongique des ongles ne touchant pas la lunule |

sanofi-aventis Canada Inc. |

26 mars 2007 |

En attente de la décision |

| Pentacel |

Immunisation systématique des enfants de 2 à 59 mois contre la diphtérie, le tétanos, la coqueluche, la poliomyélite et l’haemophilus influenzae de type b.

Le médicament est offert au Canada sous forme de fiole monodose de Act-HIB

(poudre lyophilisée pour injection) et d’une ampoule à dose unique (0,5 ml)

de Quadracel (suspension pour injection). |

sanofi pasteur Limited |

27 mars 2007 |

En attente de la décision |

| Quadracel |

Primovaccination des nourrissons à partir de l’âge de 2 mois et comme vaccin

de rappel pour les enfants jusqu’à 7 ans contre la diphtérie, le tétanos, la

coqueluche et la poliomyélite. |

|

|

|

| ratiopharm Inc. |

|

|

28 août 2008 |

en cours |

| ratio-Salbutamol HFA |

Atténuation des malaises respiratoires causés par des spasmes et par le rétrécissement du diamètre des bronches |

ratiopharm Inc. |

18 juillet 2008 |

Audience : 6 juillet 2009 |

| Strattera |

Traitement des enfants d’au moins six ans, des adolescents et des adultes atteint de troubles déficitaires de l’attention avec hyperactivité (TDAH) |

Eli Lilly Canada Inc. |

15 décembre 2006 |

Engagement de conformité volontaire

(Voir les détails à la page 16) |

APPELS INTERJETÉS AUPRÈS DE LA COUR FÉDÉRALE

Au cours de 2008, certaines décisions du Conseil ont été soumises à la révision judiciaire de la Cour fédérale.

Adderall XR, Shire Canada Inc. et Concerta, Janssen-Ortho Inc.

En janvier 2006, le Conseil a émis un Avis d’audience dans cette affaire. Le 15 décembre 2006, le Conseil a par voie d’ordonnance rejeté la requête déposée par Shire Canada Inc. aux fins que le Conseil corrige son Avis d’audience de manière à limiter son examen à la période commençant à la date d’attribution du brevet lié au médicament Adderall XR. Shire a déposé une requête en révision judiciaire devant la Cour fédérale. Le 19 décembre 2007, la Cour fédérale a rendu sa décision par laquelle elle rejetait la requête de Shire. Shire a interjeté appel de cette dernière décision devant la Cour d’appel fédérale, mais a retiré sa requête le 5 novembre 2008.

Dans cette affaire, Janssen-Ortho Inc., qui exploite le brevet du produit médicamenteux Concerta, a été admis comme intervenant devant la Cour fédérale dans l’affaire de la révision judiciaire de la décision relative à la compétence du Conseil. Janssen-Ortho a aussi renoncé à l’appel le 27 novembre 2008.

Copaxone, Teva Neuroscience G.P.-S.E.N.C.

Le 8 mai 2006, le Conseil a émis un Avis d’audience dans cette affaire.

Le 25 février 2008, le Panel d’audience a rendu sa décision et ses motifs et, le 12 mai 2008, son ordonnance. Teva Neuroscience a déposé une requête en révision judiciaire auprès de la Cour fédérale. La date de l’audience n’a pas encore été fixée.

Nicoderm, sanofi-aventis Canada Inc.

sanofi-aventis a déposé une requête en révision judiciaire de la désicion du Conseil de poursuivre l’audience sur le fond. La Cour fédérale n’a pas annoncée la date de l’audience.

Pentacel et Quadracel, sanofi pasteur Limitée

Le 27 mars 2007, le Conseil a émis un Avis d’audience dans cette affaire

Suite à la décision du Panel d’audience rendue le 26 novembre 2007 qui rejetait la requête de sanofi pasteur aux fins que le Conseil substitue son conseiller juridique dans l’affaire, sanofi pasteur a déposé une requête en révision judiciaire auprès de la Cour fédérale. La Cour fédérale a rejeté la requête de sanofi pasteur.

Le Panel a fini d’entendre l’affaire sur le fond le 6 janvier 2009 et sa décision est en instance.

Thalomid, Celgene Corporation

Le Panel d’audience a entendu les parties concernant la compétence du Conseil dans l’affaire du produit médicamenteux Thalomid qui était administré à des patients canadiens en vertu du Programme d’accès spécial de Santé Canada. Dans la décision qu’il a rendue le 21 janvier 2008, le Conseil a confirmé sa compétence sur le prix du médicament Thalomid. Celgene Corporation a soumis une requête en révision judiciaire par la Cour fédérale, laquelle requête a été entendue le 3 mars 2009. Dans sa décision du 17 mars 2009, la Cour fédérale a renversé la décision du Conseil. Le Procureur général du Canada a interjeté appel de la décision de la Cour fédérale auprès de la Cour d’appel fédérale. La date de l’audience n’est pas encore connue.

Depuis la création du CEPMB en 1987, le Conseil a approuvé 54 engagements de conformité volontaire et engagé 23 audiences publiques. Ces mesures ont donné lieu à des réductions de prix et au remboursement des recettes excessives par voie de paiements au gouvernement du Canada et (ou) de remboursements faits directement aux clients tels que des hôpitaux et des cliniques. En 2008-2009, la valeur des remboursements faits au gouvernement du Canada dépassait les 27 millions de dollars. De plus amples renseignements sur les engagements de conformité volontaire et sur les ordonnances du Conseil sont offerts à l’annexe 3, à la page 54.

COMMUNIQUÉ DU CONSEIL DU 18 AOÛT 2008 À SES INTERVENANTS

APRÈS LA PUBLICATION, LE 18 AOÛT 2008, D’UN COMMUNIQUÉ DU CONSEIL À L’INTENTION DE SES INTERVENANTS QUI TRAITAIT DE L’OBLIGATION IMPOSÉE AUX BREVETÉS DE FAIRE RAPPORT DES AVANTAGES QU’ILS CONSENTENT À LEURS CLIENTS, RX&D ET AL ET PFIZER CANADA INC. ONT SOUMIS UNE REQUÊTE EN RÉVISION JUDICIAIRE DU COMMUNIQUÉ DU CONSEIL. LA COUR FÉDÉRALE DOIT ENTENDRE CES DEUX REQUÊTES LES 16 ET 17 JUIN 2009.

MODIFICATIONS APPORTÉES AU RÈGLEMENT SUR LES MÉDICAMENTS BREVETÉS

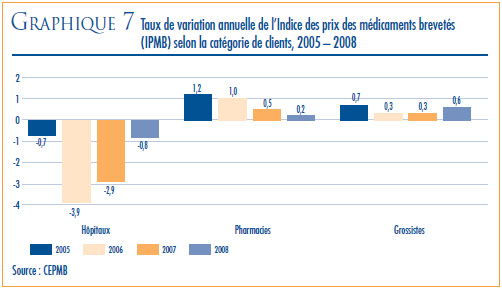

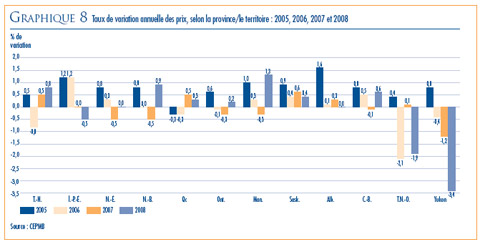

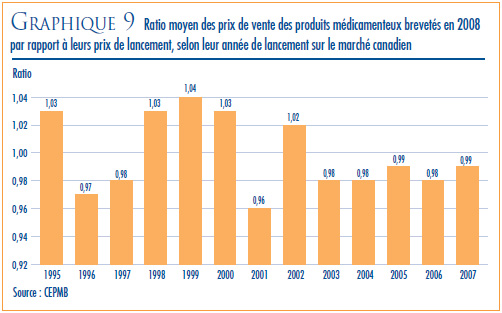

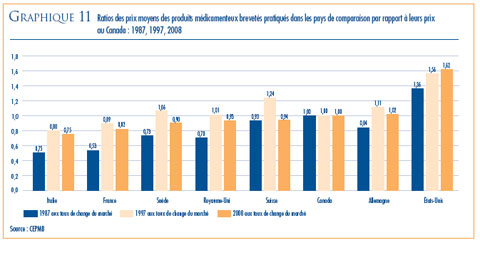

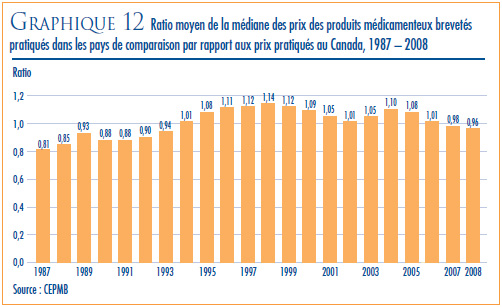

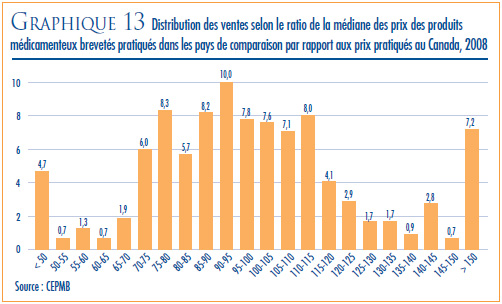

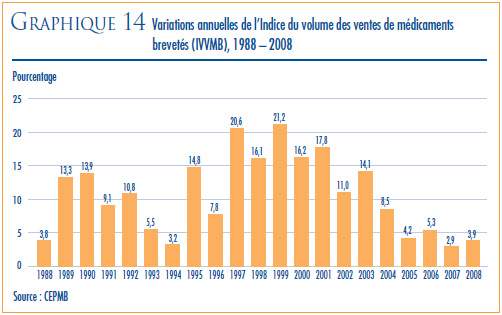

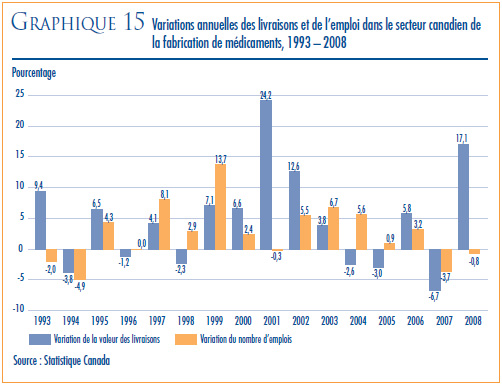

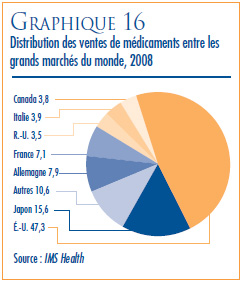

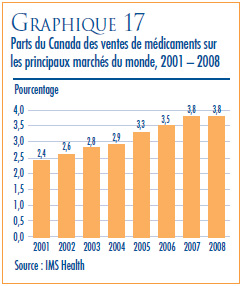

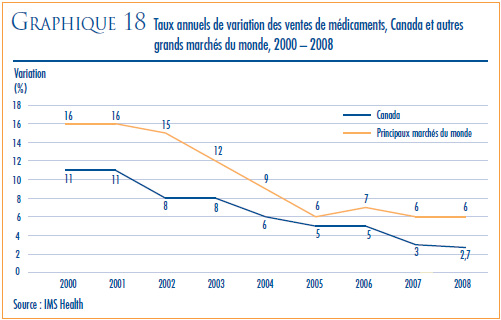

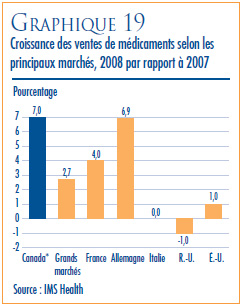

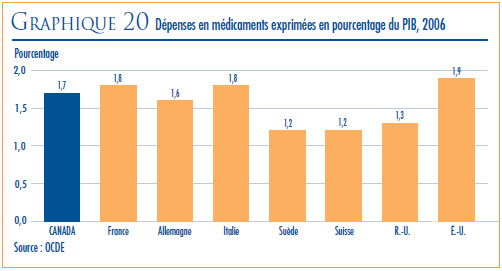

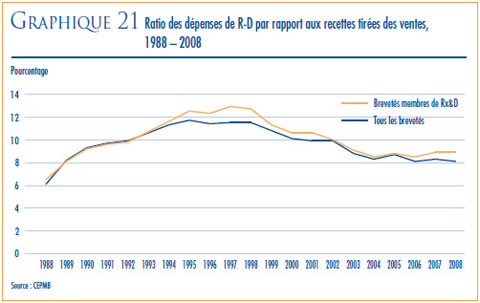

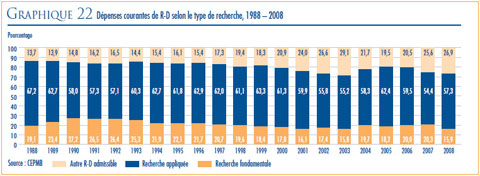

Les modifications apportées au Règlement sur les médicaments brevetés, 1994 (le « Règlement ») ont été enregistrées le 6 mars 2008 et publiées le 19 mars suivant dans la partie II de la Gazette du Canada. Ces modifications ont rendu le processus d’examen du prix des médicaments brevetés plus efficient et plus célère.