2004 Rapport Annuel

La section Rapport sur les principales tendances des médicaments du présent rapport annuel a été réorganisée. De plus, des graphiques et des tableaux ont été ajoutés. Le Conseil espère que cette analyse plus exhaustive des principaux indices vous aidera à mieux comprendre la conjoncture actuelle quant aux médicaments brevetés au Canada. Ces changements vont dans le sens du mandat de rapport du CEPMB dont l'objectif est d'éclairer les processus de prise de décisions et d'élaboration de politiques en faisant entre autres rapport des tendances des prix des produits pharmaceutiques.

Téléchargez le PDF

Table des matières

- Lettre au Ministre

- Faits saillants de l’exercice 2004

- Mot du President

- Le Conseil d'examen du prix des médicaments brevetés : Mandat et compétences

- Réglementation des prix des médicaments brevetés

- Certificat de décision préalable

- Engagements de conformité volontaire

- Activités quasi-judiciaires

- Rapport sur les principales tendances des médicaments

- Tendances des ventes

- Tendances des prix

- Comparaison des prix pratiqués au Canada aux prix pratiqués dans d'autres pays

- Volume des ventes de médicaments brevetés

- Tendances de l'industrie canadienne de fabrication de médicaments

- Le contexte mondial

- Système national d'information sur les médicaments prescrits

- Analyse des dépenses de recherche-développement

- Initiatives de politique et de recherche

- Gouvernance

- Biographies des membres du Conseil

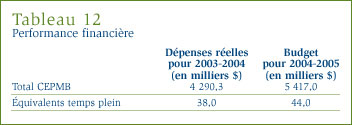

- Budget

- Publications

- Glossaire

- Acronymes

- Annexe 1

- Annexe 2

- Annexe 3

- Médicaments brevetés pour usage humain et titulaires des brevets au Canada

- Notes

Le 31 mai 2005

L'honorable Ujjal Dosanjh, C.P., député

Ministre de la Santé

Chambre des communes

Ottawa (Ontario)

K1A 0A6

Monsieur le ministre,

J'ai l'honneur de vous présenter, conformément aux articles 89 et 100 de la Loi sur les brevets, le Rapport annuel du Conseil d'examen du prix des médicaments brevetés pour l'exercice terminé le 31 décembre 2004.

Je vous prie d'agréer, Monsieur le ministre, l'assurance de mes sentiments distingués.

Le vice-président,

Réal Sureau

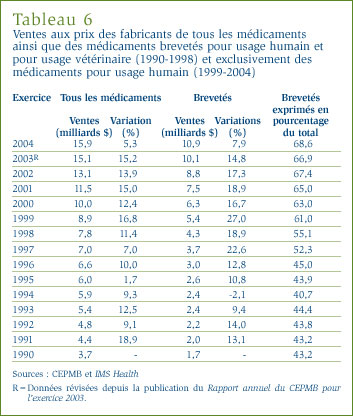

Ventes

- Au Canada, la valeur totale des ventes au prix du fabricant de tous les médicaments pour usage humain a augmenté de 5,3 % par rapport à l'exercice 2003 pour se situer à 15,9 milliards de dollars. Ce taux de croissance de la valeur des ventes n'a jamais été aussi bas depuis 1997.

- La valeur des ventes des médicaments brevetés a totalisé 10,9 milliards de dollars, soit 7,9 % de plus qu'en 2003. Ce taux de croissance de la valeur des ventes est le plus modeste depuis 1996.

- Les médicaments brevetés absorbent 68,6 % de la valeur totale des ventes de médicaments, un taux légèrement plus élevé que l'an dernier.

Conformité

- Quatre-vingt-quatorze médicaments ont été lancés sur le marché canadien, dont 25 nouvelles substances actives. En date du 31 mars 2005, les prix de 90 nouveaux médicaments brevetés avaient fait l'objet d'un examen du CEPMB. Les prix de 68 de ces 90 nouveaux médicaments ont été jugés conformes aux Lignes directrices et ceux de 22 médicaments sont actuellement sous enquête.

Application

- Le Conseil a émis trois Avis d'audience et accepté huit engagements de conformité volontaire.

Tendances des prix des medicaments

- Les prix des médicaments brevetés mesurés à l'aide de l'Indice des prix des médicaments brevetés (IPMB) ont reculé de 0,2 %. L'analyse des prix selon la catégorie thérapeutique révèle des écarts importants par rapport à l'exercice précédent.

- Le ratio des prix des médicaments brevetés pratiqués au Canada par rapport à la médiane des prix pratiqués dans les différents pays de comparaison nommés dans le Règlement sur les médicaments brevetés est inférieur au prix médian international, soit à environ 91 % de celui-ci. Les prix des médicaments brevetés pratiqués au Canada sont habituellement inférieurs aux prix pratiqués en Suède, en Allemagne, au Royaume Uni et en Suisse, mais supérieurs aux prix pratiqués en France et en Italie. Cette année encore, les prix pratiqués aux États-Unis sont très supérieurs aux prix pratiqués en Europe et au Canada.

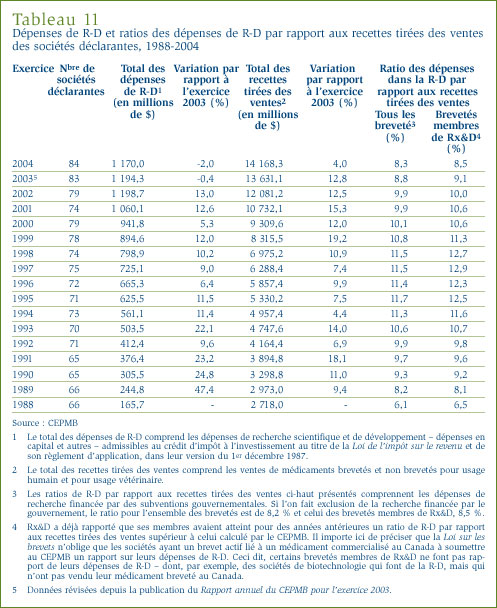

Recherche et développement

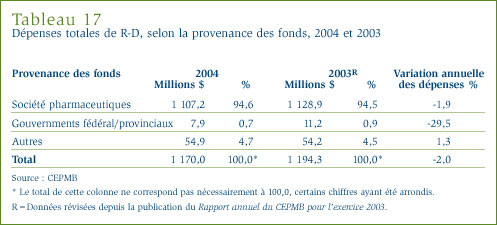

- Les brevetés ont déclaré des dépenses de R-D totalisant 1,17 milliard de dollars, soit 2 % de moins que l'exercice précédent pour lequel ces dépenses ont totalisé 1,19 milliard de dollars. Dans le cas des brevetés membres de Rx&D, ces dépenses ont totalisé 1 008,3 millions de dollars, soit 86,2 % des dépenses de R-D déclarées.

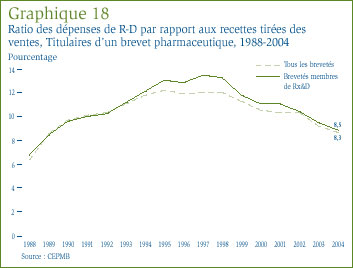

- Le ratio des dépenses de R-D par rapport aux recettes tirées des ventes pour tous les brevetés a reculé, passant de 8,8 % qu'il était en 2003 à 8,3 %. Dans le cas des brevetés membres de Rx&D, leur ratio est passé de 9,1 % à 8,5 % au cours de la même période. Ces deux ratios ont reculé au cours des dernières années, après avoir été en hausse entre 1988 et le milieu des années 1990. Dans les faits, ces ratios sont les moins élevés depuis 1989.

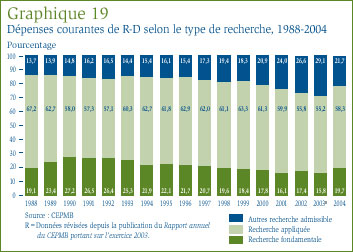

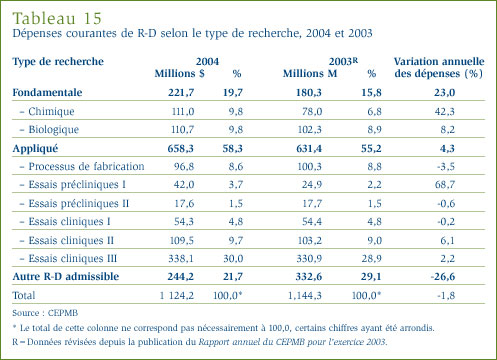

- La valeur des dépenses dans la recherche fondamentale a représenté 19,7 % des dépenses courantes dans la R-D et a totalisé 221,7 millions de dollars. Ces dépenses ont augmenté de 23 % par rapport à l'exercice précédent.

Cette année, l'insigne honneur m'est donné de signer le Mot du président dans le rapport annuel pour l'exercice 2004 du Conseil d'examen du prix des médicaments brevetés.

À l'instar de l'environnement dynamique des soins de santé, le CEPMB a connu au cours de la dernière année de nombreux changements dont le plus important a probablement été son évolution organisationnelle. En effet, après une décennie à la barre du CEPMB, le mandat du Dr Elgie est arrivé à son terme. L'une des influences marquantes du Dr Elgie a été sa capacité d'encourager ses collaborateurs à continuer d'étudier et de discuter des questions et des politiques qui orientent le travail du CEPMB. Le Dr Elgie a beaucoup accompli durant son passage au CEPMB. À preuve, le CEPMB a constamment atteint son objectif de protection des consommateurs contre les prix excessifs des médicaments.

En ma qualité de vice-président, j'assume les fonctions de la présidence du CEPMB d'ici à ce que soit nommé un nouveau président. L'exemple du Dr Elgie me guide dans l'exercice de ces fonctions dont l'objectif premier est d'appliquer les valeurs et la mission du CEPMB.

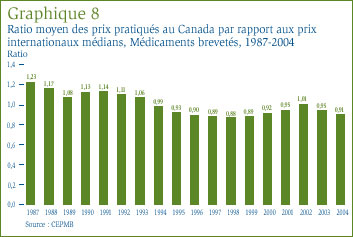

Les prix des produits pharmaceutiques demeurent au centre de nos discussions sur les politiques publiques. Le régime canadien de soins de santé, dont le CEPMB constitue un élément clé, a servi à protéger les consommateurs canadiens contre les prix excessifs des médicaments brevetés. En 1987, les prix des médicaments brevetés pratiqués au Canada étaient les deuxièmes plus élevés au monde, se situant à 23 % au-dessus de la médiane des prix internationaux et au-dessus également des prix des six pays européens utilisés aux fins des comparaisons des prix internationaux. Suite à la création du CEPMB et de l'adoption de ses Lignes directrices, le ratio des prix canadiens a diminué, mais au début des années 90 les prix des médicaments brevetés dépassaient encore d'environ 10 % la médiane des prix internationaux. Conscient de ne pas avoir atteint son objectif, le Conseil a modifié ses Lignes directrices en 1994. Depuis, les prix canadiens des médicaments brevetés se situent de 5 à 12 % sous la médiane des prix internationaux.

En 2004, le CEPMB a pris connaissance d'articles publiés dans les médias annonçant une hausse des prix des médicaments et a commencé à recevoir des questions des régimes publics d'assurance-médicaments concernant les préavis d'augmentation de prix reçus. Le Conseil a été mis au courant d'informations selon lesquelles un certain nombre de fabricants de médicaments brevetés avaient annoncé publiquement les augmentations des prix de leurs médicaments. Ces augmentations, si elles sont appliquées, pourraient faire renverser les tendances des prix observées tout au cours de la dernière décennie. Par

conséquent, nous avons engagé une discussion publique sur les augmentations des prix et publié à cette fin un document de discussion. Nous prenons actuellement acte des mémoires que nous ont fait parvenir les intervenants après quoi le Conseil déterminera les mesures qu'il y a lieu d'appliquer.

Au cours de la dernière décennie, le secteur des médicaments brevetés a enregistré une forte croissance - sa part de l'ensemble des ventes de médicaments brevetés au Canada ayant en effet passé de 45 % qu'elle était en 1996 à plus de 68 % en 2004. Cette même année, la valeur totale des ventes de tous les médicaments frisait les 16 milliards de dollars. Ces augmentations se sont également reflétées au niveau des dépenses des gouvernements et des consommateurs plus particulièrement au niveau de la protection de l'assurance privée et des sommes investies personnellement pour se procurer des médicaments.

Dans son dernier rapport, l'Institut canadien d'information sur la santé (ICIS) a estimé à 22 milliards de dollars la valeur totale des dépenses engagées au Canada pour l'achat de médicaments, ce qui représente environ 17 % de la valeur totale des dépenses en soins de santé. Les régimes publics ont cherché à mieux saisir les raisons d'une telle croissance des dépenses en médicaments afin de déterminer si elle est justifiée. Ils ont à cette fin adopté de nouvelles approches afin de limiter les coûts et de favoriser une collaboration.

Le CEPMB, pour sa part, a été appelé à se pencher sur les questions ayant trait aux coûts des médicaments. Nos études antérieures ont démontré que le lancement sur le marché canadien de nouveaux médicaments et le recours plus grand aux médicaments par le régime de soins de santé constituent les principaux facteurs à la source des augmentations des dépenses en médicaments.

Au titre du Système national d'information sur les médicaments prescrits (SNIUMP), le CEPMB a mis en place diverses initiatives. Le SNIUMP a pour mandat de fournir des analyses critiques des prix, de l'utilisation et des tendances des coûts des médicaments de manière à fournir à notre régime de santé des renseignements plus complets et plus exacts sur la façon dont sont utilisés les médicaments d'ordonnance ainsi que sur les sources d'augmentation des coûts. À l'heure actuelle, le CEPMB participe à différents projets qui permettront de fournir ces éléments d'information aux juridictions participantes.

Comme l'a démontré le SNIUMP, la collaboration entre les différentes instances gouvernementales constitue un élément important des solutions aux problèmes qui affectent actuellement le régime de soins de santé et, par ricochet, tous les Canadiens et toutes les Canadiennes. En septembre, les premiers ministres du pays ont convenu de pousser plus loin leur collaboration en adoptant la Stratégie nationale sur les produits pharmaceutiques dans le cadre de leur entente générale sur les soins de santé. Ils ont déclaré que " L'accès aux médicaments à des prix abordables constitue une condition incontournable à la santé de notre population ". Un groupe de travail ministériel étudie actuellement différents sujets clés portant, entre autres, sur l'assurance-médicaments en situation de catastrophe, l'adoption d'un formulaire national des médicaments couverts par l'assurance-médicaments, l'amélioration de l'accès aux médicaments constituant une découverte et aux médicaments non brevetés et l'atteinte d'une parité internationale des prix des médicaments non brevetés.

Non seulement assistons-nous à une plus grande collaboration entre les différentes instances canadiennes, mais également entre tous les intervenants du régime de soins de santé avec l'objectif d'améliorer la gestion des produits pharmaceutiques au cours des prochaines années.

Le CEPMB est à juste titre fier de la contribution qu'il a apportée à la société canadienne en prenant les mesures nécessaires pour que les Canadiens et les Canadiennes n'aient pas à acheter des médicaments brevetés à des prix excessifs. Nous nous promettons de continuer de travailler en collaboration avec nos partenaires et nos intervenants dans le meilleur intérêt de la population canadienne.

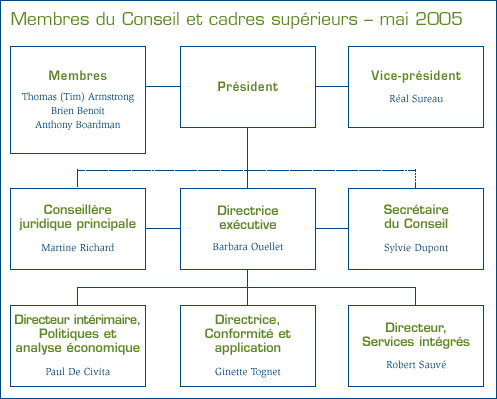

Enfin, permettez-moi de souhaiter la plus cordiale des bienvenues au Dr Brien Benoit, membre du Consiel depuis le 19 mai 2005. Je souhaite également la bienvenue à M. Anthony Boardman qui a été nommé au Conseil en mars pour un second mandat ainsi qu'à Mme Barbara Ouellet, notre nouvelle directrice exécutive depuis janvier 2005. Je tiens également à remercier Mme Ingrid Sketris pour sa contribution insigne à titre de membre du Conseil. Le mandat de Mme Sketris a pris fin en mai 2004.

Je saisis également l'occasion de remercier les membres du personnel du CEPMB pour leur contribution professionnelle et dévouée. Je souhaite remercier tout particulièrement M. Wayne Critchley qui pendant 15 ans a occupé le poste de directeur exécutif du CEPMB et qui a grandement contribué à son évolution. Mes meilleurs vœux de succès s'adressent à nos anciens collègues ainsi qu'aux nouveaux qui se joignent à notre équipe.

Le Vice-président,

Réal Sureau

Le Conseil d'examen du prix des médicaments brevetés est un organisme indépendant qui détient des pouvoirs quasi-judiciaires. Il a été créé par le Parlement en 1987 en vertu de la Loi sur les brevets (Loi). Le Ministre de la Santé est responsable de l'application des dispositions pharmaceutiques de la Loi formulées aux articles 79 à 103.

Même s'il fait techniquement partie du portefeuille de la Santé, le CEPMB exerce son mandat en toute indépendance du Ministre de la Santé.[1] Il fonctionne d'une façon indépendante des autres organismes, dont Santé Canada qui vérifie l'innocuité et l'efficacité des médicaments et les régimes publiques d'assurance-médicaments qui approuvent l'inscription des médicaments sur leurs formulaires respectifs aux fins de leur admissibilité à un remboursement.

Mandat

Le CEPMB est investi du double rôle suivant :

- Réglementation - Protéger les intérêts des consommateurs et contribuer au régime de santé canadien en exerçant un contrôle pour que les prix départ-usine des médicaments brevetés ne soient pas excessifs.

- Rapports - Éclairer les processus décisionnel et d'élaboration des politiques en établissant des rapports sur les tendances des prix des médicaments et sur les dépenses que les brevetés engagent dans la R-D.

Compétence du CEPMB

Réglementation - Le CEPMB passe en revue les prix départ-usine, à savoir les prix auxquels les brevetés vendent leurs médicaments pour usage humain ou vétérinaire distribués au Canada sous ordonnance ou en vente libre aux grossistes, aux hôpitaux et aux pharmacies pour que ces prix ne soient pas excessifs. Le CEPMB exerce un contrôle sur le prix de chaque médicament breveté, soit de chaque concentration de chaque forme posologique de chaque médicament breveté offert sur le marché canadien. C'est habituellement à ce niveau que Santé Canada attribue le numéro d'identification de drogue (DIN). C'est également à ce niveau que le CEPMB exerce son contrôle.

Au Canada, c'est Santé Canada qui évalue les nouveaux médicaments pour en assurer la conformité à la Loi sur les aliments et drogues et à son règlement d'application. L'autorisation officielle de commercialiser ou de distribuer un médicament est accordée au moyen d'un Avis de conformité. Dans certains cas, un médicament peut être temporairement distribué même si l'avis de conformité n'a pas été émis, nommément à titre de drogue de recherche ou de médicament distribué dans le cadre du Programme d'accès spécial.

Le CEPMB n'est pas habilité à exercer un contrôle sur les prix des médicaments non brevetés, incluant les médicaments génériques vendus en vertu de licences obligatoires. Il n'a droit de regard sur les prix de vente au gros et au détail ni sur les honoraires des pharmaciens. La distribution et l'ordonnance des médicaments ne relèvent pas non plus de la compétence du CEPMB.

Aux fins de la réglementation des prix, le Règlement sur les médicaments brevetés (Règlement) exige des brevetés qu'ils soumettent deux fois par année des données sur les prix et sur les ventes de chaque concentration de chaque forme posologique de chaque médicament breveté qu'ils offrent sur le marché canadien. Les brevetés sont également tenus en vertu du Règlement de présenter une fois par année un rapport sur les dépenses de R-D qu'ils effectuent au Canada.

Les fabricants doivent également informer le CEPMB de leur intention de vendre un nouveau médicament breveté sur le marché canadien, mais ils ne sont pas tenus de faire approuver au préalable le prix auquel ils offriront leur médicament.

Les brevetés doivent se conformer aux dispositions de la Loi sur les brevets de manière à maintenir les prix des médicaments brevetés à des niveaux non excessifs. Lorsque, à l'issue d'une audience publique, le Conseil arrive à la conclusion que le prix d'un médicament vendu sur tout marché canadien est excessif, il peut obliger le breveté à réduire le prix de son médicament et prendre les mesures qui s'imposent pour que le breveté rembourse les recettes excessives qu'il a perçues.

Rapports - Le CEPMB rend annuellement compte de ses activités au Parlement par le truchement du ministre de la Santé. Le rapport annuel, qui porte sur une année civile, passe en revue les principales activités du CEPMB, analyse les prix des médicaments brevetés et les tendances des prix de tous les médicaments, et fait rapport des dépenses de R-D déclarées par les titulaires de brevets pharmaceutiques. Le CEPMB fait également rapport de ses activités au moyen de son feuillet trimestriel La Nouvelle et de différentes études.

En vertu d'une entente intervenue entre les ministres fédéral, provinciaux et territoriaux de la Santé et à la demande expresse du ministre de la Santé, le CEPMB effectue des recherches sur l'utilisation et la gestion des produits pharmaceutiques au Canada et en fait rapport au titre du Système national d'information sur l'utilisation des médicaments prescrits (SNIUMP).

Ventes de médicaments au Canada

La valeur totale des ventes au prix du fabricant des médicaments pour usage humain est évaluée à 15,9 milliards de dollars pour l'exercice 2004, ce qui représente une augmentation de 5,3 % par rapport à l'exercice 2003. Les brevetés ont fait rapport de ventes de médicaments brevetés totalisant 10,9 milliards de dollars, soit 7,9 % de plus que l'exercice précédent.

Conformité et Lignes directrices sur les prix excessifs

En vertu de l'article 82 de la Loi sur les brevets (Loi), les brevetés sont tenus d'informer le CEPMB de leur intention de lancer un médicament sur le marché canadien et de la date à laquelle ils envisagent le faire.

En vertu du Règlement sur les médicaments brevetés, 1994 (Règlement), les brevetés doivent :

- remplir le formulaire Renseignements identifiant le médicament (Formulaire 1) dans les 30 jours suivant la réception de l'Avis de conformité ou de la date de la première vente du médicament, soit la première éventualité

- faire rapport des prix de lancement de leurs médicaments brevetés et de la valeur de leurs ventes (Formulaire 2) dans les 60 jours suivant la date de la première vente

- tant qu'un brevet lié au médicament est en vigueur, continuer de soumettre des données détaillées sur les prix et sur les ventes de chaque médicament breveté et ce, pour chaque semestre de l'exercice (Formulaire 2).

Le CEPMB passe en revue sur une base régulière les données fournies sur le prix de tous les médicaments brevetés offerts sur le marché canadien afin de s'assurer que les prix pratiqués sont conformes à ses Lignes directrices sur les prix excessifs. Ces Lignes directrices sont publiées dans le Compendium des Lignes directrices, politiques et procédures (Compendium) qui est affiché sur notre site Web sous la rubrique " Loi, Règlement et Lignes directrices ". Vous pouvez également en obtenir copie en composant notre numéro sans frais 1 877 861-2350.

Lignes directrices sur les prix excessifs

Les Lignes directrices sur les prix excessifs tiennent compte des facteurs de détermination des prix cités à l'article 85 de la Loi. Elles ont été formulées en consultation avec différents intervenants, dont les ministres de la Santé des provinces et des territoires, des associations de consommateurs et des représentants du secteur pharmaceutique. D'une façon générale, les Lignes directrices prévoient ce qui suit :

- les prix de la plupart des nouveaux médicaments brevetés sont limités de manière à ce que le coût de revient de la thérapie à l'aide de ce médicament ne soit pas supérieur au coût de la thérapie utilisée au Canada pour traiter la même condition

- les prix des médicaments brevetés constituant une découverte ou apportant une amélioration importante ne peuvent être supérieurs à la médiane des prix pratiqués dans les sept pays industrialisés nommés dans le Règlement, à savoir l'Allemagne, la France, l'Italie, la Suède, la Suisse, le Royaume Uni et les États-Unis

- les taux d'augmentation des prix des médicaments brevetés existants ne peuvent être supérieurs à l'Indice des prix à la consommation

- le prix d'un médicament breveté au Canada ne peut en aucun temps être supérieur au prix le plus élevé pratiqué pour le même médicament dans les pays de comparaison nommés dans le Règlement.

Le personnel du Conseil passe en revue les prix de tous les médicaments brevetés commercialisés au Canada. Le personnel effectue une enquête lorsque le prix d'un médicament breveté lui apparaît supérieur au prix que permettent les Lignes directrices et que les circonstances justifient la tenue d'une enquête pour faire la lumière sur les faits. Vous trouverez à l'annexe 1, à la page 45, de plus amples explications sur les critères qui justifient la tenue d'une enquête. Une enquête peut mener aux résultats suivants :

- sa fermeture lorsque le prix se révèle conforme aux Lignes directrices

- un engagement de conformité volontaire en vertu duquel le fabricant s'engage à réduire le prix de son médicament et à prendre d'autres mesures pour se conformer aux Lignes directrices, ou

- une audience publique pour déterminer si le prix du médicament est excessif ainsi que l'ordonnance qu'il y a lieu d'imposer.

Depuis 2001, dans un effort pour améliorer la transparence de son processus d'examen du prix, le CEPMB publie chaque mois sur son site Web la liste des Nouveaux médicaments brevetés ayant fait l'objet d'un rapport au CEPMB. Cette liste contient de l'information sur le statut de l'examen (par ex. à l'étude, conforme aux Lignes directrices, engagement de conformité volontaire, avis d'audience). Les médicaments classés " à l'étude " comprennent les médicaments sous enquête. Comme il en a été fait mention dans la livraison d'avril 2005 de La Nouvelle, à compter de 2005, les médicaments qui font l'objet d'une enquête ne seront plus classés sous la rubrique " à l'étude ". Lorsque le prix semblera supérieur aux limites autorisées par les Lignes directrices et lorsque les conditions justifiant une enquête seront en place, le médicament en cause sera inscrit sous la nouvelle rubrique " sous enquête ".

Nouvelles substances actives approuvées en 2004

Santé Canada a approuvé 17 nouvelles substances actives (NSA) en 2004, mais elles n'ont pas toutes été offertes sur le marché canadien cette même année. [2] La liste du CEPMB des nouvelles substances actives n'est pas nécessairement identique à celle des nouvelles substances approuvées par la Direction des produits thérapeutiques de Santé Canada pour l'une ou l'autre des raisons suivantes :

- la NSA n'est pas brevetée et, par conséquent, n'est pas assujettie à la compétence du CEPMB

- la NSA ne figure pas sur la liste de la Direction des produits thérapeutiques parce qu'elle est vendue au titre du Programme d'accès spécial avant même d'avoir reçu son Avis de conformité

- la NSA peut avoir été approuvée, mais elle n'a pas encore été vendue.

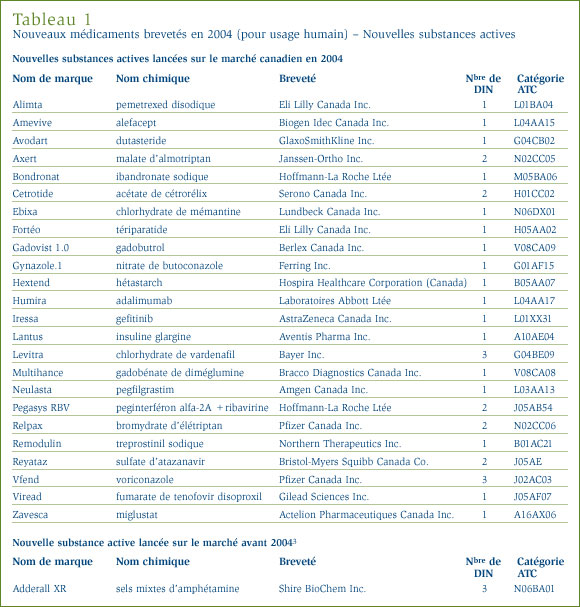

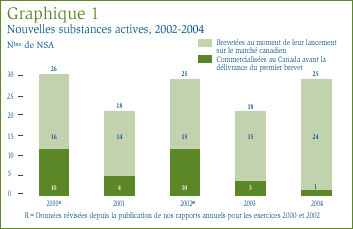

Comme le montrent le tableau 1, à la page 10, et le graphique 1, une des 25 NSA brevetées devenues assujetties à l'examen du CEPMB était commercialisée sur le marché canadien avant 2004.

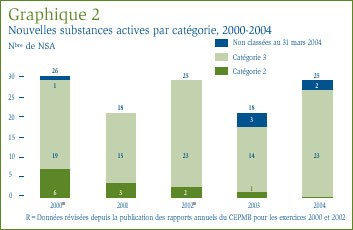

Une NSA peut être associée à différents DIN lorsqu'elle est distribuée sous diverses formes posologiques et dans diverses concentrations. Les 25 NSA approuvées en 2004 ont été commercialisées sous 36 présentations (DIN). Le graphique 2 ventile les NSA brevetées pour usage humain selon la catégorie attribuée aux fins de l'examen des prix pour la période de 2000 à 2004 inclusivement. [4]

Les rapports sommaires des examens du prix des nouvelles substances actives sont affichés sur notre site Web.

Depuis la publication de notre rapport annuel pour l'exercice 2003, nous avons mis à jour les graphiques 1 et 2 de manière à y inclure la nouvelle substance active Dicetel (bromure de pinaverium, Solvay Pharma Inc.) lancée sur le marché canadien en 2000. Le breveté a fait rapport de ce médicament au CEPMB en mars 2004 et son prix est actuellement sous examen.

Nouveaux médicaments brevetés commercialisés au Canada en 2004

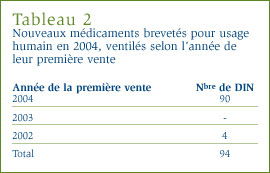

Au total, 94 nouveaux médicaments brevetés pour usage humain, aussi appelés DIN, ont été lancés sur le marché canadien en 2004. Certains de ces nouveaux médicaments représentent une ou plusieurs concentrations d'une NSA et d'autres, de nouvelles présentations de médicaments existants.

Aux fins de notre examen du prix, tout médicament breveté lancé sur le marché canadien ou commercialisé avant l'obtention de son premier brevet entre le 1er décembre 2003 et le 30 novembre 2004 est réputé avoir obtenu son brevet en 2004. [5]

Six (6,4 %) de ces 94 nouveaux médicaments brevetés ont été commercialisés au Canada avant la délivrance d'un premier brevet canadien qui les assujettit automatiquement à la compétence du Conseil. Ces DIN sont identifiés par les lettres PBA (pour premier brevet accordé) dans l'annexe 2, à la page 46. Le tableau 2, à la page 12, présente le nombre de médicaments brevetés selon la première année de leur commercialisation. Pour ces médicaments, le délai écoulé entre la date de la première vente et celle de l'obtention du premier brevet varie entre plusieurs mois et deux années.

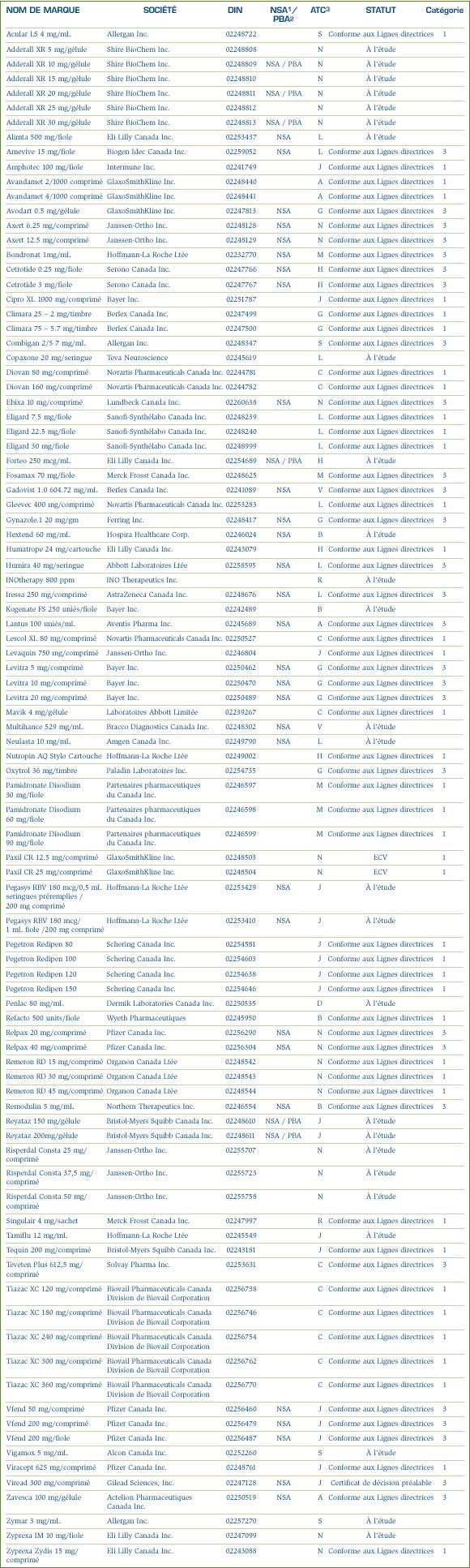

Examen du prix des nouveaux médicaments brevetés pour usage humain

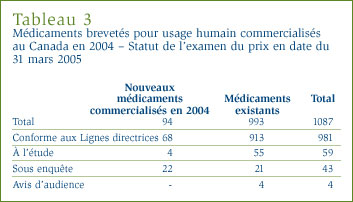

La liste des 94 nouveaux médicaments brevetés, incluant le statut de l'examen des prix en date du 31 mars 2005, est présentée à l'annexe 2, à la page 46. Des 94 nouveaux DIN brevetés, 90 alors avaient fait l'objet d'un examen du prix. De ces 90 DIN, 25 ont été commercialisés à des prix supérieurs aux prix autorisés, justifiant ainsi une enquête. Au moment de la publication du présent rapport, trois enquêtes ont été complétées, dont deux suite à un engagement de conformité volontaire et une parce que le prix s'est révélé conforme aux Lignes directrices. Ainsi, les prix de 22 autres médicaments sont actuellement sous enquête. Vous trouverez à l'annexe 1, à la page 45, de plus amples explications sur les critères qui justifient la tenue d'une enquête. Les prix de 68 nouveaux médicaments brevetés lancés sur le marché canadien ont été jugés conformes aux Lignes directrices.

Examen du prix des médicaments brevetés existants pour usage humain

Aux fins du présent rapport, les médicaments existants désignent tous les médicaments brevetés commercialisés sur le marché canadien avant le 1er décembre 2003. Les Lignes directrices du CEPMB limitent les augmentations des prix des médicaments existants aux variations de l'Indice des prix à la consommation (IPC). Par ailleurs, le prix d'un médicament breveté ne peut être supérieur à son prix de vente le plus élevé des sept pays de comparaison nommés dans le Règlement (ces pays sont l'Allemagne, la France, l'Italie, la Suède, la Suisse, le Royaume Uni et les États-Unis). Au total, 993 médicaments brevetés existants pour usage humain (DIN) ont été commercialisés au Canada au cours de l'exercice 2004.

En début d'exercice, 51 enquêtes étaient en cours et 11 nouvelles se sont ajoutées parce que les prix de ces médicaments ne semblaient pas conformes aux Lignes directrices. En fin d'exercice, 41 des 62 enquêtes étaient finalisées, laissant 21 enquêtes en cours.

Au moment de la rédaction du présent rapport :

- les prix des 913 DIN existants (92 %) ont, après examen, été jugés conformes aux Lignes directrices

- 21 DIN faisaient l'objet d'une enquête engagées en raison des prix pratiqués au cours d'exercices antérieurs (5 DIN étaient de nouveaux médicaments lancés sur le marché canadien en 2002, 6 de nouveaux médicaments lancés sur le marché canadien en 2003, 10 des médicaments existants - 5 en 2003 et 5 autres en 2004)

- 4 DIN, dont 3 concernant le Nicoderm et 1 concernant le Dovobet, faisaient l'objet d'une audience en vertu de l'article 83 de la Loi (voir la rubrique Activités quasi-judiciaires à la page 18)

- 55 DIN étaient encore à l'étude.

Le tableau 3 présente un aperçu du statut d'examen, de conformité et d'enquête en date du 31 mars 2005 des médicaments brevetés nouveaux et existants commercialisés au Canada au cours de l'exercice 2004.

Nous avons mentionné dans le rapport annuel de l'an dernier que le CEPMB s'était intéressé d'une façon toute particulière à certaines initiatives touchant l'examen des échéanciers. Ce projet a donné lieu à une diminution importante du nombre d'enquêtes en cours qui sont passées de 67 à 51 entre le 31 mars 2003 et le 31 mars 2004. Le CEPMB a poursuivi son travail au niveau de ce projet. D'autres initiatives ont été mises en œuvre en 2004 (voir page 34). Le nombre d'enquêtes a continué de diminuer passant à 43 en date du 31 mars 2005.

PCEM / CEPMB

Le Programme commun d'évaluation des médicaments (PCEM), un processus unifié d'évaluation des nouveaux médicaments, donne lieu à la formulation de recommandations à l'intention des régimes d'assurance-médicaments fédéral, provinciaux et territoriaux (F-P-T) quant à l'opportunité d'ajouter certains médicaments à leurs formulaires respectifs. À l'exception du Québec, toutes les provinces et tous les territoires participent à ce programme. Le PCEM évalue les nouveaux médicaments et communique les recommandations formulées par le Comité consultatif canadien d'expertise sur les médicaments (CCCEM) concernant la liste des médicaments admissibles à un remboursement par les régimes publics d'assurance-médicaments. Au moment de prendre des décisions concernant les médicaments qu'il y a lieu d'inscrire sur les formulaires de médicaments admissibles à un remboursement, les différents régimes publics d'assurance-médicaments évaluent la recommandation formulée au titre du PCEM à la lumière de leur mandat, de leurs priorités et de leurs ressources respectives. Vous trouverez de plus amples renseignements sur le PCEM et sur le CCCEM sur le site Web de l'Office canadien de coordination de l'évaluation des technologies de la santé (OCCETS) (http://www.ccohta.ca).

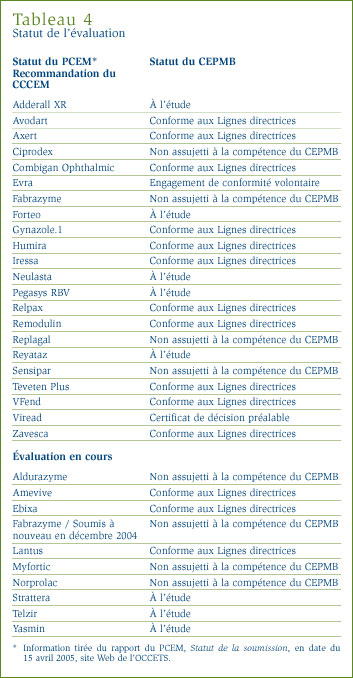

Le tableau 4 présente de l'information sur le statut des examens du PCEM et sur l'examen des prix du CEPMB.

Suivi : nouveaux médicaments brevetés mentionnés dans des rapports annuels antérieurs

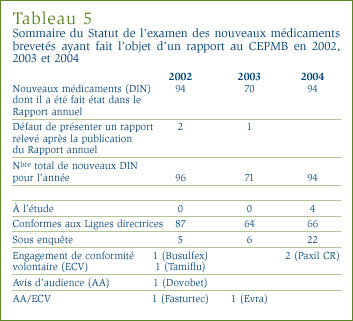

Le tableau qui suit constitue une mise à jour en date du 31 mars 2005 des nouveaux médicaments brevetés, exprimés en DIN, dont il a été fait état dans les rapports annuels d'exercices antérieurs.

Mise à jour des médicaments existants tirés du Rapport annuel 2003

Dans son rapport annuel de l'an dernier, le Conseil mentionnait que les prix de 41 des 974 médicaments brevetés pour usage humain commercialisés au Canada en 2003 étaient sous examen au moment d'aller sous presse. Il est ressorti de ces examens que les prix de 19 de ces médicaments étaient conformes aux Lignes directrices et que les prix de quatre DIN semblaient supérieurs aux limites autorisées et justifiaient la tenue d'une enquête. Les prix de 18 DIN encore à l'étude sont comptabilisés dans le tableau 3, à la page 12.

Le Conseil mentionnait également dans son rapport annuel de 2003 que 39 DIN étaient sous enquête. Trente quatre de ces enquêtes sont closes : 28 de ces cas, les prix ont été reconnus conformes aux Lignes directrices; six cas, à savoir Fasturtec, One-Alpha, Tamiflu, Starnoc, Busulfex et Prolastin, ont été réglés au moyen d'un Engagement de conformité volontaire (voir la rubrique Engagements de conformité volontaire à la page 15).

Médicaments brevetés pour usage vétérinaire

En septembre 2003, le CEPMB a adopté le processus d'examen qui ne s'engage que sur réception d'une plainte relative au prix d'un médicament pour usage vétérinaire breveté. Cette décision a été communiquée aux intervenants dans la livraison de janvier 2004 de La Nouvelle. Étant donné que le Règlement ne fait aucune distinction entre les médicaments brevetés pour usage humain et les médicaments brevetés pour usage vétérinaire en ce qui a trait à la présentation de rapport, il doit être modifié pour permettre cette distinction. Les modifications proposées et soumises à une consultation auprès des intervenants ont été publiées dans la livraison de janvier 2005 de La Nouvelle. La date limite de réception des mémoires des intervenants sur les changements proposés au Règlement a été fixée au 15 avril 2005. Le Conseil fera rapport dans son Programme de recherche du suivi qu'il donnera à cette initiative et publiera les mémoires reçus.

Dans l'intervalle, le processus d'examen des médicaments brevetés pour usage vétérinaire est maintenu. Le personnel du Conseil ne passe en revue que les prix des nouveaux médicaments brevetés pour usage vétérinaire. Les médicaments existants ne font l'objet d'un examen que sur réception d'une plainte fondée. Le Conseil n'a reçu en 2004 aucune plainte concernant le prix d'un médicament breveté pour usage vétérinaire.

Notre rapport annuel pour l'exercice 2003 mentionnait que les prix de sept DIN étaient à l'étude. Les prix de cinq de ces DIN ont été jugés conformes aux Lignes directrices alors que les prix des deux autres DIN et le prix d'un nouveau médicament lancé sur le marché canadien en 2003 étaient à l'étude au moment de la rédaction du présent rapport. Les rapports sommaires de l'examen du prix des médicaments pour usage vétérinaire sont affichés sur notre site Web sous les rubriques " Médicaments brevetés; Rapports sur les nouveaux médicaments brevetés pour usage vétérinaire ".

En vertu de l'alinéa 4 de l'article 98 de la Loi sur les brevets, le Conseil peut, à la demande du breveté, émettre un certificat de décision préalable lorsqu'il est convaincu que le prix pratiqué ou proposé du médicament n'est pas supérieur au prix maximal non excessif établi en vertu des Lignes directrices du CEPMB. Ce certificat n'engage d'aucune façon la décision ultérieure du CEPMB. Comme le prévoit l'alinéa 4 de l'article 98 de la Loi, tout examen mené aux fins de la délivrance d'un certificat doit se fonder sur les faits importants alors disponibles.

Viread, Gilead Sciences Inc.

Le 13 avril 2004, le Président du Conseil a pris la décision de publier un Avis et Commentaires dans lequel il proposait de délivrer un certificat de décision préalable concernant le prix du médicament breveté Viread.

Le Viread est indiqué pour le traitement des infections au VIH-1. Il est distribué au Canada par Gilead Sciences, Inc. depuis le mois de mars 2004.

À l'issue de négociations avec le personnel du Conseil, Gilead a demandé au Conseil de délivrer un certificat de décision préalable relativement au prix moyen de vente du comprimé de 300 mg de Viread à 15,1250 $.

Le personnel du Conseil a recommandé au Conseil de conclure que, à la lumière des facteurs mentionnés à l'article 85 de la Loi, il n'existait pas de motifs justifiant une ordonnance à l'encontre du Viread en vertu de l'article 83 de la Loi.

Le Conseil a reçu un mémoire présenté par le Conseil canadien de surveillance et d'accès aux traitements (CCSAT) suite à la publication d'un Avis et commentaires. Les ministres de la Santé des provinces et des territoires n'ont soumis aucun mémoire dans cette affaire. Gilead et le personnel du Conseil ont répliqué par écrit au mémoire du CCSAT.

Après avoir pris connaissance des mémoires du CCSAT, de Gilead et du personnel du Conseil et à la lumière des faits portés à sa connaissance, le Président du Conseil est arrivé à la conclusion qu'il n'existait pas de motifs justifiant une ordonnance en vertu de l'article 83 de la Loi et qu'il était de l'intérêt public de délivrer un certificat de décision préalable relativement au prix proposé du médicament Viread. Le CEPMB continuera d'exercer un suivi du prix du Viread afin de s'assurer qu'il demeure conforme à ses Lignes directrices tant et aussi longtemps que le médicament sera assujetti à sa compétence.

Le Certificat de décision préalable et les motifs du Conseil sont publiés sur notre site Web sous les rubriques " Publications; Certificats de décision préalable; Viread ". Vous pouvez obtenir des copies des mémoires auprès de la Secrétaire du Conseil.

En vertu de la politique de conformité et d'application du CEPMB, les brevetés ont la possibilité de conclure un engagement de conformité volontaire (engagement) lorsque, après enquête, le personnel du Conseil arrive à la conclusion que le prix d'un médicament fixé par le breveté semble supérieur au prix maximal autorisé en vertu des Lignes directrices sur les prix excessifs.

Engagement écrit pris par le breveté de baisser le prix de son médicament pour le rendre conforme aux Lignes directrices du CEPMB sur les prix excessifs. Vous trouverez de plus amples renseignements et définitions dans la section " Glossaire " du présent rapport.

L'acceptation de cet engagement par le Président constitue une alternative aux procédures quasi-judiciaires qui s'engagent suite à la publication d'un Avis d'audience. La politique du Conseil sur la conformité et l'application autorise la présentation d'un engagement de conformité volontaire après la publication d'un Avis d'audience. L'engagement soumis à ce point requiert l'aval du Conseil.

En 2004, cinq engagements de conformité volontaire ont été acceptés pour les médicaments brevetés suivants :

- One-Alpha, LEO Pharma Inc.

- Fasturtec, Sanofi-Synthélabo Canada Inc.

- Prolastin, Bayer Inc.

- Starnoc, Servier Canada Inc.

- Busulfex, ESP Pharma Inc.

En février 2005, le Conseil a accepté l'engagement soumis par Janssen-Ortho Inc. pour son médicament breveté Evra. En mars 2005, le Président a accepté deux autres engagements, soit un présenté par GlaxoSmithKline Inc. pour son médicament Paxil CR et un autre présenté par Hoffmann-La Roche Limitée pour son médicament Tamiflu.

One-Alpha, LEO Pharma Inc.

One-Alpha est indiqué pour le traitement de l'hypocalcémie, de l'hyperthyroïdisme secondaire et de l'ostéotrophie chez les patients souffrant d'insuffisance rénale chronique.

Le 6 mai 2004, le Président a accepté l'engagement soumis par LEO Pharma Inc. pour son médicament breveté One-Alpha (alfacalcidol). LEO Pharma commercialise ce médicament au Canada depuis janvier 2001.

Comme le prévoyait l'engagement, LEO Pharma a réduit le prix moyen de son médicament pour qu'il se situe dans les limites du prix maximal non excessif établi à 13,3750 $ le millilitre pour 2004. En guise de remboursement des recettes excessives encaissées au cours de la période du 1er janvier 2001 au 31 décembre 2003, LEO Pharma a remis un chèque de 23 049,10 $ au gouvernement du Canada.

Le rapport annuel portant sur l'exercice 2003 présentait de plus amples renseignements concernant l'engagement soumis par LEO Pharma pour son médicament One-Alpha. Cet engagement est également affiché sur notre site Web sous les rubriques " Publications; Engagements de conformité volontaire; One-Alpha ".

Fasturtec, Sanofi-Synthélabo Canada Inc.

Le Fasturtec est indiqué pour le traitement et la prévention de l'hyperuricémie chez les enfants et les adultes atteints d'un cancer. Il est administré par intraveineuse exclusivement en milieu hospitalier.

Le Conseil a mis fin aux procédures qu'il avait engagées le 20 mai 2004 relativement au médicament breveté Fasturtec en acceptant l'engagement de Sanofi-Synthélabo Canada Inc. (Sanofi). Comme le prévoyait cet engagement, Sanofi a à compter du 26 juillet 2004 réduit le prix de la fiole de son médicament qui est passé de 295 $ à environ 125 $.

Cet engagement est favorable pour les consommateurs canadiens et pour le régime de soins de santé étant donné qu'il donne lieu à une réduction immédiate du prix du Fasturtec à moins de la moitié de son prix de vente moyen et qu'il fait en sorte qu'aucun consommateur canadien n'aura à l'avenir à acheter ce médicament à un prix plus élevé que le prix maximal non excessif. Le prix du Fasturtec est ainsi devenu conforme aux Lignes directrices du CEPMB et doit le demeurer tant et aussi longtemps que le médicament sera assujetti à la compétence du Conseil, soit au moins jusqu'en 2015.

L'engagement établit que le prix de vente moyen du Fasturtec pour 2004 ne sera pas supérieur au prix maximal non excessif établi à 124,7854 $ la fiole. L'engagement prévoit également le remboursement des recettes excessives encaissées entre le 21 mai 2002 et le 31 décembre 2003 au moyen de rabais consentis à différents clients de Sanofi, à savoir aux 28 hôpitaux qui ont acheté du Fasturtec au cours de la période où le prix du médicament était excessif.

Dans son mémoire, le personnel du Conseil a noté que Sanofi se proposait de maintenir pour son médicament un prix de liste beaucoup plus élevé que le prix réduit et ce, malgré l'engagement pris de faire en sorte qu'aucun client canadien n'aurait à acheter le Fasturtec à un prix supérieur au prix réduit. Vous trouverez dans le présent rapport de plus amples renseignements sur cette initiative du Conseil sous la rubrique " Initiatives de politique de recherche " à la page 35.

Prolastin, Bayer Inc.

Le Prolastin, un dérivé du plasma humain, est indiqué pour le traitement d'un trouble génétique rare, plus précisément comme traitement de substitution chronique chez les personnes atteintes d'une déficience congénitale d'Alpha 1-PI (déficience d'antitrypsine alpha 1) et démontrant cliniquement un emphysème panlobulaire.

Le 9 juillet 2004, le Président a accepté l'engagement que lui a soumis Bayer Inc. concernant le prix de son médicament breveté Prolastin.

L'engagement reconnaît que le prix maximal non excessif d'une fiole de Prolastin était de 288 $ pour 2003 et que le prix de transaction moyen ne pouvait être supérieur à ce montant.

Bayer s'est également engagé à vendre son médicament au Canada au cours des années 2004, 2005 et 2006 à un prix se situant dans les limites (a) du prix maximal non excessif établi pour 2003 et rajusté en fonction de l'IPC et (b) du prix international médian établi pour ces mêmes années. De plus, si Bayer devait augmenter après 2006 le prix du Prolastin à un niveau supérieur au prix rajusté en fonction de l'IPC établi à l'aide de la méthodologie décrite dans les Lignes directrices, il devra en donner un préavis écrit au CEPMB et fournir les éléments de preuve justifiant l'augmentation. Considérant ces circonstances particulières, le Président a accepté l'engagement. Le CEPMB se réserve toutefois le droit d'engager une enquête en vertu de sa politique de conformité et d'application si les circonstances le justifient.

Starnoc, Servier Canada Inc.

Le Starnoc est indiqué pour le traitement à court terme et pour le traitement symptomatique de l'insomnie chez les patients éprouvant de la difficulté à s'endormir.

Après avoir pris connaissance de l'engagement soumis par Servier Canada Inc., le CEPMB a mis fin à son enquête sur le prix du médicament breveté Starnoc. Par cet engagement, Servier Canada Inc. s'est engagé à réduire de plus de 40 % le prix de son médicament et à rembourser au gouvernement du Canada les recettes excessives encaissées grâce à la vente de son médicament à un prix excessif.

Le 15 juillet, le Président a accepté l'engagement qui reconnaissait que le prix maximal non excessif de la gélule de 5 mg de Starnoc était de 0,4526 $ pour l'année 2000 et de 0,4964 $ pour l'année 2004 alors que pour la gélule 10 mg ce prix était respectivement de 0,6816 $ et de 0,7475 $ pour les années 2000 et 2004.

Pour faire en sorte que Servier n'encaisse pas de recettes excessives en raison d'une pratique de prix excessifs entre le 1er janvier et le 30 juin 2004, Servier a remis en 2004 la somme de 739 739,99 $ au gouvernement du Canada.

De plus, pour rembourser le reliquat des recettes excessives de 3 838 801,86 $, Servier pratiquera jusqu'à la fin de l'année 2005 des prix inférieurs aux prix rajustés en fonction de l'IPC pour tous ses médicaments brevetés. Dans l'éventualité où les recettes excessives n'auraient pas été totalement remboursées à la fin du mois de décembre 2005, Servier remettra au gouvernement du Canada le solde des recettes excessives qu'il a encaissées et ce, au plus tard le 30 janvier 2006.

Les prix du Starnoc demeureront assujettis à la compétence du CEPMB jusqu'à l'échéance de son brevet, soit jusqu'en juin 2007.

Busulfex, ESP Pharma Inc.

Le Busulfex est un agent antinéoplasique indiqué pour utilisation en combinaison avec d'autres agents chimiothérapeutiques et (ou) avec la radiothérapie comme schéma préalable à la transplantation de cellules hématopoïétiques souches ou de la moelle osseuse.

Le CEPMB a mis fin à son enquête sur le prix du médicament Busulfex après que le breveté se soit engagé à réduire de plus de 7 % le prix de son médicament.

Le 16 novembre, le Président a accepté l'engagement soumis par ESP Pharma. En vertu de cet engagement et en conformité avec les Lignes directrices du CEPMB, ESP a réduit le prix de transaction moyen de l'ampoule de Busulfex au niveau du prix maximal non excessif établi pour 2004 à 359,89 $. En guise de remboursement des recettes excessives encaissées, ESP a versé 150 646,99 $ au gouvernement du Canada.

Le Busulfex est commercialisé au Canada depuis avril 1999 quoique le brevet du médicament n'a été délivré qu'en juillet 2002. Même si le Busulfex n'est techniquement assujetti à la compétence du CEPMB que depuis juillet 2002, la compétence du CEPMB en matière d'examen du prix est rétroactive à la période préalable à la délivrance du brevet soit dans le présent cas à avril 1999.

Le prix du Busulfex demeurera assujetti à la compétence du CEPMB jusqu'en août 2014, soit jusqu'à l'échéance du brevet.

Evra, Janssen-Ortho Inc.

Le Evra est un timbre contraceptif transdermique indiqué pour empêcher la grossesse chez les femmes utilisant des contraceptifs hormonaux.

Le 21 février 2005, le Conseil a mis fin aux procédures engagées le 23 décembre 2004 concernant le médicament breveté Evra en acceptant l'engagement soumis par Janssen-Ortho Inc. En vertu de cet engagement, Janssen-Ortho a réduit d'environ 45 % le prix de son médicament, soit à 4,47 $ le timbre.

Pour rembourser les recettes excédentaires encaissées grâce à la vente du médicament Evra à un prix excessif entre la date de la première vente et le 30 juin 2004, Janssen-Ortho a remis au gouvernement du Canada un chèque de 1 359 263,67 $. D'autre part, le reliquat des recettes excédentaires encaissées entre le 1er juillet et le 31 décembre 2004, soit 1 496 019,02 $, sera remboursé au moyen d'une réduction du prix d'un autre médicament breveté de Janssen-Ortho, en l'occurrence le Levaquin 5mg/mL et 25mg/mL. Cette réduction de prix est entrée en vigueur le 1er mars 2005.

Si, en date du 31 décembre 2005, le montant des recettes excessives perçues de la vente du médicament Evra à un prix excessif n'a pas été intégralement remboursé, Janssen-Ortho remettra au gouvernement du Canada le reliquat de ces recettes au plus tard le 31 janvier 2006.

Le prix du Evra demeurera assujetti à la compétence du CEPMB jusqu'en juin 2016, soit jusqu'à la date d'échéance du brevet.

Paxil CR, GlaxoSmithKline Inc.

Le Paxil CR, contrairement aux autres présentations du Paxil, un antidépresseur, permet une libération contrôlée de la substance active. Le Paxil CR est distribué sous forme de comprimés de deux concentrations, à savoir de 12,5 mg et de 25 mg.

Pour se conformer aux Lignes directrices du CEPMB, GlaxoSmithKline (GSK) s'est engagé à porter le prix de transaction moyen de son médicament Paxil CR à un niveau inférieur au prix maximal non excessif établi pour 2005 au cours de la période de rapport allant du 1er janvier au 30 juin 2005. Pour 2005, le prix maximal non excessif d'un comprimé de 12,5 mg est de 1,5861 $ et celui d'un comprimé de 25 mg, de 1,7019 $.

GSK a remboursé les recettes excessives encaissées entre le 5 janvier et le 31 décembre 2004 en remettant au gouvernement du Canada la somme de 310 403,64 $.

Le prix du Paxil CR demeurera assujetti à la compétence du CEPMB jusqu'en juillet 2016, soit jusqu'à l'échéance du brevet.

Tamiflu, Hoffmann-La Roche Limitée

Le Tamiflu est un inhibiteur de neuraminidase à action directe.

Afin de se conformer aux Lignes directrices du CEPMB sur les prix excessifs, Hoffmann-La Roche Limitée (Roche) a reconnu que le prix maximal non excessif de la gélule de 75 mg de son médicament Tamiflu était de 3,7695 $ pour la période de janvier à décembre 2003 et de 3,8383 $ pour la période de janvier à décembre 2004. Roche s'est de plus engagé à maintenir le prix de transaction moyen de la gélule de 75 mg de Tamiflu sous la barre du prix maximal non excessif établi à 3,8917 $ pour 2005. De plus, Roche doit remettre au gouvernement du Canada les recettes excédentaires encaissées entre le 1er janvier 2003 et le 31 décembre 2004 au moyen d'un chèque de 442 973,47 $.

Le prix du Tamiflu demeurera assujetti à la compétence du CEPMB jusqu'à l'échéance de son brevet, soit jusqu'en mai 2019.

Nicoderm, Hoechst Marion Roussel Canada Inc.

Le Nicoderm est un timbre de nicotine transdermique administré pour atténuer les symptômes d´assuétude à la nicotine chez les personnes qui cessent de fumer.

Le 20 avril 1999, le Conseil a publié un Avis d´audience aux fins de déterminer en vertu des articles 83 et 85 de la Loi sur les brevets si Hoechst Marion Roussel Canada Inc. (HMRC) vendait ou avait vendu sur le marché canadien son médicament Nicoderm à des prix que le Conseil considérait excessifs et, le cas échéant, de déterminer l´ordonnance qu´il y avait lieu d´imposer. Ce cas a été mentionné à diverses reprises dans les derniers rapports annuels et dans La Nouvelle.

Suite aux décisions rendues en 1999 et 2000 par lesquelles le Conseil confirmait sa compétence à tenir une audience sur le prix du Nicoderm, HMRC a déposé deux demandes de révision judiciaire devant la Cour fédérale du Canada visant à faire infirmer les décisions du Conseil. Les 16 et 17 mai 2005, la Cour fédérale a entendu les demandes de révision judiciaire, mais elle n´a pas encore rendu ses décisions.

Fasturtec, Sanofi-Synthélabo Canada Inc.

Le Fasturtec est indiqué pour le traitement et la prévention de l´hyperuricémie chez les enfants et les adultes atteints d´un cancer. Ce médicament est administré par voie intraveineuse.

Le 28 juin 2004, le Conseil a mis fin aux procédures engagées le mois précédent concernant le prix du médicament Fasturtec en acceptant l´engagement de conformité volontaire de Sanofi-Synthélabo Canada Inc. Sanofi s´engageait ainsi à réduire à compter du 26 juillet 2004 le prix de son médicament qui passait ainsi de 295 $ à 125 $ la fiole.

Vous trouverez de plus amples renseignements sur cette affaire à la page 16 du présent rapport, dans la section portant l´intitulé Engagements de conformité volontaire.

Dovobet, LEO Pharma Inc.

Le Dovobet est indiqué pour le traitement topique des lésions actives du psoriasis vulgaris chez les adultes.

Le Conseil a publié un Avis d´audience le 29 novembre 2004 dans l´affaire LEO Pharma Inc. et le prix de son médicament breveté Dovobet. L´audience a pour objet de déterminer si, en vertu des articles 83 et 85 de la Loi sur les brevets, LEO Pharma Inc. vend ou a vendu son médicament Dovobet sur tout marché canadien à un prix que le Conseil juge excessif et de décider de l´ordonnance qu´il y a lieu de prononcer.

Le Conseil a tenu une conférence préparatoire à l´audience le 19 janvier 2005 puis trois jours d´audience en mars. Le Conseil doit entendre cette cause sur le fond en septembre.

Evra, Janssen-Ortho Inc.

Le Evra est un timbre contraceptif transdermique indiqué pour empêcher la grossesse chez les femmes utilisant des contraceptifs hormonaux.

Le 23 décembre 2004, le Conseil a publié un Avis d´audience à l´encontre de Janssen-Ortho Inc. et du prix de son médicament breveté Evra. Le 21 février 2005, le Conseil a approuvé l´engagement soumis par Janssen-Ortho Inc. et par lequel le fabricant s´engageait à réduire le prix de son médicament Evra.

En vertu de cet engagement, Janssen-Ortho a réduit de 45 % le prix de son médicament Evra qui est ainsi passé à 4,47 $ le timbre. Janssen-Ortho Inc. s´est également engagé à rembourser les recettes excessives qu´il a encaissées au moyen d´un paiement au gouvernement du Canada et à réduire le prix d´un autre de ses médicaments brevetés, en l´occurrence le Levaquin.

Vous trouverez de plus amples renseignements sur cette affaire à la page 17 du présent rapport, dans la section portant l´intitulé Engagements de conformité volontaire.

La présente section a été réorganisée et de nouveaux tableaux et graphiques y ont été ajoutés. Nous espérons que cette analyse plus exhaustive des principaux indices vous aidera à mieux comprendre la conjoncture actuelle quant aux médicaments brevetés au Canada. Ces changements vont dans le sens du mandat de rapport du CEPMB dont l'objectif est d'éclairer les processus de prise de décisions et d'élaboration de politiques en faisant entre autres rapport des tendances des prix des produits pharmaceutiques.

La valeur des ventes des médicaments a totalisé 15,9 milliards de dollars en 2004, ce qui représente une augmentation de 5,3 % par rapport aux ventes de 2003. [6] Ce taux de croissance, qui est beaucoup moindre que le taux de 15,2 % enregistré en 2003, est de fait le taux le plus bas enregistré depuis 1996. Le tableau 6 présente les valeurs estimées des ventes de médicaments aux prix des fabricants effectuées entre 1990 et 2004.

Ventes et prix : L'augmentation de la valeur des ventes de médicaments ne sous-tend pas nécessairement une augmentation des prix des médicaments et vice versa. [7] Plusieurs autres facteurs - à savoir des facteurs ayant une incidence sur le volume et sur la composition de l'utilisation des médicaments - peuvent donner lieu à des taux marqués de croissance de la valeur des ventes et ce, même lorsque les prix des médicaments sont en baisse. Au nombre de ces facteurs, citons les suivants : [8]

- variations démographiques

- variations de la composition démographique de la population (par ex. vieillissement de la population et, partant, une recrudescence des problèmes de santé)

- augmentation de l'incidence (au sein de certains groupes démographiques) de problèmes de santé pouvant être traités au moyen de médicaments

- changements des habitudes d'ordonnance des médecins (qui, par exemple, sont portés à prescrire les nouveaux médicaments pour traiter une condition qu'ils traitaient avec des médicaments existants.

Les nouveaux médicaments sont plus dispendieux que les anciens et possiblement plus efficaces)

- recours plus régulier à des pharmacothérapies en remplacement d'autres traitements (par ex. la chirurgie)

- utilisation de nouvelles pharmacothérapies pour traiter des conditions pour lesquelles il n'existait aucun traitement efficace, et

- plus grande propension des médecins et des patients (par ex. suite à de nouvelles découvertes médicales) à utiliser des médicaments pour traiter des conditions qui n'étaient jusque là pas considérées problématiques.

Composition des ventes au prix du fabricant : Le CEPMB détermine la valeur des ventes au prix du fabricant en faisant la somme de la valeur des ventes des médicaments brevetés, des médicaments non brevetés et des médicaments génériques. À cette fin, l'expression " médicament breveté " s'entend de tout médicament assujetti à la compétence du CEPMB aux fins de l'examen du prix. Un " médicament de marque non breveté " est un médicament vendu par un breveté (à savoir un fabricant commercialisant au Canada un ou plusieurs médicaments assujettis à l'examen du prix du CEPMB), mais qui n'est pas breveté (soit parce que le brevet est en instance, parce que tous les brevets liés au médicament sont arrivés à échéance ou, encore, parce que le médicament n'a jamais été breveté).

En vertu du Règlement sur les médicaments brevetés, les brevetés doivent faire rapport au CEPMB de la valeur totale de leurs ventes de médicaments brevetés et non brevetés sur le marché canadien. Les brevetés doivent également soumettre des renseignements sur leurs ventes de médicaments brevetés, ventilés selon le médicament et la catégorie de client. À partir de ces éléments d'information, le CEPMB calcule la valeur des ventes de médicaments brevetés de chaque breveté et fait un estimé de la valeur des ventes de médicaments non brevetés de chacun. Le CEPMB complète ses calculs en estimant la valeur des ventes de médicaments génériques des membres de l'Association canadienne du médicament générique (ACMG) à l'aide des données de IMS Health. [9]

Pour revenir au tableau 6, à la page 19, la valeur des ventes de médicaments brevetés est passée à 10,9 milliards de dollars, ce qui représente une augmentation de 7,9 % par rapport à la valeur de l'exercice 2003. Cette augmentation de la valeur des ventes est la plus faible depuis 1994. En 2004, les médicaments brevetés ont accaparé 68,6 % de la valeur totale des ventes de médicaments, soit un peu plus que l'exercice précédent. La part de la valeur des ventes des médicaments brevetés au prix du fabricant a augmenté d'une façon marquée depuis le milieu des années quatre-vingt-dix alors qu'elle représentait moins de la moitié de la valeur de l'ensemble des ventes.

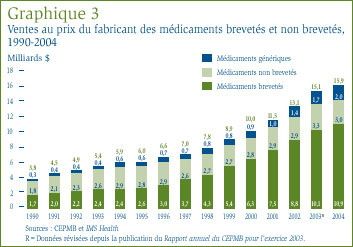

Le graphique 3 présente de plus amples renseignements concernant la composition des ventes des médicaments au prix du fabricant. La baisse de la valeur relative des médicaments de marque non brevetés est particulièrement marquée. En 1995, la valeur des ventes de médicaments de marque non brevetés représentait presque la moitié de la valeur de l'ensemble des ventes de médicaments, mais elle ne représentait plus que 18,9 % de la valeur totale des ventes en 2004. Par ailleurs, la valeur des ventes des médicaments génériques par rapport à l'ensemble des ventes de médicaments a augmenté au cours de la même période, passant de 10,0 % qu'elle était en 1995 à 12,5 % en 2004. Au cours de cette période, la valeur des ventes des médicaments génériques a plus que triplé, passant de 0,6 milliard de dollars à 2,0 milliards de dollars.

Comment expliquer ce ralentissement impressionnant de la croissance des ventes des médicaments brevetés en 2004 ? Les brevets de plusieurs médicaments importants sont venus à échéance en 2004 alors que d'autres médicaments brevetés ont continué de perdre leur part de marché au profit de médicaments non brevetés. Les retraits du marché de médicaments (la plupart effectués au cours du deuxième semestre de l'exercice 2004) ont également contribué, quoique dans une mesure relativement modeste, à une réduction de la croissance de la valeur des ventes.

Des facteurs à plus long terme interviennent également. Tout au long des années quatre-vingt-dix, la croissance des ventes de médicaments brevetés a largement été associée à l'arrivée successive sur le marché de nouveaux médicaments " supervendeurs ". Depuis le début de la présente décennie, l'industrie pharmaceutique n'a pas lancé sur le marché un nombre suffisant de médicaments " supervendeurs " pour maintenir les taux de croissance élevés enregistrés au cours des années quatre-vingt-dix. Les produits lancés sur le marché depuis l'année 2000 ont moins favorisé un accroissement des ventes que ne l'ont fait les médicaments lancés sur le marché à la fin des années quatre-vingt-dix et ce, tant en termes absolus qu'en termes de base de ventes (laquelle, dans le cas des médicaments brevetés, a plus que doublé par rapport à 1999). Le ralentissement de la croissance des ventes des médicaments brevetés a été masqué au cours des premières années de la présente décennie par une progression des ventes de médicaments " supervendeurs " lancés sur le marché canadien à la fin des années quatre-vingt-dix.

Ventes selon la catégorie thérapeutique : Aux fins de ses examens du prix, le CEPMB classe les médicaments suivant le système de classification ATC (Anatomique, Thérapeutique, Chimique) de l'Organisation mondiale de la santé. Ce système hiérarchique classe les médicaments selon leurs utilisations thérapeutiques principales et leur composition chimique. Au plus haut niveau de ce système, à savoir au niveau I, le système ATC classifie les médicaments selon la partie de l'anatomie humaine auxquels ils sont principalement associés.

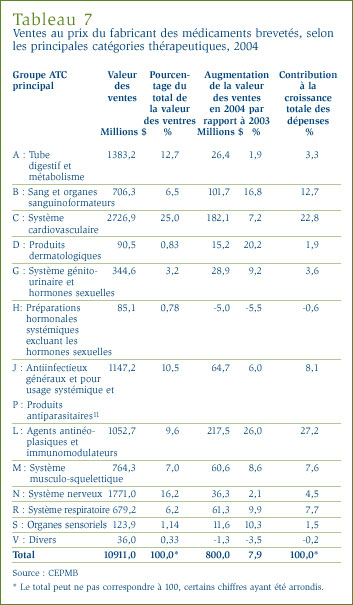

Le tableau 7 ventile selon la catégorie thérapeutique, à savoir les catégories de niveau I, les ventes au prix du fabricant des médicaments brevetés effectuées au Canada en 2004. [10] Le tableau ventile les ventes effectuées en 2004 selon les différentes catégories, leur part de l'ensemble des ventes ainsi que le taux d'augmentation/diminution de la valeur des ventes par rapport à l'exercice précédent. La dernière colonne de ce tableau présente le ratio d'augmentation des ventes des médicaments appartenant aux différentes catégories ATC par rapport à l'augmentation générale des ventes ou, autrement dit, par rapport à la contribution des médicaments de chaque " catégorie ATC " à l'augmentation des ventes. Les valeurs figurant dans cette colonne révèlent les catégories ATC ayant contribué largement à la croissance des ventes. En 2004, ces principaux facteurs étaient les suivants :

- agents antinéoplasiques et immunomodulateurs (à la source de 27,2 % de l'augmentation de la valeur des ventes de médicaments brevetés)

- médicaments pour le système cardiovasculaire, tels que des agents réducteurs de lipides et médicaments servant à traiter l'hypertension (22,8 %)

- médicaments servant à traiter le sang et les organes sanguinoformateurs (12,7 %), et

- antiinfectieux généraux et pour usage systémique (8,1 %).

Ces quatre catégories de médicaments sont à la source de presque les trois quarts de la croissance de la valeur des ventes de médicaments au prix du fabricant entre 2003 et 2004. Ce sont les médicaments pour le système cardiovasculaire qui depuis de nombreuses années constituent la principale source d'augmentation de la valeur des ventes. Quant aux agents antinéoplasiques et aux agents immunomodulateurs (essentiellement utilisés en chimiothérapie), leur contribution à la croissance des ventes est sans précédent. Il est également important de noter que plusieurs catégories thérapeutiques qui étaient jadis considérées comme des facteurs importants d'augmentation de la valeur des ventes - telles que les médicaments utilisés pour traiter le tube digestif et le métabolisme, le système nerveux et le système respiratoire - ont eu peu d'incidence sur la croissance des ventes en 2004.

Le CEPMB compile l'Indice des prix des médicaments brevetés (IPMB) qui lui permet d'observer les tendances des prix des médicaments brevetés. L'IPMB mesure la variation moyenne par rapport à l'année précédente des prix du fabricant, soit le prix départ-usine, des médicaments brevetés offerts sur le marché canadien. L'IPMB est calculé chaque année à l'aide des données sur les prix et les ventes dont les brevetés ont fait rapport au CEPMB. [12]

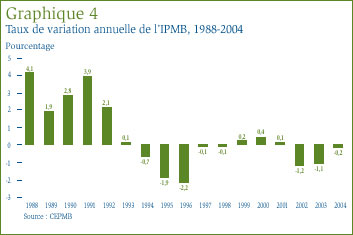

Le graphique 4 présente les variations annuelles de l'IPMB pour les années 1988 à 2004. Selon la mesure prise par l'IPMB, les prix des médicaments brevetés pratiqués par les brevetés ont reculé d'une moyenne de 0,2 % en 2004. Ce résultat s'inscrit dans une suite de diminutions ou d'augmentations négligeables commencée en 1993. Comme cela a été le cas au cours des années antérieures, la stabilité des prix observée en 2004 a été généralisée, la majorité des prix des médicaments brevetés ayant peu ou pas changé.

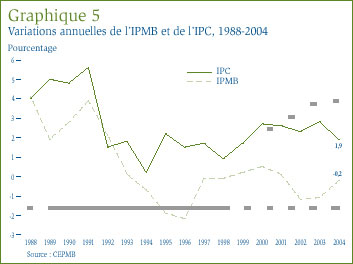

Comparaison de l'IPMB et de l'IPC : La Loi sur les brevets prévoit que le CEPMB doit tenir compte des variations de l'Indice des prix à la consommation (IPC) lorsqu'il est appelé à déterminer si le prix d'un médicament breveté est ou non excessif. Le graphique 5 qui suit présente les variations annuelles de l'IPMB par rapport aux variations de l'IPC pour les mêmes années. L'inflation générale des prix, mesurée au moyen de l'IPC, a été supérieure à l'augmentation moyenne des prix des médicaments brevetés presque chaque année depuis 1988. [13] La situation s'est répétée en 2004 alors que le taux d'inflation mesuré à l'aide de l'IPC dépassait d'environ 2,1%[14] le taux de variation de l'IPMB, quoique l'écart entre ces deux indices s'est considérablement résorbé entre 2003 et 2004.

Il n'est pas surprenant que l'IPMB ait augmenté moins rapidement que l'IPC. Les Lignes directrices du CEPMB prévoient que la moyenne des augmentations des prix des médicaments brevetés sur une période de trois années consécutives ne doit pas être supérieure à la moyenne du taux d'inflation mesuré à l'aide de l'IPC. Les Lignes directrices limitent également les augmentations sur douze mois des prix. En effet, ces augmentations ne peuvent être supérieures à une fois et demie le taux d'inflation de l'année en cours. Ces exigences, appliquées sur une base individuelle aux différents médicaments brevetés, a pour effet de limiter les augmentations de l'IPMB. En pratique, les variations de l'IPMB n'ont jamais atteint cette limite étant donné que certains fabricants n'augmentent pas les prix de leurs médicaments dans toute la mesure autorisée en vertu des Lignes directrices lorsqu'ils ne réduisent tout simplement pas leurs prix.

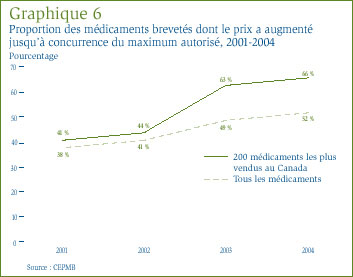

Le graphique 6 présente de l'information sur la mesure dans laquelle les fabricants ont augmenté les prix de leurs médicaments entre 2001 et 2004. En 2004, les prix de 52 % de l'ensemble des médicaments brevetés ont augmenté d'un taux variant entre 0 % et le taux maximal autorisé, alors que cette proportion n'était que de 38 % en 2001. Si l'on restreint l'analyse aux 200 médicaments les plus vendus au Canada en 2004, les prix de 66 % de ces médicaments ont augmenté d'un taux se situant dans les limites autorisées par rapport à seulement 41 % en 2001.

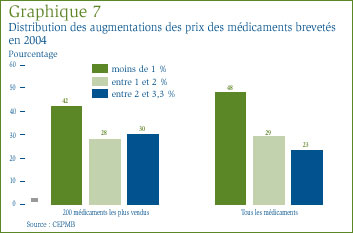

Le graphique 7 présente de l'information sur la mesure dans laquelle les fabricants ont appliqué les augmentations autorisées en vertu des Lignes directrices. On peut y voir que, en 2004, les prix de 48 % des médicaments brevetés ont augmenté de 1 % et les prix de 52 % des médicaments, de 1 à 3,3 %. Si on limite l'analyse aux 200 médicaments brevetés les plus vendus au pays, les prix de 42 % de ces médicaments ont augmenté de 1 % et ceux de 58 % des médicaments, de 1 à 3,3 %. Les Lignes directrices prévoient que les augmentations annuelles des prix des médicaments brevetés ne peuvent représenter plus d'une fois et demie le taux de variation prévu de l'IPC. Pour 2004, le taux maximal d'augmentation des prix des médicaments était de 3,3 %.

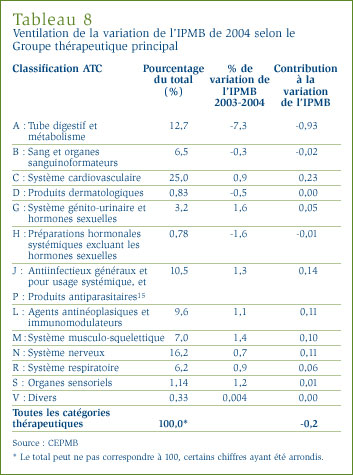

Variation des prix selon la catégorie thérapeutique : Le tableau 8, à la page 24, présente les taux moyens de variation des prix des médicaments brevetés appartenant aux mêmes catégories thérapeutiques.

Ce tableau a été établi en appliquant la méthode de calcul de l'IPMB aux données sur les prix des différents médicaments brevetés appartenant à la même catégorie thérapeutique. Le tableau présente la part des ventes des médicaments brevetés appartenant aux différentes catégories de médicaments brevetés ainsi que le taux moyen de variation des prix. La dernière colonne du tableau est le résultat de la multiplication du taux moyen de variation des prix des médicaments de la catégorie par sa part de l'ensemble des ventes, ce qui donne la " contribution " du groupe de médicaments à la variation de l'IPMB (tel qu'illustré dans le graphique 7). Les valeurs figurant dans cette colonne révèlent les principales catégories de médicaments à la source des variations des prix de l'ensemble des médicaments brevetés.

Les résultats du tableau 8 montrent bien qu'il ne faut pas se fier à une seule mesure générale de variation des prix. Il apparaît d'une façon évidente que plusieurs catégories thérapeutiques ont connu entre 2003 et 2004 des augmentations marquées des prix des médicaments et ce, malgré une baisse de l'IPMB. Il apparaît également clairement que la plus importante influence sur l'IPMB a été la baisse des prix des médicaments utilisés pour traiter le tube digestif et le métabolisme (catégorie A de l'ATC). La contribution de cette catégorie de médicaments contrebalance largement les contributions des autres catégories de médicaments : sans les variations de prix observées au niveau des médicaments de la catégorie A, l'IPMB aurait augmenté d'environ 0,7 %.

Au cours de 2004, le CEPMB a eu vent d'augmentations des prix de médicaments brevetés. En raison du nombre assez élevé d'augmentations de prix rapportées en 2004, le CEPMB a organisé une consultation sur la question des augmentations des prix des médicaments brevetés dont la première étape a été la publication le 8 mars 2005 d'un document de discussion. Le CEPMB poursuivra son analyse de la question des augmentations de prix au cours de l'exercice 2005 et fera rapport de son examen de politique dans son Programme de recherche.

La Loi sur les brevets et le Règlement sur les médicaments brevetés exigent des brevetés qu'ils dévoilent au CEPMB les prix départ-usine publiquement disponibles qu'ils pratiquent dans les sept pays de comparaison nommés dans le Règlement qui sont la France, l'Allemagne, l'Italie, la Suède, la Suisse, le Royaume Uni et les États-Unis. Le CEPMB utilise ces données aux fins suivantes :

- pour effectuer les comparaisons des prix internationaux (CPI) prévues dans les Lignes directrices, et

- pour comparer les prix des médicaments pratiqués au Canada aux prix pratiqués dans d'autres pays.

Le graphique 8 révèle le ratio moyen des prix pratiqués au Canada par rapport à la médiane des prix pratiqués dans les sept pays de comparaison (le prix international médian) pour les années 1987 à 2004. [16] En 1987, les prix canadiens dépassaient en moyenne de 23 % le prix international médian, mais le ratio moyen est passé à 0,93 en 1995 pour ensuite se situer entre 5 et 12 % sous le prix international médian entre 1995 et 2001. Après avoir augmenté à 1,01 en 2002, le ratio moyen est descendu sous la parité. En effet, en 2004, le ratio moyen était de 0,91.

Les statistiques présentées dans le graphique 8 correspondent à une moyenne pondérée du ratio du prix canadien par rapport au prix international médian. Cette moyenne est pondérée en fonction de la valeur des ventes de chaque médicament breveté ayant fait l'objet d'un rapport des prix pratiqués dans l'un ou l'autre des pays de comparaison nommés dans le Règlement. Ce calcul sous-tend la conversion des prix exprimés dans la devise des différents pays de comparaison en équivalents exprimés en dollars canadiens. [17] De cette manière, les variations des ratios moyens permettent de dégager :

- les tendances des prix pratiqués au Canada

- les tendances des prix internationaux

- les variations des taux de change

- les variations des groupes de médicaments couverts (alors que de nouveaux médicaments brevetés sont lancés sur le marché canadien et que d'autres changent de statut suite à l'échéance du brevet), et

- des variations des parts de revenus des différents médicaments.

L'analyse de la sensibilité révèle que les variations des taux de change - et plus particulièrement l'augmentation de la valeur de la couronne suédoise par rapport au dollar canadien [18] - sont grosso modo à la source des trois quarts du recul du ratio moyen entre 2003 et 2004. L'augmentation des prix pratiqués dans les différents pays de comparaison et les variations des pondérations en fonction des ventes sont à la source de l'autre quart. Les mouvements des prix canadiens n'ont pratiquement pas contribué à la baisse du ratio moyen.

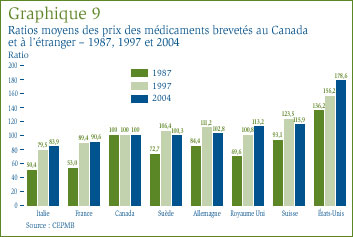

Le graphique 9 illustre la relation entre les prix des médicaments brevetés au Canada et les prix de ces mêmes médicaments dans les sept pays de comparaison. En 1987, les prix pratiqués au Canada étaient généralement inférieurs aux prix pratiqués aux États-Unis, mais supérieurs aux prix pratiqués dans les autres pays de comparaison. Au milieu des années 1990, la situation avait radicalement changé, les prix canadiens se situant alors dans la juste moyenne des prix pratiqués dans les six pays de comparaison européens. La situation n'a guère changé en 2004. En effet, les prix des médicaments brevetés au Canada sont en général inférieurs aux prix pratiqués en Suède, en Allemagne, au Royaume Uni et en Suisse, mais supérieurs aux prix pratiqués en France et en Italie. Comme cela a été le cas au cours des années précédentes, les prix pratiqués aux États-Unis [19] semblent largement supérieurs aux prix pratiqués en Europe et au Canada. L'écart s'agrandit.

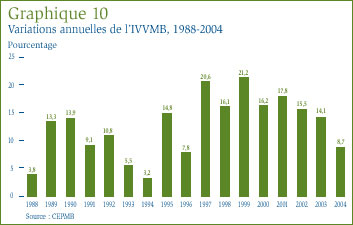

Dans le contexte des médicaments, le concept d' « utilisation » désigne en règle générale les quantités physiques de médicaments vendus ou consommés. Les données sur les prix et sur les ventes utilisées pour calculer l'IPMB permettent également au CEPMB d'observer les tendances quant à l'utilisation faite des médicaments brevetés au Canada. À cette fin, le CEPMB compile l'indice du volume des ventes de médicaments brevetés (IVVMB). [20] Le graphique 10 présente pour les années 1988 à 2004 les taux moyens de croissance de l'utilisation faite des médicaments brevetés mesurés à l'aide de l'IVVMB. Ces résultats confirment qu'au cours des dernières années la croissance de l'utilisation des médicaments brevetés a été la principale cause de l'augmentation des ventes, avec des taux de croissance relativement équivalents aux taux de croissance des ventes. Cette tendance s'est répétée en 2004 : l'utilisation des médicaments brevetés a augmenté de 8,7 %, soit le taux le plus faible observé depuis 1996.

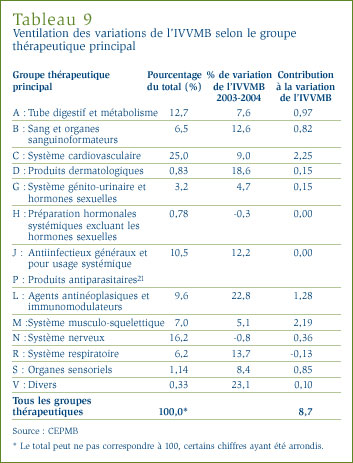

Croissance du volume des ventes de médicaments brevetés selon le groupe thérapeutique : Le tableau 9 présente les taux moyens de croissance de l'utilisation faite des médicaments brevetés ventilés selon les principaux groupes thérapeutiques. Les résultats présentés dans ce tableau ont été obtenus en appliquant la méthodologie de l'IVVMB aux données relatives au volume des ventes de médicaments brevetés des différents groupes thérapeutiques. Le tableau présente la part des ventes des médicaments brevetés selon le groupe thérapeutique ainsi que le taux moyen de croissance de l'utilisation faite des médicaments des différents groupes. La dernière colonne présente la contribution du groupe thérapeutique à la variation de l'IVVMB. Cette contribution a été calculée en multipliant le taux moyen d'utilisation des médicaments des différents groupes par leur part de l'ensemble des ventes. Les valeurs présentées dans cette troisième colonne permettent de reconnaître les groupes de médicaments qui constituent les principales sources de croissance des volumes de vente des médicaments brevetés. Au nombre de ces principales sources, citons les suivantes :

- médicaments utilisés pour traiter le système cardiovasculaire (2,25 % de l'augmentation de l'IVVMB)

- médicaments utilisés pour traiter le système musculo-squelettique (2,19 %)

- agents antinéoplasiques et agents immunomodulateurs (1,28 %).

À l'échelle mondiale, l'industrie de fabrication de médicaments est dominée par des multinationales établies dans plusieurs pays. La plupart de ces multinationales ont des filiales au Canada qui, avec une poignée de fabricants canadiens, exercent la mainmise sur la fabrication, la vente et la distribution de médicaments au Canada.

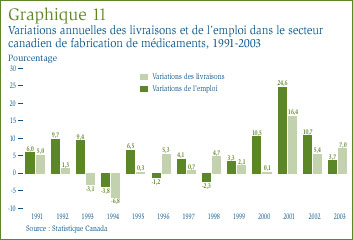

Selon Statistique Canada, l'industrie canadienne de fabrication de médicaments a livré en 2003 pour 7,8 milliards de dollars de médicaments, ce qui représente 1,4 % de la valeur totale des livraisons du secteur manufacturier canadien. De ce montant de 7,8 milliards de dollars, 3,4 milliards sont associés à l'exportation, ce qui sous-tend que l'industrie pharmaceutique canadienne n'a livré en 2003 que pour environ 4,4 milliards de dollars de la valeur totale des ventes de médicaments au Canada que le CEPMB a estimée à 15,1 milliards de dollars. La part des exportations est encore plus grande si l'on considère que le calcul ne tient compte que des médicaments de marque (étant donné que la plupart des médicaments génériques offerts sur le marché canadien sont fabriqués au Canada). [22] L'industrie canadienne fournit de l'emploi à 29 312 personnes, soit à

1,5 % de l'effectif du secteur manufacturier. [23] Le graphique 11 présente les taux annuelsde variation des livraisons et des emplois du secteur de la fabrication de médicaments. Au cours de la présente décennie, les taux de croissance de la production et de l'emploi du secteur canadien de fabrication de médicaments sont largement supérieurs à ceux de l'ensemble du secteur manufacturier.

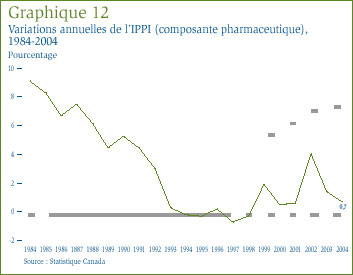

Le contexte se prête à un examen des dernières tendances des prix de vente des médicaments fabriqués au Canada. L'indice des prix des produits industriels (composante pharmaceutique) que compile Statistique Canada a été tout particulièrement conçu à cette fin. [24] Le graphique 12 présente les taux annuels de variation de l'IPPI (composante pharmaceutique) pour les années 1984 à 2004. D'une façon générale, les prix inclus dans l'IPPI (composante pharmaceutique) n'ont pas suivi l'inflation des prix enregistrée au Canada. Le taux d'augmentation de l'IPPI (composante pharmaceutique) a reculé d'une façon constante entre 1984 et 1993. L'indice n'a pratiquement pas bougé entre 1993 et 2001, mais a augmenté de 0,7 % en 2004.

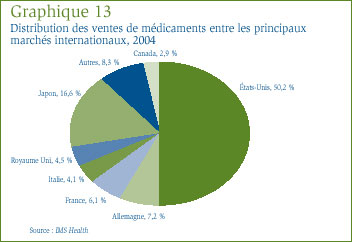

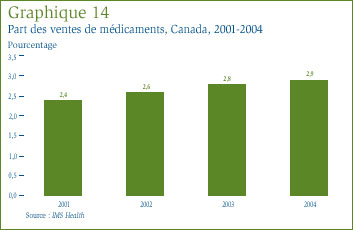

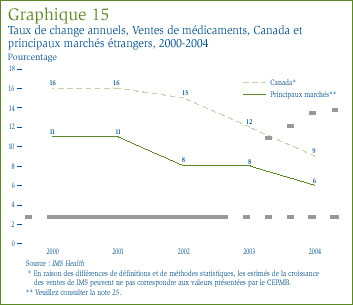

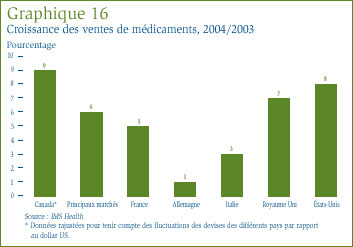

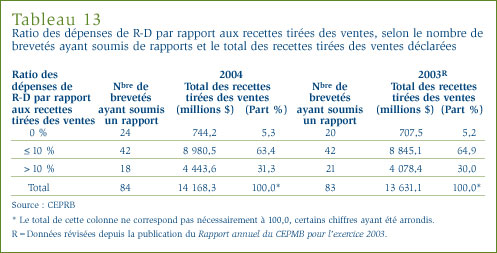

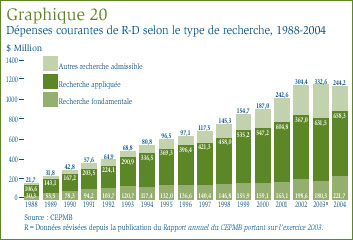

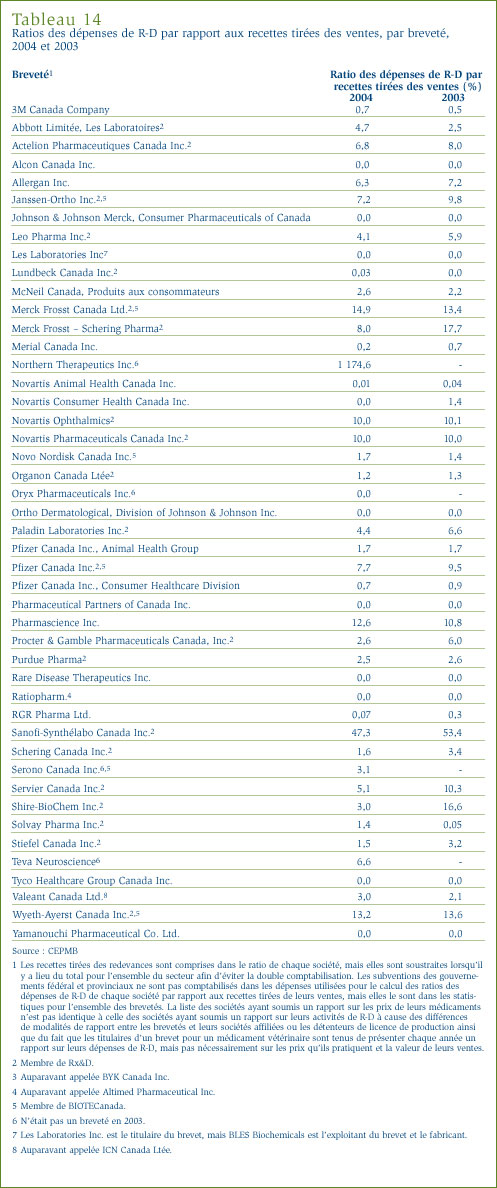

IMS Health fait régulièrement rapport des ventes des fabricants au secteur du détail dans un vaste nombre de pays. Selon IMS Health, ces ventes sur les principaux marchés ont totalisé 452,3 milliards de dollars en 2004. [25] Le graphique 13 présente la répartition de ce montant entre les marchés. Au Canada, les ventes de médicaments ont représenté 2,9 % de l'ensemble des ventes sur les principaux marchés. Le marché des États-Unis est de loin le plus important marché au monde, avec des ventes de médicaments supérieures au total combiné des ventes effectuées au Canada, en France, en Allemagne, en Italie, au Japon et au Royaume Uni.