Renseignements connexes

Conseil d’examen du prix des médicaments brevetés

Centre Standard Life

Case postale L40

333, avenue Laurier Ouest

Bureau 1400

Ottawa (Ontario) K1P 1C1

Téléphone : 1-877-861-2350

ATS : 613-288-9654

Courriel : PMPRB.Information-Renseignements.CEPMB@pmprb-cepmb.gc.ca

Remerciements

Le CEPMB souhaite remercier les membres du Comité consultatif du SNIUMP pour leur supervision spécialisée et leur orientation dans le cadre de la rédaction du présent rapport. Veuillez noter que les déclarations et les constatations concernant le présent rapport ne reflètent pas nécessairement celles des membres et de leurs organisations.

Nous remercions sincèrement Patricia Carruthers‑Czyzewski, B. Sc. (phm.), M. Sc., Sintera Inc. pour sa contribution experte à l’élaboration de la méthodologie, à l’évaluation scientifique des médicaments aux dernières étapes de développement et à la sélection des médicaments émergents qui figurent dans le présent rapport.

Nous remercions Allison Carey d’avoir dirigé le projet avec l’aide de Jared Berger, Nevzeta Bosnic d’avoir orienté l’élaboration de la méthodologie, la rédaction du rapport, et la sélection des médicaments, ainsi que Tanya Potashnik, Elena Lungu et Thy Dinh d’avoir supervisé la rédaction du rapport. Le CEPMB tient également à souligner la contribution de Karine Landry et de Dianne Breau, membres du personnel analytique et scientifique, ainsi que de Carol McKinley, de Sarah Parker et de Shirin Paynter, membres de l’équipe rédactionnelle.

Avertissement

Le SNIUMP est une initiative de recherche indépendante des activités réglementaires du Conseil du CEPMB. Les priorités de recherche, les données, les déclarations et les opinions présentées ou reproduites dans les rapports du SNIUMP ne représentent pas la position du CEPMB au sujet des questions réglementaires. Les rapports du SNIUMP ne contiennent pas d’information confidentielle ou protégée en vertu des articles 87 et 88 de la Loi sur les brevets, et la mention d’un médicament dans un rapport du SNIUMP ne revient pas à reconnaître ou à nier que le médicament fait l’objet d’une demande de brevet en vertu des articles 80, 81 ou 82 de la Loi sur les brevets ou que son prix est ou n’est pas excessif au sens de l’article 85 de la Loi sur les brevets.

Bien qu’ils soient en partie fondés sur des données obtenues avec l’autorisation de GlobalData et à partir de la base de données MIDASMC d’IQVIA, les énoncés, les résultats, les conclusions, les points de vue et les opinions exprimés dans le présent rapport sont exclusivement ceux du CEPMB et ne sont pas imputables à GlobalData Plc ou à IQVIA.

Sommaire

L’Observateur des médicaments émergents (OMÉ) est un rapport d’analyse prospective qui présente une sélection de nouveaux médicaments qui en sont aux dernières étapes de l’évaluation clinique et qui pourraient avoir une incidence importante sur la pratique clinique future et sur les dépenses en médicaments au Canada.

Les médicaments en essais cliniques de phase III ou en attente d’homologation par la Food and Drug Administration (FDA) des États-Unis sont considérés pour la sélection s’ils peuvent répondre à un besoin thérapeutique non comblé, offrir un mécanisme nouveau ou un avantage thérapeutique par rapport aux traitements existants, ou traiter une affection grave. La sélection finale présente des médicaments provenant d’un large éventail de domaines thérapeutiques et comprend une liste de thérapies géniques.

L’information contenue dans l’Observateur des médicaments émergents (en anglais Meds Pipeline Monitor) s’inscrit dans le prolongement de la recherche publiée antérieurement sous un titre différent en anglais (New Drug Pipeline Monitor), mais sous le même titre en français, et suit une démarche renouvelée de la sélection des médicaments. Le nouveau titre anglais (Meds Pipeline Monitor) témoigne du lien entre la présente série et sa publication complémentaire, Meds Entry Watch (Veille des médicaments mis en marché), qui se penche sur la dynamique post-commercialisation des médicaments nouvellement approuvés. Ensemble, ces deux rapports permettent de surveiller l’éventail complet des médicaments nouveaux et émergents au Canada et à l’étranger, et fournissent des renseignements clés aux décideurs, aux chercheurs, aux patients, aux cliniciens et aux autres intervenants. Les prochaines éditions de la publication annuelle feront le suivi de la liste des médicaments émergents qui figure dans le présent rapport.

Faits saillants relatifs aux médicaments émergents en 2018

- En 2018, près de 6 000 nouveaux médicaments faisaient l’objet d’une évaluation clinique.

- Les traitements contre le cancer dominaient la combinaison thérapeutique, représentant le tiers des médicaments à toutes les phases de l’évaluation clinique. D’autres domaines thérapeutiques importants comprenaient les traitements contre les maladies infectieuses comme le VIH et la pneumonie (12 % des médicaments) et les médicaments contre les maladies et les troubles du système nerveux tels que la maladie d’Alzheimer et la dépression (11 % des médicaments).

- Sur les 6 000 médicaments, 733 (12 %) étaient en essais cliniques de phase III ou en attente d’homologation par la FDA, représentant un large éventail de domaines thérapeutiques.

- Trente des sept cent trente-trois médicaments qui en sont aux dernières étapes de l’évaluation clinique, dont neuf thérapies géniques, ont été sélectionnés pour le présent rapport en fonction de leurs répercussions budgétaires éventuelles. Certains de ces médicaments offrent des possibilités de percées en ce qui concerne la réponse à des besoins auparavant non comblés ou pourraient traiter de grandes populations de patients.

- Sur les 30 nouveaux médicaments sélectionnés, 20 ont été désignés comme étant des médicaments orphelins par la FDA ou l’Agence européenne des médicaments (dont 8 thérapies géniques), 9 étaient des médicaments oncologiques et 3 étaient des produits biologiquesNote de bas de page i.

Liste de termes

Les termes suivants et leurs définitions s’appliquent aux fins du présent rapport.

Autorisation de mise en marché : Processus d’approbation de la commercialisation d’un médicament dans un pays donné; au Canada, l’approbation de la commercialisation est accordée à la suite d’une évaluation scientifique approfondie de l’innocuité, de l’efficacité et de la qualité d’un produit, comme l’exigent la Loi sur les aliments et drogues et son RèglementNote de bas de page ii.

Efficacité clinique : Réponse maximale possible d’un médicament en contexte de recherche médicale et capacité d’avoir un effet thérapeutique suffisant en contexte cliniqueNote de bas de page iii.

En attente d’homologation : Un médicament est en attente d’homologation une fois que tous les essais cliniques nécessaires sont terminés et qu’il attend l’homologation ou l’approbation de son utilisation par un organisme de réglementationNote de bas de page iv .

Essai clinique de phase III : Essai, contrôlé ou non, effectué après que des données préliminaires qui permettent de penser que le médicament est efficace ont été obtenues. L’objectif est de recueillir des données supplémentaires afin de confirmer l’efficacité clinique et l’innocuité du médicament dans les conditions d’utilisation proposéesNote de bas de page v. Les essais de phase III sont habituellement des essais randomisés à double insu menés auprès de plusieurs centaines ou de plusieurs milliers de patients.

Ingrédient médicinal : Substance chimique ou biologique responsable de l’effet pharmacologique d’un produit médicamenteux. Parfois appelé molécule, substance active ou ingrédient actifNote de bas de page vi.

Médicament : Terme général englobant à la fois le produit médicamenteux final et les ingrédients médicinaux, notamment les substances actives et les produits biologiques fabriqués chimiquement, ainsi que les thérapies géniques. Les médicaments sont déclarés au niveau des ingrédients médicinaux et peuvent faire référence à un seul ingrédient ou à une combinaison unique d’ingrédients.

Médicaments émergents : Ensemble de nouveaux médicaments candidats qui font l’objet de recherches actives et de mises au point par une société de biotechnologie ou de produits pharmaceutiques.

Nouveau médicament : Ingrédient médicinal dont la mise en marché n’a pas encore été autorisée par un organisme de réglementationNote de bas de page vii.

Thérapie génique : Une « technique utilisée pour traiter des maladies génétiques qui consiste à remplacer un gène absent ou défectueux par un gène sainNote de bas de page viii », selon la définition de Santé Canada.

Introduction

L’Observateur des médicaments émergents (OMÉ) est la suite de la recherche d’analyse prospective qui a été publiée par les années passées sous le même titre. Il présente une sélection de médicaments qui en sont à l’étape des essais cliniques de phase III ou en attente d’homologation par la Food and Drug Administration (FDA) des États-Unis et qui peuvent avoir une incidence importante sur la pratique clinique et les dépenses en médicaments au Canada.

La présente édition de l’OMÉ adopte une approche renouvelée du processus de sélection par la désignation de médicaments candidats provenant d’un large éventail de domaines thérapeutiques. Elle contient aussi une liste de médicaments potentiellement importants issus du domaine d’évolution rapide des thérapies géniques. La nouvelle méthodologie, qui est décrite en détail dans la section suivante, utilise un ensemble précis de critères pour dresser la liste des médicaments candidats. Les médicaments figurant dans le présent rapport feront l’objet d’un suivi dans les prochaines éditions de l’OMÉ pour que l’on puisse déterminer s’ils réussissent à faire leur entrée sur le marché et, si oui, à quel moment.

Pour mettre en contexte la sélection des médicaments, l’OMÉ comprend également un aperçu de l’ensemble des médicaments émergents, qui met l’accent sur la ventilation thérapeutique de chaque phase de développement.

L’Observateur des médicaments émergents est une publication qui accompagne la Veille des médicaments mis en marché, qui analyse la dynamique du marché des médicaments nouvellement approuvés au Canada et à l’étranger. Ensemble, ces deux rapports du Conseil d’examen du prix des médicaments breveté (CEPMB) permettent de surveiller le continuum post‑commercialisation des médicaments émergents aux dernières étapes de développement et des nouveaux médicaments lancés, en plus de fournir de l’information sur les médicaments émergents et les pressions changeantes sur les coûts aux décideurs, aux chercheurs, aux patients, aux cliniciens et à d’autres intervenants.

Méthodologie

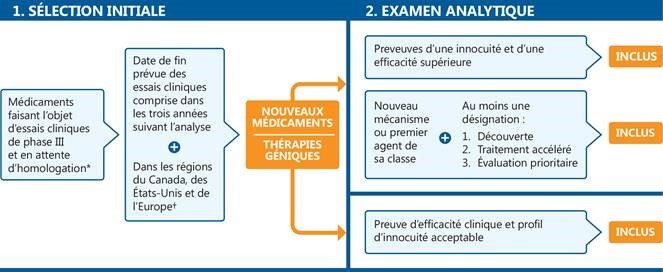

L’OMÉ se concentre sur les nouveaux médicaments faisant l’objet d’essais cliniques de phase III au Canada, aux États-Unis et en Europe, ou en attente d’homologation par la FDA. La sélection des médicaments émergents à inclure dans le présent rapport repose sur un processus en deux étapes (figure 1). À l’étape de la sélection initiale, on choisit des médicaments qui en sont aux derniers stades de l’évaluation clinique, tandis qu’à l’étape de l’examen analytique, on effectue une évaluation plus rigoureuse de chaque médicament potentiel afin de déterminer les médicaments qui peuvent avoir une incidence clinique et budgétaire importante. À la seconde étape, on tient compte d’un ensemble précis de critères, en plus des résultats d’un examen approfondi des données cliniques et des publications scientifiques.

La méthodologie sera examinée annuellement et perfectionnée au besoin.

Figure 1. Processus de sélection des médicaments présentés dans l’Observateur des médicaments émergents

* En attente d’homologation par la Food and Drug Administration (FDA) des États-Unis.

† Essais cliniques de phase III menés au Canada, aux États-Unis ou sur le continent européen (à l’exclusion de la Russie et de la Turquie).

Figure description

Cet organigramme décrit la procédure de sélection des nouveaux médicaments inscrits. Le schéma comprend deux étapes :

1. Sélection initiale

Cette étape comprend d’abord tous les médicaments faisant l’objet d’essais cliniques de phase III ou en attente d’homologation par la Food and Drug Administration des États-Unis. À l’étape suivante, les seuls médicaments retenus sont ceux dont la date de fin prévue des essais cliniques est comprise dans les trois années suivant l’analyse, dans les régions du Canada, des États-Unis et de l’Europe. Pour qu’un médicament satisfasse au critère géographique, des essais cliniques de phase III doivent être menés au Canada, aux États-Unis ou sur le continent européen (à l’exclusion de la Russie et de la Turquie).

2. Examen analytique

L’étape d’examen analytique comprend deux parties : une voie pour les nouveaux médicaments et une autre pour les thérapies géniques.

- Les nouveaux médicaments doivent satisfaire au moins l’une des exigences suivantes pour figurer dans la liste :

- Preuves d’une innocuité et d’une efficacité supérieure

- Nouveau mécanisme ou premier agent de sa classe, avec au moins une désignation parmi les suivantes : découverte, traitement accéléré ou évaluation prioritaire

- Les thérapies géniques doivent présenter une preuve d’efficacité clinique et un profil d’innocuité acceptable pour figurer dans la liste.

Étape 1. Sélection initiale

On utilise la base de données GlobalData Healthcare pour dresser une liste des médicaments en essais cliniques de phase III ou en attente d’homologation par la FDA. Ces médicaments servent de base pour l’étape de la sélection initiale.

La géographie des médicaments, qui s’entend de la région géographique ou du pays où le médicament est commercialisé ou en développement, est limitée au Canada et à d’autres pays ayant des processus de réglementation et d’approbation semblables, soit les États-Unis et l’Europe géographique (à l’exclusion de la Russie et de la Turquie). Seuls les nouveaux ingrédients médicinaux accompagnés de données adéquates sur l’innocuité et l’efficacité découlant d’essais cliniques peuvent être considérés pour la sélection.

Les médicaments approuvés ou vendus au Canada, aux États-Unis ou en Europe pour toute autre indication ou dans toute autre concentration ou formulation sont exclus pendant le processus de sélection, tout comme les médicaments dont les essais cliniques sont inactifs, suspendus, retirés ou terminés.

Le processus de sélection distingue deux catégories de médicaments candidats : a) les nouveaux médicaments et b) les nouvelles thérapies géniques. Comme l’illustre la figure 1, le processus de sélection initiale est le même pour les deux groupes, mais l’examen analytique est légèrement différent, car les données accessibles pour les thérapies géniques sont plus limitées.

Étape 2. Examen analytique

Critères de sélection : nouveaux médicaments (à l’exclusion des thérapies géniques)

La seconde étape du processus tient compte d’un certain nombre de critères de sélection pour déterminer la liste finale des médicaments candidats. Ces critères sont détaillés au tableau 1.

Tableau 1. Critères de sélection pour l’Observateur des médicaments émergents : nouveaux médicaments (à l’exclusion des thérapies géniques)

| Critères de sélection |

|

Amélioration de l’innocuité et de l’efficacité démontrée dans les essais cliniques : médicament qui démontre une innocuité accrue, de nouvelles mesures des résultats, ou bien une espérance de vie accrue ou une meilleure qualité de vie.

|

|

Nouveau mécanisme/premier de sa classe : médicament qui utilise un nouveau mécanisme d’interaction biochimique pour produire un effet médical, ou médicament qui est le premier de sa classe thérapeutique.

De plus, le médicament doit correspondre à l’une ou à plusieurs des trois désignations suivantes de la FDA pour le développement et l’examen accélérés :

Découverte – médicament destiné à traiter un problème de santé grave et pour lequel des données cliniques préliminaires indiquent qu’il peut démontrer une amélioration importante sur un ou des paramètres cliniquement significatifs par rapport au traitement disponible.

Désignation accélérée – médicament destiné à traiter un problème de santé grave et à répondre à un besoin médical non comblé.

Examen prioritaire – médicament qui améliorerait considérablement l’innocuité ou l’efficacité du traitement, du diagnostic ou de la prévention d’un problème de santé grave par rapport aux applications standard.

|

Critères de sélection : thérapies géniques

On utilise une démarche plus générale pour dresser la liste finale des thérapies géniques, étant donné que les données cliniques accessibles sur ce groupe sont relativement limitées. On conserve sur la liste les thérapies géniques pour lesquelles les résultats préliminaires (ou définitifs) des essais de phase III indiquent qu’il y a des données probantes sur l’efficacité clinique de la thérapie et un profil d’innocuité acceptable.

Renseignements descriptifs supplémentaires

Le profil de chaque médicament candidat retenu est fourni, ce qui comprend un aperçu de l’indication et du mécanisme d’action, ainsi qu’un résumé des résultats publiés applicables des essais cliniques. Les attributs particuliers qui peuvent influer sur l’adoption éventuelle ou le coût de chaque médicament sont déterminés. Le tableau 2 présente une description détaillée des principaux attributs.

Tableau 2. Principaux attributs des médicaments sélectionnés pour l’Observateur des médicaments émergents

| Attribut |

Pertinence |

Source de données |

|

Essais cliniques de phase III au Canada |

Les médicaments mis à l’essai au Canada sont susceptibles d’intéresser les Canadiens. |

GlobalData Healthcare;

Base de données sur les essais cliniques de Santé Canada;

Registre des essais cliniques des National Institutes of Health |

| Désignation de médicament rare ou orphelin |

Les médicaments utilisés dans le traitement des maladies ou des problèmes de santé rares ont généralement des coûts de traitement élevés et peuvent entraîner des dépenses importantes. |

GlobalData Healthcare |

| Médicament biologique |

Ces molécules complexes produites par des organismes vivants devraient avoir des coûts de traitement élevés et entraîner ainsi des dépenses importantes. |

| Traitement d’appoint |

Les médicaments conçus pour être utilisés en association avec des médicaments existants peuvent augmenter les coûts de traitement et contribuer à une augmentation des dépenses. |

Le profil précise également les répercussions possibles sur les coûts, le cas échéant, y compris les revenus mondiaux prévus déclarés par GlobalData ou l’appartenance du médicament à un domaine thérapeutique à coût élevé ou à un domaine thérapeutique qui enregistre le plus de ventes. Dans le présent rapport, les domaines thérapeutiques sont définis au niveau ATC4Note de bas de page ix. Un domaine thérapeutique est considéré comme étant à coût élevé s’il comprend au moins un médicament dont le coût annuel du traitement dépasse 10 000 dollars ou, dans le cas de l’oncologie, un traitement de 28 jours de plus de 5 000 dollars. Ces coûts sont fondés soit sur des posologies hypothétiques, soit sur le coût moyen du traitement observé dans les régimes publics ou privés d’assurance-médicaments. Les domaines thérapeutiques comprennent les cinq classes présentant les revenus mondiaux les plus élevés en 2018 selon les données dans la base de données MIDASMC d’IQVIA.

Les indications et les domaines thérapeutiques des médicaments présentés correspondent à leur stade d’essai clinique de phase III ou d’attente d’homologation. Un seul essai clinique peut évaluer plusieurs indications dans le même domaine thérapeutique. Ces médicaments peuvent avoir des indications supplémentaires à divers stades de l’évaluation clinique qui ne sont pas mentionnées dans le présent rapport. La description scientifique fournie s’applique directement à l’indication ou aux indications précisée(s) pour les médicaments sélectionnés.

Sources des données

La base de données GlobalData Healthcare est la principale source de données pour la désignation des médicaments émergents et la consignation des renseignements cliniques correspondants, y compris la date de fin des essais cliniques. GlobalData Healthcare fait le suivi des médicaments depuis leur découverte préclinique, en passant par les essais cliniques, jusqu’au lancement sur le marché et aux ventes subséquentes. La base de données est une ressource complète de médicaments à divers stades de développement clinique. Les capacités de recherche permettent une sélection contrôlée d’attributs particuliers, notamment la phase de développement clinique, le domaine thérapeutique, le type de molécule, l’indication, la géographie du médicament, le mécanisme d’action et les désignations de la FDA.

Étant donné que la sélection se limite aux nouveaux médicaments, d’autres sources d’information sont comparées pour confirmer que les médicaments candidats n’ont pas été approuvés ou vendus auparavant. Ces sources comprennent les données de vente enregistrées de la base de données MIDASMC d’IQVIA (tous droits réservés), les dossiers d’approbation réglementaire des National Institutes of Health, de la FDA des États-Unis, de l’Agence européenne des médicaments et de Santé Canada, et des renseignements issus de la base de données sur les essais cliniques de Santé Canada et de ClinicalTrials.org.

Limites

La présente analyse donne un aperçu des médicaments émergents pour une période donnée. Bien qu’il soit censé être représentatif de la composition des médicaments au cours de l’année complète, l’ensemble des médicaments émergents est assez dynamique, et la part des médicaments dans un domaine thérapeutique particulier variera.

L’évaluation se limite aux médicaments en développement destinés à la commercialisation au Canada ou dans d’autres pays ayant des processus de réglementation et d’approbation semblables, soit les États-Unis et l’Europe (à l’exclusion de la Russie et de la Turquie). Les médicaments qui n’ont pas encore reçu d’autorisation de mise en marché dans ces pays ont été considérés comme des médicaments candidats potentiels, même s’ils ont été approuvés ailleurs dans le monde.

Certains des médicaments sélectionnés peuvent faire l’objet d’essais cliniques pour des indications supplémentaires; la présente analyse ne fait état que des indications aux derniers stades de développement, c’est-à-dire lors des essais cliniques de phase III ou avant l’homologation par la FDA des États-Unis, qui répondent aux critères de sélection énoncés dans la méthodologie.

Pour chaque médicament choisi, le(s) fabricant(s) principal(aux) et le nom commercial, le cas échéant, sont précisés avec l’indication. Dans certains cas, d’autres fabricants, y compris des filiales, peuvent également participer au développement du médicament avec l’entreprise primaire, ou d’autres fabricants peuvent mettre au point le même médicament pour d’autres indications.

L’analyse des coûts qui fait partie du présent rapport indique si un médicament donné appartient à un domaine thérapeutique à coût élevé ou à un domaine thérapeutique qui enregistre le plus de ventes en fonction des données historiques sur les ventes. Même si cela peut indiquer la possibilité qu’un médicament présenté devienne un médicament très coûteux ou très vendu, cette information demeure incertaine à ce stade précoce. À l’inverse, les médicaments qui ne sont pas désignés comme faisant partie d’un domaine thérapeutique à coût élevé ou d’un domaine thérapeutique qui enregistre le plus de ventes peuvent tout de même devenir des médicaments très coûteux ou très vendus une fois qu’ils sont commercialisés. Des médicaments à coût élevé ont été introduits dans des domaines thérapeutiques qui n’ont jamais été désignés comme tels, et des médicaments qui figurent parmi les plus vendus sont souvent introduits dans de nouveaux domaines thérapeutiques ou dans des domaines qui n’ont jamais été reconnus comme étant des domaines qui enregistrent le plus de ventes.

Bien que le présent rapport tente de définir les médicaments émergents les plus importants, la sélection n’est pas exhaustive, et certains médicaments qui ne sont pas inclus dans cette sélection peuvent avoir une incidence importante sur la pratique clinique future ou les dépenses en médicaments au Canada.

Les listes présentées sont valides en date du 1er mai 2019. En raison de la nature imprévisible et rapide de l’entrée sur le marché des médicaments émergents, certains des médicaments énumérés dans la présente édition peuvent avoir été approuvés ou commercialisés au Canada, aux États-Unis ou en Europe après cette date. De plus, des médicaments émergents qui n’ont pas été inclus dans le présent rapport parce qu’ils ne répondaient pas aux critères de sélection de l’OMÉ au moment de l’analyse peuvent y répondre maintenant. Ceux-ci, ainsi que le reste de la liste des médicaments émergents, seront pris en considération pour la prochaine édition du rapport.

Aperçu des médicaments émergents en 2018

L’innovation pharmaceutique transforme le développement et l’application des traitements médicaux dans le monde entier. En 2018, près de 6 000 nouveaux médicaments étaient en évaluation clinique ou en attente d’homologation par la FDA, soit 87 % de l’ensemble des médicaments émergents.

Les traitements contre le cancer dominaient la combinaison thérapeutique, représentant le tiers des médicaments à toutes les phases de l’évaluation clinique. D’autres domaines thérapeutiques importants comprenaient les traitements contre les maladies infectieuses comme le VIH et la pneumonie (12 % des médicaments) et les médicaments contre les maladies et les troubles du système nerveux tels que la maladie d’Alzheimer et la dépression (11 % des médicaments).

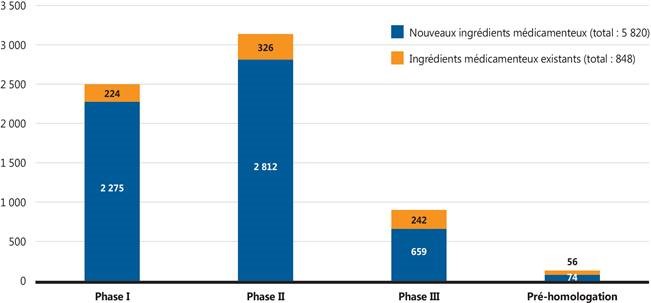

La figure 2 donne un aperçu des médicaments émergents en 2018, y compris du nombre de nouveaux ingrédients médicinaux pour chaque phase de l’évaluation clinique. Sur les 5 820 nouveaux médicaments, 733 (12 %) étaient en essais cliniques de phase III ou en attente d’homologation par la FDA.

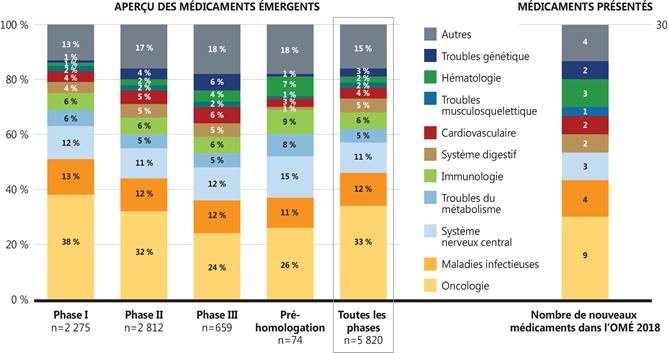

Dans l’ensemble, les médicaments émergents représentaient un large éventail de domaines thérapeutiques. La figure 3 illustre la répartition des nouveaux médicaments par domaine thérapeutique, y compris pour les médicaments émergents sélectionnés dans le présent rapport.

Figure 2. Nombre de médicaments émergents selon le stade de l’évaluation clinique

Source de données : Base de données GlobalData Healthcare (consultée en juillet 2018).

Figure description

Ce graphique à barres empilées illustre le nombre de médicaments distincts pour chaque phase des essais cliniques en 2018, c’est-à-dire le nombre de nouveaux ingrédients médicamenteux et le nombre d’ingrédients médicamenteux existants. En tout, 5 820 nouveaux ingrédients médicamenteux et 848 ingrédients médicamenteux existants étaient en développement.

| |

Phase I |

Phase II |

Phase III |

Pré-homologation |

| Nouveaux ingrédients médicamenteux |

2 275 |

2 812 |

659 |

74 |

| Ingrédients médicamenteux existants |

224 |

326 |

242 |

56 |

Figure 3. Répartition par classe thérapeutique, aperçu des médicaments émergents et médicaments retenus dans l’OMÉ, 2018

Source de données : Base de données GlobalData Healthcare (consultée en juillet 2018).

Figure description

Cette figure comprend deux diagrammes à barres qui montrent la répartition de tous les nouveaux médicaments en cours de développement selon le domaine thérapeutique. La répartition est fournie sous forme de pourcentage de l’ensemble des médicaments par phase de développement, ainsi qu’en fonction du pourcentage total pour toutes les phases. Le nombre de nouveaux médicaments retenus dans cette édition de L’Observateur des médicaments émergents figure dans une colonne distincte.

|

Domaine thérapeutique |

Phase I |

Phase II |

Phase III |

Pré-homologation |

Toutes les phases |

Nombre de nouveaux médicaments dans L’Observateur des médicaments émergents, 2018 |

| Oncologie |

38 % |

32 % |

24 % |

26 % |

33 % |

9 |

| Maladies infectieuses |

13 % |

12 % |

12 % |

11 % |

12 % |

4 |

| Système nerveux central |

12 % |

11 % |

12 % |

15 % |

11 % |

3 |

| Métabolisme |

6 % |

5 % |

5 % |

8 % |

5 % |

- |

| Immunologie |

6 % |

6 % |

6 % |

9 % |

6 % |

– |

| Système digestif |

4 % |

5 % |

5 % |

1 % |

5 % |

2 |

| Cardiovasculaire |

4 % |

5 % |

6 % |

3 % |

4 % |

2 |

| Troubles musculosquelettique |

2 % |

2 % |

2 % |

1 % |

2 % |

1 |

| Hématologie |

1 % |

2 % |

4 % |

7 % |

2 % |

3 |

| Troubles génétique |

1 % |

4 % |

6 % |

1 % |

3 % |

2 |

| Autres |

13 % |

17 % |

18 % |

18 % |

15 % |

4 |

L’Observateur des médicaments émergents 2018

En appliquant les critères de sélection décrits dans la section « Méthodologie », on a sélectionné pour le présent rapport 30 des 733 médicaments aux dernières étapes de l’évaluation clinique. Sur les 30 nouveaux médicaments, 20 ont été désignés comme étant des médicaments orphelins par la FDA ou l’Agence européenne des médicaments (dont 8 thérapies géniques), 9 sont des médicaments oncologiques et 3 sont des produits biologiques.

Le tableau 3 présente une liste complète des médicaments émergents sélectionnés, y compris les critères de sélection, les indications et les attributs admissibles organisés par grande classe thérapeutique. Le tableau 4 présente une liste similaire pour les thérapies géniques.

La liste est valide en date du 1er mai 2019. Les médicaments sélectionnés feront l’objet d’un suivi dans les prochaines éditions du rapport.

Tableau 3. Liste des nouveaux médicaments sélectionnés pour 2018

Médicament (nom commercial)

Entreprise

Critères de selection |

Indication(s)* |

Description et principaux attributs |

| Cardiovasculaire |

|

Élamiprétide (Bendavia [É.-U.])

Stealth BioTherapeutics inc.

- Innocuité et efficacité accrues

- Nouveau mécanisme

- Désignation accélérée

|

Maladies mitochondriales (myopathie) |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Un tétrapeptide aromatique-cationique qui augmente l’énergie mitochondriale.Note de bas de page 1

- Nouvelle cible thérapeutique dans la gestion de l’insuffisance cardiaque.Note de bas de page 2

- Performance accrue à l’exercice après 5 jours de traitement chez les patients atteints de myopathie mitochondriale primaire sans préoccupations accrues en matière de sécurité.Note de bas de page 3

|

| Système nerveux central |

|

Rapastinel

Allergan Plc

- Nouveau mécanisme

- Découverte

- Désignation accélérée

|

Trouble dépressif majeur |

- Désignation de médicament orphelin

- Un nouveau modulateur des récepteurs NMDA (N-méthyl-D-aspartate).

- Grand besoin non satisfait de nouveaux médicaments avec de nouveaux mécanismes d’action qui peuvent traiter efficacement les patients dont l’état ne s’améliore pas avec les traitements antidépresseurs courants.

- Le revenu global devrait être de 15 millions de dollars en 2020 et de 519 millions de dollars d’ici 2024.

|

|

Ubrogépant

Allergan Plc

- Innocuité et efficacité accrues

- Nouveau mécanisme

|

Migraines |

- Essais cliniques au Canada

- Un antagoniste des récepteurs du peptide lié au gène de la calcitonine de prochaine génération, par voie orale.

- Sécuritaire et efficace dans le traitement aigu des migraines chez un vaste éventail de patients qui ont eu une réponse insuffisante à un triptan ou chez qui les triptans sont contre-indiqués, ainsi que chez les patients présentant un risque cardiovasculaire moyen à grave.

- Le revenu global devrait être de 32 millions de dollars en 2020 et de 470 millions de dollars d’ici 2024.

|

| Système digestif et métabolisme |

|

Cénicriviroc

Allergan Plc

- Innocuité et efficacité accrues

- Désignation accélérée

|

Fibrose hépatique; stéatohépatite non alcoolique (SHNA) |

- Essais cliniques au Canada

- Un antagoniste des récepteurs de la chimiokine de type 2 (CCR2) et de type 5 (CCR5) chez les personnes séropositives qui ont été traitées auparavant.Note de bas de page 4

- Pour le traitement oral de la stéatohépatite non alcoolique (SHNA) avec fibrose hépatique.Note de bas de page 5 Après un an de traitement, deux fois plus de patients ont connu une amélioration de la fibrose et aucune aggravation de la SHNA comparativement au placebo.Note de bas de page 6

- La prévalence de la stéatose hépatique non alcoolique (NAFLD) est en hausse partout dans le monde. Actuellement, aucune pharmacothérapie spécifique n’est approuvée pour la NAFLD.Note de bas de page 7

- Dans les études réalisées à ce jour, l’innocuité et la tolérabilité étaient comparables à celles du placebo.Note de bas de page 8

- Le revenu global devrait être de 73 millions de dollars d’ici 2024.

|

|

Setmélanotide

Rhythm Pharmaceuticals, inc.

- Innocuité et efficacité accrues

- Nouveau mécanisme

- Découverte

|

Obésité |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Nouvelle classe d’agoniste du récepteur de mélanocortines MC4R pour traiter les troubles génétiques rares de l’obésité.

- La setmélanotide entraîne une perte de poids chez les personnes obèses qui présentent un déficit total de la pro-opiomélanocortine (POMC). Bien que le déficit de POMC soit très rare, de 1 à 5 % des personnes gravement obèses présentent des mutations hétérozygotes du gène MC4R.Note de bas de page 9

- Le revenu global devrait être de 22 millions de dollars en 2020 et de 542 millions de dollars d’ici 2024.

|

| Système génito-urinaire et hormones sexuelles |

|

Vilaprisan

Bayer AG

- Innocuité et efficacité accrues

- Nouveau mécanisme

|

Leiomyome utérin (fibromes utérins) |

- Un nouveau modulateur sélectif puissant des récepteurs de la progestérone.

- Il a été démontré qu’il provoque des changements bénins de l’endomètre (PRM-associated endometrial changes, ou PAEC), qui disparaissent à mesure que le traitement est interrompu. Contrairement au traitement par agonistes de la gonadolibérine (GnRHa), il n’induit pas l’hypo-œstrogénie ni les symptômes connexes.Note de bas de page 10

- Le revenu global devrait être de 286 millions de dollars d’ici 2024.

|

| Hématologie |

|

Fitusiran

Sanofi et Alnylam Pharmaceuticals, inc.

- Innocuité et efficacité accrues

|

Hémophilie A; hémophilie B |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Un petit ARN interférent (ARNi) mis au point pour supprimer la synthèse hépatique de l’antithrombine.

- Le traitement actuel de l’hémophilie nécessite de fréquentes perfusions intraveineuses de facteurs de coagulation, qui sont associées à une protection hémostatique variable, à un lourd fardeau associé aux traitements et à un risque de développement d’alloanticorps inhibiteurs.

- L’administration sous-cutanée mensuelle de fitusiran a entraîné une diminution dose-dépendante de la concentration d’antithrombine et une plus grande production de thrombines chez les participants atteints d’hémophilie A ou B qui n’avaient pas d’alloanticorps inhibiteurs.Note de bas de page 11

- Le revenu global devrait être de 400 millions de dollars d’ici 2024.

|

|

Vadadustat

Akebia Therapeutics Inc et Otsuka Holdings Co., Ltée

- Innocuité et efficacité accrues

- Nouveau mécanisme

|

Anémie dans la maladie rénale chronique (MRC); anémie rénale |

- Essais cliniques au Canada

- Un inhibiteur titrable d’enzyme du domaine de la prolyle hydroxylase (PHD pour prolyl hydroxylase domain-containing enzyme) qui constitue un nouveau traitement pharmacologique de l’anémie.

- Il a été démontré qu’il augmentait les taux d’hémoglobine (Hb)Note de bas de page 12 et maintenait les concentrations moyennes d’Hb chez les patients en hémodialyse qui recevaient auparavant de l’époétine.Note de bas de page 13

- Le revenu global devrait être de 60 millions de dollars en 2020 et de 1 milliard de dollars d’ici 2024.

|

| Maladies infectieuse |

|

Cabotégravir

ViiV Healthcare UK Ltée

- Innocuité et efficacité accrues

|

Infections au VIH (SIDA) |

- Essais cliniques au Canada

- Traitement d’appoint

- Un puissant inhibiteur de transfert de brin de l’intégrase sous forme de comprimé oral administré quotidiennement et de nanosuspension injectable à longue durée d’action.

- Il a une longue demi-vie et peut être préparé sous forme de nanosuspension à longue durée d’action pour l’administration parentérale (intramusculaire à toutes les 4 et 8 semaines).Note de bas de page 14

- Peu d’interactions avec les médicaments concomitants couramment utilisés.Note de bas de page 15

- Peut offrir une autre option thérapeutique pour le traitement et la prévention de l’infection à VIH-1 qui ne nécessite pas l’adhésion à un schéma posologique quotidien.Note de bas de page 16

- En combinaison avec le double traitement avec l’analogue nucléosidique inhibiteur de la transcriptase inverse (ANITI), il a démontré une activité antivirale puissante durant la phase d’induction; en tant que traitement de maintien à deux médicaments, le cabotégravir avec la rilpivirine a entraîné une activité antivirale semblable à l’efavirenz en plus du traitement à deux ANITI jusqu’à la fin de la semaine 96.Note de bas de page 17

- Offre une solution de rechange aux schémas posologiques quotidiens et peut améliorer l’observance thérapeutique à la prophylaxie préexposition (PrEP).Note de bas de page 18

- Le revenu global devrait être de 81 millions de dollars en 2019 et de 501 millions de dollars d’ici 2024.

|

|

Fostemsavir trométhamine

ViiV Healthcare UK Ltée

- Innocuité et efficacité accrues

- Découverte

- Désignation accélérée

|

Infections à VIH (SIDA) |

- Essais cliniques au Canada

- Traitement d’appoint

- Un inhibiteur de l’attachement au récepteur CD4 de prochaine génération qui est actif, peu importe le tropisme viral, sans résistance croisée à l’un ou l’autre des composés antirétroviraux existants.Note de bas de page 19

- Dans une étude, 82 % des patients traités avec du fostemsavir et un traitement de base optimal de médicaments antirétroviraux ont obtenu une suppression virologique en deçà de 50 copies/mL chez des personnes séropositives qui ont été traitées auparavant.Note de bas de page 20

- Le revenu global devrait être de 19 millions de dollars en 2020 et de 265 millions de dollars d’ici 2024.

|

|

Léfamuline

Nabriva Therapeutics Plc

- Innocuité et efficacité accrues

- Nouveau mécanisme

- Désignation accélérée

|

Pneumonie bactérienne acquise dans la collectivité |

- Nouvel antibiotique (pleuromutiline); présente un mécanisme d’action unique par l’inhibition de la synthèse des protéines en se liant au centre peptidyl transférase de la sous-unité 50S du ribosome bactérien, empêchant ainsi la liaison de l’ARN de transfert pour le transfert du peptide.Note de bas de page 21

- A démontré une activité puissante contre tous les isolats gonococciques.Note de bas de page 22

- Ce pourrait être un antibiotique de première ligne prometteur pour le traitement des infections transmissibles sexuellement (ITS), en particulier dans les populations présentant des taux élevés de résistance aux antibiotiques courants.Note de bas de page 23

- Le revenu global devrait être de 15 millions de dollars en 2019 et de 311 millions de dollars d’ici 2024.

|

|

Murépavadine

Polyphor AG

- Nouveau mécanisme

- Désignation accélérée

|

Pneumonie associée au ventilateur (PAV); pneumonie nosocomiale |

- Un peptidomimétique antimicrobien spécifique au pathogène avec un nouveau mécanisme d’action non lytique; nouvelle classe d’antibiotiques ciblant les protéines de membrane externe.

- A démontré une activité puissante contre une vaste collection d’isolats cliniques de Pseudomonas aeruginosa de souches XDR.Note de bas de page 24

|

| Troubles musculosquelettique |

|

Palovarotène

Clementia Pharmaceuticals inc.

- Innocuité et efficacité accrues

- Nouveau mécanisme

- Découverte

- Désignation accélérée

|

Fibrodysplasie ossifiante progressive (FOP) |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Un nouvel agoniste gamma du récepteur de l’acide rétinoïque hautement sélectif.

- Il est allégué qu’il inverse les caractéristiques structurelles, fonctionnelles et inflammatoires de l’emphysème induit par l’inhalation de la fumée de cigarette.Note de bas de page 25

- Le revenu global devrait être de 15 millions de dollars en 2020 et de 261 millions de dollars d’ici 2024.

|

| Oncologie |

|

Entinostat

Syndax Pharamceuticals, inc.

- Innocuité et efficacité accrues

- Découverte

|

Cancer du sein métastatique |

- Désignation de médicament orphelin

- Traitement d’appoint

- Un inhibiteur synthétique de l’histone-désacétylase dérivé du benzamide.

- Inverse la résistance au cisplatine.Note de bas de page 26

- Le revenu global devrait être de 16 millions de dollars en 2020 et de 423 millions de dollars en 2024.

- Domaine thérapeutique à coût élevé.†

|

|

Ipatasertib

Array BioPharma inc. et Genentech inc.

- Innocuité et efficacité accrues

|

Cancer du sein métastatique; cancer de la prostate métastatique hormono-résistant (résistant à la castration, androgéno-indépendant) |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Produit biologique

- Traitement d’appoint

- Un inhibiteur oral homologue du virus oncogène du thymus murin (v‑Akt).

- Dans le cas du cancer de la prostate métastatique résistant à la castration, le blocage combiné avec l’abiratérone et l’ipatasertib a révélé une activité antitumorale supérieure à l’abiratérone seul, en particulier chez les patients présentant le gène suppresseur de tumeur PTEN (phosphatase et homologue de la tensine).Note de bas de page 27

- Amélioration des résultats chez un sous-ensemble de patients atteints d’un cancer du sein métastatique triple négatif lorsque combiné avec le paclitaxel dans le traitement de première ligne.Note de bas de page 28, Note de bas de page 29 Les traitements qui ciblent ce cancer – qui représente environ 20 % des cancers du sein – demeurent inaccessibles.

- Le revenu global devrait être de 4 millions de dollars en 2020 et de 410 millions de dollars d’ici 2024.

- Domaine thérapeutique à coût élevé†; domaine thérapeutique le plus vendu‡

|

|

Chlorhydrate de melphalan flufénamide

Oncopeptides AB

- Innocuité et efficacité accrues

- Nouveau mécanisme

|

Myélome multiple réfractaire; myélome multiple récidivant |

- Désignation de médicament orphelin

- Traitement d’appoint

- Agent alkylant à base de peptides; un nouveau promédicament du melphalan à base de dipeptides.

- Seul ou combiné au cisplatine, à la gemcitabine ou au dasatinib, est prometteur comme nouveau traitement du carcinome urothélial (CU).Note de bas de page 30

- Surmonte la résistance aux médicaments et améliore les résultats pour les patients atteints du myélome multiple.Note de bas de page 31

- Domaine thérapeutique à coût élevé.†

|

|

Dichlorhydrate de quizartinib

Daiichi Sankyo Co., Ltée

- Innocuité et efficacité accrues

- Découverte

- Désignation accélérée

- Examen prioritaire

|

Leucémie myéloïde aiguë (LMA) réfractaire; leucémie myéloïde aiguë récidivante |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Un inhibiteur à petites molécules ciblant le récepteur FLT3 de la tyrosine kinase, administré oralement une fois par jour. Ce récepteur est couramment exprimé dans la leucémie myéloïde aiguë et subit une mutation chez environ 25 % des patients atteints de cette maladie.

- Les données de l’étude QuANTUM-R (NCT02039726) ont confirmé l’efficacité et l’innocuité du quizartinib qui ont été observées lors d’essais antérieurs, et ont démontré la valeur du traitement ciblant la mutation FLF3-ITD. Il s’agit du premier essai visant à démontrer une meilleure survie globale chez les patients atteints de la leucémie myéloïde aiguë associée à la mutation FLF3-ITD-AML, résistants au traitement ou qui ont fait une rechute après un traitement antérieur.

- Les données préliminaires de l’étude QuANTUM-R montrent une meilleure survie globale chez les patients atteints de la leucémie myéloïde aiguë associée à la mutation FLF3-ITD-AML, résistants au traitement ou qui ont fait une rechute après un traitement antérieur.

- Le revenu global devrait être de 20 millions de dollars en 2019 et de 334 millions de dollars d’ici 2024.

- Domaine thérapeutique à coût élevé†; domaine thérapeutique le plus vendu‡

|

|

Racotumomab (Vaxira)

Innogene Kalbiotech Pte., Ltée

- Innocuité et efficacité accrues

|

Cancer du poumon non à petites cellules |

- Un vaccin anti-idiotype (anti-Id) à base d’anticorps monoclonaux qui vise les gangliosides contenant du NeuGc, comme le NeuGcGM3, un néoantigène spécifique aux tumeurs largement signalé dans de nombreux cancers chez les humains.

- Administration intradermique comme vaccin contre le cancer.Note de bas de page 32

- Immunogénicité élevée démontrée et faible toxicité.Note de bas de page 33

- Domaine thérapeutique à coût élevé†; domaine thérapeutique le plus vendu‡

|

|

Sélinexor

Karyopharm Therapeutics, inc.

- Nouveau mécanisme

- Désignation accélérée

- Examen prioritaire

|

Myélome multiple récidivant ou réfractaire |

- Désignation de médicament orphelin

- Nouvelle classe d’inhibiteur sélectif de l’exportation nucléaire (SINE) administré par voie orale. Il se lie à une protéine d’exportation nucléaire, XPO1 (CRM1), et l’inhibe.

- Dans un essai de phase II (STORM), il a été administré en combinaison avec une dexaméthasone à faible dose et on a constaté une régression tumorale chez 25,4 % de ces patients; chez deux patients, les tumeurs ont complètement disparu. Les réponses ont duré une médiane de 4,4 mois.

- Le revenu global devrait être de 30 millions de dollars en 2019 et de 451 millions de dollars d’ici 2024.

- Domaine thérapeutique à coût élevé†

|

|

Ublituximab

TG Therapeutics, inc; LFB S.A.

- Innocuité et efficacité accrues

|

Leucémie lymphoïde chronique (LLC) réfractaire; leucémie lymphocytique chronique (LLC) récurrente |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Produit biologique

- Traitement d’appoint

- Un anticorps monoclonal anti-CD20 glycomodifié de prochaine génération.

- Nouvelle génération avec une cytotoxicité dépendante du complément et une cytotoxicité cellulaire dépendante des anticorps contre les cellules B malignes plus élevées.Note de bas de page 34

- Efficacité démontrée chez les patients présentant un risque élevé de leucémie lymphocytique chronique (LLC) et de lymphome non hodgkinien à cellules B dans les traitements de première ligne, les traitements subséquents et chez les patients réfractaires au traitement par le rituximab.Note de bas de page 35

- En combinaison avec l’ibrutinib, les taux de réponse ont été rapides et élevés.Note de bas de page 36

- Le revenu global devrait être de 2 millions de dollars en 2020 et de 297 millions de dollars d’ici 2024.

- Domaine thérapeutique à coût élevé†; domaine thérapeutique le plus vendu‡

|

| Ophtalmologie |

|

Acétate de zurétinol

Novelion Therapeutics, inc.

- Innocuité et efficacité accrues

- Désignation accélérée

|

Amaurose congénitale de Leber; rétinite |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Rétinoïde oral; il s’agit d’un rétinoïde synthétique de remplacement pour le 11-cis-rétinal.

- Pourrait améliorer considérablement la fonction visuelle et l’acuité comme solution de rechange à la thérapie génique dans les maladies rétiniennes héritées. Son administration par voie orale, si elle est approuvée, la différencierait comme traitement potentiel, en particulier pour les patients qui ne peuvent être traités par des options plus invasives, comme les jeunes enfants, en raison de difficultés chirurgicales intraoculaires dans les yeux sous-développés.Note de bas de page 37

- Le revenu global devrait être de 24 millions de dollars en 2019 et de 91 millions de dollars d’ici 2024.

|

* Un seul essai clinique peut évaluer plusieurs indications dans le même domaine thérapeutique.

† Un domaine thérapeutique à coût élevé comprend au moins un médicament dont le coût annuel de traitement est supérieur à 10 000 $ ou, dans le cas des médicaments oncologiques, un cycle de traitement dont le coût est supérieur à 5 000 $. Les domaines thérapeutiques sont définis au quatrième niveau ATC (« ATC4 »).

‡ Les domaines thérapeutiques les plus vendus comprennent les cinq classes présentant les revenus mondiaux les plus élevés en 2018 selon les données dans la base de données MIDASMC d’IQVIA. Les domaines thérapeutiques sont définis au quatrième niveau ATC (« ATC4 »).

Source de données : Base de données GlobalData Healthcare (consultée en juillet 2018). Données d’analyse des coûts élevés recueillies à partir de la base de données sur les payeurs privés d’IQVIA, 2017.

Tableau 4. Liste des thérapies géniques sélectionnées pour 2018

Médicament (nom commercial)

Entreprise

Critères de selection |

Indication(s)* |

Description et principaux attributs |

| Cardiovasculaire |

|

Alferminogène tadénovec (Generx; Ad5FGF-4)

Angionetics inc.

|

Angine réfractaire en raison d’une ischémie myocardique |

- Essais cliniques au Canada

- Thérapie génique; facteur de croissance angiogénique; vise à stimuler la croissance naturelle de la circulation microvasculaire en cas d’insuffisance microvasculaire cardiaque chez les patients atteints d’ischémie myocardique et d’une angine de poitrine symptomatique en raison d’une maladie coronarienne avancée.

- Une administration intracoronarienne ponctuelle, non chirurgicale au moyen d’un cathéter standard pour perfusion cardiaque par un cardiologue dans le cadre d’une intervention de routine en consultation externe.

- Dans le cadre d’un essai en cours de phase III (AFFIRM) réalisé chez des patients de 55 à 75 ans souffrant d’angine réfractaire en raison d’une ischémie myocardique.Note de bas de page 38

|

| Système nerveux central |

|

Onasemnogène abéparvovec (ChariSMA; Zolgensma; AVXS-101)

AveXis inc.

- Découverte

- Désignation accélérée

- Examen prioritaire

|

Amyotrophie spinale (Maladie d’Aran-Duchenne) |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Il s’agit d’un virus adéno-associé recombinant non réplicant de sérotype 9 (AAV9) contenant de l’acide désoxyribonucléique complémentaire (ADNc) du gène SMN1, codant la protéine de survie des motoneurones humains, sous le contrôle de l’amplificateur du cytomégalovirus/du promoteur de la β-actine-hybride du poulet.

- Administration sous forme de perfusion unique.

- L’essai de phase I (STAR) a démontré une augmentation spectaculaire de la survie et une amélioration transformatrice dans l’atteinte des jalons de développement comparativement à l’histoire naturelle de l’amyotrophie spinale de type 1.Note de bas de page 39

- Les essais de phase III chez les nourrissons qui ont reçu un diagnostic d’amyotrophie spinale sont en cours.Note de bas de page 40,Note de bas de page 41,Note de bas de page 42

- Fait l’objet d’un pré-enregistrement dans l’Union européenne et aux États-Unis.

- Le revenu global devrait être de 451 millions de dollars en 2019 et de 2,04 milliards de dollars d’ici 2024.

- Domaine thérapeutique à coût élevé.†

|

| Troubles génétique |

|

Elivaldogene tavalentivec (Lenti-D)

Bluebird Bio inc.

|

Leucodystrophie avec insuffisance surrénale |

- Désignation de médicament orphelin

- Une thérapie génique au Lenti-D pour la leucodystrophie avec insuffisance surrénale liée au chromosome X, un trouble neurologique dévastateur dont l’incidence à la naissance est estimée à 1 nouveau-né sur 17 000. Ce trouble métabolique altère la bêta-oxydation des peroxysomes des acides gras à chaîne très longue.

- Des cellules CD34+ sont prélevées du patient par aphérèse et transduites avec le vecteur lentiviral Lenti-D. Le patient reçoit un traitement de conditionnement au busulfan et à la cyclophosphamide, après quoi le produit génétique Lenti-D, constitué des cellules CD34+ transduites, est perfusé.

- Les premiers résultats de l’étude Starbeam (ALD-102; phase II/III portent à croire que le traitement génique Lenti-D peut constituer une solution de rechange sûre et efficace à la transplantation de cellules souches allogéniques chez les garçons atteints de leucodystrophie avec insuffisance surrénale avec atteinte cérébrale à un stade précoce.Note de bas de page 43

- Le revenu global devrait être de 11 millions de dollars en 2019 et de 169 millions de dollars d’ici 2024.

- Domaine thérapeutique à coût élevé†

|

|

NSR-REP1 (AAV2-REP1)

Nightstar Therapeutics PLC

|

Choroïdérémie |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Un vecteur viral adéno-associé (AAV2) encodant la protéine d’escorte RAB 1 (REP1).

- Administré sous forme d’injection sous-rétinienne après une vitrectomie.

- La choroïdérémie est une dystrophie choriorétinienne héréditaire liée au chromosome X qui entraîne la cécité chez les adultes d’un âge avancé. On estime que sa prévalence se situe entre 1 personne sur 50 000 à 100 000 personnes. Il n’existe actuellement aucun traitement efficace.Note de bas de page 44

- Les études de phase I et II menées avec la thérapie génique RSSR-REP-1 chez des patients atteints de choroïdérémie ont produit des résultats encourageants, ce qui donne à penser qu’il est possible non seulement de ralentir ou d’arrêter la perte de vision, mais aussi d’améliorer l’acuité visuelle chez certains patients.Note de bas de page 45

- L’essai de phase III enregistré (STAR) chez les patients atteints de choroïdérémie a été amorcé dans de nombreux pays, dont le Canada.Note de bas de page 46

- Le revenu global devrait être de 192 millions de dollars en 2021 et de 604 millions de dollars d’ici 2024.

|

| Hématologie |

|

BB-305 (LentiGlobin)

Bluebird Bio inc.

|

Bêta-thalassémie majeure |

- Désignation de médicament orphelin

- Une thérapie génique pour le traitement de la bêta-thalassémie majeure, un trouble sanguin rare et potentiellement débilitant.

- Il est administré en une seule dose directement dans le sang (perfusion par voie IV) à la suite d’une chimiothérapie avec le busulfan.Note de bas de page 47

- Il peut améliorer la survie et la qualité de vie en réduisant ou en éliminant la nécessité des transfusions sanguines et du traitement par chélation du fer.

- Dans les essais de phase IIINote de bas de page 48,Note de bas de page 49

- Fait l’objet d’un pré-enregistrement dans l’Union européenne.

|

| Ophtalmologie |

|

Lénadogène nolparvovec

GenSight Biologics SA

|

Neuropathie optique héréditaire de Leber (NOHL) |

- Désignation de médicament orphelin

- Un vecteur viral recombinant adéno-associé de sérotype 2 (rAAV2/2) encodant le gène ND4 de type sauvage (rAAV2/2-ND4).

- Il est administré par injection intravitréelle contenant les génomes viraux de l’anticorps 9E10 dans une solution saline équilibrée (SSE) de 90 μL avec une solution de 0,001 % de Pluronic F68®.

- Dans les essais de phase III pour le traitement de l’atrophie optique ou de la NOHLNote de bas de page 50,Note de bas de page 51 en raison de la mutation du gène G11778A-ND4.

|

|

NT-501 (Renexxus)

Neurotech Pharmaceuticals inc.

|

Téléangiectasie maculaire; rétinite pigmentaire |

- Désignation de médicament orphelin

- Un implant de facteur neurotrophique ciliaire (CNTF) constitué de cellules encapsulées dans une membrane polymérique semi-perméable et de matrices de soutien. Le NT-501 contient des cellules de NTC-201 qui sécrètent le CNTF humain recombinant, dérivé des cellules NTC-200 génétiquement modifiées.

- Thérapie par cellules encapsulées (TEC) : la plateforme est insérée au cours d’une seule intervention chirurgicale externe au moyen d’une petite incision sclérale et peut être retirée par la même incision au besoin.

- Des études de phase II ont été réalisées chez des patients souffrant de rétinite pigmentaire avec des résultats prometteurs;Note de bas de page 52 Note de bas de page 53 début des essais de phase III chez les patients atteints de télangiectasie maculaire.Note de bas de page 54,Note de bas de page 55

|

| Oncologie |

|

Tavokinogène telséplasmide (TAVO [É.-U.])

OncoSec Medical inc.

|

Mélanome métastatique |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- Une cytokine immunomodulatrice qui libère l’interleukine-12 (IL-12), une protéine immunostimulante, dans le microenvironnement de la tumeur.

- Administrée au moyen d’ImmunoPulse, un dispositif introduit dans la tumeur par électroporation.

- Une combinaison de tavokinogène telséplasmide et de pembrolizumab a permis de réduire efficacement les tumeurs chez les patients atteints d’un mélanome avancé chez qui les traitements visant la mort cellulaire programmée de la protéine PD-1 (anti-PD-1) avaient échoué, selon les premiers résultats d’un essai de phase IIb (incluant un site canadien).Note de bas de page 56, Note de bas de page 57

|

|

Flucytosine à libération prolongée (LP) plus vocimagène amirétrorepvec (Toca-511)

Tocagen inc.

- Découverte

- Désignation accélérée

|

Gliome de haut grade; astrocytome de type anaplasique; glioblastome multiforme (GBM) récurrent |

- Essais cliniques au Canada

- Désignation de médicament orphelin

- La combinaison est appelée le schéma posologique du Toca : au cours de la première étape, les patients reçoivent du vocimagène amirétrorepvec (Toca 511), un virus qui se reproduit et infecte sélectivement les cellules cancéreuses durant la chirurgie; la deuxième étape exige que les patients reçoivent des cycles de 5-fluorocytosine (Toca FC) à libération prolongée.

- Après la réussite de l’étude de phase I chez les patients atteints d’un gliome de grade élevé, le schéma posologique du Toca a démontré un profil d’innocuité favorable, une survie prolongée du patient comparativement à d’autres thérapies et une régression tumorale complète. Avec le traitement courant, la survie médiane des patients récemment diagnostiqués est d’environ 14 à 16 mois. Après la récidive, cette période de survie chute à 7‑9 mois en moyenne. À l’inverse, les résultats de la phase I du schéma posologique du Toca ont révélé une longévité médiane de 14,4 mois chez les patients ayant connu une récidive.Note de bas de page 58

- Essai en phase III chez les patients atteints d’un glioblastomeNote de bas de page 59.

|

*Un seul essai clinique peut évaluer plusieurs indications dans le même domaine thérapeutique.

†Un domaine thérapeutique à coût élevé comprend au moins un médicament dont le coût annuel de traitement est supérieur à 10 000 $ ou, dans le cas des médicaments oncologiques, un cycle de traitement dont le coût est supérieur à 5 000 $. Les domaines thérapeutiques sont définis au quatrième niveau ATC (« ATC4 »).