Conseil d’examen du prix des médicaments brevetés

L’honorable Jane Philpott

Ministre de la Santé

ISSN: 2371-7815

Table des matières

Message du vice-président

Aperçu de nos plans

Raison d’être, mandat et rôle : composition et responsabilités

Contexte opérationnel : les conditions qui influent sur notre travail

Risques clés : facteurs susceptibles d’influer sur notre capacité de réaliser nos plans et d’atteindre nos résultats

Résultats prévus : ce que nous voulons réaliser au cours de l’année et ultérieurement

Dépenses et ressources humaines

Renseignements supplémentaires

Annexe A : Définitions

Notes en fin d’ouvrage

Message du vice-président

À titre de vice-président et président intérimaire du Conseil, j’ai le plaisir de vous présenter le plan ministériel du Conseil d’examen du prix des médicaments brevetés (CEPMB) pour 2017-2018.

Notre Plan ministériel 2017-2018 présente aux parlementaires et aux Canadiens des renseignements sur notre travail et sur les résultats que nous tenterons d’atteindre au cours de la prochaine année. Afin d’améliorer la présentation de rapports à l’intention des Canadiens, nous adoptons un nouveau rapport simplifié, lequel remplace le Rapport sur les plans et les priorités.

Le titre du rapport a été modifié afin de tenir compte de son but : communiquer nos objectifs de rendement annuels ainsi que les prévisions au chapitre des ressources financières et humaines afin de livrer ces résultats. Le rapport a aussi été restructuré afin de présenter plus clairement, plus simplement et de façon plus équilibrée les résultats réels que nous tentons d’atteindre, tout en continuant de faire preuve de transparence quant à la façon dont les deniers publics seront utilisés. Nous y décrivons les programmes et les services que nous offrons aux Canadiens, nos priorités pour 2017-2018, et la façon dont notre travail nous permettra d’honorer les engagements indiqués dans notre mandat ministériel et d’atteindre les priorités du gouvernement.

En 2017-2018, la principale priorité du CEPMB est d’appuyer la ministre de la Santé dans ses efforts continus visant à améliorer l’accès des patients aux médicaments d’ordonnance dont ils ont besoin en réduisant leur coût et en les rendant plus abordables pour les Canadiens. Pour ce faire, le CEPMB modernisera son cadre de réglementation afin de garantir qu’il demeure pertinent et efficace pour protéger les consommateurs des prix excessifs dans un marché pharmaceutique dynamique en constante évolution. En 2016-2017, le CEPMB a reçu un nombre record d’observations d’intervenants et de particuliers intéressés lorsqu’il a présenté son document de travail sur la réforme de ses lignes directrices. En 2017-2018, le CEPMB collaborera avec les représentants de Santé Canada afin d’élaborer une réponse politique à ces observations et de poursuivre la consultation des intervenants dans le but de mettre en œuvre le nouveau cadre de réglementation en 2018-2019. En ce qui a trait au programme de production de rapports, le CEPMB continuera d’étudier les nouveaux sujets et les tendances pharmaceutiques devant faire l’objet de rapports afin de mieux répondre aux besoins en matière d’information de nos intervenants ainsi que d’appuyer les efforts faits par les administrations fédérale, provinciales et territoriales pour gérer les dépenses pharmaceutiques d’une façon durable.

Dr Mitchell Levine

Vice-président

Aperçu de nos plans

Priorité 1 – Réglementation et rapports axés sur le consommateur

Le mandat de réglementation du CEPMB consiste à veiller à ce que les prix des médicaments brevetés vendus au Canada ne soient pas excessifs. En axant ses ressources d’application de la loi sur les affaires pouvant avoir une valeur jurisprudentielle et sur celles dans lesquelles les payeurs n’ont pas de pouvoir compensatoire, le CEPMB utilisera au maximum ses pouvoirs de protection des consommateurs en vertu du cadre de réglementation actuel. Le mandat en matière de production de rapports qu’a le CEPMB consiste à fournir aux intervenants de l’information sur les tendances de l’industrie pharmaceutique. En offrant aux payeurs, en temps opportun, des renseignements sur le marché ciblés, le CEPMB aide les payeurs à mieux gérer leurs budgets pharmaceutiques.

Priorité 2 – Modernisation du cadre

L’an dernier, le CEPMB a lancé des consultations sur la réforme de ses lignes directrices, première étape de la modernisation de son cadre de réglementation. En 2017-2018, le CEPMB collaborera avec des représentants de Santé Canada pour rédiger des réponses aux commentaires reçus des intervenants et poursuivra les consultations sur la réforme de la réglementation afin de mettre en œuvre un régime de réglementation moderne et rationalisé en 2018-2019.

Priorité 3 – Partenariats stratégiques et sensibilisation du public

Afin de réussir dans ses efforts de rationalisation et de modernisation de son cadre de réglementation, le CEPMB doit obtenir du soutien à l’égard de son mandat et sensibiliser la population au rôle qu’il joue au sein du système pharmaceutique canadien. Pour ce faire, il doit bâtir des partenariats stratégiques avec des payeurs publics et privés ainsi qu’avec des organismes de réglementation de l’industrie pharmaceutique nationaux et internationaux, tout en expliquant à la population, de manière proactive, le travail qu’il fait.

Le CEPMB soutiendra les efforts continus faits par la ministre de la Santé pour réaliser les priorités clés de son mandat, soit améliorer l’accès des patients aux médicaments d’ordonnance dont ils ont besoin en réduisant les coûts et en les rendant plus abordables pour les Canadiens.

Pour plus de renseignements sur les plans, les priorités et les résultats prévus du CEPMB, consulter la section « Résultats prévus » dans le présent rapport.

Raison d’être, mandat et rôle : composition et responsabilités

Raison d’être

Créé par le Parlement en 1987, le Conseil d’examen du prix des médicaments brevetés (CEPMB) est un organisme indépendant qui détient des pouvoirs quasi judiciaires. Il est investi d’un double mandat :

- réglementation – veiller à ce que les prix auxquels les titulaires de brevet vendent leurs médicaments au Canada ne soient pas excessifs;

- rapport – faire rapport des tendances des prix de tous les médicaments ainsi que des dépenses des brevetés dans la recherche et le développement au Canada.

Dans l’exécution de son mandat, le CEPMB veille à la protection des Canadiens en s’assurant que les médicaments brevetés ne sont pas vendus au Canada à des prix excessifs et que les intervenants sont tenus informés des tendances relatives aux produits pharmaceutiques.

Mandat et rôle

Le CEPMB a été créé à la suite des modifications apportées à la Loi sur les brevets (la Loi) en 1987 (projet de loi C-22) et ses pouvoirs de redressement ont été modifiés par d’autres modifications en 1993 (projet de loi C-91). Ces deux ensembles de modifications faisaient partie de réformes politiques visant à équilibrer le mandat de protection des consommateurs du CEPMB et les mesures de protection des brevets en vue d’encourager les efforts des titulaires de brevets pharmaceutiques en matière de R-D.

Le CEPMB a un double mandat :

Réglementation

Le CEPMB est responsable de s’assurer que les prix départ-usine auxquels les brevetés vendent leurs médicaments brevetés sur ordonnance ou en vente libre aux grossistes, aux hôpitaux, aux pharmacies et aux autres au Canada pour usage humain ou vétérinaire ne sont pas excessifs. Le CEPMB réglemente le prix de chaque médicament breveté auquel Santé Canada a attribué un numéro d'identification du médicament (DIN) dans le cadre de son processus d’examen du prix. Le mandat du CEPMB porte également sur des médicaments qui sont offerts en vertu du Programme d’accès spécial, par l’entremise d’une demande d’essai clinique et en tant que drogues nouvelles de recherche. Les médicaments brevetés en vente libre et les médicaments brevetés à usage vétérinaire sont également réglementés par le Conseil en fonction des plaintes reçues.

Rapport

Chaque année, le CEPMB rend compte au Parlement, par le truchement du ministre de la Santé, de ses activités relatives à l’examen du prix, des prix des médicaments brevetés et des tendances relatives à tous les médicaments d’ordonnance ainsi que des dépenses de R–D déclarées par les sociétés pharmaceutiques détentrices de brevets. De plus, par suite de l’établissement du Système national d’information sur l’utilisation des médicaments prescrits (SNIUMP) Notes de bas de page i par les ministres de la Santé fédéral, provinciaux et territoriaux en septembre 2001, le CEPMB réalise des analyses critiques des tendances relatives aux prix, à l’utilisation et aux coûts pour les médicaments brevetés et non brevetés distribués sous ordonnance pour que les participants clés du système de soins de santé au Canada aient des renseignements plus complets et plus justes sur la façon dont on utilise les médicaments d’ordonnance et sur les facteurs à l’origine des pressions exercées en ce qui a trait aux coûts. Cette fonction vise à aider les gouvernements fédéral, provinciaux et territoriaux et d’autres parties intéressées à se munir d’une source centralisée d’information crédible sur les tendances dans l’industrie pharmaceutique. Dans le cadre de sa fonction de rapport, le CEPMB collabore de plus en plus avec les gouvernements provinciaux et territoriaux en vertu de l’initiative du SNIUMP, et travaille plus étroitement avec les principales administrations par l’entremise du Conseil de la fédération, afin de fournir des analyses des prix et des marchés pertinentes dans l’optique de réduire les prix des médicaments d’ordonnance achetés par les payeurs publics au Canada.

Pour obtenir de plus amples renseignements généraux sur le ministère, consulter la section « Renseignements supplémentaires » du présent rapport. Pour plus de renseignements sur les engagements organisationnels formulés dans la lettre de mandat du ministère, consulter la lettre de mandat de la ministre sur le site Web du premier ministre du Canada. Notes de bas de page ii

Contexte opérationnel : les conditions qui influent sur notre travail

Le CEPMB œuvre dans un environnement complexe au sein duquel existent des enjeux et des intérêts politiques, économiques, sociaux, juridiques, commerciaux et technologiques inter reliés et parfois concurrentiels.

De par sa nature, l’industrie pharmaceutique est une des industries les plus réglementées au monde. Le Canada ne fait pas exception : la réglementation pharmaceutique est un secteur de compétence partagée. À l’échelle fédérale, Santé Canada examine les nouveaux médicaments pour en assurer l’innocuité, l’efficacité et la qualité, et le CEPMB établit leurs prix plafonds tant qu’ils sont brevetés. L’Agence canadienne des médicaments et des technologies de la santé (ACMTS), organisme indépendant sans but lucratif subventionné par les gouvernements fédéral, provinciaux et territoriaux, effectue des évaluations économiques de nouveaux médicaments et formule des recommandations en matière de remboursement aux tiers payeurs publics participants. À l’échelle provinciale et territoriale, les ministres de la Santé et les gestionnaires des régimes d’assurance-médicaments décident quels médicaments sont remboursés à la population de bénéficiaires et négocient les prix directement avec les fabricants pharmaceutiques. À l’extérieur des gouvernements, les compagnies d’assurance-maladie privées gèrent les régimes d’assurance-médicaments des employeurs et négocient également les prix directement avec les fabricants. Les règles établissant si les assureurs privés sont liés par les décisions de remboursement relatives aux régimes d’assurance-médicaments publics ou s’ils bénéficieront des négociations de prix, et dans quelle mesure, varient par province.

Le prix des médicaments brevetés au Canada a augmenté de façon constante par rapport aux prix observés dans les sept pays auxquels se compare le Canada en vertu de sa réglementation (France, Allemagne, Italie, Suède, Suisse, Royaume-Uni et États-Unis – les sept pays de comparaison du CEPMB) et se trouve maintenant au troisième rang, n’étant devancé que par l’Allemagne et les États-Unis. Depuis 2000, les dépenses en médicaments brevetés du Canada exprimées en pourcentage du PIB ont connu une hausse de 184 %, dépassant les sept pays de comparaison du CEPMB au cours de cette période. Outre les sept pays de comparaison du CEPMB, les prix en Australie, en Autriche, en Espagne, en Finlande, aux Pays-Bas et en Nouvelle Zélande sont de 14 % à 34 % inférieurs à ceux du Canada. Si l’on tient compte de tous les médicaments prescrits et non seulement des médicaments brevetés, les dépenses par habitant au Canada et en tant que pourcentage du PIB sont plus élevées que celles de la plupart des autres pays.

Tandis que les prix au Canada augmentent, l’investissement en R-D diminue. Depuis 2003, les membres de Médicaments novateurs Canada (MNC) n’ont pas respecté leur engagement de 10 %, et le ratio actuel s’établit à 4,9 % des ventes. Il s’agit du deuxième plus faible ratio enregistré depuis 1988 (le plus bas, soit 4,8 %, a été enregistré en 2014), lorsque le CEPMB a produit son tout premier rapport sur la R-D. Par opposition, le ratio moyen de R et D des sept pays de comparaison du CEPMB est constamment supérieur à 20 %.

Le prix élevé des médicaments brevetés et le creux record de l’investissement en R-D remettent beaucoup en question l’efficacité du CEPMB pour atteindre les objectifs de la politique du gouvernement de 1987. Ces préoccupations ont été exprimées à nouveau récemment par le Groupe consultatif sur l’innovation des soins de santé dans son rapport du 17 juillet 2015 intitulé « Libre cours à l’innovation : Soins de santé excellents pour le Canada », qui conclut que le CEPMB doit être renforcé afin d’assurer « une protection des consommateurs plus efficace contre les médicaments brevetés à prix élevé ». Ces mêmes préoccupations sont ce qui a incité le CEPMB à entreprendre un processus de planification stratégique d’un an, qui permettra à l’organisation de s’affirmer à nouveau en tant que garantie efficace contre l’abus des prix excessifs des fabricants pharmaceutiques et en tant que source précieuse de renseignements sur le marché pour les décideurs et les tiers payants. Pour atteindre le premier de ces deux objectifs, il faudra apporter des changements au cadre réglementaire du CEPMB. Ces changements sont en harmonie avec les efforts en cours des ministres FPT de la Santé consistant à « réduire le prix des produits pharmaceutiques » tout en « améliorant la capacité financière, l’accessibilité et l’utilisation appropriée des médicaments d’ordonnance » et sont complémentaires à ces efforts.

Risques clés : facteurs susceptibles d’influer sur notre capacité de réaliser nos plans et d’atteindre nos résultats

Principaux risques

Le CEPMB a été créé en 1987, dans le cadre de modifications apportées à la Loi sur les brevets, dans le contexte d’une réorganisation majeure du régime de brevets pharmaceutiques au Canada qui visait à maintenir l’équilibre entre des objectifs de politiques susceptibles d’être en concurrence. D’une part, le gouvernement a renforcé la protection que confèrent les brevets aux médicaments afin d’encourager davantage d’investissement en recherche et développement (R-D) de la part de l’industrie pharmaceutique au Canada. D’autre part, le gouvernement a cherché à atténuer les répercussions de ce changement sur les Canadiens en créant le CEPMB, une agence de protection des consommateurs ayant pour mandat de veiller à ce que les prix des médicaments brevetés au Canada ne soient pas « excessifs ».

Au moment de la création du CEPMB, on connaissait peu de choses de la relation entre le prix, la protection de la PI et l’investissement en R- D. Les tiers payants publics et privés commençaient tout juste à déployer des efforts pour contrôler le coût des médicaments d’ordonnance, et le concept d’« établissement des prix en fonction des références internationales » (c.-à-d. la comparaison des prix dans un pays aux prix dans d’autres pays) était tout nouveau. Les efforts de R-D du secteur se concentraient sur la mise en marché de médicaments qui traitaient les maladies et les problèmes les plus courants, tels que l’hypercholestérolémie, l’hypertension artérielle et la dépression, et dont le prix était en général à la portée des consommateurs et des tiers payants. Les prix courants officiels se rapprochaient du prix véritablement payé sur le marché et ne variaient pas de façon considérable d’un tiers payant à l’autre (p. ex. public par rapport à privé). Enfin, le gouvernement croyait que les compagnies pharmaceutiques tendraient à éviter d’abuser de leurs droits de brevet nouvellement renforcés par égard aux intérêts politiques investis pour assurer l’adoption des lois et règlements connexes.

Par contre, à l’heure actuelle, les données empiriques ne confirment pas l’idée que le prix et la propriété intellectuelle sont des leviers politiques particulièrement efficaces pour attirer la R-D pharmaceutique. D’autres facteurs, comme l’emplacement du siège social, l’infrastructure des essais cliniques et les grappes scientifiques, semblent être des déterminants beaucoup plus importants des secteurs où les investissements pharmaceutiques sont effectués dans une économie mondiale. Les rabais confidentiels des prix courants sont devenus la norme de l’industrie, ce qui fait obstacle aux efforts déployés afin de maîtriser les dépenses pharmaceutiques en fonction des prix courants publics à l’échelle internationale et permet aux entreprises d’exercer une discrimination entre différents tiers payants selon une perception du pouvoir de négociation de l’autre partie et sa capacité de payer. Au Canada, cela entraîne un écart de prix croissant entre les tiers payants publics, qui sont en mesure de négocier collectivement par l’entremise de l’Alliance pancanadienne pharmaceutique (APP), les tiers payants privés, qui peuvent ne pas avoir la souplesse nécessaire pour le faire en vertu des lois sur la concurrence, et les clients payants, qui ne disposent d’aucune capacité de négociation. En ce qui a trait à l’industrie, l’ère des « médicaments vedettes » commercialisés en masse a évolué vers une ère où le rendement de l’investissement le plus rentable découle des médicaments spécialisés très onéreux. Ces « médicaments de niche », comme sont souvent appelés ceux qui connaissent le plus de succès, ciblent des maladies et des affections graves, moins communes et non traitées, mais à un prix que même les tiers payants les mieux nantis ont du mal à payer. Enfin, la position de l’industrie pharmaceutique canadienne d’aujourd’hui est que toutes les obligations découlant des réformes de la fin des années 1980 et du début des années 1990 doivent tenir compte du passage du temps et du fait qu’un bon nombre de ces changements se sont depuis ancrés comme des normes minimales en vertu des accords commerciaux bilatéraux et multilatéraux (p. ex. ALENA et ADPIC de l’OMC).

La réalité d’aujourd’hui est que les seules contraintes significatives sur le prix que les entreprises pharmaceutiques peuvent demander pour leurs produits sont : ce que le marché peut supporter et ce que les organismes de réglementation peuvent imposer avec efficacité. Dans les cas où une société détient un monopole sur la seule option de traitement d’une maladie ou d’un trouble particulier, les tiers payants n’ont parfois pas d’autre choix que de payer le prix demandé, peu importe s’il est exorbitant. Bien que le système soit peut être en mesure d’absorber un, deux, ou même des dizaines de nouveaux médicaments très onéreux, il risque de s’effondrer sous le poids de centaines de ces médicaments, même si ces derniers sont habituellement très rentables ou bénéfiques sur le plan thérapeutique. L’inquiétude croissante au sujet de la durabilité a mené d’autres pays ayant des systèmes de santé publique à prendre des mesures pour résoudre les problèmes d’accessibilité financière, optimiser les ressources et suivre le rythme d’un marché pharmaceutique qui évolue rapidement.

blanc

| Risques |

Stratégie de réponse au risque |

Lien aux programmes du ministère |

Lien aux engagements de la lettre de mandat ou aux priorités pangouvernementales et ministérielles |

Réforme internationale des régimes d’établissement des prix et de remboursement

- Si on ne réussit pas à suivre le rythme des réformes relatives à la limitation des coûts entamées par les autorités internationales en matière d’établissement des prix et de remboursement des produits pharmaceutiques, on risque d’élargir l’écart de prix entre le Canada et la plupart des pays membres de l’OCDE et, par conséquent, les Canadiens pourraient payer des prix plus élevés par rapport aux autres pays industrialisés.

|

Le CEPMB :

- collaborera avec des représentants de Santé Canada afin d’élaborer une réponse stratégique aux commentaires des intervenants et du public quant à la réforme de son cadre de réglementation, et

- examinera les possibilités de renforcer ses liens avec les autorités internationales en matière d’établissement des prix et de remboursement pour partager des renseignements sur la situation du marché et demeurer au courant des pratiques exemplaires.

|

Le programme de réglementation du prix des médicaments brevetés

Le programme sur les tendances relatives aux produits pharmaceutiques

|

Rendre les médicaments d’ordonnance plus abordables

|

Les ententes confidentielles portant sur l’inscription de produits et l’APP

- En raison des ententes confidentielles et de l’augmentation de la participation des gouvernements fédéral, provinciaux et territoriaux à l’APP, les payeurs publics ont encore plus de pouvoir de négociation par rapport aux assureurs privés, qui, quant à eux, ne participent pas à des négociations collectives. Ceci pourrait élargir l’écart de prix entre les payeurs publics et privés dont la véritable étendue ne peut être calculée.

|

Le CEPMB :

- collaborera avec des représentants de Santé Canada afin d’élaborer une réponse stratégique aux commentaires des intervenants et du public quant à la réforme de son cadre de réglementation,

- continuera d’axer ses ressources d’application de la loi sur les affaires les plus importantes pour les payeurs publics et privés, et

- travaillera en vue d’officialiser sa fonction élargie de rapport en appuyant les négociations dans le cadre de l’APP.

|

Le programme de réglementation du prix des médicaments brevetés

Le programme sur les tendances relatives aux produits pharmaceutiques

|

Rendre les médicaments d’ordonnance plus abordables

|

Capacité de tenir des audiences

- La capacité du Conseil de tenir des audiences dépend du nombre de membres siégeant sur le Conseil et, actuellement, trois sièges vacants doivent être comblés en 2017-2018. Le fait de ne pas combler les sièges vacants de manière opportune pourrait retarder la tenue d’audiences sur les prix excessifs; par conséquent, les Canadiens pourraient payer des prix excessifs pour une durée plus longue qu'elle ne l'aurait été autrement.

|

Le PMPRB appuiera Santé Canada et le Bureau du conseil privé (BCP) dans leurs efforts visant à s’assurer de combler les sièges vacants dans les plus brefs délais pour que tous les cinq membres du Conseil soient en mesure de tenir des audiences. |

Le programme de réglementation du prix des médicaments brevetés |

Rendre les médicaments d’ordonnance plus abordables |

Gestion des contestations judiciaires

- Le CEPMB continuera de faire face à des procédures judiciaires à différents niveaux mettant en question sa compétence et (ou) la constitutionnalité de ses dispositions habilitante; de telles instances risquent de limiter la compétence du CEPMB et de réduire sa capacité de réaliser son mandat de protection de consommateurs.

|

Le CEPMB travaille en étroite collaboration avec le procureur général dans le cadre de ces affaires de manière à atténuer tout risque que ses pouvoirs en matière de protection des consommateurs soient restreints par suite d’une décision défavorable de la cour. |

Le programme de réglementation du prix des médicaments brevetés |

Rendre les médicaments d’ordonnance plus abordables |

Résultats prévus : ce que nous voulons réaliser au cours de l’année et ultérieurement

Programmes

Titre du programme – Le programme de réglementation du prix des médicaments brevetés

Description

Le CEPMB est un organisme indépendant qui détient des pouvoirs quasi judiciaires et qui est responsable de s’assurer que les prix auxquels les brevetés vendent leurs médicaments brevetés au Canada ne sont pas excessifs en vertu des facteurs d’examen du prix prévus à la Loi. Pour décider si un prix est excessif, le Conseil doit tenir compte des facteurs suivants : les prix de vente du médicament et des autres médicaments de la même catégorie thérapeutique au Canada et dans chacun des sept pays mis en comparaison nommés dans le Règlement sur les médicaments brevetés (le Règlement); les variations de l’Indice des prix à la consommation (IPC); et, conformément à la Loi, tous les autres facteurs précisés par les règlements d’application visant l’examen du prixNotes de bas de page iii. En vertu de la Loi et du Règlement, les brevetés sont tenus de faire rapport des renseignements sur les prix et les ventes pour chaque médicament breveté vendu au Canada, jusqu’à échéance du brevet ou des brevets. Le personnel du Conseil examine les renseignements soumis par les brevetés au lancement et à chaque période de rapport, et ce, pour tous les médicaments brevetés vendus au Canada. S’il conclut que le prix d’un médicament breveté semble excessif, le personnel du Conseil mène une enquête sur le prix. Une enquête peut se solder par un des résultats suivants : la fermeture de l’enquête lorsqu’il apparaît que le prix n’est pas excessif; un engagement de conformité volontaire par lequel le breveté s’engage à réduire le prix de son produit et à rembourser les recettes excessives qu’il en a tirées au moyen d’un paiement et (ou) d’une réduction du prix d’un autre produit médicamenteux breveté; ou une audience publique dont l’objet est de déterminer si le prix du produit médicamenteux est ou non excessif, y compris une ordonnance corrective rendue par le Conseil. Si le Panel d’audience du Conseil conclut, à l’issue d’une audience publique, qu’un prix est ou était excessif, il peut ordonner au breveté de réduire le prix de son produit et de prendre des mesures qui lui sont dictées pour rembourser les recettes excessives tirées de ce produit. Ce programme assure la protection des Canadiens et de leur système des soins de santé en effectuant l’examen des prix auxquels les brevetés vendent leurs médicaments brevetés au Canada afin d’éviter les prix excessifs.

Faits saillants de la planification

Malgré le fait que le prix d’environ 95 % des médicaments brevetés déclarés au CEPMB est fixé conformément aux lignes directrices, ou à un prix qui ne justifie pas la tenue d’une enquête, le prix des médicaments brevetés au Canada a augmenté de façon constante par rapport aux prix observés dans les sept pays auxquels se compare le Canada, et le prix de plus de 50 % des médicaments brevetés au Canada est maintenant supérieur au prix médian des sept pays de comparaison du CEPMB. Le CEPMB consulte présentement les intervenants et le public à propos de changements à ses lignes directrices qui lui permettraient d’inverser ces tendances.

Modernisation du cadre

En 2016-2017, le CEPMB a reçu un nombre record d’observations de divers intervenants et membres intéressés du public sur son document de discussion sur la réforme des lignes directrices. En 2017-2018, le CEPMB collaborera avec des représentants de Santé Canada à l’élaboration d’une réponse stratégique à ces observations et continuera de consulter les intervenants en vue de faire entrer en vigueur un nouveau cadre réglementaire d’ici 2018-2019.

Réglementation et rapports axés sur le consommateur

Bien que des changements au cadre réglementaire du CEPMB soient envisagés, ce dernier tentera de tirer le meilleur parti des pouvoirs en matière de protection des consommateurs aux termes du régime actuel en attribuant en priorité ses ressources d’application de la loi aux cas qui peuvent avoir une valeur de précédent et aux circonstances où les tiers payeurs n’ont pas de pouvoirs compensatoires. De plus, comme toujours, le CEPMB encouragera la conformité volontaire avec ses lignes directrices en donnant des séances d’information sur leur application et en procédant à l’examen du prix des médicaments brevetés nouveaux et existants conformément aux normes de service établies.

Partenariats stratégiques et sensibilisation du public

Afin de réussir à simplifier et à moderniser son cadre réglementaire, le CEPMB doit obtenir le soutien de son mandat et accroître la sensibilisation à son rôle au sein du système pharmaceutique canadien. Il y arrivera en nouant des partenariats stratégiques avec des tiers payants publics et privés et des organismes nationaux et internationaux de réglementation pharmaceutique, et grâce à une communication plus proactive de son travail au public.

Résultats prévus

blanc

| Résultats attendus |

Indicateurs de rendement |

Objectif |

Date d’atteinte de l’objectif |

Résultats réels pour 2013-2014 |

Résultats réels pour 2014-2015 |

Résultats réels pour 2015-2016 |

| La conformité des brevets à la Loi sur les brevets, à la réglementation et aux Lignes directrices sur les prix excessifs (les Lignes directrices) |

Pourcentage de médicaments brevetés dont les prix sont fixés en conséquence de la conformité volontaire, suivant les Lignes directrices ou ne justifient pas la tenue d’une enquête |

95 % Notes de bas de page iv |

Le 31 mars chaque année |

94,0 % |

95,3 % |

93 % |

| Taux de conformité aux ordonnances du Conseil relatives au prix ou à la compétence et aux engagements de conformité volontaire |

100 % |

Le 31 mars chaque année |

100 % |

100 % |

100 % |

| Au Canada, les prix des médicaments brevetés se situent dans la fourchette des prix pratiqués dans les sept pays de comparaison nommés dans le Règlement |

Les prix canadiens des médicaments brevetés se trouvent en dessous de la médiane des prix internationaux Notes de bas de page v |

50 % |

Le 31 mars chaque année |

s. o. |

s. o. |

s. o. |

Ressources financières budgétaires (dollars)

blanc

| Budget principal des dépenses de 2017-2018 |

Dépenses prévues pour 2017-2018 |

Dépenses prévues pour 2018-2019 |

Dépenses prévues pour 2019-2020 |

| 6 706 989 |

6 706 989 |

6 706 989 |

6 706 989 |

Ressources humaines (équivalents temps plein ou ETP)

blanc

| Nombre d’ETP prévus 2017-2018 |

Nombre d’ETP prévus 2018-2019 |

Nombre d’ETP prévus 2019-2020 |

| 33 |

33 |

33 |

Titre du programme – Le programme sur les tendances relatives aux produits pharmaceutiques

Description

Chaque année le CEPMB rend compte au Parlement, par le truchement du ministre de la Santé, de ses activités d’analyse des prix, des prix des médicaments brevetés, des tendances des prix de l’ensemble des médicaments d’ordonnance et des dépenses en recherche et développement (R-D) déclarées par les sociétés pharmaceutiques brevetés. À l’appui de cette exigence en matière de rapport, le programme sur les tendances relatives aux produits pharmaceutiques fournit des renseignements complets et précis sur les tendances relatives aux prix auxquels les fabricants vendent leurs médicaments brevetés au Canada et sur les dépenses de recherche et développement des brevetés aux intervenants intéressés, notamment l’industrie (c.-à-d. de médicaments de marque, issus de la biotechnologie et générique); les gouvernements fédéral, provinciaux et territoriaux; les groupes de défense de droits des consommateurs et des patients; les tiers payants; et autres. Ces renseignements permettent également de rassurer les Canadiens en leur démontrant que les prix des médicaments brevetés ne sont pas excessifs. De plus, suivant l’établissement du SNIUMP par les ministres de la Santé fédéral, provinciaux et territoriaux, la ministre fédéral de la Santé a demandé au CEPMB d’effectuer des analyses des tendances relatives aux prix, à l’utilisation et aux coûts des médicaments d’ordonnance brevetés et non brevetés afin de s’assurer que le système canadien de soins de santé possède des renseignements plus exhaustifs et précis sur l’utilisation de tout médicaments d’ordonnance et sur les facteurs à l’origine des augmentations de coûts. Cette fonction vise à fournir aux gouvernements fédéral, provinciaux et territoriaux ainsi, qu’aux autres intervenants intéressés, une source d’information centrale et fiable concernant les prix de tous les médicaments d’ordonnance.

Faits saillants de la planification

Si le CEPMB souhaite réussir à simplifier et à moderniser ses lignes directrices et à réformer globalement la réglementation et la législation fédérales, il doit nouer des relations avec un réseau hétérogène d’intervenants de l’industrie pharmaceutique ayant tous des intérêts et des points de vue quant à ces changements. Pour y arriver, le CEPMB doit accroître la sensibilisation à l’égard de son mandat de protection des consommateurs et s’appuyer sur sa réputation de courtier honnête auprès des intervenants et du public en général.

Modernisation du cadre

Sans objet.

Réglementation et rapports axés sur le consommateur

Dans le cadre de sa fonction de reddition de comptes, le CEPMB tirera profit d’autres occasions de collaboration avec les tiers payants publics et privés, notamment en mettant en place des systèmes qui faciliteront et normaliseront la diffusion de données sur les prix, l’utilisation et les coûts afin que les assureurs puissent prendre plus rapidement des décisions éclairées, à l’avantage des patients. Comme par les années passées, le CEPMB publiera son programme de recherche du SNIUMP qui reflète les priorités établies par le Comité consultatif du SNIUMP et énonce les rapports qui doivent être réalisés et publiés chaque année. Enfin, le CEPMB continuera d’accroître et d’élargir la portée des sujets de nature pharmaceutique sur lesquels il fait rapport et de promouvoir sa fonction de reddition de comptes afin de sensibiliser ses intervenants et de les informer des principales questions pharmaceutiques.

Partenariats stratégiques et sensibilisation du public

Le CEPMB continuera d’élaborer des rapports analytiques officiels et non officiels harmonisés avec les besoins des consommateurs et d’autres intervenants intéressés. Il continuera particulièrement à appuyer les efforts FPT préconisant la durabilité des dépenses pharmaceutiques en fournissant en temps opportun des renseignements exacts liés aux initiatives d’établissement des prix, notamment pour les médicaments génériques et les médicaments de marque.

Le CEPMB continuera aussi de renforcer et d’élargir ses liens avec les autorités responsables de l’établissement des prix des médicaments et de leur remboursement dans d’autres pays afin d’échanger des renseignements sur le marché et de se tenir au courant des derniers développements relatifs à la limitation des coûts des médicaments à l’échelle mondiale notamment grâce à sa participation à l’initiative Pharmaceutical Pricing and Reimbursement Information (PPRI) et à sa collaboration avec l’Organisation mondiale de la Santé sur la question du juste prix des médicaments.

Résultats prévus

blanc

| Résultats attendus |

Indicateurs de rendement |

Objectif |

Date d’atteinte de l’objectif |

Résultats réels pour 2013-2014 |

Résultats réels pour 2014-2015 |

Résultats réels pour 2015-2016 |

| Information sur les tendances pharmaceutiques et les facteurs à l’origine des coûts offerte aux intervenants |

Nombre de nouveaux rapports/nouvelles études sur le site Web du CEPMB Notes de bas de page vi |

12 rapports/ études |

Le 31 mars chaque année |

s. o. |

15 rapports/ études |

15 rapports/ études |

| |

Nombre de présentations du CEPMB à un public externe |

10 séances d’information |

Le 31 mars chaque année |

8 séances d’informationNotes de bas de page vii |

25 séances d’information |

13 séances d’information |

Ressources financières budgétaires (dollars)

blanc

| Budget principal des dépenses de 2017-2018 |

Dépenses prévues pour 2017-2018 |

Dépenses prévues pour 2018-2019 |

Dépenses prévues pour 2019-2020 |

| 1 575 179 |

1 575 179 |

1 575 179 |

1 575 179 |

Ressources humaines (équivalents temps plein ou ETP)

blanc

| Nombre d’ETP prévus 2017-2018 |

Nombre d’ETP prévus 2018-2019 |

Nombre d’ETP prévus 2019-2020 |

| 13 |

13 |

13 |

Services internes

Description

On entend par Services internes les groupes d’activités et de ressources connexes que le gouvernement fédéral considère comme des services de soutien aux programmes ou qui sont requis pour respecter les obligations d’une organisation. Les Services internes renvoient aux activités et aux ressources de 10 catégories de services distinctes qui soutiennent l’exécution de programmes dans l’organisation, sans égard au modèle de prestation des Services internes du ministère. Les 10 catégories de service sont : services de gestion et de surveillance, services des communications, services juridiques, services de gestion des ressources humaines, services de gestion des finances, services de gestion de l’information, services des technologies de l’information, services de gestion des biens, services de gestion du matériel et services de gestion des acquisitions.

Faits saillants de la planification

Le CEPMB entreprendra des opérations de numérisation de l’information qui comprendront, entre autres, la numérisation de toute l’information actuellement en sa possession. Ces opérations devraient se terminer au cours de l’exercice 2018-2019. Le CEPMB continuera d’améliorer son système de gestion des documents électroniques (le SGID) et de renforcer ses processus opérationnels afin d’en accroître la valeur pour l’organisation et de réduire, dans la mesure du possible, le fardeau administratif.

Ressources financières budgétaires (dollars)

blanc

| Budget principal des dépenses de 2017-2018 |

Dépenses prévues pour 2017-2018 |

Dépenses prévues pour 2018-2019 |

Dépenses prévues pour 2019-2020 |

| 2 584 153 |

2 584 153 |

2 584 153 |

2 584 153 |

Ressources humaines (équivalents temps plein ou ETP)

blanc

| Nombre d’ETP prévus pour 2017-2018 |

Nombre d’ETP prévus pour 2018-2019 |

Nombre d’ETP prévus pour 2019-2020 |

| 20 |

20 |

20 |

Dépenses et ressources humaines

Dépenses prévues

Sommaire de la planification budgétaire pour les programmes et les Services internes (dollars)

blanc

| Programmes et Services internes |

Dépenses pour

2014-2015 |

Dépenses pour

2015-2016 |

Dépenses prévues pour

2016-2017 |

Budget principal des dépenses de 2017-2018 |

Dépenses prévues pour

2017-2018 |

Dépenses prévues pour

2018-2019 |

Dépenses prévues pour

2019-2020 |

| Le programme de réglementation du prix des médicaments brevetés |

3 543 891 |

5 399 127 |

6 057 857 |

6 706 989 |

6 706 989 |

6 706 989 |

6 706 989 |

| Le programme des tendances relatives aux produits pharmaceutiques |

1 301 871 |

1 688 584 |

1 719 073 |

1 575 179 |

1 575 179 |

1 575 179 |

1 575 179 |

| Total partiel |

4 845 762 |

7 087 711 |

7 776 930 |

8 282 168 |

8 282 168 |

8 282 168 |

8 282 168 |

| Services internes |

3 084 518 |

2 410 650 |

2 580 715 |

2 584 153 |

2 584 153 |

2 584 153 |

2 584 153 |

| Total |

7 930 280 |

9 498 361 |

10 357 645 |

10 866 321 |

10 866 321 |

10 866 321 |

10 866 321 |

Les fonds attribués au CEPMB comprennent une affectation à but spécial (ABS) de 2 438 000 $, destinée à la tenue d’audiences publiques. Cette ABS ne peut être utilisée que pour supporter les coûts liés à ces audiences publiques, comme les prestations de conseillers juridiques externes et de témoins experts, entre autres. Tout solde non utilisé doit être renvoyé au Trésor.

En 2015-2016, les dépenses réelles ont été considérablement plus élevées qu’en 2014-2015. Cette différence s’explique en grande partie par les dépenses réglées grâce à l’ABS, qui s’élevaient à 1 213 627 $, et dont la majeure partie concernait le dossier Soliris. D’autres dépenses liées à ce dossier ont été engagées en 2016-2017.

Les prévisions de dépenses pour 2017-2018 et au-delà sont fondées sur l’hypothèse que le CEPMB dépensera la totalité des 2,44 millions de dollars de l’ABS réservée aux audiences publiques. Une hypothèse car ces dépenses dépendront du nombre d’audiences, mais aussi de leur longueur et de leur complexité, autant de facteurs qui sont difficiles à prévoir.

Ressources humaines planifiées

Sommaire de la planification des ressources humaines pour les programmes et Services internes (équivalents temps plein ou ETP)

blanc

| Programmes et Services internes |

Équivalents temps plein pour

2014-2015 |

Équivalents temps plein pour

2015-2016 |

Équivalents temps plein prévus pour 2016-2017 |

Équivalents temps plein prévus pour 2017-2018 |

Équivalents temps plein prévus pour 2018-2019 |

Équivalents temps plein prévus pour 2019-2020 |

| Le programme de réglementation du prix des médicaments brevetés Regulation Program |

24,7 |

31,1 |

32,6 |

33,0 |

33,0 |

33,0 |

| Le programme des tendances relatives aux produits pharmaceutiques |

9,2 |

12,8 |

12,7 |

13,0 |

13,0 |

13,0 |

| Total partiel |

33,9 |

43,9 |

45,3 |

46,0 |

46,0 |

46,0 |

| Services internes |

22,3 |

18,6 |

19,8 |

20,0 |

20,0 |

20,0 |

| Total |

56,2 |

62,5 |

65,1 |

66,0 |

66,0 |

66,0 |

En 2015-2016, le CEPMB a procédé à une restructuration interne, en déplaçant des ETP des services internes au programme sur les tendances, afin que sa structure corresponde davantage aux activités menées par le personnel. Par ailleurs, on a augmenté le nombre d’employés du programme de réglementation pour faire face à l’évolution de la charge de travail.

La dotation concernant le programme de réglementation et les services internes a pris fin en 2016-2017. Le CEPMB a maintenant un effectif complet.

La différence entre les nombres d’ETP prévus pour 2016-2017 et 2017-2018 est due essentiellement aux mesures prises par la direction pour stabiliser et maîtriser les futures dépenses salariales et au réaménagement des ressources, destinés à répondre aux besoins du programme.

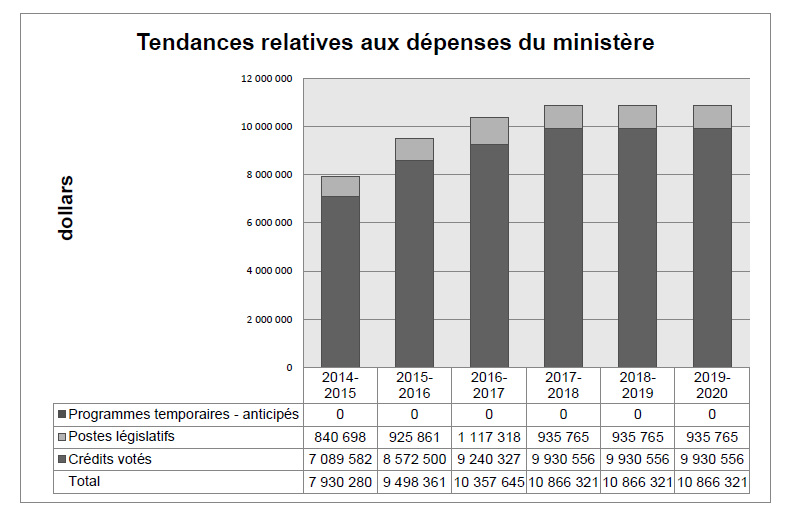

Tendances relatives aux dépenses du ministère

Tendances relatives aux dépenses du ministère

Le graphique à barres ci-après illustre les tendances des dépenses prévues et des dépenses réelles du CEPMB au fil du temps. Il présente les dépenses législatives et les dépenses votées réelles pour les exercices 2014-2015, 2015-2016 ainsi que les dépenses législatives et les dépenses votées prévues pour les exercices 2016-2017, 2017-2018, 2018-2019 et 2019-2020.

Les fonds attribués au CEPMB comprennent une affectation à but spécial (ABS) de 2 438 000 $, du crédit 1 (dépenses de programme), destinée à la tenue d’audiences publiques. Cette ABS ne peut être utilisée que pour supporter les coûts liés à ces audiences publiques, comme les prestations de conseillers juridiques externes et de témoins experts, entre autres. Tout solde non utilisé doit être renvoyé au Trésor public

Les dépenses du CEPMB pour 2015-2016 sont nettement plus élevées qu’en 2014-2015, essentiellement en raison de l’augmentation des dépenses engagées pour les audiences. En 2015-2016, le CEPMB a dépensé 1,2 M$ contre 154 000 $ en 2014-2015.

Étant donné qu’il est difficile de prévoir le nombre et la complexité des audiences, on se fonde, pour les prévisions des dépenses de 2017-2018 et des années ultérieures, sur l’hypothèse que la totalité des fonds de l’ABS sera dépensée.

Budget des dépenses par crédit voté

Pour obtenir de l’information sur les crédits du CEPMB consulter le https://www.canada.ca/fr/secretariat-conseil-tresor/services/depenses-prevues/plan-depenses-budget-principal.html. Notes de bas de page viii

État des résultats condensé prospectif

L’état des résultats condensé prospectif donne un aperçu général des opérations du CEPMB. Les prévisions des renseignements financiers concernant les dépenses et les recettes sont préparées selon la méthode de comptabilité d’exercice afin de renforcer la responsabilisation et d’améliorer la transparence et la gestion financière.

Étant donné que l’état des résultats condensé prospectif est préparé selon la méthode de comptabilité d’exercice et que les montants des dépenses projetées et des dépenses prévues présentées dans d’autres sections du Plan ministériel sont établis selon la méthode de comptabilité axée sur les dépenses, il est possible que les montants diffèrent.

Un état des résultats prospectif plus détaillé et des notes afférentes, notamment un rapprochement des coûts de fonctionnement nets et des autorisations demandées, se trouve sur le http://www.pmprb-cepmb.gc.ca/fr/accueil.Notes de bas de page ix

État des résultats condensé prospectif

Pour l’exercice se terminant le 31 mars 2018 (en dollars)

blanc

| Renseignements financiers |

Résultats projetés de 2016-2017 |

Résultats prévus pour 2017-2018 |

Écart

(résultats prévus pour 2017-2018 moins résultats projetés de 2016-2017) |

| Total des dépenses |

11 591 051 |

11 991 436 |

400 385 |

| Total des revenus |

448 |

- |

(448) |

| Coût de fonctionnement net avant le financement du gouvernement et les transferts |

11 590 603 |

11 991 436 |

400 833 |

Le CEPMB prévoit 12,0 M$ de dépenses en se fondant sur le budget principal des dépenses de 2017-2018 et sur l’anticipation des charges cumulées. Cette somme ne comprend pas les futurs budgets supplémentaires. Elle représente une augmentation de 0,4 M$ par rapport aux projections de 2016-2017.

Cette augmentation est principalement attribuable au fait suivant :

- Les prévisions de dépenses pour 2017-2018 sont fondées sur l’hypothèse que le CEPMB dépensera la totalité des 2,44 millions de dollars de l’ABS réservée aux audiences publiques. Il s’agit d’une hypothèse car ces dépenses dépendront du nombre d’audiences mais aussi de leur longueur et de leur complexité, autant de facteurs qui sont difficiles à prévoir

Renseignements supplémentaires

Renseignements ministériels

Profil organisationnel

Ministre de tutelle : L’honorable Jane Philpott

Administrateur général : Mitch Levine, Vice-président Notes de bas de page x

Portefeuille ministériel : Santé

Instruments habilitants : Loi sur les brevetsNotes de bas de page xi et Règlements sur les médicaments brevetésNotes de bas de page xii

Année d’incorporation ou de création : 1987

Autres : La ministre de la Santé est responsable de l’application des dispositions pharmaceutiques de la Loi sur les brevets (la Loi) formulées aux articles 79 à 103. Même s’il fait partie du portefeuille de la Santé, le CEPMB, en raison de ses responsabilités quasi judiciaires, exerce son mandat en toute indépendance à l’égard du ministre. Il fonctionne également d’une façon indépendante de Santé Canada, qui approuve les médicaments sur les plans de l’innocuité, de l’efficacité et de la qualité; d’autres membres du portefeuille de la Santé, comme l’Agence de la santé publique du Canada, les Instituts de recherche en santé du Canada et l’Agence canadienne d’inspection des aliments; des responsables des régimes publics fédéral, provinciaux et territoriaux d’assurance-médicaments, qui autorisent l’inscription des médicaments sur leurs formulaires de médicaments admissibles à un remboursement; et du Programme commun d’évaluation des médicaments, qui est géré par l’Agence canadienne des médicaments et des technologies de la santé (ACMTS), et qui formule des recommandations sur les médicaments qui devraient être admissibles à un remboursement dans le cadre des régimes publics d’assurance-médicaments participants.

Cadre de présentation de rapports

Voici les résultats stratégiques et l’Architecture d’alignement des programmes de référence pour 2017-2018 du Conseil du prix des médicaments brevetés :

1. Résultat stratégique : Les médicaments brevetés ne peuvent être vendus au Canada à des prix excessifs, afin de protéger les intérêts de la population canadienne. La population canadienne est également tenue informée.

1.1 Programme : Le programme de réglementation du prix des médicaments brevetés

1.2 Programme : Le programme sur les tendances relatives aux produits pharmaceutiques

Services internes

Renseignements connexes sur les programmes de niveau inférieur

Le CEPMB n’a aucun programme de niveau inférieur. Le CEPMB a un seul résultat stratégique, deux programmes à l’appui de ce résultat et des services internes.

Dépenses fiscales fédérales

Il est possible de recourir au régime fiscal pour atteindre des objectifs de la politique publique en appliquant des mesures spéciales, comme de faibles taux d’impôt, des exemptions, des déductions, des reports et des crédits. Le ministère des Finances Canada publie chaque année des estimations et des projections du coût de ces mesures dans le Rapport sur les dépenses fiscales fédérales.Notes de bas de page xiii Ce rapport donne aussi des renseignements généraux détaillés sur les dépenses fiscales, y compris les descriptions, les objectifs, les renseignements historiques et les renvois aux programmes des dépenses fédéraux connexes. Les mesures fiscales présentées dans ce rapport relèvent du ministre des Finances.

Coordonnées de l’organisation

Le Conseil d’examen du prix des médicaments brevetés

C.P. L40

Centre Standard Life

333, avenue Laurier Ouest

Bureau 1400

Ottawa (Ontario) K1P 1C1

Téléphone : 613-952-7360

Sans frais : 1-877-861-2350

Télécopieur : 613-952-7626

ATS : 613-957-4373

Courriel : pmprb@pmprb-cepmb.gc.ca

Site Web : www.pmprb-cepmb.gc.ca

Annexe A : Définitions

architecture d’alignement des programmes (Program Alignment Architecture)

Répertoire structuré de tous les programmes d’un ministère ou organisme qui décrit les liens hiérarchiques entre les programmes et les liens aux résultats stratégiques auxquels ils contribuent.

brevet (patent)

Instrument émis par le Commissaire aux brevets sous forme de lettres patentes. Le brevet confère à son titulaire un monopole d’une durée limitée pour les allégations formulées. Le brevet confère également à son titulaire et à ses représentants légaux le droit exclusif de fabriquer, de construire, d’exploiter ou de vendre son invention.

breveté (patentee)

Aux termes du paragraphe 79(1) de la Loi sur les brevets, le mot « breveté » désigne « la personne ayant droit aux retombées d’un brevet pour une invention liée à un médicament, ainsi que quiconque était titulaire d’un brevet pour une telle invention ou qui exerce ou a exercé les droits d’un titulaire dans un cadre autre qu’une licence prorogée en vertu du paragraphe 11(1) de la Loi de 1992 modifiant la Loi sur les brevets ».

cadre ministériel des résultats (Departmental Results Framework)

Comprend les responsabilités essentielles, les résultats ministériels et les indicateurs de résultat ministériel.

CEPMB7 (PMPRB7)

La France, l’Allemagne, l’Italie, la Suède, la Suisse, le Royaume-Uni et les États-Unis.

crédit (appropriation)

Autorisation donnée par le Parlement d’effectuer des paiements sur le Trésor.

dépenses budgétaires (budgetary expenditures)

Dépenses de fonctionnement et en capital; paiements de transfert à d’autres ordres de gouvernement, à des organisations ou à des particuliers; et paiements à des sociétés d’État.

dépenses législatives (statutory expenditures)

Dépenses approuvées par le Parlement à la suite de l’adoption d’une loi autre qu’une loi de crédits. La loi précise les fins auxquelles peuvent servir les dépenses et les conditions dans lesquelles elles peuvent être effectuées.

dépenses non budgétaires (non-budgetary expenditures)

Recettes et décaissements nets au titre de prêts, de placements et d’avances, qui modifient la composition des actifs financiers du gouvernement du Canada.

dépenses prévues (planned spending)

En ce qui a trait aux Plans ministériels et aux Rapports sur les résultats ministériels, les dépenses prévues s’entendent des montants approuvés par le Conseil du Trésor au plus tard le 1er février. Elles peuvent donc comprendre des montants qui s’ajoutent aux dépenses prévues indiquées dans le budget principal des dépenses.

Un ministère est censé être au courant des autorisations qu’il a demandées et obtenues. La détermination des dépenses prévues relève du ministère, et ce dernier doit être en mesure de justifier les dépenses et les augmentations présentées dans son Plan ministériel et son Rapport sur les résultats ministériels.

dépenses votées (voted expenditures)

Dépenses approuvées annuellement par le Parlement par une loi de crédits. Le libellé de chaque crédit énonce les conditions selon lesquelles les dépenses peuvent être effectuées.

équivalent temps plein (full-time equivalent)

Mesure utilisée pour représenter une année-personne complète d’un employé dans le budget ministériel. Les équivalents temps plein sont calculés par un rapport entre les heures de travail assignées et les heures de travail prévues. Les heures normales sont établies dans les conventions collectives.

indicateur de rendement (performance indicator)

Moyen qualitatif ou quantitatif de mesurer un extrant ou un résultat en vue de déterminer le rendement d’une organisation, d’un programme, d’une politique ou d’une initiative par rapport aux résultats attendus.

indicateur de résultat ministériel (Departmental Result Indicator)

Facteur ou variable qui présente une façon valide et fiable de mesurer ou de décrire les progrès réalisés par rapport à un résultat ministériel.

initiative horizontale (horizontal initiatives)

Initiative dans le cadre de laquelle au moins deux organisations fédérales, par l’intermédiaire d’une entente de financement approuvée, s’efforcent d’atteindre des résultats communs définis, et qui a été désignée (p. ex., par le Cabinet ou par un organisme central, entre autres) comme une initiative horizontale aux fins de gestion et de présentation de rapports.

médicament (medicine)

Toute substance ou tout mélange de substances produites biologiquement, chimiquement ou autrement qui est appliqué ou administré in vivo pour faciliter le diagnostic, le traitement, l’atténuation ou la prévention d’une maladie, de symptômes, de troubles ou d’états physiques anormaux ou, encore, pour modifier des fonctions organiques chez les humains ou chez les animaux. Cette définition comprend les vaccins, les préparations topiques, les anesthésiques et les produits de diagnostic in vivo quel que soit le mode d’administration (p. ex. préparations transdermiques, gélules, solutions injectables, solutions pour inhalation, etc.). Cette définition exclut les appareils médicaux, les produits de diagnostic in vitro et les désinfectants qui ne sont pas utilisés in vivo.

plan (plans)

Exposé des choix stratégiques qui montre comment une organisation entend réaliser ses priorités et obtenir les résultats connexes. De façon générale, un plan explique la logique qui sous-tend les stratégies retenues et tend à mettre l’accent sur des mesures qui se traduisent par des résultats attendus.

Plan ministériel (Departmental Plan)

Fournit les renseignements sur les plans et le rendement attendu des ministères appropriés au cours d’une période de trois ans. Les plans ministériels sont présentés au Parlement au printemps.

priorité (priorities)

Plan ou projet qu’une organisation a choisi de cibler et dont elle rendra compte au cours de la période de planification. Il s’agit de ce qui importe le plus ou qui doit être fait en premier pour appuyer la réalisation du ou des résultats stratégiques souhaités.

priorités pangouvernementales (government-wide priorities)

Aux fins du Plan ministériel 2017-2018, les priorités pangouvernementales sont des thèmes de haut niveau qui présentent le programme du gouvernement issu du discours du Trône de 2015 (c.-à-d. la croissance de la classe moyenne, un gouvernement ouvert et transparent, un environnement sain et une économie forte, la diversité en tant que force du Canada, ainsi que la sécurité et les possibilités).

production de rapports sur le rendement (performance reporting)

Processus de communication d’information sur le rendement fondée sur des éléments probants. La production de rapports sur le rendement appuie la prise de décisions, la responsabilisation et la transparence.

produit médicamenteux (drug product)

Présentation d’un médicament qui se distingue par sa forme pharmaceutique et la concentration de son ingrédient actif.

programme (program)

Groupe d’intrants constitué de ressources et d’activités connexes qui est géré pour répondre à des besoins précis et pour obtenir les résultats visés, et qui est traité comme une unité budgétaire.

programme temporisé (program)

Programme ayant une durée fixe et dont le financement et l’autorisation politique ne sont pas permanents. Lorsqu’un tel programme arrive à échéance, une décision doit être prise quant à son maintien. Dans le cas d’un renouvellement, la décision précise la portée, le niveau de financement et la durée.

Rapport sur les résultats ministériels (Departmental Results Report)

Présente de l’information sur les réalisations réelles par rapport aux plans, aux priorités et aux résultats attendus énoncés dans le Plan ministériel correspondant.

rendement (performance)

Utilisation qu’une organisation a faite de ses ressources en vue d’obtenir ses résultats, mesure dans laquelle ces résultats se comparent à ceux que l’organisation souhaitait obtenir, et mesure dans laquelle les leçons apprises ont été cernées.

Responsabilité essentielle (Core Responsibility)

Fonction ou rôle permanent exercé par un ministère. Les intentions du ministère concernant une Responsabilité essentielle se traduisent par un ou plusieurs résultats ministériels auxquels le ministère cherche à contribuer ou sur lesquels il veut avoir une influence.

résultat (results)

Conséquence externe attribuable en partie aux activités d’une organisation, d’une politique, d’un programme ou d’une initiative. Les résultats ne relèvent pas d’une organisation, d’une politique, d’un programme ou d’une initiative unique, mais ils s’inscrivent dans la sphère d’influence de l’organisation.

résultat ministériel (Departmental Result)

Changements sur lesquels les ministères veulent exercer une influence. Ils devraient subir l’influence des résultats des programmes, mais ils échappent généralement au contrôle direct des ministères.

résultat stratégique (Strategic Outcome)

Avantage durable et à long terme pour les Canadiens qui est rattaché au mandat, à la vision et aux fonctions de base d’une organisation.

Structure de la gestion, des ressources et des résultats (Management, Resources and Results Structure)

Cadre exhaustif comprenant l’inventaire des programmes, des ressources, des résultats, des indicateurs de rendement et de l’information de gouvernance d’une organisation. Les programmes et les résultats sont présentés d’après le lien hiérarchique qui les unit, et les résultats stratégiques auxquels ils contribuent. La Structure de la gestion, des ressources et des résultats découle de l’architecture d’alignement des programmes.