Observateur des médicaments orphelins (OMO)

PDF - 324 ko

Contexte et approche

Afin de favoriser le développement de médicaments, certains pays ont adopté des cadres de réglementation pour les médicaments orphelins. Parmi ces pays, notons les suivants : États-Unis (É.-U.) (1983), Singapour (1991), Japon (1993), Australie (1997), Union Européenne (UE) (1999/2000), Taiwan (2000) et Corée du Sud (2003).

L’Observateur des médicaments orphelins analyse l’approbation internationale de médicaments orphelins sélectionnés et évalue leur disponibilité au Canada. Cette analyse s’intéresse à certains médicaments orphelins sélectionnés, répertoriés dans la classe des substances actives et relevés d’après les critères suivants :

- Médicaments qui ont la désignation de médicament orphelin et dont la mise en marché a été approuvée aux É.-U. et/ou dans l’UE au cours des dix dernières années (2005-2014); et

- Médicaments qui ont uniquement des indications orphelines.

Le marché international analysé inclut le Canada et les sept pays de comparaison pris en compte par le Conseil d’examen du prix des médicaments brevetés (CEPMB7), soit la France, l’Allemagne, l’Italie, la Suède, la Suisse, le Royaume-Uni (R.-U.) et les É.-U. Les résultats font état des ventes et des prix pour 2014.

D’après les critères de sélection, 134 médicaments orphelins ont été relevés; ils représentaient 2,9 % des ventes internationales de produits pharmaceutiques en 2014.

Méthodologie

Dans le cadre de cette analyse, on a utilisé la base de données sur la désignation des produits pharmaceutiques orphelins de la Food and Drug Administration (FDA) des É. U. et le registre des produits médicinaux orphelins de la Communauté européenne pour dresser une liste des médicaments orphelins.

Pour présenter les données sur la disponibilité, l’utilisation des marchés, les ventes et l’établissement des prix des médicaments orphelins sélectionnés, la base de données MIDASMC d’IMS AG a été utilisée. Bien que cette base de données soit exhaustive, il est possible que les renseignements sur les ventes des produits à faible utilisation ne s’y trouvent pas. Cette limite a une incidence sur l’analyse et pourrait sous estimer les ventes des médicaments orphelins sélectionnés, surtout sur les marchés plus petits. La disponibilité des médicaments pour le Canada a été validée davantage à partir d’autres sources de données, notamment la base de données des avis de conformité de Santé Canada.

L’analyse n’évalue pas le calendrier de la disponibilité sur le marché, ni la portée d’utilisation dans l’ensemble des marchés.

Résultats clés

1. Davantage de médicaments sont désignés et approuvés pour des indications orphelines aux É.-U. que dans l’UE

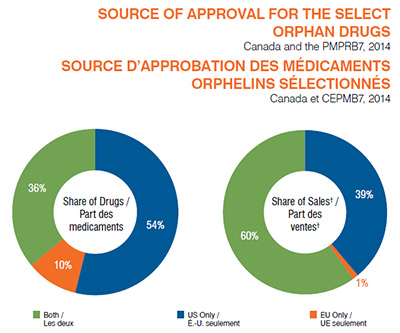

La majorité des médicaments orphelins sélectionnés ont reçu la désignation de médicaments orphelins et l’approbation de commercialisation seulement aux É.-U. (54 %; n = 72); une proportion considérable des médicaments ont été approuvés à la fois aux É.-U. et dans l’UE (36 %; n = 49); et une faible proportion de médicaments ont été approuvés seulement dans l’UE (10 %; n = 13).

En ce qui a trait aux ventes, les médicaments ayant reçu la désignation de médicament orphelin tant aux É.-U. que dans l’UE dominent le marché (60 %), en raison de l’approbation internationale à grande échelle. Les médicaments orphelins dont la désignation est approuvée aux É. U. seulement occupent une part considérable des ventes internationales (39 %); alors que les médicaments dont la désignation de médicament orphelin est approuvée seulement dans l’UE occupent une part négligeable des ventes (1 %) étant donné leur utilisation internationale limitée, surtout aux É.-U.

Section 1

Cliquer sur l'image pour l'agrandir

Description de la figure

Ces deux diagrammes circulaires présentent (1) la part des médicaments orphelins analysés et (2) leur part respective des ventes pour le Canada et le CEPMB7 en 2014 selon la source d’approbation de commercialisation : aux États-Unis et dans l’Union européenne; dans l’Union européenne seulement; et aux États-Unis seulement.

Le diagramme circulaire de gauche illustre la part des médicaments.

États-Unis et Union européenne : 36 % des médicaments orphelins analysés; Union européenne seulement : 10 %; États-Unis seulement : 54 %.

Le diagramme circulaire de droite illustre la part des ventes, notamment pour le Canada et les pays du CEPMB7 : la France, l’Allemagne, l’Italie, la Suède, la Suisse, le Royaume-Uni et les États-Unis.

États-Unis et Union européenne : 60 % des médicaments orphelins analysés; Union européenne seulement : 1 %; États-Unis seulement : 39 %.

2. Bon nombre de médicaments orphelins sont approuvés au Canada

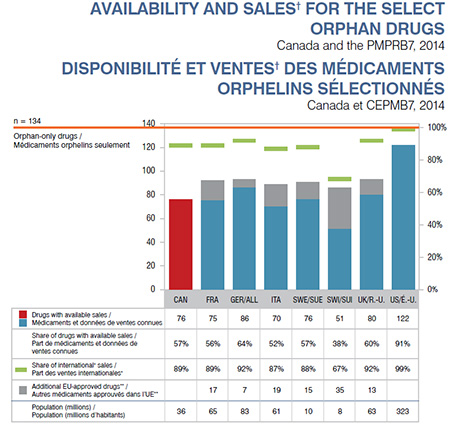

Bien que le Canada n’ait pas encore de cadre de réglementation des médicaments orphelins, 57 % des médicaments orphelins sélectionnés ont reçu l’approbation de commercialisation avant la fin de 2014 par l’entremise des processus de soumission réguliers. Ces médicaments correspondent à 89 % des ventes internationales, ce qui suppose que leur utilisation et/ou leur coût sont assez élevés. Alors que les Canadiens sont en mesure d’accéder à certains des médicaments orphelins non offerts ou non approuvés par l’entremise du Programme d’accès spécial (PAS) de Santé Canada, les données relatives à ces médicaments ne figurent pas dans les résultats.

La disponibilité et les ventes internationales respectives des médicaments orphelins sélectionnés au Canada correspondent à celles des marchés européens, là où la disponibilité des médicaments est de l’ordre de 38 % à 64 % et les ventes correspondantes varient entre 67 % et 92 %. Puisqu’il est possible que les renseignements sur les ventes pour les produits peu utilisés ne soient pas toujours accessibles, le graphique rend compte également des autres médicaments orphelins approuvés dans l’UE sans les données de ventes dans les pays européens respectifs.

Le marché des É.-U. affiche la plus grande part de disponibilité et de ventes pour les médicaments orphelins sélectionnés, 91 % d’entre eux étant approuvés par la FDA, avec 99 % des ventes.

Section 2

Cliquer sur l'image pour l'agrandir

Description de la figure

Ce graphique à barres et le tableau connexe illustrent la disponibilité et les ventes des 134 médicaments orphelins sélectionnés aux fins d’analyse pour le Canada et les pays du CEPMB7 en 2014.

|

Canada |

France |

Allemagne |

Italie |

Suède |

Suisse |

Royaume-Uni |

États-Unis |

| Nombre de médicaments dont les ventes sont connues |

76 |

75 |

86 |

70 |

76 |

51 |

80 |

122 |

| Part des médicaments dont les ventes sont connues |

57 % |

56 % |

64 % |

52 % |

57 % |

38 % |

60 % |

91 % |

| Part des ventes internationales† |

89 % |

89 % |

92 % |

87 % |

88 % |

67 % |

92 % |

99 % |

| Autres médicaments approuvés dans l’Union européenne sans données de ventes connues dans les pays respectifs |

|

17 |

7 |

19 |

15 |

35 |

13 |

|

| Population (millions d'habitants) |

36 |

65 |

83 |

61 |

10 |

8 |

63 |

323 |

Les ventes et la disponibilité des médicaments par pays ont été établies d’après la base de données MIDASMC d’IMS AG. Les renseignements sur la disponibilité des médicaments ont été complétés avec des données provenant des sources suivantes : base de données sur la désignation des produits pharmaceutiques orphelins de la FDA des É. U.; registre des produits médicinaux orphelins de la Communauté européenne; et sources de données canadiennes, dont la base de données des avis de conformité de Santé Canada. Les ventes déclarées comprennent le Canada et les pays du CEPMB7.

3. Le Canada a approuvé neuf des dix principaux médicaments orphelins sélectionnés

En 2014, les 10 médicaments orphelins les plus vendus représentaient 50 % du marché des médicaments n’ayant que la désignation orpheline. Il s’agissait en majeure partie de médicaments oncologiques et/ou biologiques. Seul un de ces médicaments n’était pas

offert au Canada à la fin de 2014 : le facteur de coagulation VIIa (recombinant) – utilisé pour traiter et prévenir les épisodes de saignement chez les patients atteints d’hémophilie A ou B.

Les prix médians à l’étranger pour la majorité de ces médicaments sont égaux ou supérieurs aux prix canadiens, sauf pour le chlorhydrate de bendamustine (Treanda), dont le prix est considérablement plus élevé au Canada.

Dix médicaments orphelins les plus vendus†, Canada et CEPMB7, 2014

| Substance active (nom commercial) |

Part des ventes internationales pour les médicaments orphelins* |

Forme posologique et concentration |

Prix canadien |

Prix médian à l’étranger** |

| Lénalidomide (Revlimid)O,M |

9,0 % |

Capsule, 10 mg |

S.O. |

387 $ |

| Ipilimumab (Yervoy)O,B |

7,1 % |

Flacon, 5 mg/mL |

9 256 $ |

12 653 $ |

| Dasatinib (Sprycel)O,M |

6,4 % |

Comprimé, 100 mg |

147 $ |

196 $ |

| Nilotinib (Tasigna)O |

5,9 % |

Capsule, 150 mg |

28 $ |

37 $ |

| Chlorhydrate de bendamustine (Treanda)O,M |

5,2 % |

Flacon, 100 mg/flacon |

1 212 $ |

439 $ |

| Facteur de coagulation VIIa (recombinant) (Novoseven)B,M |

3,7 % |

Flacon, 5 mg/mL |

Pas disponible au Canada |

4 414 $ |

| Eculizumab (Soliris)B,M |

3,6 % |

Flacon, 10 mg/mL |

S.O. |

6 248 $ |

| Azacitidine (Vidaza)O,M |

3,3 % |

Flacon, 100 mg/flacon |

S.O. |

511 $ |

| Déférasirox (Exjade)M |

3,0 % |

Comprimé, 500 mg |

43 $ |

39 $ |

| Ibrutinib (Imbruvica)O,M |

2,9 % |

Capsule, 140 mg |

92 $ |

97 $ |

| Total |

50 % |

|

|

|

O, oncologie; B, biologique; M, indications orphelines multiples.

* La part des ventes présentée correspond à celle des marchés analysés, dont le Canada et les sept pays de comparaison du CEPMB7 : la France, l’Allemagne, l’Italie, la Suède, la Suisse, le Royaume-Uni (R.-U.) et les États-Unis (É.-U.).

** Le prix étranger est le prix médian de l’ensemble des pays du CEPMB7.

4. Les médicaments orphelins non offerts au Canada constituent une faible part du marché international

Bien que les médicaments orphelins sélectionnés qui ne sont pas offerts au Canada représentent une part appréciable des médicaments de ce marché (43 %, n = 58), ils ne constituent qu’une faible part des ventes internationales (11 %). Cependant, le Programme d’accès spécial (PAS) a permis l’accès à certains d’entre eux (n = 21), pendant que d’autres (n = 9) ont été approuvés au Canada en 2015, étant donné les délais de lancement habituels des nouveaux produits. Il importe de noter que des options de traitement de deuxième intention peuvent être possibles pour certains médicaments orphelins non offerts au Canada.

Les ventes de médicaments qui ne sont pas offerts au Canada sont très concentrées, les dix médicaments principaux de ce lot représentant un volume de ventes appréciable (9,4 %). Le tableau énumère les dix médicaments orphelins sélectionnés qui ne sont pas offerts au Canada. La majorité de ces médicaments sont uniquement offerts aux É.-U. et deux sont approuvés dans l’UE. La moitié de ces médicaments sont des produits biologiques et seulement deux de ceux-ci sont réservés au traitement du cancer. En général, le prix de ces médicaments est très élevé.

Dix médicaments orphelins sélectionnés les plus vendus† qui ne sont pas offerts au Canada, Canada et CEPMB7, 2014

| Substance active |

Description CTA* |

Part des ventes internationales pour les médicaments orphelins** |

Désignation de médicament orphelin |

Année d’approbation de commercialisation aux É.-U./dans l’UE |

Prix médian à l’étranger*** |

| Facteur de coagulation VIIa (recombinant)B,M |

Sang et organes hématopoïétiques |

3,7 % |

É.-U. |

2014 |

4 414 $ (flacon, 5 mg/mL) |

| CarfilzomibO |

Antinéoplasiques et immunomodulateurs |

2,3 % |

É.-U. |

2012 |

S.O. |

| DécitabineO,M |

Antinéoplasiques et immunomodulateurs |

1,6 % |

É.-U. et UE |

2006/2012 |

1 627 $ (flacon, 50 mg/flacon) |

| Complexe prothrombique concentré (humain)B |

Sang et organes hématopoïétiques |

0,4 % |

É.-U. |

2013 |

S.O. |

| Caproate d’hydroxyprogestérone |

Système génito urinaire et hormones sexuelles |

0,3 % |

É.-U. |

2011 |

S.O. |

| Benzoate/acétate de phényle |

Utilisations variées |

0,3 % |

É.-U. |

2005 |

S.O. |

| BélataceptB |

Antinéoplasiques et immunomodulateurs |

0,2 % |

É.-U. |

2011 |

676 $ (flacon, 250 mg/flacon) |

| EcallantideB |

Sang et organes hématopoïétiques |

0,2 % |

É.-U. |

2009 |

S.O. |

| Ziconotide |

Système nerveux |

0,2 % |

UE |

2005 |

798 $ (flacon, 100 mcg/mL) |

| PegloticaseB |

Système musculo squelettique |

0,2 % |

É.-U. |

2010 |

S.O. |

| |

Total |

9,4 % |

|

|

|

O, oncologie; B, biologique; M, indications orphelines multiples.

* Classement thérapeutique anatomique de l’Organisation mondiale de la santé

** La part des ventes présentée correspond à celle des marchés du Canada et des pays du CEPMB7 : la France, l’Allemagne, l’Italie, la Suède, la Suisse, le Royaume-Uni (R.-U.) et les États-Unis (É.-U.).

*** Le prix étranger est le prix médian de l’ensemble des pays du CEPMB7.

Médicaments obtenus au Canada par l’entremise du Programme d’accès spécial (PAS) : décitabine, caproate d’hydroxyprogestérone, benzoate de sodium/phénylacétate de sodium, bélatacept, et pegloticase; médicament approuvé en 2015 : carfilzomib.

Source de données : †Base de données MIDASMC, ventes départ-usine, IMS AG. Tous droits réservés.

Les données sur la population proviennent de Worldometers.

Avis de non-responsabilité : Bien que fondés en partie sur les données fournies en vertu d’une licence par la base de données MIDASMC d’IMS AG, les énoncés, les constatations, les observations, les avis et les opinions exprimés dans le présent rapport peuvent seulement être attribués au CEPMB et ne doivent pas être interprétés comme appartenant à IMS AG.

Le SNIUMP est une initiative de recherche qui fonctionne indépendamment des activités de réglementation du CEPMB.