Conseil d’examen du prix des médicaments brevetés

L’honorable Rona Ambrose

Ministre de la Santé

ISSN : 2292-6291

Erratum

L’unité de mesure financière sur l’axe vertical du graphique « Tendances relatives aux dépenses du ministère » dans les versions anglaise et française en formats HTML et PDF du Rapport sur les plans et les priorités 2015-2016 du Conseil d’examen du prix des médicaments brevetés doit indiquer des milliers de dollars, et non des millions de dollars tel qu’affiché.

Table des matières

Message de la présidente

Section I : Vue d’ensemble des dépenses de l’organisation

Section II : Analyse des programmes par résultat stratégique

Section III : Renseignements supplémentaires

Section IV : Coordonnées de l’organisation

Annexe : Définitions

Notes de fin de document

Message de la présidente

J’ai le plaisir de vous présenter le Rapport sur les plans et les priorités 2015–2016 du Conseil d’examen du prix des médicaments brevetés (CEPMB).

Le CEPMB est un organisme indépendant qui détient des pouvoirs quasi judiciaires dont le mandat vise à protéger les consommateurs des médicaments brevetés de prix jugés excessifs. En tant que membre du portefeuille de la Santé, le CEPMB joue un rôle de premier plan dans l’objectif global d’améliorer la santé des Canadiens par l’entremise d’un système de santé responsable, accessible et viable.

Comme beaucoup d’autres pays, le Canada est confronté à une croissance des coûts de soins de santé et les payeurs de partout au pays peinent à concilier des budgets de soins de santé limités à l’accès aux nouvelles technologies prometteuses. Malgré les récentes tendances de stabilisation des dépenses en matière de médicaments prescrits, la croissance des ventes de médicaments brevetés au Canada continue de surpasser celle des sept pays auxquels nous nous comparons dans le Règlement sur les médicaments brevetésNotes de bas de page 1(le Règlement), à l’exception des États-Unis. Les prix des médicaments brevetés au Canada se trouvent maintenant au troisième rang de ces pays de comparaison, à quasi égalité avec l’Allemagne.

Le CEPMB a été formé en 1987, dans le cadre de modifications apportées à la Loi sur les brevets, dans le contexte d’une réorganisation majeure du régime de brevets sur les médicaments du Canada qui visait à maintenir l’équilibre entre des objectifs de politiques susceptibles d’être en concurrence. D’une part, le gouvernement a renforcé la protection que confèrent les brevets aux médicaments afin d’encourager davantage d’investissement en R-D de la part de l’industrie pharmaceutique au Canada. D’autre part, le gouvernement a cherché à atténuer les répercussions de ce changement sur les Canadiens en créant le CEPMB, une agence de protection des consommateurs ayant pour mandat de veiller à ce que les prix des médicaments brevetés au Canada ne deviennent pas « excessifs ».

Dans les années qui ont suivi, la protection de la propriété intellectuelle des produits pharmaceutiques au Canada a été davantage renforcée grâce à une succession de réformes législatives et réglementairesNotes de bas de page 2 tandis que le mandat du CEPMB est resté essentiellement le même. Au cours de la même période, de nombreux autres pays développés proposant des régimes équivalents ont introduit des mesures pour résoudre les problèmes d’accessibilité, optimiser les ressources et suivre le rythme d’un marché pharmaceutique en évolution rapide.

La prochaine mise en œuvre de l’Accord économique et commercial global (AECG) nécessitera des modifications à la Loi sur les brevets afin de fournir aux sociétés pharmaceutiques brevetées jusqu’à deux ans d’exclusivité de marché supplémentaire. Un tel changement pourrait précipiter un débat quant à savoir si l’équilibre politique actuel fonctionne comme prévu. À mesure que se déroulera le débat en 2015–2016, le CEPMB examinera l’éventuelle nécessité d’apporter des changements à ses fonctions de détermination du prix et de production de rapports – et dans quelle mesure – s’il doit continuer de servir de contrepoids efficace aux droits de brevet des fabricants de produits pharmaceutiques en veillant à ce que les Canadiens ne paient pas un prix excessif pour les médicaments brevetés.

Comme toujours, le CEPMB fera passer la protection des intérêts des consommateurs avant tout, en reconnaissant cependant la valeur que les médicaments novateurs offrent aux patients.

Mary Catherine Lindberg

Section I : Vue d’ensemble des dépenses de l’organisation

Profil organisationnel

Ministre compétent : L’honorable Rona Ambrose

Administrateur général : Mary-Catherine Lindberg, Présidente

Portefeuille ministériel : Santé

Principales autorités législatives : Loi sur les brevetsNotes de bas de page i et Règlements sur les médicaments brevetésNotes de bas de page ii

Année de création : 1987

Autre : Le ministre de la Santé est responsable de l’application des dispositions de la Loi sur les brevets (la Loi) formulées aux articles 79 à 103. Le CEPMB fait partie du portefeuille de la Santé, qui comprend Santé Canada, l’Agence de la santé publique du Canada, les Instituts de recherche en santé du Canada et l’Agence canadienne d’inspection des aliments. Le portefeuille de la Santé aide le ministre de la Santé à maintenir et à améliorer la santé des Canadiens.

Même s’il fait partie du portefeuille de la Santé, le CEPMB exerce son mandat en toute indépendance vis-à-vis du ministre de la Santé. Il fonctionne d’une façon indépendante des autres organismes, dont Santé Canada, qui autorise la vente des médicaments au Canada après avoir vérifié leur innocuité, leur efficacité et leur qualité; les régimes publics fédéral, provinciaux et territoriaux d’assurance-médicaments qui autorisent l’inscription des médicaments sur leurs formulaires de médicaments admissibles à un remboursement; et le Programme commun d’examen des médicaments, géré par l’Association canadienne des médicaments et des technologies de la santé qui évalue l’efficience des médicaments avant leur inscription sur les formulaires des régimes publics d’assurance-médicaments participants.

Contexte organisationnel

Raison d’être

Créé par le Parlement en 1987, le Conseil d’examen du prix des médicaments brevetés (CEPMB) est un organisme indépendant qui détient des pouvoirs quasi judiciaires. Il est investi d’un double mandat :

- Réglementaire – Veiller à ce que les prix auxquels les brevetés vendent leurs médicaments brevetés au Canada ne soient pas excessifs;

- Production de rapports – Sur les tendances pharmaceutiques de tous les médicaments et sur les dépenses de R-D effectuées par les titulaires de brevet.

Dans l’exécution de son mandat, le CEPMB veille à la protection des Canadiens en s’assurant que les médicaments brevetés ne sont pas vendus au Canada à des prix excessifs et que les intervenants sont tenus informés des tendances relatives aux produits pharmaceutiques.

Responsabilités

Le CEPMB a été créé à la suite des modifications apportées à la Loi sur les brevets (la Loi) en 1987 (projet de loi C-22) et ses pouvoirs de redressement ont été complétés par d’autres modifications en 1993 (projet de loi C-91). Ces modifications faisaient partie de réformes politiques visant à équilibrer le mandat portant sur la protection du consommateur du CEPMB avec des mesures de protection des brevets visant à encourager les efforts des titulaires de brevets pharmaceutiques en matière de recherche et de développement.

Le CEPMB a un double mandat :

Réglementation du prix des médicaments brevetés

Il incombe au CEPMB de s’assurer que les prix départ-usine, à savoir les prix auxquels les brevetés vendent, au Canada, à leurs différents clients (grossistes, hôpitaux, pharmacies et autres) leurs médicaments brevetés pour usage humain ou pour usage vétérinaire distribués sous ordonnance ou en vente libre, ne sont pas excessifs. Le CEPMB réglemente le prix de chaque médicament breveté auquel Santé Canada a attribué un numéro d’identification du médicament (DIN) dans le cadre de son processus d’examen. Le mandat du CEPMB porte également sur des médicaments qui sont offerts en vertu du Programme d’accès spécial, par l’entremise d’une demande d’essai clinique et en tant que drogues nouvelles de recherche. Les médicaments brevetés en vente libre et les médicaments brevetés à usage vétérinaire sont également réglementés par le CEPMB en fonction des plaintes reçues.

Dans le cas où, à l’issue d’une audience publique, le Conseil juge que le prix d’un médicament breveté vendu sur un marché canadien est ou était excessif, il peut rendre une ordonnance obligeant le breveté à réduire le prix de son médicament et à appliquer les mesures qui lui sont dictées pour rembourser les recettes excessives qu’il a tirées de la vente de son médicament à un prix excessif.

Rapports sur les tendances relatives aux produits pharmaceutiques

Chaque année, le CEPMB rend compte au Parlement, par le truchement du ministre de la Santé, de ses principales activités, de ses analyses du prix des médicaments brevetés et des tendances relatives aux produits pharmaceutiques d’ordonnance ainsi que des dépenses de R–D déclarées par les sociétés pharmaceutiques détentrices de brevets. De plus, par suite de l’établissement du Système national d’information sur l’utilisation des médicaments prescritsNotes de bas de page iii (SNIUMP) par les ministres de la Santé fédéral, provinciaux et territoriaux en septembre 2001, le CEPMB réalise des analyses critiques des tendances relatives aux prix, à l’utilisation et aux coûts pour les médicaments brevetés et non brevetés distribués sous ordonnance pour que le système de santé au Canada ait des renseignements plus complets et plus justes sur la façon dont on utilise les médicaments d’ordonnance et sur les facteurs à l’origine des augmentations de coûts. Cette fonction vise à aider les gouvernements fédéral, provinciaux et territoriaux et d’autres parties intéressées à se munir d’une source centralisée d’information crédible sur les tendances dans l’industrie pharmaceutique.

Résultat stratégique et Architecture d’alignement des programmes

- 1. Résultat stratégique : Les médicaments brevetés ne peuvent être vendus au Canada à des prix excessifs, afin de protéger les intérêts de la population canadienne. La population canadienne est également tenue informée.

- 1.1 Programme : Le programme de réglementation du prix des médicaments brevetés

- 1.2 Programme : Le programme sur les tendances relatives aux produits pharmaceutiques

- Services internes

Priorités organisationnelles

| Priorité |

TypeNotes de bas de page 3 |

Résultat stratégique et programmes |

| Traiter des prix actuels et des lacunes en matière d’information |

Nouvelle |

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. Cette priorité est liée aux programmes 1.1 et 1.2. |

| Description |

|

Pourquoi est-ce une priorité?

L’environnement pharmaceutique d’aujourd’hui est dynamique et ne cesse d’évoluer. En tant que micro-organisme détenant un effectif limité, mais efficace, le CEPMB est bien équipé pour répondre aux changements dans son environnement en ajustant ses pratiques réglementaires et de présentation de rapports d’une année à l’autre de manière à servir au mieux son mandat de protection des consommateurs. Depuis 2010, les payeurs publics au Canada ont réalisé d’importants progrès dans leurs efforts pour obtenir des réductions de prix de la part des fabricants de produits pharmaceutiques en exploitant le pouvoir d’achat combiné des provinces et des territoires par l’entremise de l’Alliance pancanadienne pharmaceutique (APP)Notes de bas de page iv. Bien que le CEPMB ait cherché à structurer ces efforts par l’entremise de sa fonction de production de rapports en fournissant aux payeurs publics de l’information et des analyses des prix, le succès de l’APP à faire baisser les prix soulève des questions légitimes quant à la façon dont la fonction de réglementation des prix du CEPMB peut continuer d’appuyer les gouvernements provinciaux et territoriaux. Cependant, les payeurs privés, qui sont responsables de la majorité des dépenses pharmaceutiques au Canada, ne bénéficient pas des réductions de prix négociés par l’APP. En outre, les personnes qui ont le moins de moyens ont tendance à payer les prix les plus élevés au Canada, avec un consommateur sur dix qui se dit être incapable de payer ses ordonnances. L’accent que met actuellement l’industrie des médicaments sur les produits de créneau inquiète beaucoup les payeurs publics et privés, car ceux-ci peuvent offrir un bénéfice thérapeutique important, mais à un coût très élevé.

|

|

Quels sont les plans pour réaliser cette priorité?

Sur le plan réglementaire, le CEPMB :

- cherchera des occasions de répondre aux cas de prix excessifs sous la forme de discrimination par les prix et de segmentation du marché.

Sur le plan de la production de rapports, le CEPMB :

- renforcera son partenariat avec les payeurs publics afin de fournir de l’information sur les prix encore plus pertinente et opportune;

- élargira la portée des enjeux pharmaceutiques sur lesquels il rend compte afin de fournir aux payeurs privés et aux consommateurs de l’information qui les aidera à faire des choix plus éclairés et plus rentables.

|

| Priorité |

Type |

Résultat stratégique et programmes |

| Sensibiliser davantage le public |

Nouvelle |

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. Cette priorité est liée aux programmes 1.1 et 1.2. |

| Description |

|

Pourquoi est-ce une priorité?

Afin d’être pleinement informé des changements pertinents dans son environnement, et d’y répondre, le CEPMB doit susciter la participation d’un réseau hétérogène d’intervenants de l’industrie pharmaceutique, chacun y ayant son propre intérêt et y proposant une perspective unique. Pour ce faire de façon efficace, le CEPMB doit renforcer la sensibilisation de son mandat de protection des consommateurs et s’appuyer sur sa réputation de courtier honnête auprès des parties prenantes et du grand public.

|

|

Quels sont les plans pour réaliser cette priorité?

Le CEPMB :

- adoptera une approche plus proactive pour communiquer ses réalisations en matière de réglementation et de production de rapports aux intervenants et au public;

- cherchera des occasions de tirer parti des partenariats stratégiques;

- élargira la portée des questions pharmaceutiques sur lesquelles il rend compte

|

| Priorité |

Type |

Résultat stratégique et programmes |

| Modernisation des règlements |

Nouvelle |

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. Cette priorité est liée aux programmes 1.1 et 1.2. |

| Description |

|

Pourquoi est-ce une priorité?

Comme beaucoup d’autres pays, le Canada est confronté à une croissance des coûts de soins de santé et les payeurs publics et tiers de partout au pays peinent à concilier des budgets de soins de santé limités à l’accès aux nouvelles technologies prometteuses. Au Canada, cela a pris la forme d’ententes confidentielles relatives à l’inscription des produits (EIP) négociées entre gestionnaires de régimes d’assurance-médicaments provinciaux, soit individuellement, soit aux termes de l’APP et des fabricants de produits pharmaceutiques. Les ententes confidentielles sont également la norme internationale, même si les responsables du remboursement explorent de nouvelles façons de fixer les prix. Les premiers compliquent la tâche du CEPMB de vérifier le vrai prix d’un médicament, ce qui peut conduire à une pression à la hausse sur les prix dans le marché privé. Les derniers peuvent s’avérer un facteur contribuant à la hausse récente des prix canadiens des médicaments brevetés par rapport aux sept autres pays auxquels le Canada se compare en vertu du Règlement sur les médicaments brevetés. L’engagement récent du Canada en vertu de l’Accord économique et commercial global (AECG) avec l’Union européenne visant à modifier la Loi sur les brevets afin de prolonger la durée d’un brevet pharmaceutique de deux ans pourrait rouvrir le débat sur le juste équilibre entre la propriété intellectuelle et la protection des consommateurs.

|

|

Quels sont les plans pour réaliser cette priorité?

Le CEPMB examinera l’éventuelle nécessité d’apporter des changements à ses fonctions de détermination du prix et de production de rapports – et dans quelle mesure – s’il doit continuer de rencontrer son résultat stratégique de veiller à ce que les Canadiens ne paient pas un prix excessif pour les médicaments brevetés.

|

| Priorité |

Type |

Résultat stratégique et programmes |

| Engagement des employés et synergie organisationnelle |

Nouvelle |

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. Cette priorité est liée aux programmes 1.1 et 1.2. |

| Description |

|

Pourquoi est-ce une priorité?

En réponse aux commentaires provenant du Sondage auprès des fonctionnaires fédéraux de 2011 et à un rapport de planification de la relève produit par des experts indépendants, le CEPMB a lancé un processus pour susciter l'engagement du personnel et obtenir leurs commentaires et leur appui relativement à la direction stratégique et aux priorités du CEPMB au cours des trois prochaines années. Dans le cadre de ce processus, le personnel acquerra une meilleure compréhension du cadre opérationnel du CEPMB et de la façon dont chaque direction peut contribuer à l’atteinte du résultat stratégique de l’organisation.

|

|

Quels sont les plans pour réaliser cette priorité?

Le CEPMB mettra l’accent sur :

- une communication plus claire et plus structurée entre le personnel de gestion et au sein de celui-ci;

- une plus grande collaboration interne;

- une meilleure intégration de ses processus d’affaires;

- l’utilisation optimale de l’éventail de compétences diversifiées des employés.

|

Analyse des risques

Principaux risques

| Risque |

Stratégie de réaction au risque |

Lien vers l’Architecture d’alignement des programmes |

| À mesure que les provinces et les territoires décident de formaliser l’APP et obtiennent davantage de réductions de prix de la part des fabricants de produits pharmaceutiques, les prix plafonds fixés par le CEPMB courent le risque de devenir de moins en moins pertinents pour les payeurs publics. |

- Le CEPMB renforcera son partenariat avec les payeurs publics afin de mieux anticiper leurs besoins en matière d’information concernant le marché et pour fournir à l’APP des analyses et de l’information sur les prix encore plus pertinentes et opportunes.

- Le CEPMB mènera des interventions réglementaires ciblées qui mettent l’accent sur les cas de prix excessifs sous la forme de discrimination par les prix et (ou) de segmentation du marché afin de réduire l’écart entre les prix des secteurs publics et privés.

|

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. |

| Les efforts déployés par les responsables du remboursement dans l’UE pour réduire les prix pourraient faire en sorte que le Canada se classe au deuxième rang des prix des médicaments brevetés les plus élevés, dépassé seulement par les États-Unis, des sept pays de comparaison du CEPMB et (ou) que les prix soient plus élevés que la médiane internationale. |

- Le CEPMB examinera l’éventuelle nécessité d’apporter des changements à ses fonctions de protection du consommateur – et dans quelle mesure – afin de veiller à ce que les Canadiens paient un prix équitable pour les médicaments brevetés.

- Le CEPMB renforcera les liens avec les responsables du remboursement dans d’autres pays afin de partager l’information concernant le marché et de se tenir au courant de l’évolution de la situation à l’échelle internationale.

|

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. |

| La mise en œuvre de l’AECG pourrait précipiter un débat sur le bon fonctionnement de l’équilibre entre les mesures de protection des brevets et la protection du consommateur. |

- Le CEPMB examinera l’éventuelle nécessité d’apporter des changements à ses fonctions de protection du consommateur – et dans quelle mesure – afin de veiller à ce que les Canadiens paient un prix équitable pour les médicaments brevetés.

|

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. |

| Procédures judiciaires en cours |

- Le 25 juin 2014, le procureur général a déposé des avis d’appel à l’égard des deux décisions rendues par la Cour fédérale le 27 mai 2014, au sujet de la compétence du Conseil à l’égard de certains produits existants vendus par Ratiopharm Inc. (actuellement Teva Canada Limitée) et Sandoz Canada Inc.

|

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. |

| Compte tenu de la nature hautement spécialisée de son mandat de protection des consommateurs, le CEPMB dépend de sa capacité à attirer et à retenir des experts en la matière. |

- Le CEPMB a fait de l’engagement des employés l’une de ses quatre priorités stratégiques et est en voie d’embaucher du personnel possédant les compétences requises pour faire avancer ses priorités.

|

Le CEPMB n’a qu’un résultat stratégique. Ainsi, toutes les priorités se rapportent à ce résultat. |

Comme ce fut le cas au cours des dernières années, de nombreux pays continuent une lutte pour restreindre la hausse des coûts des soins de santé. Des changements récents aux systèmes réglementaires pharmaceutiques étrangers et nationaux ont mis l’accent sur des mesures de contrôle des coûts. Le CEPMB continue de surveiller et d’évaluer l’impact des changements nationaux et étrangers aux systèmes réglementaires pharmaceutiques sur son processus d’examen des prix.

L’engagement récent du Canada envers l’AECG de modifier la Loi sur les brevets afin de prolonger la durée d’un brevet de médicament de deux ans devrait rouvrir le débat sur l’équilibre approprié entre la propriété intellectuelle et la protection des consommateurs. Le programme de réglementation des prix du CEPMB pourrait donc faire l’objet d’un examen plus approfondi.

Le cadre juridique du CEPMB est resté essentiellement le même depuis 1987 alors que les régimes en place dans d’autres pays développés ont subi des changements considérables afin de répondre aux questions d’abordabilité et de suivre le rythme d’un marché pharmaceutique en évolution rapide. En 2015–2016, le CEPMB examinera l’éventuelle nécessité d’apporter des changements à ses fonctions de protection du consommateur, et dans quelle mesure, afin d’aborder des enjeux similaires au Canada.

En tant qu’organisme fédéral expert sur les questions afférentes au prix des médicaments, le CEPMB, par l’entremise du Programme sur les tendances relatives aux produits pharmaceutiques, concourt à la prise de décisions éclairées en faisant rapport des tendances relatives aux produits pharmaceutiques. En outre, le CEPMB entreprend des études et effectue des analyses sur divers sujets qui ont trait à l’établissement des prix et aux coûts des produits pharmaceutiques. Au moyen d’analyses critiques sur les tendances relatives aux prix, à l’utilisation et aux coûts, effectuées dans le cadre de l’initiative SNIUMP, le CEPMB fournit au système de santé du Canada de l’information exhaustive et exacte sur la façon dont les médicaments d’ordonnance sont utilisés et sur les déterminants des coûts. Depuis 2013–2014, le CEPMB a mis l’accent sur des stratégies destinées à améliorer l’efficacité et la pertinence de son mandat en matière de présentation de rapports. Pour garantir la pertinence des rapports du SNIUMP, le CEPMB a lancé une stratégie d’engagement plus vaste afin de déterminer les priorités en matière de recherche et les domaines d’intérêt émergents. Le CEPMB a intensifié ses efforts de communication avec les principaux intervenants, parmi lesquels des universitaires, les partenaires fédéraux du portefeuille de la santé, les collectivités gouvernementales chargées de l’élaboration de politiques et de la recherche, l’industrie pharmaceutique et de l’assurance ainsi que les professionnels de la santé, les groupes de défense des patients et des consommateurs. En 2015–2016, le CEPMB renforcera son partenariat avec les payeurs publics afin de fournir des analyses et de l’information sur les prix encore plus pertinentes et opportunes.

Compte tenu de la nature hautement spécialisée de son mandat de protection des consommateurs, le CEPMB doit continuer d’attirer et de retenir des experts en la matière. Une des stratégies clés pour attirer et retenir les meilleurs effectifs consiste à créer une culture qui valorise les employés et qui sait reconnaître et récompenser leurs efforts de diverses façons. Pour être une organisation qui se veut efficace, le CEPMB doit encourager ses employés à donner le meilleur d’eux-mêmes en créant une culture de reconnaissance, axée sur le rendement. En 2015–2016, le CEPMB mettra en œuvre un certain nombre de mesures proposées par le personnel visant à encourager une plus grande collaboration interne, à mieux intégrer les processus opérationnels et à mettre à profit davantage les compétences variées et spéciales de ses effectifs.

Dépenses prévues

Ressources financières budgétaires (En dollars)

2015–2016

Budget principal des dépenses |

2015–2016

Dépenses prévues |

2016–2017

Dépenses prévues |

2017–2018

Dépenses prévues |

| 10 945 181 |

10 945 181 |

10 945 181 |

10 945 181 |

Ressources humaines (Équivalent temps plein – ETP)

| 2015–2016 |

2016–2017 |

2017–2018 |

| 71 |

71 |

71 |

Sommaire de planification budgétaire pour le Résultat stratégique et les Programmes (En dollars)

| Résultat stratégique, Programmes et Services internes |

2012–2013 Dépenses |

2013–2014 Dépenses |

2014–2015 Dépenses projetées |

2015–2016 Budget principal des dépenses |

2015–2016 Dépenses prévues |

2016–2017 Dépenses prévues |

2017–2018 Dépenses prévues |

| Résultat stratégique 1 : Les médicaments brevetés ne peuvent être vendus au Canada à des prix excessifs, afin de protéger les intérêts de la population canadienne. La population canadienne est également tenue informée. |

| Le programme de réglementation du prix des médicaments brevetés |

3 888 795 |

6 395 602Footnote a |

3 636 684 |

6 834 096Footnote b |

6 834 096 |

6 834 096 |

6 834 096 |

| Le programme sur les tendances relatives aux produits pharmaceutiques |

983 279 |

1 146 790 |

1 391 086 |

1 506 994 |

1 506 994 |

1 506 994 |

1 506 994 |

| Total partiel |

4 872 074 |

7 542 392 |

5 027 770 |

8 341 090 |

8 341 090 |

8 341 090 |

8 341 090 |

| Total partiel Services internes |

3 184 729 |

2 998 175 |

3 198 053 |

2 604 091 |

2 604 091 |

2 604 091 |

2 604 091 |

| Total |

8 056 803 |

10 540 567 |

8 225 823 |

10 945 181 |

10 945 181 |

10 945 181 |

10 945 181 |

Harmonisation avec les résultats du gouvernement du Canada

Harmonisation des dépenses prévues pour 2015–2016 par Secteur de dépenses du Cadre pangouvernementalNotes de bas de page v (En dollars)

| Résultat stratégique |

Programme |

Secteur de dépenses |

Résultat du gouvernement du Canada |

Dépenses prévues 2015–2016 |

| Les médicaments brevetés ne peuvent être vendus au Canada à des prix excessifs, afin de protéger les intérêts de la population canadienne. La population canadienne est également tenue informée. |

Le programme de réglementation du prix des médicaments brevetés |

Affaires sociales |

Des Canadiens en santé |

6 834 096 |

| Le programme sur les tendances relatives aux produits pharmaceutiques |

Affaires sociales |

Des Canadiens en santé |

1 506 994 |

Total des dépenses prévues par Secteurs de dépenses (En dollars)

| Secteur de dépenses |

Total des dépenses prévues |

| Affaires économiques |

|

| Affaires sociales |

8 341 090 |

| Affaires internationales |

|

| Affaires gouvernementales |

|

Tendances relatives aux dépenses du ministère

Tendances relatives aux dépenses du ministère

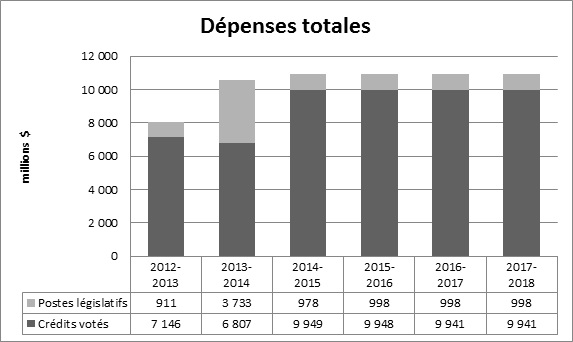

Le graphique à barres qui suit montre les tendances qui se dégagent des dépenses prévues et des dépenses réelles au fil du temps du CEPMB. Les dépenses sont répartis entre les dépenses votées (crédits votés) et les dépenses législatives (postes législatifs). Le graphique illustre les dépenses réelles des exercices 2012–2013 et 2013–2014, les dépenses projetées pour l’exercice 2014–2015 et les dépenses prévues pour les exercices 2015–2016, 2016–2017 et 2017–2018.

Tendances relatives aux dépenses du ministèreLe graphique à barres qui suit montre les tendances qui se dégagent des dépenses prévues et des dépenses réelles au fil du temps du CEPMB. Les dépenses sont répartis entre les dépenses votées (crédits votés) et les dépenses législatives (postes législatifs). Le graphique illustre les dépenses réelles des exercices 2012–2013 et 2013–2014, les dépenses projetées pour l’exercice 2014–2015 et les dépenses prévues pour les exercices 2015–2016, 2016–2017 et 2017–2018.

L’écart entre les dépenses de 2012–2013 et 2013–2014 est en grande partie imputable au financement supplémentaire reçu au moyen d’un mandat de rajustement pour couvrir le montant que la Cour fédérale a ordonné de rembourser à un breveté. La Cour fédérale a annulé une ordonnance du Conseil et ordonné dans sa décision qu’un revenu excédentaire de 2 801 285 $ soit remboursé par le CEPMB au breveté, avec l’intérêt approprié et les frais déterminés.

Le Budget principal des dépenses de 2015–2016 comprend le financement d’une affectation à but spécial (ABS) d’une somme de 2 470 000 $. L’ABS est destinée à la tenue d’audiences publiques et ne peut être utilisée que pour couvrir les coûts des conseillers juridiques externes, des témoins experts, etc. Tout montant d’une ABS non utilisé doit être reversé au Fonds du Trésor (le Trésor).

En raison de difficultés rattachées à la prévision du nombre et de la complexité d’audiences tenues, aux fins de la prévision des dépenses anticipées pour 2015–2016 et les années à venir, on suppose que le financement d’ABS sera entièrement utilisé.

Budget des dépenses par crédits votés

Pour plus d’information sur les crédits organisationnels du CEPMB, prière de consulter le Budget principal des dépenses 2015–2016 sur le site Web du Secrétariat du Conseil du Trésor du CanadaNotes de bas de page vi.

Section II : Analyse des programmes par résultat stratégique

Résultat stratégique :

Les médicaments brevetés ne peuvent être vendus au Canada à des prix excessifs, afin de protéger les intérêts de la population canadienne. La population canadienne est également tenue informée.

Programme 1.1 : Le programme de réglementation du prix des médicaments brevetés

Description

Le CEPMB est un organisme indépendant qui détient des pouvoirs quasi judiciaires et qui est responsable de s’assurer que les prix auxquels les brevetés vendent leurs médicaments brevetés au Canada ne sont pas excessifs en vertu des facteurs d’examen du prix prévus à la Loi sur les brevets (la Loi). Pour décider si un prix est excessif, le Conseil doit tenir compte des facteurs suivants : les prix de vente du médicament et des autres médicaments de la même catégorie thérapeutique au Canada et dans les sept pays de comparaison nommés dans le Règlement sur les médicaments brevetés (le Règlement); les variations de l’Indice des prix à la consommation (IPC); et, conformément à la Loi, tous les autres facteurs précisés par les règlements d’application visant l’examen du prix. En vertu de la Loi et du Règlement, les brevetés sont tenus de faire rapport des renseignements sur les prix et les ventes pour chaque médicament breveté vendu au Canada, jusqu’à échéance du brevet ou des brevets. Le personnel du Conseil examine les renseignements soumis par les brevetés au lancement et à chaque période de rapport, et ce, pour tous les médicaments brevetés vendus au Canada. S’il conclut que le prix d’un médicament breveté semble excessif, le personnel du Conseil mène une enquête sur le prix. Une enquête peut mener aux résultats suivants : la fermeture de l’enquête lorsqu’il apparaît que le prix est non excessif; un Engagement de conformité volontaire par lequel le breveté s’engage à réduire le prix de son produit et à rembourser les recettes excessives au moyen d’un paiement et (ou) d’une réduction du prix d’un autre produit médicamenteux breveté; ou une audience publique dont l’objet est de déterminer si le prix du produit médicamenteux est ou non excessif, y compris une ordonnance corrective rendue par le Conseil. Si le Panel d’audience du Conseil conclut, à l’issue d’une audience publique, qu’un prix est ou était excessif, il peut ordonner au breveté de réduire le prix et de prendre des mesures qui lui sont dictées pour rembourser les recettes excessives. Ce programme assure la protection des Canadiens et de leur système des soins de santé en effectuant l’examen des prix auxquels les brevetés vendent leurs médicaments brevetés au Canada afin d’éviter les prix excessifs.

Ressources financières budgétaires (En dollars)

2015–2016

Budget principal des dépenses |

2015–2016

Dépenses prévues |

2016–2017

Dépenses prévues |

2017–2018

Dépenses prévues |

| 6 834 096 |

6 834 096 |

6 834 096 |

6 834 096 |

Ressources humaines (Équivalent temps plein – ETP)

| 2015–2016 |

2016–2017 |

2017–2018 |

| 42 |

42 |

42 |

Mesure de rendement

| Résultats attendus |

Indicateurs de rendement |

Cibles |

Date de réalisation |

| La conformité des brevets à la Loi sur les brevets, à la réglementation et aux Lignes directrices sur les prix excessifs (les Lignes directrices) |

Pourcentage de médicaments brevetés dont les prix sont fixés en conséquence de la conformité volontaire, suivant les Lignes directrices ou ne justifient pas la tenue d’une enquête |

95 % |

Le 31 mars chaque année |

| Taux de conformité aux ordonnances du Conseil relatives au prix ou à la compétence et aux engagements de conformité volontaire |

100 % |

Le 31 mars chaque année |

| Au Canada, les prix des médicaments brevetés se situent dans la fourchette des prix pratiqués dans les sept pays de comparaison nommés dans le Règlement |

Les prix canadiens des nouveaux médicaments brevetés correspondent à la moyenne du prix médian international ou se trouvent en dessous de la médiane |

100 % |

Le 31 mars chaque année |

| Les prix canadiens des médicaments brevetés existants correspondent à la moyenne du prix médian international ou se trouvent en dessous de la médiane |

100 % |

Le 31 mars chaque année |

Faits saillants de la planification

Le CEPMB mènera des interventions réglementaires ciblées qui mettent l’accent sur les cas de prix excessifs sous la forme de discrimination par les prix et (ou) de segmentation du marché afin de réduire l’écart entre les prix des secteurs publics et privés, notamment en ce qui concerne les médicaments biologiques et orphelins. Le CEPMB examinera l’éventuelle nécessité d’apporter des changements à ses fonctions de réglementation et de production de rapports – et dans quelle mesure – s’il doit continuer de rencontrer son résultat stratégique de veiller à ce que les Canadiens ne paient pas un prix excessif pour les produits médicamenteux brevetés.

Programme 1.2 : Le programme sur les tendances relatives aux produits pharmaceutiques

Description

Le CEPMB rend annuellement compte au Parlement, par le truchement du ministre de la Santé, de ses activités d’examen du prix, des prix des médicaments brevetés et des tendances observées au niveau des prix de tous les médicaments ainsi que des dépenses de R–D rapportées par les brevetés pharmaceutiques. En soutien à cette exigence en matière de rapport, le programme sur les tendances relatives aux produits pharmaceutiques fournit des renseignements complets et précis sur les tendances relatives aux prix auxquels les fabricants vendent les médicaments brevetés au Canada et aux dépenses de l’intention des intervenants intéressés, notamment : l’industrie (de marque, biotechnologique et générique); les gouvernements fédéral, provinciaux et territoriaux; les groupes de défense de droits des consommateurs et des patients; les tiers payants; et autres. Ces renseignements permettent également de rassurer les Canadiens que les prix des médicaments brevetés ne sont pas excessifs. De plus, par suite de l’établissement du SNIUMP par les ministres de la Santé fédéral, provinciaux et territoriaux, le ministre fédéral de la Santé a demandé que le CEPMB réalise des analyses critiques des tendances relatives aux prix, à l’utilisation et aux coûts pour les médicaments brevetés et non brevetés distribués sous ordonnance pour que le système de santé au Canada ait des renseignements plus complets et plus justes sur la façon dont on utilise les médicaments d’ordonnance et sur les facteurs à l’origine des augmentations de coûts. Cette fonction vise à fournir aux gouvernements fédéral, provinciaux et territoriaux ainsi, qu’aux autres intervenants intéressés, une source d’information centrale et fiable concernant les prix de tout médicament d’ordonnance.

Ressources financières budgétaires (En dollars)

2015–2016

Dépenses prévues |

2016–2017

Dépenses prévues |

2017–2018

Dépenses prévues |

| 1 506 994 |

1 506 994 |

1 506 994 |

Ressources humaines (ETP)

| 2015–2016 |

2016–2017 |

2017–2018 |

| 10 |

10 |

10 |

Mesure de rendement

| Résultats attendus |

Indicateurs de rendement |

Cibles |

Date de réalisation |

| Information sur les tendances pharmaceutiques et les facteurs à l’origine des coûts offerte aux intervenants |

Nombre de nouveaux rapports/nouvelles études sur le site Web du CEPMB |

12 rapports et études |

Le 31 mars chaque année |

| Nombre de présentations du CEPMB à un public externe |

10 séances d’information |

Le 31 mars chaque année |

Faits saillants de la planification

Le CEPMB adoptera une approche plus proactive pour communiquer ses réalisations en matière de réglementation et de production de rapports au public et s’appuiera sur sa réputation de courtier honnête pour identifier, analyser et faire état des questions d’intérêt pharmaceutique. Cela comprend des efforts pour renforcer son partenariat avec les payeurs publics afin de fournir des analyses et de l’information sur les prix encore plus pertinentes et opportunes qui élargissent la portée des enjeux pharmaceutiques sur lesquels il rend compte pour fournir aux payeurs privés et aux consommateurs de l’information qui les aidera à faire des choix plus éclairés et plus rentables. En dernier lieu, le CEPMB renforcera les liens avec les responsables du remboursement dans d’autres pays afin de partager l’information concernant le marché et de se tenir au courant de l’évolution de la situation dans ce domaine. Le CEPMB continuera également de publier son Programme de recherche du SNIUMP qui reflète les priorités identifiées par le Comité consultatif du SNIUMP et qui énumère les rapports qu’il prévoit terminer et publier chaque année.

Services internes

Description

Les services internes sont des groupes d’activités et de ressources connexes qui sont gérés de façon à répondre aux besoins des programmes et des autres obligations générales d’une organisation. Les services internes comprennent uniquement les activités et les ressources qui s’appliquent à l’ensemble d’une organisation, et non celles prévues pour un programme précis. Ces groupes sont les suivants : services de gestion et de surveillance, services des communications, services juridiques, services de gestion des ressources humaines, services de gestion financière, services de gestion de l’information, services des technologies de l’information, services des biens immobiliers, services du matériel et services de gestion des acquisitions.

Ressources financières budgétaires (En dollars)

2015–2016

Budget principal des dépenses |

2015–2016

Dépenses prévues |

2016–2017

Dépenses prévues |

2017–2018

Dépenses prévues |

| 2 604 091 |

2 604 091 |

2 604 091 |

2 604 091 |

Ressources humaines (ETP)

| 2015–2016 |

2016–2017 |

2017–2018 |

| 19 |

19 |

19 |

Faits saillants de la planification

Le CEPMB mettra en œuvre un certain nombre de mesures proposées par le personnel visant à encourager une plus grande collaboration interne, à mieux intégrer les processus opérationnels et à miser davantage sur les compétences variées et spéciales de ses effectifs afin de réaliser ses objectifs stratégiques. Il fournira également une plus grande responsabilisation de gestion dans ce domaine en offrant au personnel la possibilité d’évaluer officiellement dans quelle mesure il juge que les gestionnaires préconisent ces mesures dans leurs directions respectives.

Section III : Renseignements supplémentaires

État des résultats prospectif

L’état des résultats condensé prospectif donne un aperçu général des opérations du CEPMB. Les prévisions financières concernant les dépenses et les recettes sont préparées sur une base de comptabilité d’exercice pour renforcer la responsabilisation et améliorer la transparence et la gestion financière.

Comme l’état des résultats prospectif est établi sur une base de comptabilité d’exercice et les prévisions et les dépenses prévues présentées dans d’autres sections du présent rapport sont établies sur la base des dépenses, les montants diffèrent.

Un état des résultats prospectif plus détaillé Notes de bas de page vii et des notes afférentes, comprenant un rapprochement des coûts de fonctionnement net et des autorisations demandées, peut être trouvé sur le site Web du Conseil d’examen du prix des médicaments brevetés.

État des résultats condensé prospectif

Pour l’exercice ayant pris fin le 31 mars

(En dollars)

| Renseignements financiers |

2014–2015 Résultats estimatifs |

2015–2016 Résultats prévus |

Variation |

| Total des dépenses |

9 161 120 |

12 016 985 |

2 855 865 |

| Total des revenusNotes de bas de page 4 |

- |

- |

- |

| Coût de fonctionnement net |

9 161 120 |

12 016 985 |

2 855 865 |

Tableaux de renseignements supplémentaires

Les tableaux de renseignements supplémentairesNotes de bas de page viii énumérés dans le Rapport sur les plans et les priorités de 2015–2016 sont affichés sur le site Web du Conseil d’examen du prix des médicaments brevetés.

Dépenses fiscales et évaluations

Il est possible de recourir au régime fiscal pour atteindre des objectifs de la politique publique en appliquant des mesures spéciales, comme de faibles taux d’impôt, des exemptions, des déductions, des reports et des crédits. Le ministère des Finances Canada publie annuellement des estimations et des projections du coût de ces mesures dans son rapport intitulé Dépenses fiscales et évaluationsNotes de bas de page xi. Les mesures fiscales présentées dans le rapport Dépenses fiscales et évaluations relèvent de la responsabilité du ministre des Finances.

Section IV : Coordonnées de l’organisation

Le Conseil d’examen du prix des médicaments brevetés

C.P. L40

Centre Standard Life

333, avenue Laurier Ouest

Bureau 1400

Ottawa (Ontario) K1P 1C1

Téléphone : 613-952-7360

Sans frais : 1-877-861-2350

Télécopieur : 613-952-7626

ATS : 613-957-4373

Courriel : pmprb@pmprb-cepmb.gc.ca

Site Web : www.pmprb-cepmb.gc.ca

Annexe : Définitions

Architecture d’alignement des programmes : Inventaire structuré des programmes d’une organisation décrivant la relation hiérarchique entre les programmes et le résultat stratégique auquel ils contribuent.

Cadre pangouvernemental : Présente les contributions financières des organisations fédérales qui reçoivent des crédits en alignant leurs programmes à un ensemble de 16 objectifs de haut niveau définis pour le gouvernement dans son ensemble, groupés en quatre domaines de dépenses.

Cible : Rendement quantifiable ou taux de succès qu’une organisation, qu’un programme ou qu’une initiative prévoit atteindre pour une période donnée. Les cibles peuvent être quantitatives ou qualitatives.

Crédit : Toute autorisation du Parlement de verser une somme d’argent à même le Trésor.

Dépenses budgétaires : Comprend les dépenses de fonctionnement et de capital; les paiements de transfert à d’autres ordres gouvernementaux, organisations ou individus; et les paiements aux sociétés d’État.

Dépenses non budgétaires : Comprend les dépenses nettes et les recettes liées aux prêts, placements et avances, qui changent la composition des actifs financiers du gouvernement du Canada.

Dépenses prévues : Aux fins du Rapport sur les plans et les priorités (RPP) et des Rapports ministériels sur le rendement (RMR), les dépenses prévues font référence aux montants qui reçoivent l’approbation du Conseil du Trésor d’ici le 1er février. Par conséquent, les dépenses prévues peuvent comprendre des montants supplémentaires aux dépenses présentées dans le Budget principal des dépenses.

On s’attend à ce qu’un ministère soit informé des pouvoirs qu’il a demandés et reçus. La détermination des dépenses prévues est une responsabilité ministérielle et les ministères doivent être en mesure de défendre les montants des dépenses et de la comptabilité d’exercice présentés dans leurs RPP et RMR.

Équivalent temps plein : Indicateur de la mesure dans laquelle un employé représente une charge complète d’année-personne dans un budget ministériel. Les équivalents temps plein sont calculés selon un taux d’heures de travail assignées en relation aux heures normales de travail. Les heures normales de travail sont établies dans les conventions collectives.

Indicateur de rendement : Moyen quantitatif ou qualitatif de mesurer un extrant ou un résultat en vue de déterminer le rendement d’une organisation, d’un programme, d’une politique ou d’une initiative selon les résultats escomptés.

Plans : Formulation de choix stratégique qui explique comment une organisation prévoit respecter ses priorités et atteindre les résultats connexes. En général, un plan précise la logique derrière les stratégies retenues et met l’accent sur les mesures qui mènent au résultat escompté.

Priorités : plans ou projets sur lesquels une organisation a décidé de se concentrer ou de faire état pendant la période de planification. Les priorités représentent les éléments les plus éléments ou ceux que l’on doit accomplir en premier pour soutenir la réalisation du résultat stratégique souhaité.

Programme : Groupe d’intrant constitué de ressources et d’activités connexes qui est géré pour répondre à un ou des besoins précis et pour réaliser les résultats escomptés, et qui est souvent traité comme une unité budgétaire.

Programme temporarisé : Programme d’une durée limitée qui ne dispose d’aucun pouvoir permanent en matière de financement et de politique. Lorsque le programme arrive à échéance, on doit prendre une décision quant à sa poursuite. Dans le cas d’un renouvellement, la décision doit préciser la portée, le niveau de financement et la durée.

Rapport de rendement : Processus de communication de l’information sur le rendement fondé sur des éléments probants. Le rapport de rendement appuie la prise de décision, l’obligation de rendre compte et la transparence.

Rapport ministériel sur le rendement : Rapports sur les réalisations réelles d’une organisation compétente relativement aux plans, priorités et résultats escomptés énoncés dans le Rapport sur les plans et priorités correspondant. Ces rapports sont déposés au Parlement à l’automne.

Rapport sur les plans et les priorités : Procure de l’information sur les plans et le rendement escompté des organisations compétentes pour une période de trois ans. Ces rapports sont déposés au Parlement au printemps.

Rendement : Ce qu’une organisation fait de ses ressources pour atteindre les résultats escomptés, dans quelle mesure ces résultats se comparent favorablement à ce que l’organisation cherchait à réaliser et dans quelle mesure les leçons à retenir ont été cernées.

Résultat : Conséquence externe attribuable, en partie, à une organisation, à une politique, à un programme ou à une initiative. Les résultats ne sont pas du ressort d’une seule organisation, d’une seule politique, d’un seul programme ou d’une seule initiative, et relèvent plutôt de la sphère d’influence de l’organisation.

Résultat stratégique : Avantage durable et à long terme pour les Canadiens découlant du mandat, de la vision et des fonctions essentielles d’une organisation.

Résultats du gouvernement du Canada : Ensemble de 16 objectifs de haut niveau définis pour le gouvernement dans son ensemble, groupés en quatre domaines de dépenses : affaires économiques, affaires sociales, affaires internationales et affaires gouvernementales.

Structure de la gestion, des ressources et des résultats : Cadre global qui comprend l’inventaire des programmes, ressources, résultats, indicateurs de performance et informations sur la gouvernance d’une organisation. Les programmes et les résultats sont présentés en relation hiérarchique les uns aux autres et relativement au résultat stratégique auquel ils contribuent. La Structure de la gestion, des ressources et des résultats est établie à partir de l’Architecture d’alignement des programmes.